MoviePass co-founder’s new startup PreShow gives you free movie tickets for watching ads

As founding CEO of MoviePass, Stacy Spikes has already changed the way we think about paying for movie tickets. Now he’s pursuing a new approach — providing a free ticket to people who watch 15 to 20 minutes of ads.

Spikes noted that when it comes to watching movies outside the theater, there are three basic business models — pay-per-view, subscription and ad-supported. MoviePass brought a subscription approach into theaters, but Spikes (who stepped down as MoviePass CEO in 2016) told me he kept wondering, “Well, why can’t you have an ad-supported version that will allow you to go to movies for free?”

It’s hard to imagine digital advertising being worth enough to really pay for that ticket, but Spikes insisted, “You’re paying your way. This is not going to be a loss-leader model. It’s an ad-revenue based business.”

To make that work, he said the new service, called PreShow, is bringing a of couple innovations to the table. First, there’s facial recognition technology that ensures you’re actually present and watching the ad.

Spikes demonstrated this feature for me last week, showing me how his face unlocked the PreShow app. Once he’d chosen the film he wanted to watch, he was presented with a package of video ads that were specifically selected to run with that movie — and any time he looked away from the screen or moved too far away from his phone, the ads would stop playing. (Apparently the sensitivity can be dialed up or down depending on user feedback.)

Spikes also said the ads should tie into the film in some way, whether that’s thematically, or by highlighting products that are also featured in the movie. And they’ll always include an opportunity to further engage with the advertiser.

So although 15 to 20 minutes might sound like a long time to watch ads, it should be more interesting for the viewer than just a random collection of promotional videos. And for the advertisers that are already paying for product placement in a film, this could be a way to reinforce their message with consumers who are actually watching the movie. (Spikes also compared this to the marketing packages that usually play before showtime in theaters — hence the company name.)

By watching one of these 15 to 20-minute packages, you should earn enough points to purchase a ticket at the theater using a virtual credit card provided by PreShow. Technically, those points can be used to buy any movie ticket, but Spikes said you won’t be able to earn more than two tickets at once, “so people don’t stockpile.”

As for whether PreShow is competing with his old company, Spikes said, “I don’t think they’re competitive in any way. If you compare a subscription platform to an ad platform to a pay-per-view platform, they’re different animals.”

Stacy Spikes

The plan is to start testing the service with a select group of users in the next three to six months, and to find those users, PreShow is launching a Kickstarter campaign today. Pledge levels range from $15 to $60, with the amount you pay determining how early you get access, and how many friend invites you receive.

Spikes said he’s less interested in raising money (which is why the campaign’s official goal is only $10,000) and more in attracting film lovers who want to try the app.

“It’s a way to have innovation happen more organically, versus if you just open it up for the general public,” Spikes said.

Powered by WPeMatico

Xbox One S is reportedly getting a disc-free version in May

The writing has been on the wall for physical media for a while now. In May, Microsoft is reportedly set to hammer another nail into that coffin with the launch of the Xbox One S All-Digital. As advertised, the latest version of the console will drop the Blu-ray drive in favor of an all downloadable experience.

Rumors about the XOSAD have been floating around since last year — when the console still went by the decidedly Top Gunny name of “Maverick.” A new report from Windows Central offers more insight into the system, along with a potential May 7 release date — which puts it roughly in line with those initial reports.

The system is said to offer 1TB of storage, which should serve players well in the transition away from discs. It also apparently will be bundled with a handful of download codes to get started, including Minecraft, Forza Horizon 3 and Sea of Thieves.

With the obvious lack of disc drive, the system looks more or less identical to the standard One S. As for pricing, we expect it to be more affordable than its predecessor. The move is part of a broader push from Microsoft to wean games off physical media. It’s a play that also includes digital-first services like the Xbox Game Pass.

Powered by WPeMatico

Razer hooks up with Tencent to focus on mobile gaming

Razer is summoning a big gun as it bids to develop its mobile gaming strategy. The Hong Kong-listed company — which sells laptops, smartphones and gaming peripherals — said today it is working with Tencent on a raft of initiatives related to smartphone-based games.

The collaboration will cover hardware, software and services. Some of the objectives include optimizing Tencent games — which include megahit PUBG and Fortnite — for Razer’s smartphones, mobile controllers and its Cortex Android launcher app. The duo also said they may “explore additional monetization opportunities for mobile gaming,” which could see Tencent integrate Razer’s services, which include a rewards/loyalty program, in some areas.

The news comes on the same day as Razer’s latest earnings, which saw annual revenue grow 38 percent to reach $712.4 million. Razer recorded a net loss of $97 million for the year, down from $164 million in 2017.

The big-name partnership announcement comes at an opportune time for Razer, which has struggled to convince investors of its business. The company was among a wave of much-championed tech companies to go public in Hong Kong — Razer’s listing raised more than $500 million in late 2017 — but its share price has struggled. Razer currently trades at HK$1.44, which is some way down from a HK$3.88 list price and HK$4.58 at the end of its trading day debut. Razer CEO Min Liang Tan has previously lamented a lack of tech savviness within Hong Kong’s public markets despite a flurry of IPOs, which have included names like local services giant Meituan.

Nabbing Tencent, which is one of (if not the) biggest games companies in the world, is a PR coup, but it remains to be seen just what impact the relationship will have at this stage. Subsequent tie-ins, and potentially an investor, would be notable developments and perhaps positive signals that the market is seeking.

Still, Razer CEO Min Liang Tan is bullish about the company’s prospects on mobile.

The company’s Razer smartphones were never designed to be “iPhone-killers” that sold on volume, but there’s still uncertainty around the unit with recent reports suggesting the third-generation phone may have been canceled following some layoffs. (Tan declined to comment on that.)

Mobile is tough — just ask past giants like LG and HTC about that… and Razer’s phone and gaming-focus was quickly copied by others, including a fairly brazen clone effort from Xiaomi, to make sales particularly challenging. But Liang maintains that, in doing so, Razer created a mobile gaming phone market that didn’t exist before, and ultimately that is more important than shifting its own smartphones.

“Nobody was talking about gaming smartphones [before the Razer phone], without us doing that, the genre would still be perceived as casual gaming,” Tan told TechCrunch in an interview. “Even from day one, it was about creating this new category… we don’t see others as competition.”

With that in mind, he said that this year is about focusing on the software side of Razer’s mobile gaming business.

Tan said Razer “will never” publish games as Tencent and others do, instead, he said that the focus is on helping discovery, creating a more immersive experience and tying in other services, which include its Razer Gold loyalty points.

Outside of gaming, Razer is also making a push into payments through a service that operates in Southeast Asia. Fueled by the acquisition of MOL one year ago, Razer has moved from allowing people to buy credit over-the-counter to launch an e-wallet in two countries, Malaysia and Singapore, as it goes after a slice of Southeast Asia’s fintech boom, which has attracted non-traditional players that include AirAsia, Grab and Go-Jek, among others.

Powered by WPeMatico

Windows Virtual Desktop is now in public preview

Last year, Microsoft announced the launch of its Windows Virtual Desktop service. At the time, this was a private preview, but starting today, any enterprise user who wants to try out what using a virtual Windows 10 desktop that’s hosted in the Azure cloud looks like will be able to give it a try.

It’s worth noting that this is very much a product for businesses. You’re not going to use this to play Apex Legends on a virtual machine somewhere in the cloud. The idea here is that a service like this, which also includes access to Office 365 ProPlus, makes managing machines and the software that runs on them easier for enterprises. It also allows employers in regulated industries to provide their mobile workers with a virtual desktop that ensures that all of their precious data remains secure.

One stand-out feature here is that businesses can run multiple Windows 10 sessions on a single virtual machine.

It’s also worth noting that many of the features of this service are powered by technology from FSLogix, which Microsoft acquired last year. Specifically, these technologies allow Microsoft to give the non-persistent users relatively fast access to applications like their Outlook and OneDrive applications, for example.

For most Microsoft 365 enterprise customers, access to this service is simply part of the subscription cost they already pay — though they will need an Azure subscription and to pay for the virtual machines that run in the cloud.

Right now, the service is only available in the US East 2 and US Central Azure regions. Over time, and once the preview is over, Microsoft will expand it to all of its cloud regions.

Powered by WPeMatico

Microsoft Defender comes to the Mac

Microsoft today announced that it is bringing its Microsoft Defender Advanced Threat Protection (ATP) to the Mac. Previously, this was a Windows solution for protecting the machines of Microsoft 365 subscribers and assets of the IT admins that try to keep them safe. It was also previously called Windows Defender ATP, but given that it is now on the Mac, too, Microsoft decided to drop the “Windows Defender” moniker in favor or “Microsoft Defender.”

“For us, it’s all about experiences that follow the person and help the individual be more productive,” Jared Spataro, Microsoft’s corporate VP for Office and Windows, told me. “Just like we did with Office back in the day — that was a big move for us to move it off of Windows-only — but it was absolutely the right thing. So that’s where we’re headed.”

He stressed that this means that Microsoft is moving off its “Windows-centric approach to life.” He likened it to bringing the Office apps to the iPad and Android. “We’re just headed in that same direction of saying that it’s our intent that we can secure every endpoint so that this Microsoft 365 experience is not just Windows-centric,” Spataro said. Indeed, he argued that the news here isn’t even so much the launch of this service for the Mac but that Microsoft is reorienting the way it thinks about how it can deliver value for Microsoft 365 clients.

Given that Microsoft Defender is part of the Microsoft 365 package, you may wonder why those users would even care about the Mac, but there are plenty of enterprises that use a mix of Windows machines and Mac, and which provide all of their employees with Office already. Having a security solution that spans both systems can greatly reduce complexity for IT departments — and keeping up with security vulnerabilities on one system is hard enough to begin with.

In addition to the launch of the Mac version of Microsoft Defender ATP, the company also today announced the launch of new threat and vulnerability management capabilities for the service. Over the last few months, Microsoft had already launched a number of new features that help businesses proactively monitor and identify security threats.

“What we’re hearing from customers now is that the landscape is getting increasingly sophisticated, the volume of alerts that we’re starting to get is pretty overwhelming,” Spataro said. “We really don’t have the budget to hire the thousands of people required to sort through all this and figure out what to do.”

So with this new tool, Microsoft uses its machine learning smarts to prioritize threads and present them to its customers for remediation.

To Spataro, these announcements come down to the fact that Microsoft is slowly morphing into more of a security company than ever before. “I think we’ve made a lot more progress than people realize,” he said. “And it’s been driven by the market.” He noted that its customers have long asked Microsoft to help them protect their endpoints. Now, he argues, customers have realized that Microsoft is moving to this person-centric approach (instead of a Windows-centric one) and that the company may now be able to help them protect large parts of their systems. At the same time, Microsoft realized that it could use all of the billions of signals it gets from its users to better help its customers proactively.

Powered by WPeMatico

Despite short-term questions, games software/hardware to top $200 billion by 2023

Contributor

There has been some negative sentiment surrounding the games industry recently, with stock prices of public games companies in question in both the U.S. and China. While being contrarian to market sentiment is always risky, it’s also possible that folks might be taking a long-term solution to a short-term problem. Games industry software/hardware combined revenue could drive well over $200 billion of revenue by 2023, and there was a record $5.7 billion investment in games companies in 2018. So what’s going on?

The games industry isn’t one monolithic sector. Depending on how you slice it, the market is made up of 15 sectors, eight platform types (e.g. mobile, PC, console) and even more proprietary hardware/software platforms (e.g. iOS, Android, Xbox One, Sony PS4, Nintendo Switch).

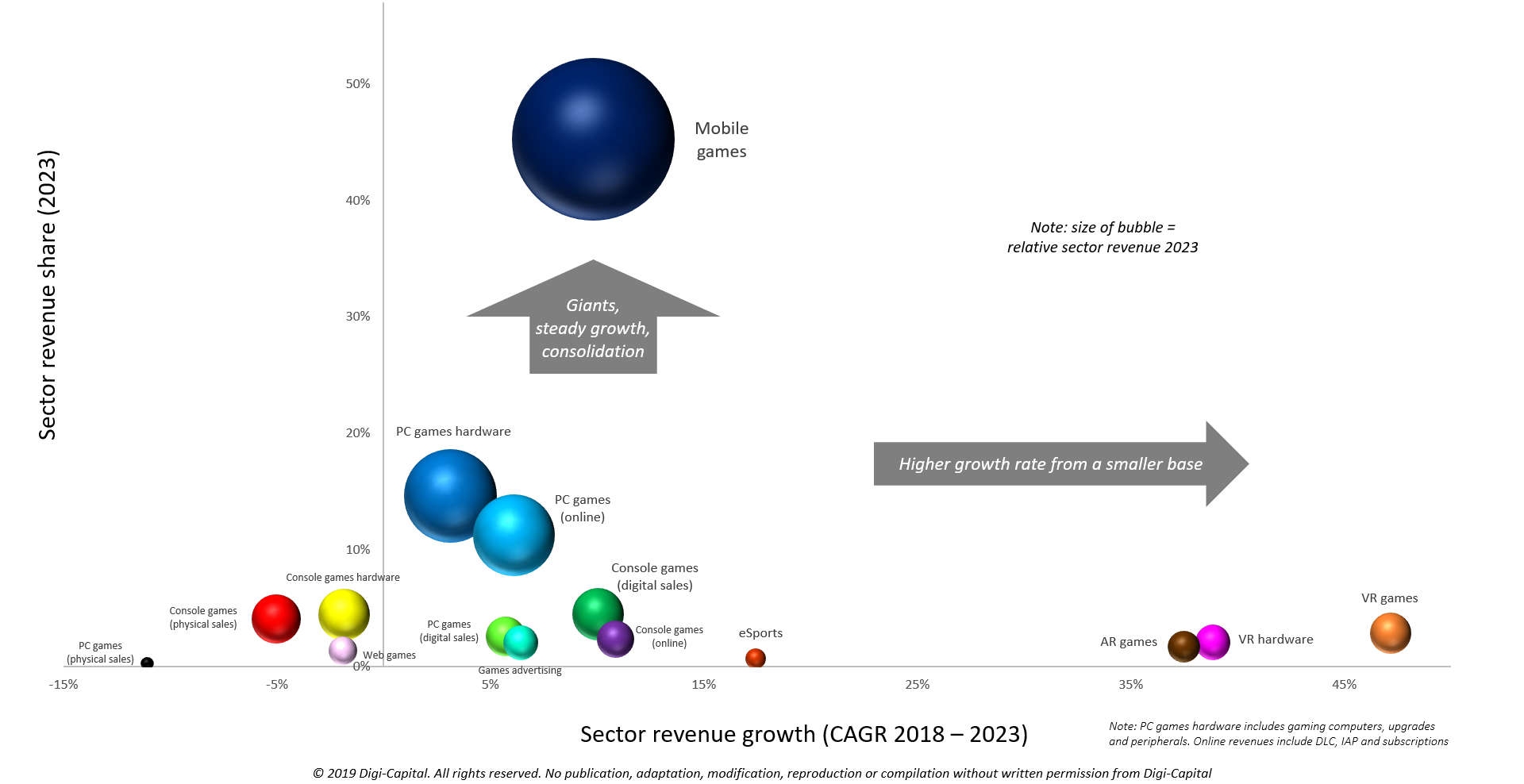

Games software/hardware sector revenue share versus growth (2018-2023)

(Note: See selected data below. Free charts do not include all the numbers, axes and data from Digi-Capital’s Games Report, with underlying data sourced directly from companies and reliable secondary sources.)

Mobile games rule

We first forecast mobile’s dominance of the games market way back in 2011. At that time, many traditional games companies didn’t believe mobile/online games could become the driving force for games. Some of those companies no longer exist, so what’s happening today is nothing new.

Total global mobile app store revenues (gross across games and non-games apps, including app store revenue share) topped $100 billion for the first time in 2018. Mobile games delivered around three quarters of that number, as they have consistently for years. So where mobile games drove more than $70 billion gross revenue globally last year, they could top $100 billion revenue (again gross, including app store revenue share) in their own right in the next five years. But like all games sectors, mobile games are hit-driven. And this could be the source of some of the mismatch between the market’s understanding of short-term trends and long-term potential.

For example, Supercell’s Clash of Clans and Clash Royale have delivered over $10 billion revenue to date. However, Supercell also saw revenues and profits decline in 2018 for the second year in a row as its franchises matured. Yet Supercell’s newest franchise, Brawl Stars, delivered $100 million revenue within its first two months. Swings and roundabouts.

Epic Games had the biggest breakout mobile games hit of 2018, with Fortnite contributing significantly to a reported $3 billion profit in 2018. It also anchored part of the interest behind a record $1.25 billion fundraising round last year. Yet the company removed once-dominant mobile franchise Infinity Blade from the App Store, and redirected internal development resources to focus on Fortnite by closing Paragon and stopping further development on Unreal Tournament. We will come back to Fortnite in the context of mobile games becoming platforms in their own right.

Perhaps the biggest concern for mobile games after last year is China, in which the regulator ceased approving new games for most of 2018. This weighed particularly heavily on market heavyweights Tencent and NetEase, although the regulator returned to approving their games this year. However, the regulator again stopped accepting games in February, only to approve more games in March. This regulatory risk has resulted in our downgrading Chinese games revenue growth rates until a clearer long-term pattern emerges.

Niantic’s mobile AR smash Pokémon GO took just over 1 percent of mobile games revenue globally last year, and has been reported to drive some astonishingly big numbers: 800 million downloads, more than $2.5 billion lifetime revenue, 147 million MAU, 5 million DAU, 78 percent of users aged 18 to 34, 144 billion steps taken by users, 500 million visits to sponsored locations and Niantic’s valuation of nearly $4 billion (Note: Not all of these figures have been confirmed by Niantic.) Off the back of this, Niantic is exploring Pokémon GO’s potential to become a platform, with GO Snapshot challenging Snapchat, and the Niantic Real World Platform as a serious AR Cloud player. We’ll come back to these.

PC games hardware/software is big, too

PC games hardware/software is made up of four individual sectors, including PC games hardware (gaming computers, upgrades and peripherals), PC games, online (DLC, IAP and subscriptions), PC games (digital sales) and PC games (physical sales). While each subsector has different characteristics, scales and growth rates, together they make up the only part of the market close to mobile games long-term. Google’s new Stadia cloud gaming platform and competitors could also fundamentally impact high-end gaming across all platforms (not just PC). Mobile games software and PC games hardware/software combined could deliver three quarters of total games industry revenues by 2023.

Selected multiplayer PC games (ex-China)

While PC games hardware is massive, users are buying that hardware mainly to play MMO/MOBA games. This part of the market is consolidated around franchises from major public games publishers such as Tencent and Activision Blizzard, as well as independents like Wargaming and Bluehole.

The console abides

Console games were the market leader for games hardware/software for decades, and remain huge despite no longer being an engine of growth. The highest growth here could come from console games (digital sales) and console games (online), with console games hardware and console games (physical sales) both ex-growth long-term. Despite flattish platform growth for console games hardware/software, they could still deliver multiple tens of billions of dollars revenue by 2023.

High-growth from a low base

Of the remaining market sectors, a handful are small today but have high-growth potential long-term. These include VR games, VR hardware, AR games and esports. Yet taken individually, each sector is likely to deliver in the 1 percent to 2 percent range of total games market revenue in five years’ time. So great for indie developers, but more challenging commercially for the big guns in terms of scale.

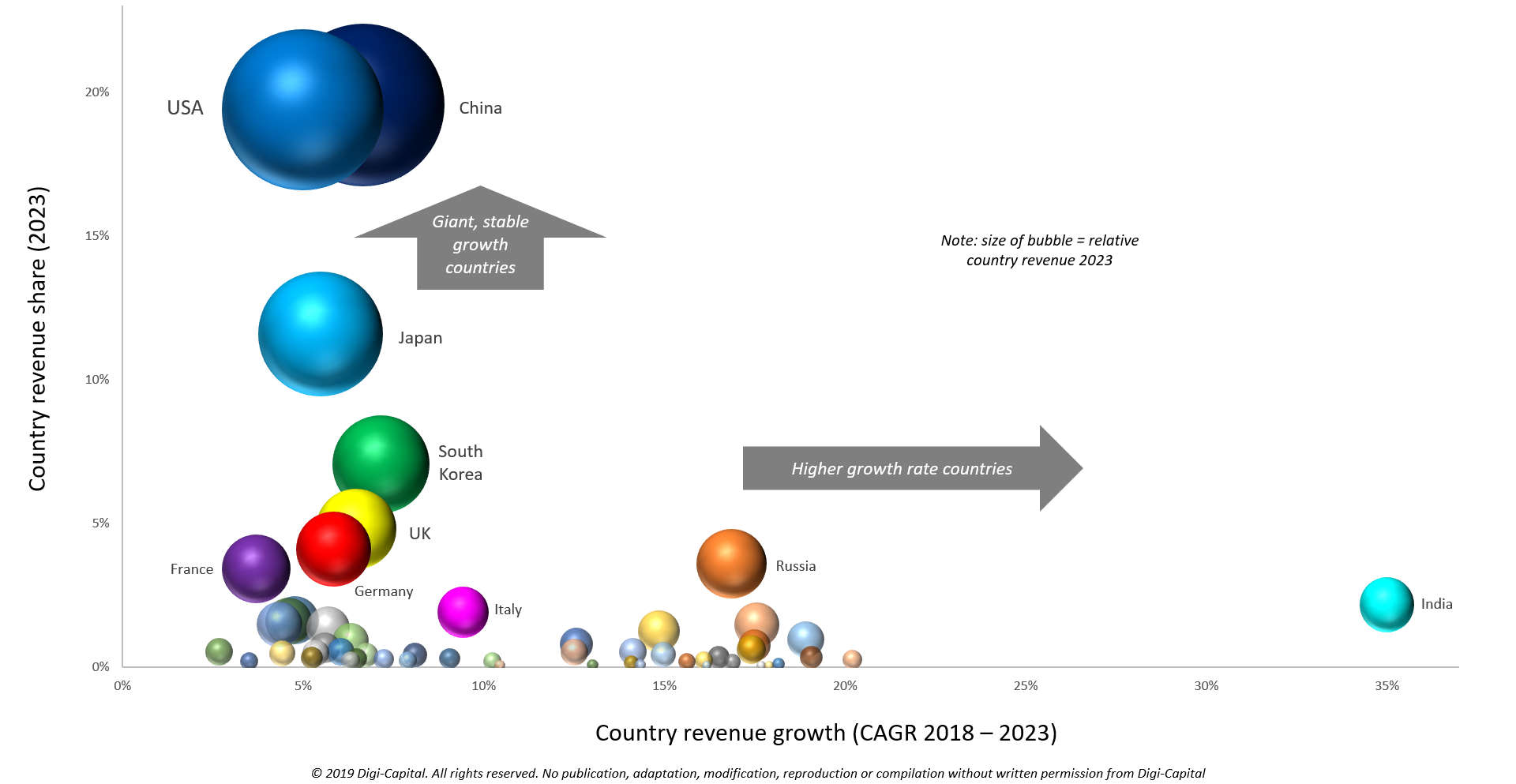

United nations of games

Geographical games market discussions tend to focus on China and the U.S., but there are more than 50 country markets driving growth at a global level. Scales and growth rates vary dramatically from giant, stable growth countries such as China (even with its current uncertainty), the U.S. and Japan to higher growth markets like India and Russia. In aggregate, Asia could take around half of global games market revenue by 2023 (despite short-term concerns about China). Europe might deliver around a quarter of global revenue, followed by North America at around one fifth in the same time frame. Countries in MEA and Latin America make up the balance at a much lower level.

Concentration versus growth

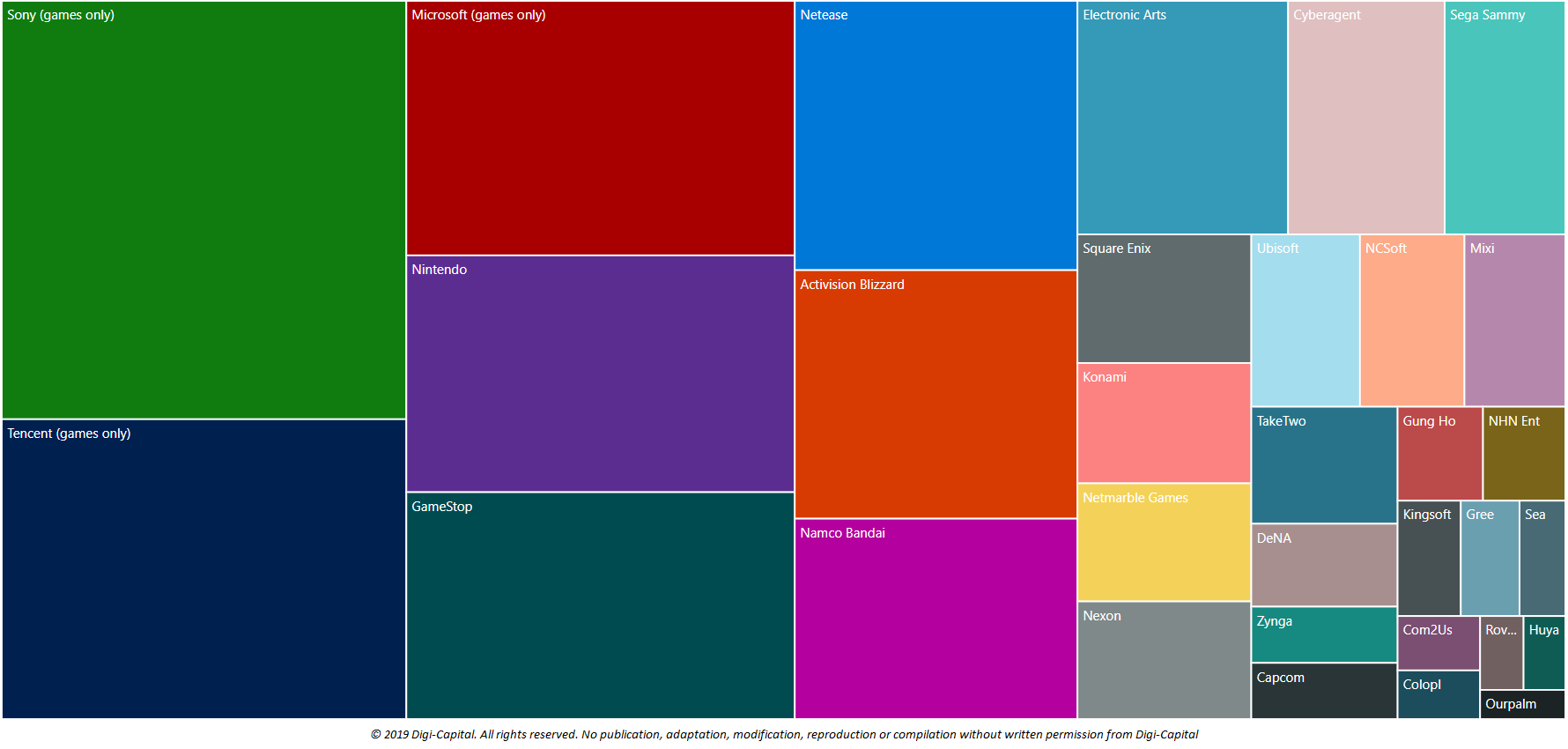

The law of big numbers caught up with the games industry years ago, with the 10 largest publicly listed games companies taking three quarters of public games company revenues globally (Note: This ratio does not include private games company revenues, which are substantial). When you already produce billions to tens of billions of dollars in revenue, high growth rates aren’t easy to come by as new hits counterbalance maturing franchises.

Public games company revenue share

(Note: Heat map displays relative revenue scale of publicly listed games companies. Private games company revenues not shown on this chart.)

Top grossing mobile games of recent years (outside China) often came from independents. Standouts include Supercell, King, Epic Games, Niantic, Machine Zone and others. Perhaps in response to this dynamic, there was more than $75 billion of games M&A over the last five years. Major games companies have been buying both growth and cash flow.

Mobile games as platforms?

The beauty of what Steve Jobs created with the App Store is that it democratized distribution of apps at scale beyond the early social games market. It also enabled indie games developers to build some of the rocket ships we’ve seen over the last decade. Yet despite massive growth, even the biggest mobile games couldn’t really be described as platforms in the traditional sense. Not yet.

Where Tencent’s WeChat messaging platform looks like a domestic app store rival with its “mini-programs,” some mobile games pureplays are taking very different routes to becoming platforms in their own right.

For Epic Games, the recent Marshmello concert in Fortnite held out the tantalizing prospect of the beginnings of the “Metaverse” on ubiquitous, affordable mobile devices. With 10.7 million concurrent attendees, this represents a significant milestone in the evolution of games as platforms. Given Fortnite’s previous records for streaming on Twitch and concurrent esports tournament viewers, the savvy Tim Sweeney is beginning to leverage all that scale in a totally new way. Together with building its own app store and the quality of its Unreal Engine, the lessons learned from Fortnite and partial owner Tencent are leading to new horizons.

Where Epic Games is building a metaverse that is a little like Ready Player One without the headsets, Niantic has taken a different approach. Leveraging the real-world, big data stream coming from Pokémon GO, Niantic is building the core of an AR cloud ecosystem to challenge Google, Apple and Facebook. It could also move the company far beyond its entertainment origins for real-world navigation, social, e-commerce, advertising and more.

Epic Games and Niantic could become two of the most valuable platform companies in the world, with long-term potential even they might not fully understand yet.

To infinity and beyond

All this potential doesn’t mean that short-term concerns aren’t valid, or that some games companies (even those currently at scale) might not fall from grace. Some of the volatility of recent times could turn out to be right on the money. When we talked to Epic Games’ CEO Tim Sweeney about all of this, he said “I think that we’re just in the final days of a long transition away from the old retail-centric game release model. Good times ahead.”

With the long-term prospects for games still looking positive, the brave, bold and lucky could have a bright future.

Powered by WPeMatico

Morphin instantly Deepfakes your face into GIFs

Want to star in your favorite memes and movie scenes? Upload a selfie to Morphin, choose your favorite GIF and your face is grafted in to create a personalized copy you can share anywhere. Become Tony Stark as he suits up like Iron Man. Drop the mic like Obama, dance like Drake or slap your mug on Fortnite characters.

Now after three years in stealth developing image-mapping technology, Morphin is ready to launch its put-you-in-a-GIF maker. While it might look like just a toy, investors see real business potential. Morphin raised $1 million last summer from Betaworks, the incubator that spawned Giphy, plus Founders Fund, Precursor, Shrug Capital and Boost.vc’s accelerator.

Elon Musk as Iron Man

“We believe in the future you’ll be able to be the main character in your own film. Imagine a super hero movie where you’re the main protagonist?,” co-founder Loic Ledoux asks. “That sounded like science fiction a few years ago and now with AI and computer vision we definitely see our tech going there.”

Ledoux also wants to reclaim faceswaps as something fun rather than a weapon for misinformation. “Deepfakes brought something pretty negative to computer vision. But it’s not all bad. It’s about how you use the tech to give people a new tool for self expressions and storytelling.” And since Morphin re-generates the whole clip from scratch with CGI animation, they look right at a glance, but clearly aren’t manipulated copies of the original video designed to fool anyone.

Kanye performs magic

Morphin started three years ago with the intention to build personalized avatars for games and VR so you could be a FIFA soccer player or Skyrim knight. Ledoux had started a 3D printing company to explore opportunities in scanning and modeling when he saw a chance to connect your real and virtual faces. He teamed up with his co-founder Nicholas Heriveaux, who’d spent 13 years working on 3D tech while modding games like Grand Theft Auto to insert his avatar and assets.

What they quickly recognized was that “People were just reacting to themselves on the screen,” ignoring the gameplay, Ledoux recalls. “Being able to see yourself as a hero was the underlying sentiment, so we focused on video completely.” Recognizable GIFs became its preferred medium, as they combine familiarity and the ability to convey complex emotions with a template that’s easy to personalize so they stand out.

Morphin’s tech no longer requires 3D scanning hardware and it works with just a regular selfie. You just snap a headshot, select a GIF from its iOS or Android app’s library and a few seconds later you have a CGI version of yourself in the scene (with no watermark) that you can export and post. “We wanted it to be super straightforward because we wanted people to relate to the content,” Ledoux notes. Over 1 million scenes have been created by 50,000 beta users, and each time a celebrity shares one of the GIFs Morphin has been sending them for marketing, scores of their followers demand to know which app they were using.

Morphin’s nine-person French team will have to keep innovating to stay ahead of avatar-making competitors like the ubiquitous Snapchat Bitmoji, Genies, Moji Edit and Mirror AI. Facebook, Microsoft and Google all have launched or are building their own avatar creators. But these typically live as 2D stickers or 3D AR animations you overlay on the real world. By using GIFs as a canvas, Morphin takes the pressure off your visage looking perfect and instead emphasizes the message you’re trying to get across.

The challenge will be for Morphin to become a consistent part of people’s communication stack. It’s easy to imagine playing with it and posting a few GIFs. But iconic new GIFs don’t emerge each day and without a social network to stay for, Morphin is at risk of becoming merely a forgotten tool. The app might need TikTok-style challenges like submitting the best personalized GIF to match a prompt or a GIF browsing feed to keep people coming back.

Turning Donald Glover into Jay Gatsby

Morphin isn’t racing to monetize yet, but sees a chance to sell longer premium video scenes à la carte or as an unlimited subscription. Ledoux eventually hopes to unlock new forms of storytelling beyond existing GIFs. There’s also a chance for Morphin to highlight sponsored clips from upcoming movies or TV shows. “In the long-term we’re more interested in the analogy of Lil Miquela and how people are interacting with digital characters,” Ledoux explains, citing a virtual pop star whose developer Brud recently raised at a $125 million valuation.

One of the most exciting things about Morphin is that it will allow people to take the spotlight no matter how they look. Often times certain races, genders and looks are unfairly excluded from starring in today’s most popular media. But Morphin could let the underrepresented take their rightful place as stars of the screen.

Your faithful author Josh Constine dropping the mic like Obama

Powered by WPeMatico

What latency feels like on Google’s Stadia cloud gaming platform

After peppering Google employees with questions regarding Stadia’s latency, pricing and supported devices, to mostly no avail, I got my hands on one of their new controllers and pressed play on the Doom 2016 gameplay they were showing off on a big-screen TV.

Things started off pretty ugly. The frame rate dropped to a fast-paced PowerPoint presentation, the resolution dipped between 4K crispness and indecipherable blurriness and latency seemed to be as much as a half-second. As the Google employees looked nervously at each other, someone grabbed the controller from me and restarted the system.

After a system restart, things moved along much, much more smoothly. But what the situation sums up is that when it comes to game streaming, things can be unpredictable. To give Google credit, they stress-tested their system by running Stadia on hotel Wi-Fi rather than taking me down to Mountain View and letting me play with Stadia under much more controlled conditions.

Stadia is Google’s cloud game-streaming service and, while there’s a lot we don’t know, the basic tenants are clear. It moves console-level gaming online into your Chrome browser and lets you access it from devices like smartphones that wouldn’t be able to handle the GPU-load initially.

Despite the initial hiccup, my experience with Stadia was largely positive. Doom 2016 was in crisp 4K and I was able to focus on the game without thinking about the service I was playing it on, which is ultimately the best endorsement of a new platform like this.

This will likely be a great service for more casual gamers, but might not be the best fit for the most hardcore users playing multi-player titles. While you may be launching this service directly from YouTube feeds of esports gamers, this is something they probably wouldn’t use. That’s because the latency between input and something being displayed onscreen isn’t imperceptible, though it’s probably good enough for the vast majority of users (myself included), which is still a worthy prize for the company’s efforts to take on the massive gaming market.

Google Stadia VP Phil Harrison wouldn’t give me a proper range of where exactly latency fell, but he did say it was less than the time it took for a human to perceive something and react — which another Google employee then told me differed person-to-person, but was generally 70ms-130ms — so I suppose the most official number we’ll get is that the latency is probably somewhere less than 70ms.

There is no hard truth here, though, because latency will really depend on your geographic proximity to the data center. Being in San Francisco, I connected to a data center roughly 50 miles away in San Jose. Google confirmed to me that not all rural users in supported countries will be able to signup for the service at launch because of this.

Other interesting things to note:

- Google said they’d confirm devices later, but when asked about iOS support at launch they highlighted that they were focused on Pixel devices at launch.

- It doesn’t sound like you’ll be able to restore purchases of games you’ve previously gotten; you’ll unsurprisingly have to buy all of your Stadia titles on the platform.

- You’ll be able to access games from YouTube streams, but there will also be an online hub for all your content and you can access games via links.

- The controller was nice and probably felt most similar to the design of Sony’s DualShock controller.

We’ll probably be hearing a lot more at Google I/O this summer, but with my first hands-on demo, the service certainly works and it certainly feels console-quality. The big freaking question is how Google prices this, because that pricing is going to determine whether it’s a service for casual gamers or hardcore gamers, and that will determine whether it’s a success.

Update: We were playing a level from Doom 2016, not Doom Eternal

Powered by WPeMatico

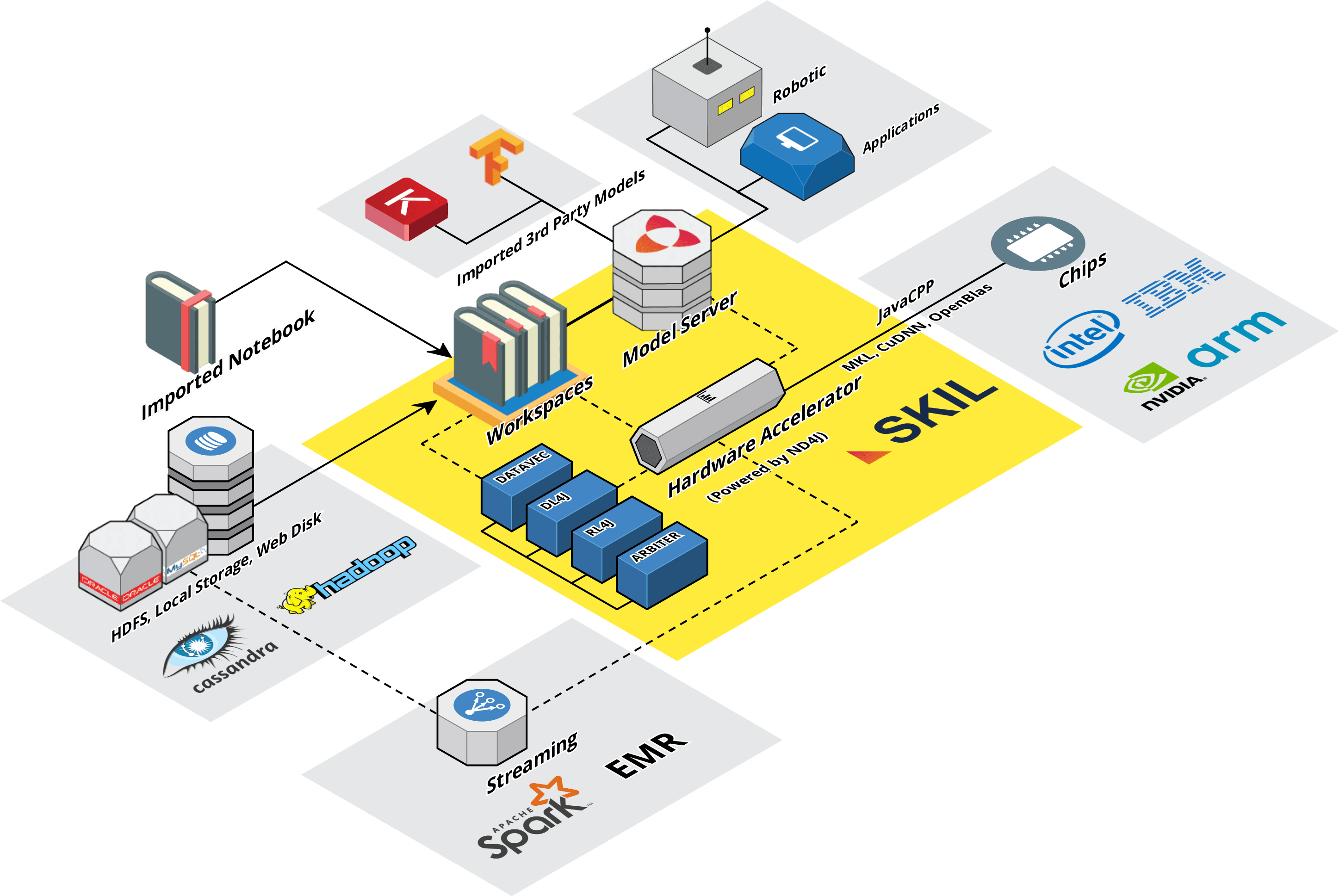

Skymind raises $11.5M to bring deep learning to more enterprises

Skymind, a Y Combinator-incubated AI platform that aims to make deep learning more accessible to enterprises, today announced that it has raised an $11.5 million Series A round led by TransLink Capital, with participation from ServiceNow, Sumitomo’s Presidio Ventures, UpHonest Capital and GovTech Fund. Early investors Y Combinator, Tencent, Mandra Capital, Hemi Ventures, and GMO Ventures, also joined the round/ With this, the company has now raised a total of $17.9 million in funding.

The inclusion of TransLink Capital gives a hint as to how the company is planning to use the funding. One of TransLink’s specialties is helping entrepreneurs develop customers in Asia. Skymind believes that it has a major opportunity in that market, so having TransLink lead this round makes a lot of sense. Skymind also plans to use the round to build out its team in North America and fuel customer acquisition there.

The inclusion of TransLink Capital gives a hint as to how the company is planning to use the funding. One of TransLink’s specialties is helping entrepreneurs develop customers in Asia. Skymind believes that it has a major opportunity in that market, so having TransLink lead this round makes a lot of sense. Skymind also plans to use the round to build out its team in North America and fuel customer acquisition there.

“TransLink is the perfect lead for this round, because they know how to make connections between North America and Asia,” Skymind CEO Chris Nicholson told me. “That’s where the most growth is globally, and there are a lot of potential synergies. We’re also really excited to have strategic investors like ServiceNow and Sumitomo’s Presidio Ventures backing us for the first time. We’re already collaborating with ServiceNow, and Skymind software will be part of some powerful new technologies they roll out.”

It’s no secret that enterprises know that they have to adapt AI in some form but are struggling with figuring out how to do so. Skymind’s tools, including its core SKIL framework, allow data scientists to create workflows that take them from ingesting the data to cleaning it up, training their models and putting them into production. The promise here is that Skymind’s tools eliminate the gap that often exists between the data scientists and IT.

“The two big opportunities with AI are better customer experiences and more efficiency, and both are based on making smarter decisions about data, which is what AI does,” said Nicholson. “The main types of data that matter to enterprises are text and time series data (think web logs or payments). So we see a lot of demand for natural-language processing and for predictions around streams of data, like logs.”

Current Skymind customers include the likes of ServiceNow and telco company Orange, while some of its technology partners that integrate its services into their portfolio include Cisco and SoftBank .

It’s worth noting that Skymind is also the company behind Deeplearning4j, one of the most popular open-source AI tools for Java. The company is also a major contributor to the Python-based Keras deep learning framework.

Powered by WPeMatico

Music’s next big startup Splice raises $57.5M to sell samples

Tech has a bad reputation for pulling money out of musicians’ pockets, but Splice is changing that. The audio sample marketplace and music production collaboration tool has now paid out $15 million to artists since 2013, doubling in the last year. Splice lets musicians sell their sounds for royalty-free use, and songs by Eminem, Ariana Grande and Marshmello that were powered by those samples have topped the charts. Splice charges $7.99 per month for unlimited access to its array of 3 million synthesizers, drum hits, vocal flares and other sounds. Despite being designed for serious musicians, Splice’s suite of tools now has 2.5 million users, up from 1.5 million a year ago.

Steve Martocci

“Music is going through a beautiful moment,” says Steve Martocci, Splice’s co-founder and CEO who formerly built and sold GroupMe. “The tailwinds from the success of streaming are great. As more people realize how big the market it, how much people want to create music, there’s a huge opportunity here.”

Now Union Square Ventures and True Ventures are seizing on that opportunity, co-leading a $57.5 million Series C for Splice. “It’s all about scale,” Martocci tells me. “We’re investing in ourselves. Continuing to build new products. Continuing to work with bigger artists. We think there’s so much about the creative process and ecosystem of musicians that needs to be fixed. We want to diversify the content available so all artists in all genres feel like we have what they need.”

The round, which includes DFJ Growth, Flybridge, Lerer Hippeau, Liontree, Founders Circle Capital and Matt Pincus, brings Splice to $104.5 million in total funding. Splice wouldn’t disclose the valuation, but using the industry standard of selling 20 percent equity for a Series C, Splice could be valued in the ballpark of $285 million. That would make it one of the top music startups that isn’t selling streaming, tickets or hardware. Its success has also begun to draw competition from companies like Native Instruments, which launched its Sounds.com marketplace last year.

Splice’s subscription revenue is pooled and then doled out to artists based on whose samples got the most downloads. Creators range from bedroom tinkerers to Drake’s Grammy-winning producer Boi-1da. Martocci confirms that artists receive the majority of Splice’s sample marketplace revenue, saying, “they’re very favorable deals.” That’s especially great for the music production industry, because a lot of Splice’s sample creators aren’t celebrity DJs; Martocci says they’re audio engineers and other “people behind the scenes getting an opportunity to step into the light with an amazing revenue opportunity, but also an opportunity to be seen for their creative contributions.”

Splice began with a eureka moment at a concert. A friend asked Martocci why there weren’t great tools for producing music like there are for building software like GroupMe. After eventually leaving his chat app that Skype acquired, Martocci connected with Splice co-founder Matt Aimonetti and discovered he’d been an audio engineer for half of his life. They saw a chance to build a GitHub for music, with version control and admin permissions for making saving and collaborating on productions simple. By 2015 Splice had launched its Sounds subscription library, and the next year began selling rent-to-own software synthesizers to make avoiding piracy affordable for creators.

Fast-forward and Martocci tells me prioritization across Splice’s different product lines will be one of its big challenges. Luckily, he has a new crew of lieutenants to help. Former product lead for Apple Music and Beats by Dre VP Ryan Walsh has joined as chief product officer because, Martocci says, “he felt like his mission in music was unfinished.” Former chief financial officer of Marvel Entertainment Chris Acquaviva is now Splice’s CFO, who offers deep licensing expertise. And bringing the creator community vibe, MakerBot’s former CHRO, Kavita Vora, has become Splice’s chief people officer.

In an era when tech public image has been tested by non-stop scandals from the industry giants, Splice is pulling in ace talent that want to work on something unequivocally positive. Martocci tells me parents tell him that their kids spend all their time playing Fortnite and making music on Splice, but the latter is screen time they’re happy to encourage.

Powered by WPeMatico