Fortnite, copyright and the legal precedent that could still mean trouble for Epic Games

Contributor

A new U.S. Supreme Court decision is pitting entertainers and video game developers against one another in a high-stakes battle royale.

The decision in Fourth Estate Public Benefit Corp. v. Wall-Street.com LLC raises interesting questions about several lawsuits brought against Epic Games, the publisher of popular multiplayer game Fortnite.

In Fortnite, players may make in-game purchases, allowing player avatars to perform popular dance moves (called emotes), such as the Carlton, the Floss, and the Milly Rock.

Five performers, all represented by the same law firm, recently filed separate lawsuits against Epic Games in the Central District of California, each alleging: (i) the performer created a dance; (ii) the dance is uniquely identified with the performer; (iii) an Epic emote is a copy of the dance; and (iv) Epic’s use of the dance infringes the plaintiff’s copyright in the dance move and the dancer’s right to publicity under California statutory and common law.

In short, the dance creators argue that Epic Games used their copyrightable dance moves in violation of existing law.

The building battle

What do these Fortnite lawsuits in California have to do with the US Supreme Court? US copyright law says that a copyright owner can’t sue for copyright infringement until “registration of the copyright claim has been made” with the US Copyright Office. Prior to the recent Supreme Court decision in Fourth Estate, lower federal courts split over what this language means.

Some (including the federal courts in California) concluded that a copyright claimant could sue an alleged infringer upon delivering a completed copyright application to the Copyright Office. Other lower federal courts held that the suit could not be brought until the Copyright Office issued a registration, meaning that the Office viewed the work to be copyrightable.

Because the Copyright Office now takes over seven months to process a copyright application and issue a registration, claimants often chose to sue in California federal courts, which had adopted the quicker “application approach.” This was the route chosen by the plaintiffs in all five Fortnite cases.

Down (but not out)

On March 4, 2019, in Fourth Estate, the Supreme Court ruled that California federal courts and others following the application approach were wrong, and that a plaintiff cannot sue for copyright infringement unless the Copyright Office has issued a copyright registration.

This had an immediate impact on the Fortnite lawsuits because the Copyright Office had not yet registered any of the dances and, indeed, had found two of the plaintiffs’ dances uncopyrightable. Recognizing their vulnerability, plaintiffs preemptively withdrew these lawsuits, announcing they would refile the complaints once the Copyright Office issued registrations.

Epic question #1: are the emote dances copyrightable?

The central question is whether the dances used in Fortnite emotes are copyrightable material protected under US law. If not, then Epic Games’ use of the dances is not copyright infringement, and in-game sales of the particular dances may continue unfettered.

Dance moves fall into a gray area in copyright law. Copyright law does protect “choreographic works,” but the Copyright Office says that “social dance steps and simple routines” are not protected. What’s the difference between the two? The Copyright Office says that choreography commonly involves “the composition and arrangement of a related series of dance movements and patterns organized into a coherent whole” and “a story, theme, or abstract composition conveyed through movement.” Dances that don’t meet this standard can’t be copyrighted, even if they are “novel and distinctive.”

So are the Fortnite plaintiffs’ dances “choreographic works” in the eyes of the Copyright Office? Herein lies a clash of cultures. The performer-plaintiffs undoubtedly feel they have created something not just unique, but a work entitled to protection for which they are owed damages. But the buttoned-down Copyright Office may not agree.

The Copyright Office has already denied Alfonso Ribeiro a copyright registration for the Carlton, a widely recognized dance popularized by Ribeiro during his days as Carlton Banks on the show Fresh Prince of Bel Air. The Office stated that the Carlton was “a simple routine made up of three dance steps” and “is not registrable as a choreographic work.”

The plaintiffs’ lawyer in the Epic Games cases has disclosed that 2 Milly’s application for copyright in the Milly Rock was also rejected, but that a long “variant” of Backpack Kid’s Floss dance was accepted for registration. The Copyright Office’s view on the other two plaintiffs’ dances has not yet been reported.

If a registration is denied

Denial of a copyright registration is not necessarily a dead end for these lawsuits. The Copyright Act allows a plaintiff who has been refused a copyright registration by the Copyright Office to still sue a potentially offending party for copyright infringement. However, the Copyright Office can then join the lawsuit by asserting that the plaintiff’s work is not entitled to copyright protection.

Historically, the federal courts have usually followed the Copyright Office’s view that a work is uncopyrightable. If the other Fortnite plaintiffs are denied registration, as Ribeiro and 2 Milly were, they will all face an uphill fight on their copyright claims.

Other issues to overcome

Even if the plaintiffs’ copyright claims survive, they face other problems, including originality, which is a requirement of copyright. If their dances are composed of moves contained in dances previously created by others, the plaintiffs may fail to convince the court that their dances are sufficiently original to warrant their own copyright. For example, Ribeiro has stated in interviews that moves by Eddie Murphy, Courtney Cox and Bruce Springsteen inspired him when he created the Carlton.

Ownership of the dance can also be at issue if the dance was created in the course of employment (such as while working as an actor on a television show), as the law may hold that the employer owns the copyright.

Epic question #2: the right to publicity

The plaintiffs’ right to publicity arguments could go further than their copyright infringement claims. The right to publicity claims were based on the assertion that plaintiffs’ dances are uniquely associated with them and that Epic Games digitally copied the plaintiffs performing the dances, then created a code that allows avatars to identically perform the dances. Some side-by-side comparisons of the original dance performances and the Epic emote versions (speed adjusted) look strikingly similar for the few seconds the emote lasts. According to plaintiffs, this use misappropriated their “identity.”

Their assertion is not as far-fetched as it may seem, given the broad reading courts in California have given to the state’s common law and statutory publicity law. For example, the Ninth Circuit has previously ruled that an ad featuring a robot with a wig that turned letters on a board wrongfully took Vanna White’s identity, and that animatronic robots sitting at airport bars vaguely resembling “Norm” and “Cliff,” characters from the popular TV show Cheers, misappropriated the identities of the actors who played the roles, George Wendt and John Ratzenberger.

There remains an open question on whether the courts will be willing to take another step and find that a game avatar having no physical resemblance to a performer misappropriates the performer’s publicity rights just because the avatar does a dance popularly associated with the performer.

Once the Copyright Office announces its decisions on the outstanding copyright applications, the Fortnite plaintiffs may choose to re-file their cases; and this question could eventually be decided.

Powered by WPeMatico

Scalyr launches PowerQueries for advanced log management

Log management service Scalyr today announced the beta launch of PowerQueries, its new tools for letting its users create advanced search operations as they manage their log files and troubleshoot potential issues. The new service allows users to perform complex actions to group, transform, filter and sort their large data sets, as well as to create table lookups and joins. The company promises these queries will happen just as fast as Scalyr’s standard queries and that getting started with these more advanced queries is pretty straightforward.

Scalyr founder and chairman Steve Newman argues that the company’s competitors may offer similar tools, but that “their query languages are too complex, hard-to-learn and hard-to-use.” He also stressed that Scalyr made a conscious decision not to use any machine learning tools to power this and its other services to help admins and developers prioritize issues and instead decided to focus on its query language and making it easier for its users to manage their logs that way.

“So we thought about how we could leverage our strengths — real-time performance, ease-of-use and scalability — to provide similar but better functionality,” he said in today’s announcement. “As a result, we came up with a set of simple but powerful queries that address advanced use cases while improving the user experience dramatically. Like the rest of our solution, our PowerQueries are fast, easy-to-learn and easy-to-use.”

Current Scalyr customers cover a wide range of verticals. They include the likes of NBCUniversal, Barracuda Networks, Spiceworks, John Hopkins University, Giphy, OkCupid and Flexport. Currently, Scalyr has more than 300 paying customers. As Newman stressed, more than 3,500 employees from these customers regularly use the service. He attributes this to the fact that it’s relatively easy to use, thanks to Scalyr’s focus on usability.

The company raised its last funding round — a $20 million Series A round — back in 2017. As Scalyr’s newly minted CEO Christine Heckart told me, though, the company is currently seeing rapid growth and has quickly added headcount in recent months to capitalize on this opportunity. Given this, I wouldn’t be surprised if we saw Scalyr raise another round in the not-so-distant future, especially considering that the log management market itself is also rapidly growing (and has changed quite a bit since Scalyr launched back in 2011), as more companies start their own digital transformation projects, which often allows them to replace some of their legacy IT tools with more modern systems.

Powered by WPeMatico

Gjirafa raises a $6.7M Series B from Rockaway Capital to digitise the Balkans

There’s nothing like a niche language to create a sort of lock-in for a startup, and that’s exactly what’s happened with Gjirafa. Focusing exclusively on Albanian-speaking countries, co-founder and CEO Mergim Cahani started out developing an Albanian language search engine and then literally digitizing the country’s information, from bus timetables to a database of local businesses and venues, and beyond.

Investors were attracted to this “emerging-market approach” and put in a $2 million Series A three years ago to “grow the Balkans’ internet economy” by digitizing and indexing information in Albania and Kosovo, thus making Gjirafa the regional leader in search, e-commerce and online advertising.

Today it claims 3 million monthly unique users across its services and has now raised a Series B round of $6.7 million from Rockaway Capital, which has been backing the company since 2016. The new funding is intended for scaling the current products regionally.

The Series B will allow the company to double their current team (currently at 70 full-time, and about 100 in total with part-time), scale with the existing products regionally and deliver other digital services that aren’t available in the region.

Dušan Zábrodský, investment partner at Rockaway, says: “Mergim Cahani and his team validated our trust and truly succeeded in building a centrepiece of innovation for the whole region. Thanks to this very positive experience we are committed to build up a digital economy in the region and we actively explore new investment opportunities where we can use our knowledge to digitalize traditional industries.”

He says Rockaway group’s investment is long-term and strategic because they think Gjirafa could become an entire platform/network of additional services that will be used throughout the region.

Using the same strategy, Rockaway previously found success in the DACH region, where it built up an online travel group under the Invia Group brand, and in the field of e-commerce through Mall Group, which operates on seven markets in the CEE region. These groups have contributed significantly to Rockaway’s revenues, which crossed the threshold of €2 billion in 2018.

Gjirafa has become the largest e-commerce player in the region, having a leading OTT product: GjirafaVideo and GjirafaStudio, equivalent to Hulu and Netflix; producing its own content it currently has about 1 million minutes of video consumed a day (and growing double-digits on monthly basis) and more than 80 live channels online.

Gjirafa, Inc., is the fastest-growing company in the region, and the growth is impressive at 314 percent CAGR. To put it in perspective: when GDP indicators are normalized for the Balkans region versus the U.S., it has an equivalent revenue growth as Google had between 2001-2004 and continuing on the same path.

Powered by WPeMatico

Alibaba acquires Israeli startup Infinity Augmented Reality

Infinity Augmented Reality, an Israeli startup, has been acquired by Alibaba, the companies announced this weekend. The deal’s terms were not disclosed. Alibaba and InfinityAR have had a strategic partnership since 2016, when Alibaba Group led InfinityAR’s Series C. Since then, the two have collaborated on augmented reality, computer vision and artificial intelligence projects.

Founded in 2013, the startup’s augmented glasses platform enables developers in a wide range of industries (retail, gaming, medical, etc.) to integrate AR into their apps. InfinityAR’s products include software for ODMs and OEMs and a SDK plug-in for 3D engines.

Alibaba’s foray into virtual reality started three years ago, when it invested in Magic Leap and then announced a new research lab in China to develop ways of incorporating virtual reality into its e-commerce platform.

InfinityAR’s research and development team will begin working out of Alibaba’s Israel Machine Laboratory, part of Alibaba DAMO Academy, the R&D initiative into which it is pouring $15 billion with the goal of eventually serving two billion customers and creating 100 million jobs by 2036. DAMO Academy collaborates with universities around the world, and Alibaba’s Israel Machine Laboratory has a partnership with Tel Aviv University focused on video analysis and machine learning.

In a press statement, the laboratory’s head, Lihi Zelnik-Manor, said “Alibaba is delighted to be working with InfinityAR as one team after three years of partnership. The talented team brings unique knowhow in sensor fusion, computer vision and navigation technologies. We look forward to exploring these leading technologies and offering additional benefits to customers, partners and developers.”

Powered by WPeMatico

Apple could announce its gaming subscription service on Monday

Apple is about to announce some new services on Monday. While everybody expects a video streaming service as well as a news subscription, a new report from Bloomberg says that the company might also mention its gaming subscription.

Cheddar first reported back in January that Apple has been working on a gaming subscription. Users could pay a monthly subscription fee to access a library of games. We’re most likely talking about iOS games for the iPhone and iPad here.

Games are the most popular category on the App Store, so it makes sense to turn this category into a subscription business. And yet, most of them are free-to-play, ad-supported games. Apple doesn’t necessarily want to target those games in particular.

According to Bloomberg, the service will focus on paid games from third-party developers, such as Minecraft, NBA 2K games and the GTA franchise. Users would essentially pay to access this bundle of games. Apple would redistribute revenue to game developers based on how much time users spend within a game in particular.

It’s still unclear whether Apple will announce the service or launch it on Monday. The gaming industry is more fragmented than the movie and TV industry, so it makes sense to talk about the service publicly even if it’s not ready just yet.

Powered by WPeMatico

Flying taxi startup Blade is helping Silicon Valley CEOs bypass traffic

One year after a $38 million Series B valued on-demand aviation startup Blade at $140 million, the company has begun taxiing the Bay Area’s elite.

As part of a new pilot program, Blade has given 200 people in San Francisco and Silicon Valley exclusive access to its mobile app, allowing them to book helicopters, private jets and even seaplanes at a moments notice for $200 per seat, at least.

Blade, backed by Lerer Hippeau, Airbus, former Google CEO Eric Schmidt and others, currently flies passengers around the New York City area, where it’s headquartered, offering the region’s wealthy $800 flights to the Hamptons, among other flights at various price points. According to Business Insider, it has worked with Uber in the past to help deep-pocketed Coachella attendees fly to and from the Van Nuys Airport to Palm Springs, renting out six-seat helicopters for more than $4,000 a pop.

Its latest pilot seems to target business travelers, connecting riders to the San Francisco International Airport and Oakland International Airport to Palo Alto, San Jose, Monterey and Napa Valley. The goal is to shorten trips made excruciatingly long due to bad traffic in major cities like New York, Los Angeles and San Francisco. Recently, the startup partnered with American Airlines to better establish its network of helicopters, a big step for the company as it works to integrate with existing transportation infrastructure.

New work with @flybladenow pic.twitter.com/eONvKU3rhM

— Tyler Babin (@Tyler_Babin) March 11, 2019

Blade, led by founder and chief executive officer Rob Wiesenthal, a former Warner Music Group executive, has raised about $50 million in venture capital funding to date. To launch at scale and, ultimately, to compete with the likes of soon-to-be-public transportation behemoth Uber, it will have to land a lot more investment support.

Uber too has lofty plans to develop a consumer aerial ridesharing business, as do several other privately-funded startups. Called UberAIR, Uber will offer short-term shareable flights to commuters as soon as 2023. The company has raised billions of dollars to turn this sci-fi concept into reality.

Then there’s Kitty Hawk, a company launched by former Google vice president and Udacity co-founder Sebastian Thrun, which is developing an aircraft that can take off like a helicopter but fly like a plane for short-term urban transportation purposes. Others in the air taxi or vertical take-off and landing aircraft space, including Volocopter, Lilium and Joby Aviation, have raised tens of millions to eliminate traffic congestion or, rather, to chauffer the rich.

Blade’s next stop is India, the Financial Times reports, where it will conduct a pilot connecting travelers in downtown Mumbai and Pune. The company tells TechCrunch they are currently exploring one additional domestic pilot and one additional international pilot.

Powered by WPeMatico

Startups Weekly: A much-needed unicorn IPO update

As I’m sure everyone reading this knows, female-founded businesses receive just over 2 percent of venture capital on an annual basis. Most of those checks are written to early-stage startups. It’s extremely difficult for female founders to garner late-stage support, let alone cash $100 million checks.

Maybe that’s finally changing. This week, not one but two female-founded and led companies, Glossier and Rent The Runway, raised nine-figure rounds and cemented their status as unicorn companies. According to PitchBook data from 2018, there are only about 15 unicorn startups with female founders. Though I’m sure that number has increased in the last year, you get the point: There are hundreds of privately held billion-dollar companies and shockingly few of those have women founders (even fewer have female CEOs)…

Moving on…

I spent a good part of the week at San Francisco’s Pier 48 in a room full of vest-wearing investors. We listened to some 200 YC companies make their 120-second pitch and though it was a bit of a whirlwind, there were definitely some standouts. ICYMI: We wrote about each and every company that pitched on day 1 and day 2. If you’re looking for the inside scoop on the companies that forwent demo day and raised rounds, or were acquired, before hitting the stage, we’ve got that too.

Lyft: This week, Lyft set the terms for its highly-anticipated initial public offering, expected to be completed next week. The company will charge between $62 and $68 per share, raising more than $2 billion at a valuation of ~$23 billion. We previously reported its initial market cap would be around $18.5 billion, but that was before we knew that Lyft’s IPO was already oversubscribed. Here’s a little more background on the Lyft IPO for those interested.

Uber: The global ride-hailing business flew a little more under the radar this week than last week, but still managed to grab a few headlines. The company has decided to sell its stock on the New York Stock Exchange, which is the least surprising IPO development of 2019, considering its key U.S. competitor, Lyft, has been working with the Nasdaq on its IPO. Uber is expected to unveil its S-1 in April.

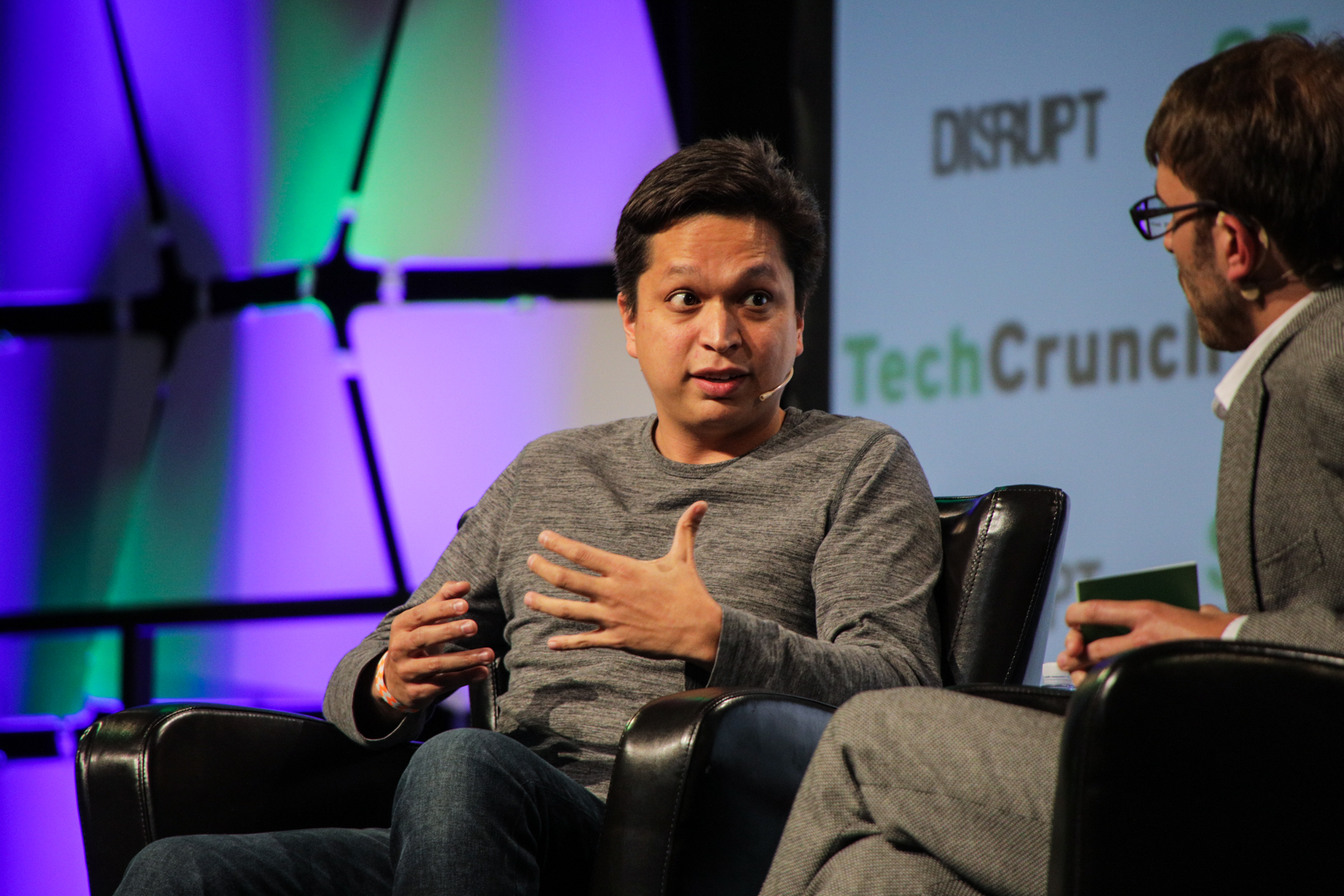

Ben Silbermann, co-founder and CEO of Pinterest, at TechCrunch Disrupt SF 2017.

Pinterest: Pinterest, the nearly decade-old visual search engine, unveiled its S-1 on Friday, one of the final steps ahead of its NYSE IPO, expected in April. The $12.3 billion company, which will trade under the ticker symbol “PINS,” posted revenue of $755.9 million in the year ending December 31, 2018, up from $472.8 million in 2017. It has roughly doubled its monthly active user count since early 2016, hitting 265 million last year. The company’s net loss, meanwhile, shrank to $62.9 million in 2018 from $130 million in 2017.

Zoom: Not necessarily the buzziest of companies, but its S-1 filing, published Friday, stands out for one important reason: Zoom is profitable! I know, what insanity! Anyway, the startup is going public on the Nasdaq as soon as next month after raising about $150 million in venture capital funding. The full deets are here.

General Catalyst, a well-known venture capital firm, is diving more seriously into the business of funding seed-stage business. The firm, which has investments in Warby Parker, Oscar and Stripe, announced earlier this week its plan to invest at least $25 million each year in nascent teams.

Earlier this week, Opendoor, the SoftBank -backed real estate startup, filed paperwork to raise even more money. According to TechCrunch’s Ingrid Lunden, the business is planning to raise up to $200 million at a valuation of roughly $3.7 billion. It’s possible this is a Series E extension; after all, the company raised its $400 million Series E only six months ago. Backers of OpenDoor include the usual suspects: Andreessen Horowitz, Coatue, General Atlantic, GV, Initialized Capital, Khosla Ventures, NEA and Norwest Venture Partners.

Startup capital

- UiPath is raising $400M at a more than $7B valuation

- Ola raises $300M as part of a new EV deal with Hyundai and Kia

- Music startup Splice raises $57.5M to sell samples

- Iterable lands $50M to expand its cross-channel marketing platform

- Guesty, meant for property managers on Airbnb, raises $35M

- Travis Kalanick invests in Kargo, the ‘Uber for Trucks’

- Catch emerges from Y Combinator with $5.1M

Backstage Capital founder and managing partner Arlan Hamilton, center.

Axios’ Dan Primack and Kia Kokalitcheva published a report this week revealing Backstage Capital hadn’t raised its debut fund in total. Backstage founder Arlan Hamilton was quick to point out that she had been honest about the challenges of fundraising during various speaking engagements, and even on the Gimlet “Startup” podcast, which featured her in its latest season. A Twitter debate ensued and later, Hamilton announced she was stepping down as CEO of Backstage Studio, the operations arm of the venture fund, to focus on raising capital and amplifying founders. TechCrunch’s Megan Rose Dickey has the full story.

This week, TechCrunch’s Connie Loizos revisited a long-held debate: Pro rata rights, or the right of an earlier investor in a company to maintain the percentage that he or she (or their venture firm) owns as that company matures and takes on more funding. Here’s why pro rata rights matter (at least, to VCs).

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and I chat about Glossier, Rent The Runway and YC Demo Days. Then, in a special Equity Shot, we unpack the numbers behind the Pinterest and Zoom IPO filings.

Want more TechCrunch newsletters? Sign up here.

Powered by WPeMatico

Equity Shot: Pinterest and Zoom file to go public

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

What a Friday. This afternoon (mere hours after we released our regularly scheduled episode no less!), both Pinterest and Zoom dropped their public S-1 filings. So we rolled up our proverbial sleeves and ran through the numbers. If you want to follow along, the Pinterest S-1 is here, and the Zoom document is here.

Got it? Great. Pinterest’s long-awaited IPO filing paints a picture of a company cutting its losses while expanding its revenue. That’s the correct direction for both its top and bottom lines.

As Kate points out, it’s not in the same league as Lyft when it comes to scale, but it’s still quite large.

More than big enough to go public, whether it’s big enough to meet, let alone surpass its final private valuation ($12.3 billion) isn’t clear yet. Peeking through the numbers, Pinterest has been improving margins and accelerating growth, a surprisingly winsome brace of metrics for the decacorn.

Pinterest has raised a boatload of venture capital, about $1.5 billion since it was founded in 2010. Its IPO filing lists both early and late-stage investors, like Bessemer Venture Partners, FirstMark Capital, Andreessen Horowitz, Fidelity and Valiant Capital Partners as key stakeholders. Interestingly, it doesn’t state the percent ownership of each of these entities, which isn’t something we’ve ever seen before.

Next, Zoom’s S-1 filing was more dark horse entrance than Katy Perry album drop, but the firm has a history of rapid growth (over 100 percent, yearly) and more recently, profit. Yes, the enterprise-facing video conferencing unicorn actually makes money!

In 2019, the year in which the market is bated on Uber’s debut, profit almost feels out of place. We know Zoom’s CEO Eric Yuan, which helps. As Kate explains, this isn’t his first time as a founder. Nor is it his first major success. Yuan sold his last company, WebEx, for $3.2 billion to Cisco years ago then vowed never to sell Zoom (he wasn’t thrilled with how that WebEx acquisition turned out).

Should we have been that surprised to see a VC-backed tech company post a profit — no. But that tells you a little something about this bubble we live in, doesn’t it?

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

Our 9 favorite startups from Y Combinator W19 Demo Day 2

Heathcare kiosks, a home-cooked food marketplace, and a way for startups to earn interest on their funding topped our list of high-potential companies from Y Combinator’s Winter 2019 Demo Day 2. 88 startups launched on stage at the lauded accelerator, though some of the best skipped the stage as they’d already raised tons of money.

Be sure to check out our write-ups of all 85 startups from day 1 plus our top picks, as well as the full set from day 2. But now, after asking investors and conferring with the TechCrunch team, here are our 9 favorites from day 2.

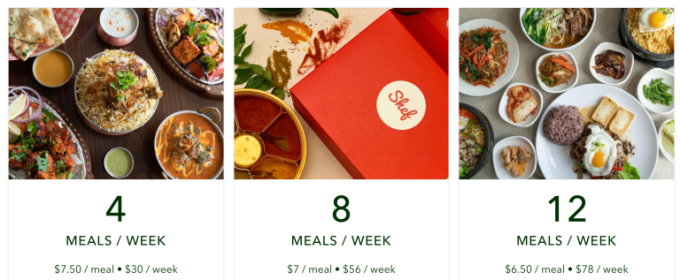

Shef

Two months ago, California passed the first law in the country legalizing the sale of home cooked food. Shef creates a marketplace where home chefs can find nearby customers. Shef’s meals cost around $6.50 compared to $20 per meal for traditional food delivery, and the startup takes a 22 percent cut of every transaction. It’s been growing 50 percent week over week thanks to deals with large property management companies that offer the marketplace as a perk to their residents. Shef wants to be the Airbnb of home cooked food.

Why we picked Shef: Deregulation creates gold rush opportunities and Shef was quick to seize this one, getting started just days after the law passed. Food delivery is a massive megatrend but high costs make it unaffordable or a luxury for many. If a parent is already cooking meals for their whole family, it takes minimal effort to produce a few extra portions to sell to the neighbors at accessible rates.

Handle

This startup automates the collection process of unpaid construction invoices. Construction companies are often forced to pay for their own jobs when customers are late on payments. According to Handle, there are $104 billion in unpaid construction invoices every year. Handle launched six weeks ago and is currently collecting $22,800 in monthly revenue. The founders previously launched an Andreessen Horowitz-backed company called Tenfold.

Why we picked Handle: Construction might seem like an unsexy vertical, but it’s massive and rife with inefficiencies this startup tackles. Handle helps contractors demand payments, instantly file liens that ensure they’re compensated for work or materials, or exchange unpaid invoices for cash. Even modest fees could add up quickly given how much money moves through the industry. And there are surely secondary business models to explore using all the data Handle collects on the construction market.

Blueberry Medical

This pediatric telemedicine company provides medical care instantly to families. Blueberry provides constant contact, the ability to talk to a pediatrician 24/7 and at-home testing kits for a total of $15 per month. They’ve just completed a paid consumer pilot and say they were able to resolve 84 percent of issues without in-person care. They’ve partnered with insurance providers to reduce ER visits.

Why we picked Blueberry: Questionable emergency room visits are a nightmare for parents, a huge source of unnecessary costs, and a drain on resources for needy patients. Parents already spend so much time and money trying to keep their kids safe that this is a no-brainer subscription. And the urgent and emotional pull of pediatrics is a smart wedge into telemedicine for all demographics.

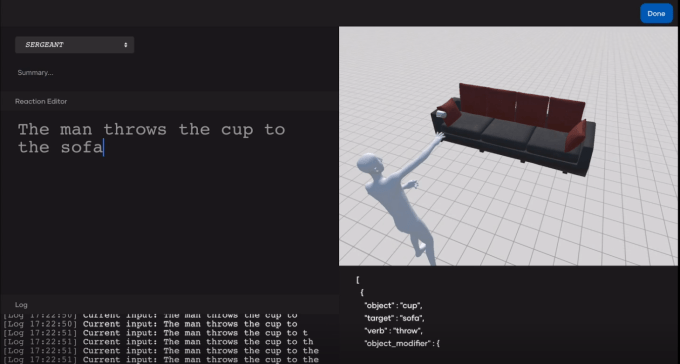

rct studio

Led by a team of YC alums behind Raven, an AI startup acquired by Baidu in 2017, rct studio is a creative studio for immersive and interactive film. The platform provides a real time “text to render “engine (so the text “A man sits on a sofa” would generate 3D imagery of a man sitting on a sofa) that supports mainstream 3D engines like Unity and Unreal, as well as a creative tool for film professionals to craft immersive and open-ended entertainment experiences called Morpheus Engine.

Why we picked rct studio: Netflix’s Bandersnatch was just the start of mainstream interactive film. With strong technology, an innovative application, and proven talent, rct could become a critical tool for creating this kind of media. And even if the tech falls short of producing polished media, it could be used for storyboards and mockups.

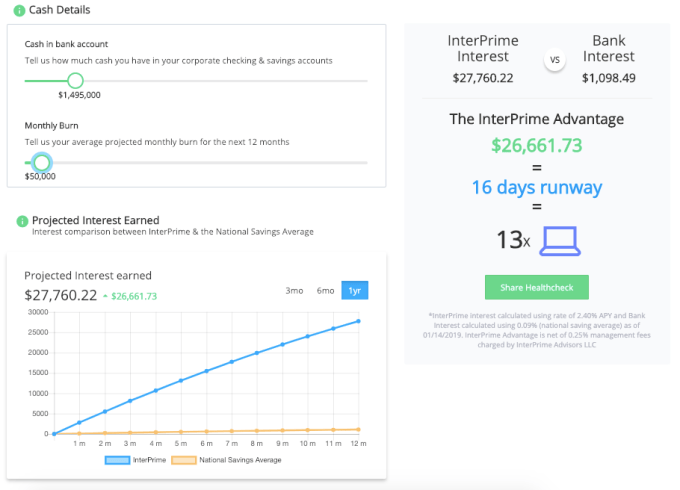

Interprime

Provides “Apple level” treasury services to startups. Startups are raising a lot of money with no way to manage it, says Interprime. They want to help these businesses by managing these big investments by helping them earn interest on their funding while retaining liquidity. They take a .25 percent advisory fee for all the investment they oversee. So far, they have $10 million in investment capital they are servicing.

Why we picked Interprime: The explosion of early stage startup funding evidenced by Y Combinator itself has created new banking opportunities. Silicon Valley Bank is ripe for competition and Interprime’s focus on startups could unlock new financial services. With Interprime’s YC affiliation, it has access to tons of potential customers.

Nabis

Nabis

Nabis is tackling the cannabis shipping and logistics business, working with suppliers to ship out goods to retailers reliably. It’s illegal for FedEx to ship weed so Nabis has swooped in and is helping ship and connect while taking cuts of the proceeds, a price the suppliers are willing to pay due to their 98 percent on-time shipping record.

Why we picked Nabis: Quirky regulation creates efficiency gaps in the marijuana business where incumbents can’t participate since they’re not allowed to handle the flower. As more states legalize and cannabis finds its way into more products, moving goods from farm to processor to retailer could spawn a big market for Nabis with a legal moat. It’s already working with many top marijuana brands, and could sell them additional services around business intelligence and distribution.

WeatherCheck

This startup measures weather damage for insurance companies. WeatherCheck has secured $4.7 million in annual bookings in the five months since it launched to help insurance carriers reduce their overall claims expense. To use the service, insurers upload data about their properties. WeatherCheck then monitors the weather and sends notifications to insurance companies, if, for example, a property has been damaged by hail.

Why we picked WeatherCheck: Extreme weather is only getting worse due to climate change. With 10.7 million US properties impacted by hail damage in 2017, WeatherCheck has found a smart initial market from which to expand. It’s easy to imagine the startup working on flood, earthquake, tornado, and wildfire claims too. Insurance is a fierce market, and old-school providers could get a leg up with WeatherCheck’s tech.

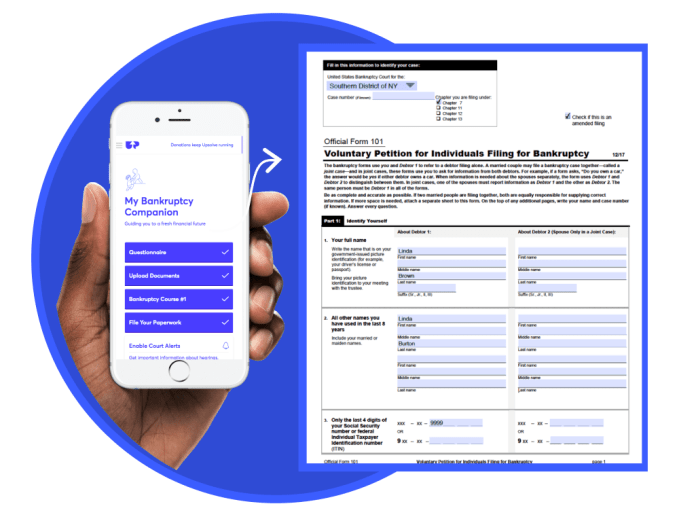

Upsolve

Upsolve wants to help low-income individuals file for bankruptcy more easily. The non-profit service gets referral fees from pointing non low-income families to bankruptcy lawyers and is able to offer the service for free. The company says that medical bills, layoffs and predatory loans can leave low-income families in dire situations and that in the last 6 months, their non-profit has alleviated customers from $24 million in debt.

Why we picked Upsolve: Financial hardship is rampant. With the potential for another recession and automation threatening jobs, many families could be at risk for bankruptcy. But the process is so stigmatized that some people avoid it at all costs. Upsolve could democratize access to this financial strategy while inserting itself into a lucrative transaction type.

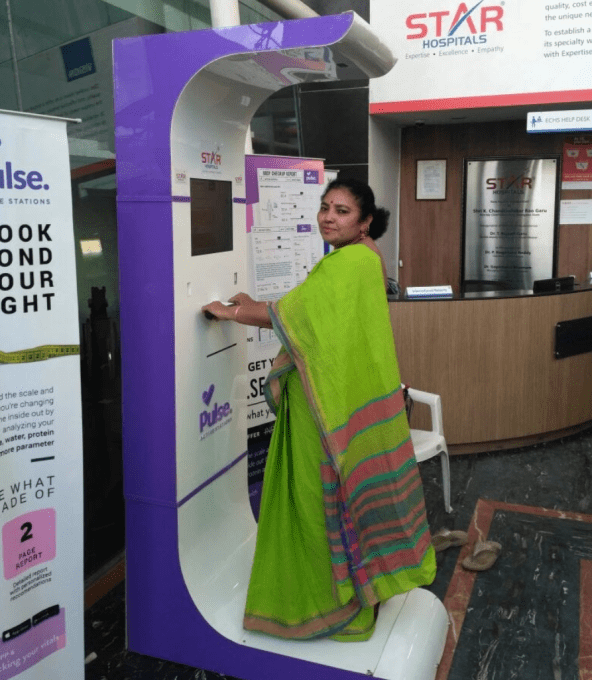

Pulse Active Stations Network

This startup makes health kiosks for India, meant to be installed in train stations. Co-founder Joginder Tanikella says that there are 600,000 preventable deaths in India as many in the region don’t get regular doctor checkups. “But everyone takes trains,” he says. Their in-station kiosk measures 21 health parameters. The company made $28,000 in revenue last month. Charging $1 per test, Tanikella says each machine pays for itself within 3 months. In the future, the kiosks will allow them to sell insurance and refer users to doctors.

Why we picked Pulse: Telemedicine can’t do everything, but plenty of people around the world can’t make it in to a full-fledged doctor’s office. Pulse creates a mid-point where hardware sensors can measure body fat, blood pressure, pulse, and bone strength to improve accuracy for diagnosing diabetes, osteoarthritis, cardiac problems, and more. Pulse’s companion app could spark additional revenue streams, and there’s clearly a much bigger market for this than just India.

Honorable Mentions

-Allo, a marketplace where parents can exchange babysitting and errand-running

-Shiok, a lab-grown shrimp substitute

-WithFriends, a subscription platform for small retail businesses

—

More Y Combinator coverage from TechCrunch:

Additional reporting by Kate Clark, Lucas Matney, and Greg Kumparak

Powered by WPeMatico

Firefox is now a better iPad browser

Mozilla today announced a new iOS version of Firefox that has been specifically optimized for Apple’s iPad. Given the launch of the new iPad mini this week, that’s impeccable timing. It’s also an admission that building a browser for tablets is different from building a browser for phones, which is what Mozilla mostly focused on in recent years.

“We know that iPads aren’t just bigger versions of iPhones,” Mozilla writes in today’s announcement. “You use them differently, you need them for different things. So rather than just make a bigger version of our browser for iOS, we made Firefox for iPad look and feel like it was custom made for a tablet.”

So with this new version, Firefox for iPad gets support for iOS features like split screen and the ability to set Firefox as the default browser in Outlook for iOS. The team also optimized tab management for these larger screens, including the option to see tabs as large tiles, “making it easy to see what they are, see if they spark joy and close with a tap if not.” And if you have a few tabs you want to share, then you can do so with the Send Tabs feature Mozilla introduced earlier this year.

Starting a private browsing session on iOS always took a few extra tabs. The iPad version makes this a one-tap affair as it prominently highlights this feature in the tab bar.

Because quite a few iPad users also use a keyboard, it’s no surprise that this version of Firefox also supports keyboard shortcuts.

If you are an iPad user in search of an alternative browser, Firefox may now be a viable option for you. Give it a try and let us know what you think in the comments (just don’t remind us how you work from home for only a few hours a day and make good money… believe me, we’re aware).

Powered by WPeMatico