Zoom addresses CFO’s past workplace conduct ahead of IPO

Zoom, the only profitable unicorn in line to go public, priced its initial public offering at between $28 and $32 per share Monday morning. The video conferencing business plans to trade on the Nasdaq under the ticker symbol “ZM.”

Zoom, valued at $1 billion in 2017, initially filed to go public in March. According to its amended IPO filing, the company will raise up to $348.1 million by selling 10.9 million Class A shares. The offering will grant Zoom a fully diluted market value of $8.7 billion, a more than 8x increase to its latest private market valuation.

Although the company has garnered praise for its stellar financials — Zoom posted $330 million in revenue in the year ending January 31, 2019, a remarkable 2x increase year-over-year, with a gross profit of $269.5 million — the road to IPO hasn’t been without hiccups.

The company’s founder and chief executive officer Eric Yuan last night published an open letter concerning the conduct of Zoom’s chief financial officer Kelly Steckelberg. According to the letter, Zoom was recently informed by an anonymous source that Steckelberg had an “undisclosed, consensual relationship” during her tenure at a previous employer.

Steckelberg was most recently the CEO of the online dating site Zoosk; before that, she was a senior director in consumer finance at Cisco . The letter does not specify where the relationship took place, when or with whom.

Losing a CFO mere days before an IPO would have been a major loss for Zoom. CFOs often become the face of the IPO, handling the grueling tasks associated with crafting an IPO prospectus, leading the roadshow and more, while also maintaining day-to-day financial operations.

Yuan writes that the Zoom’s board of directors conducted a full investigation into the matter and determined that Steckelberg would stay on as Zoom’s CFO: “Kelly expressed regret for what transpired at her former employer, took ownership for the situation, and made clear to us that she had learned valuable lessons from the experience,” he wrote.

“We appreciated Kelly’s openness and candor during this process,” he continued. “It is clear that this matter related only to circumstances at her former employer. During Kelly’s tenure at Zoom, she has been an incredible contributor, as well as a model steward of our culture, values, and high standards since joining the Company.”

We reached out to Zoosk for comment. Zoom declined to comment further.

Zoom, expected to make the final call on its IPO price next Wednesday, will likely price at the top of the range and see a clean pop on its first day on the markets given its clean track record and positive financials. The business was founded in 2011 by Eric Yuan, an early engineer at WebEx, which sold to Cisco for $3.2 billion in 2007. Before launching Zoom, he spent four years at Cisco as its vice president of engineering.

Zoom has raised $145 million to date from investors, including Emergence Capital, which owns a 12.2 percent pre-IPO stake; Sequoia Capital (11.1 percent pre-IPO stake); Digital Mobile Venture (8.5 percent), a fund affiliated with former Zoom board member Samuel Chen; and Bucantini Enterprises Limited (5.9 percent), a fund owned by Li Ka-shing, a Chinese billionaire and among the richest people in the world.

Morgan Stanley, JP Morgan and Goldman Sachs are leading its offering.

Powered by WPeMatico

Partnering with Visa, emerging market lender Branch International raises $170 million

The San Francisco-based startup Branch International, which makes small personal loans in emerging markets, has raised $170 million and announced a partnership with Visa to offer virtual, pre-paid debit cards to Branch client networks in Africa, South-Asia and Latin America.

Branch — which has 150 employees in San Francisco, Lagos, Nairobi, Mexico City and Mumbai — makes loans starting at $2 to individuals in emerging and frontier markets. The company also uses an algorithmic model to determine credit worthiness, build credit profiles and offer liquidity via mobile phones.

“We’ll use [the money] to deepen existing business in Africa. Later this year we’ll announce high-yield savings accounts…in Africa,” says Branch co-founder and chief executive Matt Flannery.

The $170 million round from Foundation Capital and its new debit card partner, Visa, will support Branch’s international expansion, which could include Brazil and Indonesia, according to Flannery. Branch launched in Mexico and India within the last year. In Africa, it offers its services in Kenya, Nigeria and Tanzania.

A potential Branch customer

The Branch-Visa partnership will allow individuals to obtain virtual Visa accounts with which to create accounts on Branch’s app. This gives Branch larger reach in countries such as Nigeria — Africa’s most populous country with 190 million people — where cards have factored more prominently than mobile money in connecting unbanked and underbanked populations to finance.

Founded in 2015, Branch started operating in Kenya, where mobile money payment products such as Safaricom’s M-Pesa (which does not require a card or bank account to use) have scaled significantly. M-Pesa now has 25 million users, according to sector stats released by the Communications Authority of Kenya. Branch has more than 3 million customers and has processed 13 million loans and disbursed more than $350 million, according to company stats.

Branch has one of the most downloaded fintech apps in Africa, per Google Play app numbers combined for Nigeria and Kenya, according to Flannery.

Already profitable, Branch International expects to reach $100 million in revenues this year, with roughly 70 percent of that generated in Africa, according to Flannery.

In addition to Visa and Foundation Capital, the $170 Series C round included participation from Branch’s existing investors Andreessen Horowitz, Trinity Ventures, Formation 8, the IFC, CreditEase and Victory Park, while adding new investors Greenspring, Foxhaven and B Capital.

Branch last raised $70 million in 2018. The company’s overall VC haul and $100 million revenue peg register as pretty big numbers for a startup focused primarily on Africa. Pan-African e-commerce startup Jumia, which also announced its NYSE IPO last month, generated $140 million in revenue (without profitability) in 2018.

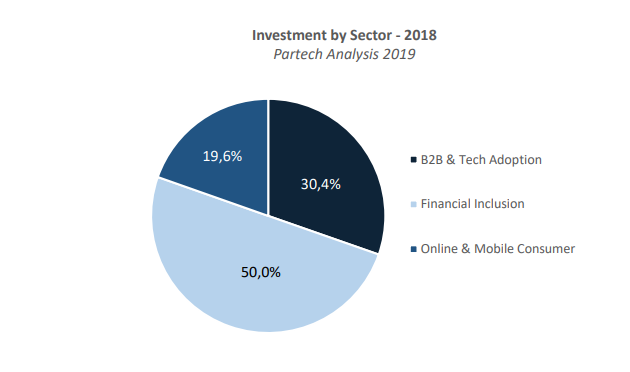

Startups building financial technologies for Africa’s 1.2 billion population have gained the attention of investors. As a sector, fintech (or financial inclusion) attracted 50 percent of the estimated $1.1 billion funding to African startups in 2018, according to Partech.

Startups building financial technologies for Africa’s 1.2 billion population have gained the attention of investors. As a sector, fintech (or financial inclusion) attracted 50 percent of the estimated $1.1 billion funding to African startups in 2018, according to Partech.

Branch’s recent round and plans to add countries internationally also tracks a trend of fintech-related products growing in Africa, then expanding outward. This includes M-Pesa, which generated big numbers in Kenya before operating in 10 countries around the world. Nigerian payments startup Paga announced its pending expansion in Asia and Mexico late last year. And payment services such as Kenya’s SimbaPay have also connected to global networks like China’s WeChat.

Powered by WPeMatico

RightHand Robotics debuts a new pick and place system

Reliable pick and place systems have long been a kind of Holy Grail among industrial robotics. The job of moving products in and out of bins is high among the jobs that many warehouse and fulfillment centers are looking to automate.

For a few years now, RightHand Robotics has been one of the more exciting startups in the space. The company has managed to drum up $34 million in funding from investors like Menlo Ventures, GV and Playground Global. This week at the ProMat conference in Chicago, the company unveiled RightPick2, the second generation of its piece-picking solution.

The news comes as the company notes that the previous version of its platform has crossed the 10 million pick threshold. This latest version features a number of upgrades on both the hardware and software fronts.

That list includes the fifth generation of the industrial gripper, which is capable of lifting up to 2 kg, coupled with new depth-sensing cameras from Intel and an improved arm from Universal Robots. That’s coupled with improvements to the system’s RightPick.AI vision/motion control software.

The results, as evidenced in the above demo, are pretty impressive. The system is speedy, fluid and capable of picking up a versatile array of different products, while capturing barcodes for order fulfillment in the process.

Powered by WPeMatico

When to ditch that nightmare customer (before they kill your startup)

Three million dollars. That’s the largest amount of money I’ve ever walked away from in terms of a customer contract that I decided we shouldn’t take.

It sucked. It was, at the time, more than half of the total amount of funds we had raised and it also represented just a shade more than the previous year’s revenue. It was a Fortune 500 company and the market leader in their industry. This was pocket money to them — which was part of the problem.

Good entrepreneurs spend a lot of time worrying about customers. We worry about the customers we have, the ones we don’t have, the ones we lost, and the ones we’re in danger of losing. We worry so much about where the next customer is going to come from that we never think twice about whether we should take on, or keep, a customer that’s more trouble than they’re worth.

The customer is king

As entrepreneurs, we need to be unflinchingly customer-first. We are the drivers, but the customers are holding the map. We should spend copious amounts of time listening, usually through data, to figure out our next move. We should know the risks when we go off-road, not only the setbacks that come with making the wrong choice, but the fact that we’ll hear about it from all sides until we right the ship.

Powered by WPeMatico

Roblox hits milestone of 90M monthly active users

Kids gaming platform Roblox, most recently valued at over $2.5 billion, has reached a new milestone of 90 million monthly active users, the company said on Sunday. That’s up from the 70 million monthly actives it claimed at its last funding round — a $150 million Series F announced last fall. The sizable increase in users is credited to Roblox’s international expansion efforts, and particularly its more recent support for the French and German languages.

The top 150 games that run on the Roblox platform are now available in both languages, along with community moderation, customer support and parental resources.

The gaming company also has been steadily growing as more kids join after hearing about it from friends or seeing its games played on YouTube, for example. Like Fortnite, it has become a place that kids go to “hang out” online even when not actively playing.

The games themselves are built by third-party creators, while Roblox gets a share of the revenue the games generate from the sale of virtual goods. In 2017, Roblox paid out $30 million to its creator community, and later said that number would more than double in 2018. It says that players and creators now spend more than a billion hours per month on its platform.

Roblox’s growth has not been without its challenges, however. Bad actors last year subverted the game’s protections to assault a child’s in-game avatar — a serious problem for a game aimed at kids, and a PR crisis, as well. But the company addressed the problem by quickly securing its platform to prevent future hacks of this kind, apologized to parents, banned the hackers and soon after launched a “digital civility initiative” as part of its broader push for online safety.

Months later, Roblox was still surging.

International expansion was part of the plan when Roblox chose to raise additional funding, despite already being cash-flow positive.

As CEO David Baszucki explained last fall, the idea was to create “a war chest, to have a buffer, to have the opportunity to do acquisitions,” and “to have a strong balance sheet as we grow internationally.”

The company soon made good on its to-do list, making its first acquisition in October 2018 when it picked up the app performance startup, PacketZoom. It also followed Minecraft’s footsteps into the education market, and has since been working to make its service available to a global base of users.

On that front, Roblox says Europe has played a key role, with millions of users and hundreds of thousands of game creators — like those behind the Roblox games “Ski Resort” (Germany), “Crash Course” (France) and “Heists 2 (U.K.).

In addition to French and German, Roblox is available in English, Portuguese and Spanish, and plans to support more languages in the coming months, it says.

But the company doesn’t want to face another incident or PR crisis as it moves into new countries.

On that front, Roblox is working with digital safety leaders in both France and Germany, as part of its Digital Civility Initiative. In France, it’s working with e-Enfance; and in Germany, it’s working with Unterhaltungssoftware Selbstkontrolle (USK). Roblox also added USK’s managing director, Elisabeth Secker, to the company’s Trust & Safety Advisory Board.

“We are excited to welcome Roblox as a new member to the USK and I’m honored to join the company’s Trust & Safety Advisory Board,” said Elisabeth Secker, Managing Director of the Entertainment Software Self-Regulation Body (USK), in a statement. “We are happy to support Roblox in their efforts to make their platform not only safe, but also to empower kids, teens, and parents with the skills they need to create positive online experiences.”

Powered by WPeMatico

Online university degree provider 2U acquires Trilogy for $750M to expand into tech bootcamps and training

As more universities turn to offering online degrees to expand their student bodies by way of cyberspace, one of the pioneers in enabling that trend has made an acquisition to expand into new territory around skills training and continuing education. 2U, which helps build online degree programs for a number of top universities, is paying $750 million to acquire Trilogy Education, which creates online and in-person “boot camps” — continuing education programs — in collaboration with universities to train those already in the workforce with tech skills in areas like coding, data analytics, UX/UI and cybersecurity.

The deal, which is expected to close in the next 60 days, is coming in a combination of cash and shares — $400 million in cash and $350 million in newly issued shares of 2U common stock — the company said. It’s a decent exit for Trilogy, which was valued at $545 million (according to PitchBook) when it raised $50 million in June 2018. Its investors include Highland Capital, Macquarie and Exceed, among others.

2U, meanwhile, has a market cap of $3.85 billion and is publicly traded on Nasdaq.

The acquisition helps 2U consolidate its university footprint, which will get bumped up to 68 from its previous 36. And it presents an obvious opportunity to up-sell and cross-sell: those who are already jumping into building degree programs can diversify into more skills training, while those who have yet to build full degree services but have created skills training programs now might consider how to parlay that experience into degrees — all from one provider, 2U. This also opens more generally a bigger window for 2U to expand into the continuing education market, which it estimates is worth some $366 billion.

It also helps it better compete with other companies that have already built a dual-track approach to online education, building degrees as well as short courses, like Coursera (Udacity and Udemy are among those that have focused on further education).

“[Trilogy Education] is a natural strategic fit and growth driver for 2U that will extend our reach across the career curriculum continuum, deepen our relationships with new and existing partners, drive marketing efficiencies, and open a more direct corporate training and enterprise sales channel for the company. We expect the addition of Trilogy to accelerate our path to $1 billion in revenue by one year from 2022 to 2021,” 2U co-founder and CEO Christopher “Chip” Paucek said in a statement. “Increasingly, universities are attempting to add practical, technical skills to their degrees. We simply future-proof the degree by adding this type of technical competency.”

The presence of commercial companies building educational courses for nonprofit universities, and taking a cut in the process, has seen more than a little controversy. The business spin that is put on education through these programs not only calls into question how and what schools (and their partners) prioritise in the curriculum, but they raise issues around how higher education is priced, and who profits from these degrees — which sometimes can still cost more than $60,000, despite no physical time in classrooms. (There is an excellent dive into the issue here in the Huffington Post, featuring an interview with the co-founder of 2U, John Katzman, who also founded the Princeton Review.)

To be fair, some of the issues around higher education — such as the exorbitantly high cost in some countries, and the fact that it still feels like a largely elitist endeavor with the odds of students gaining acceptance and achieving in top universities still in favor of too-small a privileged subset of families — cannot be completely tied to the development of online learning courses powered by for-profit companies.

And you could also argue that this was bound to be the next step, given how technology has evolved across all of education, and the fact that edtech is not a core competency for many institutions.

One of the potential positives that comes out of online degree programs is that it gives opportunities to a much wider group of would-be students, and mass market is something that Trilogy knows: it has to date already provided courses for 20,000 people and 1,200 instructors across 120 programs, it says, with an emphasis on practical skills to bring up local workforces, and working with universities to build these courses and connecting with big companies — customers include Google, Microsoft and Bank of America — to deliver them.

“By joining forces with 2U, Trilogy Education can empower universities to reach more students, in more places, throughout more of their lives, while driving positive economic impact in their local regions,” Trilogy Education CEO and founder Dan Sommer said in a statement. “Trilogy and 2U share a belief that universities are critical to lifelong learning and to meeting the workforce development needs of local economies both domestically and internationally, and we’re proud to further our mission and continue this important work as part of the 2U family.

Powered by WPeMatico

Klaviyo raises $150M Series B after building company the old-fashioned way

Klaviyo, a Boston-based email marketing firm founded in 2012, went about building its email marketing business the old-fashioned way. First it built a profitable company, then it went looking for funding to accelerate the growth. Today, it announced a massive $150 million Series B with the entire sum coming from Summit Partners.

The company had raised just $8.5 million before today’s announcement. Co-founder Andrew Bialecki wrote in a blog post announcing the funding that they decided to bootstrap for the first several years because they felt it was the right way to build a business — that, and they had no idea how to raise money.

“We came from families that started small businesses from scratch and ran them for decades. They may not have been huge, but they were real, lasting businesses. We wanted to try to build something like that. The second reason is much less idealistic. We had no idea how to raise money,” he wrote in the blog post.

What is the company doing to warrant such a huge investment? It has created an email marketing platform, which in and of itself is not that special, but what the company has done that it feels is different is build a platform where the data lives with the messaging. This enables them to build highly customized messages quickly.

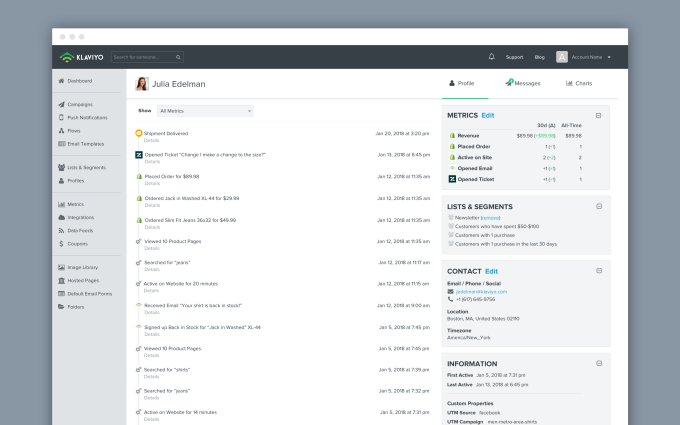

Screenshot: Klaviyo

Bialecki says there are two problems with email marketing tools today. The first is they aren’t really very smart. Most companies are still sending the same message to everyone, regardless of whether they are a new customer or a repeat one. Secondly, while they are probably measuring things like open rates and click-through rates, most platforms aren’t measuring the most important metric of all, and that’s revenue generated as a result of the email campaign.

To be fair, many companies are building highly customized email marketing campaigns based on analytics. In fact, he admits that many people ask if this isn’t a solved problem. Clearly, there are many companies selling email marketing solutions, but he says his company’s approach is different. “Our point of view is that there’s a ton of noise about this, a lot of marketing about marketing companies saying they solve these problems, but they don’t actually,” he said.

He believes the reason for that is simple. “They just don’t store all the customer data themselves. They delegate that job to data warehouses, customer data platforms or some other [platforms]. Then they try to connect them up and it’s a really bad experience.”

He said having all the data stored on the company’s platform lets their users respond much more quickly to changing situations and to deliver email that’s more personalized and in context of the user’s actual experience.

Michael Medici, a managing director at Summit Partners, who is joining the company board as part of this investment, says the company is a combination of product vision and technical expertise. “Klaviyo continues to change the playing field in commerce, allowing companies of all sizes to harness the power of data-driven customer engagement activity to grow sales – and the results are impressive,” he said in a statement.

The company is growing in leaps and bounds. It currently has 12,000 customers. To put that into perspective, it had just 1,000 at the end of 2016 and 5,000 at the end of 2017.

The company certainly understands that marketing is just one channel, but the goal up until now was to concentrate on email marketing, and get that right. Moving forward with the big investment, the company can accelerate growth and expand the platform into other areas like mobile and websites.

“We think the big change coming is to own all of those channels. Right now, businesses are forced to choose between going through some intermediary like Google or Facebook for ads, or selling on a marketplace like Amazon. If you’re a consumer business, we think you can go directly to customers,” he said.

He adds, “Our mentality is that we’re going to be a self-sustaining business, and we want to be here for decades.” With this kind of money, it certainly has the runway to be around for the foreseeable future.

Powered by WPeMatico

Sources: Y Combinator’s growth fund to back challenger bank Monzo

Just five months after announcing £85 million in Series E funding, Monzo is already gearing up to raise additional funding, which would almost double its valuation.

As reported in the Sunday Times yesterday, the U.K. challenger bank is close to raising £100 million in further funding in a new round led by an unnamed U.S. investor. If the deal goes through, it will reportedly give Monzo a pre-money valuation of close to £2 billion, up from £1 billion in October.

Now TechCrunch has learned that the new U.S. backer is Y Combinator.

According to multiple sources within investor circles on both sides of the pond, the Silicon Valley accelerator and venture capital fund plans to invest in Monzo out of its growth fund, the vehicle it typically uses to double down on fast-growing companies within its alumni.

Notably, Monzo isn’t a graduate of YC. However, Monzo co-founder Tom Blomfield’s previous startup, the payments company GoCardless, did go through the accelerator program, making Blomfield himself an alumni.

Monzo declined to comment. Y Combinator couldn’t be reached at the time of publication and I’ll update this post should I hear back.

Meanwhile, the news that Y Combinator is lining up to invest in Monzo makes a lot of sense in a number of ways beyond Blomfield’s previous ties to the accelerator. The challenger bank already boasts a plethora of U.S. investors, such as U.S. venture capital firm General Catalyst, Thrive Capital and Stripe.

And, as TechCrunch reported exclusively, Monzo has quietly begun working on a U.S. launch. This includes setting up a small team states-side to begin laying the groundwork to bring a version of Monzo to North America. It will initially be powered by a U.S. banking partner while Monzo works on the necessary regulatory licenses to go it alone.

Monzo continues to grow at a clip here in the U.K., too. To date, the challenger bank claims more than 1.7 million customers since it launched in 2015.

Powered by WPeMatico

Fleetsmith lands $30M Series B to grow Apple device management platform

Fleetsmith launched in 2016 with a mission to manage Apple devices in the cloud. It simplified an IT activity that had previously been complex, with help from Apple’s Device Enrollment Program. Over the last year, the startup has beefed up its offering considerably, and today it announced a $30 million Series B round led by Menlo Ventures.

Tiger Global Management, Upfront Ventures and Harrison Metal also participated. Under the terms of the deal, Naomi Pilosof Ionita, a partner at Menlo, will join the company board. Her colleague Matt Murphy will become a board observer. With today’s announcement, the startup has now raised more than $40 million, according to data supplied by the company.

Company co-founder and CEO Zack Blum says the original mission was about solving a pain point he and his co-founders were feeling around finding a modern approach to managing Apple devices. “From a customer perspective, they can ship devices directly to their employees. The employee unwraps it, connects to Wi-Fi and the device is enrolled automatically in Fleetsmith,” Blum explained.

He says that this automated approach, combined with the product’s security and intelligence capabilities, means that IT doesn’t have to worry about devices being registered and up-to-date, regardless of where an employee happens to be in the world.

It has moved from solving that problem for SMBs to having a broader mission for companies of all sizes, especially those with distributed work forces, which can benefit from enrolling in this automated fashion from anywhere. Once enrolled, companies can push security updates to all of the company’s employees and force updates if desired (or at least send strong reminders to avoid updating in the middle of a client meeting).

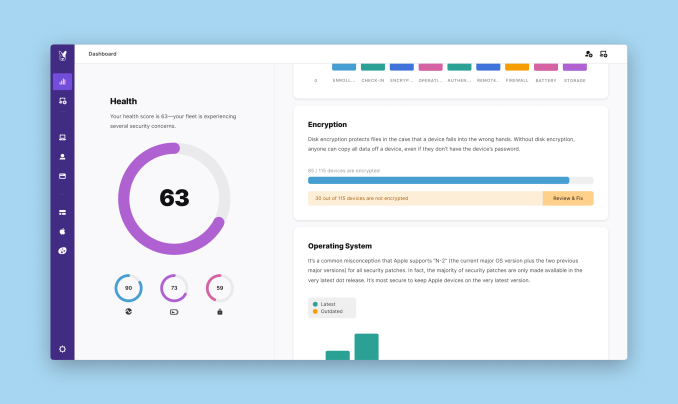

Over the last year, the company developed a dashboard for IT to monitor all of the devices under its management, including providing an overall health score with any potential problems it has found. For example, there may be a number of MacBook Pros without disk encryption enabled.

The dashboard ties into the identity management component of Office 365 and G Suite. IT can import the employee directory into the dashboard from either tool, and employees can sign into Fleetsmith with either set of credentials, providing a quick way to manage all employees in an organization.

Screenshot: Fleetsmith

Fleetsmith has also set up a partner program with Managed Service Providers (MSPs) to expand its reach further. MSPs manage IT for SMBs, and building a relationship with these types of companies can help it expand much more quickly.

The approach seems to be working, as the company has 30 employees and 1,500 customers. With the new cash in pocket, it intends to hire more people and continue building out the product’s capabilities, while expanding beyond the U.S. to markets overseas.

Powered by WPeMatico

The team behind Baidu’s first smart speaker is now using AI to make films

The HBO sci-fi blockbuster Westworld has been an inspiring look into what humanlike robots can do for us in the meatspace. While current technologies are not quite advanced enough to make Westworld a reality, startups are attempting to replicate the sort of human-robot interaction it presents in virtual space.

Rct studio, which just graduated from Y Combinator and ranked among TechCrunch’s nine favorite picks from the batch, is one of them. The “Westworld” in the TV series, a far-future theme park staffed by highly convincing androids, lets visitors live out their heroic and sadistic fantasies free of consequences.

There are a few reasons why rct studio, which is keeping mum about the meaning of its deliberately lower-cased name for later revelation, is going for the computer-generated world. Besides the technical challenge, playing a fictional universe out virtually does away the geographic constraint. The Westworld experience, in contrast, happens within a confined, meticulously built park.

“Westworld is built in a physical world. I think in this age and time, that’s not what we want to get into,” Xinjie Ma, who heads up marketing for rct, told TechCrunch. “Doing it in the physical environment is too hard, but we can build a virtual world that’s completely under control.”

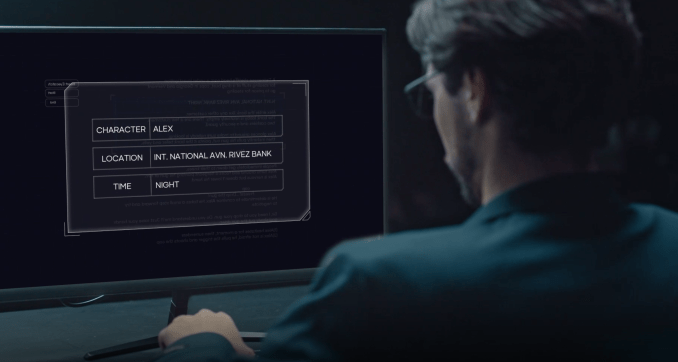

Rct studio wants to build the Westworld experience in virtual worlds. / Image: rct studio

The startup appears suitable to undertake the task. The eight-people team is led by Cheng Lyu, the 29-year-old entrepreneur who goes by Jesse and helped Baidu build up its smart speaker unit from scratch after the Chinese search giant acquired his voice startup Raven in 2017. Along with several of Raven’s core members, Lyu left Baidu in 2018 to start rct.

“We appreciate a lot the support and opportunities given by Baidu and during the years we have grown up dramatically,” said Ma, who previously oversaw marketing at Raven.

Let AI write the script

Immersive films, or games, depending on how one wants to classify the emerging field, are already available with pre-written scripts for users to pick from. Rct wants to take the experience to the next level by recruiting artificial intelligence for screenwriting.

At the center of the project is the company’s proprietary engine, Morpheus. Rct feeds it mountains of data based on human-written storylines so the characters it powers know how to adapt to situations in real time. When the codes are sophisticated enough, rct hopes the engine can self-learn and formulate its own ideas.

“It takes an enormous amount of time and effort for humans to come up with a story logic. With machines, we can quickly produce an infinite number of narrative choices,” said Ma.

To venture through rct’s immersive worlds, users wear a virtual reality headset and control their simulated self via voice. The choice of audio came as a natural step given the team’s experience with natural language processing, but the startup also welcomes the chance to develop new devices for more lifelike journeys.

“It’s sort of like how the film Ready Player One built its own gadgets for the virtual world. Or Apple, which designs its own devices to carry out superior software experience,” explained Ma.

On the creative front, rct believes Morpheus could be a productivity tool for filmmakers as it can take a story arc and dissect it into a decision-making tree within seconds. The engine can also render text to 3D images, so when a filmmaker inputs the text “the man throws the cup to the desk behind the sofa,” the computer can instantly produce the corresponding animation.

Path to monetization

Investors are buying into rct’s offering. The startup is about to close its Series A funding round just months after banking seed money from Y Combinator and Chinese venture capital firm Skysaga, the startup told TechCrunch.

The company has a few imminent tasks before achieving its Westworld dream. For one, it needs a lot of technical talent to train Morpheus with screenplay data. No one on the team had experience in filmmaking, so it’s on the lookout for a creative head who appreciates AI’s application in films.

Rct studio’s software takes a story arc and dissects it into a decision-making tree within seconds. / Image: rct studio

“Not all filmmakers we approach like what we do, which is understandable because it’s a very mature industry, while others get excited about tech’s possibility,” said Ma.

The startup’s entry into the fictional world was less about a passion for films than an imperative to shake up a traditional space with AI. Smart speakers were its first foray, but making changes to tangible objects that people are already accustomed to proved challenging. There has been some interest in voice-controlled speakers, but they are far from achieving ubiquity. Then movies crossed the team’s mind.

“There are two main routes to make use of AI. One is to target a vertical sector, like cars and speakers, but these things have physical constraints. The other application, like Alpha Go, largely exists in the lab. We wanted something that’s both free of physical limitation and holds commercial potential.”

The Beijing and Los Angeles-based startup isn’t content with just making the software. Eventually, it wants to release its own films. The company has inked a long-term partnership with Future Affairs Administration, a Chinese sci-fi publisher representing about 200 writers, including the Hugo award-winning Cixin Liu. The pair is expected to start co-producing interactive films within a year.

Rct’s path is reminiscent of a giant that precedes it: Pixar Animation Studios . The Chinese company didn’t exactly look to the California-based studio for inspiration, but the analog was a useful shortcut to pitch to investors.

“A confident company doesn’t really draw parallels with others, but we do share similarities to Pixar, which also started as a tech company, publishes its own films, and has built its own engine,” said Ma. “A lot of studios are asking how much we price our engine at, but we are targeting the consumer market. Making our own films carry so many more possibilities than simply selling a piece of software.”

Powered by WPeMatico