Jio Health combines online and offline healthcare in Southeast Asia, starting in Vietnam

The internet is often lauded for the potential to increase the impact of a range of primary services in emerging markets, including education, commerce, banking and healthcare. While many of those platforms are now being built, a few are finding that a hybrid approach combining online and offline is advantageous.

That’s exactly what Jio Health, a “full stack” (forgive the phrase) healthcare startup is bringing to consumers in Southeast Asia, starting in Vietnam.

The company started as a U.S.-based venture that worked with healthcare providers around the “Obamacare” initiative, before sensing the opportunity overseas and relocating to Vietnam, the Southeast Asian market of 95 million people and a fast-growing young population.

Today, it operates an online healthcare app and a physical facility in Saigon; it also has licenses for prescriptions and over the counter drug sales. The serviced launched nearly a year ago; already the company has some 130 staff, including 70 caregivers — including doctors — and a tech team of 30.

The idea is to offer services digitally, but also provide a physical location for when it is needed. Therein, the company ensures that “every element of that journey” is controlled and of the required standard; that’s in contrast to services that partner with hospitals or other care centers.

The scope of Jio Health’s services range from pediatrics to primary care, chronic disease management and ancillary services, which will soon cover areas like eye care, dermatology and cancer.

“Our initial research [before moving] found that healthcare in Vietnam was unlike the U.S.,” Raghu Rai, founder and CEO of Jio Health, told TechCrunch in an interview. “Spending is primarily driven by the consumer (out of pocket) and there’s no real digital infrastructure to speak of.”

Rai — a U.S. citizen — said doctors typically “have minutes per patient” and get through “hundreds” of consultations in every morning shift. That gave him an idea to make things more efficient.

“We can probably address north of 80 percent of consumers’ health needs,” he said of Jio Health,” but we also have referral partnerships with certain hospitals.”

Raghu Rai is CEO and founder of Jio Health

The process begins when a consumer downloads the Jio Health app and inputs primary information. A representative is then dispatched to visit the consumer in person, potentially within “hours” of the submission of information, according to Rai.

He believes that Jio Health can save its users money and time by using remote consultancy for many diagnoses. The company also works with health insurance companies for areas like annual checkups, and Rai said that McDonald’s and 7-Eleven are among the corporations that offer Jio Health among the providers for their staff; they’re not exclusive.

This week, Jio Health announced that it has closed a $5 million Series A funding from Southeast Asia’s Monk’s Hill Ventures . Rai said the company plans to use the capital for expansion. In particular, he said, the company is adding new care categories this month — including eye care and dermatology — and it is working toward expanding its brand through marketing.

Further down the line, Rai said the company hopes to expand to Hanoi before the end of this year. While there is interest in moving into other markets within Southeast Asia, that isn’t about to happen soon.

“We have begun to investigate other markets, but at this point feel the market in Vietnam is substantial in itself,” he told TechCrunch. “It’s very plausible that we’d be looking at international expansion plans in 2020… we’re going to be focused on Southeast Asia.”

Powered by WPeMatico

Yoshi’s Crafted World is classic gaming joy, Nintendo-style

In 1995, Yoshi had his moment. The character’s Super Mario World debut was so strong, Nintendo handed the dinosaur sidekick his own sequel. A surprise divergence from the Mario franchise found the character escorting a baby version of the plumber in search of his kidnapped twin.

Super Mario World 2: Yoshi’s Island was regarded as an instant classic for the Super Nintendo. The positive reaction was due, in part, to some bold aesthetic choices. The game featured a shaky line style, both in keeping with the playful infant motif and to further highlight that the title wasn’t just another Mario game.

Yoshi’s island has received a number of its own sequels and spinoffs over the years. This is, after all, Nintendo we’re talking about here. The company has turned riding out IP into a kind of art form. But while many of those followups were generally well-received, but none managed to capture the pure joy of the original.

2015’s Yoshi’s Wooly World came close, but ultimately failed to meet the high standards of many Mario fans. And the fact that the Wii U was ultimately a doomed console didn’t help matters much.

From a design perspective, Yoshi’s Crafted World clearly shares a lot of common DNA with that predecessor and, for that matter, Kirby’s Epic Yarn, with developer Good-Feel being a common denominator in all three. But the Switch title is a far more fully realized and cohesive package than the Wii U title. And like Yoshi’s Island before it, it’s a joy to play.

The first time I saw gameplay footage, I’d assume the game was a bit more of an open-world adventure — the Yoshi’s Island to Super Mario Galaxy’s Super Mario World. But while the new title gives you some choices, it never lets you stray too far from the standard platformer path.

To this day, side scrollers continue to be Nintendo’s bread and butter, even as it pushes the boundaries of gaming with other titles. At its worst, that means redundancy. At its best, however, Nintendo manages to put a fresh spin on the age old genre, as is the case here.

Clever mechanics like 3D world flipping and paths that point Yoshi down roads in a third dimension keep gameplay interesting. The addition of seemingly infinite Mario 3-style cardboard costumes, coupled with the DIY crafted design language, meanwhile, make it downright joy to play.

Yoshi’s Crafted World is an all-ages title, through and through. In fact, on first playing, the game asks whether you want to play “Mellow Mode” or “Classic Mode,” reassuring you that you can switch things up at any time. Even in Classic Mode, the game does a fair bit of handholding.

But the game’s simple and slow pace is more comfort than annoyance for even older players. The title plays like a casual game, writ large with a fun through line that finds Yoshi hunting down scattered “Dream Gems,” like so many Dragon Balls. It’s never as immersive or addicting as a title like Mario Galaxy, but that’s not necessarily a bad thing. It’s the kind of game you can happily play in spurts and come back to, after you’re done living your life.

It’s a reminder that games can be an escape from, rather than cause of, frustration and stress. And it’s definitely the best Yoshi star vehicle in nearly 25 years.

Powered by WPeMatico

Ride-hailing, bike and scooter companies probably raised less money than you thought

Contributor

After years of fierce competition as private companies, Uber and Lyft are going public on U.S. markets. Scooter service providers, the transportation trend du jour, raised hundreds of millions of dollars to scatter scooters on city sidewalks (to the chagrin of residents and regulators alike) throughout 2017 and 2018. On the other side of the Pacific, Grab and Go-Jek are raising gobs of cash as they continue to scale upward and outward.

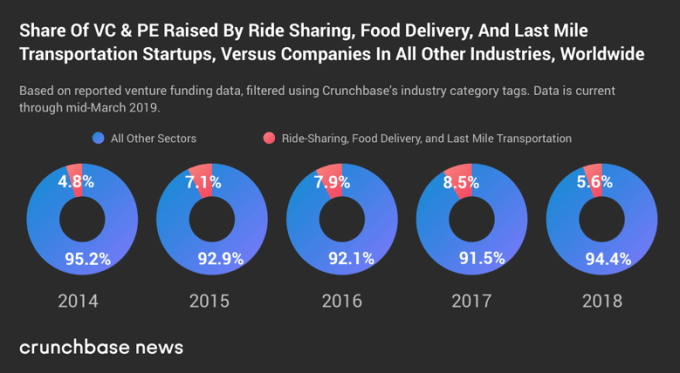

Of all the seed, early and late-stage venture funding raised over the past couple of years, how much of the total went to companies in the ride-hailing, food delivery and last-mile transportation categories (which encompasses bikes and scooters)? Probably not as much as you’d think.

Taken together, companies in these sectors raised less than 10 percent of the total venture dollar volume reported for each of the past five full calendar years.

We’ve charted it out based on yearly totals. Take a peek:

To be sure, we’re still talking about a lot of money here. Companies in these three categories raised more than $22 billion in venture funding rounds (not including private equity) in 2017 and more than $18 billion in 2018.

Ventures in the transportation space loom large in the media, and how could they not? It’s a forbiddingly capital-intensive market to play in, requiring companies to raise massive sums, which make for good headlines.

In its early years, competition between on-demand, point-to-point transportation marketplace companies rewarded brashness and speed with early scale and the long-term structural advantages conferred to first the firms which grew the fastest.

But those advantages may not have been as stiff as first expected. Lyft beat Uber to the public markets, raised its valuation during its IPO roadshow, priced at the top of its extended range and then popped 21 percent when it started trading.

That success means that the red chunks of our above chart weren’t all fool’s bets. Instead, a good chunk of the equity represented is now liquid. Of course, there’s a lot more work to do for literally every other ride-hailing, ridesharing, scooter-renting and other wheels-providing unicorns in the world: They still have to go public.

Powered by WPeMatico

Sega’s Genesis/Mega Drive Mini arrives in September

Whether you call it the Genesis or the Mega Drive, Sega’s 16 bit system holds a special place in the hearts of many a gamer who came of age in the 80s and 90s. Like the NES and Super Nintendo before it, the console that gave us a ring-hoarding hedgehog is about to get miniaturized.

Sega announced the Genesis/Mega Drive Mini last year, only to delay sales in order to fine tune the retro console. This week at Sega Fest, however, the once-mighty game maker firmed up the machine’s release date — and game selection. The Mini is due out just ahead of the holidays on September 19, carrying 40 pre-installed titles.

Along with the release date, the company announced a quarter of the titles, carrying some familiar names like Sonic the Hedgehog, Ecco the Dolphin, Altered Beats and ToeJam and Earl (full list below).

When it hits, the system will run $80 here in the States, the same price as the SNES Classic.

The full game selection (so far) is as follows:

-

Ecco the Dolphin

-

Castlevania: Bloodlines

-

Space Harrier II

-

Shining Force

-

Dr. Robotnik’s Mean Bean Machine

-

ToeJam & Earl

-

Comix Zone

-

Sonic the Hedgehog

-

Altered

-

Beast Gunstar Heroes

Powered by WPeMatico

Toast, the restaurant management platform, has raised $250M at a $2.7B valuation

Restaurant sales hit $825 billion last year in the U.S., but with margins averaging at only three to five percent per business, they’re always looking for an edge on efficiency and just generally running things in a smarter way. A startup called Toast, which has built a popular platform for restaurant management, has closed a hefty round of funding to double down on that opportunity to do that.

The company has raised $250 million on a valuation of $2.7 billion, money that it will use to invest in building technology to help restaurants with marketing, recruitment and operational efficiency, as well as start to think about expanding to more territories outside the U.S.

The basics of the funding were flagged earlier today by Prime Unicorn Index and we reached out to the company to confirm. It is being led by TCV and Tiger Global Management, with participation from Bessemer Venture Partners and T. Rowe Price Associates funds and other existing investors.

This Series E is a big bump up for the company: in its previous round in July 2018, the company was valued at $1.4 billion — partly the result of strong growth at the company. While it’s not disclosing revenue numbers or whether it is yet profitable, Toast currently serves tens of thousands of businesses — covering a range of sizes from independent venues to smaller chains — and in the last year tallied up transactions in the tens of billions of dollars, seeing growth of some 148 percent in its revenues, according to CFO Tim Barash.

The restaurant business represents a big opportunity for e-commerce companies, but there have been some notable stumbles where ambitions have not been met with success. Groupon, which spent several years acquiring and organically building a point of sale and restaurant management business, first drastically cut down and then finally called it quits and sold off its efforts, called Breadcrumb, in 2016. Amazon also pulled out of point of sale services (aimed at more than restaurants) and has in certain regions also pulled back on other restaurant efforts like its order management and delivery platform.

Barash said in an interview that he thinks the key to why Toast has steadily grown its business through all that is because a large proportion of its own employees — some 70 percent — have worked in the food service industry themselves.

“I was first a busboy, and then I worked in pizza delivery for years,” he said. “Seventy percent of our employees have worked at restaurants, including those in our product leadership, and that helps us understand the problem.”

Restaurants, as Barash points out, are complicated. “They are essentially manufacturers and retailers at the same time, all in one small physical footprint,” and so the key to building products for them is to understand that and the challenges they face in building and running those businesses.

And that’s before you consider the many other factors that can make restaurants a dicey game, from changing cuisine tastes, to changing eating habits — many get food delivered today — to the precariousness of the commercial real estate market and so much more.

The aim of Toast is to build tools to apply data science and orderly IT processes to address whichever of those variables that can be controlled by the restaurant.

Today, Toast’s products include point of sale services as well as reporting and analytics; display systems for kitchens; online ordering and delivery interfaces; and loyalty programs. It also builds its own hardware, which includes handheld order pads, payment and ordering terminals, self-service kiosks and displays for guests. It also offers links through to a network of some 100 partners, such as Grubhub for takeout food, when a restaurant does not cover those services or functions directly, to help stitch together services to work on its platform.

Tomorrow, the plan is to use the funding to enhance all of those with more advanced features that speak to some of the bigger issues and concerns Barash said its customers are voicing today.

That will include better and more services aimed at guest engagement and retention; better ways to recruit and keep people in an industry that has a high turnover of employees; and of course more tools to address how efficiently a business is operating to make it more profitable. The company has committed some $1 billion in the next five years to R&D to build more hardware and software.

Having access to this kind of tech and platform is a big deal, especially for independently owned places that hope to compete against bigger chains without having to compromise on their core competency: making unique and delicious food.

In the meantime, Barash said that while Toast itself is no stranger to approaches from larger players itself — he declined to say who but said many who have ambitions to do more business with the restaurant industry had approached it over the years — the company’s long-term vision is to grow bigger and remain its own boss.

It’s an ambition that has hit the spot with investors that have an appetite for high-growth businesses.

“At TCV, we invest in companies that have the potential to reshape entire industries. By providing restaurants of all sizes with access to innovative technology, Toast is leveling the playing field and leading the industry’s transition to the cloud,” said David Yuan, general partner at TCV, in a statement, who is joining the board with this round. “Our investment will enable Toast to extend their platform beyond point-of-sale and guest-facing technology, and in doing so, create a powerful SaaS platform with a superlative business model. We’re excited to partner with Toast as they accelerate the growth of the community they serve.”

Powered by WPeMatico

Equity Shot: Lyft is public — what does that mean for other IPO-ready unicorns?

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Sure, we just aired a new episode, but things keep happening, and after talking about this crop of IPOs for so long, we can’t help ourselves. (You can follow us on Twitter, here and here, by the way, if Equity isn’t enough for you.)

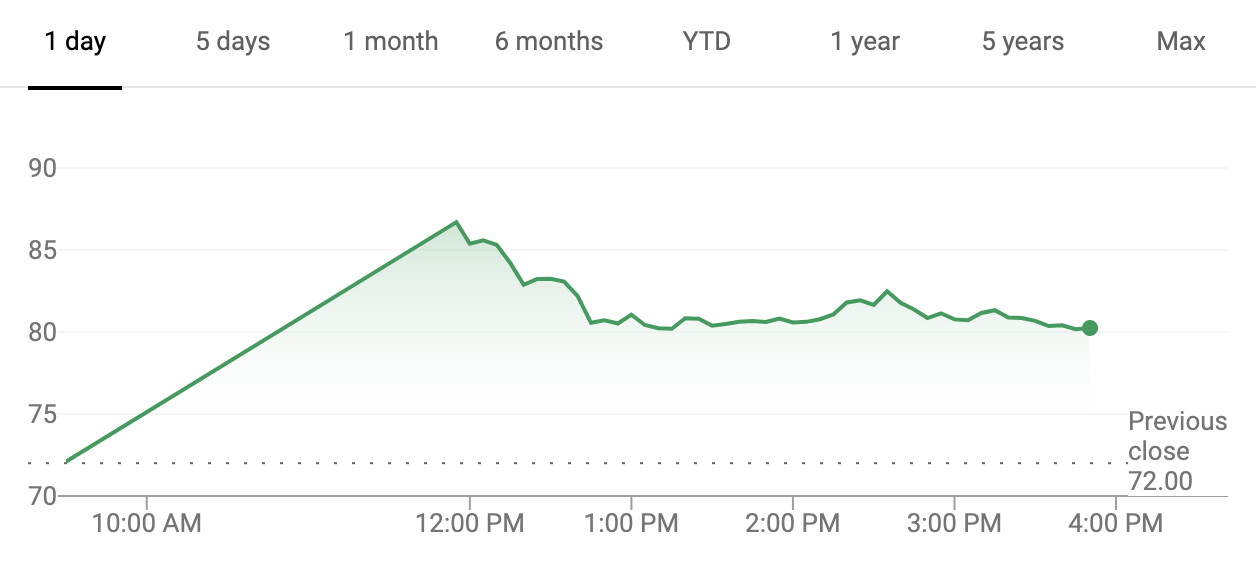

Lyft, as you know, started trading today, closing the loop on a long saga that brought the smaller of the two domestic ride-hailing unicorns to the public markets.

After so much speculation about which of the two would get out the door first, Lyft did, and now we get to see what sort of pricing shenanigans happen next. Does Uber drop rates and punish Lyft? Or does Uber work to cut its losses, lowering its expenses and providing a clearer path toward profitability before its April IPO roadshow kicks off? (Not a path to profitability, mind; Uber and Lyft need to show a path to the direction of profitability first.)

We hit all the bases, going over the company’s pricing path, its varying share figures, final raise metrics and more. If you want the hard stuff, we’ve got a shot for you.

Now that the Lyft IPO has wrapped, we’ll be shifting our focus to Pinterest, Zoom and, of course, Uber. Stay tuned.

OK, now we’re done. Until next Friday. Unless something else happens.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

Remote workers and nomads represent the next tech hub

Amid calls for a dozen different global cities to replace Silicon Valley — Austin, Beijing, London, New York — nobody has yet nominated “nowhere.” But it’s now a possibility.

There are two trends to unpack here. The first is startups that are fully, or almost fully, remote, with employees distributed around the world. There’s a growing list of significant companies in this category: Automattic, Buffer, GitLab, Invision, Toptal and Zapier all have from 100 to nearly 1,000 remote employees.

The second trend is nomadic founders with no fixed location. For a generation of founders, moving to Silicon Valley was de rigueur. Later, the emergence of accelerators and investors worldwide allowed a wider range of potential home bases. But now there’s a third wave: a culture of traveling with its own, growing support networks and best practices.

You don’t have to look far to find startup gurus and VCs who strongly advise against being remote, much less a nomad. The basic reasoning is simple: Not having a location doesn’t add anything, so why do it? Startups are fragile, so it’s best to avoid any work practice that could disrupt delicate growth cycles.

Powered by WPeMatico

Lyft closes up 9% on first day of trading

Pink confetti fell from the ceiling Friday as Lyft co-founders Logan Green and John Zimmer celebrated their company’s IPO. The stock offering was a bona fide success, with shares selling for $87.24 apiece Friday morning — 21 percent higher than Lyft’s initial $72 share price — and closing at $78.29 per share.

Lyft raised roughly $2.3 billion Thursday evening, hours before ringing the opening bell of the Nasdaq on Friday around noon Pacific. The IPO gave Lyft an initial market cap of about $24 billion, representing an 11x revenue multiple and a 1.6x step-up from its most recent private valuation of $15.1 billion.

On Bloomberg TV, Lyft’s co-founders discussed the company’s long-term prospects, including international growth, autonomous vehicle plans, the future of car ownership and insurance.

“We are confident that the business will be very profitable,” Green told Emily Chang. “We are making tremendous progress going after this once-in-a-generation shift where this entire industry, a $1.2 trillion market, could flip from an ownership model to a service model and we are leading the way there.”

The pair opted to host their IPO in Los Angeles, Lyft’s largest market.

“We want to make a point that you can both invest in communities and build a great business,” Zimmer said. “It was fun to ring the bell with several members of our driver community and have many of them participate in our IPO because we gave them a bonus to do so.”

Powered by WPeMatico

ServiceNow teams with Workplace by Facebook on service chatbot

One of the great things about enterprise chat applications, beyond giving employees a common channel to communicate, is the ability to integrate with other enterprise applications. Today, Workplace, Facebook’s enterprise collaboration and communication application, and ServiceNow announced a new chatbot to make it easier for employees to navigate a company’s help desks inside Workplace Chat.

The beauty of the chatbot is that employees can get answers to common questions whenever they want, wherever they happen to be. The Workplace-ServiceNow integration happens in Workplace Chat and can can involve IT or HR help desk scenarios. A chatbot can help companies save time and money, and employees can get answers to common problems much faster.

Previously, getting these kind of answers would have required navigating multiple systems, making a phone call or submitting a ticket to the appropriate help desk. This approach provides a level of convenience and immediacy.

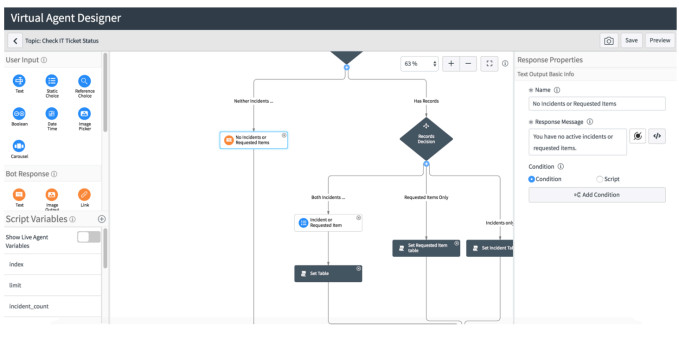

Companies can brainstorm common questions and answers and build them in the ServiceNow Virtual Agent Designer. It comes with some standard templates, and doesn’t require any kind of advanced scripting or programming skills. Instead, non-technical end users can adapt pre-populated templates to meet the needs, language and workflows of an individual organization.

Screenshot: ServiceNow

This is all part of a strategy by Facebook to integrate more enterprise applications into the tool. In May at the F8 conference, Facebook announced 52 such integrations from companies like Atlassian, SurveyMonkey, HubSpot and Marketo (the company Adobe bought in September for $4.75 billion).

This is part of a broader enterprise chat application trend around making these applications the center of every employee’s work life, while reducing task switching, the act of moving from application to application. This kind of integration is something that Slack has done very well and has up until now provided it with a differentiator, but the other enterprise players are catching on and today’s announcement with ServiceNow is part of that.

Powered by WPeMatico

20 years for swatter who got a man killed

Tyler Barriss, a prolific and seemingly unremorseful repeat swatter and bomb hoaxer whose fakery got a man killed in 2017, has been sentenced to 20 years in prison. This hopefully closes the book on a long and disturbing career of random and mercenary harassment and threats.

Not to linger on the crimes committed by Barriss, but to refresh your memory: Barriss accumulated dozens of charges generally relating to calling in fake threats in order to get police or SWAT called to a location or shut it down. Among his bomb threat targets was the FCC, which had to clear the room during a major net neutrality vote because of a call Barriss made.

Nearly at the same time, as part of a conflict relating to a $1.50 Call of Duty bet, he called the police claiming he was armed and had shot his father, and was at an address in Kansas, where he thought his target lived. Unfortunately the target had moved well before, and when the police showed up, they shot and killed the current resident, Andrew Finch.

Barriss was arrested in early 2018 and pleaded guilty to 51 various charges, facing up to 25 years in prison. The sentencing today reflects the defense’s plea that he get 20 instead, no doubt in return for cooperation and the guilty plea.

It should not go unnoted here that Finch was unarmed and on his own doorstep when police killed him — with an assault rifle — reportedly because “he was reaching for his waistband.” Apparently the officer also “believed he saw a gun come up in Mr Finch’s hands.” Well, which was it, up or down? Was he reaching for the gun or raising it? Is it common for Wichita police to shoot someone within seconds of them answering the door, without assessing the situation — for instance, where the children are? As is sadly often the case in such shootings, the police are entirely without credibility here, and the officer involved seems to have faced no consequences. Justice seems out of the question, but the family has filed a lawsuit over the matter.

If the police weren’t already considered a serious danger to others, swatting wouldn’t be a thing. The chance that police will escalate is highly unpredictable, though of course being a person of color adds considerably to that risk, as a fraudulent gun in the call will cause the police to hallucinate weapons with even greater frequency than usual.

The whole case is sad and depressing, from the astonishing pettiness of Barriss and his associates to the total lack of concern over the consequences of his actions — extending, it seems, even to his prison term: he has been in before and attempted to get online and continue his hoax habit even while incarcerated.

Barriss, it seems, is a symptom of internet culture less extreme but as inevitable as the Christchurch killer. All the worst parts about being online rolled into one and given form — and means to kill. Here’s hoping we find a way to reverse the trend.

Powered by WPeMatico