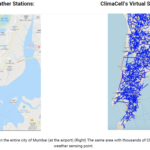

Atlassian acquires AgileCraft for $166M

Atlassian today announced that it has acquired AgileCraft, a service that aims to help enterprises plan their strategic projects and workstreams. The service provides business leaders with additional insights into the current status of technical projects and gives them insights into the bottlenecks, risks and dependencies of these projects. Indeed, the focus of AgileCraft is less on technical teams than on the business teams that support them and help them manage the digital transformation of their businesses.

The price total of the acquisition is about $166 million, with $154 million in cash and the remainder in restricted shares.

“Many leaders are still making mission-critical decisions using their instincts and best guesses instead of data,” said Scott Farquhar, Atlassian’s co-founder and co-CEO, in today’s announcement. “As Atlassian tools spread through organizations, technology leaders need better visibility into work performed by their teams. With AgileCraft joining Atlassian, we believe we’re the best company to help executives align the work across their organization – providing an all-encompassing view that connects strategy, work, and outcomes.”

As the name implies, AgileCraft focuses on the Agile methodology, though it also offers a bit of flexibility there with support for frameworks like SAFe, LeSS and Spotify. It supports pulling in data from tools like Atlassian’s Jira, but also Microsoft’s Team Foundation Server, IBM’s RTC and other services.

Atlassian will continue to operate AgileCraft, which had raised about $10.1 million before the acquisition as a standalone service. “We will continue to focus relentlessly on our customers’ success,” writes AgileCraft’s founder and CEO Steve Elliott. “We remain dedicated to pioneering enterprise agility and are thrilled to team up with the outstanding people at Atlassian to help our customers thrive.”

Over the years, Atlassian started embracing users and use cases for its tools that go beyond its core tools for developers. Jira and Confluence are the prime examples for this. Today’s acquisition continues this trend in that AgileCraft aims to bring to the rest of the company many of the methodologies that tech teams use.

“One of the critical roles we play for lots of organizations is in helping drive this kind of digital transformation where we’re really empowering the teams that are building and developing the kind of technology that moves our customers forward,” Atlassian president Jay Simons told me. “AgileCraft basically complements all of that by extending visibility into what teams are using Atlassian products to do up into key stakeholders and leaders in the business that are trying to manage better visibility at a portfolio or program level.”

Simons also stressed that AgileCraft already has very strong integrations into the existing Atlassian tools — and indeed, that was one of the main drivers of the acquisition. He noted that the company plans to improve those and think about additional patterns. “We’ll continue doing what we’re doing,” he said.

Simons also noted that he expects that a lot of Jira customers will now look at AgileCraft as an additional tool in helping the businesses manage their business’s digital transformation.

Atlassian doesn’t typically make a lot of acquisitions. Its pace is close to about one major buy per year. Last year, the company picked up OpsGenie for $295 million. In 2017, it acquired Trello for $425 million, the company’s biggest acquisition to date. Other major products the company has acquired include StatusPage, BlueJimp, HipChat and Bitbucket (all the way back in 2010).

Powered by WPeMatico

ClimaCell bets on IoT for better weather forecasts

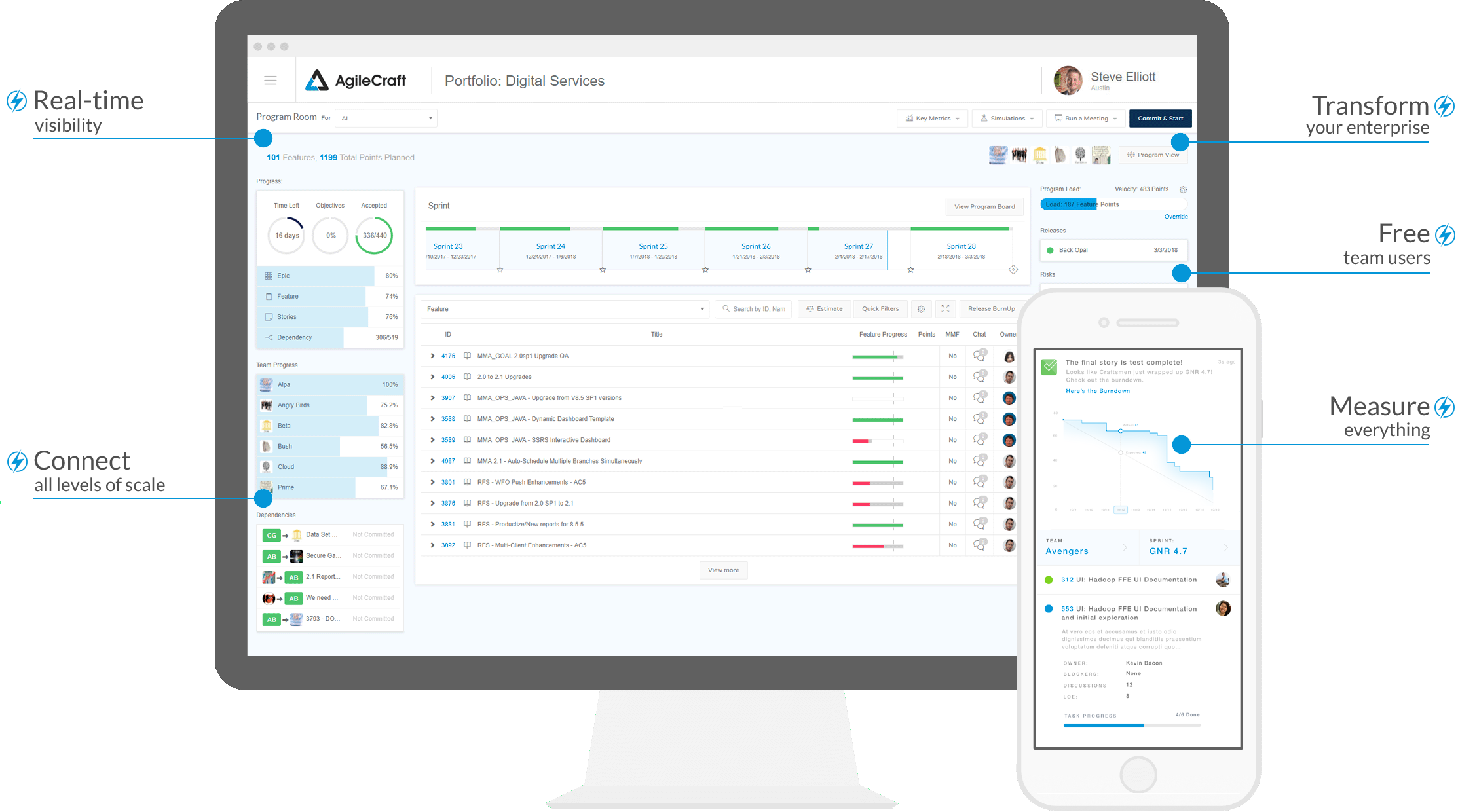

To accurately forecast the weather, you first need lots of data — not just to train your forecasting models but also to generate more precise and granular forecasts. Typically, this has been the domain of government agencies, thanks to their access to this data and the compute power to run the extremely complex models. Anybody can now buy compute power in the cloud, though, and as the Boston and Tel Aviv-based startup ClimaCell is setting out to prove, there are now also plenty of other ways to get climate data thanks to a variety of relatively non-traditional sensors that can help generate more precise local weather predictions.

Now you may say that others, like Dark Sky, for example, are already doing that with their hyperlocal forecasts. But ClimaCell’s approach is very different, and with that has attracted as clients airlines like Delta, JetBlue and United, sports teams like the New England Patriots and agtech companies like Netafim.

“The biggest problem is that to predict the weather, you need to have observations and you need to have models,” ClimaCell CEO Shimon Elkabetz told me. “The entire industry is basically repackaging the data and models of the government [agencies]. And the governments don’t create the relevant infrastructure everywhere in the world. Even in the U.S., there’s room for improvement.”

And that’s where ClimaCell’s main innovation comes in. Instead of relying on government sensors, it’s using the Internet of Things to gather more weather data from far more places than would otherwise be possible. This kind of sensing technology could turn millions of existing connected devices — like cell phones, connected vehicles, street cameras, airplanes and drones — into virtual weather stations. It’s easy enough to see how this would work. If a driver turns on a windshield wiper or fog lights, you know it’s probably raining or foggy. Often, these cars also relay temperature data. If a street camera sees rain, it’s raining.

What’s more complex is that ClimaCell has also developed the technology to gather data from how atmospheric conditions impact the signal propagation between cell phones and their base stations. And to take this one step further — and beyond the ground level — it has also figured out how to gather similar data from satellite-to-ground microwave signals.

“The idea is that everything is sensitive to weather and we can turn everything into a weather sensor,” said Elkabetz. “That’s why we call it the weather of things. It enables us to put in place virtual sensors everywhere.”

Using all this data, ClimaCell is providing its customers, like airlines, ridesharing companies and energy companies, with real-time weather data and forecasts.

Using all of this data the company also recently launched flood alerts for about 500 cities that can provide 24 to 48-hour warnings ahead of major flood events. To do this, the company combined its weather data with its own hydrological model.

For now, most of ClimaCell’s business model focuses on selling its data and predictions to other businesses. The company plans to launch a consumer app in May, though. I got a sneak peek of the app; while I can’t vouch for the forecasts, it’s a very well-designed application that you’ll probably want to look at, no matter whether you’re a weather geek or just want to see if you can get a quick bike ride in before the rain starts.

Why a consumer app? “We want to become the biggest weather technology company in the world,” Elkabetz said. To get to this point, the company has raised a total of $68 million to date from investors that include Clearvision Ventures, JetBlue Technology Ventures, Ford Smart Mobility, Envision Ventures, Canaan Partners, Fontinalis Partners and Square Peg Capital.

Powered by WPeMatico

WorkClout brings SaaS to factory floor to increase operational efficiency

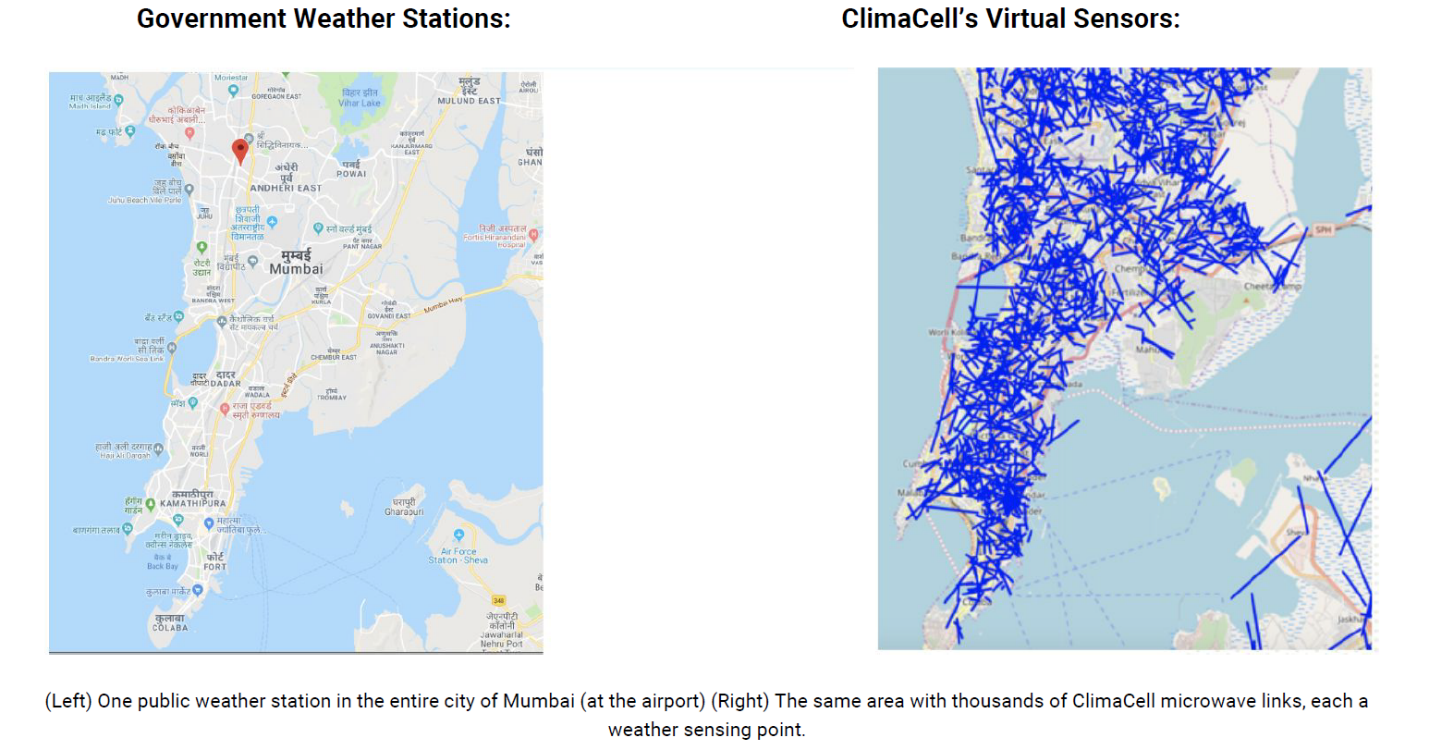

Factory software tools are often out of reach of small manufacturers, forcing them to operate with inefficient manual systems. WorkClout, a member of the Y Combinator Winter 2019 class, wants to change that by offering a more affordable SaaS alternative to traditional manufacturing software solutions.

Company co-founder and CEO Arjun Patel grew up helping out in his Dad’s factory and saw first-hand how difficult it is for small factory owners to automate. He says that traditional floor-management tools are expensive and challenging to implement.

“What motivated me is when my dad was trying to implement a similar system,” Patel said, noting that his father’s system had cost more than $240,000, took over a year to get going and wasn’t really doing what he wanted it to do. That’s when he decided to help.

He teamed up with Bryan Trang, who became the CPO, and Richard Girges, who became the CTO, to build the system that his dad (and others in a similar situation) needed. Specifically, the company developed a cloud software solution that helps manufacturers increase their operational efficiency. “Two things that we do really well is track every action on the factory floor and use that data to make suggestions on how to increase efficiency. We also determine how much work can be done in a given time period, taking finite resources into consideration,” Patel explained.

He said that one of the main problems that small-to-medium sized manufacturers face is a lack of visibility into their businesses. WorkClout looks at orders, activities, labor and resources to determine the best course of action to complete an order in the most cost-effective way.

“WorkClout gives our customers a better way to allocate resources and greater visibility of what’s actually happening on the factory floor. The more data that they have, the more accurate picture they have of what’s going on,” Patel said.

Production Schedule view. Screenshot: WorkClout

The company is still working on the pricing model, but today it charges administrative users like plant management, accounting and sales. Machine operators get access to the data for free. The current rate for paid users starts at $99 per user per month. There is an additional one-time charge for implementation and training.

As for the Y Combinator experience, Patel says that it has helped him focus on what’s important. “It really makes you hone in on building the product and getting customers, then making sure those two things are leading to customer happiness,” he said.

While the company does have to help customers get going today, the goal is to make the product more self-serve over time as they begin to understand the different verticals for which they are developing solutions. The startup launched in December and already has 13 customers, generating $100,000 in annual recurring revenue (ARR), according to Patel.

Powered by WPeMatico

America Movil acquires Nextel in Brazil for $905M

Latin America continues to remain a focus for investors that are eyeing up its large population and growth potential. In the latest development, America Movil, the Latin American carrier that is part of the Carlos Slim empire, today announced that it would acquire Nextel in Brazil, owned by NII (formerly Nextel International), for $905 million. NII in turn said that once the deal is closed, it has received approval “to dissolve and wind up NII.”

This is a move to scale up an existing carrier in competition with existing large players like Telefonica (which co-owns Vivo with Portugal Telecom), Telecom Italia and Oi (owned by Telemar). America Movil already has an operation in the country, Claro, which it plans to merge with Nextel to “consolidate its position as one of the leading telecommunication service providers in Brazil, strengthening its mobile network capacity, spectrum portfolio, subscriber base, coverage and quality, particularly in the cities of São Paulo and Rio de Janeiro, the main markets in Brazil.”

America Movil — based out of Mexico — has been on a consolidation spree, swallowing up other smaller holdings in a variety of markets in the region. In January, it acquired Telefonica’s assets in Guatemala and El Salvador respectively for $333 million and $315 million.

The Nextel Brazil deal will include buying a 70 percent stake in the carrier from NII, as well as a remaining 30 percent stake from AI Brazil Holdings BV, NII said today. AI Brazil Holdings is controlled by Len Blavatnik’s Access Industries, the company that owns Warner Music, Deezer and a number of other assets and investments. It had reportedly also been interested in increasing its share in the carrier, before agreeing to sell its stake altogether.

The acquisition is the final chapter for the struggling business, which had originally been the international division of Nextel but had spun out as a separate company before Sprint acquired Nextel in the US in 2005. NII’s focus had been mobile carrier operations across a range of developing markets but it struggled and had been through multiple bankruptcy processes.

“The announcement of this transaction marks the culmination of an extensive multi-year process to pursue a strategic path for Nextel Brazil and provides our best opportunity to monetize our remaining operating assets in light of the competitive landscape in Brazil and long-term need to raise significant capital to fund business operations, debt service and capital expenditures necessary to remain competitive in the future,” stated Dan Freiman, NII’s Chief Financial Officer, in a statement. “Management and our Board of Directors believe the transaction is in the best interest of NII’s stockholders.”

The deal represents a final chapter of sorts for the Nextel brand, which had been a trailblazer in the mobile market through its push-to-talk, walkie-talkie-style mobile service. This was was an early mover in the bigger wave of messaging services that competed with basic carrier SMS, and some came to think of it as the first mobile social network. Over time, though, the iDEN digital network that carried the service became outmoded and most carriers that offered iDEN-based services (including Nextel) discontinued them to focus on 3G and subsequent mobile technologies.

More generally, the acquisition underscores how a number of investors, willing to ride the waves of economic and political ups and downs in Latin America, continue to view the growth opportunities in the region.

NII — which is based out of Reston, VA — was traded on Nasdaq and had a market cap as of last market close, of just $322 million. The company currently has 3.3 million subscribers. But while it was reportedly looking for a buyer of the business in Brazil, its last remaining asset, for some time, this final price — at nearly three times its market cap — is a sign of how some might see locked up value in Nextel Brazil that exceeded all that.

Last week, Paypal and Dragoneer collectively committed $850 million towards MercadoLibre, a marketplace in Argentina. The week before that, SoftBank announced that it would set up a new $2 billion fund to invest in tech companies out of the region, and to help existing portfolio companies to expand there. (By coincidence, the SoftBank venture will be led by Marcelo Claure, who is also executive chairman of Sprint, which swallowed up the US part of Nextel years ago and eventually got acquired by SoftBank.)

Powered by WPeMatico

Slack hands over control of encryption keys to regulated customers

Slack announced today that it is launching Enterprise Key Management (EKM) for Slack, a new tool that enables customers to control their encryption keys in the enterprise version of the communications app. The keys are managed in the AWS KMS key management tool.

Geoff Belknap, chief security officer (CSO) at Slack, says the new tool should appeal to customers in regulated industries who might need tighter control over security. “Markets like financial services, healthcare and government are typically underserved in terms of which collaboration tools they can use, so we wanted to design an experience that catered to their particular security needs,” Belknap told TechCrunch.

Slack currently encrypts data in transit and at rest, but the new tool augments this by giving customers greater control over the encryption keys that Slack uses to encrypt messages and files being shared inside the app.

He said that regulated industries in particular have been requesting the ability to control their own encryption keys, including the ability to revoke them if it was required for security reasons. “EKM is a key requirement for growing enterprise companies of all sizes, and was a requested feature from many of our Enterprise Grid customers. We wanted to give these customers full control over their encryption keys, and when or if they want to revoke them,” he said.

Screenshot: Slack

Belknap says this is especially important when customers involve people outside the organization, such as contractors, partners or vendors in Slack communications. “A big benefit of EKM is that in the event of a security threat or if you ever experience suspicious activity, your security team can cut off access to the content at any time if necessary,” Belknap explained.

In addition to controlling the encryption keys, customers can gain greater visibility into activity inside of Slack via the Audit Logs API. “Detailed activity logs tell customers exactly when and where their data is being accessed, so they can be alerted of risks and anomalies immediately,” he said. If a customer finds suspicious activity, it can cut off access.

EKM for Slack is generally available today for Enterprise Grid customers for an additional fee. Slack, which announced plans to go public last month, has raised more than $1 billion on a $7 billion valuation.

Powered by WPeMatico

Decade in review: Trends in seed- and early-stage funding

We’ve decided to step back from the breaking news for a minute to conduct a review of seed and early-stage funding trends over the last decade for U.S.-based companies.

I’m fairly certain we can all agree that the environment for startups has changed dramatically in the past 10 years, specifically in two major ways:

- The development of seed funding as its own class and;

- The expansion of growth stage investing.

What we’ve also seen are recent concerns raised about the decline in seed stage funding by Mark Suster, a partner at UpFront Ventures, as there has not been commensurate growth in early stage funding (Series A and B), to meet this growth in seed-financed companies. This is often expressed as the Series A crunch.

So with venture funding at an all-time high, along with increased growth in supergiant rounds, now seems like an appropriate time to conduct this kind of review.

Setting the stage

First, let’s set the stage for our analysis and explain where our data comes from with a few quick facts:

- Rounds below $1 million can be the most difficult to capture adequately as many angel and pre-seed deals are not reported.

- Luckily, Crunchbase has an “active founder community” that adds early stage financings.

- By “active founder community” we are referring to many founders who are active on Crunchbase adding their company, themselves as founders, and their fundings.

- Around 47 percent of fundings below $5 million in the U.S. are added by contributors, as distinct from our analyst teams who process the news, track Twitter, and work directly with our venture partners.

- For this study, we bucket U.S. funding rounds by size to indicate stage.

- Given the high percentage of self-reported seed financing, data added after the end of a quarter needs to be factored in.

- For this reason we use projected data for many of the Crunchbase quarterly reports in order to more accurately reflect recent funding trends. For the charts below we are using actual data, with some provisions for the data lag when discussing the trends.

Now, let’s take a look at the trends.

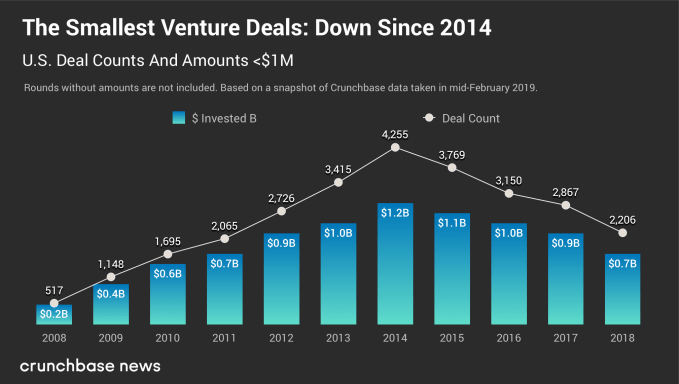

Rounds below $1 million are slumping

Since 2014 we have seen mostly double-digit declines in less than $1 million rounds each year – a strong pivot from 2008-2014 when we saw double-digit growth.

In 2018 seed funding counts and amounts below $1 million were down from 2015 at 41 and 35 percent respectively. Given that data at this stage can be added long after the round took place, we assess there could be a 20 percentage-point relative increase in 2018 compared to 2017.

If we factor this in, 2018 seed funding counts and amounts below $1 million are down from 2015 at 30 and 23 percent respectively. In other words, seed below $1 million are closer to 2012 and 2017 levels.

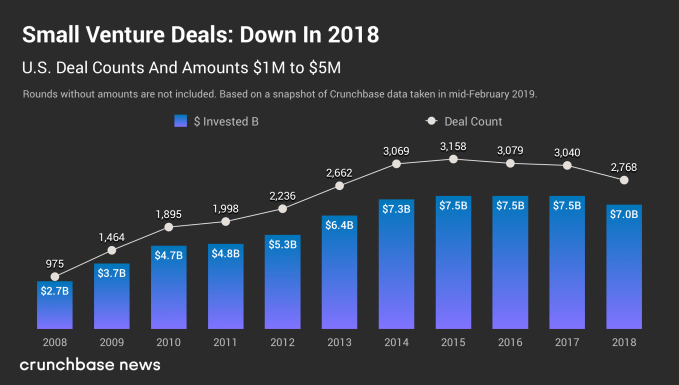

$1 million to $5 million rounds are flattening

Round from $1 million to $5 million also experienced growth from 2008 through 2015, more than threefold for counts and close to threefold for amounts. Upward growth stalled from 2015. However, we do not see a substantial downward trend in the last three years. Dollars invested are stable at $7.5 billion from 2015 through 2017. Counts and amounts are down in 2018 from the 2015 height by 12 percent for deal count and 6 percent for amounts.

At Crunchbase we are always cautious about reporting downward trends for the most recent year or quarter, as data does flow in after the close of the most recent time period. If the trend is over a greater time period, that is a stronger signal for change in the market. Based on data continuing to be added after the end of a year for the previous year, we assess around 10 percentage point increase relative to 2017. This would make 2018 roughly equivalent to 2017 on rounds and slightly up on amounts.

Seed funds take bigger stakes

Why is seed flattening? Seed investors report putting more dollars into fewer deals. Or as they raise more substantial subsequent funds, they are putting more dollars into the same number of transactions. Seed funds need to get enough equity for a meaningful stake, should a startup survive to raise subsequent rounds. Seed funds are investing in fewer startups for more equity.

Larger venture funds taking a less active role in seed

UpFront Ventures’ Suster (referenced earlier) also talks about larger venture firms becoming less active in seed, as investing at the seed stage can limit their ability down the road to invest in competitive startups who emerge as growing contenders in a specific sector. The growth of more substantial funds in venture allows firms to see deals mature before investing, perhaps paying more to get the equity they want, and allowing startups not growing as quickly to fail or get acquired.

As Fred Wilson from Union Square Ventures notes, “In the first five years of this decade, we saw the seed portion of the market explode. In the last five years of this decade we saw the growth portion of the market explode. But over those last ten years, the middle part, the traditional venture capital market, has not changed much.”

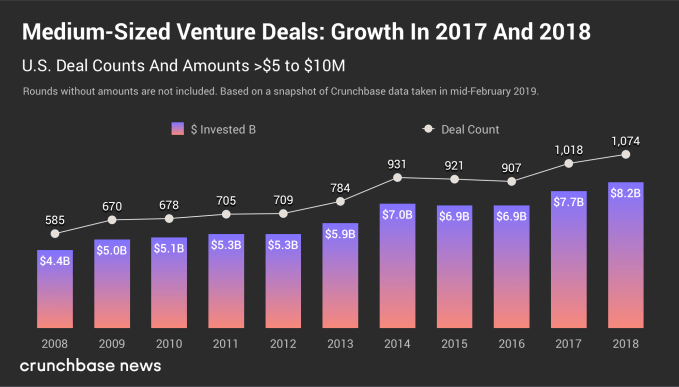

The middle is growing

For the middle, Series A and B rounds (which used to be the first institutional money in), the market for $5 million to $10 million rounds has almost doubled, but it has taken from 2008 to 2018. In that same period, growth has been slower than round below $5 million. Growth has continued past 2015. Since 2015, rounds are down slightly for one year, and then continue to grow in 2017 and 2018. Counts are up from 2015 by 17 percent and dollars by 18 percent.

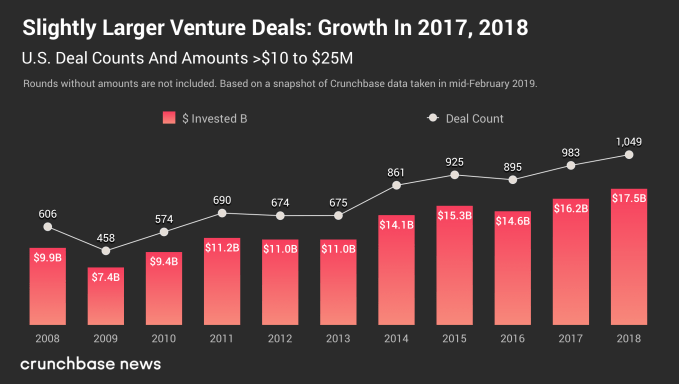

$10 to $25 million rounds are growing

Rounds of $10 million to $25 million have grown over 11 years by 73 percentage points for counts, and 78 percentage points for amounts. This is a slower pace than $5 million to $10 million rounds, but continuing to edge up year over year.

Seed is maturing

Seed is its own class that is here to stay. Indeed pre-seed, seed and seed extension all seem to have specific dynamics. Of the 600-plus active seed funds who have raised a fund below $100 million, close to half have raised more than one fund. In the last three years in the U.S. we have not seen a slowing of seed funds raised for $100 million and below.

Conclusion

When we take into account the data lag, dollars for below $5 million is projected to be $8.5 billion, close to the height in 2015 of $8.6 billion. Deal counts are down from the height by a fifth, which does mean less seed-funded startups in the U.S. Provided that capital allocation is greater than $5 million continues to grow, less seed funded startups will die before raising a Series A. More companies have a chance to succeed, which is good for seed funds, and ultimately for the whole ecosystem.

Powered by WPeMatico

To get big faster, younger unicorns start buying startups sooner

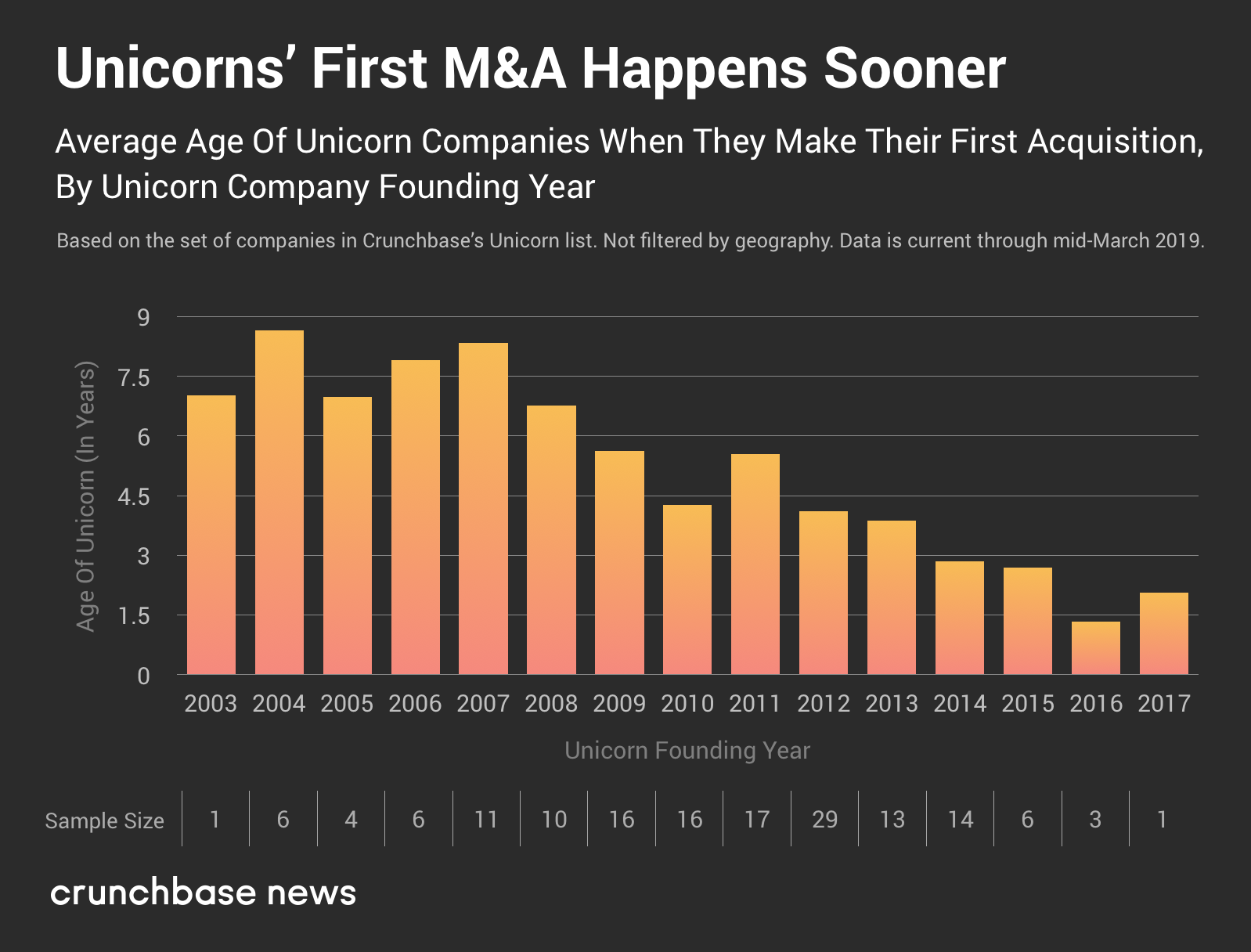

In the name of getting big quick, it seems like some of the most valuable private tech companies are turning to mergers and acquisitions (M&A) as a way to accelerate business growth. So-called “unicorns”—privately-held technology companies which achieve billion-dollar valuations sometime before (or as a direct result of) going public or exiting via M&A—are chomping at the bit to make their first acquisitions, suggesting a mounting pressure on companies to grow even quicker.

Analysis of Crunchbase data indicates that, on average, recently founded unicorn companies are more likely to make their first M&A transactions sooner after founding than their older counterparts. In other words, younger unicorns buy other companies earlier. Here’s the data.

The narrowing gap between founding and first M&A

Using M&A data for companies in Crunchbase’s unicorn list, we found out when unicorn companies made their first M&A transactions on average. (We detail a bit more of the methodology in a note at the end.) Companies founded in more recent years were quickest to hit the M&A trail.

Eleven unicorn companies founded in 2007 took an average of roughly 8.33 years before making their first acquisitions. At time of writing, 29 unicorns founded in 2012 have made their first startup purchases, averaging just 4.1 years before doing so.

Note that there’s a bit of a sampling bias here. To an extent, it’s expected that unicorn companies founded in more recent years will have a lower average age of first acquisition, because there are many unicorn companies which haven’t yet made their first M&A deals.

The bulk of all M&A transactions by unicorns (not just the first ones) occur within the first seven years after founding.

We should take recent years’ dramatic reduction in average time until first acquisition with a heftier grain of salt (again, there are plenty of unicorns which haven’t yet gone shopping for startups). Even with that caveat made, averages have steadily trended lower between 2007 and 2012, after remaining steady (across an admittedly small sample set) since the start of the unicorn era.

This suggests that younger unicorns are increasingly using M&A transactions as a way to accelerate their path to massive market power.

It’s a big move for a company to buy another one. There’s all the financial particulars to negotiate, the legal and regulatory hurdles to clear, and the inevitable friction of integrating teams and technology from one entity with another. And that’s when the process is amicable and goes smoothly. The amount of time and resources a company commits to carrying out an M&A strategy is nontrivial, so it’s understandable why a company would put this process off to a later date or eschew it entirely. That high-growth tech companies are pursuing such a time and energy-intense strategy earlier on in the venture life-cycle points to the benefits M&A can bring to startups seeking to scale speedily.

Methodology notes

We found this by analyzing the set of acquisitions made by companies in Crunchbase’s list of unicorns, which we used as a proxy for “high-performing private technology companies” as a collective whole. We found the time elapsed between unicorns’ listed founding dates (which, note, have varying levels of precision) and the date of their first-ever acquisitions, regardless of whether the acquirer had achieved unicorn status. We then plotted the resulting data in a couple of ways.

More information about Crunchbase News’s methodology can be found on a dedicated page on this site.

Powered by WPeMatico

Pre- and Post-Money SAFEs: Choosing the right one for your startup

Contributor

With Y Combinator’s Demo Day taking place at Pier 48 in San Francisco next week, its largest batch of companies ever is getting ready to present to an audience of select investors. Having taken Atrium through Demo Day myself, I have first-hand knowledge of the process. When the founders have finished their pitches, the time to talk numbers will closely follow. Chief among the many decisions founders will face during this time is whether to opt for the Pre-Money SAFE or the new Post-Money SAFE, the two standardized legal documents that YC has introduced in recent years.

Both versions are meant to make the process fast, easy and fair for both parties in the early-stage fundraising process. But there are crucial differences between the two that founders should examine carefully.

Essentially, the Pre-Money SAFE is exceptionally favorable to founders because it gets them pre-valuation funding like a convertible note, but debt-free. The Post-Money SAFE sweetens some of the terms for investors, like locking in their percentage ownership in a priced round later on.

Overall, we expect the Post-Money version to become more common, especially if the company is raising a round above $1 million or $2 million, and the investors have more leverage to ask for it in the negotiation.

(Note: This article is aimed at giving founders a general understanding of the changes from Pre-Money SAFEs to Post-Money SAFEs. The information provided is based on my professional experience and opinions, and should not be used without careful consideration and advice by qualified advisors and legal counsel. Also, to learn more and ask questions about Pre and Post-Money SAFEs, join me on April 16th for a webinar where I’ll dive in a bit deeper.)

Two structures for raising startup investment

Today there are two general ways of structuring a startup fundraising round. The first can be called a “priced equity round,” and is characterized by the sale of preferred stock with a fixed valuation.

Powered by WPeMatico

Startups Weekly: Uber’s headline-grabbing week and sextech at SXSW

I spent the week at SXSW, Austin’s really, really huge technology, music, comedy and film festival. It’s my first year making the trek down here for the event, which I did to interview sextech entrepreneur Lora DiCarlo founder Lora Haddock, whose robotics innovation reward was infamously revoked at this year’s CES.

“I brush my teeth and I masturbate. It’s all normal,” she said, addressing the stigma surrounding female-focused pleasure tech. Haddock, during our chat, also announced the first-ever government grant for a sextech startup, a $99,637 funding for Lora DiCarlo from the state of Oregon. Lora DiCarlo plans to release its first product, the Osé, this fall.

Here’s what happened while I was wondering confused around Austin.

Uber dominated the news cycle this week; here’s the TL;DR. The ride-hailing company is probably, most likely going to unveil its S-1 next month and it’s tying up some loose ends ahead of its big IPO. Uber wants to raise roughly $1 billion at a valuation of between $5 billion and $10 billion for its autonomous vehicles unit — yes, the same one that was burning through $20 million per month. Waymo, similarly, is looking to raise outside capital for the first time for its AV efforts.

Top TPG dealmaker caught in college admissions scandal

Bill McGlashan, who built his career as a top investor at the private equity firm TPG, was fired (or maybe quit?) says the firm after he was caught up in what the Justice Department said is the largest college admissions scandal it has ever prosecuted. Even worse, McGlashan lead TPG’s social impact strategy under the Rise Fund brand, making the charges particularly damning.

HotelTonight and Slack stakeholder Accel raised $2.525 billion, sources confirm to TechCrunch; $525 million for its fourteenth early-stage fund, $1.5 billion for its fifth growth fund and $500 million for its second Leaders Fund, or a dedicated pool of capital meant to help the firm strengthen its positions on particularly competitive bets. Plus, 137 Ventures announced its fourth fund with $210 million in committed capital. The firm provides liquidity to founders and early employees of “sustainable, fast-growing, private companies.” In essence, 137 Ventures buys shares directly from employees at unicorn tech companies, like Palantir, Flexport and Airbnb.

Last week, we reported Y Combinator president Sam Altman would be stepping down to focus on OpenAI. TechCrunch’s Connie Loizos questions whether he had a positive or negative influence on the accelerator during his presidency. Altman was part of the first YC startup class in 2005 and began working part-time as a YC partner in 2011. He was ultimately made the head of the organization five years ago.

Brian O’Malley’s HotelTonight win

Forerunner Ventures general partner Brian O’Malley went long on HotelTonight and it paid off. For your weekend reading, we thought you might enjoy an oral history from O’Malley about how he stumbled upon HotelTonight and remained connected to the company across its nine-year history.

Here’s your weekly reminder to send me tips, suggestions and more to kate.clark@techcrunch.com or @KateClarkTweets.

- Drivezy is raising $100M+ at a $400M valuation, eyes US expansion

- Newsela gets $50M to expand its content repository

- AgroStar gets $27M Series C to give more Indian farmers increased crop production with data analytics

- Investing app Stash raises $65M

- Truepill, the ‘AWS for pharmacies,’ raises $10M from Initialized Capital

- Flight-hailing app BlackBird raises $10M to replace driving with flying

In an announcement that shocked VC Twitter, Tiger Global announced that Lee Fixel, whom Bill Gurley once said is one of the smartest investors on the scene, is leaving the firm at the end of June. Scott Shleifer and Chase Coleman will continue as co-managers of the portfolios Fixel has overseen, with Shleifer taking over as its head. “Lee has been a driving force behind the expansion of Tiger Global’s private equity investing activities in the United States and India, and he has distinguished himself as a world-class investor across multiple sectors and stages,” the firm stated. And on the hiring front, Canvas Ventures is expanding its team of three general partners to four with the hiring of Mike Ghaffary, a former general partner at Social Capital.

Subscribers to TechCrunch’s premium content can learn which types of startups are most often profitable.

YC demo days are coming up quick. The TechCrunch staff has been meeting with YC startups and documenting their journey through the startup accelerator. I spoke to YourChoice Therapeutics, a startup developing unisex, non-hormonal birth control, and Bottomless, which operates a direct-to-consumer coffee delivery service. TechCrunch’s Lucas Matney wrote about Jetpack Aviation, a YC startup, and its $380,000 flying motorcycle, and Adventurous, an augmented reality scavenger hunt crafted for families. TechCrunch’s Megan Rose Dickey spoke to Ysplit, which wants to make it so you never have to owe anyone money ever again.

This week on Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines, Crunchbase News’ editor-in-chief Alex Wilhelm and TechCrunch’s Connie Loizos discuss Uber’s IPO and Stash’s big round. Listen here.

Want more TechCrunch newsletters? Sign up here.

Powered by WPeMatico