Creative agency Virtue introduces genderless voice Q to challenge biases in technology

Siri, Alexa, Google Assistant, Cortana and Bixby — almost all virtual assistants have something in common. Their default voices are women’s, though the role that plays in reinforcing gender stereotypes has been long documented, even inspiring the dystopian romance “Her.” Virtue, the creative agency owned by publisher Vice, wants to challenge the trend with a genderless voice called Q.

The project, done in collaboration with Copenhagen Pride, Equal AI, Koalition Interactive and thirtysoundsgood, wants technology companies to think outside the binary.

“Technology companies are continuing to gender their voice technology to fit scenarios in which they believe consumers will feel most comfortable adopting and using it,” says Q’s website. “A male voice is used in more authoritative roles, such as banking and insurance apps, and a female voice in more service-oriented roles, such as Alexa and Siri.”

To develop Q, Virtue worked with Anna Jørgensen, a linguist and researcher at the University of Copenhagen. They recorded the voices of five non-binary people, then used software to modulate the recordings to between 145-175 Hz, the range defined by researchers as gender neutral. The recordings were further refined after surveying 4,600 people and asking them to define the voices on a scale from 1 (male) to 5 (female).

Virtue is encouraging people to share Q with Apple, Amazon and Microsoft, noting that even when different options are given for voice assistants, they are still usually categorized as male or female. As the project’s mission statement puts it, “as society continues to break down the gender binary, recognizing those who neither identify as male nor female, the technology we create should follow.”

Powered by WPeMatico

Blind users can now explore photos by touch with Microsoft’s Seeing AI

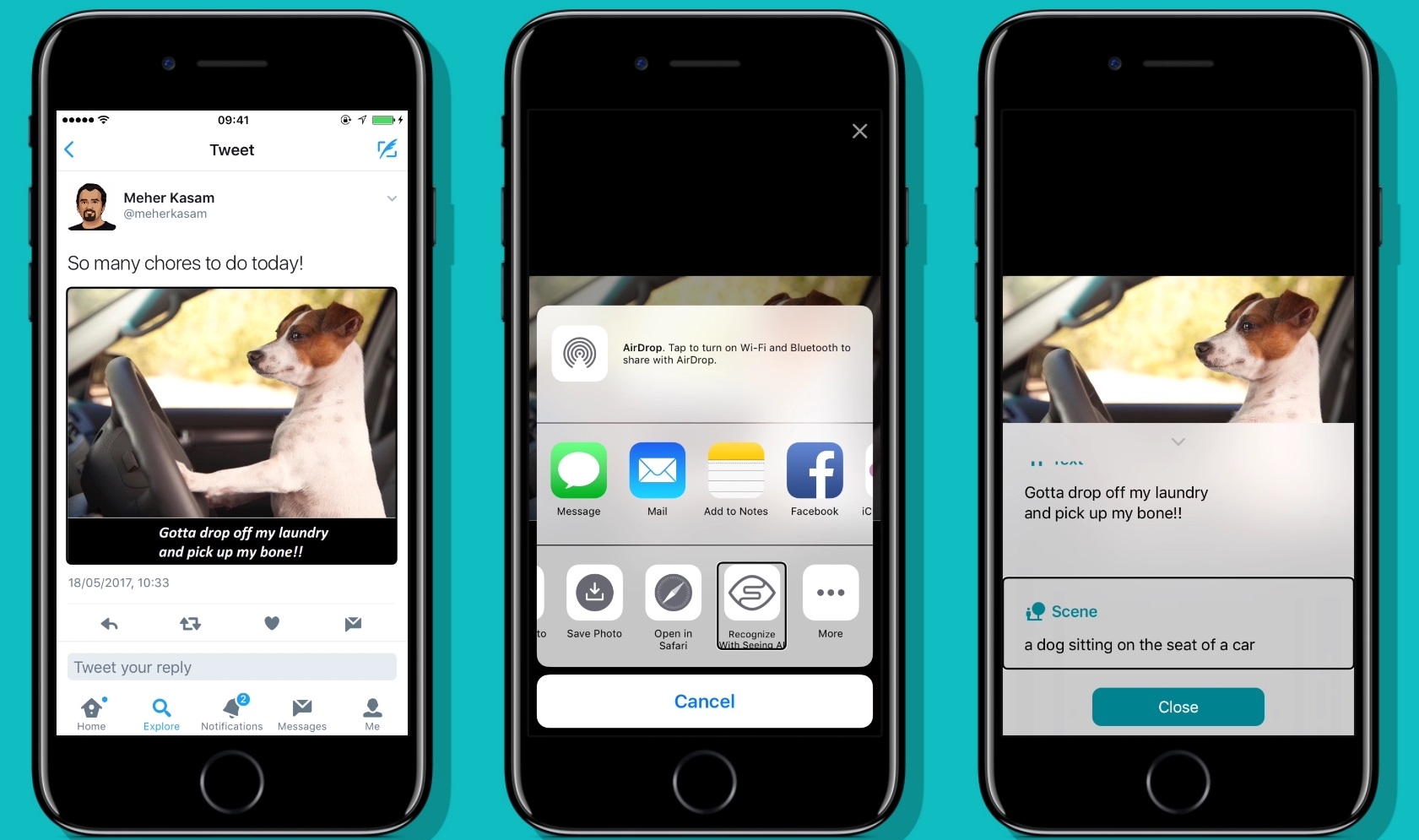

Microsoft’s Seeing AI is an app that lets blind and limited-vision folks convert visual data into audio feedback, and it just got a useful new feature. Users can now use touch to explore the objects and people in photos.

It’s powered by machine learning, of course, specifically object and scene recognition. All you need to do is take a photo or open one up in the viewer and tap anywhere on it.

“This new feature enables users to tap their finger to an image on a touch-screen to hear a description of objects within an image and the spatial relationship between them,” wrote Seeing AI lead Saqib Shaikh in a blog post. “The app can even describe the physical appearance of people and predict their mood.”

Because there’s facial recognition built in as well, you could very well take a picture of your friends and hear who’s doing what and where, and whether there’s a dog in the picture (important) and so on. This was possible on an image-wide scale already, as you can see in this image:

But the app now lets users tap around to find where objects are — obviously important to understanding the picture or recognizing it from before. Other details that may not have made it into the overall description may also appear on closer inspection, such as flowers in the foreground or a movie poster in the background.

But the app now lets users tap around to find where objects are — obviously important to understanding the picture or recognizing it from before. Other details that may not have made it into the overall description may also appear on closer inspection, such as flowers in the foreground or a movie poster in the background.

In addition to this, the app now natively supports the iPad, which is certainly going to be nice for the many people who use Apple’s tablets as their primary interface for media and interactions. Lastly, there are a few improvements to the interface so users can order things in the app to their preference.

Seeing AI is free — you can download it for iOS devices here.

Powered by WPeMatico

Former CEO Zain Jaffer files wrongful termination lawsuit against Vungle

Vungle founder Zain Jaffer filed a lawsuit today accusing the mobile advertising company of wrongfully terminating him from the role of CEO.

The lawsuit cites a section of the California labor code that it says “expressly and specifically prohibits discrimination and retaliation by employers based upon an arrest or detention that did not result in conviction.”

Jaffer was arrested in October 2017 in an incident involving his young son — the charges included performing a lewd act on a child and assault with a deadly weapon. Last year, the charges were dropped, with the San Mateo District Attorney’s Office saying it did “not believe that there was any sexual conduct by Mr. Jaffer that evening,” while “the injuries were the result of Mr. Jaffer being in a state of unconsciousness caused by prescription medication.”

Afterwards, Jaffer began looking into either selling his Vungle shares or pursuing a leadership change at the company, something he alludes to in his statement on the suit:

Once I was absolved of any wrongdoing, I was looking forward to a friendly relationship with the Company. Instead, Vungle unfairly and unlawfully sought to destroy my career, blocked my efforts to sell my own shares or transfer shares to family members, and tried to prevent me from purchasing shares in the Company.

When reached by TechCrunch, a Vungle spokesperson declined to comment on the lawsuit.

The suit does not specify the amount that Jaffer is seeking, but his attorney Joann Rezzo reportedly told Bloomberg that he has suffered at least $100 million worth of harm. When asked about damages, Jaffer’s spokesperson sent us the following statement from Rezzo:

The amount to be awarded would be entirely within the discretion of the jury. My firm won almost $20M for an employee who asserted similar claims against Allstate Insurance Company. Mr. Jaffer’s potential recovery is much, much higher.

The suit she’s referring to involved a former Allstate employee who was awarded $18.6 million after he was fired following an arrest for domestic violence and possession of marijuana paraphernalia. All the charges were eventually dismissed.

You can read Jaffer’s full lawsuit below.

Jaffer v. Vungle Conformed … by on Scribd

Powered by WPeMatico

Startup Law A to Z: Employment Law

Your startup will not succeed unless you, the founder, build an exceptional team. Great teams are built on top of great culture. Yet any venture-backed startup founder will tell you, myself included, that developing a positive corporate culture is more art than science, requiring constant and creative recalibration as your company grows. What then does this have to do with employment law?

First, building an exceptional team means hiring great people; whether that involves W-9s for consultants, I-9s for employees, lengthy H-1B visa applications, or a new employee handbook, you need to hire the right people in the right way. Second, one bad employment-related legal dispute can have ripple effects throughout an organization, undermining employee morale and executive credibility in one fell swoop, with palpable culture fallout.

Fortunately, when working to promote healthy company culture, founders can look to employment law for some preventive medicine. In fact, transparency through written policies, clearly communicated in advance and followed in practice, can help create the trust and accountability which are foundational to positive company culture. Moreover, in the event employment disputes do arise, well-drafted employment policies actually provide valuable guidance through difficult to navigate situations, while limiting downside risks to the company, as well.

This article, the fourth in Extra Crunch’s exclusive five-part “Startup Law A to Z” series, follows previous articles on customer contracts, intellectual property (IP) and corporate matters. This series is calculated to provide founders the information needed to assess legal risks in the areas common to most startups.

After reading this article, or other “Startup Law A to Z” articles, should you identify legal risks facing your startup, Extra Crunch resources can help. For example, the Verified Experts of Extra Crunch include some of the most experienced and skilled startup lawyers in practice today. So use these resources to identify attorneys focused on serving companies at your stage and then reach out for further guidance in the particular issues at hand.

The Employment Law checklist:

Employee vs. independent contractor classification

- Payroll Taxes and Payroll Providers

- Federal Classification: 21-Part Test

- State Classification: Various tests, e.g., Dynamex in California

- Intentional vs. Unintentional Misclassification and Penalties

Minimum wage and hour laws

- Application to founders

- Federal Fair Labor Standards Act (FLSA)

- State Laws

Meal and rest breaks, vacation pay

- Federal Fair Labor Standards Act (FLSA)

- State Laws

Deferred compensation

- Rule 409A

- Founders

- Employees

Sexual harassment, discrimination, and related claims

- Federal:

- Civil Rights Act of 1964

- Age Discrimination in Employment Act of 1967 (ADEA)

- Americans with Disabilities Act of 1990 (ADA)

- Equal Pay Act of 1963

- Genetic Information Nondiscrimination Act of 2008

- State Laws

- Employee Handbook

- Documentation and Investigation

Work authorization / immigration

- Form I-9 (Employees) and W-9 (Independent Contractors)

- For Temporary Workers:

- Visa Waiver Program

- B-1

- Employee Visas:

- H1-B

- L-1

- O-1

- Students:

- F-1 with OPT STEM Extension

- Other Visas:

- EB-5

- E Visas (E-1, E-2, E3)

Employee vs. independent contractor classification

One of the biggest employment law issues that startups get wrong, often willingly, is “employee” versus “independent contractor” classification. For employees, a startup must withhold and pay federal, state, and local income taxes, state disability, and payments under the Federal Unemployment Tax Act and Federal Insurance Contribution Act (i.e. Social Security and Medicare), not to mention contributions for federal and state unemployment and workers compensation insurance. Given this complexity, startups should absolutely hire a payroll provider to help manage the process, such as ADP, Gusto, Paychex or Quickbooks.

Of course, all of this gets expensive. Instead, far too many early-stage startups simply hire “independent contractors” to avoid everything mentioned above, often misclassifying these workers in the process, whether under federal law, state law, or both.

Powered by WPeMatico

Google’s new voice recognition system works instantly and offline (if you have a Pixel)

Voice recognition is a standard part of the smartphone package these days, and a corresponding part is the delay while you wait for Siri, Alexa or Google to return your query, either correctly interpreted or horribly mangled. Google’s latest speech recognition works entirely offline, eliminating that delay altogether — though of course mangling is still an option.

The delay occurs because your voice, or some data derived from it anyway, has to travel from your phone to the servers of whoever operates the service, where it is analyzed and sent back a short time later. This can take anywhere from a handful of milliseconds to multiple entire seconds (what a nightmare!), or longer if your packets get lost in the ether.

Why not just do the voice recognition on the device? There’s nothing these companies would like more, but turning voice into text on the order of milliseconds takes quite a bit of computing power. It’s not just about hearing a sound and writing a word — understanding what someone is saying word by word involves a whole lot of context about language and intention.

Your phone could do it, for sure, but it wouldn’t be much faster than sending it off to the cloud, and it would eat up your battery. But steady advancements in the field have made it plausible to do so, and Google’s latest product makes it available to anyone with a Pixel.

Google’s work on the topic, documented in a paper here, built on previous advances to create a model small and efficient enough to fit on a phone (it’s 80 megabytes, if you’re curious), but capable of hearing and transcribing speech as you say it. No need to wait until you’ve finished a sentence to think whether you meant “their” or “there” — it figures it out on the fly.

Google’s work on the topic, documented in a paper here, built on previous advances to create a model small and efficient enough to fit on a phone (it’s 80 megabytes, if you’re curious), but capable of hearing and transcribing speech as you say it. No need to wait until you’ve finished a sentence to think whether you meant “their” or “there” — it figures it out on the fly.

So what’s the catch? Well, it only works in Gboard, Google’s keyboard app, and it only works on Pixels, and it only works in American English. So in a way this is just kind of a stress test for the real thing.

“Given the trends in the industry, with the convergence of specialized hardware and algorithmic improvements, we are hopeful that the techniques presented here can soon be adopted in more languages and across broader domains of application,” writes Google, as if it is the trends that need to do the hard work of localization.

Making speech recognition more responsive, and to have it work offline, is a nice development. But it’s sort of funny considering hardly any of Google’s other products work offline. Are you going to dictate into a shared document while you’re offline? Write an email? Ask for a conversion between liters and cups? You’re going to need a connection for that! Of course this will also be better on slow and spotty connections, but you have to admit it’s a little ironic.

Powered by WPeMatico

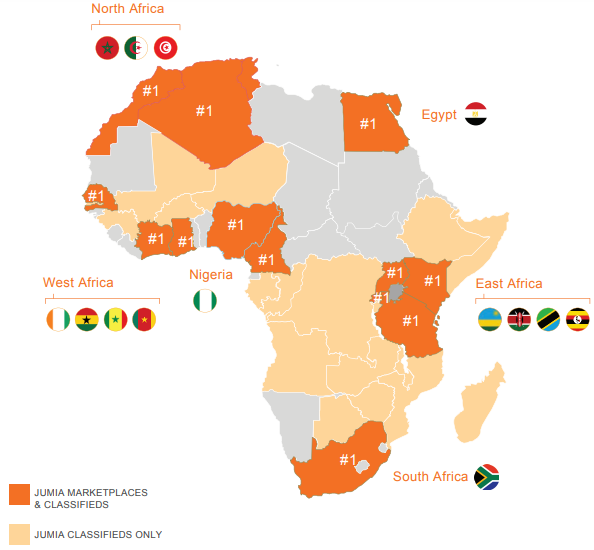

African e-commerce startup Jumia files for IPO on NYSE

Pan-African e-commerce company Jumia filed for an IPO on the New York Stock Exchange today, per SEC documents and confirmation from CEO Sacha Poignonnec to TechCrunch.

The valuation, share price and timeline for public stock sales will be determined over the coming weeks for the Nigeria-headquartered company.

With a smooth filing process, Jumia will become the first African tech startup to list on a major global exchange.

Poignonnec would not pinpoint a date for the actual IPO, but noted the minimum SEC timeline for beginning sales activities (such as road shows) is 15 days after submitting first documents. Lead adviser on the listing is Morgan Stanley .

There have been numerous press reports on an anticipated Jumia IPO, but none of them confirmed by Jumia execs or an actual SEC, S-1 filing until today.

Jumia’s move to go public comes as several notable consumer digital sales startups have faltered in Nigeria — Africa’s most populous nation, largest economy and unofficial bellwether for e-commerce startup development on the continent. Konga.com, an early Jumia competitor in the race to wire African online retail, was sold in a distressed acquisition in 2018.

With the imminent IPO capital, Jumia will double down on its current strategy and regional focus.

“You’ll see in the prospectus that last year Jumia had 4 million consumers in countries that cover the vast majority of Africa. We’re really focused on growing our existing business, leadership position, number of sellers and consumer adoption in those markets,” Poignonnec said.

The pending IPO creates another milestone for Jumia. The venture became the first African startup unicorn in 2016, achieving a $1 billion valuation after a $326 funding round that included Goldman Sachs, AXA and MTN.

Founded in Lagos in 2012 with Rocket Internet backing, Jumia now operates multiple online verticals in 14 African countries, spanning Ghana, Kenya, Ivory Coast, Morocco and Egypt. Goods and services lines include Jumia Food (an online takeout service), Jumia Flights (for travel bookings) and Jumia Deals (for classifieds). Jumia processed more than 13 million packages in 2018, according to company data.

Starting in Nigeria, the company created many of the components for its digital sales operations. This includes its JumiaPay payment platform and a delivery service of trucks and motorbikes that have become ubiquitous with the Lagos landscape.

Starting in Nigeria, the company created many of the components for its digital sales operations. This includes its JumiaPay payment platform and a delivery service of trucks and motorbikes that have become ubiquitous with the Lagos landscape.

Jumia has also opened itself up to traders and SMEs by allowing local merchants to harness Jumia to sell online. “There are over 81,000 active sellers on our platform. There’s a dedicated sellers page where they can sign-up and have access to our payment and delivery network, data, and analytic services,” Jumia Nigeria CEO Juliet Anammah told TechCrunch.

The most popular goods on Jumia’s shopping mall site include smartphones (priced in the $80 to $100 range), washing machines, fashion items, women’s hair care products and 32-inch TVs, according to Anammah.

E-commerce ventures, particularly in Nigeria, have captured the attention of VC investors looking to tap into Africa’s growing consumer markets. McKinsey & Company projects consumer spending on the continent to reach $2.1 trillion by 2025, with African e-commerce accounting for up to 10 percent of retail sales.

Jumia has not yet turned a profit, but a snapshot of the company’s performance from shareholder Rocket Internet’s latest annual report shows an improving revenue profile. The company generated €93.8 million in revenues in 2017, up 11 percent from 2016, though its losses widened (with a negative EBITDA of €120 million). Rocket Internet is set to release full 2018 results (with updated Jumia figures) April 4, 2019.

Jumia’s move to list on the NYSE comes during an up and down period for B2C digital commerce in Nigeria. The distressed acquisition of Konga.com, backed by roughly $100 million in VC, created losses for investors, such as South African media, internet and investment company Naspers .

In late 2018, Nigerian online sales platform DealDey shut down. And TechCrunch reported this week that consumer-focused venture Gloo.ng has dropped B2C e-commerce altogether to pivot to e-procurement. The CEO cited better unit economics from B2B sales.

In late 2018, Nigerian online sales platform DealDey shut down. And TechCrunch reported this week that consumer-focused venture Gloo.ng has dropped B2C e-commerce altogether to pivot to e-procurement. The CEO cited better unit economics from B2B sales.

As demonstrated in other global startup markets, consumer-focused online retail can be a game of capital attrition to outpace competitors and reach critical mass before turning a profit. With its unicorn status and pending windfall from an NYSE listing, Jumia could be better positioned than any venture to win on e-commerce at scale in Africa.

Powered by WPeMatico

Goalsetter gives parents a way to teach their kids how to save money

When the bubble burst in the year 2000, Tanya Van Court lost over $1 million in stock and options over the course of a few minutes. Then and there she vowed to never let something like that happen to her children.

Five years later, her daughter Gabrielle was born. At the time, she was a VP of Digital Product Dev at ESPN. She then went on to work as SVP of Digital Products, Parenting & Preschool for Nickelodeon and, in 2013, moved to SVP of Marketing at Discovery Education, leading the charge to roll out digital textbooks nationwide.

Today, she runs Goalsetter, an app that allows parents and their kids to replace gift-giving with goal-giving.

It started when her daughter Gabrielle was eight years old. Van Court told her daughter that if she could save $100, Van Court would match that $100 and start her an investment account. After learning how exactly an investment account works, Gabrielle decided all she wanted for her ninth birthday was a bike and an investment account.

“I thought that these are amazing things for a nine-year-old to want, but she was going to get all kinds of stuff she didn’t want or need instead,” said Van Court. “I realized how early consumerism starts. We all have more and more and more and value things less and less and less.”

After conversations with fellow moms, Van Court got to work on Goalsetter. The app has two main branches: a savings account for kids and a financial literacy learning center with fun quizzes.

Kids and parents together sign up for the app, where kids input some of their goals, from college tuition to a new bike or gaming console. Kids can then earn their allowance through the app, and can also receive ‘GoalCards’ (replacing a gift card) from parents and relatives to save towards their goals.

Moreover, parents can round-up their debit card swipes to go towards their kids bigger goals, such as college tuition or a first car. Parents can also set up auto-save to set aside a few dollars each month.

“Moms in particular all feel the pain of their kids having too much stuff,” said Van Court. “When they step on yet another lego in the house or go into the kids room to find 80 toys, only five of which they play with, these become daily pain points for moms. The idea of teaching kids how to save instead of teaching them how to acquire more stuff really resonates with moms.”

Goalsetter also offers a financial literacy quiz game called “It’s LIT” that is mapped to financial literacy standards for K – 12. The game uses pop culture memes, song lyrics, etc. to engage kids while teaching them the fundamentals of personal finance. Parents can choose to reward their kids with money toward their goals for each question they get right.

What’s more, Goalsetter has plans to launch “It’s LIT” as a curriculum to school districts, complete with lesson plan materials, quizzes and more.

Alongside the curriculum, Goalsetter makes money by charging a dollar for every GoalCard sent through the platform. Goalsetter donates 5 percent of its transaction fee to children’s related charities. The company also has a donation function that allows users to pay the company whatever amount they find appropriate for the features offered.

Gaolsetter skews a bit younger than some of its competitors, including Current, Greenlight, and Step.

Goalsetter currently has more than 20,000 users and was recently featured on Shark Tank — Van Court turned down Mr. Wonderful’s investment offer.

The company graduated from the Entrepreneurs’ Roundtable Accelerator in 2017 and has raised a total of $2.1 million, including investment from Morgan Stanley, CFSI sponsored by JP Morgan Chase, Pipeline Angels and Backstage Capital.

“When the bubble burst, I had to learn the hard way that what goes up can actually come down,” said Van Court. “Our mission is to teach children that money has real value that can go towards the things you want to accomplish in life, and to people who are in need of it.”

Powered by WPeMatico

Truepill, the ‘AWS for pharmacies,’ gets $10M from Initialized Capital

Venture capitalists’ latest on-demand delivery bet is in the pharmaceutical space.

Truepill, an online pharmacy powering delivery for the likes of Hims, Nurx, LemonAID and other direct-to-consumer healthcare brands, has nabbed a $10 million Series A from early-stage VC fund Initialized Capital. The investment brings the Y Combinator graduate’s total raised to $13.4 million. Y Combinator, Sound Ventures, Tuesday Capital and others participated in the round.

Founded in 2016, the San Mateo-based startup employs 150 workers and plans to expand its team and fulfillment facilities into the U.K. with the fresh funding. Truepill is currently active in all 50 states and has delivered 1 million subscriptions for birth control, erectile dysfunction medication, hair loss treatment and more.

It is, as co-founders Sid Viswanathan and Umar Afridi explained, Amazon Web Services for pharmacies.

“We are really only scratching the surface of where this telemedicine landscape is going to go,” Viswanathan, who became a product manager at LinkedIn after the social network acquired his transcription service CardMunch, told TechCrunch. “We are catering to this first wave of those companies and we want to be that pharmacy fulfillment service powering that entire shift … We want to build the next generation of pharmacy infrastructure.”

Afridi, for his part, previously spent more than a decade as a pharmacist at retail chains like CVS and Fred Meyer.

In addition to operating a prescription delivery service, Truepill provides a set of APIs that give its customers programmatic access to its pharmacy and allows brands to fully customize packaging.

Foundation Capital, Index Ventures, Social Capital, Box Group and Joe Montana are also Truepill stakeholders.

Powered by WPeMatico

Investing app Stash raises $65M, launches banking and ‘stock-back’ rewards with Green Dot

Stash, the fintech startup and app that aims to introduce new people to the world of investing, is unveiling some interesting new services while also announcing that it has raised more funding to expand its business. The company is introducing mobile-based banking accounts from Green Dot Bank, and, alongside it, a new rewards program called “Stock-Back.” When users spend money using their Stash accounts, they get “points” — which are either stocks in the companies where they are buying goods, or shares in ETFs approved by Stash. On top of that, Stash also said it raised a Series E of $65 million that it will be using to grow its business on the back of these two launches.

A spokesperson for the company said that Stash is not disclosing the full round of investors in this round. For context, Stash was valued at $350 million post-money in its Series D, according to figures from PitchBook, and a source says the valuation is now “much higher” than $400 million.

But from the looks of it, the $65 million appears to include participation from Breyer Capital, a previous investor whose founder Jim Breyer has heartily endorsed the new Stock-Back service and accompanying loyalty program that’s tied in with it, which was tested early with companies like Netflix, T-Mobile and Chipotle all offering stock when people used their Stash accounts to pay for goods and services at the companies.

“I have invested in and served on the Board of many leading companies, and it’s clear how a program like Stock-Back can power immense brand loyalty,” he said in a statement today. “The early data shows unequivocally that share ownership drives increased sales and customer appreciation. This innovative new technology from STASH will have CEOs and CMOs knocking on their door.”

From what we understand, the round was led by a private institutional investor and includes 40 percent existing and 60 percent new investors. Previous backers in addition to Breyer include Union Square Ventures, Coatue Management, Entree, Goodwater and Valar. “We’re really excited and proud to be working with this incredible group of VCs,” the spokesperson noted.

The Green Dot-powered banking service comes with the core features that will sound familiar to those who have used or looked at next-generation banking services before. It will include a debit card-based account, no overdraft or monthly maintenance fees, access to a network of ATMs that can be used for free and direct deposit services, as well as “personal guidance” for their financial planning activities, from saving to investing.

Stash is part of a wave of fintech startups — others include the likes of Robinhood, Acorns, YieldStreet, Revolut and many others — that have tapped into the popularity of apps and the advent of new financial services technology to democratise how individuals can save, spend, invest, borrow and lend money, moving many of those operations and transactions out of the hands of the big incumbent players who used to control them.

The average age of a Stash user is 29 and average income is less than $50,000 per year, and tying in transactions made using Stash’s banking service — by way of reward points that are being picked up incidentally — will make it even more seamless for these users to take some of their money and invest with it, while at the same time demystifying some of the process and making it more likely that those users will choose to invest even more down the line.

The idea of tying investments to what you are actually purchasing is a clever one. For a startup whose user base includes no-nonsense professionals from fields like teaching, nursing and retail, this is the embodiment of putting your money where your mouth is — literally speaking, as the investments can include things like shares in Chipotle each time you buy food there, and T-Mobile every time you pay your phone bill for all the talking you do.

Stash is positioning Stock-Back as a rewards program, with the percentages varying by business or brand and going as high as five percent in Stock-Back in some cases — as is the case, at launch, when people use their Stash debit cards to pay their Spotify and Netflix dues.

Ultimately, the aim of this is to present a way for ordinary, modestly-salaried people not only to potentially make money, but to be better engaged in how financial systems work, and how their daily actions impact that — the idea being that this knowledge can only help them in the long run.

“80% of Americans are living paycheck-to-paycheck. Stock-Back is our way of utilizing STASH’s smart, patent-pending technology to help people build better financial habits and invest in their future,” said co-founder and president, Ed Robinson, in a statement. “Our ability to give customers the opportunity to save and build portfolios that mirror their spending behavior and preferences is incredibly powerful.”

Powered by WPeMatico

Pluto is travel insurance aimed at millennials

Pitched as “travel insurance for people who don’t like insurance,” U.K.-based Pluto Insurance is officially launching today with an online travel insurance product targeting millennials.

Citing research that says 40 percent of millennials don’t actually buy travel insurance, mistakenly believing that it isn’t required, the mobile-first offering not only attempts to demystify travel insurance, but is also unbundling it in a way that ensures you only pay for the cover you need or desire.

“We’ve spoken to hundreds of millennials and three things keep coming up,” says Pluto co-founder and CEO Alex Rainey. “Travel insurance is too complicated and it’s hard to know what you’re actually buying. Secondly, a lot of younger people don’t think they need it. But most importantly, there is a distinct lack of trust towards insurers, and it’s easy to see why. With exclusions buried in the fine print and insurers expecting people to print out a claim form and post it in.”

To remedy this, Rainey says Pluto wants to make travel insurance more tailored, letting you build your own policy online. “We work hard to make sure everything is easy to understand, ensuring we always explain our cover in plain English,” he says. The startup also lets you submit a claim via the mobile web app “in under 10 minutes.”

Insurance options includes gadget cover, baggage cover, cancellation cover, level of excess, cover for certain activities and travel disruption. As you add more cover, the price of your insurance changes in real time with each decision. Once you’ve built your policy, a short summary of your cover is displayed before you go ahead and purchase.

Meanwhile, the insurance itself — which, at launch, doesn’t cover pre-existing conditions, although that will be offered in the future — is in partnership with Zurich, which Rainey says was chosen because they had a 99 percent claims payout rate in 2017. “This is so so important for us to solve the trust issues in insurance,” he adds.

To that end, Pluto integrates with Facebook Messenger, including letting you use the messaging app to start a claim. You can also search your policy, check a summary of your cover or chat to a Pluto team member.

“Our customers want to do everything from their phone, when and where they want. We’ve made sure that’s possible,” says Rainey.

Powered by WPeMatico