Google Drive adds workflow integrations with DocuSign, K2 and Nintex

Google today announced a few new workflow integrations for its Drive file storage service that’ll bring to the service support for some features from DocuSign and process automation platforms K2 and Nintex.

None of these new integrations are all that unusual, but if you use a combination of Drive and the newly supported tools, they will undoubtedly make your daily work a little bit easier.

For DocuSign, the new integration lets you prepare, sign and store your documents right in Google Drive, as well as trigger actions like billing, account activation and payments after an agreement has been signed.

The K2 integration is a bit different and focuses on that company’s machine learning tools. It’ll allow users to train models on a workflow (using Google machine learning tools) and then, for example, determine whether a loan should be automatically approved or denied, with all of the information about those requests and the approval process stored in a Google Sheet. The integration also supports more pedestrian use cases, though, including the ability to make lots of documents in Drive more easily discoverable.

“K2 is committed to simplifying the way in which our customers connect and manage their information, whether it resides on-premise or in the cloud,” said Eyal Inbar, vice president of Global Technology Alliances at K2. “By integrating with Google Drive, we are able to put the next-generation of content management services in the hands of our customers so they can build and implement powerful workflows into their applications.”

Nintex’s solution seems to be a bit more specialized, with a focus on contract management lifecycles for HR, legal and sales use cases. There’s nothing exciting about managing contracts, but that’s probably a good thing, and ideally, adding more automation will help to keep it that way.

Powered by WPeMatico

WhatsApp’s Brian Acton to talk Signal Foundation and leaving Facebook at Disrupt SF

“We give them the power. That’s the bad part. We buy their products. We sign up for these websites. Delete Facebook, right?”

That’s WhatsApp founder Brian Acton’s most recent quote about his former employer, Facebook. Acton has seemingly been fueled by his experience running WhatsApp from within Facebook, which has been scrutinized for profiting from collecting data on users.

Which explains why now, two years after leaving Facebook, Acton has found a new groove as founder and executive chairman of the Signal Technology Foundation, a 501(c)(3) nonprofit organization dedicated to doing the foundational work around making private communication accessible, secure and ubiquitous. Acton invested $50 million of his own money to start Signal Foundation in February of 2018.

At TechCrunch Disrupt SF in October, we’ll hear more from Acton about Signal Foundation and his predictions for the future of communication and privacy. And, of course, we’ll try to learn more about what Facebook was up to with WhatsApp, why he left and how it felt leaving $850 million on the table.

Though he was rejected for positions at Facebook and Twitter in 2009, Acton is actually a Silicon Valley veteran, working in the industry (mostly as a software builder) for more than 25 years at places like Apple, Yahoo and Adobe before founding WhatsApp.

The chat app he built with co-founder Jan Koum grew to 1.5 billion users and, eventually, saw a $19 billion buyout from Mark Zuckerberg in 2014. But when Facebook wanted to lay the basis for targeted ads and commercial messaging within the encrypted chat app he’d spent years building, he walked away.

The Signal Foundation is all about ensuring people have access to private communication that doesn’t cost their own personal data.

“We believe there is an opportunity to act in the public interest and make a meaningful contribution to society by building sustainable technology that respects users and does not rely on the commoditization of personal data,” Acton wrote when it was first announced. In many ways, the Signal Foundation is a symbol and a continuation of Acton’s most expensive moral stand.

We’re thrilled to hear from Acton about what’s next at Signal Foundation. We’ll also try to learn more about his exit at Facebook and his feelings about the products he spent so much time building there.

After all, unsavvy regulators, legions of competitors and user backlash have all failed to compel Facebook to treat people better. But the real power lies with the talent that tech giants fight over. When people like Acton speak up or walk out, employers are forced to listen.

“No filter” is Acton’s style, so get ready for some fireworks when we sit down with him onstage at Disrupt SF.

Disrupt SF runs October 2 to October 4 at the Moscone Center. Tickets are available here.

Powered by WPeMatico

Verizon flips on 5G for phones in parts of Chicago and Minneapolis

Verizon (which owns the company that owns TechCrunch) announced today that it has activated its 5G Ultra Wideband Network in parts of Minneapolis and Chicago. The news is the first step for the carrier’s plan to bring the technology to north of 30 U.S. cities at some point this year.

It’s all still baby steps, of course. While the roll out has started a week ahead of schedule, it’s only available in “parts” of the two Midwestern cities, according to the company. Those in the right spots, however, can expect top speeds of up to 1Gbps, per Verizon’s press materials.

Here are the areas that will get coverage:

In Chicago, 5G coverage is concentrated in areas of the West Loop and the South Loop, around landmarks like Union Station, Willis Tower, The Art Institute of Chicago, Millennium Park and The Chicago Theatre. Customers also have 5G Ultra Wideband service in the Verizon store on The Magnificent Mile and throughout The Gold Coast, Old Town and River North.

In Minneapolis, service is concentrated in the Downtown area, including Downtown West and Downtown East, as well as inside and around U.S. Bank Stadium, the site of this weekend’s NCAA men’s basketball Final Four. Verizon 5G Ultra Wideband service is also available around landmarks like the Minneapolis Convention Center, the Minneapolis Central Library, the Mill City Museum, Target Center and First Avenue venues, The Commons, areas of Elliot Park and in the Verizon store in The Mall of America.

The other big rub here is the extremely limited availability of 5G handsets at present. The phones were seemingly all over the place at Mobile World Congress back in February, but actually getting your hands on one is another question entirely. Currently the Moto Z3 is the only phone that can access those speeds on Verizon, when paired with the 5G Moto Mod.

It’s important to temper expectations in all of this. Full coverage — especially for those outside of major cities — is going to take a while. And even for those who are in big cities, chances are it’s going to take a while to get it. That’s going to be coupled with limited availability of 5G options (Apple, for one, isn’t expected to go 5G until 2020 at the earliest) and some high-price premiums on already expensive flagship devices.

That said, the long-promised era of 5G is, indeed, finally dawning.

Powered by WPeMatico

T-Mobile’s mobile TV service to include Viacom channels like MTV, Nickelodeon, Comedy Central & more

T-Mobile and Viacom this morning announced a deal that will bring Viacom’s TV channels — like MTV, Nickelodeon, Comedy Central, BET, Paramount and others — to T-Mobile’s new mobile video service planned for later this year. The agreement will allow T-Mobile to offer live, linear feeds of the Viacom channels as well as on-demand viewing.

To date, the carrier’s mobile video plans have been murky. Last year, T-Mobile acquired the Denver-based startup Layer3 TV in order to launch a new over-the-top video service in 2018. It missed that window, saying that it needed more time to work on features and make “quality improvements.”

The company later said that it didn’t want to offer another Amazon Channels-like “skinny bundle” consisting of individual subscriptions to various channels, but wanted to offer something more differentiated where customers could create their own media subscriptions in “smaller pieces,” like “five, six, seven or eight dollars at a time.”

Today, T-Mobile says it still plans to move forward with both its home and mobile TV offerings, made possible by the acquisition of Layer3 TV. The in-home TV service is designed to leverage 5G technology to replace cable. Meanwhile, Viacom will be a “cornerstone launch partner” for T-Mobile’s mobile TV efforts, on track for a launch this year.

“Viacom represents the best of the best, most-popular brands on cable, so they are an amazing partner for us,” said John Legere, CEO of T-Mobile, in a statement. “TV programming has never been better, but consumers are fed up with rising costs, hidden fees, lousy customer service, non-stop BS. And MacGyvering together a bunch of subscriptions, apps and dongles isn’t much better. That’s why T-Mobile is on a mission to give consumers a better way to watch what they want, when they want,” he said.

Not much is known about T-Mobile’s mobile TV plans at this point, like a more specific launch time frame or price points. It’s also unclear if T-Mobile will go the route of bundling in its TV service with its mobile plans. That’s been a popular strategy for AT&T, which today operates two over-the-top services — a low-end service called WatchTV designed for bundling and its more premium service DirecTV Now. (It also plans to launch another featuring Warner Bros. content.)

Viacom has deals with other carriers besides T-Mobile, having recently renewed its contract with AT&T for DirecTV Now carriage. It also participates in various other streaming services, including its own service (by way of acquisition) Pluto TV, and has invested in Philo.

“Today’s landmark announcement marks a major step forward in our strategy to accelerate the presence of our brands on mobile and other next-generation platforms,” said Bob Bakish, Viacom president and CEO, in a release. “We’re so excited to partner with T-Mobile to provide millions of subscribers with access to our networks and more choice in a new service that will be unlike any other in the market.”

Powered by WPeMatico

Torch takes $10M to teach empathy to executives

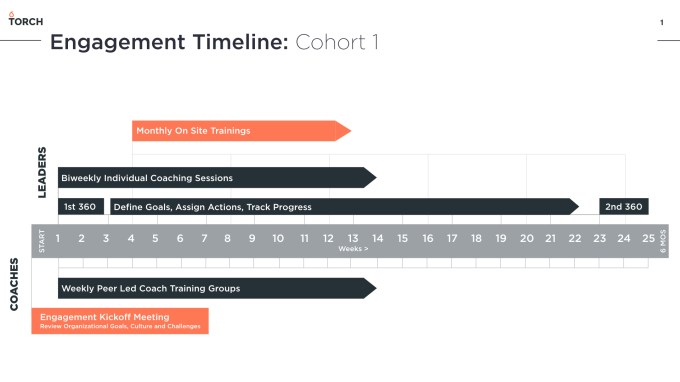

When everyone always tells you “yes,” you can become a monster. Leaders especially need honest feedback to grow. “If you look at rich people like Donald Trump and you neglect them, you get more Donald Trumps,” says Torch co-founder and CEO Cameron Yarbrough about our gruff president. His app wants to make executive coaching (a polite word for therapy) part of even the busiest executive’s schedule. Torch conducts a 360-degree interview with a client and their employees to assess weaknesses, lays out improvement goals and provides one-on-one video chat sessions with trained counselors.

“Essentially we’re trying to help that person develop the capacity to be a more loving human being in the workplace,” Yarbrough explains. That’s crucial in the age of “hustle porn,” where everyone tries to pretend they’re working all the time and constantly “crushing it.” That can leave leaders facing challenges feeling alone and unworthy. Torch wants to provide a private place to reach out for a helping hand or shoulder to cry on.

Now Torch is ready to lead the way to better management for more companies, as it’s just raised a $10 million Series A round led by Norwest Venture Partners, along with Initialized Capital, Y Combinator and West Ventures. It already has 100 clients, including Reddit and Atrium, but the new cash will fuel its go-to market strategy. Rather than trying to democratize access to coaching, Torch is doubling-down on teaching founders, C-suites and other senior executives how to care… or not care too much.

“I came out of a tough family myself and I had to do a ton of therapy and a ton of meditation to emerge and be an effective leader myself,” Yarbrough recalls. “Philosophically, I care about personal growth. It’s just true all the way down to birth for me. What I’m selling is authentic to who I am.”

Torch’s co-founders met when they were in grad school for counseling psychology degrees, practicing group therapy sessions together. Yarbrough went on to practice clinically and start Well Clinic in the Bay Area, while Keegan Walden got his PhD. Yarbrough worked with married couples to resolve troubles, and “the next thing I know I was working with high-profile startup founders, who like anybody have their fair share of conflicts.”

Torch co-founders (from left): Cameron Yarbrough and Keegan Walden

Coaching romantic partners to be upfront about expectations and kind during arguments translated seamlessly to keep co-founders from buckling under stress. As Yarbrough explains, “I was noticing that they were consistently having problems with five different things:

1. Communication – Surfacing problems early with kindness

2. Healthy workplace boundaries – Making sure people don’t step on each others’ toes

3. How to manage conflict in a healthy way – Staying calm and avoiding finger-pointing

4. How to be positively influential – Being motivational without being annoying or pushy

5. How to manage one’s ego, whether that’s insecurity or narcissism – Seeing the team’s win as the first priority

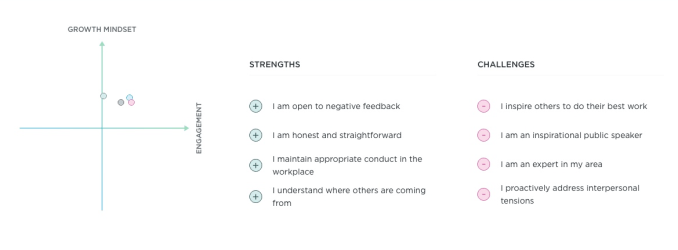

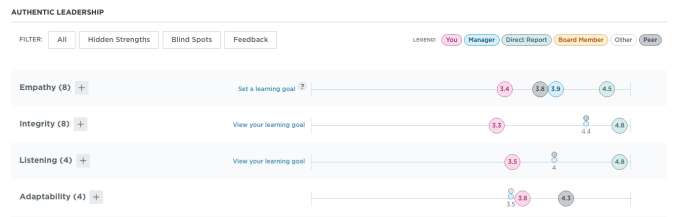

To address those, companies hire Torch to coach one or more of their executives. Torch conducts extensive 360-degree interviews with the exec, as well as their reports, employees and peers. It seeks to score them on empathy, visionary thinking, communication, conflict, management and collaboration, Torch then structures goals and improvement timelines that it tracks with follow-up interviews with the team and quantifiable metrics that can all be tracked by HR through a software dashboard.

To make progress on these fronts, execs do video chat sessions through Torch’s app with coaches trained in these skills. “These are all working people with by nature very tight schedules. They don’t have time to come in for a live session so we come to them in the form of video,” Yarbrough tells me. Rates vary from $500 per month to $1,500 per month for a senior coach in the U.S., Europe, APAC or EMEA, with Torch scoring a significant margin. “We’re B2B only. We’re not focused on being the most affordable solution. We’re focused on being the most effective. And we find that there’s less price sensitivity for senior leaders where the cost of their underperformance is incredibly high to the organization.” Torch’s top source of churn is clients’ going out of business, not ceasing to want its services.

Here are two examples of how big-wigs get better with Torch. “Let’s say we have a client who really just wants to be liked all the time, so much so that they have a hard time getting things done. The feedback from the 360 would come back like ‘I find that Cameron is continually telling me what I want to hear but I don’t know what the expectations are of me and I need him to be more direct,’ ” Yarbrough explains. “The problem is those leaders will eventually fire those people who are failing, but they’ll say they had no idea they weren’t performing because he never told them.” Torch’s coaches can teach them to practice tough-love when necessary and to be more transparent. Meanwhile, a boss who storms around the office and “is super-direct and unkind” could be instructed on how to “develop more empathic attunement.”

Yarbrough specifically designed Torch’s software to not be too prescriptive and leave room for the relationship between the coach and client to unfold. And for privacy, coaches don’t record notes and HR only sees the performance goals and progress, not the content of the video chats. It wants execs to feel comfortable getting real without the worry their personal or trade secrets could leak. “And if someone is bringing in something about trauma or that’s super-sensitive about their personal life, their coach will refer them out to psychotherapists,” Yarbrough assures me.

Torch’s direct competition comes from boutique executive coaching firms around the world, while on the tech side, BetterUp is trying to make coaching scale to every type of employee. But its biggest foe is the stubborn status quo of stiff-upper-lipping it.

The startup world has been plagued by too many tragic suicides, deep depression and paralyzing burnout. It’s easy for founders to judge their own worth not by self-confidence or even the absolute value of their accomplishments, but by their status relative to yesterday. That means one blown deal, employee quitting or product delay can make an executive feel awful. But if they turn to their peers or investors, it could hurt their partnership and fundraising prospects. To keep putting in the work, they need an emotional outlet.

“We ultimately have to create this great software that super-powers human beings. People are not robots yet. They will be someday, but not yet,” Yarbrough concludes with a laugh. IQ alone doesn’t make people succeed. Torch can help them develop the EQ, or emotional intelligence quotient, they need to become a boss that’s looked up to.

Powered by WPeMatico

Andreessen Horowitz isn’t alone in leaving behind VC as we know it — and more company is coming

This morning, Forbes wrote a lengthy profile of Andreessen Horowitz, the now 10-year-old venture firm that its rivals love to hate but nevertheless tend to copy. It’s a great read that revisits some of the firm’s wins and losses and, interestingly, regrets, including the founders’ early predisposition to talk trash about the rest of the venture industry.

As Ben Horowitz tells reporter Alex Konrad, “I kind of regret it, because I feel like I hurt people’s feelings who were perfectly good businesses . . . I went too far.”

The story also suggests that Andreessen Horowitz — whose agency-like model has been widely replicated by other big venture firms — is re-shaping venture capital a second time. It’s doing this, says Forbes, by turning itself into a registered investment advisor.

But the firm isn’t alone is morphing into something very different than it once was, including an RIA. SoftBank is already one. General Catalyst appears to be in the process of registering as one, too. (It recently withdrew its status as a so-called exempt reporting advisor.) Other big firms with a range of un-VC-like products are similarly eyeing the same move.

They don’t have much choice. While VCs have traditionally been able to dabble in new areas through their limited partner agreements with their own investors, they’ve also faced what’s traditionally been a 20 percent cap on these activities, like buying in the public markets, investing in other funds, issuing debt to fund buyouts, and acquiring equity through secondary transactions.

Put another way, 20 percent of their capital could be used to experiment, but the rest had to be funneled into typical venture capital-type deals.

For Andreessen Horowitz, that cap clearly began to grate. An early and enduring believer in cryptocurrencies, marketplaces, and applications, the firm grew particularly frustrated over its inability to invest more of its flagship fund into crypto startups. It raised a separate crypto fund last year so it could move more aggressively on opportunities, but according to Forbes, the constraints that came with creating that separate legal entity gave rise to new aggravations.

By becoming a registered investment advisor, Andreessen Horowitz will no longer have to limit these stakes, including in its general fund — the newest of which it’s expected to announce shortly. It will also have the freedom to invest any percentage of its fund that it wants in larger high-growth companies, to buy shares from founders and early investors, and to trade public stocks, as Forbes notes.

It’s the same reason that SoftBank is a registered investment advisor and other big firms with more assets will invariably be, as well. As longtime startup attorney Barry Kramer observes, “Like the now-giant operating companies that VCs once funded, like Google and Apple and Amazon — each of which used to play in discrete market segments and now overlap — hedge funds, mutual funds, secondary funds, and venture funds that used to play in discrete market segments are starting to overlap, too.”

In fact, the opportunity to shop for secondary stakes alone could drive a venture firm to restructure. “Secondary markets are eating” the public markets, observes Barrett Cohn on the investment bank Scenic Advisement, which helps broker sales between equity buyers and sellers. Cohn has a vested interest in this turnabout, but it’s also hard to argue he’s wrong, considering how long startups remain private, and how much more secondary activity now takes place before companies are acquired, go public, or conk out.

Little wonder the powerful venture capital lobby group — the National Venture Capital Association — has been trying to talk the SEC into changing its definition of what constitutes a venture capital firm. It recognizes that it will lose more and more members if venture firms aren’t afforded more flexibility.

In the meantime, becoming an RIA isn’t without its downsides — a lot of them, notes Bob Raynard, the managing director of the fund administration services company Standish Management in San Francisco.

Though he thinks many firms like Andreessen Horowitz may not have a choice at a certain point (“I think there are a lot of other growth equity and venture firms that should be registered for their own sake”), the new rules to which it will be adapting can “be quite onerous,” beginning with a complete lack of privacy, as well as expenses.

One estimate we found suggests that the median annual compliance costs are eight times higher for RIAs than for exempt registered advisors.

“If [Andreessen Horowitz] is becoming an RIA, its cost structure just went way up,” says Raynard, observing that a compliance officer will have to sign off on everything an employee at the firm does, as well as the investing decisions that its partners’ spouses, children, and even parents make. “As a VC, you don’t have to report your trades,” Raynard notes, but an RIA has to ensure that nothing and no one with a pecuniary interest in the firm creates an expensive misstep.

One could also imagine it creating headaches for limited partners, who typically like to invest in distinct asset classes, whether venture capital or private equity or hedge funds. If Andreessen Horowitz, among other firms, starts to look like an amalgamation of all three, how will it be viewed? In which bucket will it land?

The firm declined to answer that question and others of ours today, saying it’s focused for now on completing the process of registering as an RIA. Raynard pushes back on the idea that its new look might throw off the institutions that have long funded it, however. “I think regulators will view it as a good thing, and I think most LPs would view it as a favorable shift, because of increased outside scrutiny involved.”

Indeed, Raynard thinks that beyond expenses and added layers of management and and an eagle-eyed SEC watching more closely, a bigger trade-off as venture firms become investment firms more broadly could be that it becomes harder to recruit.

Despite widespread interest in working for a brand-name firm, “if you’re a junior-level person and you’re being recruited by a firm that’s a registered investment advisor versus a venture firm where your deals are not being scrutinized and you have some privacy,” says Raynard, “it’s something you’re going to think about.”

Powered by WPeMatico

BuzzFeed teams up with Eko to create interactive recipes and other videos

BuzzFeed and Eko have been working together to create a wide range of interactive videos, which they began launching in the past week or so — starting with this Tasty potato recipe that allows you to customize your ingredients, revealing a bit about your personality in the process.

There’s also an interactive Tarot reading, a video quiz that determines which kind of dog you are and this customizable ramen video.

I spoke with BuzzFeed and Eko executives last week to learn more about how they’re working together, and where it might go next.

These videos — usually brief and based on existing BuzzFeed formats — feel pretty different from previous Eko showcases like “That Moment When,” which is more of a comedic, Choose Your Own Adventure-style story.

Eko’s Chief Creative Officer Alon Benari acknowledged that in the past, the company usually “started from a traditional video and injected interactivity into it.” But while “this is one of the first projects where we did the other path” — namely, taking an interactive format like a quiz and introducing video — the focus is still on “bringing together the best of both worlds.”

“This isn’t a direction change,” added Vice President of Business Development Ivy Sheibar. “We have a full pipeline of what you would consider coming more from traditional video.”

As for BuzzFeed, Chief Marketing Officer Ben Kaufman suggested that this is a natural extension of the publisher’s strategy to experiment with new formats. By offering this kind of interactivity, BuzzFeed can tailor videos to their viewers’ needs and interests (for example, by customizing video recipes based on dietary restrictions) while also “allowing our audience to engage with our videos and create data feedback loops.”

In addition to providing the technical platform to create these videos, Kaufman said Eko’s team shared important insights from years of experience with interactivity.

“One of the things they trained us on was what the meaning of a meaningful choice was — [a choice] where actually as an audience member you would take that to heart and makes you feel like, ‘This video is really made for me,’ ” he said.

Kaufman added that as BuzzFeed and Eko continue rolling out different types of interactive videos, “Our goal in the next few weeks is to crack this, to build a real deep audience connection, see what they are loving and go heavy into scaling that.”

Powered by WPeMatico

Foursnap? Snapchat tries ‘Status’ location check-ins

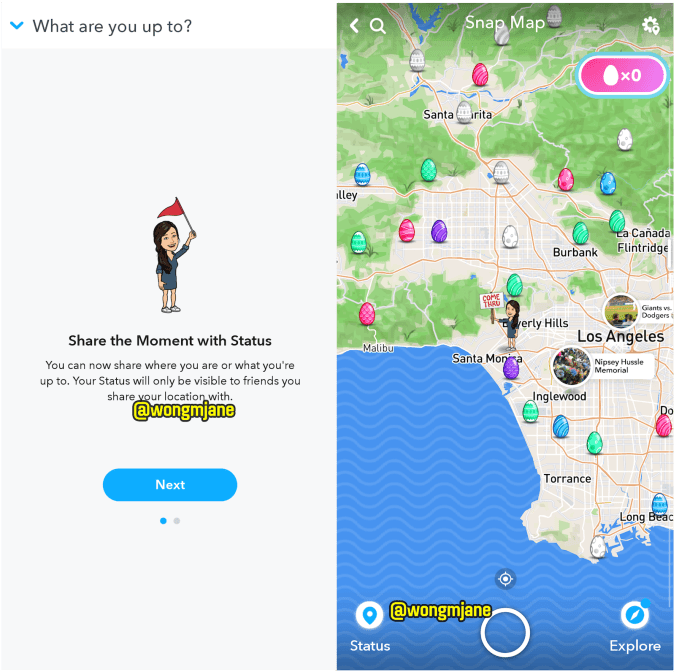

Today’s teens missed the Foursquare era, so Snapchat is giving them another shot with a new feature to aid in-person meetups. Snapchat is now testing Status, an option to share to the Snap Map a Bitmoji depicting what you’re up to at a certain place. You could show your little avatar playing video games, watching TV, asking friends to hit you up and more. And Snapchat will compile these into a private diary of what you’ve been doing, called Passport

This fixes the biggest problem with Snap Map and many other location check-in apps. Just because someone is down the street doesn’t mean they want you to drop in on them. They could working, in a meeting or on a date. Snapchat Status lets people convey their activity and intention so you can tell the difference between “I’m nearby but stuck with my parents” and “I’m nearby and want to hang out!” As Snapchat refocuses on messaging after Instagram stole its Stories thunder, Status could ensure there’s more to see that makes Snap Map worth opening.

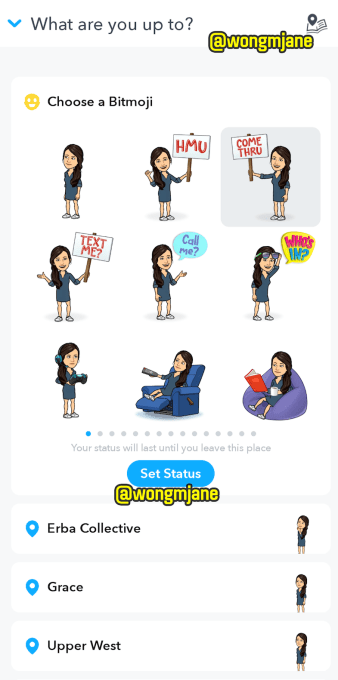

Snapchat Status and Passport were first spotted by reverse-engineering expert and frequent TechCrunch tipster Jane Manchun Wong. “Share the Moment with Status,” the introduction to the feature explains. “You can now share where you are or what you’re up to. Your Status will only be visible to friends you share your location with.” To see your status, you choose from reams of poses for your Bitmoji ranging from them reading a book to holding a sign saying “text me?”

Snapchat Status and Passport were first spotted by reverse-engineering expert and frequent TechCrunch tipster Jane Manchun Wong. “Share the Moment with Status,” the introduction to the feature explains. “You can now share where you are or what you’re up to. Your Status will only be visible to friends you share your location with.” To see your status, you choose from reams of poses for your Bitmoji ranging from them reading a book to holding a sign saying “text me?”

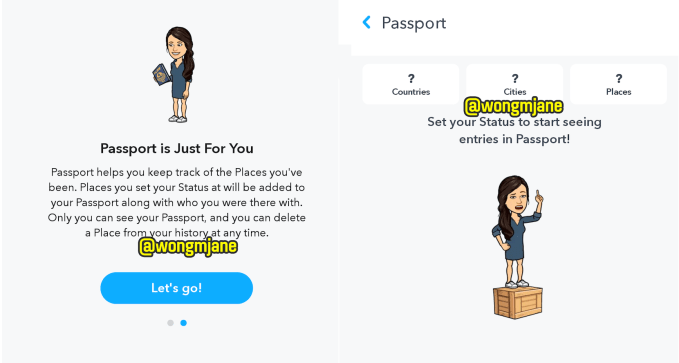

Meanwhile, “Passport is Just For You: Passport helps you keep track of the Places you’ve been. Places you set your Status at will be added to your Passport along with who you were there with. Only you ca see your Passport, and you can delete a Place from your history at any time.” Your Status only lasts until you leave a place, but it’s tallied along with the number of countries and cities you’ve check into on your Passport.

A Snap spokesperson confirms that “Yes, we are currently testing new ways for Snapchatters to better communicate on the Snap Map with their friends. This test is running with a percentage of Snapchatters in Australia.” Previously, special Bitmoji were only displayed on the Snap Map involuntarily, like when you were road tripping or flying to a new place; visited somewhere special like a beach, mall or major event; or if there was a breaking news moment.

If you don’t want to use Status or even show up on Snap Map, you can go into ghost mode at any time, plus all your location-based content disappears if you don’t open the app for eight hours. And if you do want to be found, you can check who’s viewed your location or Status in case you need to know who’s blowing you off.

Snap launched Snap Map back in June 2017, basing the idea off its acquisition of French location startup Zenly that it bought for $213 million in cash plus bonuses. Beyond spurring real-world interaction, Snap has also made Snap Map an embeddable way to explore breaking news events or hotspots around the world. Status could provide structured data about your behavior, which could beef up Snapchat’s scrawny repository of ad-targeting information. The app could even try surfacing nearby businesses or discounts.

Snapchat’s tighter-knit social graph and stronger track record on privacy lets it offer features that would freak people out if built by Mark Zuckerberg. Given Facebook is aggressively cloning Snap’s whole product philosophy, from its direct copy of Stories to ephemeral messaging to its premium content hubs Watch and IGTV, Snapchat desperately needs to differentiate. Luckily, Facebook has failed to figure out offline meetups, and has yet to roll out the “Your Emoji” status feature that similarly tries to convey what you’re up to visually but within Messenger instead of a map.

Doubling down on Snap Map is a smart move because its one of the few areas where Facebook can’t follow.

Powered by WPeMatico

Green New Deal doesn’t go far enough

Contributor

While I applaud the direction proposed in the Green New Deal resolution, it simply does not go far enough. The hard truth is that we must keep more fossil fuels in the ground. Not only that, we must redouble our efforts to keep forests standing — a critical yet oft-overlooked factor in the only promising equations to stop climate catastrophe.

There are two promising paths toward a solution: cut off the billions of dollars still flowing into fossil fuel extraction and expansion; and strengthen the rights of indigenous and frontline communities, which has consistently been proven to be one of the most efficient ways to properly manage forests and natural resources.

On October 8, 2018, the UN Intergovernmental Panel on Climate Change’s (IPCC) report was released — and it did not pull any punches. The report clearly states that if global temperatures rise by 1.5° Celsius, the impacts will be much worse than previously predicted. The report also said that to have a reasonable chance of staying under 1.5° we must immediately embark on an unprecedented global effort to reshape our economic priorities over the next 12 years. As the biggest carbon polluter in history, the U.S. largely owns this problem — therefore we must lead in the solution.

If you’re in a hole and you want to get out, stop digging.

Regrettably, recent remarks by Senator Feinstein and House Speaker Pelosi dismissing the Green New Deal show that even those often considered allies in the fight against catastrophic climate change are unwilling to marry urgency with action. “If we wait until 2050 to make change, then our Earth is going to die. We will quite literally have an apocalypse,” said 16-year-old Isha Clarke, one of the youths who confronted Sen. Feinstein asking for her support of a Green New Deal. The bottom line is that we need politicians to stand up and fight back against the corporate special interest groups that are compromising our future.

The science is clear. Emissions just from the oil, gas and coal reserves already in production would take the world well beyond 1.5° Celsius. And standing forests, particularly tropical forests, are under constant threat of destruction for profit — despite the fact that they are some of the best protection against climate change that we have (intact forests act as critical carbon sinks, keeping carbon out of our atmosphere).

If you’re in a hole and you want to get out, stop digging. We need an immediate end to the expansion of fossil fuel extraction and infrastructure and an end to deforestation. In-depth research makes clear that Wall Street banks, insurance companies and other financiers continue to pump trillions of dollars into the same companies that have been shamelessly profiting off climate destruction for decades.

The Green New Deal calls for “achiev[ing] net-zero greenhouse gas emissions” through measures that include “meeting 100 percent of the power demand in the U.S. through clean, renewable, and zero-emission energy sources” within 10 years, and restoring and protecting natural ecosystems that would remove greenhouse gases from the atmosphere, support climate resiliency, and enhance biodiversity. The resolution requires “obtaining the free, prior, and informed consent of indigenous peoples for all decisions that affect indigenous peoples and their traditional territories, honoring all treaties and agreements with indigenous peoples, and protecting and enforcing the sovereignty and land rights of indigenous peoples.” This is a solid start to this very necessary conversation.

However, “net zero” could imply a continuation of fossil fuel production and use. For example, if corporations are allowed to cancel out their emissions with wrongheaded geoengineering schemes and tradeable carbon offsets, we will be in the same hole. Without an explicit commitment to keep fossil fuels in the ground, the resolution as currently written falls short.

Achieving the goals of the Green New Deal must also go hand in hand with transforming the financial sector. Banks like JPMorgan Chase must no longer be allowed to profit from financing the construction of tar sands pipelines and the destruction of rainforests for palm oil, endangering the livelihoods of indigenous communities in its wake. They need to be held accountable for the damage done to people and the planet. And they need to rapidly shift their financing to solar and wind power; energy storage and grid modernization; electrification of transport, heating and industrial processes; and energy efficiency, which are all key technologies in achieving the goals of the Green New Deal.

Powered by WPeMatico