India’s OYO enters Japan in partnership with SoftBank

Fresh from closing a notable investment from Airbnb, India’s OYO has expanded its footprint into Japan. The move comes through a joint venture with investor SoftBank — which led OYO’s $1 billion round last year through its Vision Fund — which will cover hotel-based accommodation and home rentals.

Financial details around the joint venture were not disclosed. An OYO representative declined to go into details when asked.

OYO started in India, where it initially aggregated budget hotels; it has since expanded into China, Malaysia, Nepal, the U.K., the UAE, Indonesia, the Philippines and — now — Japan. China, in particular, has shown promise, with OYO’s room inventory there reportedly double what it is in India.

The evolution has not just been a geographical one. Its business has moved from a laser focus on the long-tail of budget hotels to a broader “hospitality” play. It now includes managed private homes and, in India, wedding venues, holiday packages and co-working — while its hotel supply is a mixture of franchised and leased. It has also advanced its focus from budget-minded consumers to cover business travelers, too.

The Japanese JV will be led by Prasun Choudhary, whom OYO describes as a founding member of its team. Like OYO business elsewhere in the world, the company is appealing to small and medium hotel franchises and owners. On the consumer side, its prime segment is domestic and international travelers who seek “budget to mid-segment hospitality,” to use part of a statement from OYO founder and CEO Ritesh Agarwal, who is pictured in the image at the top of this post.

Agarwal is a Thiel fellow who started the company in 2011 when aged just 18. His original business, called Oravel, was an Airbnb clone that pivoted to become OYO. Today, that company is valued at $5 billion after raising more than $1.5 billion from investors.

SoftBank has previously struck joint ventures to bring other Vision Fund companies to Japan. Those include WeWork, Chinese ride-hailing firm Didi Chuxing and India’s Paytm, which launched a payment service in the country.

Powered by WPeMatico

OpenClassrooms partners with Microsoft on a masters-level AI diploma

French startup OpenClassrooms is announcing a new partnership for a masters-level online program. Students who enroll in this program will access a fully online program about artificial intelligence. Eventually, future graduates will join companies — Microsoft will likely hire some of them.

If you aren’t familiar with OpenClassrooms, the company started with basic massive open online course content for people willing to learn more about a particular topic. The startup then started offering full-fledged diplomas that require six months, a year or more.

OpenClassrooms is accredited to deliver official degrees in France — and the company plans to do the same in the U.S. and the U.K. It’s not 100 percent just you learning by yourself, as you get to talk to a mentor every week to discuss your progress. And it’s been working quite well for the company.

An online path generally costs less than a traditional degree, and you’re more flexible when it comes to hours, days and semesters. The startup is so confident that it guarantees you’ll find a job within six months of graduation.

More recently, OpenClassrooms has been partnering with companies to offer apprenticeship programs. The idea is that you work for a company several days a week and study when you’re not working. It’s a win-win, as some companies struggle to find the right candidates, and some students want to start working right away and don’t want to pay for their studies. And OpenClassrooms gets paid by companies directly. Uber, Deliveroo, Capgemini, BNP Paribas and dozens of others participate in the apprenticeship program.

Microsoft will help OpenClassrooms design a new degree around data science, machine learning and all things artificial intelligence. The company will provide content and projects. OpenClassrooms will recruit 1,000 candidates in France, the U.K. and the U.S. as part of this program.

Powered by WPeMatico

Swedish fintech Zaver has raised $1.2M seed for its P2P payments platform

Zaver, a Swedish fintech that has built a payments platform to facilitate peer-to-peer trades and more, has picked up just over $1.2 million in seed funding. Backing the burgeoning startup are VC firms Inventure and Inbox Capital, as well as a number of relatively well-established angel investors.

They include Joen Bonnier (partner at Atomico), Tom Dinkelspiel, Pontus Hagnö, Fabian Hielte (owner of Ernström & C:o and a previous investor in Spotify and iZettle), Bo Mattsson (founder of Cint) and Fredrik Österberg (founder of Evolution Gaming).

Aiming to disrupt the market for P2P payment solutions, Zaver is developing a SaaS and accompanying apps to bring together buyers, sellers and merchants with the promise of “secure payments on your terms.” The fintech startup aims to facilitate trades between peers by enabling the use of flexible payment methods such as direct payments, “buy now, pay later” and installments.

To support this, Zaver’s platform claims to embed “intelligent fraud detection” algorithms in tandem with the automatic creation of “verified digital agreements” between transacting parties.

“The Zaver app is the first platform-independent checkout solution for P2P transactions,” says Amir Marandi, who co-founded Zaver alongside Linus Malmén — both former engineering students at KTH Royal Institute of Technology.

“With Zaver’s intelligent fraud prevention, automated and immediate credit decisions and cryptographically signed digital receipts, peers can do safe payments on their own terms with people they really don’t know that well,” he says. “We try to make P2P trades as safe as possible for all parties involved and offer flexible payment options, without compromising on the user experience.”

In addition, Zaver for Business enables merchants to utilise the platform to increase conversion and reduce transaction costs. “Our mission with this product is to reduce the need of a physical card reader,” adds Marandi.

Zaver’s typical user is described as a young student who wants to sell their iPhone on a classified site in a secure way, or a plumber who wants to buy a used VW Golf today and pay later. Meanwhile, the typical customer of Zaver for Business is a company with omni-channel sales, selling products/services online and offline.

“Our main competitors are not the kind of business you might expect,” explains Marandi. “It’s not the banks, but rather upcoming startups wanting to innovate the payment industry. The most direct competitor today I would say is the credit card industry.”

To that end, Zaver makes money from the transaction fees it charges merchants (which it says are up to 70 percent cheaper than traditional payment services), and on interest charged when someone chooses to pay via installments.

Adds Marandi: “Using automated systems for the entire customer journey we are able to offer individualised interest rates at the point of sale. The system automatically chooses an interest rate for you, based on your creditworthiness.”

Powered by WPeMatico

Africa Roundup: Jumia files for IPO, OneFi acquires Amplify, FlexClub expands in Mexico

Less than a decade ago IPOs, acquisitions and global expansion by African startups were more possibility than reality. March saw all three from the continent’s tech scene.

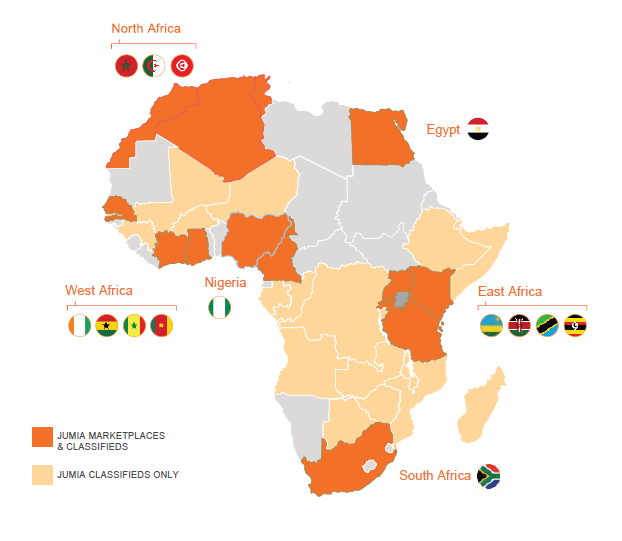

Pan-African e-commerce company Jumia filed for an IPO on the New York Stock Exchange, per SEC documents and confirmation from chief executive Sacha Poignonnec.

In an updated filing, (since the March 12 original) Jumia indicated it will offer 13,500,000 ADR shares, for an offering price of $13 to $16 per share to trade under the ticker symbol “JMIA.” The IPO could raise up to $216 million for Jumia.

Since our first story (and reflected in the latest SEC docs), Mastercard Europe agreed upfront to buy $50 million in Jumia ordinary shares.

With a smooth filing process, Jumia will become the first African startup to list on a major global exchange. The company is incorporated in Germany, but maintains its headquarters in Nigeria, and operates exclusively in Africa, with 4,000 employees on the continent.

The pending IPO creates another milestone for Jumia. The venture became the first African startup unicorn in 2016, achieving a $1 billion valuation after a funding round that included Goldman Sachs, AXA and MTN.

Founded in Lagos in 2012 with Rocket Internet backing, Jumia now operates multiple online verticals in 14 African countries. Goods and services lines include Jumia Food (an online takeout service), Jumia Flights (for travel bookings) and Jumia Deals (for classifieds). Jumia processed more than 13 million packages in 2018, according to company data. The company has started to generate annual revenues over $100 million, but like many burn-rate startups, has done so while racking up big losses.

There’ll be a lot more to cover, analyze and debate pre and post Jumia’s NYSE bell toll — which could happen in coming weeks or months. For example, can Jumia generate a profit; is it really an African startup; will Jumia become an acquisition target for a big outside name or an acquirer of smaller startups in African e-commerce? Stay tuned for continuing TechCrunch coverage.

On the acquisition front, Lagos-based online lending startup OneFi bought Nigerian payment solutions company Amplify for an undisclosed amount.

OneFi is taking over Amplify’s IP, team and client network of more than 1,000 merchants to which Amplify provides payment processing services, OneFi CEO Chijioke Dozie told TechCrunch.

The purchase of Amplify caps off a busy period for OneFi. Over the last seven months the Nigerian venture secured a $5 million lending facility from Lendable, announced a payment partnership with Visa and became one of the first (known) African startups to receive a global credit rating. OneFi is also dropping the name of its signature product, Paylater, and will simply go by OneFi (for now).

Collectively, these moves represent a pivot for OneFi away from operating primarily as a digital lender, toward becoming an online consumer finance platform.

“We’re not a bank but we’re offering more banking services…Customers are now coming to us not just for loans but for cheaper funds transfer, more convenient bill payment, and to know their credit scores,” said Dozie.

OneFi will add payment options for clients on social media apps, including WhatsApp, this quarter — something in which Amplify already holds a specialization and client base. Through its Visa partnership, OneFi will also offer clients virtual Visa wallets on mobile phones and start providing QR code payment options at supermarkets, on public transit and across other POS points in Nigeria.

On the back of the acquisition, OneFi is in the process of raising a round and will look to expand internationally, considering Senegal, Côte d’Ivoire, DRC, Ghana and Egypt and Europe for Diaspora markets.

On African startups expanding globally, FlexClub — a South African venture that matches investors and drivers to cars for ride-hailing services — announced it will expand in Mexico in a partnership with Uber after closing a $1.2 million seed round led by CRE Venture Capital.

The move comes as Africa’s tech-transit space continues to produce unique mobility solutions shaped around local needs.

FlexClub touts itself as a “gig economy investment platform” that is creating new asset classes in emerging markets, according to chief executive and co-founder Tinashe Ruzane.

That asset class, for now, is ride-hail vehicles. FlexClub allows investors to go on the site and purchase a car (ultimately managed and serviced by FlexClub). The startup then connects that car to an Uber driver who uses earnings to pay a weekly rental charge.

Those fees generate monthly fixed-rate interest income for the investor. The driver has the option of buying the car after 12 months, with a descending purchase price over time.

FlexClub’s platform manages the investment, rental income and disbursement of funds across all parties. The startup also handles insurance, maintenance and upkeep of the cars.

Ruzane envisions this as a model to finance multiple asset classes in emerging markets — where lending options are fewer for individuals who may not have credit histories.

“Our goal is to make this completely passive… where investors can invest in different kinds of assets on our platform, login to a dash, and see this is how my five cars in South Africa are doing, my vans in Mexico, my motorbikes in Indonesia — with a diversified portfolio around the world,” he explained.

FlexClub will begin work matching investors to cars and Uber drivers in Mexico in April. The startup sees opportunities to move into other mobility classes, such as Africa’s ride-hail motorcycle taxi and three-wheel tuk-tuk market, CEO Tinashe Ruzane told TechCrunch in this feature.

And finally, francophone Africa will see a boost in funds and support for startups. The Dakar Network Angels group launched last month, making its first investment to cleantech venture Coliba — an Ivorian startup that uses a mobile app to coordinate waste recycling

The deal is part of Dakar Network Angels’ mission of convening experts and capital to bridge the resource gap for startups in French-speaking Africa — or 24 of the continent’s 54 countries.

The organization — which goes by DNA for short — will offer seed fund investments of between $25,000 to $100,000 to early-stage ventures with high growth potential. These rounds will come with the entrepreneurial guidance of DNA’s angel network.

Launched in Senegal, the organization’s founder Marieme Diop — a VC investor at Orange Digital Ventures — named the goal of bridging VC disparities between francophone and non-francophone Africa as the primary driver for DNA. She pointed to funding data by Partech, indicating that 76 percent of investment to African startups goes to three English-speaking countries — Nigeria, Kenya and South Africa.

To gain consideration for DNA investment, startups must gain referral by a member. DNA will take a minority stake (less than 10 percent) in ventures that receive seed funds and provide program mentorship until exits, Diop told TechCrunch.

To become an angel, members must commit to investing a minimum of $10,000 a year (for those coming on as individuals), $20,000 (for corporates) and be on hand to support the portfolio startups, according to DNA’s Corporate Membership Charter.

More Africa Related Stories @TechCrunch

- Seven Africa-focused startups present at Y Combinator’s Demo Day

- Nigeria’s Gloo.ng drops consumer e-commerce, pivots to e-procurement

- Why Warriors’ Andre Iguodala joined African unicorn Jumia’s board

- Nala has built a hassle-free, offline mobile money payment platform for Africa

African Tech Around The Net

- African tech startups raised over $1.2bn in funding in 2018 – Partech report

- Microsoft’s Azure cloud data centers expand to South Africa

- Applications open for Jack Ma’s Africa Netpreneur Prize

Powered by WPeMatico

Talking the future of media with Northzone’s Pär-Jörgen Pärson

We live in the subscription streaming era of media. Across film, TV, music, and audiobooks, subscription streaming platforms now shape the market. Gaming and podcasting could be next. Where are the startup opportunities in this shift, and in the next shift that will occur?

I sat down with Pär-Jörgen “PJ” Pärson, a partner at European venture firm Northzone, to discuss this at SLUSH this past winter. Pärson – a Swede who now runs Northzone’s office in NYC – led the top early-stage investor in Spotify and led the $35 million Series C in $45/month sports streaming service fuboTV (which has roughly 250,000 subscribers).

In the transcript below, we dive into the core investment thesis that has guided him for 20 years, how he went from running a fish distribution to running a VC firm, his best practices for effective board meetings and VC-entrepreneur relationships, and his assessment of the big social platforms, AR/VR, voice interfaces, blockchain, and the frontier of media. It has been edited for length and clarity.

From Fish to VC

Eric Peckham:

Northzone isn’t your first VC firm — Back in 1998, you created Cell Ventures, which was more of a holding company or studio model. What was your playbook then?

Powered by WPeMatico

Femtech’s billion-dollar year

There are a lot of people who never thought they’d see the day venture capitalists would funnel millions into femtech businesses, direct-to-consumer tampon retailers no less. But that’s our new reality and Cora is proof.

San Francisco-based Cora, which develops and sells organic tampons, pads and other personal care products, has just closed a $7.5 million Series A led by Harbinger Ventures. Cora is one of many femtech startups to raise funding this week alone, in what is turning out to be a red-hot year for VC investment in the space.

Femtech, defined as any software, diagnostics, products and services that leverage technology to improve women’s health, has attracted at least $241 million in VC funding so far this year, according to PitchBook. That puts the sector on pace to secure nearly $1 billion in investment by year-end, greatly surpassing last year’s record of $650 million. For more historical context, startups in the space brought in only $62 million in 2012, $225 million in 2014 and $231 million in 2016.

“Investors have realized there is a huge pent-up demand in the market for healthier products for women,” Cora co-founder Molly Hayward tells TechCrunch. “The way in which the VC world is structured, there just has not been a lot of representation. It’s really difficult to understand the value of a product you aren’t ever going to use or to understand a problem you aren’t ever going to have, particularly around period care. This isn’t something we were talking about as a society five years ago.”

The four-year-old startup operates a little differently than your run-of-the-mill D2C company. Like TOMS, the popular footwear brand, Cora donates a month’s supply of products for every month’s supply sold. To date, Cora has donated 5 million pads to girls in India and Kenya and 100,000 products to women in the U.S.

“To me, [Cora] was this incredible, holistic opportunity to change the way that women experience their period,” Hayward said.

Investors must be excited about Cora’s growth. Though she didn’t disclose specific numbers, Hayward says the brand has expanded 400 percent year-over-year, a metric they are expecting to sustain with this new bout of funding. Cora’s products are sold on a subscription basis, with prices ranging from $8 per month for six tampons to $16 per month for 24. For those unfamiliar with the costs of such products, $8 for six tampons comes at quite the premium. A box of 50 Playtex tampons, for example, retails for around $9.

Investors must be excited about Cora’s growth. Though she didn’t disclose specific numbers, Hayward says the brand has expanded 400 percent year-over-year, a metric they are expecting to sustain with this new bout of funding. Cora’s products are sold on a subscription basis, with prices ranging from $8 per month for six tampons to $16 per month for 24. For those unfamiliar with the costs of such products, $8 for six tampons comes at quite the premium. A box of 50 Playtex tampons, for example, retails for around $9.

In Cora’s case, customers are shelling out extra cash for millennial-inspired branding, a soothing unboxing experience and a general ease of access to its products, as well as Cora’s organic, hypoallergenic and compostable materials, which aren’t characteristic of many similar products on the market.

Cora plans to use the capital to put more of its items in Target stores, where it already sells its tampons and pads, and expand its portfolio of products. As part of the funding, Cora has added two more women to its board of directors: Lisa Bougie, the former GM of Stitch Fix, and Andrea Freedman, the former chief financial officer of Method. Its board is now 80 percent female.

Powered by WPeMatico

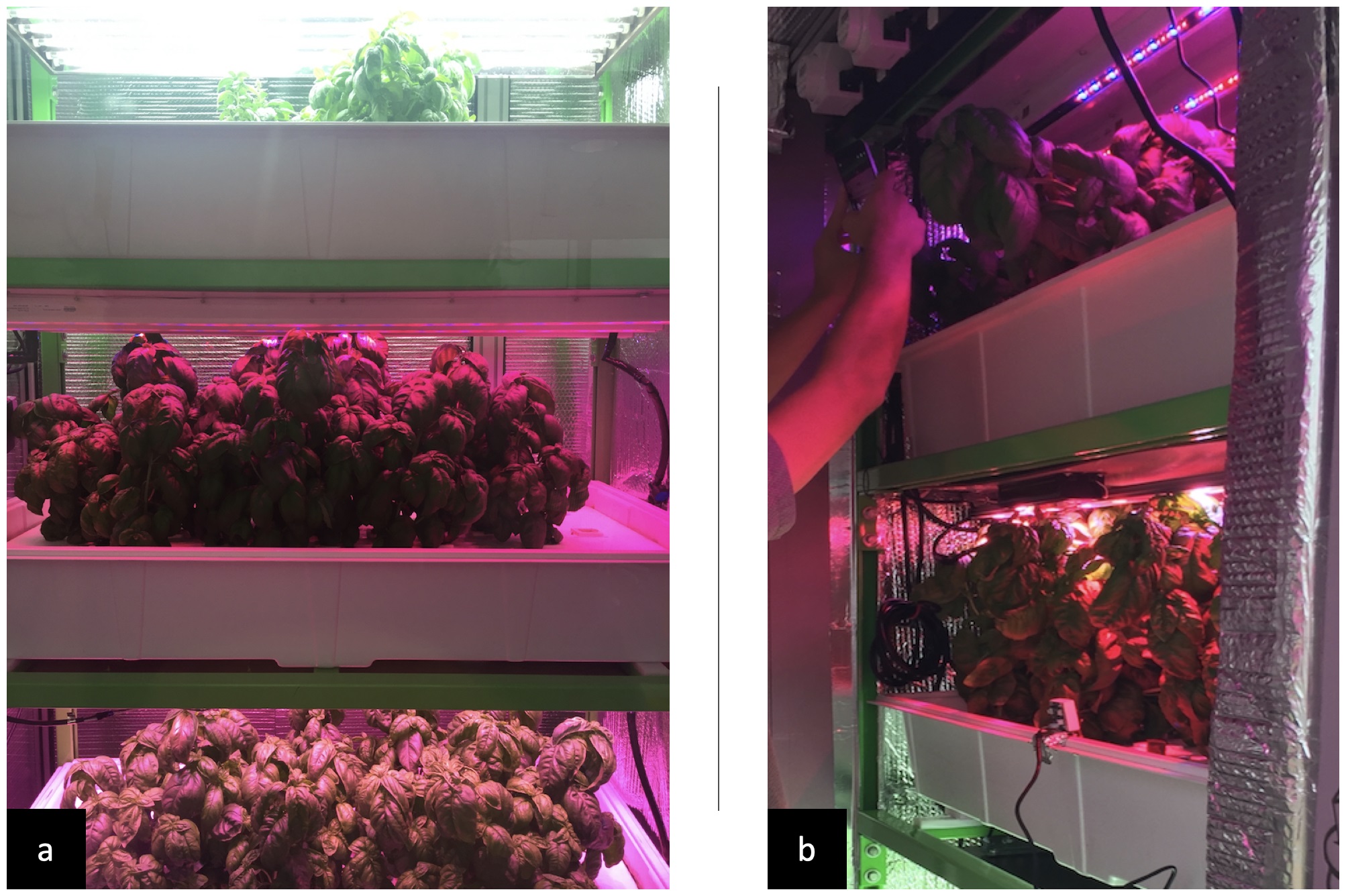

MIT’s ‘cyber-agriculture’ optimizes basil flavors

The days when you could simply grow a basil plant from a seed by placing it on your windowsill and watering it regularly are gone — there’s no point now that machine learning-optimized hydroponic “cyber-agriculture” has produced a superior plant with more robust flavors. The future of pesto is here.

This research didn’t come out of a desire to improve sauces, however. It’s a study from MIT’s Media Lab and the University of Texas at Austin aimed at understanding how to both improve and automate farming.

In the study, published today in PLOS ONE, the question being asked was whether a growing environment could find and execute a growing strategy that resulted in a given goal — in this case, basil with stronger flavors.

Such a task is one with numerous variables to modify — soil type, plant characteristics, watering frequency and volume, lighting and so on — and a measurable outcome: concentration of flavor-producing molecules. That means it’s a natural fit for a machine learning model, which from that variety of inputs can make a prediction as to which will produce the best output.

“We’re really interested in building networked tools that can take a plant’s experience, its phenotype, the set of stresses it encounters, and its genetics, and digitize that to allow us to understand the plant-environment interaction,” explained MIT’s Caleb Harper in a news release. The better you understand those interactions, the better you can design the plant’s lifecycle, perhaps increasing yield, improving flavor or reducing waste.

In this case the team limited the machine learning model to analyzing and switching up the type and duration of light experienced by the plants, with the goal of increasing flavor concentration.

A first round of nine plants had light regimens designed by hand based on prior knowledge of what basil generally likes. The plants were harvested and analyzed. Then a simple model was used to make similar but slightly tweaked regimens that took the results of the first round into account. Then a third, more sophisticated model was created from the data and given significantly more leeway in its ability to recommend changes to the environment.

A first round of nine plants had light regimens designed by hand based on prior knowledge of what basil generally likes. The plants were harvested and analyzed. Then a simple model was used to make similar but slightly tweaked regimens that took the results of the first round into account. Then a third, more sophisticated model was created from the data and given significantly more leeway in its ability to recommend changes to the environment.

To the researchers’ surprise, the model recommended a highly extreme measure: Keep the plant’s UV lights on 24/7.

Naturally this isn’t how basil grows in the wild, since, as you may know, there are few places where the sun shines all day long and all night strong. And the arctic and antarctic, while fascinating ecosystems, aren’t known for their flavorful herbs and spices.

Nevertheless, the “recipe” of keeping the lights on was followed (it was an experiment, after all), and incredibly, this produced a massive increase in flavor molecules, doubling the amount found in control plants.

“You couldn’t have discovered this any other way,” said co-author John de la Parra. “Unless you’re in Antarctica, there isn’t a 24-hour photoperiod to test in the real world. You had to have artificial circumstances in order to discover that.”

But while a more flavorful basil is a welcome result, it’s not really the point. The team is more happy that the method yielded good data, validating the platform and software they used.

“You can see this paper as the opening shot for many different things that can be applied, and it’s an exhibition of the power of the tools that we’ve built so far,” said de la Parra. “With systems like ours, we can vastly increase the amount of knowledge that can be gained much more quickly.”

If we’re going to feed the world, it’s not going to be done with amber waves of grain, i.e. with traditional farming methods. Vertical, hydroponic, computer-optimized — we’ll need all these advances and more to bring food production into the 21st century.

Powered by WPeMatico

The uncertain future of shared electric scooters

Cities all over the world have seen an influx of two-wheeled, electric kick scooters on the road over the last couple of years. Scooters from the likes of Bird, Lime, Spin, Uber’s JUMP, Lyft and others are all trying to own the first and the last mile. The first mile is often understood as the distance between a transportation hub and someone’s starting point while the last mile is the distance between a transportation hub and someone’s final destination. These companies want both, and some (Uber, Lyft) also want everything in between.

The rise of electric scooters is often compared to the rise of ride-hailing, but there are some key differences at play. For one, cities are in charge of regulation — not the states. And since these are much smaller vehicles, cities can easily pick them up and throw them in the back of a truck if they become a nuisance. Meanwhile, as part of city regulation, data-sharing is not optional — it’s a requirement in order for companies to receive permission to deploy scooters on city streets.

The startup ecosystem had become accustomed to the ethos of begging for forgiveness, rather than asking for permission. But that’s not the case with electric scooters. These companies have found their entire businesses to be contingent on the continued approval from individual cities all over the world. That inherently creates a number of potential conflicts.

It’s also unclear whether the increase in people riding scooters is indicative of people adopting shared services or simply adopting a new mode of transportation. Some industry insiders wonder if it’s just a matter of time between consumers ditch shared scooters in exchange for their own.

Between city regulators capping the growth of operators, the vast number of companies going after the first and last miles and the threat of the shift from shared to ownership, it’s all going to come down to the survival of the fittest.

At the mercy of cities

Unlike the ride-sharing market, electric scooter operators are entirely dependent upon cities. These cities, rightfully so, have a number of concerns ranging from safety to sidewalk congestion to equal access to transportation.

Powered by WPeMatico

HyperSciences raises an untraditional $9.6M for its hypersonic drilling vision

We profiled HyperSciences in February, when the team had just successfully completed a launch milestone for a small business grant with NASA. The last time we checked in, the hypersonic drilling company had raised about $5 million as part of an untraditional Reg A offering. By the end of March, HyperSciences rounded out its first major round with $9.6 million from 3,552 individual investors on SeedInvest in the equity crowdfunding platform’s second largest raise to date.

The heart of HyperSciences’ work is its hypersonic propulsion system that can fire a projectile at five times the speed of sound. At its most simplistic, HyperSciences’ hypersonic engine can fire upward to power suborbital space launches (HyperDrone) and point downward to penetrate deep pockets of geothermal energy, for example (HyperDrill).

Rather than going the normal venture capital route, HyperSciences decided to raise from regular people who believed in its vision. The way the company sees it, traditional VC would have likely forced HyperSciences to narrow its mission.

“Reg A lets everyone who cares about our planned hypersonic future vote with their checkbook,” HyperSciences founder and CEO Mark Russell told TechCrunch. “I think that’s important.” Russell comes from a family-run mining business and is no stranger to the challenges of a public company.

“I’ve learned a lot from running ops in the back offices,” Russell said. “Based on our public company experiences, we do like that the SEC Reg A process has a clear path to taking your company to the public markets as the next step in the process.”

With infusions of $125,000 from NASA’s Small Business Innovation Research grant and $1 million from Shell’s Global’s GameChanger program, HyperSciences is happy to bounce between research grants with a boost from the Reg A’s special form of “mini-IPO” in order to maintain its autonomy for the time being.

Russell explained that the Reg A’s intensive SEC process requires a fair level of maturity from a company — and enough capital to jump through all the hoops. “You’re not typically a seller of t-shirts in Reg A crowd financing,” Russell said.

HyperSciences’ next milestone will come in May when the company will demo its drilling tech in a field test for Shell. The company plans to leverage its new funding for additional future field testing, pushing its existing business plan forward and moving toward sustainability.

“Our investors are more like smart ‘crowd VCs.’ They’re generally are pretty savvy and see that we went through a stringent process to get here,” Russell said. “We’ve provided them with enough information to make a great decision.”

Powered by WPeMatico

WeWork acquires Managed by Q

Managed by Q, the office management platform based out of New York, has today been acquired by The We Company, formerly known as WeWork.

Financial terms were not disclosed. The WSJ reports that it was a cash and stock deal. Managed by Q, which has 500 employees, will remain as a wholly owned separate entity and CEO Dan Teran will remain following the acquisition to join WeWork leadership.

Upon its latest financing in January, Managed by Q was valued at $249 million, according to PitchBook.

Here’s what Teran had to say in a prepared statement:

We are excited for this incredible opportunity to deepen our commitment to realizing our ambitious vision of building an operating system for the built world. WeWork is uniquely positioned to invest in workplace technology and services, and I look forward to partnering with their team to build more robust products for our clients and create a global platform to help companies push the bounds on our collective potential.

Managed by Q was founded in 2014 with a plan to change the way that offices run. The platform allowed office managers and other decision-makers to handle supply stocking, cleaning, IT support and other non-work related tasks in the office by simply using the Managed by Q dashboard. Managed by Q serves the demand through a combination of in-house operators and third-party vendors and service providers.

Notably, Managed by Q took a different tack than most other logistics companies, employing their operators as W2 workers instead of 1099 contractors. Moreover, Managed by Q offered a stock option plan to operators that gives 5 percent of the company back to those employees.

The company has raised a total of $128.25 million since launch from investors such as GV, RRE and Kapor Capital. Managed by Q currently serves the markets of New York, San Francisco, Los Angeles, Chicago, Boston and Silicon Valley, with plans to aggressively expand following the acquisition, according to the WSJ.

Not only has Managed by Q swiftly matured into a big player in the NY tech scene and Future of Work space, but it has also fostered interesting competition and consolidation within the space. Managed by Q has itself made several acquisitions, including the purchase of NVS (an office space planning and project management service) and Hivy (an internal comms tool to let employees tell office managers what they need).

Powered by WPeMatico