How Salesforce paved the way for the SaaS platform approach

When we think of enterprise SaaS companies today, just about every startup in the space aspires to be a platform. That means they want people using their stack of services to build entirely new applications, either to enhance the base product, or even build entirely independent companies. But when Salesforce launched Force.com, the company’s Platform as a Service, in 2007, there wasn’t any model.

It turns out that Force.com was actually the culmination of a series of incremental steps after the launch of the first version of Salesforce in February, 2000, all of which were designed to make the software more flexible for customers. Company co-founder and CTO Parker Harris says they didn’t have this goal to be a platform early on. “We were a solution first, I would say. We didn’t say ‘let’s build a platform and then build sales-force automation on top of it.’ We wanted a solution that people could actually use,” Harris told TechCrunch.

The march toward becoming a full-fledged platform started with simple customization. That first version of Salesforce was pretty basic, and the company learned over time that customers didn’t always use the same language it did to describe customers and accounts — and that was something that would need to change.

Customizing the product

Powered by WPeMatico

Could Walmart be the next big company to launch a game streaming service?

Google stole the spotlight at this year’s GDC with the launch of Stadia. What the game streaming service lacked in specifics, it more than made up for in buzz. The software giant certainly isn’t the only one eyeing the space, however. A new report from US Gamer puts Walmart in the running, as well.

The retailer has spent the last several years making a push into the high-tech sphere. It has made some high-profile acquisitions, including Jet.com, in a bid to compete with the likes of Amazon. The company has even been testing out inventory-checking robots in around 50 or so of its stores. And with the recent exit of CTO Jeremy King, it could well be looking for the next big thing.

According to the reports, Walmart has been meeting with developers and publishers at GDC. It’s tough to say how advanced these talks are, and those involved with the leaks have understandably wished to remain anonymous. The company certainly has the back-end infrastructure to attempt a service. It also has a loyal base of customers in the U.S. to whom it sells a lot of video games.

But given how it abandoned plans for a video streaming service as of January, the talks could be little more than just talk.

Powered by WPeMatico

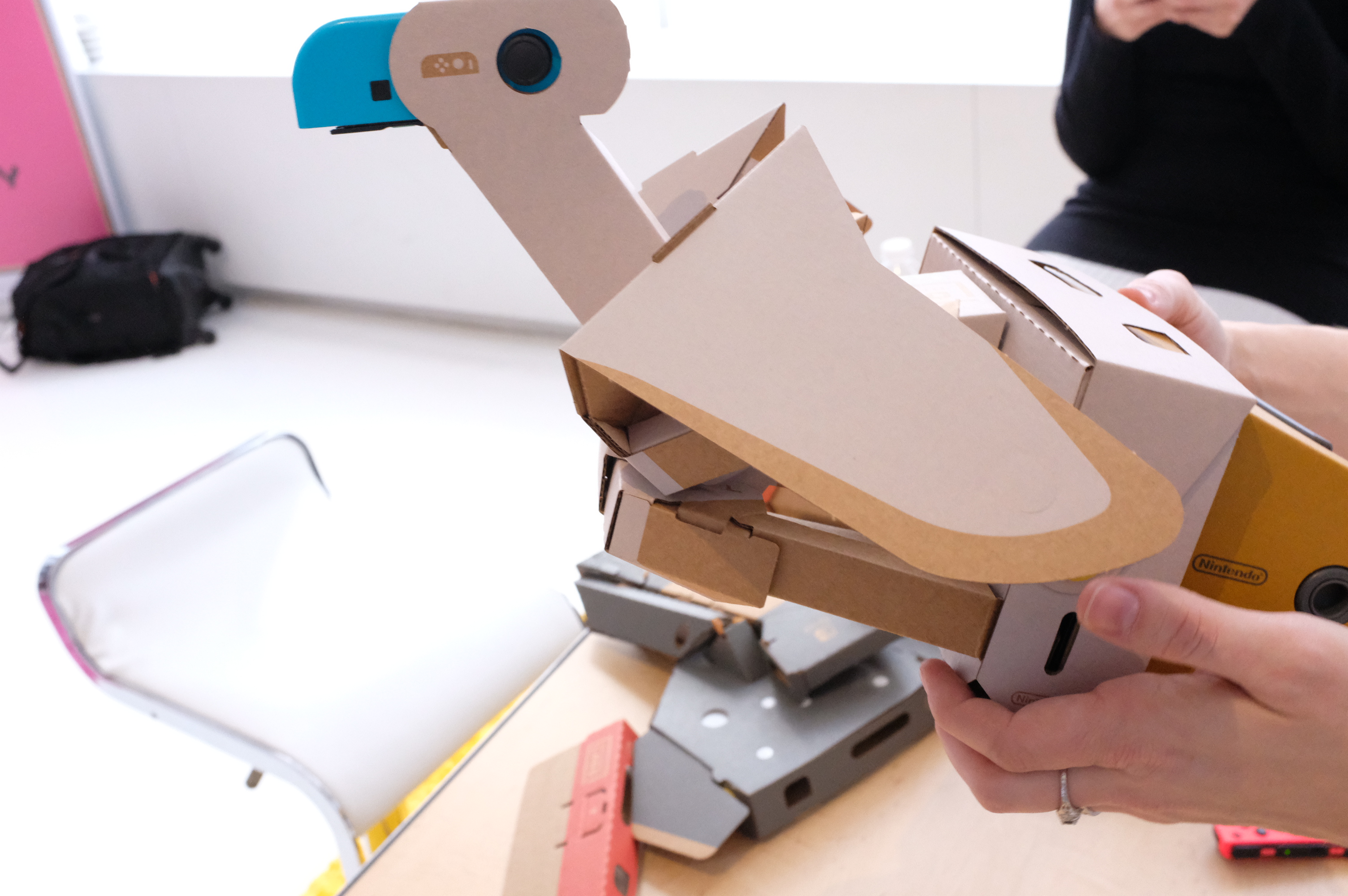

Nintendo’s Labo: VR Kit is not Virtual Boy 2.0

Even the most successful tech company is going to have a stumble from time to time. Nintendo’s 45 years in the video game industry is spotted with a few doozies, but none are more infamous than the Virtual Boy. The 1994 portable console was marketed as an early home entry into virtual reality, but in actual reality ended up being little more than a blood-red headache.

Nintendo knew the comparisons to the doomed console would come fast and furiously when it launched its next VR venture, so the company took the time to get it just right. In a sense, Labo VR is a cautious push into the virtual realm. It’s nowhere near the all-in approach of Oculus, Vive or even PlayStation VR, for that matter — but it’s uniquely Nintendo.

Like the first Labo kits, it’s a friendly reminder that Nintendo’s chief job is to surprise and delight, and it happily delivers on both fronts. But just as the Labo piano shouldn’t be mistaken for a real musical instrument, Labo VR ought not be viewed as a real virtual reality.

It’s not just the pop-out cardboard form factor, either. Google made that a perfectly acceptable beginner’s approach to VR. It’s more that Nintendo has taken a very casual approach to all of this. The kit’s virtual reality experience is an extension of Labo itself. It’s no more important than the process of building the headset and various accessories step by step on the app. Or, for that matter, sharing all of the above experiences with others.

During a demo of the new kits in New York this week, Nintendo was quick to point out that the headsets are built without a strap. It claims this was a conscious decision so that the experience can be passed around and shared. I’m sure there are some practical reasons behind this decision as well, but it’s certainly a nice thought.

Virtual reality is, by nature of its form factor, a solitary experience. Labo VR doesn’t have any sort of video-out feature to share the experience on a big screen (for now, at least), so the idea of offering it up in a more social play-and-pass scenario is appealing. This goes double for the fact that, like the original Labo kits, all of the games included fall under the casual banner. The experiences share a common lineage with Nintendo analog titles like Mario Party or Mario Paint.

Your mileage with each title will vary. Certainly some (Bird and Blaster spring to mind) will stay with you longer than others and demand more repeat play. On the whole, each buildable peripheral launches with one (maybe two) compatible games. The good news, however, is that, like Labo, the company packs a lot of controllers (and therefore experiences) into a single kit.

The standard Labo: VR Kit ships with six Toy-Con projects (VR Goggles, Toy-Con Blaster, Toy-Con Camera, Toy-Con Bird, Toy-Con Wind Pedal and Toy-Con Elephant), while the cheaper Starter Set comes with two (Goggles and Blaster). If you go for the latter to dip your toes in the water or just to save on cash, there are a pair of “expansion sets” to get the full experience.

Unlike the last time Nintendo came to town with a Labo press tour, we didn’t actually get any time to build. That said, if previous kits are any indication, that’s half of the fun and value proposition here. Also, the amount of time you’ll spend building varies greatly from project to project — take it from me, someone who spent most of a work morning building that damn piano.

Once built, the VR experience is about on-par with what you’d expect from a Google VR. Again, it’s a set of lenses attached to a hunk of cardboard. This is no Rift or Vive and the immersiveness of your own experience will vary. The graphics are cartoony and oftentimes just large polygons. But a well-crafted casual gaming experience can be enough to pull you out of your own head for a bit. Bird is the best example of this.

The controller clips on the headset, with a Toy-Con popping out the other end like a beak. As a player, you hook your hands on either side of the display and flap along as you play a bird, flying around trees and completing different missions to feed an army of hatchlings. It’s a relaxing reprieve from some of the faster-paced games, as you glide around the skies. Add in the foot-controlled Wind Pedal, and the system delivers a puff of air to your face as you boost your bird, adding to the effect.

Blaster, a big, fun novelty gun, is the most engaging of the bunch. When I ended my demos with some extra time to spare, the Nintendo rep asked me if I wanted to give any of the games another go. The answer was simple. A simple first-person shooter, Blaster pits you against an army of alien blobs. You load the gun by cocking it like a shot-gun, and pull the trigger to an explosive effect.

Honorable mention goes to Doodle, which uses the bizarre elephant-shaped controller. The experience is unique from the rest in that it’s not actually a game, but rather a 3D drawing tool. It’s one of the more clever additions to the pack, though actually drawing on a 3D plane with a cardboard controller shaped like an elephant’s trunk is easier said than done. The implementation is a bit lacking, but it offers interesting insight into where Labo VR might go in the future.

Honestly, I just scratched the surface during my briefing. But there’s little question that Labo VR is a fun and singular experience. There’s also a special screen holder, so users who have rough time with VR can experience a 2D version of the games and accessories. Also, as with the standard Labo kit, Nintendo has bundled in Toy-Con Garage, so users can start building their own games when they tire of the pre-packaged experiences.

If there’s one disappointment in all of this, it’s that it will likely be a while before we see a full standalone VR experience from Nintendo. The idea of playing as Mario, Link and the like in virtual reality is no doubt something of a lifelong dream for plenty of gamers who grew up on the characters. But while Virtual Boy is a quarter-century in the past, the memory still lingers.

Until then, Labo VR is a fully engaging take on VR, and a uniquely Nintendo one, to boot.

Powered by WPeMatico

To fund Y Combinator’s top startups, VCs scoop them before Demo Day

Hundreds gathered this week at San Francisco’s Pier 48 to see the more than 200 companies in Y Combinator’s Winter 2019 cohort present their two-minute pitches. The audience of venture capitalists, who collectively manage hundreds of billions of dollars, noted their favorites. The very best investors, however, had already had their pick of the litter.

What many don’t realize about the Demo Day tradition is that pitching isn’t a requirement; in fact, some YC graduates skip out on their stage opportunity altogether. Why? Because they’ve already raised capital or are in the final stages of closing a deal.

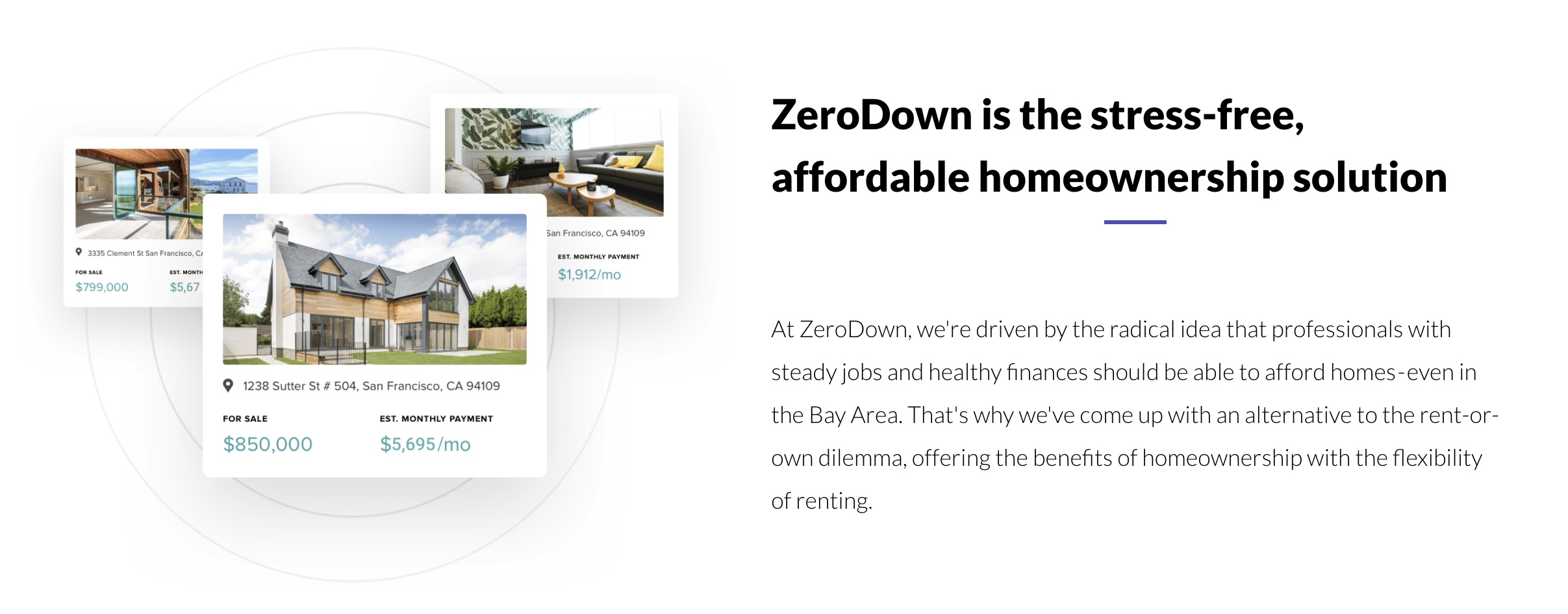

ZeroDown, Overview.AI and Catch are among the startups in YC’s W19 batch that forwent Demo Day this week, having already pocketed venture capital. ZeroDown, a financing solution for real estate purchases in the Bay Area, raised a round upwards of $10 million at a $75 million valuation, sources tell TechCrunch. ZeroDown hasn’t responded to requests for comment, nor has its rumored lead investor: Goodwater Capital.

Without requiring a down payment, ZeroDown purchases homes outright for customers and helps them work toward ownership with monthly payments determined by their income. The business was founded by Zenefits co-founder and former chief technology officer Laks Srini, former Zenefits chief operating officer Abhijeet Dwivedi and Hari Viswanathan, a former Zenefits staff engineer.

The founders’ experience building Zenefits, despite its shortcomings, helped ZeroDown garner significant buzz ahead of Demo Day. Sources tell TechCrunch the startup had actually raised a small seed round ahead of YC from former YC president Sam Altman, who recently stepped down from the role to focus on OpenAI, an AI research organization. Altman is said to have encouraged ZeroDown to complete the respected Silicon Valley accelerator program, which, if nothing else, grants its companies a priceless network with which no other incubator or accelerator can compete.

Overview .AI’s founders’ resumes are impressive, too. Russell Nibbelink and Christopher Van Dyke were previously engineers at Salesforce and Tesla, respectively. An industrial automation startup, Overview is developing a smart camera capable of learning a machine’s routine to detect deviations, crashes or anomalies. TechCrunch hasn’t been able to get in touch with Overview’s team or pinpoint the size of its seed round, though sources confirm it skipped Demo Day because of a deal.

Catch, for its part, closed a $5.1 million seed round co-led by Khosla Ventures, NYCA Partners and Steve Jang prior to Demo Day. Instead of pitching their health insurance platform at the big event, Catch published a blog post announcing its first feature, The Catch Health Explorer.

“This is only the first glimpse of what we’re building this year,” Catch wrote in the blog post. “In a few months, we’ll be bringing end-to-end health insurance enrollment for individual plans into Catch to provide the best health insurance enrollment experience in the country.”

TechCrunch has more details on the healthtech startup’s funding, which included participation from Kleiner Perkins, the Urban Innovation Fund and the Graduate Fund.

Four more startups, Truora, Middesk, Glide and FlockJay had deals in the final stages when they walked onto the Demo Day stage, deciding to make their pitches rather than skip the big finale. Sources tell TechCrunch that renowned venture capital firm Accel invested in both Truora and Middesk, among other YC W19 graduates. Truora offers fast, reliable and affordable background checks for the Latin America market, while Middesk does due diligence for businesses to help them conduct risk and compliance assessments on customers.

Finally, Glide, which allows users to quickly and easily create well-designed mobile apps from Google Sheets pages, landed support from First Round Capital, and FlockJay, the operator an online sales academy that teaches job seekers from underrepresented backgrounds the skills and training they need to pursue a career in tech sales, secured investment from Lightspeed Venture Partners, according to sources familiar with the deal.

Pre-Demo Day M&A

Raising ahead of Demo Day isn’t a new phenomenon. Companies, thanks to the invaluable YC network, increase their chances at raising, as well as their valuation, the moment they enroll in the accelerator. They can begin chatting with VCs when they see fit, and they’re encouraged to mingle with YC alumni, a process that can result in pre-Demo Day acquisitions.

This year, Elph, a blockchain infrastructure startup, was bought by Brex, a buzzworthy fintech unicorn that itself graduated from YC only two years ago. The deal closed just one week before Demo Day. Brex’s head of engineering, Cosmin Nicolaescu, tells TechCrunch the Elph five-person team — including co-founders Ritik Malhotra and Tanooj Luthra, who previously founded the Box-acquired startup Steem — were being eyed by several larger companies as Brex negotiated the deal.

“For me, it was important to get them before batch day because that opens the floodgates,” Nicolaescu told TechCrunch. “The reason why I really liked them is they are very entrepreneurial, which aligns with what we want to do. Each of our products is really like its own business.”

Of course, Brex offers a credit card for startups and has no plans to dabble with blockchain or cryptocurrency. The Elph team, rather, will bring their infrastructure security know-how to Brex, helping the $1.1 billion company build its next product, a credit card for large enterprises. Brex declined to disclose the terms of its acquisition.

Hunting for the best deals

Y Combinator partners Michael Seibel and Dalton Caldwell, and moderator Josh Constine, speak onstage during TechCrunch Disrupt SF 2018. (Photo by Kimberly White/Getty Images)

Ultimately, it’s up to startups to determine the cost at which they’ll give up equity. YC companies raise capital under the SAFE model, or a simple agreement for future equity, a form of fundraising invented by YC. Basically, an investor makes a cash investment in a YC startup, then receives company stock at a later date, typically upon a Series A or post-seed deal. YC made the switch from investing in startups on a pre-money safe basis to a post-money safe in 2018 to make cap table math easier for founders.

Michael Seibel, the chief executive officer of YC, says the accelerator works with each startup to develop a personalized fundraising plan. The businesses that raise at valuations north of $10 million, he explained, do so because of high demand.

“Each company decides on the amount of money they want to raise, the valuation they want to raise at, and when they want to start fundraising,” Seibel told TechCrunch via email. “YC is only an advisor and does not dictate how our companies operate. The vast majority of companies complete fundraising in the 1 to 2 months after Demo Day. According to our data, there is little correlation between the companies who are most in demand on Demo Day and ones who go on to become extremely successful. Our advice to founders is not to over optimize the fundraising process.”

Though Seibel says the majority raise in the months following Demo Day, it seems the very best investors know to be proactive about reviewing and investing in the batch before the big event.

Khosla Ventures, like other top VC firms, meets with YC companies as early as possible, partner Kristina Simmons tells TechCrunch, even scheduling interviews with companies in the period between when a startup is accepted to YC to before they actually begin the program. Another Khosla partner, Evan Moore, echoed Seibel’s statement, claiming there isn’t a correlation between the future unicorns and those that raise capital ahead of Demo Day. Moore is a co-founder of DoorDash, a YC graduate now worth $7.1 billion. DoorDash closed its first round of capital in the weeks following Demo Day.

“I think a lot of the activity before demo day is driven by investor FOMO,” Moore wrote in an email to TechCrunch. “I’ve had investors ask me how to get into a company without even knowing what the company does! I mostly see this as a side effect of a good thing: YC has helped tip the scale toward founders by creating an environment where investors compete. This dynamic isn’t what many investors are used to, so every batch some complain about valuations and how easy the founders have it, but making it easier for ambitious entrepreneurs to get funding and pursue their vision is a good thing for the economy.”

This year, given the number of recent changes at YC — namely the size of its latest batch — there was added pressure on the accelerator to showcase its best group yet. And while some did tell TechCrunch they were especially impressed with the lineup, others indeed expressed frustration with valuations.

Many YC startups are fundraising at valuations at or higher than $10 million. For context, that’s actually perfectly in line with the median seed-stage valuation in 2018. According to PitchBook, U.S. startups raised seed rounds at a median post-valuation of $10 million last year; so far this year, companies are raising seed rounds at a slightly higher post-valuation of $11 million. With that said, many of the startups in YC’s cohorts are not as mature as the average seed-stage company. Per PitchBook, a company can be several years of age before it secures its seed round.

I did not talk to a single company in this batch raising under $10M post (admittedly I only was able to speak with a fraction of the 205).

— Peter Rojas (@peterrojas) March 20, 2019

Nonetheless, pricey deals can come as a disappointment to the seed investors who find themselves at YC every year but because their reputations aren’t as lofty as say, Accel, aren’t able to book pre-Demo Day meetings with YC’s top of class.

The question is who is Y Combinator serving? And the answer is founders, not investors. YC is under no obligation to serve up deals of a certain valuation nor is it responsible for which investors gain access to its best companies at what time. After all, startups are raking in larger and larger rounds, earlier in their lifespans; shouldn’t YC, a microcosm for the Silicon Valley startup ecosystem, advise their startups to charge the best investors the going rate?

Powered by WPeMatico

Gig workers need health & benefits — Catch is their safety net

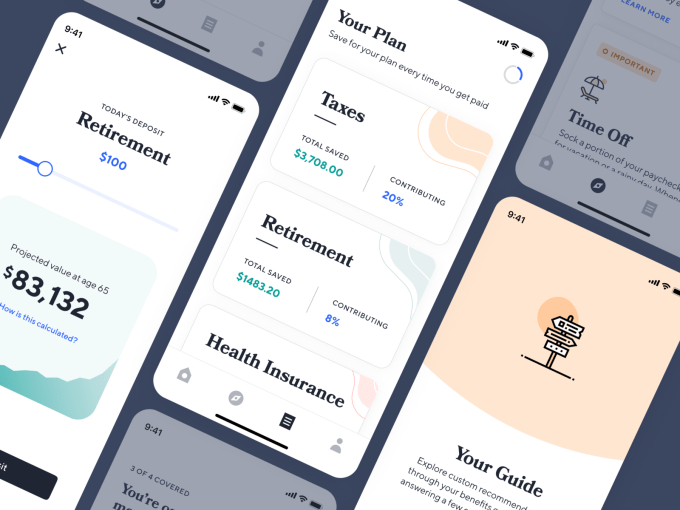

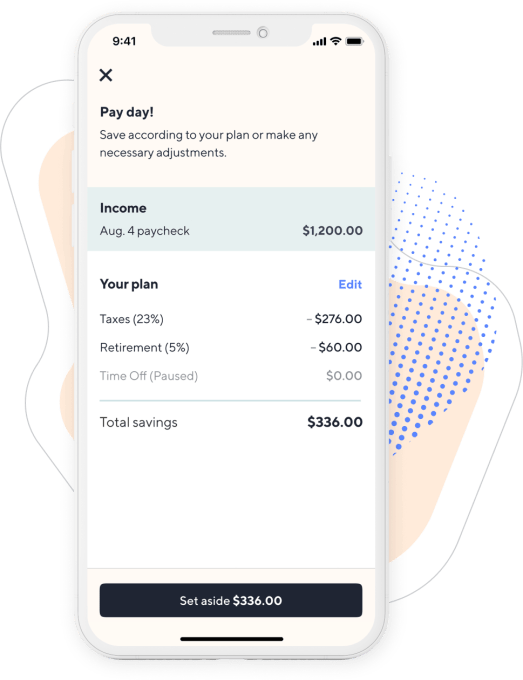

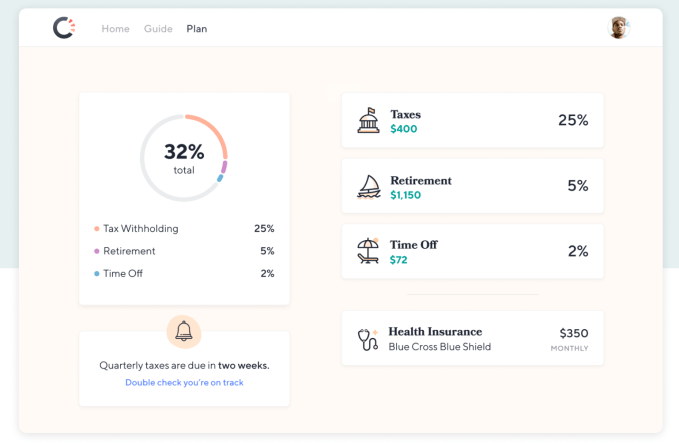

One of the hottest Y Combinator startups just raised a big seed round to clean up the mess created by Uber, Postmates and the gig economy. Catch sells health insurance, retirement savings plans and tax withholding directly to freelancers, contractors, or anyone uncovered. By building and curating simplified benefits services, Catch can offer a safety net for the future of work.

“In order to stay competitive as a society, we need to address inequality and volatility. We think Catch is the first step to offering alternatives to the mandate that benefits can only come from an employer or the government,” writes Catch co-founder and COO Kristen Tyrrell. Her co-founder and CEO Andrew Ambrosino, a former Kleiner Perkins design fellow, stumbled onto the problem as he struggled to juggle all the paperwork and programs companies typically hire an HR manager to handle. “Setting up a benefits plan was a pain. You had to become an expert in the space, and even once you were, executing and getting the stuff you needed was pretty difficult.” Catch does all this annoying but essential work for you.

Now Catch is getting its first press after piloting its product with tens of thousands of users. TechCrunch caught wind of its highly competitive seed round closing, and Catch confirms it has raised $5.1 million at a $20.5 million post-money valuation co-led by Khosla Ventures, Kindred Ventures, and NYCA Partners. This follow-up to its $1 million pre-seed will fuel its expansion into full heath insurance enrollment, life insurance and more. Catch is part of a growing trend that sees the best Y Combinator startup fully funded before Demo Day even arrives.

“Benefits, as a system built and provided by employers, created the mid-century middle class. In the post-war economic boom, companies offering benefits in the form of health insurance and pensions enabled familial stability that led to expansive growth and prosperity,” recalls Tyrrell, who was formerly the director of product at student debt repayment benefits startup FutureFuel.io. “Emboldened by private-sector growth (and apparent self-sufficiency), the 1970s and 80s saw a massive shift in financial risk management from the government to employers. The public safety net contracted in favor of privatized solutions. As technological advances progressed, employers and employees continued to redefine what work looked like. The bureaucratic and inflexible benefits system was unable to keep up. The private safety net crumbled.”

That problem has ballooned in recent years with the advent of the on-demand economy, where millions become Uber drivers, Instacart shoppers, DoorDash deliverers and TaskRabbits. Meanwhile, the destigmatization of remote work and digital nomadism has turned more people into permanent freelancers and contractors, or full-time employees without benefits. “A new class of worker emerged: one with volatile, complex income streams and limited access to second-order financial products like automated savings, individual retirement plans, and independent health insurance. We entered the new millennium with rot under the surface of new opportunity from the proliferation of the internet,” Tyrrell declares. “The last 15 years are borrowed time for the unconventional proletariat. It is time to come to terms and design a safety net that is personal, portable, modern and flexible. That’s why we built Catch.”

Catch co-founders Andrew Ambrosino and Kristen Tyrrell

Currently Catch offers the following services, each with their own way of earning the startup revenue:

- Health Explorer lets users compare plans from insurers and calculate subsidies, while Catch serves as a broker collecting a fee from insurance providers

- Retirement Savings gives users a Catch robo-advisor compatible with IRA and Roth IRA, while Catch earns the industry standard 1 basis point on saved assets

- Tax Withholding provides an FDIC-insured Catch account that automatically saves what you’ll need to pay taxes later, while Catch earns interest on the funds

- Time Off Savings similarly lets you automatically squirrel away money to finance “paid” time off, while Catch earns interest

These and the rest of Catch’s services are curated through its Guide. You answer a few questions about which benefits you have and need, connect your bank account, choose which programs you want and get push notifications whenever Catch needs your decisions or approvals. It’s designed to minimize busy work so if you have a child, you can add them to all your programs with a click instead of slogging through reconfiguring them all one at a time. That simplicity has ignited explosive growth for Catch, with the balances it holds for tax withholding, time off and retirement balances up 300 percent in each of the last three months.

In 2019 it plans to add Catch-branded student loan refinancing, vision and dental enrollment plus payments via existing providers, life insurance through a partner such as Ladder or Ethos and full health insurance enrollment plus subsidies and premium payments via existing insurance companies like Blue Shield and Oscar. And in 2020 it’s hoping to build out its own blended retirement savings solution and income-smoothing tools.

In 2019 it plans to add Catch-branded student loan refinancing, vision and dental enrollment plus payments via existing providers, life insurance through a partner such as Ladder or Ethos and full health insurance enrollment plus subsidies and premium payments via existing insurance companies like Blue Shield and Oscar. And in 2020 it’s hoping to build out its own blended retirement savings solution and income-smoothing tools.

If any of this sounds boring, that’s kind of the point. Instead of sorting through this mind-numbing stuff unassisted, Catch holds your hand. Its benefits Guide is available on the web today and it’s beta testing iOS and Android apps that will launch soon. Catch is focused on direct-to-consumer sales because “We’ve seen too many startups waste time on channels/partnerships before they know people truly want their product and get lost along the way,” Tyrrell writes. Eventually it wants to set up integrations directly into where users get paid.

Catch’s biggest competition is people haphazardly managing benefits with Excel spreadsheets and a mishmash of healthcare.gov and solutions for specific programs. Twenty-one percent of Americans have saved $0 for retirement, which you could see as either a challenge to scaling Catch or a massive greenfield opportunity. Track.tax, one of its direct competitors, charges a subscription price that has driven users to Catch. And automated advisors like Betterment and Wealthfront accounts don’t work so well for gig workers with lots of income volatility.

So do the founders think the gig economy, with its suppression of benefits, helps or hinders our species? “We believe the story is complex, but overall, the existing state of the gig economy is hurting society. Without better systems to provide support for freelance/contract workers, we are making people more precarious and less likely to succeed financially.”

When I ask what keeps the founders up at night, Tyrrell admits “The safety net is not built for individuals. It’s built to be distributed through HR departments and employers. We are very worried that the products we offer aren’t on equal footing with group/company products.” For example, there’s a $6,000/year IRA limit for individuals while the corporate equivalent 401k limit is $19,000, and health insurance is much cheaper for groups than individuals.

To surmount those humps, Catch assembled a huge list of angel investors who’ve built a range of financial services, including NerdWallet founder Jake Gibson, Earnest founders Louis Beryl and Ben Hutchinson, ANDCO (acquired by Fiverr) founder Leif Abraham, Totem founder Neal Khosla, Commuter Club founder Petko Plachkov, Playable (acquired by Stripe) founder Tad Milbourn and Synapse founder Bruno Faviero. It also brought on a wide range of venture funds to open doors for it. Those include Urban Innovation Fund, Kleiner Perkins, Y Combinator, Tempo Ventures, Prehype, Loup Ventures, Indicator Ventures, Ground Up Ventures and Graduate Fund.

Hopefully the fact that there are three lead investors and so many more in the round won’t mean that none feel truly accountable to oversee the company. With 80 million Americans lacking employer-sponsored benefits and 27 million without health insurance and median job tenure down to 2.8 years for people ages 25 to 34 leading to more gaps between jobs, our workforce is vulnerable. Catch can’t operate like a traditional software startup with leniency for screw-ups. If it can move cautiously and fix things, it could earn labor’s trust and become a fundamental piece of the welfare stack.

Powered by WPeMatico

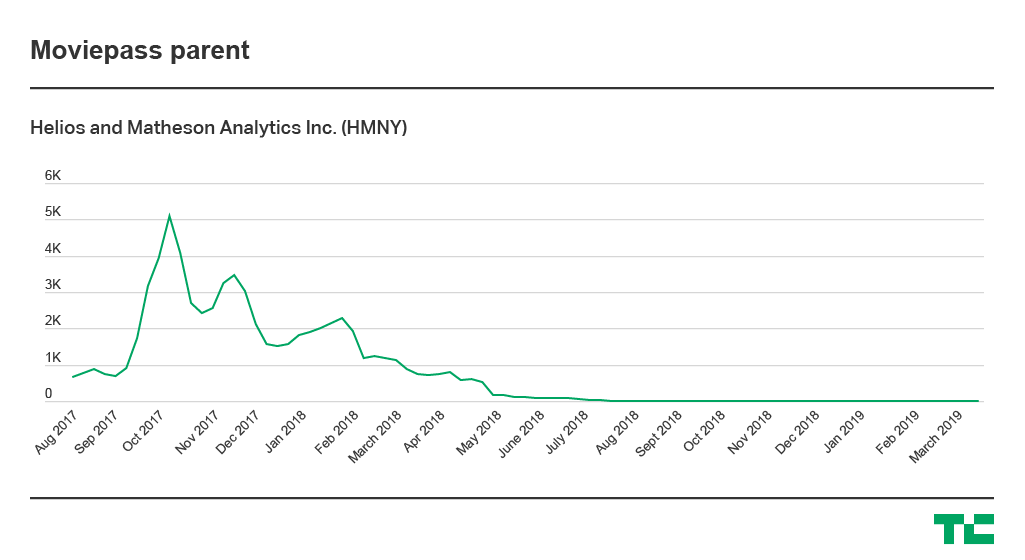

MoviePass parent’s CEO says its rebooted subscription service is already (sort of) profitable

Two days after MoviePass announced the return of the company’s unlimited ticket plan, Ted Farnsworth, CEO of its parent company Helios and Matheson Analytics, sat down with TechCrunch to offer insight into the state of the beleaguered service.

According to the executive, MoviePass Uncapped is already seeing positive results. While he didn’t share concrete numbers, he says that sign-ups have increased “well over 800 percent in the last few days. And that’s conservative.”

Asked what it would take to make the company’s subscription business profitable, Farnsworth says, “Well, it’s profitable right now.” As for when it turned the corner, he added, “I will tell you this, because it’s out there: MoviePass has actually paid Helios back money over the past several months, towards the loans that they have. So, that gives you an idea of when we really started focusing on getting rid of the 20 percent of the abusers.”

Important caveat: A Helios & Matheson spokesperson later clarified that Farnsworth meant MoviePass’ subscription business is profitable on a revenue-per-subscriber basis. In other words, it’s not losing money on subscriptions, but the business unit isn’t necessarily profitable when you take overhead and debt into account.

The plan marks a return to the initial unlimited model that helped turn MoviePass into a household name in the past year. But that success arrived with a massive price, as the service began hemorrhaging money. MoviePass withdrew the unlimited plan and began reworking its plans on what seemed to be a weekly basis.

In July, at the height of what was supposed to be the Summer of MoviePass, the service experienced an outage as it struggled to pay bills. Helios secured a $5 million loan from creditors Hudson Bay Capital Management in order to turn the lights back on.

WEST HOLLYWOOD, CA – FEBRUARY 24: Ted Farnsworth attends the 27th annual Elton John AIDS Foundation Academy Awards Viewing Party sponsored by IMDb and Neuro Drinks celebrating EJAF and the 91st Academy Awards on February 24, 2019 in West Hollywood, California. (Photo by Jamie McCarthy/Getty Images for EJAF)

“I think the big SNAFU there was the credit card company,” the executive explains. “When one company sold to the other, we had been doing business with them for four years. They decided it was too much credit for them and literally call the credit line on a Friday night and I do a personal guarantee on a Saturday.”

However things might have gone down on the back end, the optics of such a situation were clearly less than ideal. MoviePass’ struggles were very public from the beginning, as part of a publicly traded company. A literal shut down for the service appeared to be just the latest sign that the too good to be true service was exactly that.

And while Farnsworth admits that the company would have benefited from a bit more privacy, he claims that he never had any doubts about MoviePass’ future, even as he negotiated with creditors for a fresh cash injection.

“There were no moments in my mind where I thought it would go down. In my mind, I thought it was too big to fail,” he says. “You created a household name in less than a year. I think any time you have something like that, where you’re going to run into issues from sheer growth. Our investors did well investing along the way. The investors believed in us and they still do. We knew we had to slow it down to get in front of the fraud side because there were so many moving parts. It was moving so fast.”

It’s that “fraud” that was at the center of MoviePass’ woes, says Farnsworth. MoviePass’ initial downfall, he believes, was the product of too many users “gaming the system.” He believes the total number of users that fall into that category to have been around 20 percent of the overall subscriber base.

It was a minority, certainly, but still a sizable figure, given that, by June of last year, that total figure had exceeded three million. By that point, the service also comprised around five percent of U.S. box office receipts. Much of the past year has been spent attempting to plug holes in the subscription service as the MoviePass boat began rapidly taking on water.

To be clear, “gaming the system” doesn’t just mean watching a lot of movies — Farnsworth says he’s happy to have “hardcore” users, even if they’re buying way more than $9.95 or $14.95 worth of tickets. Instead, his concern is users who are doing things like sharing their subscription or just using a MoviePass ticket to use the theater’s restroom — something surprisingly common in places like Times Square, where public bathrooms are hard to come by.

One of the primary fixes, Farnsworth says, is utilizing mobile tracking to ensure that subscribers are, in fact, using the service as intended, and looking for “red flags” like constantly changing the device using the app. Users are already required to enable location-based tracking in order to enable ticket purchase. This will utilize that to ping the ticket purchaser’s location, in order to make sure that they’re actually attending the movies for which they’ve purchased tickets.

“For instance, another issue is where people would go to the theater, they’ll pick up the ticket, they’ll hand their ticket to the kid or their child or their friend or whatever it is … and the person that’s paying the subscription goes back home or whatever they do,” he says. The new strategy: “When the movie starts, 30 minutes later [we’re] able to ping them inside the theater, just to make sure they still are at that theater.”

Looking ahead, Farnsworth says that the days of constantly changing pricing and restrictions are over, and that the company is committed to the unlimited plan. In fact, in his telling, the goal was always to get back to the unlimited plan — it was just that MoviePass had to figure out how to cut down on fraud to make the plan work.

At the same time, he says MoviePass’ film studio will also be an important part of the business. It has been overshadowed by the headlines about the company’s subscription struggles, but MoviePass Films has titles starring Bruce Willis, Al Pacino and Sylvester Stallone scheduled for this year.

MoviePass also invested in “Gotti,” and although the film was reviled by critics and only grossed $4.3 million at the box office, Farnsworth doesn’t see it as a failure.

“We never looked at Gotti as a money-maker” he says. “They only projected that it would do a $1.3 million in the box office here. Because then, when we pushed it with MoviePass, we took that up to five million. So, I mean, when you can take a movie — I gotta be careful here, but when you take a movie that might not be that great or perfect, and you can move that needle, [that] was always our theory of subscription.”

Check back later for our full interview with Farnsworth. Also, this post has been updated to reflect that MoviePass recently saw 800 percent growth in sign-ups (not subscribers), and to clarify Farnsworth’s remarks about profitability.

Powered by WPeMatico

This is what the Huawei P30 will look like

You can already find many leaked photos of Huawei’s next flagship device — the P30 and P30 Pro. The company is set to announce the new product at an event in Paris next week. So here’s what you should expect.

Reliable phone leaker Evan Blass tweeted many different photos of the new devices in three different tweets:

— Evan Blass (@evleaks) March 20, 2019

As you can see, both devices feature three cameras on the back of the device. The notch is getting smaller and now looks like a teardrop. Compared to the P20 and P20 Pro, the fingerprint sensor is gone. It looks like Huawei is going to integrate the fingerprint sensor in the display just like Samsung did with the Samsung Galaxy S10.

Also, mysmartprice shared some ads with some specifications. The P30 Pro will have a 10x hybrid zoom while the P30 will have a 5x hybrid zoom — it’s unclear how it’ll work to combine a hardware zoom with a software zoom. Huawei has been doing some good work on the camera front, so this is going to be a key part of next week’s presentation.

For the first time, Huawei will put wireless charging in its flagship device — it’s about time. And it looks like the P30 Pro will adopt a curved display for the first time, as well. I’ll be covering the event next week, so stay tuned.

Powered by WPeMatico

HoneyBook, a client management platform for creative businesses, raises $28M Series C led by Citi Ventures

HoneyBook co-founders Oz and Naama Alon

HoneyBook, a customer-relationship management platform aimed at small businesses in creative fields, announced today it has raised a $28 million Series C led by Citi Ventures. All of its existing investors, including Norwest Venture Partners, Aleph, Vintage Investment Partners and Hillsven Capital, also returned for the round. Citi is a strategic partner for HoneyBook and this will enable it to offer new financial products to freelancers, its co-founder and CEO Oz Alon told TechCrunch.

This brings HoneyBook’s total raised so far to $72 million. It is using the funds to grow its teams in San Francisco and Tel Aviv and build new features for its user base, including small companies, people who work by themselves (“solopreneurs”) and freelancers. Like other CRMs, HoneyBook helps them develop relationships with potential new clients, manage projects, send invoices and accept payments, but with tools scaled for their business’ needs.

Alon told TechCrunch in an email that one segment HoneyBook is focused on is millennials (he cites a survey that found 49 percent of people under 40 plan to start their own business). HoneyBook currently claims tens of thousands of customers and has passed $1 billion in business booked using its software, along with 75,000 members in Rising Tide, the company’s online community for creative entrepreneurs.

Other management software platforms competing for the attention of entrepreneurs and freelancers include Tave, Dubsado and 17hats. One of the main ways HoneyBook differentiates is by enabling its users to accept online payments without integrating with a third-party service. Thanks to this, its users “transact more than 80 percent of their business online, significantly more than any other payments platform serving this audience, Alon said. Its partnership with Citi will also allow the company to develop more unique services for its target customers, he added.

In a prepared statement, Citi Ventures’ Israel director and venture investing lead Omit Shinar said, “We are in the midst of a period of extensive changes in societal structures and economic models. The fintech ecosystem is producing more and more breakthrough innovations that serve the needs of modern consumers, and we believe, as a pioneer in its space, HoneyBook can become a market leader in the U.S.”

Powered by WPeMatico

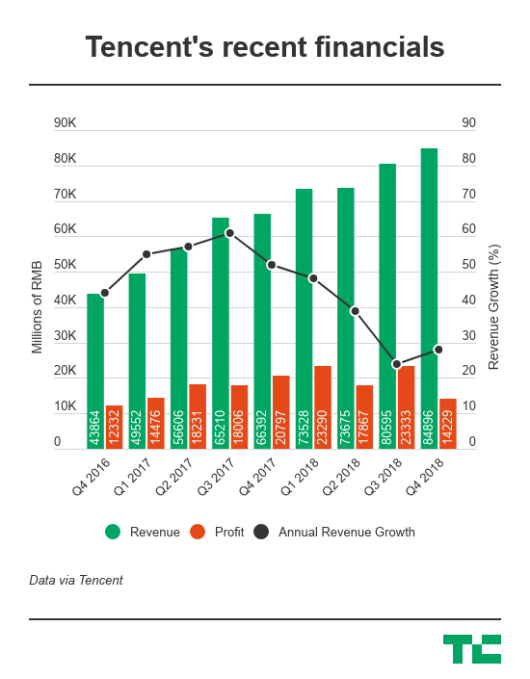

Tencent Q4 profit disappoints, but cloud and payments gain ground

China’s Tencent reported disappointing profits in the fourth quarter on the back of surging costs but saw emerging businesses pick up steam as it plots to diversify amid slackening gaming revenues.

Net profit for the quarter slid 32 percent to 14.2 billion yuan ($2.1 billion), behind analysts’ forecast of 18.3 billion yuan. The decrease was due to one-off expenses related to its portfolio companies and investments in non-gaming segments like video content and financial technology.

Excluding non-cash items and M&A deals, Tencent’s net profit from the period rose 13 percent to 19.7 billion yuan ($2.88 billion). The company has to date invested in more than 700 companies, 100 of which are valued over $1 billion each and 60 of which have gone public.

Quarterly revenue edged up 28 percent to 84.9 billion yuan ($12.4 billion) beating expectations.

The Hong Kong-listed company is best known for its billion-user WeChat messenger but had for years relied heavily on a high-margin gaming business. That was until a months-long freeze on games approvals last year that delayed monetization for new titles, spurring a major reorg in the firm to put more focus on enterprise services, including cloud computing and financial technology.

Tencent has received approvals for eight games since China resumed the licensing process, although its blockbusters PlayerUnknown Battlegrounds and Fortnite have yet to get the green light. The firm also warned of a “sizeable backlog” for license applications in the industry, which means its “scheduled game releases will initially be slower than in some prior years.”

Video games for the quarter contributed 28.5 percent of Tencent’s total revenues, compared to 36.7 percent in the year-earlier period. Despite the domestic fiasco, Tencent remains as the world’s largest games publisher by revenue, according to data compiled by NewZoo. The firm has also gotten more aggressive in taking its titles global.

Social network revenues rose 25 percent on account of growth in live streaming and video subscriptions. The segment made up 22.9 percent of total revenues. Tencent has in recent years spent heavily on making original content and licensing programs as it competes with Baidu’s iQiyi video streaming site. Tencent claimed 89 million subscribers in the latest quarter, compared with iQiyi’s 87.4 million.

Tencent has been relatively slow to monetize WeChat in contrast to its western counterpart Facebook, though it’s under more pressure to step up its game. Tencent’s advertising revenue from the quarter grew 38 percent thanks to expanding advertising inventory on WeChat. Ads accounted for 20 percent of the firm’s quarterly revenues.

All told, WeChat and its local version Weixin reached nearly 1.1 billion monthly active users; 750 million of them checked their friends’ WeChat feeds, and Tencent recently introduced a Snap Story-like feature to lock users in as it vies for eyeball time with challenger TikTok.

The “others” category, composed of financial technology and cloud computing, grew 71.8 percent to generate 28.5 percent of total revenues. WeChat’s e-wallet, which is going neck-and-neck with Alibaba affiliate Alipay, saw daily transaction volume exceed 1 billion last year. During the fourth quarter, merchants who used WeChat Pay monthly grew more than 80 percent year-over-year.

Meanwhile, cloud revenues doubled to 9.1 billion yuan in 2018, thanks to Tencent’s dominance in the gaming sector as its cloud infrastructure now powers over half of the China-based games companies and is following these clients overseas. Tencent meets Alibaba head-on again in the cloud sector. For comparison, Alibaba’s most recent quarterly cloud revenue was 6.6 billion yuan. Just yesterday, the e-commerce leader claimed that its cloud business is larger than the second to eight players in China combined.

Powered by WPeMatico

Epic Games CEO says Apex Legends hasn’t made a dent in Fortnite

In the wake of Apex Legends, which has briskly grown to 50 million players, many have wondered whether Fortnite has felt the impact.

But Epic Games CEO Tim Sweeney told GamesBeat that Apex hasn’t really made a dent. Without being asked about Apex Legends, Sweeney said “an Apex Legends worth” of players have come over to Fortnite.

“We’re very close to hitting 250 million Fortnite players,” said Sweeney. “Since Apex Legends came out, we’ve gained an Apex Legends worth of Fortnite players, which is amazing.”

He went on to say that the only game that noticeably takes Fortnite gamers away from Fortnite is FIFA.

“We hit a Fortnite non-event peak twice after Apex was out,” said Sweeney. “We haven’t seen any visible cut into Fortnite. It’s a funny thing. The only game you can see where its peaks cut into Fortnite playtime is FIFA. It’s another game for everybody, wildly popular around the world.”

On the one hand, Apex only has about one-fifth of the players that Fortnite has. In a world where Netflix sees Fortnite as a greater threat than HBO, the scale of the two games isn’t comparable.

However, Apex is picking up some serious steam. It only took seven days for Apex to hit 25 million users (it took Fortnite 41 days), and one month to hit 50 million users (it took Fortnite more than four months).

As impressive as that is, it’s also to be expected that a game like Apex, a relative latecomer to the Battle Royale genre, would grow faster by reaping the benefits of the entire industry’s years of work and growth. It’s also worth noting that EA paid a pretty penny to successfully launch Apex Legends, with Ninja alone earning $1 million for streaming the game at launch.

“What Apex Legends has done is re-energized a lot of shooter players, people who come in and out of shooters depending on what’s popular,” said Sweeney. “It’s awesome to see other games picking up on battle royale, adding their unique spin to it and advancing the state of the industry.”

Adding a unique spin is exactly what Apex Legends has done. They’ve taken the fundamental building blocks of Battle Royale and the free-to-play model and tweaked them to be, in some ways, better.

Where play is concerned, Apex is a markedly team-oriented game, complete with a beautifully executed non-verbal comms system and a Jumpmaster mechanic to encourage teammates to land and play as a unit. Plus, Apex uses a hero system to give each character their own unique abilities.

This not only makes each fight interesting, but it gives Apex a different way to monetize beyond its recently launched BattlePass. The company just introduced its first new character, which can be unlocked with Apex Coins, the games virtual currency.

Only time will tell if Respawn and EA can build something as sticky as Fortnite, which has truly become a pop culture phenomenon. But there is one clear winner in this epic competition between Fortnite and Apex, and that’s gamers.

Powered by WPeMatico