To stop copycats, Snapchat shares itself

Evan Spiegel has finally found a way to fight back against Mark Zuckerberg’s army of clones. For 2.5 years, Snapchat foolishly tried to take the high road versus Facebook, with Spiegel claiming “Our values are hard to copy”. That inaction allowed Zuckerberg to accrue over 1 billion daily Stories users across Instagram, WhatsApp, and Facebook compared to Snapchat’s 186 million total daily users. Meanwhile, the whole tech industry scrambled to build knock-offs of Snap’s vision of an ephemeral, visual future.

But Snapchat’s new strategy is a rallying call for the rest of the social web that’s scared of being squashed beneath Facebook’s boot. It rearranges the adage of “if you can’t beat them, join them” into “to beat them, join us”. As a unified front, Snap’s partners get the infrastructure they need to focus on what differentiates them, while Snapchat gains the reach and entrenchment necessary to weather the war.

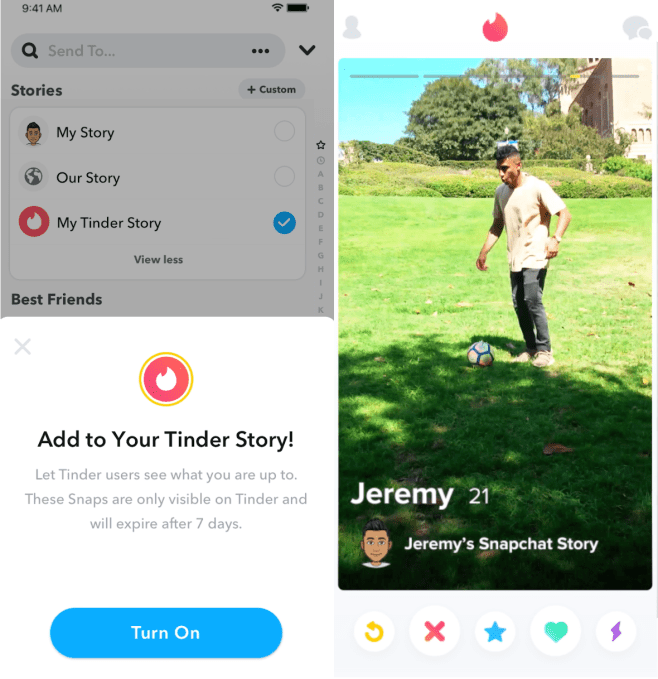

Tinder lets you use Snapchat Stories as profile photos

Snapchat’s plan is to let other apps embed the best parts of it rather than building their own half-rate copies.

Why reinvent the wheel of Stories, Bitmoji, and ads when you can reuse the original? A high-ranking Snap executive told me on background that this is indeed the strategy. If it’s going to invent these products, and others want something similar, it’s smarter to enable and partly control the Snapchatification than to try to ignore it. Otherwise, Facebook might be the one to platform-tize what Snap inspired everyone to want.

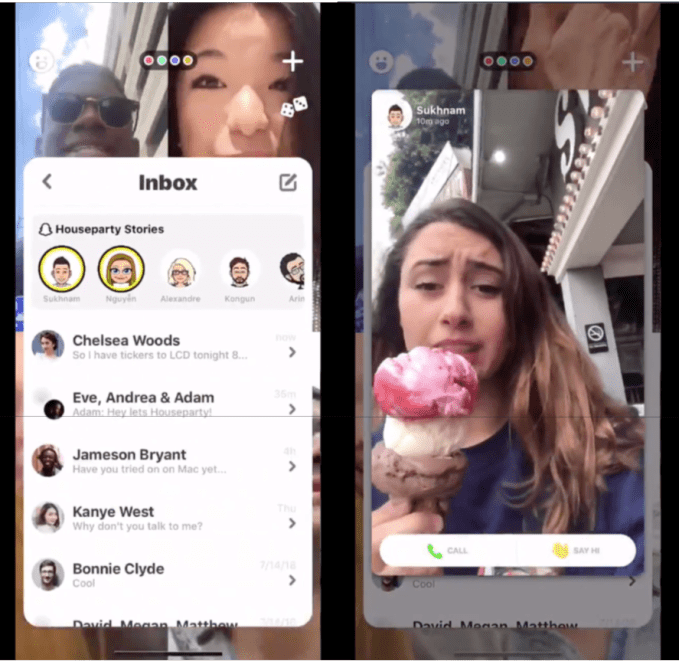

The “Camera company” corrected course and took back control of its destiny this week at its first ever Snap Partner Summit in its hometown of Los Angeles. Now it’s a camera platform thanks to Snap Kit. Its new Story Kit will implant Snapchat Stories into other apps later this year. They can display a more traditional carousel of your friends’ Stories, or lace them into their app in a custom format. Houseparty’s Stories carousel shares what your buddies are up to outside of the group video chat app. Tinder will let you show off your Snapchat Story alongside your photos to seduce potential matches. But the camera stays inside Snapchat, with new options to share out to these App Stories.

Snap CEO Evan Spiegel presents at the Snap Partner Summit

This is how Snapchat colonizes the native app ecosystem similarly to how Facebook invaded the web with the Like button. Snap’s strong privacy record makes these partners willing to host it where now they might fear that Facebook and its history with Cambridge Analytica could tarnish their brand.

Instead of watching these other apps spin up mini competitors that further fragment the Stories world, Snap saves developers the slow and costly hassle while instantly giving them best-in-class tools to boost their own engagement. Each outpost makes your Snapchat account a little more indispensable, grants its camera new utility, and reminds you to visit again. It’s another reason to stick with Snap rather than straying to other versions of Stories.

If Spiegel knows what’s up, he’ll douse the Story Kit partnerships team with resources so they can sign up as many apps as possible before Facebook can copy this idea too. For now, Snap isn’t injecting ads into App Stories, but it could easily do so and split the cash with its host. This would attract partners, generate revenue, and give Snap’s advertisers more reach.

Houseparty embeds Snapchat Stories

Either way, Snap will score those benefits with its new Ad Kit. Later this year the Snapchat Audience Network will launch allowing partners to host Snap’s full-screen vertical video ads and earn an as-yet-undisclosed revenue share. They won’t have to build up an ad sales force or build an auction and delivery system, but just drop in an SDK to start displaying ads to both Snapchat users and non-users. The company’s message again is that it’s becoming easier to cooperate with Snapchat than copy it.

Snap’s new ad network

Giving its advertisers more reach and reusability for Snap’s somewhat proprietary ad unit format helps Snap address its core challenge: scale. Snap’s 186 million total users can look small in comparison to Instagram, Facebook, or YouTube, especially since that count sank in Q2 and Q3 before stabilzing in Q4 of last year. That makes it tougher for advertisers to justify the chore of spending on Snapchat. Ad Kit and potentially Story Kit give Snap more reach even without user growth.

Added size could tip the cards in Snap’s favor given it’s already popular with an extremely important demographic. Snapchat now reaches 75 percent of 13 to 34-year olds in the US, and 90 percent of 13 to 24-year olds there. It claims to now reach more of that younger age group than Facebook in the most lucrative countries: the US, Canada, UK, France, and Australia.

Facebook has massively neglected this segment. Case in point: Facebook Messenger’s Stickers feature that’s popular with kids has hardly improved since its launch in 2013, which I hear was a fight to get approved internally. Meanwhile, Snapchat keeps growing its lead on virtual identity with Bitmoji. Now Snap will let you put your personalized Bitmoji avatar on your FitBit smart watch face, use them to joke about Venmo purchases, and even represent yourself with one in Snap’s new multiplayer games platform.

Again, Snap wants partners to integrate the real thing rather than try to build some half-assed facsimile of Bitmoji. Surprisingly, Facebook’s Avatars have been mired in development for over a year and Apple’s Memoji can’t escape iMessage and FaceTime yet. That’s why Snapchat would be wise to double-down on trying to make Bitmoji the ubiquitous way to represent yourself without a photograph. Facebook’s lack of design cool and Bitmoji’s massive headstart with this differentiated product is a powerful way for Snap to wedge itself into partnerships.

Snap needs all the help it can get if the underdog is going to carve out a substantial and sustainable piece of social networking. Teaming up was the theme of the rest of the Snap Partner Summit. It’s built ways for Netflix, GoFundMe, VSCO, and Anchor to share stickers and for publishers like the Washington Post to share articles back to Snapchat. It’s got Zynga and ZeptoLab building real-time multiplayer Snap Games that live inside chat and are a clever way of slipping ads into messaging.

Snapchat’s new Scan augmented reality utility platform has signed up Giphy and Photomath as well as former partners Shazam and Amazon to let you squeeze extra interactivity out of your surroundings. And since the physical world is too vast for any one developer to fill with AR experiences, Snap beefed up its Lens Studio platform with new templates and creator profiles so developers add to its warchest of 400,000 special effects. Facebook may be able to clone Snap’s features, but not its developer army.

“If we can show the right Lens in the right moment, we can inspire a whole new world of creativity” says Snap co-founder Bobby Murphy . From partnerships to utilities to toys, all the new announcements drive attention back to Snapchat’s camera. That makes it ripe to become the augmented reality brower of the world.

It all feels like a coming of age moment for Snapchat, punctuated by the glitzy press event where media bigwigs gnoshed on Chinese steak buns and played with AR art installations in West Hollywood.

Spiegel has discovered a method of capitalizing on his penchant for inspiring mobile product design. With this strategy in place and Snap’s reengineered Android app and new languages rolling out now, I believe Snapchat will grow again, at least in terms of deeper engagement if not also total user count. Perhaps it will need a little bit more funding to get it over the hurdle, but I expect it will reach profitability before the end of 2020.

During a pre-event press briefing with a dozen Snap executives including Spiegel and Murphy (that was on ‘background’ so we can’t quote or specify who said what), one Snap higher-up joked that Facebook has been copying it for seven years so it’s started to feel normal. Zuckerberg recently declared he wanted to reorient Facebook around privacy, ephemerality, and messaging — the core tenets of Snapchat. But a Snap leader used some colorful language to describe how they don’t care what Facebook says its philosophy is until it fixes the 2 billion-user product that keeps doing harm.

Subtly throwing shade from the stage, Spiegel concluded that “Our camera lets the natural light from our world penetrate the darkness of the Internet . . . as we use the Internet more and more in our daily lives, we need a way to make it a bit more human.” That apparently means making other apps a bit more Snapchat.

Powered by WPeMatico

Dissecting what Lyft’s IPO means for Uber and the future of mobility

Extra Crunch offers members the opportunity to tune into conference calls led and moderated by the TechCrunch writers you read every day. This week, TechCrunch’s Kirsten Korosec and Kate Clark led a deep-dive discussion into Lyft’s IPO and the outlook for the business going forward.

After skyrocketing nearly 10% on its first day hitting the public markets, Lyft stock has faded back down towards its IPO price as some investors grow more concerned over the company’s path to profitability (or lack thereof) and the long-term fundamentals of the business. But Lyft’s public listing is bigger than just the latest in increasingly common unicorn IPOs. As the first public “transportation-as-a-service” company, Lyft offers the first inside glimpse into the business model and its economics, and its development may ultimately act as the canary in the coal mine for the future of transportation.

“Lyft, hasn’t just survived, they’ve grown. 18.6 million people took at least one ride in the last quarter of 2018. That’s up from 16.6 million in late-2016. That illustrates the growth that the company has had. They’ve also said that they have 39% share of the ride-sharing market in the US. That’s up from 22% in 2016.

To me, the big question is let’s say they had Uber’s share, which is 66%, would they be able to make a profit? Is that the determination? And I’m not convinced that it is, which is why all these other aspects of the transportation-as-a-service business model [micromobility, AVs, etc.] are going to be really important.”

Image via Getty Images / Mario Tama

Kirsten and Kate dive deeper into what the market response to Lyft means for Uber and the timeline for its impending IPO. The two also elaborate on their skepticism of ride-hailing economics and debate which innovative transportation model will ultimately drive the path to profitability for Lyft, Uber and others.

For access to the full transcription and the call audio, and for the opportunity to participate in future conference calls, become a member of Extra Crunch. Learn more and try it for free.

Danny Crichton: Good afternoon and good morning everyone this is Danny Crichton, executive editor of Extra Crunch. Thanks so much for joining us today with TechCrunch reporters Kate and Kirsten.

I’ll start with a quick introduction for our two writers today. We have Kate Clark, our venture capital reporter. Kate has been with us for a while now covering everything in the startup and venture world. She’s also one of the hosts of TechCrunch’s podcast Equity and also writes our Startups Weekly newsletter.

Our other writer today is Kirsten, our intrepid automotive writer covering all things Elon Musk, Tesla, and everything else in the autonomous vehicle space. Kirsten has also been with us for quite some time and also writes a newsletter that she just introduced in the last couple of weeks, around transportation. So with that, I’m going to hand off the conversation to the two of them now.

Kirsten Korosec: Thanks so much Danny. This is Kirsten Korosec here. The newsletter is in a bit of a soft launch but it is being published Fridays and we hope to have an email subscription coming sometime in the future, so just keep an eye out for that.

I should also mention I too have a podcast centered around autonomous vehicles and future transportation called The Autonocast that comes out weekly. Thanks so much for joining the call and just a reminder, we want participation. So at about the halfway point, we’ll turn and open up the line and answer questions. Let’s get started.

Before we dig into all the hot takes out there, I think it’s worth providing a primer of sorts — a general timeline of events. We all probably know Lyft of course and most of us think of 2012 as the launch date when it came to San Francisco, but really Lyft was build out of the service of Zimride. Which is the ride-sharing company that John Zimmer and Logan Green founded in 2007.

A lot of attention has been placed on Lyft in 2018 with what happened in the past year, in the run-up to the IPO. But I think it is worth noting the intense activity and growth that happened between 2014 and 2016. These are critically important years for Lyft, just a frenzy of activity in a period where the company gained ground, investors, and partners.

To showcase the amount of activity that was happening; Lyft had two separate funding rounds, one for $530 million another for $150 million, just two months apart in 2015. You might also recall in early-2016 its partnership with GM and the automakers’ $500 million dollar investment as part of the Series F $1 billion dollar fundraising effort.

That was really interesting because GM’s president at the time Dan Ammann took a seat on the board, which he has since vacated. As Lyft and GM started realizing that they were competitors. Now, Dan is the CEO of GM Cruise which is the self-driving unit of GM.

2017 and 2018 were also big years, as Lyft launched their first international market in Toronto. They made big moves on the autonomous vehicle front, which we’ll talk about today, and in micromobility. Their scooter business launched in Denver in 2018. They bought Motivate, which is the oldest and largest electric bike share company in North America. Then, we finally get to the end of 2018, and this is when Lyft confidentially files a statement with the FDC and we’re off with the races to the IPO.

The last two months or three months is when Lyft unveiled its prospectus, met with investors, priced its IPO and made its public debut. So Kate what are the nuts and bolts of the IPO and what’s happening right now?

Kate Clark: Hi everybody this is Kate. So I’m just going to mention really quickly the timeline these last couple of months in the run-up to Lyft’s highly historical IPO. So going back to December, that’s when Lyft initially filed confidentially to go public. We later find out that they are going public on the NASDAQ when they eventually unveiled their S1 in early March.

This is after Lyft had raised $5 billion in debt and equity funding at a $15 billion dollar valuation, so there are a lot of people paying attention to what was the first ever rideshare IPO. So then in early-March, we’re able to get a closer look at Lyft’s S1, which tells us that the company has $911 million in losses in 2018 and revenues of $2.2 billion. So after calculating and pulling together some data, a lot of people were quick to find out that that means Lyft has some of the largest losses ever for any IPO. But also has some of the largest revenues ever for any pre-IPO company, just following Google and Facebook in that category.

So this is a really interesting IPO for a lot of people given these sky-high losses but also these huge, huge revenues. The next we see Lyft price their IPO between $62 and $68 dollars a share. Some people were quick to say that that was maybe a little underpriced, given that this was a highly anticipated IPO with a ton of demand. So on the second day of Lyft’s roadshow, the process, they say that their IPO is oversubscribed. So demand is apparently huge, their oversubscribed, so they decide we’re going to increase the price of our shares.

Image via GettyImages / maybefalse

So Lyft then says they gonna charge a max of $72 per share and then on the day of their IPO they charge $72 per share, the next day opening at $87 per share. So we see a huge IPO pop that I don’t think was particularly surprising given that they already spoke of this demand, and we had already known that there was a lot of demand on Wall Street. Not just for Lyft but just for unicorn IPO’s of this stature, given that there are so few of these. So Lyft began trading hitting $87 per share though, if you’ve been following the news that’s not were Lyft is today.

Kirsten: Yeah so I was just about to ask — Kate give me the latest numbers, you know a lot of focus is on that opening day but things haven’t exactly sustained. So what’s happened in the past few days?

Kate: Yeah it’s really tough to manage expectations after an IPO. I mean, I think there has been a lot of criticism towards Lyft now and I think it’s trading below its initial share price. So as I mentioned Lyft opened at $87 per share, it priced at $72, but almost immediately they began trading below that $72 price per share. So they closed Tuesday trading at $68.96 per share. Still boasting a market cap larger than $19 billion. So they’re still significantly valued at more than they were as a private company at $15 billion but it doesn’t look good to be trading below a price per share so quickly.

However, it actually did hit its IPO price for just a minute today, so maybe let’s give it a few more hours and see where it closes. It’s possible that it will sort of jump towards that $72, but it’s still trading quite significantly below that $87.

Kirsten: With IPOs like this, and especially such a high profile one, there’s going to be a ton of attention on share price and on volatility. And so I’m wondering, in your view, what did this first week, or first few days of volatility say to you? What does it say about Lyft’s future and, well certainly, its present?

Kate: Yeah. I mean, it’s hard to say. I think a lot of people were questioning if Wall Street was going to be interested in a company like Lyft that’s extremely unprofitable at this time and has years left before it will reach profitability, if indeed it ever reaches profitability.

So at this point you got to wonder, do some of these investors that did buy Lyft right off the bat, were they really long on Lyft? Because it does look like a lot of those investors have already sold their stock and perhaps weren’t as invested in Lyft’s long-term profitability plan, which involves a lot of very iffy things, like the future of autonomous vehicles, which we’ll talk about later in this call. And there’s a lot of uncertainty there.

But with that said, it’s not uncommon for a stock to experience volatility right off the bat, and you can’t assume the future of that stock price just because of some early volatility.

And we gathered some examples of IPOs where there was some early volatility that did not determine the long term future. So Carvana, for example, which is an online used car dealer in the automotive space, and it did experience volatility at first, with the stock sliding in the first few months but ultimately trended upward.

Kate: So Carvana opened at $13.50 a share, falling below its IPO price, so it didn’t even have the IPO pop. And then in 2018, it hit an all-time high of $65 per share. Today, it’s trading around $58 per share, so that’s ultimately a positive story to be told there.

And then another example on the other side of things is Snap, which actually took four months to dip beneath its 2017 IPO price, and we all know Snap has definitely not been a success story and it’s trading well below its offer price. But then finally, Facebook, for example, dropped below its IPO price on its second day of trading and then actually had a rough first year on the stock market before the stock ultimately took off and became a very obvious success.

Kirsten: So, Kate, I’m wondering why you think that there was that initial run up on that first day. Was it excitement? Was there something material that was pushing the price up? What was the cause?

Kate: I think there was a lot of excitement and demand around this IPO because it was very much one-of-a-kind, and there were a lot of investors that it seemed were really long on the possibility of Lyft becoming this hugely profitable company. And I think a lot of that was because in the S1, although you did see these really, really big losses — quite major, just ridiculously huge losses — you did see that they were shrinking over time and that there was definitely a path in which Lyft could take where it would reach profitability, say, in the next five years.

And I think Wall Street was really paying attention to that, and they were not paying attention to some of the other metrics. Now, they’ve taken off their rose-colored glasses and they’re looking at Lyft as a public company, and it’s just a little bit different now that it’s actually completed its debut.

Kirsten: Well, so, I mean, I like to view IPOs often times, and especially in Lyft’s case, as a measure of an investors’ faith in the company’s growth prospects, because this is a company that while it does have quite a bit of revenue, it has significant losses and it’s really planning not just for the present day but for the future. It’s been called a disruptive business for a reason, and it is certainly very forward-looking. So I’m wondering if you think it was a good strategy for Lyft. They wanted to open it up to “the everyman” when they actually went to market. They did a different approach, and do you think this might have had an effect? I mean, it’s very on-brand for them to do this, but I’m wondering if you thought that means that some of the investors aren’t as disciplined.

Kate: Do you mean with the fact they were providing bonuses to their employees and drivers to actually participate in the IPO as well?

Kirsten: Absolutely. That’s actually a really good point that maybe you can elaborate on. Lyft did a little bit of a more open approach for its IPO. Typically IPOs can be closed off to only large, institutional investors. So did this set them up perhaps to have more volatility?

Kate: Yeah, Lyft provided some of their drivers up to, I think, $10,000 to, in theory, actually buy stock in the IPO. Do I think that had a high impact? I don’t know. I think there’s not enough comparison, not enough data to really make a decision or to make a hot take on whether that really was part of the volatility. I think just given the uncertain nature of Lyft’s future and their big losses, I think their volatility was pretty inevitable, and I think people paying attention to this are probably not particularly surprised by how the stock has fared in these first couple days.

And I do want to add there’s this six-month lock-up period for the venture capital funds that own Lyft and as well as their employees, so I think we’re not sure what’s going to happen when that lock-up period ends and those holders can just sell their stock right then or how that will impact the stock price, as well.

Image via TechCrunch/MRD

Kirsten: So something to keep an eye on. It reminds me a lot of a company I write a lot about, which is Tesla, and I’ve been covering them for years. And it’s one of the most volatile stocks, and their investors, they certainly have large, institutional investors, but the number of fanboys that they have with smaller investors, either prop up the share price sometimes or add to that volatility, and I’m kind of really curious to see if that happens with Lyft. If you go to a shareholder meeting at Tesla, for example, it’s filled with people who are passionate about the brand and its CEO, Elon Musk.

And Lyft and possibly Uber, if they end up finally going through with their IPO, you can see that potentially happening because people feel very strongly about the brand and also the service it provides. So I’m curious to see how this all sort of shakes out. And I tend to take the view that I invest personally in mutual funds and things like that. I don’t invest in any of these companies, but the long, patient view tends to be the better one, and trying to catch a falling knife, as investors have told me, is never really a good idea.

So I’m curious to see if investors sort of grow up and learn with Lyft, if they’ll become disciplined and just sort of wait it out and see them play out the growth prospects for the company in the long term. So, we’ve been talking about Lyft and I can’t not talk about Uber as a result. I’m wondering what you think this might mean for Uber. The big story initially was let’s beat Uber to IPO and I’m wondering what this means then. Is this indicative of what Uber is going to experience?

Kate: I think that question is really at the top of everyone’s mind right now, including my own. I will say that I still do think it was highly beneficial for Lyft to get out first. Because imagine if and when Uber does too experience volatility, which it probably will, if it were to have gone first, I think that would have frightened Lyft a lot more than Lyft’s volatility may or may not be frightening Uber. So, with that said, I think I’m of two minds right now with my thoughts on how this impacts Uber’s IPO. I think that if Lyft stock continues to be volatile and perhaps even falls lower than it already has. I do think that there is a chance Uber may ultimately decide to push its IPO back.

I think that for a few reasons, namely being that Uber is not in a huge rush to go public. They do have the ability to wait. They have filed to go public. So it’s likely to happen quite soon, but it may not happen in April as they are reportedly planning to do.

On the other hand, Lyft went public at like a $24 or $25 billion dollar market cap. Whereas Uber is going to debut at maybe a $120 billion dollar initial market cap. So these IPOs, although they are both ride hail IPOs and they are very similar companies in a lot of ways, they’re also very different and Uber is operating on an entirely different scale though it still is unprofitable. And has some of the same issues that, investors are probably noting about Lyft.

I think it’s either going to be that it’s maybe that they do decide to push it back or maybe that Uber is like, well we’re five times larger, six times larger. We have much larger statistics to show to investors. There’s just a chance it could go either way. I wish I had a better, more concrete answer, but I just don’t think we know yet.

Kirsten: Well I’m okay with not taking hot takes just a few days into this IPO. I think this is a good time to open it up to questions. While we wait for a question, I will do one quick follow up with you Kate. What do you think this means for Uber? Will it delay its IPO?

Kate: Right now, no, I don’t think they’re going to. But it’s like I said, it’s tough to say given that it’s only been a few days of Lyfts IPO. But no, I think you’ve got to imagine that they are ready to discuss the possibilities of Lyfts IPO and already planned ahead if there was volatility. They maybe already assumed that would happen, given that that’s not uncommon. So right now I’m going to say no, I don’t think they’re going to delay, but it’s certainly still a possibility.

Kirsten: Okay, great. I think another really interesting piece for Uber was their acquisition of Careem. This is a deal that was made right before their IPO, so it was shifting attention away from Lyft, just for a moment.

Why did Uber do this? Is this not a signal that they’re delaying their IPO? Is this just prepping for it? What are you hearing on it? I’m wondering if this might have just been a strategy to show the world investors, specifically potential shareholders, what the road ahead is going to look like. Or is it some other reason — Is it to justify their really big losses?

Image via Careem / Facebook

Kate: I think it’s the latter two things you said. Just to give some background Uber is paying about $3.1 billion to acquire Careem, which is a Middle Eastern ride-hailing company. So basically just the Uber of the Middle East. Uber does have a history of acquiring, smaller competitors like this in different markets where it’s not active, just as a way for Uber to quickly grow essentially.

So I do think it’s a big deal to make just before going public. So I guess we don’t know if they necessarily will go public in April, but I think it was a move to present to public market investors as a prep for an IPO, to show “we just acquired this company, here’s more evidence of future growth”. Like you mentioned, it’s definitely a justification of those huge losses that we know Uber has.

Kirsten: Thanks for that. Questions?

Caller Question: Hi there, so when we talk about looking ahead and moving towards profitability — what role, if any, do you think the acquisition of a scooter or other mobility companies will have for companies like Lyft and Uber?

Kirsten: That’s a great question. I think it’s going to be a huge piece of both of their businesses. A lot of people describe this as the first ride-hailing IPO. We need to stop calling this a ride-hailing company. These are transportation-as-a-service companies and they’re making money. But generating revenue as opposed to making profit is a totally different thing. When you start talking about ridesharing, it’s a tough business. With those it’s an asset-light business, right? They don’t own the cars and then they technically don’t employ these drivers.

But at the same time, as of 2016 only something like 1% of people in the US were using rideshare. So you see this opportunity, but they’re not pushing forward. There is a ton of car ownership still that’s happening. Yes, sharing has absolutely increased, but 17 million new cars were sold in the US last year. So scooters, bike share and other businesses are going to be key to their paths to profitability because ride-sharing alone is just difficult to make a profit. It’s not difficult to generate revenue. It’s difficult to make a profit on.

And I’m wondering, talking about that road to profitability, I do think it’s worth noting how much they have grown. Lyft, hasn’t just survived, they’ve grown. 18.6 million people took at least one ride in the last quarter of 2018. That’s up from 16.6 million in late 2016, that illustrates the growth that the company has had.

They’ve also said that they have 39% share of the ride-sharing market in the US. That’s up from 22% in 2016. To me, the big question is let’s say they had Uber’s share, which is 66%, would they be able to make a profit? Is that the determination? And I’m not convinced that it is, which is why all these other aspects of the transportation-as-a-service business model are going to be really important.

Kate: I think what you pointed out is important, about Lyft and Uber both becoming transportation businesses, not ride-hailing companies and I think their long-term visions involve scooters, bikes, autonomous vehicles, all sorts of different models of transportation beyond just car sharing.

Kirsten: I hate to be wishy-washy here and say, I don’t know, but I do really think that it’s going to come down to a variety of items all coming together. It’s just not going to be enough for Lyft to scale up its ride-hailing business. And I should point out that Uber should be treated in some ways the same way, but there are some distinct differences. But it’s important for us to think of Lyft as a transportation-as-a-service business. I mean they say in their prospectus that transportation is a massive market opportunity. The hard part of course is turning that into a profit. There might be opportunity there.

So there’s this asset-light business that they have right now, which is the ride-hailing, but then they are making acquisitions in the micromobility space and that is going to become more capital intensive. And that’s going to force them to change their business. And then there’s the autonomous vehicle piece. And then finally, I actually think that one of the pieces of their S1 that has really not received much attention at all is what they’re pursuing in terms of public transportation. And they have said that they, and Uber, intend on being a piece of the public transit ecosystem.

Now that doesn’t mean that they’re going to necessarily be operating buses, but there are people that I’ve talked to in the industry who actually feel like, in Uber’s case, they want to control every mode of transportation. For Lyft, I see them seeing more of the opportunity financially with the data piece and becoming more of a platform and becoming that one-stop shop where you use an app to figure out if you want to use the scooter or a bike, or ride-hailing or buy that ticket for the L in Chicago or the Bart System.

So I really think that the public transit piece often gets ignored and cities are having so much more control now and weighing in. We see this in New York City with congestion pricing. It’s going to force Lyft and Uber to take advantage of these opportunities and use their platform in a way that perhaps accelerates faster than they had intended.

Kate: I’m very interested in the public transportation element, but I’m also very skeptical of the scooters and bikes in the future for Lyft, I think, given the unit economics, I certainly wouldn’t rely on them to be Lyft’s path to profitability. I think autonomous vehicles are a much more interesting path towards profitability. So a lot of companies, Uber, Lyft, Waymo and more are focusing on autonomous vehicles and their development, whether that be with hardware or software. How does Lyft’s strategy with autonomous vehicles differentiate from some of their competitors or does it does differentiate?

Kirsten: It does differentiate, and the funny thing is, is that so you don’t see micromobility necessarily as the oath to profitability and are interested in AVs and I write about AVs, but I see that AVs as a harder path to profitability in a way because of the nuts and bolts that it takes to develop them.

So just to weigh in really quickly on the micromobility piece and then I’ll move on to AVs; To show the opportunity but also the volatility in a real-world example for micromobility, I was in Austin for South by Southwest, I think you were there too, and you probably saw scooters everywhere, right? 18 months ago there were no scooters or bike share in the city. Then bike share came first.

Image via Flickr / Austin Transportation / https://www.flickr.com/photos/austinmobility/41536051644/in/album-72157669223418248/

And I was talking to that mayor of Austin and one of the folks from Spin, which is a Ford owned business, and they told me something that was really remarkable that I hadn’t thought about, which was that scooters were disrupting the bike share business. So bikes share came in and then scooters came in and all of a sudden they’re pulling bikes off the streets because no one was using them or were not using them at the same level as scooters.

Lyft is going to go through these same exact growing pains and people are figuring out what works. And as you mentioned, the unit economics are an issue, the wear and tear on the scooters alone is driving up costs and driving down revenues certainly, but pretty much making it very difficult to make a profit on it.

But that’s a near term business, right? So it’s at least generating revenue right now. On the other hand, you have this other piece, which is the AV piece. Lyft is doing some really interesting things on the AV piece — they kind of have a two-prong approach.

So they basically created a ton of partnerships to use their platform. So this started a couple of years ago and companies like Aptiv, drive.ai, even Waymo and nuTtonomy, which Aptiv just recently bought about a year ago and GM, and Lyft basically allows developers to use their platform and connect to their autonomous vehicle and offer these rides.

And the best example of this, if you’ve been to CES or if you have been to Las Vegas I should say more specifically, is this partnership that Lyft has with Aptiv — and Aptiv as a tier one supplier, they used to be called Delphi, they spun out, they bought nuTonomy, and they’re Aptiv now. And this is taking Aptiv automated BMW, which are on the Lyft network. If you hail a ride, you might be asked if you want a self-driving car, or “are you okay with a self-driving car?” And they have a safety driver, no humans have been pulled away from it yet. But they provided about 35,000 rides since I want to say January 2018.

Then they’re also doing Level 5, a dedicated self-driving vehicle division that launched in 2017. And here they’re basically creating an open self-driving system or open SDS. On top of that, they have partnered with Magna, an auto parts producer, to develop these self-driving systems that can be manufactured at scale.

And so you just see a rush of partnerships and sort of dual approaches and all of that costs a lot of money. And I can’t emphasize the amount of money that it costs or will cost to develop these systems and deploy them commercially. And I hear from other companies figures like $5 billion to get self-driving vehicles. So developing the full stack, doing fleet management, maintenance, all of that — that’s a lot of money. And, I’m not sure where Lyft, will get that capital, will they get it from the open market or will they have to go and ask for more capital.

Kate: So when do you think then that Lyft will be able to commercialize autonomous vehicles?

Kirsten: The timeline? So depending on who you talk to, you can hear from any of these developers between five years and 30 years. I think it’s important to talk about language and how we talk about autonomous vehicles. So to be clear, there is currently not a single commercial autonomous vehicle deployment where a human being or safety driver has been pulled away from the wheel. It just doesn’t exist.

There are plenty of pilots and Waymo is probably considered the leader in that list, though it is a bit of a confusing one for me because they have so many partnerships and they’ve become competitors to some of those partnerships. The analogy I use is “Survivor,” the reality show. Everyone wants to make these alliances so they don’t get voted off the island.

And now we’re at that point where autonomous vehicle development has entered what we call the trough of disillusionment, which is heads down, “let’s get away from the hype, let’s do the hard work.” And I think we’re going to see a lot of those partnerships and headwinds really come up in the next year, 18 months. So to put a target date on Lyft, it’s really going to depend on which one of those partnerships really play out and are real. I think the one with Aptiv seems the most real to me based on what I know the company is doing and I can see them doing a lot more pilots in the next 18 months.

Does that mean commercial deployment without a human safety driver behind the wheel? I’m not sure I can see a lot more these pilots with a human safety driver expanding beyond Las Vegas. I see pilots happening absolutely in the next year to 18 months. The issue is going to be when is that human safety driver going to be pulled out and with which partner.

Kate: So should we open it up to questions again?

Caller Question: Hi, I was just wondering how we should think about the regulatory risks that might exist as these companies expand to new cities, new markets, or even the public transport use case you mentioned. Thanks.

Kirsten: The regulatory piece is an interesting one. Let’s talk about ride-hailing first. We’ve already seen the regulatory environment, in cities, push back against companies like Uber and Lyft. I think the congestion pricing model that just launched in New York City is going to be one to watch and could be something that will put pressure on, on businesses like Lyft.

Kate: I agree and just to speak, quickly on the scooters; I think the narrative around scooters has been pretty dominated by how cities have forced them out or cities push these strict regulatory barriers on them. And I think that’s still playing out very much. There are even some scooter providers that have had to pull out of cities that they worked very hard to get into in the first place. So I think that has slowed down some of the growth there. And given that Lyft has micromobility as such a key part of their road to profitability, I think that’s partially why I am a little bit skeptical of how that’s gonna play out.

Kirsten: One thing we’ve found, and something to consider for Uber as well, in the future, if any of these AV developers end up, filing for IPOs on their own — there’s been chit chat about Waymo someday doing that or GM cruise someday— the implications for all of these companies and their relationship with cities should not be ignored or undervalued.

And I think you see a bit of that playing out with the present day track we have, which is the ride-hailing scooters and bike share cities and transit agencies or the DOT of different counties finding that they are in a more powerful position than they’ve ever been before. And they are exerting that power.

And so you will see instances like Los Angeles where they have put forth a mandatory data sharing component if you want to operate in their city. This raises some privacy concerns by the way, but it also adds another cost to a company or certainly forces them to look at their business a little bit differently.

Then you start talking about AVs and where are they will operate, how they will operate, where are they will park, what type of vehicle will be allowed in the urban center. In places like Europe, there are strict emissions rules, so that’s going to go to an AV or hybrid profile. And it’s important to think about what that regulatory framework might be and acknowledge the fact that it’s really a mishmash.

There are voluntary guidelines on the federal level right now, but there were no mandates. And so it’s really left up to the cities, counties and states to decide how an AV might be deployed. It’s going to mean probably more lobbyists in DC working with federal folks to ensure that their business doesn’t get hamstrung as a result as well as more of a presence in those cities and states and counties.

But Kate, I’m wondering what is your view from a startup perspective? Do you think of Lyft as a startup anymore are they acting like a startup or are they acting like a company that could handle all of these different complicated, various challenges? I mean, we’ve got pricing pressure, regulatory pressure or you’ve got AV development, opportunities with scooters and all this other stuff. So are they acting like a company that is able to handle this?

Image via Getty Images / Jeff Swensen

Kate: That’s an interesting question. I mean, they’re definitely not a startup anymore by, by anybody’s definition. You maybe could have still used that word, if they were still private, but even then, I know many people would yell at you for using that term for a company worth $15 billion. But now it’s a public company. It’s not a startup. I don’t think they’re acting like a startup, no. I think that they are mature in the way that they’re handling all of these different, so-called paths to profitability.

But we need to wait and see. Let’s see how this year goes, let’s see how they handle all the criticism that they’re going to undoubtedly take from Wall Street or from everyone who’s either interested in buying or just taking a seat and watching how the stock favors and then we’ll know what kind of lessons they took from all those years as a private company. Then we can decide if their behavior is really that of a mature public company.

Kirsten: I do want to make one point that I think is an interesting one on Lyft’s strategy versus Uber is in terms of AVs. Let’s all put a big asterisk that says no, AVs are still a ways out. It is important to note the Lyft and Uber’s strategies for AVs are wildly different and Uber does not take this dual approach. Uber is throwing a ton of capital towards developing their own, self-driving stack and also they’ve done, some acquisitions as well.

They’ve also had quite a bit of trouble. Last year Uber had the first self-driving vehicle fatality that happened in Tempe, Arizona, which looked like it was going to derail their self-driving unit, but it did not. They’re back, testing in a very limited way, but Lyft’s is all about what they call the democratization of autonomous vehicles.

And we can look at that as marketing speech, but I do think that it’s important to look at those words because it shows what their business model is. Their business model is partnerships, alliances, opening up the platform and casting the widest net possible. What I’m very interested to find out is which approach will end up being the winner. It’s going to be a very long game. It’s not going to be anything that’s going to be determined in the next year. I think what Lyft’s proven is that when they look like they’re down and out, they come back.

We’ll see what the better approach is. Do you do everything in-house and launch your own robo-taxi service? Or take capital partners on or do the Lyft approach, with multiple partners? Are partnerships actually too complicated? As someone who covers the startup world, do you have a thought on which one might work or not?

Kate: I have no idea which will work better and I’m sort of excited to see where this all goes, especially as Uber and Lyft are now going to be public.

That’s a good spot to end the call on.

Kirsten: Thanks so much for joining. Thanks again for being Extra Crunch subscribers, we really appreciate it. Bye everyone.

Powered by WPeMatico

Startups Weekly: US companies raised $30B in Q1 2019

Let’s start this week’s newsletter with some data. Nationally, startups pulled in $30.8 billion in the first quarter of 2019, up 22 percent year-on-year, according to Crunchbase’s latest deal round-up.

A closer look at the numbers shows a big drop in angel funding and a slight decrease in mega-rounds, or financings larger than $100 million. The number of mega-rounds fell to 57 deals in Q1 and deal value was down too. With that said, mega-rounds still accounted for $16.4 billion, making Q1 2019 the second-best quarter on record for mega-rounds.

The bottom line is these monstrous deals represented a big chunk (29 percent) of all the dollars invested in U.S. startups in Q1. As investors move downstream and startups opt to stay private longer and longer, we’ll continue to see a greater pick up in mega rounds.

Want more TechCrunch newsletters? Sign up here.

OK, on to other news…

Once trading after the pink confetti was swept up off the floor, analysts and investors had a different story to tell about one of the first unicorns to make its public debut. Lyft began the week struggling to hit its IPO price, closing several days under that $72, despite opening with a 20 percent pop at $86. What’s going on? People are shorting the Lyft stock, looking to profit off the company’s sinking value. Things are looking up though; on Friday as I typed this newsletter, Lyft was trading at about $74 per share.

.@Uber sent @Lyft a whole bunch of cakes on IPO day, how nice. pic.twitter.com/hbZC5HOxbL

— Kate Clark (@KateClarkTweets) April 5, 2019

In other IPO, or shall I say, direct listing news, Slack has reportedly chosen the NYSE for its upcoming exit. A quick reminder why Slack has opted to go public via direct listing: The company doesn’t need any IPO cash thanks to the hundreds of millions of dollars on its balance sheet, but its longtime employees and investors need the liquidity. A direct listing allows it to go public without listing any new shares, with no lockup period and no intermediary bankers. The process saves it some money and expedites the process. OK, that wasn’t as brief as I intended, moving on…

Saying goodbye to venture capital

In a story that sent the entirety of Silicon Valley into a frenzy, Forbes reported that Andreessen Horowitz was denouncing its status as a venture capital firm and would register all its employees as financial advisors. For those inclined, Crunchbase News’ Alex Wilhelm and I unpacked what this means in the latest episode of Equity; for those less inclined, here’s the TLDR: For a16z to have the freedom to make riskier bets, like buying public company stock or heaps of cryptocurrency, the title of financial advisor gives them that ability.

Femtech, defined as any software, diagnostics, products and services that leverage technology to improve women’s health, has attracted some $250 million in VC funding so far this year, according to PitchBook. That puts the sector on pace to secure nearly $1 billion in investment by year-end, greatly surpassing last year’s record of $650 million. For more historical context, startups in the space brought in only $62 million in 2012, $225 million in 2014 and $231 million in 2016.

Alternative financier Clearbanc says it will invest $1 billion in 2,000 e-commerce startups in 2019. Here’s the catch: Until the companies have paid back 106 percent of Clearbanc’s investment, Clearbanc takes a percentage of their revenues every month. Clearbanc’s goal is to help companies preserve equity, favoring a revenue share model rather than the traditional VC model, which eats equity in startups in exchange for capital. I spoke to Clearbanc co-founder Michele Romanow to learn more about Clearbanc’s attempt to disrupt venture capital.

- Home buying and selling platform Perch raises $220M in debt and equity

- Online catering marketplace ezCater gets $150M at a $1.2B valuation

- Parker Conrad’s Rippling raises $45M

- Tonal raises $45M to bring strength training to living rooms

- Elvie raises $42M to become the go-to destination for women’s health

- NextGen Jane gets $9M to fight endometriosis

- Good Dog raises $6.7M to help you find a pup

TechCrunch’s Megan Rose Dickey authored the be-all-end-all story on the shared-electric-scooter business. Here’s a quick passage: “The startup ecosystem had become accustomed to the ethos of begging for forgiveness, rather than asking for permission. But that’s not the case with electric scooters. These companies have found their entire businesses to be contingent on the continued approval from individual cities all over the world. That inherently creates a number of potential conflicts.” Extra Crunch subscribers can read the full story here.

Plus, we dropped the Niantic EC-1, in which Greg Kumparak dives deep into the history of the maker Pokemon Go, contributor Sherwood Morrison looked at remote workers and nomads, who represent the next tech hub.

TechCrunch has confirmed that Airbnb has invested between $150 million to $200 million in Indian hotel startup Oyo. Airbnb confirmed the existence of the deal but not the exact amount. The home-sharing giant is continuing to widen its focus beyond “unconventional” hotels as it prepares to begin selling pubic market investors on its long-term vision. Remember, this deal comes right after its big acquisition of HotelTonight.

WeWork acquired Managed by Q this week, a VC-backed startup that helps office managers and other decision-makers handle supply stocking, cleaning, IT support and other non-work related tasks in the office by simply using the Managed by Q dashboard. The company was most recently valued at $250 million, having raised a total of $128.25 million from investors such as GV, RRE and Kapor Capital.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and I chat about the future of a16z, Jumia’s IPO, the Midas list and more of this week’s headlines.

Powered by WPeMatico

VSCO sues PicsArt over photo filters that were allegedly reverse engineered

Photo-editing app-maker VSCO has filed a lawsuit against competitor PicsArt.

The suit focuses on 19 PicsArt filters that were supposedly “reverse engineered from VSCO’s filters,” with VSCO alleging it has become a legal issue involving false advertising and violations of the app’s terms of service.

“VSCO has invested significant time and resources in developing its presets [a.k.a. filters], which represent valuable intellectual property of VSCO,” the company writes.

In a statement, PicsArt denied the suit’s claims:

VSCO is not a direct competitor, but they clearly feel threatened by PicsArt. VSCO’s claims are meritless. It’s disappointing that they have made these false claims against us. PicsArt will vigorously defend itself against these baseless claims and all options are under consideration.

Specifically, VSCO says that at least 17 PicsArt employees created VSCO accounts — probably not an uncommon competitive practice, but the suit claims they used those accounts to reverse engineer the filters, thus violating the terms in which users “agree not to sell, license, rent, modify, distribute, copy, reproduce, transmit, publicly display, publicly perform, publish, adapt, edit or create derivative works from any VSCO Content.”

In addition, the suit accuses PicsArt of engaging in false advertising by describing the filters in its PicsArt Gold subscription as “exclusive” and “only for [PicsArt] Gold users.”

Why is VSCO so sure that the PicsArt filters were based on its own? The suit says:

VSCO’s color scientists have determined that at least nineteen presets published by PicsArt are effectively identical to VSCO presets that are only available through a VSCO account. Specifically, VSCO determined that those PicsArt filters have a Mean Color Difference (“MCD”) of less than two CIEDE2000 units (in some cases, far less than two units) compared to their VSCO counterparts. An MCD of less than two CIEDE2000 units between filters is imperceptible to the human eye and cannot have been achieved by coincidence or visual or manual approximation. On information and belief, PicsArt could have only achieved this degree of similarity between its filters and those of VSCO by using its employees’ VSCO user accounts to access the VSCO app and reverse engineer VSCO’s presets.

The suit goes on to claim that VSCO’s lawyers sent PicsArt a letter in February demanding that the company identify and remove any filters that were reverse engineered or copied from VSCO. The letter also demanded “an accounting of all profits and revenues generated from such filters” and that PicsArt identify any employees who had created VSCO accounts.

In VSCO’s telling, PicsArt then responded that it was “in the process of replacing certain underperforming filters and modifying others,” including the 19 filters in question, but it only removed 17 — and supposedly two of the new filters “were similarly reverse engineered from VSCO’s proprietary presets.” The suit also says PicsArt has failed to provide the information that VSCO demanded.

VSCO does not appear to be suing for a specific monetary value, but the suit asks for “disgorgement of any proceeds obtained from PicsArt’s use of VSCO filters,” as well as injunctive relief, compensatory damages and “the costs of corrective advertising.”

You can read the full complaint below.

VSCO Complaint by on Scribd

Powered by WPeMatico

On balance, the cloud has been a huge boon to startups

Today’s startups have a distinct advantage when it comes to launching a company because of the public cloud. You don’t have to build infrastructure or worry about what happens when you scale too quickly. The cloud vendors take care of all that for you.

But last month when Pinterest announced its IPO, the company’s cloud spend raised eyebrows. You see, the company is spending $750 million a year on cloud services, more specifically for AWS. When your business is primarily focused on photos and video, and needs to scale at a regular basis, that bill is going to be high.

That price tag prompted Erica Joy, a Microsoft engineer, to publish this tweet and start a little internal debate here at TechCrunch. Startups, after all, have a dog in this fight, and it’s worth exploring if the cloud is helping feed the startup ecosystem, or sending your bills soaring, as they have with Pinterest.

after discussion with some folks about this article and the generally ridiculous amount of money startups pay for aws, i am wondering if there is an effective, easy to use, open source tool that helps startups reduce aws spend. https://t.co/GBh40b4UOH

— EricaJoy (@EricaJoy) March 25, 2019

For starters, it’s worth pointing out that Ms. Joy works for Microsoft, which just happens to be a primary competitor of Amazon’s in the cloud business. Regardless of her personal feelings on the matter, I’m sure Microsoft would be more than happy to take over that $750 million bill from Amazon. It’s a nice chunk of business; but all that aside, do startups benefit from having access to cloud vendors?

Powered by WPeMatico

Snap is channeling Asia’s messaging giants with its move into gaming

Snap is taking a leaf out of the Asian messaging app playbook as its social messaging service enters a new era.

The company unveiled a series of new strategies that are aimed at breathing fresh life into the service that has been ruthlessly cloned by Facebook across Instagram, WhatsApp and even its primary social network. The result? Snap has consistently lost users since going public in 2017. It managed to stop the rot with a flat Q4, but resting on its laurels isn’t going to bring back the good times.

Snap has taken a three-pronged approach: extending its stories feature (and ads) into third-party apps and building out its camera play with an AR platform, but it is the launch of social games that is the most intriguing. The other moves are logical, and they fall in line with existing Snap strategies, but games is an entirely new category for the company.

It isn’t hard to see where Snap found inspiration for social games — Asian messaging companies have long twinned games and chat — but the U.S. company is applying its own twist to the genre.

Powered by WPeMatico

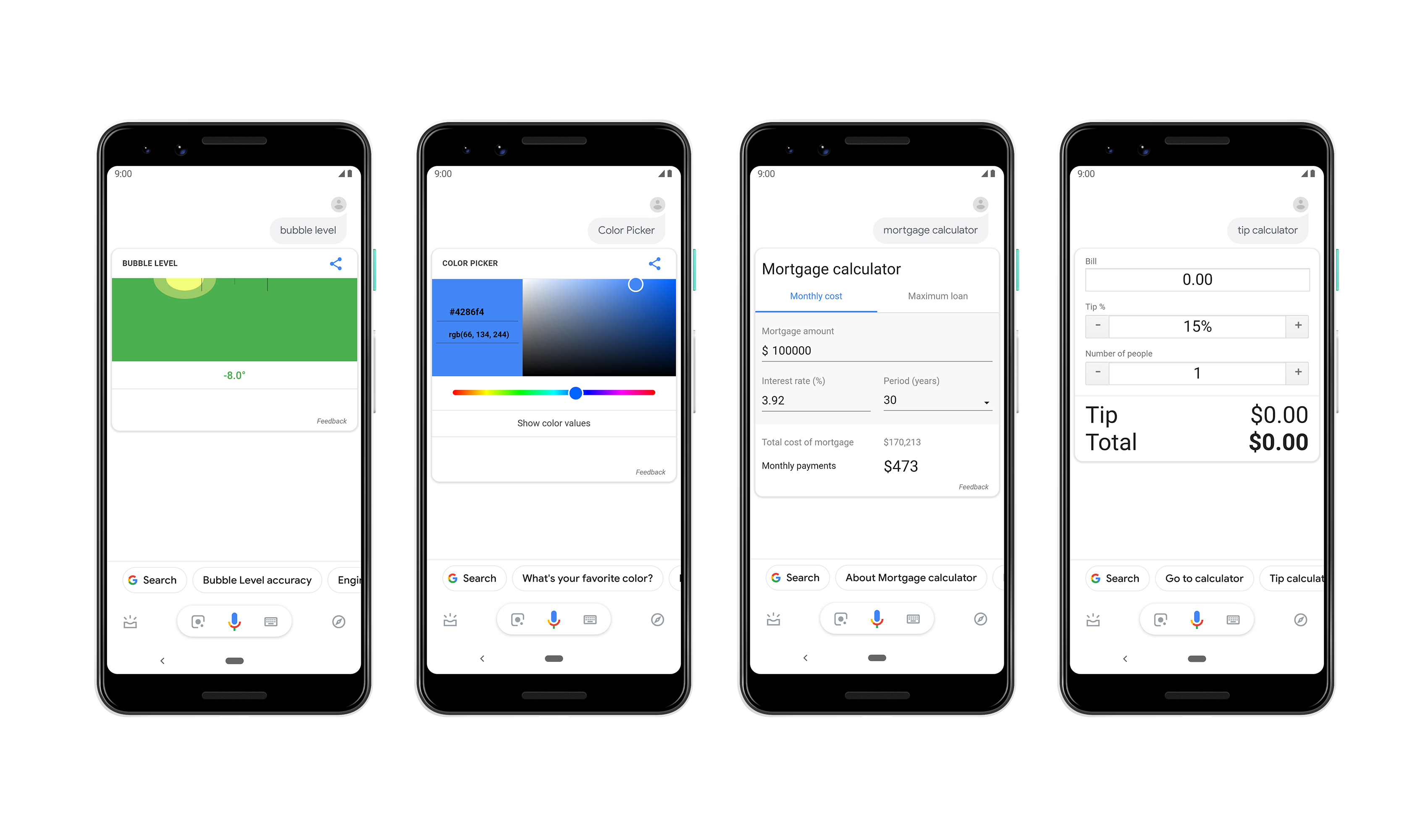

The Google Assistant on Android gets more visual responses

About half a year ago, Google gave the Assistant on phones a major visual refresh. Today, the company is following up with a couple of small but welcome tweaks that’ll see the Assistant on Android provide more and better visual responses that are more aligned with what users already expect to see from other Google services.

That means when you ask for events now, for example, the response will look exactly like what you’d see if you tried the same query from your mobile browser. Until now, Google showed a somewhat pared-down version in the Assistant.

Also — and this is going to be a bit of a controversial change — when the Assistant decides that the best answer is simply a list of websites (or when it falls back to those results because it simply doesn’t have any other answer), the Assistant used to show you a couple of boxes in a vertical layout that were not exactly user-friendly. Now, the Assistant will simply show the standard Google Search layout.

Seems like a good idea, so why would that be controversial? Together with the search results, Google will also show its usual Search ads. This marks the first time that Google is showing ads in the Assistant experience. To be fair, the Assistant will only show these kinds of results for a very small number of queries, but users will likely worry that Google will bring more ads to the rest of the Assistant.

Google tells me that advertisers can’t target their ads to Assistant users and won’t get any additional information about them.

The Assistant will now also show built-in mortgage calculators, color pickers, a tip calculator and a bubble level when you ask for those. Also, when you ask for a stock quote, you’ll now see a full interactive graph, not just the current price of the quote.

These new features are rolling out to Android phones in the U.S. now. As usual, it may take a bit before you see them pop up on your own phone.

Powered by WPeMatico

Peter Kraus dishes on the market

During my recent conversation with Peter Kraus, which was supposed to be focused on Aperture and its launch of the Aperture New World Opportunities Fund, I couldn’t help veering off into tangents about the market in general. Below is Kraus’ take on the availability of alpha generation, the Fed, inflation versus Amazon, housing, the cross-ownership of U.S. equities by a few huge funds and high-frequency trading.

Gregg Schoenberg: Will alpha be more available over the next five years than it has been over the last five?

To think that at some point equities won’t become more volatile and decline 20% to 30%… I think it’s crazy.

Peter Kraus: Do I think it’s more available in the next five years than it was in the last five years? No. Do I think people will pay more attention to it? Yes, because when markets are up to 30 percent, if you get another five, it doesn’t matter. When markets are down 30 percent and I save you five by being 25 percent down, you care.

GS: Is the Fed’s next move up or down?

PK: I think the Fed does zero, nothing. In terms of its next interest rate move, in my judgment, there’s a higher probability that it’s down versus up.

Powered by WPeMatico

EU goes after Valve for ‘geo-blocking’ Steam activation codes

Seemingly the sole government body policing tech platforms, the ol’ European Union, is now taking aim at desktop gaming’s biggest storefront, Steam, and its creator Valve.

The commission sent a “Statements of Objections” to Valve and five other video game publishers, raising a fuss over the companies’ habits of “geo-blocking” purchases, i.e. prohibiting users from using game activation codes purchased outside their country of residence.

Furthermore, the suit takes aim at Bandai Namco, Focus Home, Koch Media and ZeniMax for coming to agreements with game distributors, including Valve, that prevented consumers in some EU member states from being able to download titles that were available in other regions.

The commission claims these companies’ actions are in breach of EU antitrust rules. The letter comes after the EU opened an investigation more than two years ago.

“In a true Digital Single Market, European consumers should have the right to buy and play video games of their choice regardless of where they live in the EU. Consumers should not be prevented from shopping around between Member States to find the best available deal. Valve and the five PC video game publishers now have the chance to respond to our concerns,” Commissioner Margrethe Vestager said in a statement.

As Valve’s multitude of online defenders have noted, there are some reasons why “geo-blocking” might make sense. Pushing regional sales can help game developers find audiences in new markets while keeping bread-and-butter markets paying full price to subsidize the rest. Keeping prices uniform across the globe can leave developers in a tricky position when it comes to finding the ideal price point.

It seems likely that these companies will look to make nice with the EU and keep their practice moving along elsewhere.

We have reached out to Valve for comment.

h/t: Owen Williams

Powered by WPeMatico

New Celonis tool moves process mining vendor into customer experience

Celonis created the idea of process mining, the act of automating the understanding and improvement of internal processes. But understanding the process in and of itself only gets you so far. Ultimately, companies need to use that information to improve the customer experience, and a new operational layer announced today could help them do that.

When we think about managing the customer experience, we tend to look at the consumer-facing app or the website. If that isn’t working right, or there is unnecessary friction in the buying process, then you can lose the customer.

But Celonis co-CEO and co-founder Alexander Rinke says that eliminating friction at the front end of the process is only part of the equation. If there is a problem anywhere in the delivery system, from the manufacturer or warehouse to back-end systems, then that kind of friction can be just as problematic, he says.

“Where process mining really helps is it reveals where there’s friction. The biggest challenge companies face is that there’s a ton of operational friction. Things get stuck. Things get delivered late. Customer promises get broken,” he said.

Part of what makes Amazon work so well isn’t just that customers can easily place orders on a website or app, but also that Amazon has figured out how to pick the order and get it to the customer in the promised amount of time. If there were any delays in that process, people wouldn’t gravitate toward Amazon as much as they do.

But most companies don’t have the operational excellence of Amazon, and that’s where Celonis thinks it can help — by identifying the bumps in the operational road and finding ways to smooth those out in an automated fashion. “Initially, we sold a product for discovery, laying the land, understanding what’s going on in complex companies. And now we see more and more companies moving into operationalizing these insights, so acting on them, fixing things that are broken, and wanting to automate these fixes,” Rinke explained.

The company’s answer to this is the beta of Workflow Engine, a tool that is designed to help companies improve that operational flow. As it describes it, “The no-code, point-and-click workflow allows business analysts to arrange process steps and connect process flows across systems.” It includes templates out of the box for common tools like SAP, Oracle, Salesforce.com, ServiceNow, Jira, etc.

He says as an example, a company may have switched to electronic payments, but it’s finding customers aren’t moving with them. They can use the tool to identify those customers and offer a discount on their next order if they pay electronically without bothering the folks who are already doing it.

The company also announced a new tool to help connect easily to SAP systems. As Rinke points out, there are hundreds of these systems running the back end (finance, inventory, HR, etc.) at companies all over the world. It’s not always easy to connect to them because of their age and complexity.

To that end, the company revealed it has bought Banyas, a tool designed to help automate workflow from SAP systems, and one that should fit in nicely with the company’s vision to automate and understand process flows across large organizations.

Celonis was founded in 2011. Today it has more than 700 employees, and has raised almost $78 million.

Powered by WPeMatico