Vlocity nabs $60M Series C investment on $1B valuation

As we wrote last week in How Salesforce paved the way for the SaaS platform approach, the ability to build extensions, applications and even whole companies on top of the Salesforce platform set the stage and the bar for every SaaS company since. Vlocity certainly recognized that. Targeting five verticals, it built industry-specific CRM solutions on the Salesforce platform, and today announced a $60 million Series C round on a fat unicorn $1 billion valuation.

The round was led by Sutter Hill Ventures and Salesforce Ventures. New investors Bessemer Venture Partners and existing strategic investors Accenture and New York Life also participated. The company has now raised $163 million.

Company co-founder and CEO David Schmaier, whose extensive career includes stints with Siebel Systems and Oracle, says he and his co-founders (three of whom helped launch Veeva) wanted to take the idea of Veeva, which is a life sciences-focused company built on top of Salesforce, and extend that idea across five verticals instead of just one. Those five verticals include communications and media, insurance and financial services, health, energy and utilities and government and nonprofits.

The idea he said was to build a company with a market that was 10x the size of life sciences. “What we’re doing now is building five Veevas at once. If you could buy a product already tailored to the needs of your industry, why wouldn’t you do that?,” Schmaier said.

The theory seems to be working. He says that the company, which was founded in 2014, has already reached $100 million in revenue and expects to double that by the end of this year. Then of course, there is the unicorn valuation. While perhaps not as rare as it once was, reaching the $1 billion level is still a significant milestone for a startup.

In the Salesforce platform story, co-founder and CTO Parker Harris addressed the need for solutions like the ones from Veeva and Vlocity. “…Harris said they couldn’t build one Salesforce for healthcare and another for insurance and a third one for finance. We knew that wouldn’t scale, and so the platform [eventually] just evolved out of this really close relationship with our customers and the needs they had.” In other words, Salesforce made the platform flexible enough for companies like these to fill in the blanks.

“Vlocity is a perfect example of the incredible innovation occurring in the Salesforce ecosystem and how we are working together to provide customers in all industries the technologies they need to attract and serve customers in smarter ways,” Jujhar Singh, EVP and GM for Salesforce Industries said in a statement.

It’s also telling that of the three strategic investors in this round — New York Life, Accenture and Salesforce Ventures — Salesforce is the biggest investor, according to Schmaier.

The company has 150 customers, including investor New York Life, Verizon (which owns this publication), Cigna and the City of New York. It already has 700 employees in 20 countries. With this additional investment, you can expect those numbers to increase.

“What this Series C round allows us to do is to really put the gas on investing in product development, because verticals are all about going deep,” Schmaier said.

Powered by WPeMatico

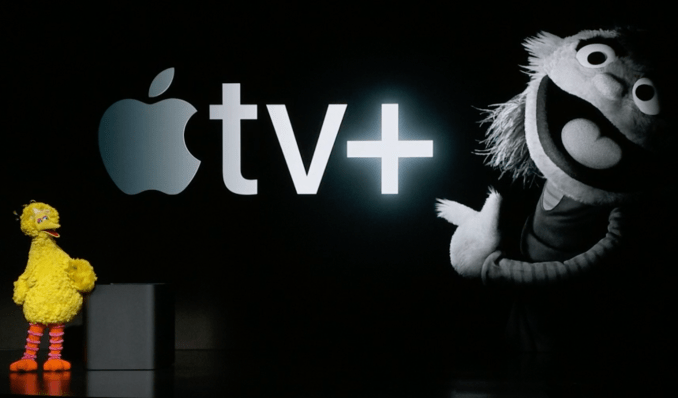

Apple TV+ makes Facebook Watch look like a joke

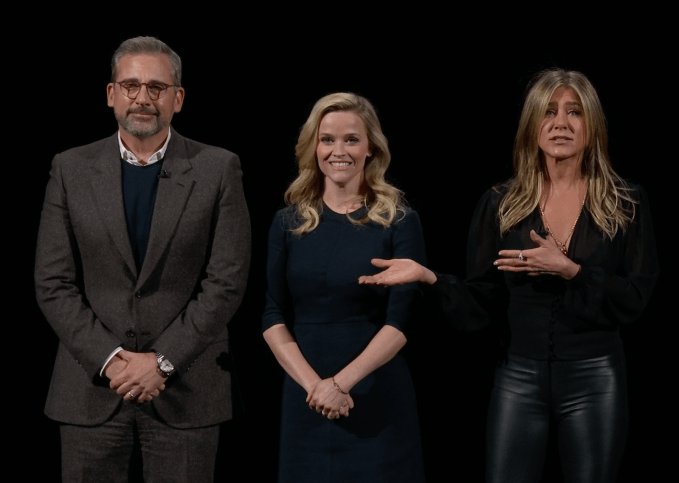

Apple flexed its wallet today in a way Facebook has scared to do. Tech giants make money by the billions, not the millions, which should give them an easy way to break into premium video distribution: buy some must-see content. That’s the strategy I’ve been advocating for Facebook but that Apple actually took to heart. Tim Cook wrote lines of zeros on some checks, and suddenly Steven Spielberg, JJ Abrams, Reese Witherspoon, Jennifer Aniston, and Oprah became the well-known faces of Apple TV+.

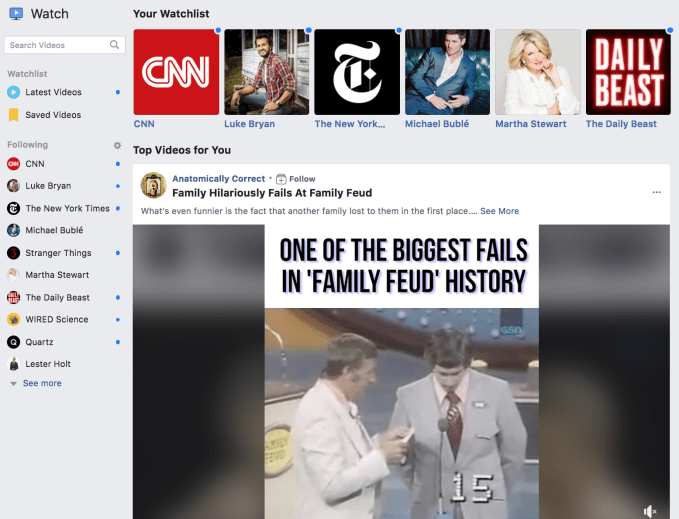

Facebook Watch has…MTV’s The Real World? The other Olsen sister? Re-runs of Buffy The Vampire Slayer? Actually, Facebook Watch is dominated by the kind of low-quality viral video memes the social network announced it would kick out of its News Feed for wasting people’s time.

And so while Apple TV+ at least has a solid base camp from which to make the uphill climb to compete with Netflix, Facebook Watch feels like it’s tripping over its own feet.

Today, Apple gave a preview of its new video subscription service that will launch in fall offering unlimited access to old favorites and new exclusives for a monthly fee. Yet even without any screenshots or pricing info, Apple still got people excited by dangling its big-name content.

Spielberg is making short films out of the Amazing Stories anthology that inspired him as a child. Abrams is spinning a tale of a musician’s rise called Little Voice Witherspoon and Aniston star in The Morning Show about anchoring a news program. And Oprah is bringing documentaries about workplace harassment and mental health.

This tentpole tactic will see Apple try to draw users into a free trial of Apple TV+ with this must-see content and then convince them to stay. And a compelling, exclusive reason to watch is exactly what’s been missing from…Facebook Watch. Instead, it chose to fund a wide array of often unscripted reality and documentary shorts that never felt special or any better than what else was openly available on the Internet, let alone what you could get from a subscription. It now claims to have 75 million people Watching at least one minute per day, but it’s failed to spawn a zeitgeist moment. Even as Facebook has scrambled to add syndicated TV cult favorites like Firefly or soccer matches to free, ad-supported video service, it’s failed to sign on anything truly newsworthy.

That’s just not going to fly anymore. Tech has evolved past the days when media products could win just based on their design, theoretical virality, or the massive audiences they’re cross-promoted to. We’re anything but starved for things to watch or listen to. And if you want us to frequent one more app or sign up for one more subscription, you’ll need A-List talent that makes us take notice. Netflix has Stranger Things. HBO has Game Of Thrones. Amazon has the Marvelous Mrs. Maisel. Disney+ has…Marvel, Star Wars, and the princesses. And now Apple has the world’s top directors and actresses.

Video has become a battle of the rich. Apple didn’t pull any punches. Facebook will need to buy some new fighters if Watch is ever going to deserve a place in the ring.

Powered by WPeMatico

No Man’s Sky’s next update will let you explore infinite space in virtual reality

No Man’s Sky just figured out a way to make a wildly absorbing space exploration game even more immersive.

Announced during Sony’s first PlayStation State of Play update, No Man’s Sky devotees will soon be able to explore an endless procedurally generated universe in virtual reality. Hello Games’ Sean Murray followed Sony’s news with a bit more color on Twitter.

The VR update is part of No Man’s Sky Beyond, the development team’s latest extremely generous bundle of new content, doled out to existing players for free. No Man’s Sky’s virtual reality makeover will launch on PlayStation VR and Steam VR this summer.

The VR update will bring enhance the first-person perspective of the existing game, allowing players to steer a starship using their thruster, reach into a bag to fetch their multitool and wave to fellow players meandering around the vastness of space.

No Man’s Sky Virtual Reality is not a separate mode. Anything that is possible in NEXT or any other update is ready and waiting in VR. pic.twitter.com/zSMSCaz4es

— Sean Murray (@NoMansSky) March 25, 2019

While we don’t know all of the details yet, that experience will dovetail nicely with the forthcoming feature cluster known as No Man’s Sky Online, “a radical new social and multiplayer experience” for the at times isolated space sim.

“No Man’s Sky Virtual Reality is not a separate mode, but the entire game brought to life in virtual reality,” Murray wrote in a blog post. According to Murray the update will offer “a true VR experience rather than a port.”

You can get a glimpse of how this will look in a teaser video, though since much of it depicts normal gameplay, there’s plenty of surprise still in store. Assuming the game runs well enough, No Man’s Sky Virtual Reality will be a far cry from gimmicky VR games that lack true depth, offering one of the most expansive — if not the most expansive — VR experiences to date.

No Man’s Sky fans should still keep an eye out — there’s one more mystery announcement left for the Beyond update, which is shaping up to make the No Man’s Sky world more epic than anyone who played the game at launch could ever have hoped for.

“By bringing full VR support, for free, to the millions of players already playing the game, No Man’s Sky will become perhaps the most-owned VR title when released,” Murray wrote.

“We are excited for that moment when millions of players will suddenly update and be able to set foot on their home planets and explore the intricate bases they have built in virtual reality for the first time.”

Powered by WPeMatico

McDonald’s is acquiring Dynamic Yield to create a more customized drive-thru

McDonald’s is announcing an agreement to acquire personalization company Dynamic Yield.

The announcement does not include a price, but a source with knowledge of the deal said that it’s more than $300 million. This is the fast food chain’s largest acquisition in 20 years.

Dynamic Yield works with brands across e-commerce, travel, finance and media to create what’s been described as an Amazon-style personalized online experience.

McDonald’s said it will use this technology to create a drive-thru menu that can be tailored to things like the weather, current restaurant traffic and trending menu items. Once you’ve started ordering, the display can also recommend additional items based on what you’ve already chosen.

In fact, the company said it tested this in several U.S. locations in 2018. The plan is to start rolling this out across the United States in 2019, and then to move into international markets. McDonald’s also plans to integrate this technology into other digital products, like self-serve kiosks and the McDonald’s mobile app.

“Technology is a critical element of our Velocity Growth Plan, enhancing the experience for our customers by providing greater convenience on their terms,” said McDonald’s president and CEO Steve Easterbrook in a statement. “With this acquisition, we’re expanding both our ability to increase the role technology and data will play in our future and the speed with which we’ll be able to implement our vision of creating more personalised experiences for our customers.”

The plan that Easterbrook is referring to was first announced in March 2017, with a focus on technology like the McDonald’s mobile app and its Experience of the Future stores.

At the same time, McDonald’s said Dynamic Yield will continue to operate as a standalone company serving existing and future clients, and that it will continue to invest in the core personalization technology.

According to Crunchbase, Dynamic Yield has raised a total of $83.3 million from investors, including Innovation Endeavors, Bessemer Venture Partners and Marker Capital, as well as strategic backers like Naver (which owns the messaging apps Line and Snow), Baidu, The New York Times and Deutsche Telekom.

“We started Dynamic Yield seven years ago with the premise that customer-centric brands must make personalization a core activity,” said Dynamic Yield co-founder and CEO Lior Agmon in a statement. “We’re thrilled to be joining an iconic global brand such as McDonald’s and are excited to innovate in ways that have a real impact on people’s daily lives.”

Powered by WPeMatico

Tell us who designed your startup’s brand

Before people ever use or buy your product, they’ll interact with your brand. What does your company stand for? How is your product different? Branding is an often overlooked, but essential component of communicating your company’s values, connecting with potential customers and, ultimately, driving conversions.

But finding the right brand designer is hard. Depending on your budget, industry and scope, brand designer and brand agency services can vary widely. It’s a niche community, and brand designers who thrive in chaotic, fast-paced startup environments are rare.

We’re demystifying the world of brand design by covering how companies like Intercom approach their brand identity, and asking founders, like you, to nominate a talented brand designer or agency with whom they’ve collaborated. We’ll be publishing more branding articles, guest posts by industry experts and brand designer profiles in the weeks to come, but we need your help. We’re relying on your recommendations to identify which brand designers and agencies to feature.

We’re especially looking for people who have experience in these three categories:

- Visual brand identity: Conveying a startup’s core values through its logo, colors, typography, graphics and other visual elements

- UX/UI design: Designing how a company’s brand is expressed through user experience and user interface elements, such as colors, shapes, fonts, illustrations and icons

- Brand narrative and strategy: Developing a startup’s story and a plan for how it is internally and externally communicated

We’re also interested in understanding how much time you’ve worked with a designer or agency, whether you’d recommend them to a friend and examples of their work.

Brand design is just one of our latest initiatives to identify the best service providers for startups. As we develop a shortlist of the top brand designers and agencies in the world, we’ll be asking them about their design philosophy, brand development process, rates and fees, and more. We’ll publish their profiles (along with your recommendations) on Extra Crunch.

We’ll continue updating our database of brand designers on a rolling basis, but in the meantime, help us share this article and nominate a brand designer or agency you know and love.

Any thoughts or questions? Email us at ec_editors@techcrunch.com.

Powered by WPeMatico

Social investment platform eToro acquires smart contract startup Firmo

Social investing and trading platform eToro announced that it has acquired Danish smart contract infrastructure provider Firmo for an undisclosed purchase price.

Firmo’s platform enables exchanges to execute smart financial contracts across various assets, including crypto derivatives, and across all major blockchains. Firmo founder and CEO Dr. Omri Ross described the company’s mission as “…enabl[ing] our users to trade any asset globally with instant settlement by tokenizing assets and executing all essential trade processes on the blockchain.” Firmo’s only disclosed investment, according to data from Pitchbook, came in the form of a modest pre-seed round from the Copenhagen Fintech Lab accelerator.

Firmo’s mission aligns well with that of eToro — which is equal parts trading platform, social network and educational resource for beginner investors — with the company having long communicated hopes of making the capital markets more open, transparent and accessible to all users and across all assets. By gobbling up Firmo, eToro will be able to accelerate its development of offerings for tokenized assets.

The acquisition represents the latest step in eToro’s broader growth plan, which has ramped up as of late. Earlier in March, the company launched a crypto-only version of its platform in the US, as well as a multi-signature digital wallet where users can store, send and receive cryptocurrencies.

The Firmo deal and eToro’s other expansion activities fit squarely into the company’s belief in the tokenization of assets and the immense, sector-defining opportunity that it creates. Etoro believes that asset tokenization and the movement of financial services onto the blockchain are all but inevitable and the company has employed the long-tailed strategy of investing heavily in related blockchain and crypto technologies despite the ongoing crypto winter.

“Blockchain and the tokenization of assets will play a major role in the future of finance,” said eToro co-founder and CEO Yoni Assia. “We believe that in time all investible assets will be tokenized and that we will see the greatest transfer of wealth ever onto the blockchain.” Assia expressed a similar sentiment in a recent conversation with TechCrunch, stating “We think [the tokenization of assets] is a bigger opportunity than the internet…”

After the acquisition, Firmo will operate as an internal R&D arm within eToro focused on developing blockchain-oriented trade execution and the infrastructure behind the digital representation of tokenized assets.

“The Firmo team has done ground-breaking work in developing practical applications for blockchain technology which will facilitate friction-less global trading,” said Assia.

“The adoption of smart contracts on the blockchain increases trust and transparency in financial services. We are incredibly proud and excited that [Firmo] will be joining the eToro family. We believe that together we have a very bright future and look forward to pursuing our shared goal to become the first truly global service provider allowing people to trade, invest and save.”

Powered by WPeMatico

Lidar startup Ouster raises $60 million in production run-up

Ouster has raised $60 million as the San Francisco-based lidar startup opens a new facility that will have the capacity to assemble and ship several thousand sensors a month by the end of 2019.

The new factory, which will have a grand opening ceremony March 28, currently produces hundreds of sensors per month. Ouster says at full capacity, the factory will produce $25 million to $50 million in inventory per month.

Lidar measures distance using laser light to generate highly accurate 3D maps of the world around the car. It’s considered by most in the self-driving car industry a key piece of technology required to safely deploy robotaxis and other autonomous vehicles (although not everyone agrees). However, the sensors are also useful in other industries — and this is where Ouster’s business model is targeted.

Ouster has cast a wider net for customers than some of its rivals. Unlike others vying solely for automotive customers working on the development of autonomous vehicles, Ouster is selling sensors to other industries. Ouster is selling its light detection and ranging radar sensors to robotics, drones, mapping, defense, building security, mining and agriculture companies.

The strategy has appeared to pay off. Ouster says it has 400 customers from 15 industries.

The $60 million in additional funding follows a Series A raise of $27 million announced back in 2017 as Ouster came out of stealth mode. In the years since, the company led by Angus Pacala has grown to more than 100 employees and announced four lidar sensors, with resolutions from 16 to 128 channels, and two product lines, the OS-1 and OS-2. The startup expects to nearly double its headcount in the coming year to support further product line development.

The $60 million in equity and debt funding includes investments from Runway Growth Capital and Silicon Valley Bank, as well as additional funding from Series A participants Cox Enterprises, Constellation Tech Ventures, Fontinalis Partners, Carthona and others.

Ouster said the additional investment has helped to develop Ouster’s product lines, including the launch of the OS-1 128 lidar sensor, and fund the expansion of its production facilities.

The company also announced the appointment of Susan Heystee, senior VP for OEM business at Verizon Connect, to its board of directors.

Waymo, the self-driving car company under Google’s Alphabet, could be a new competitor to the company. Waymo announced this month it will start selling its custom lidar sensors to companies outside of self-driving cars. Waymo will initially target robotics, security and agricultural technology. The sales will help the company scale its autonomous technology faster, making each sensor more affordable through economies of scale, Simon Verghese, head of Waymo’s lidar team, wrote in a Medium post at the time.

Powered by WPeMatico

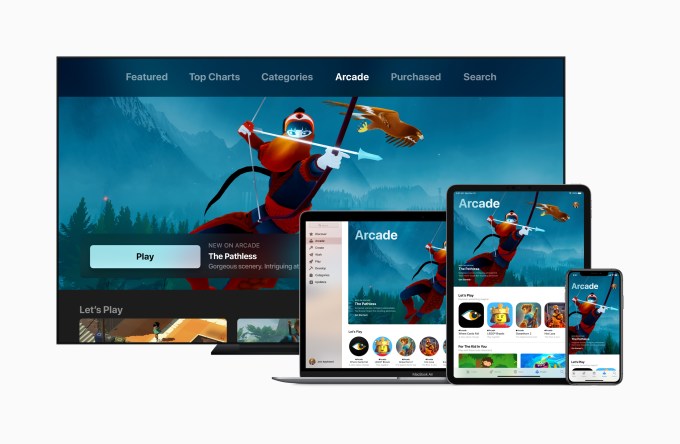

Apple Arcade is Apple’s new cross-platform gaming subscription

Apple wants to tilt the balance from ad-laden freemium gaming titles toward all-access ad-free gaming experiences that can be downloaded across platforms on iOS, macOS and tvOS.

At the company’s services event this morning, they announced Apple Arcade, their new premium subscription service for gaming across their hardware products. “We want to make gaming even better,” Apple CEO Tim Cook said onstage.

The subscription will boast 100+ new and exclusive games while Apple will be adding new content “all the time.” It looks like the company will have a hand in building out the titles by working directly with developer partners to produce titles. Early partners include names like Disney, Konami and Lego.

Another important note: All games will be playable offline. This is a content play rather than a tech product like Google’s recently announced Stadia game-streaming platform. The subscription will provide access to all of the content in the games without ads.

Apple has the benefit of building this directly into the App Store; you’ll be able to access Apple Arcade from a new bottom tab in the App Store app. This may be the company’s best chance at leveraging its strength on iOS to finally build a better home for games on Mac.

The service is coming this fall. Apple oddly didn’t detail pricing, though they did share it would be launching in 150 regions.

Powered by WPeMatico

Android users’ security and privacy at risk from shadowy ecosystem of pre-installed software, study warns

A large-scale independent study of pre-installed Android apps has cast a critical spotlight on the privacy and security risks that preloaded software poses to users of the Google developed mobile platform.

The researchers behind the paper, which has been published in preliminary form ahead of a future presentation at the IEEE Symposium on Security and Privacy, unearthed a complex ecosystem of players with a primary focus on advertising and “data-driven services” — which they argue the average Android user is unlikely to be unaware of (while also likely lacking the ability to uninstall/evade the baked in software’s privileged access to data and resources themselves).

The study, which was carried out by researchers at the Universidad Carlos III de Madrid (UC3M) and the IMDEA Networks Institute, in collaboration with the International Computer Science Institute (ICSI) at Berkeley (USA) and Stony Brook University of New York (US), encompassed more than 82,000 pre-installed Android apps across more than 1,700 devices manufactured by 214 brands, according to the IMDEA institute.

“The study shows, on the one hand, that the permission model on the Android operating system and its apps allow a large number of actors to track and obtain personal user information,” it writes. “At the same time, it reveals that the end user is not aware of these actors in the Android terminals or of the implications that this practice could have on their privacy. Furthermore, the presence of this privileged software in the system makes it difficult to eliminate it if one is not an expert user.”

An example of a well-known app that can come pre-installed on certain Android devices is Facebook .

Earlier this year the social network giant was revealed to have inked an unknown number of agreements with device makers to preload its app. And while the company has claimed these pre-installs are just placeholders — unless or until a user chooses to actively engage with and download the Facebook app, Android users essentially have to take those claims on trust with no ability to verify the company’s claims (short of finding a friendly security researcher to conduct a traffic analysis) nor remove the app from their device themselves. Facebook pre-loads can only be disabled, not deleted entirely.

The company’s preloads also sometimes include a handful of other Facebook-branded system apps which are even less visible on the device and whose function is even more opaque.

Facebook previously confirmed to TechCrunch there’s no ability for Android users to delete any of its preloaded Facebook system apps either.

“Facebook uses Android system apps to ensure people have the best possible user experience including reliably receiving notifications and having the latest version of our apps. These system apps only support the Facebook family of apps and products, are designed to be off by default until a person starts using a Facebook app, and can always be disabled,” a Facebook spokesperson told us earlier this month.

But the social network is just one of scores of companies involved in a sprawling, opaque and seemingly interlinked data gathering and trading ecosystem that Android supports and which the researchers set out to shine a light into.

In all 1,200 developers were identified behind the pre-installed software they found in the data-set they examined, as well as more than 11,000 third party libraries (SDKs). Many of the preloaded apps were found to display what the researchers dub potentially dangerous or undesired behavior.

The data-set underpinning their analysis was collected via crowd-sourcing methods — using a purpose-built app (called Firmware Scanner), and pulling data from the Lumen Privacy Monitor app. The latter provided the researchers with visibility on mobile traffic flow — via anonymized network flow metadata obtained from its users.

They also crawled the Google Play Store to compare their findings on pre-installed apps with publicly available apps — and found that just 9% of the package names in their dataset were publicly indexed on Play.

Another concerning finding relates to permissions. In addition to standard permissions defined in Android (i.e. which can be controlled by the user) the researchers say they identified more than 4,845 owner or “personalized” permissions by different actors in the manufacture and distribution of devices.

So that means they found systematic user permissions workarounds being enabled by scores of commercial deals cut in a non-transparency data-driven background Android software ecosystem.

“This type of permission allows the apps advertised on Google Play to evade Android’s permission model to access user data without requiring their consent upon installation of a new app,” writes the IMDEA.

The top-line conclusion of the study is that the supply chain around Android’s open source model is characterized by a lack of transparency — which in turn has enabled an ecosystem to grow unchecked and get established that’s rife with potentially harmful behaviors and even backdoored access to sensitive data, all without most Android users’ consent or awareness. (On the latter front the researchers carried out a small-scale survey of consent forms of some Android phones to examine user awareness.)

tl;dr the phrase ‘if it’s free you’re the product’ is a too trite cherry atop a staggeringly large yet entirely submerged data-gobbling iceberg. (Not least because Android smartphones don’t tend to be entirely free.)

“Potential partnerships and deals — made behind closed doors between stakeholders — may have made user data a commodity before users purchase their devices or decide to install software of their own,” the researchers warn. “Unfortunately, due to a lack of central authority or trust system to allow verification and attribution of the self-signed certificates that are used to sign apps, and due to a lack of any mechanism to identify the purpose and legitimacy of many of these apps and custom permissions, it is difficult to attribute unwanted and harmful app behaviors to the party or parties responsible. This has broader negative implications for accountability and liability in this ecosystem as a whole.”

The researchers go on to make a series of recommendations intended to address the lack of transparency and accountability in the Android ecosystem — including suggesting the introduction and use of certificates signed by globally-trusted certificate authorities, or a certificate transparency repository “dedicated to providing details and attribution for certificates used to sign various Android apps, including pre-installed apps, even if self-signed”.

They also suggest Android devices should be required to document all pre-installed apps, plus their purpose, and name the entity responsible for each piece of software — and do so in a manner that is “accessible and understandable to users”.

“[Android] users are not clearly informed about third-party software that is installed on their devices, including third-party tracking and advertising services embedded in many pre-installed apps, the types of data they collect from them, the capabilities and the amount of control they have on their devices, and the partnerships that allow information to be shared and control to be given to various other companies through custom permissions, backdoors, and side-channels. This necessitates a new form of privacy policy suitable for preinstalled apps to be defined and enforced to ensure that private information is at least communicated to the user in a clear and accessible way, accompanied by mechanisms to enable users to make informed decisions about how or whether to use such devices without having to root their devices,” they argue, calling for overhaul of what’s long been a moribund T&Cs system, from a consumer rights point of view.

In conclusion they couch the study as merely scratching the surface of “a much larger problem”, saying their hope for the work is to bring more attention to the pre-installed Android software ecosystem and encourage more critical examination of its impact on users’ privacy and security.

They also write that they intend to continue to work on improving the tools used to gather the data-set, as well as saying their plan is to “gradually” make the data-set itself available to the research community and regulators to encourage others to dive in.

Google has responded to the paper with the following statement — attributed to a spokesperson:

We appreciate the work of the researchers and have been in contact with them regarding concerns we have about their methodology. Modern smartphones include system software designed by their manufacturers to ensure their devices run properly and meet user expectations. The researchers’ methodology is unable to differentiate pre-installed system software — such as diallers, app stores and diagnostic tools–from malicious software that has accessed the device at a later time, making it difficult to draw clear conclusions. We work with our OEM partners to help them ensure the quality and security of all apps they decide to pre-install on devices, and provide tools and infrastructure to our partners to help them scan their software for behavior that violates our standards for privacy and security. We also provide our partners with clear policies regarding the safety of pre-installed apps, and regularly give them information about potentially dangerous pre-loads we’ve identified.

Powered by WPeMatico

Yunji, a startup that enables social commerce via WeChat, files for $200M US IPO

China’s Pinduoduo was all the rage in 2018 as the e-commerce upstart quickly rose to challenge Alibaba and raised $1.63 billion through a Nasdaq listing. Much of its success was attributable to its link to WeChat, China’s messaging leader. Now, another emerging e-commerce player that has leveraged WeChat is gearing up for a listing in the United States.

Yunji, which was founded in 2015 (the same year Pinduoduo launched), is raising up to $200 million according to its prospectus filed with the Securities and Exchange Commission last week. Reuters reported citing sources in September that Yunji planned to raise around $1 billion in the IPO at a valuation of between $7 billion and $10 billion.

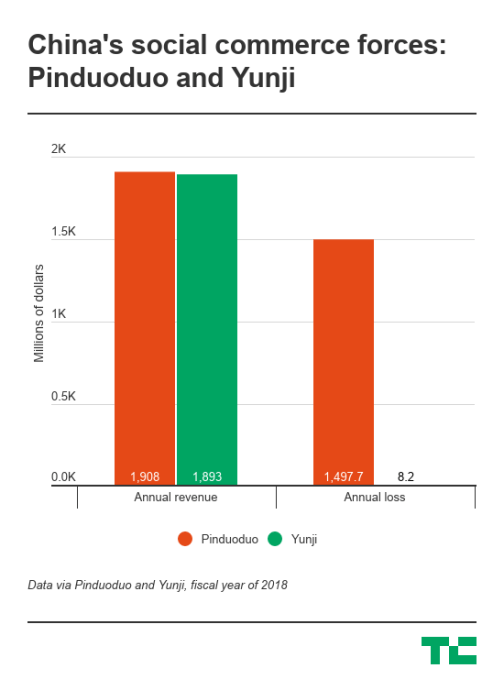

Like Pinduoduo, Yunji bills itself as a “social e-commerce” service, which means it takes advantage of social relationships on apps like WeChat to acquire, engage and sell to users. The pair differ, however, in how exactly they make money. Pinduoduo generates the bulk of its revenues — nearly 90 percent in the fourth quarter — from advertising fees collected from merchants. This is akin to Alibaba’s marketplace play of connecting buyers and third-party sellers. Yunji, which was started by e-commerce veteran Xiao Shanglue, focuses on direct sales like Alibaba’s arch-foe JD.com, derived 88 percent of its fourth-quarter revenues from selling to users.

In terms of size, Yunji was about $15 million behind Pinduoduo in revenue last year. It had 23.2 million buyers in 2018, compared to Pinduoduo’s 272.6 million monthly active users. Yunji was, however, much closer to achieving profitability than Pinduoduo, which spent most of its money on sales and marketing. Most of Yunji’s expenses went to fulfillment and logistics.

From inception, Yunji has boasted of its “innovative” membership-based e-commerce model. To join, people typically pay a fee, upon which they gain access to a variety of benefits and discounts as well as the permission to open their own micro-stores. Members then get compensated for successfully selling to others and recruiting new members.

The marketing practice helped Yunji quickly build up a large network of users. As of 2018, Yunji had 7.4 million members who contributed 11.9 percent of its annual revenues and 66.4 percent of annual transactions. But the firm went too far in exploiting the social links it controlled that it started to look like a pyramid scheme, which is banned in China. In 2017, the local government slapped Yunji with a $1.4 million fine for pyramid selling. The firm subsequently apologized and promised to revamp its marketing strategy. For instance, to avoid crossing the red line of awarding salespeople with “material” or “financial” benefits, Yunji resorted to virtual Yun-coins, which are not redeemable for cash and can only be used as coupons for future purchase.

But Yunji is still on the edge. The company warns in its prospectus that China could at any time redefine what constitutes pyramid selling.

“[T]here is no assurance that the competent governmental authorities in China that we communicate with will not change their views, or the other relevant government authorities will share the same view as our PRC legal counsel, or they will find our business model, not in violation of any applicable regulations, given the uncertainties in the interpretation and application of existing PRC laws, regulations and policies relating to our current business model, including, but not limited to, regulations regulating pyramid selling.”

Some of Yunji’s more notable investors include China’s CDH Investments and Huaxing Growth Capital, China Renaissance’s subsidiary focusing on high-growth startups.

Powered by WPeMatico