Proxy raises $13.6M to unlock anything with Bluetooth identity

You know how kings used to have trumpeters heralding their arrival wherever they went? Proxy wants to do that with Bluetooth. The startup lets you instantly unlock office doors and reserve meeting rooms using Bluetooth Low Energy signal. You never even have to pull out your phone or open an app. But Proxy is gearing up to build an entire Bluetooth identity layer for the world that could invisibly hover around its users. That could allow devices around the workplace and beyond to instantly recognize your credentials and preferences to sign you into teleconferences, pay for public transit or ask the barista for your usual.

Today, Proxy emerges from stealth after piloting its keyless, badgeless office entry tech with 50 companies. It’s raised a $13.6 million Series A round led by Kleiner Perkins to turn your phone into your skeleton key. “The door is a forcing function to solve all the hard problems — everything from safety to reliability to the experience to privacy,” says Proxy co-founder and CEO Denis Mars. “If you’re gonna do this, it’s gonna have to work right, and especially if you’re going to do this in the workplace with enterprises where there’s no room to fix it.”

But rather than creepily trying to capitalize on your data, Proxy believes you should own and control it. Each interaction is powered by an encrypted one-time token so you’re not just beaming your unprotected information out into the universe. “I’ve been really worried about how the internet world spills over to the physical world. Cookies are everywhere with no control. What’s the future going to be like? Are we going to be tracked everywhere or is there a better way?” He figured the best path to the destiny he wanted was to build it himself.

Mars and his co-founder Simon Ratner, both Australian, have been best buddies for 10 years. Ratner co-founded a video annotation startup called Omnisio that was acquired by YouTube, while Mars co-founded teleconferencing company Bitplay, which was bought by Jive Software. Ratner ended up joining Jive where the pair began plotting a new startup. “We asked ourselves what we wanted to do with the next 10 or 20 years of our lives. We both had kids and it changed our perspective. What’s meaningful that’s worth working on for a long time?”

They decided to fix a real problem while also addressing their privacy concerns. As he experimented with Internet of Things devices, Mars found every fridge and light bulb wanted you to download an app, set up a profile, enter your password and then hit a button to make something happen. He became convinced this couldn’t scale and we’d need a hands-free way to tell computers who we are. The idea for Proxy emerged. Mars wanted to know, “Can we create this universal signal that anything can pick up?”

Most offices already have infrastructure for badge-based RFID entry. The problem is that employees often forget their badges, waste time fumbling to scan them and don’t get additional value from the system elsewhere.

So rather than re-invent the wheel, Proxy integrates with existing access control systems at offices. It just replaces your cards with an app authorized to constantly emit a Bluetooth Low Energy signal with an encrypted identifier of your identity. The signal is picked up by readers that fit onto the existing fixtures. Employees can then just walk up to a door with their phone within about six feet of the sensor and the door pops open. Meanwhile, their bosses can define who can go where using the same software as before, but the user still owns their credentials.

“Data is valuable, but how does the end user benefit? How do we change all that value being stuck with these big tech companies and instead give it to the user?” Mars asks. “We need to make privacy a thing that’s not exploited.”

Mars believes now’s the time for Proxy because phone battery life is finally getting good enough that people aren’t constantly worried about running out of juice. Proxy’s Bluetooth Low Energy signal doesn’t suck up much, and geofencing can wake up the app in case it shuts down while on a long stint away from the office. Proxy has even considered putting inductive charging into its sensors so you could top up until your phone turns back on and you can unlock the door.

Opening office doors isn’t super exciting, though. What comes next is. Proxy is polishing its features that auto-reserve conference rooms when you walk inside, that sign you into your teleconferencing system when you approach the screen and that personalize workstations when you arrive. It’s also working on better office guest check-in to eliminate the annoying iPad sign-in process in the lobby. Next, Mars is eyeing “Your car, your home, all your devices. All these things are going to ask ‘can I sense you and do something useful for you?’ ”

After demoing at Y Combinator, thousands of companies reached out to Proxy, from hotel chains to corporate conglomerates to theme parks. Proxy charges for its hardware, plus a monthly subscription fee per reader. Employees are eager to ditch their keycards, so Proxy sees 90 percent adoption across all its deployments. Customers only churn if something breaks, and it hasn’t lost a customer in two years, Mars claims.

The status quo of keycards, competitors like Openpath and long-standing incumbents all typically only handle doors, while Proxy wants to build an omni-device identity system. Now Proxy has the cash to challenge them, thanks to the $13.6 million from Kleiner, Y Combinator, Coatue Management and strategic investor WeWork. In fact, Proxy now counts WeWork’s headquarters and Dropbox as clients. “With Proxy, we can give our employees, contractors and visitors a seamless smartphone-enabled access experience they love, while actually bolstering security,” says Christopher Bauer, Dropbox’s physical security systems architect.

The cash will help answer the question of “How do we turn this into a protocol so we don’t have to build the other side for everyone?,” Mars explains. Proxy will build out SDKs that can be integrated into any device, like a smoke detector that could recognize which people are in the vicinity and report that to first responders. Mars thinks hotel rooms that learn your climate, wake-up call and housekeeping preferences would be a no-brainer. Amazon Go-style autonomous retail could also benefit from the tech.

When asked what keeps him up at night, Mars concludes that “the biggest thing that scares me is that this requires us to be the most trustworthy company on the planet. There is no ‘move fast, break things’ here. It’s ‘move fast, do it right, don’t screw it up.’ “

Powered by WPeMatico

EA lays off 350 people

Though Apex Legends continues to be a bright spot for EA, the game publisher and the industry as a whole still have hurdles ahead. Today, EA confirmed that it laid off 350 people in marketing, publishing and other departments.

Kotaku obtained an email sent to employees by EA CEO Andrew Wilson, which said that the main focus is increasing the quality of its games. A part of that is “ramping down” the company’s presence in Japan and Russia. Famitsu later confirmed that the Japan office has been closed entirely.

Of the 9,000 global employees at EA, the 350 people laid off represent 3.8 percent of EA’s workforce.

EA isn’t alone. The publisher’s biggest competitor, Activision Blizzard, let go nearly 800 employees, roughly 8 percent of its workforce, in February.

“We have a vision to be the World’s Greatest Games Company,” wrote Wilson in an email obtained and published by Kotaku. “If we’re honest with ourselves, we’re not there right now. We have work to do with our games, our player relationships, and our business. Across the company, teams are already taking action to ensure we are creating higher-quality games and live services, reaching more platforms with our content and subscriptions, improving our Frostbite tools, focusing our network and cloud gaming priorities, and closing the gap between us and our player communities.”

EA sent Kotaku the following statement:

Today we took some important steps as a company to address our challenges and prepare for the opportunities ahead. As we look across a changing world around us, it’s clear that we must change with it. We’re making deliberate moves to better deliver on our commitments, refine our organization and meet the needs of our players. As part of this, we have made changes to our marketing and publishing organization, our operations teams, and we are ramping down our current presence in Japan and Russia as we focus on different ways to serve our players in those markets. In addition to organizational changes, we are deeply focused on increasing quality in our games and services. Great games will continue to be at the core of everything we do, and we are thinking differently about how to amaze and inspire our players.

This is a difficult day. The changes we’re making today will impact about 350 roles in our 9,000-person company. These are important but very hard decisions, and we do not take them lightly. We are friends and colleagues at EA, we appreciate and value everyone’s contributions, and we are doing everything we can to ensure we are looking after our people to help them through this period to find their next opportunity. This is our top priority.

Gaming continues to grow, and record-breaking titles like Fortnite and EA’s own Apex Legends show that there is plenty of money to be made. In fact, Blizzard Activision CEO announced record earnings in 2018, but also said that the company failed to reach its full potential.

That potential has to do with a shift from a model that generates revenue once for a single title to something more akin to a content subscription service. In-app purchases and gaming subscriptions are accounting for more and more of game publishers’ revenues. The Financial Times reported in 2017 that, 10 years prior, one-off sales of packaged home-console software accounted for 64 percent of the global gaming market. That number dropped to 30 percent as in-game purchases and subscriptions continue to grow in popularity, as seen with games like Fortnite and Apex Legends.

This more layered revenue structure creates something sticky with consumers, but also runs the risk of alienating them by constantly asking for more money, especially with a game that isn’t free to play.

We’ve reached out to EA and will update if/when we know more.

Powered by WPeMatico

Contacts app Cardhop comes to iOS

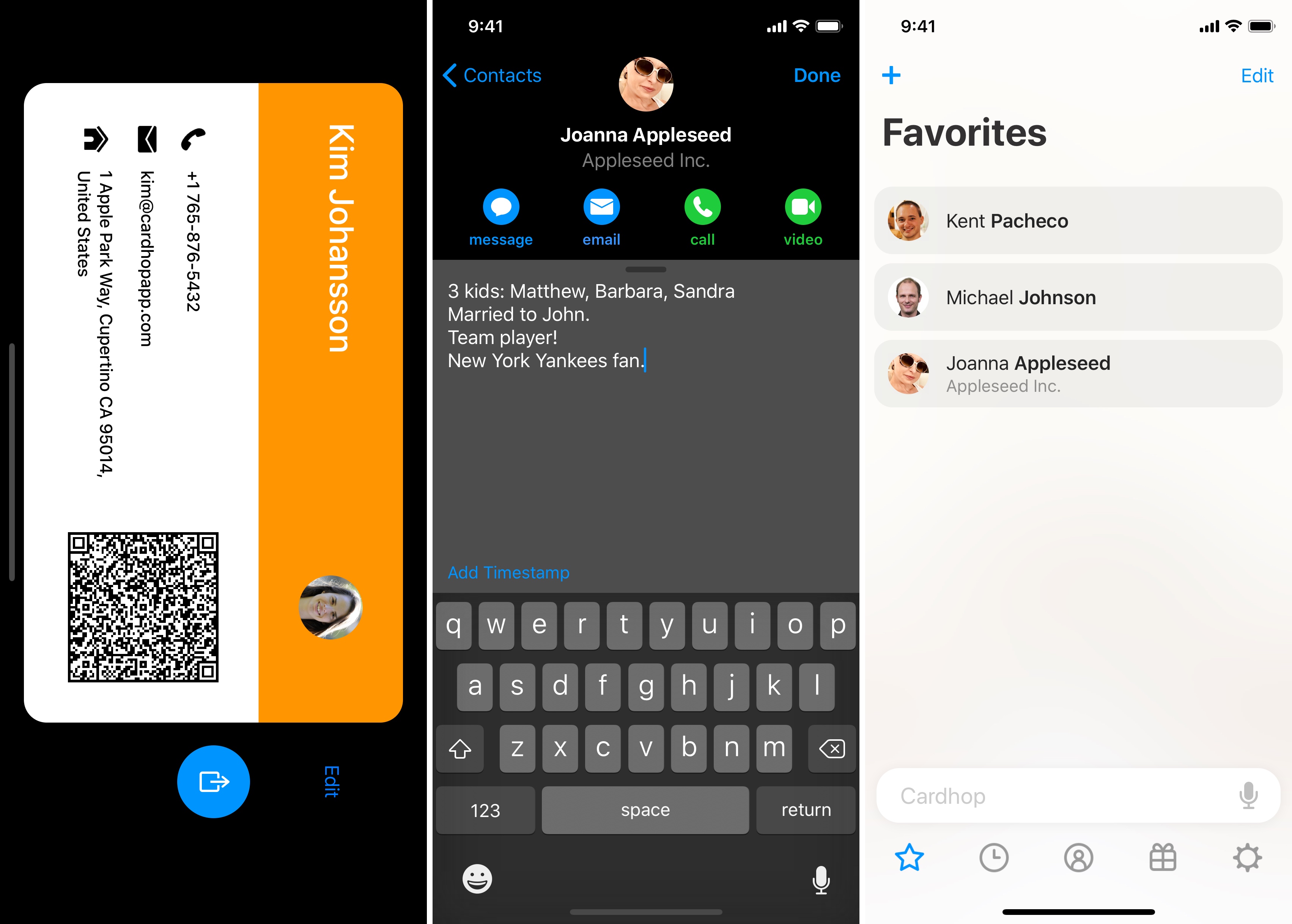

Productivity nerds, rejoice! Flexibits, the company behind Fantastical, is releasing Cardhop on the iPhone and iPad today. Cardhop, originally released on macOS, lets you text or call your contacts as well as add information more quickly.

If you have an iPhone, chances are you’re using the default Contacts app. It’s a pretty straightforward app, but it hasn’t evolved in years.

For instance, one of my biggest pain points is that I use many different messaging apps depending on the person with whom I’m talking. You can long-press on the call or video button app to change the default app to Skype, WhatsApp, Telegram and more. But that “message” button only works with Messages.

Cardhop solves that problem by becoming the gateway for all contact-based actions. In addition to phone calls, Messages, FaceTime and FaceTime Audio, the app supports WhatsApp, Telegram, Messenger, Skype, Viber and Twitter.

When you tap on the “message” button in a contact card or when you swipe on a name, you can select the messaging app to use. The “Recents” tab doesn’t just show contact names, but also actions. This way, you can repeat past actions and contact your friends using their favorite app more easily.

Cardhop also features a birthday tab with an overview of the upcoming birthdays in your contacts. Now that people use Facebook less and less, adding birthday information to your contacts could be a way to rely even less on Facebook.

Your company may be using a contact directory in G Suite or Exchange. Cardhop now supports looking up people in those directories on both iOS and macOS.

And if you share your contact information with a lot of people, Cardhop lets you customize your vCard. For instance, you can exclude your birthday or your home address. This way, when you send your information in iMessage or over Airdrop, professional contacts get a limited set of information.

You also can create a virtual business card with a QR code. This feature reminds me of the QR codes to quickly add friends on WeChat, Snapchat or Instagram.

Command line for contacts

Cardhop features a search bar right above the tab buttons. And this is the app’s most powerful feature. Just like on the map, you can learn shortcuts to trigger actions in no time.

For instance, if you type “WhatsApp Natasha” or “wa Natasha,” it launches your conversation thread with Natasha. If you type “copy Zack,” you get Zack’s contact card with a copy button next to each field (phone number, email address, etc.).

Adding a new contact is also as easy as typing things in the search area. If you type “Amy Poehler 202-555-0172” and she’s not in your address book, Cardhop creates a new entry with a first name, a last name and a phone number.

If you’re into Siri Shortcuts, you also can create custom commands to call or text your most important people in your life with a voice command.

Replacing a default app

Many companies have tried to replace a default app. Replacing Calendar or Podcasts is easier than the Phone app. The Phone app is deeply integrated with iOS. When you call someone in Cardhop, iOS jumps to the Phone app to initiate the call. And you won’t see any missed calls in Cardhop.

But Flexibits doesn’t want to reinvent the wheel and leverage the same contact database. Every time you add a card in Cardhop, it appears in the Phone app, and vice versa.

I think most people don’t need a new contact app and it could be more confusing than anything else. But if you contact a ton of people and you know Cardhop could make this process a little bit easier, Cardhop works well. It is now available in the App Store for $4.99. You can get it for $3.99 for a limited time.

Powered by WPeMatico

It’s a draw in latest Qualcomm v Apple patent scores

It’s Qualcomm 1, Apple 1 in the latest installment of the pair’s bitter patent bust-up — the litigious IP infringement claim saga that also combines a billion-dollar royalties suit filed by Cupertino alleging that the mobile chipmaker’s licensing terms are unfair.

The iPhone maker filed against Qualcomm on the latter front two years ago and the trial is due to kick off next month. But a U.S. federal court judge issued a bracing sharpener earlier this month, in the form of a preliminary ruling — finding Qualcomm owes Apple nearly $1 billion in patent royalty rebate payments. So that courtroom looks like one to watch for sure.

Yesterday’s incremental, two-fold development in the overarching saga relates to patent charges filed by Qualcomm against Apple back in 2017, via complaints to the U.S. International Trade Commission (ITC) in which it sought to block domestic imports of iPhones.

In an initial determination on one of these patent complaints published yesterday, an ITC administrative law judge found Apple violated one of Qualcomm’s patents — and recommended an import ban.

Though Apple could (and likely will) request a review of that non-binding decision.

Related: A different ITC judge found last year that Apple had violated another Qualcomm patent but did not order a ban on imports — on “public interest” grounds.

ITC staff also previously found no infringement of the very same patent, which likely bolsters the case for a review. (The patent in question, U.S. Patent No. 8,063,674, relates to “multiple supply-voltage power-up/down detectors.”)

Then, later yesterday, the ITC issued a final determination on a second Qualcomm v Apple patent complaint — finding no patent violations on the three claims that remained at issue (namely: U.S. Patent No. 9,535,490; U.S. Patent No. 8,698,558; and U.S. Patent No. 8,633,936), terminating its investigation.

Qualcomm said it intends to appeal.

The mixed bag of developments sit in the relatively “minor battle” category of this slow-motion high-tech global legal war (though, of the two, the ITC’s final decision looks more significant), along with the outcome of a jury trial in San Diego earlier this month, which found in Qualcomm’s favor over some of the same patents the ITC cleared Apple of infringing.

Reuters reports the chipmaker has cited the contradictory outcome of the earlier jury trial as grounds to push for a “reconsideration” of the ITC’s decision.

“The Commission’s decision is inconsistent with the recent unanimous jury verdict finding infringement of the same patent after Apple abandoned its invalidity defense at the end of trial,” Qualcomm said in a statement. “We will seek reconsideration by the Commission in view of the jury verdict.”

Albeit, given the extreme complexities of chipset component patent suits, it’s not really surprising a jury might reach a different outcome to an ITC judge.

In the other corner, Apple issued its now customary punchy response statement to the latest developments, swinging in with: “Qualcomm is using these cases to distract from having to answer for the real issues, their monopolistic business practices.”

Safe to say, the litigious saga continues. And iPhones continue being sold in the U.S.

Other notable (but still only partial) wins for Qualcomm include a court decision in China last year ordering a ban on iPhone sales in the market — which Apple filed an appeal to overturn. So no China iPhone ban yet.

And an injunction ordered by a court in Germany forced Apple to briefly pull certain iPhone models from sale in its own stores in January. By February the models were back on its shelves — albeit now with Qualcomm not Intel chips inside.

But it’s not all been going Qualcomm’s way in Germany. Also in January, another court in the country dismissed a separate patent claim as groundless.

A decision is also still pending in the U.S. Federal Trade Commission’s antitrust case against Qualcomm.

In that suit the chipmaker is accused of operating a monopoly and forcing exclusivity from Apple while charging “excessive” licensing fees for standards-essential patents. The trial wrapped up in January and is pending a verdict.

Powered by WPeMatico

The danger of ‘I already pay for Apple News+’

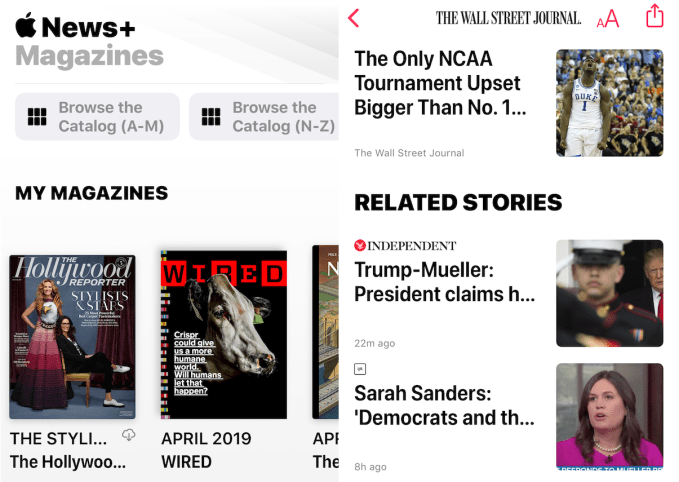

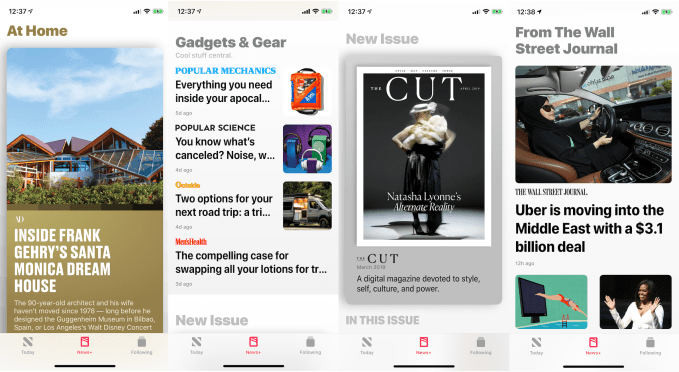

Apple doesn’t care about news, it cares about recurring revenue. That’s why publishers are crazy to jump into bed with Apple News+. They’re rendering their own subscription options unnecessary in exchange for a sliver of what Apple pays out from the mere $10 per month it charges for unlimited reading.

The unfathomable platform risk here makes Facebook’s exploitative Instant Articles program seem toothless in comparison. On Facebook, publishers became generic providers of dumb content for the social network’s smart pipe that stole the customer relationship from content creators. But at least publishers were only giving away their free content.

Apple News+ threatens to open a massive hole in news site paywalls, allowing their best premium articles to escape. Publishers hope they’ll get exposure to new audiences. But any potential new or existing direct subscriber to a publisher will no longer be willing to pay a healthy monthly fee to occasionally access that top content while supporting the rest of the newsroom. They’ll just cherry pick what they want via News+, and Apple will shave off a few cents for the publisher while owning all the data, customer relationship and power.

“Why subscribe to that publisher? I already pay for Apple News+” should be the question haunting journalists’ nightmares. For readers, $10 per month all-you-can-eat from 300-plus publishers sounds like a great deal today. But it could accelerate the demise of some of those outlets, leaving society with fewer watchdogs and storytellers. If publishers agree to the shake hands with the devil, the dark lord will just garner more followers, making its ruinous offer more tempting.

There are so many horrifying aspects of Apple News+ for publishers, it’s best just to list each and break them down.

No relationship with the reader

To succeed, publishers need attention, data and revenue, and Apple News+ gets in the way of all three. Readers visit Apple’s app, not the outlet’s site that gives it free rein to promote conference tickets, merchandise, research reports and other money-makers. Publishers don’t get their Apple News+ readers’ email addresses for follow-up marketing, cookies for ad targeting and content personalization, or their credit card info to speed up future purchases.

At the bottom of articles, Apple News+ recommends posts by an outlet’s competitors. Readers end up without a publisher’s bookmark in their browser toolbar, app on their phone or even easy access to them from News+’s default tab. They won’t see the outlet’s curation that highlights its most important content, or develop a connection with its home screen layout. They’ll miss call-outs to follow individual reporters and chances to interact with innovative new interactive formats.

Perhaps worst of all, publishers will be thrown right back into the coliseum of attention. They’ll need to debase their voice and amp up the sensationalism of their headlines or risk their users straying an inch over to someone else. But they’ll have no control of how they’re surfaced…

At the mercy of the algorithm

Which outlets earn money on Apple News+ will be largely determined by what Apple decides to show in those first few curatorial slots on screen. At any time, Apple could decide it wants more visual photo-based content or less serious world news because it placates users even if they’re less informed. It could suddenly preference shorter takes because they keep people from bouncing out of the app, or more generic shallow-dives that won’t scare off casual readers who don’t even care about that outlet. What if Apple signs up a publisher’s biggest competitor and sends them all the attention, decimating the first outlet’s discovery while still exposing its top paywalled content for cheap access?

Remember when Facebook wanted to build the world’s personalized newspaper and delivered tons of referral traffic, then abruptly decided to favor “friends and family content” while leaving publishers to starve? Now outlets are giving Apple News+ the same iron grip on their businesses. They might hire a ton of talent to give Apple what it wants, only for the strategy to change. The Wall Street Journal says it’s hiring 50 staffers to make content specifically for Apple News+. Those sound like some of the most precarious jobs in the business right now.

Remember when Facebook got the WSJ, Guardian and more to build “social reader apps” and then one day just shut off the virality and then shut down the whole platform? News+ revenue will be a drop in the bucket of iPhone sales, and Apple could at any time decide it’s not thirsty any more and let News+ rot. That and the eventual realization of platform risk and loss of relationship with the reader led the majority of Facebook’s Instant Articles launch partners like The New York Times, The Washington Post and Vox to drop the format. Publishers would be wise to come to that same conclusion now before they drive any more eyeballs to News+.

News+ isn’t built for news

Apple acquired the magazine industry’s self-distribution app Texture a year ago. Now it’s trying to cram in traditional text-based news with minimal work to adapt the product. That means National Geographic and Sports Illustrated get featured billing with animated magazine covers and ways to browse the latest “issue.” News outlets get demoted far below, with no intuitive or productive way to skim between articles beyond swiping through a chronological stack.

I only see WSJ’s content below My Magazines, a massive At Home feature from Architectural Digest, a random Gadgets & Gear section of magazine articles, another huge call-out for the new issue of The Cut plus four pieces inside of it, and one more giant look at Bloomberg’s profile of Dow Chemical. That means those magazines are likely to absorb a ton of taps and engagement time before users even make it to the WSJ, which will then only score few cents per reader.

Magazines often publish big standalone features that don’t need a ton of context. News articles are part of a continuum of information that can be laid out on a publisher’s own site where they have control, but not on Apple News+. And to make articles more visually appealing, Apple strips out some of the cross-promotional recirculation, sign-up forms and commerce opportunities on which publishers depend.

Shattered subscriptions

The whole situation feels like the music industry stumbling into the disastrous iTunes download era. Musicians earned solid revenue when someone bought their whole physical album for $16 to listen to the single, then fell in love with the other songs and ended up buying merchandise or concert tickets. Then suddenly, fans could just buy the digital single for $0.99 from iTunes, form a bond with Apple instead of the artist and the whole music business fell into a depression.

The whole situation feels like the music industry stumbling into the disastrous iTunes download era. Musicians earned solid revenue when someone bought their whole physical album for $16 to listen to the single, then fell in love with the other songs and ended up buying merchandise or concert tickets. Then suddenly, fans could just buy the digital single for $0.99 from iTunes, form a bond with Apple instead of the artist and the whole music business fell into a depression.

Apple News+’s onerous revenue-sharing deal puts publishers in the same pickle. That occasional flagship article that’s a breakout success no longer serves as a tentpole for the rest of the subscription.

Formerly, people would need to pay $30 per month for a WSJ subscription to read that article, with the price covering the research, reporting and production of the whole newspaper. Readers felt justified paying the price because they got access to the other content, and the WSJ got to keep all the money even if people didn’t read much else or declined to even visit during the month. Now someone can pop in, read the WSJ’s best or most resource-intensive article, and the publisher effectively gets paid à la carte like with an iTunes single. Publishers will be scrounging for a cut of readers’ $10 per month, which will reportedly be divided in half by Apple’s oppressive 50 percent cut, then split between all the publishers someone reads — which will be heavily skewed towards the magazines that get the spotlight.

I’ve already had friends ask why they should keep paying if most of the WSJ is in Apple News along with tons of other publishers for a third of the price. Hardcore business news addicts that want unlimited access to the finance content that’s only available for three days in Apple News+ might keep their WSJ subscription. But anyone just in it for the highlights is likely to stop paying WSJ directly — or never start.

I’m personally concerned because TechCrunch has agreed to put its new Extra Crunch $15 per month subscription content inside Apple News+ despite all the warning signs. We’re saving some perks, like access to conference calls just for direct Extra Crunch subscribers, and perhaps a taste of EC’s written content might convince people they want the bonus features. But even more likely seems the possibility that readers would balk at paying again for just some extra perks when they already get the rest from Apple News, and many newsrooms aren’t set up to do anything but write articles.

![]() It’s the “good enough” strategy we see across tech products playing out in news. When Instagram first launched Stories, it lacked a ton of Snapchat’s features, but it was good enough and conveniently located where people already spent their time and had their social graph. Snapchat didn’t suddenly lose all its users, but there was little reason for new users to sign up and growth plummeted.

It’s the “good enough” strategy we see across tech products playing out in news. When Instagram first launched Stories, it lacked a ton of Snapchat’s features, but it was good enough and conveniently located where people already spent their time and had their social graph. Snapchat didn’t suddenly lose all its users, but there was little reason for new users to sign up and growth plummeted.

Apple News is pre-loaded on your device, where you already have a credit card set up, and it’s bundled with lots of content, at a cheaper price than most individual news outlets. Even if it doesn’t offer unlimited, permanent access to every WSJ Pro story, Apple News+ will be good enough. And it gets better with each outlet that allies with this Borg.

But this time, good enough won’t just determine which tech giant wins. Apple News+ could decimate the revenue of a fundamental pillar of society we rely on to hold the powerful accountable. Yet to the journalists that surrender their content, Apple will have no accountability.

Powered by WPeMatico

Unicorns aren’t profitable, and Wall Street doesn’t care

In Silicon Valley, investors don’t expect their portfolio companies to be profitable. “Blitzscaling: The Lightning-Fast Path to Building Massively Valuable Companies,” a bible for founders, instead calls for heavy spending on growth to scale in an Amazon -like fashion.

As for Wall Street, it’s shown an affinity for stock in Jeff Bezos’ business, despite the many years it spent navigating a path to profitability, as well as other money-losing endeavors. Why? Because it too is far less concerned with profitability than market opportunity.

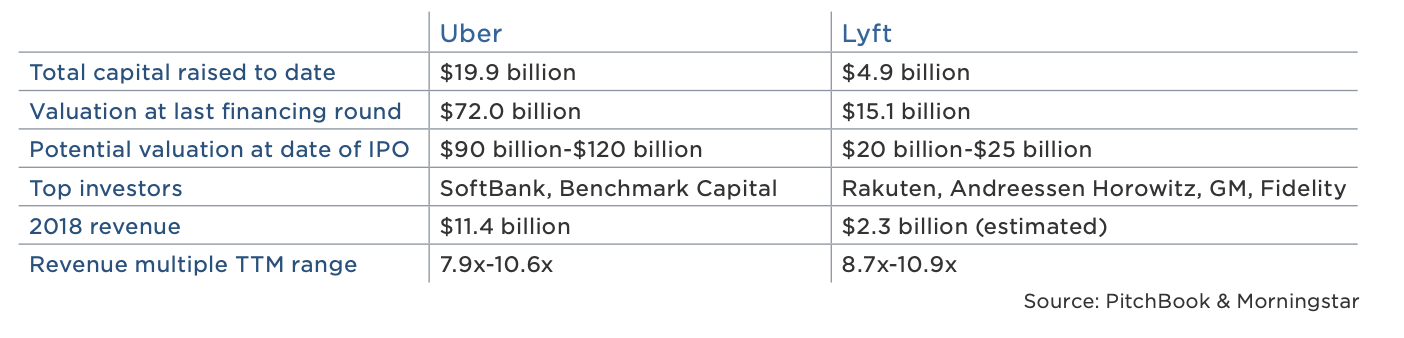

Lyft, a ride-hailing company expected to go public this week, is not profitable. It posted losses of $911 million in 2018, a statistic that will make it the biggest loser amongst U.S. startups to have gone public, according to data collected by The Wall Street Journal. On the other hand, Lyft’s $2.2 billion in 2018 revenue places it atop the list of largest annual revenues for a pre-IPO business, trailing behind only Facebook and Google in that category.

Wall Street, in short, is betting on Lyft’s revenue growth, assuming it will narrow its loses and reach profitability… eventually.

Wall Street’s hungry for unicorns

Lyft, losses notwithstanding, is growing rapidly and Wall Street is paying attention. On the second day of its road show, reports emerged that its IPO was already oversubscribed. As a result, Lyft is said to have upped the cost of its stock, with new plans to raise more than $2 billion at a valuation upwards of $25 billion. That represents a revenue multiple of more than 11x, a step up multiple of more than 1.6x from its most recent private valuation of $15.1 billion and, of course, Wall Street’s insatiable desire for unicorns, profitable or not.

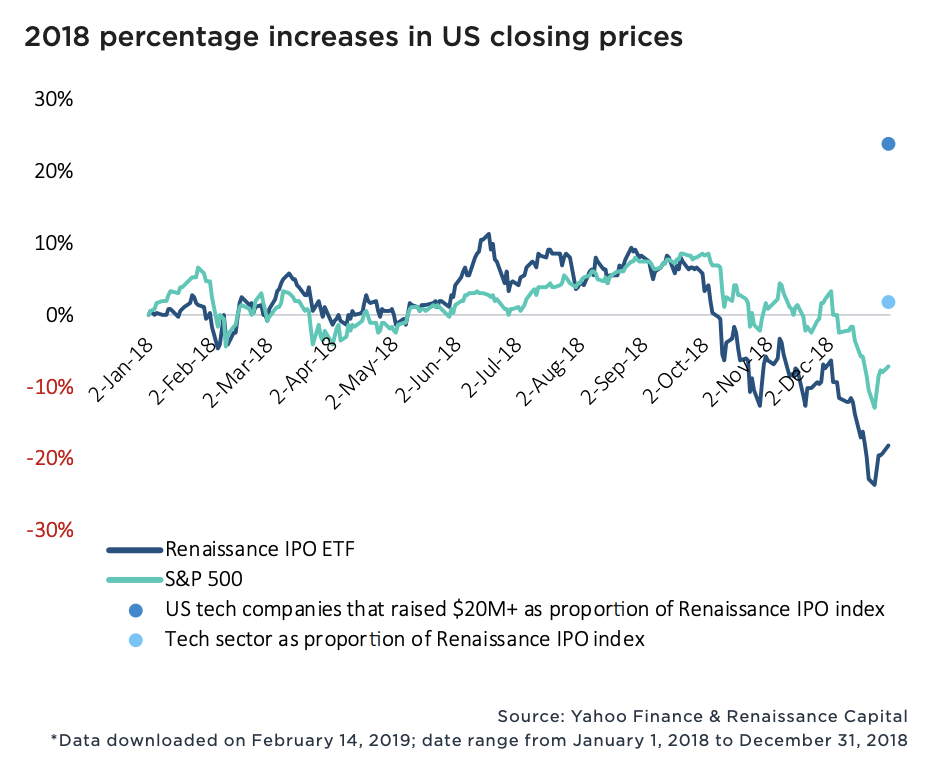

New data from PitchBook exploring the performance of billion-dollar-plus VC exits confirms Wall Street’s leniency toward unprofitable tech companies. Sixty-four percent of the 100+ companies valued at more than $1 billion to complete a VC-backed IPO since 2010 were unprofitable, and in 2018, money-losing startups actually fared better on the stock exchange than money-earning businesses. Moreover, U.S. tech companies that had raised more than $20 million traded up nearly 25 percent of 2018, while the S&P 500 technology sector posted flat returns.

Wall Street is still adapting to the rapid growth of the tech industry; public markets investors, therefore, are willing to deal with negative to minimal cash flows for, well, a very long time.

A tolerance for outsized exits

There’s no doubt Lyft and its much larger competitor, Uber, will go public at monstrous valuations. The two IPOs, set to create a whole bunch of millionaires and return a number of venture capital funds, will provide Silicon Valley a lesson in Wall Street’s tolerance for outsized exits.

Much like a seed-stage investor must bet on a founder’s vision, Wall Street, given a choice of several unprofitable businesses, has to bet on potential market value. Fortunately, this strategy can work quite well. Take Floodgate, for example. The seed fund invested a small amount of capital in Lyft when it was still a quirky idea for ridesharing called Zimride. Now, it boasts shares worth more than $100 million. I’m sure early shareholders in Amazon — which went public as a money-losing company in 1997 — are pretty happy, too.

Ultimately, Wall Street’s appetite for unicorns like Lyft is a result of the shortage of VC-backed IPOs. In 2006, it was the norm for a company to make its stock market debut at 7.9 years old, per PitchBook. In 2018, companies waited until the ripe age of 10.9 years, causing a significant slowdown in big liquidity events and stock sales.

Fund sizes, however, have grown larger and the proliferation of unicorns continues at unforeseen rates. That may mean, eventually, an influx of publicly shared unicorn stock. If that’s the case, might Wall Street start asking more of these startups? At the very least, public market investors, please don’t be swayed by WeWork‘s eventual stock offering and its “community adjusted EBITDA.” Silicon Valley’s pixie dust can’t be that potent.

Powered by WPeMatico

FTC tells ISPs to disclose exactly what information they collect on users and what it’s for

The Federal Trade Commission, in what could be considered a prelude to new regulatory action, has issued an order to several major internet service providers requiring them to share every detail of their data collection practices. The information could expose patterns of abuse or otherwise troubling data use against which the FTC — or states — may want to take action.

The letters requesting info (detailed below) went to Comcast, Google, T-Mobile and both the fixed and wireless sub-companies of Verizon and AT&T. These “represent a range of large and small ISPs, as well as fixed and mobile Internet providers,” an FTC spokesperson said. I’m not sure which is meant to be the small one, but welcome any information the agency can extract from any of them.

Since the Federal Communications Commission abdicated its role in enforcing consumer privacy at these ISPs when it and Congress allowed the Broadband Privacy Rule to be overturned, others have taken up the torch, notably California and even individual cities like Seattle. But for enterprises spanning the nation, national-level oversight is preferable to a patchwork approach, and so it may be that the FTC is preparing to take a stronger stance.

To be clear, the FTC already has consumer protection rules in place and could already go after an internet provider if it were found to be abusing the privacy of its users — you know, selling their location to anyone who asks or the like. (Still no action there, by the way.)

But the evolving media and telecom landscape, in which we see enormous companies devouring one another to best provide as many complementary services as possible, requires constant reevaluation. As the agency writes in a press release:

The FTC is initiating this study to better understand Internet service providers’ privacy practices in light of the evolution of telecommunications companies into vertically integrated platforms that also provide advertising-supported content.

Although the FTC is always extremely careful with its words, this statement gives a good idea of what they’re concerned about. If Verizon (our parent company’s parent company) wants to offer not just the connection you get on your phone, but the media you request, the ads you are served and the tracking you never heard of, it needs to show that these businesses are not somehow shirking rules behind the scenes.

For instance, if Verizon Wireless says it doesn’t collect or share information about what sites you visit, but the mysterious VZ Snooping Co (fictitious, I should add) scoops all that up and then sells it for peanuts to its sister company, that could amount to a deceptive practice. Of course it’s rarely that simple (though don’t rule it out), but the only way to be sure is to comprehensively question everyone involved and carefully compare the answers with real-world practices.

How else would we catch shady zero-rating practices, zombie cookies, backdoor deals or lip service to existing privacy laws? It takes a lot of poring over data and complaints by the detail-oriented folks at these regulatory bodies to find things out.

To that end, the letters to ISPs ask for a whole boatload of information on companies’ data practices. Here’s a summary:

- Categories of personal information collected about consumers or devices, including purposes, methods and sources of collection

- how the data has been or is being used

- third parties that provide or are provided this data and what limitations are imposed thereupon

- how such data is combined with other types of information and how long it is retained

- internal policies and practices limiting access to this information by employees or service providers

- any privacy assessments done to evaluate associated risks and policies

- how data is aggregated, anonymized or deidentified (and how those terms are defined)

- how aggregated data is used, shared, etc.

- “any data maps, inventories, or other charts, schematics, or graphic depictions” of information collection and storage

- total number of consumers who have “visited or otherwise viewed or interacted with” the privacy policy

- whether consumers are given any choice in collection and retention of data, and what the default choices are

- total number and percentage of users that have exercised such a choice, and what choices they made

- whether consumers are incentivized to (or threatened into) opt into data collection and how those programs work

- any process for allowing consumers to “access, correct, or delete” their personal information

- data deletion and retention policies for such information

Substantial, right?

Needless to say, some of this information may not be particularly flattering to ISPs. If only 1 percent of consumers have ever chosen to share their information, for instance, that reflects badly on sharing it by default. And if data capable of being combined across categories or services to de-anonymize it, even potentially, that’s another major concern.

The FTC representative declined to comment on whether there would be any collaboration with the FCC on this endeavor, whether it was preliminary to any other action and whether it can or will independently verify the information provided by the ISPs contacted. That’s an important point, considering how poorly these same companies represented their coverage data to the FCC for its yearly broadband deployment report. A reality check would be welcome.

You can read the rest of the letter here (PDF).

Powered by WPeMatico

Linear Labs’ next-gen electric motor attracts $4.5 million in funding

Linear Labs, a startup developing an electric motor for cars, scooters, robots, wind turbines and even HVAC systems, has raised $4.5 million in a seed round led by Science Inc. and Kindred Ventures.

Investors Chris and Crystal Sacca, Ryan Graves of Saltwater Ventures, Dynamic Signal CEO Russ Fradin, Masergy executive chairman and former-CEO Chris MacFarland, as well as Ustream co-founder Gyula Feher also participated in the round.

The four-year-old company was founded by Brad and Fred Hunstable, who say they have invented a lighter, more flexible electric motor. The pair came up with the motor they’ve dubbed the Hunstable Electric Turbine (HET) while working to design a device that could pump clean water and provide power for small communities in underdeveloped regions of the world.

Linear Labs currently has 50 filed patents, 21 of which are issued, with 29 patents pending.

The founders come with a background in entrepreneurship and electrical engineering. Brad Hunstable is former CEO and founder of Ustream, the live-video-streaming service that sold to IBM in 2016 for $150 million. Fred Hunstable, who comes with a background in electrical engineering and nuclear power, led Ebasco and Walker Engineering’s efforts in designing, upgrading and completing electrical infrastructure, environmental and enterprise projects as well as safety and commercial-grade evaluation programs.

The HET uses multiple rotors that can adapt to varying conditions, according to the company. It also produces twice as much torque density and three times the power density than permanent magnet motors. Linear Labs says its motor produces two times the output per given motor size, and minimum 10 percent more range.

The HET design makes it ideally suited for mobility applications such as electric vehicles because it produces high levels of torque without the need for a gearbox. This helps cut production cuts, the company contends.

“The holy grail in electric motors has always been high torque and no gearbox, and the HET achieves both in a smaller, lighter and more efficient package that is more powerful than traditional motors,” Linear Labs CTO Fred Hunstable said in a statement.

The upshot could be electric vehicles with better range and more powerful electric scooters.

The commercialization of the electric motor will result in substantial leaps in terms of energy savings, reliability enhancement, and low-cost manufacturing, according to Babak Fahimi, founding director of the Renewable Energy and Vehicular Technology (REVT) Laboratory at the University of Texas at Dallas.

The company plans to use the seed funding to market its invention to customers. It’s also hiring talent and recently added new people to its leadership team, including John Curry as their president and Jon Hurry as vice president. Curry comes from KLA-Tencor and NanoPhotonics. Hurry has held positions at Tesla and Faraday Future.

Powered by WPeMatico

Adobe announces deeper data sharing partnership with Microsoft around accounts

Microsoft and Adobe have been building a relationship for some time, and today at Adobe Summit in Las Vegas the two companies announced a deeper integration between the two platforms.

It involves sharing Marketo data, the company that Adobe acquired last September for $4.75 billion. Because it’s marketers, they were duty-bound to give it a new name. This data-sharing approach is being dubbed Account Based Experience, or ABX for short. The two companies are sharing data account data between a number of sources, including Marketo Engage in Adobe Experience Cloud and Microsoft Dynamics 365 for Sales, as well as the LinkedIn, the business social platform Microsoft bought in 2016 for a whopping $26.2 billion.

Microsoft has been trying to find ways to put that LinkedIn data to work, and tools like Marketo can use the data in LinkedIn to understand their account contacts better. Steve Lucas, former CEO at Marketo, who is now senior vice president and head of the Marketo team at Adobe, says accounts tend to be much more complex sales than selling to individuals, involving multiple decision makers. It’s a sales cycle that can stretch on for months, and having access to additional data about the account contacts can have a big impact.

“With these new account-based capabilities, marketing and sales teams will have increased alignment around the people and accounts they are engaging, and new ways to measure that business impact,” Lucas explained in a statement.

Brent Leary, principal at CRM Essentials, who has been working in CRM, customer service and marketing for years, sees this as a useful partnership for customers from both vendors. “Integrating Microsoft Dynamics and LinkedIn more closely with Marketo gives Adobe’s Experience Cloud some great data to leverage in order to have a more complete picture of B2B customers,” Leary told TechCrunch.

The goal is to close complex sales, and having access to more complete data across the two product sets can help achieve that.

Powered by WPeMatico

Game streaming’s multi-industry melee is about to begin

Almost exactly 10 years ago, I was at GDC participating in a demo of a service I didn’t think could exist: OnLive. The company had promised high-definition, low-latency streaming of games at a time when real broadband was uncommon, mobile gaming was still defined by Bejeweled (though Angry Birds was about to change that), and Netflix was still mainly in the DVD-shipping business.

Although the demo went well, the failure of OnLive and its immediate successors to gain any kind of traction or launch beyond a few select markets indicated that while it may be in the future of gaming, streaming wasn’t in its present.

Well, now it’s the future. Bandwidth is plentiful, speeds are rising, games are shifting from things you buy to services you subscribe to, and millions prefer to pay a flat fee per month rather than worry about buying individual movies, shows, tracks, or even cheeses.

Consequently, as of this week — specifically as of Google’s announcement of Stadia on Tuesday — we see practically every major tech and gaming company attempting to do the same thing. Like the beginning of a chess game, the board is set or nearly so, and each company brings a different set of competencies and potential moves to the approaching fight. Each faces different challenges as well, though they share a few as a set.

Google and Amazon bring cloud-native infrastructure and familiarity online, but is that enough to compete with the gaming know-how of Microsoft, with its own cloud clout, or Sony, which made strategic streaming acquisitions and has a service up and running already? What of the third parties like Nvidia and Valve, publishers and storefronts that may leverage consumer trust and existing games libraries to jump start a rival? It’s a wide-open field, all right.

Before we examine them, however, it is perhaps worthwhile to entertain a brief introduction to the gaming space as it stands today and the trends that have brought it to this point.

Powered by WPeMatico