Apple’s iOS will now confirm you meant to subscribe to that app

Apple has added another step to prevent users from accidentally signing up for an iOS app’s subscription — or, from being tricked into it by a scammy app not playing by the rules. The company recently rolled out a subscription confirmation dialog box that pops up as one final step to ensure you meant to opt in to the subscription being offered.

The change to iOS was first spotted by app developer David Barnard on Twitter and reported by Apple news site 9to5Mac.

Whoa! Apple added an additional confirmation step for subscriptions. This new alert comes after you confirm with Touch ID/Face ID. I hope they address this in a more elegant way in iOS 13, but I’m thrilled Apple took a definitive step to curb scam subscriptions.

@pschiller pic.twitter.com/oktaEVdx0o

— David Barnard (@drbarnard) April 11, 2019

The new confirmation box is a welcome addition, considering how many users were accidentally subscribing — particularly those with Touch ID-based phones who were trying to exit to the Home screen. Instead, they were giving the app permission to sign them up by placing their finger on the Home button, which triggered the Touch ID authentication process.

The update also arrives following several changes Apple has made to subscriptions in recent months to address problems around scammy subscriptions.

A good number of developers — especially those in the Utility category — were using sneaky tricks to tap into the subscription craze to bank thousands and even millions of dollars per year. Some apps would intentionally confuse users with their design, or make promises of “free trials” that converted in only a few days, or used other misleading tactics to get users to subscribe.

This left many consumers feeling they had been duped into paying, and a host of angry App Store reviews followed. The scams could have had a broader impact on the subscription economy, if Apple had allowed them to go unchecked, as consumers would have become wary of ever signing up for anything as a result.

That would have been a problem, given how subscriptions have become a big business for the App Store. According to one forecast, they are poised to grow to $75.7 billion by 2022, in fact.

However, Apple has since begun to crack down on bad actors, while also making subscriptions easier to manage by iOS users.

In January, it rolled out new developer guidelines to more clearly spell out what is and is not allowed; and in February it updated iOS to reduce the number of steps it took to get to your subscriptions, so you could more quickly and easily cancel them.

I decided to test Apple’s subscription confirmation on my iPhone 6S running iOS 10.3.3, and… I didn’t give Apple enough credit yesterday! The change was done server side, so it works on all iOS versions. It also cancels when you press the home button. Once again,

@pschiller pic.twitter.com/48Jt2okEyZ

— David Barnard (@drbarnard) April 12, 2019

Now, the new dialog box will ensure that users understand they’re opting in to a paid subscription, with a message that reads:

“Confirm Subscription. The subscription will continue unless canceled in Settings at least one day before a subscription period ends.”

Apple didn’t formally announce the change, but it appears to have rolled out sometime in the last week, reports say.

Powered by WPeMatico

The chat feature may soon return to Facebook’s mobile app

Facebook upset millions upon millions of users five years ago when it removed chat from its core mobile app and forced them to download Messenger to communicate privately with friends. Now it looks like it might be able to restore the option inside the Facebook app.

That’s according to a discovery from researcher Jane Manchun Wong, who discovered an unreleased feature that brings limited chat features back into the core social networking app. Wong’s finding suggests that, at this point, calling, photo sharing and reactions won’t be supported inside the Facebook app chat feature, but it remains to be seen if that is simply because it is currently in development.

Facebook is bringing the Chats back to the app for preparing integrated messaging

Tip @Techmeme pic.twitter.com/LABK7qrk0e

— Jane Manchun Wong (@wongmjane) April 12, 2019

It is unclear whether the feature will ship to users at all as this is a test. Messenger, which has more than 1.3 billion monthly users, will likely stick, but this change would give users other options for chatting with friends.

We’ve contacted Facebook for comment, although we’re yet to hear back from the company. We’ll update this story with any comment that the company does share.

As you’d expect, the discovery has been greeted with cheers from many users who were disgruntled when Facebook yanked chat from the app all those years ago. I can’t help but wonder, however, if there are more people today who are content with using Messenger to chat without the entire Facebook service bolted on. Given all of Facebook’s missteps over the past year or two, consumer opinion of the social network has never been lower, which raises the appeal of using it to connect with friends but without engaging its advertising or news feed.

Wong’s finding comes barely a month after Facebook CEO Mark Zuckerberg sketched out a plan to pivot the company’s main focus to groups and private conversation rather than its previously public forum approach. That means messaging is about to become its crucial social graph, so why not bring it back to the core Facebook app? We’ll have to wait and see, but the evidence certainly shows Facebook is weighing the merits of such a move.

Powered by WPeMatico

Equity Shot: A deep dive into the Uber S-1

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

It’s time for another Equity Shot, a quick-take episode centered around a breaking news event. This time, as you already guessed, Kate Clark and I sat down to dig into the Uber S-1. It’s a huge, complex document, but we did our best to summarize what’s inside.

First, we talked through yearly results, looking back a half-decade into Uber’s revenue growth. In the filing, Uber reported 2018 revenues of $11.27 billion, net income of $997 million and adjusted EBITDA losses of $1.85 million. We highlighted those numbers, talked about operating losses and the company’s gyrating net results that included the positive impacts of various divestitures.

Yes, this S-1 required a bit more unpacking than most. We apologize for the frantic scrolling, we were pouring through the document live and we were a bit excited. This is an IPO that’s been talked about for years and will be easily one of the largest floats of all time.

Anyway, an S-1 brings insights to more than just a company’s financials, so we spent time highlighting key stakeholders, or, in other words, the people are are going to get really really really rich off Uber’s IPO. That includes Uber co-founder and chief executive officer Travis Kalanick, famous venture capital firms like the SoftBank Vision Fund and Benchmark, and more.

The IPO, remember, is expected to sell $10 billion in stock (primary and secondary) and value the company at $100 billion or more.

If 30 minutes digging through the S-1 wasn’t enough for you, don’t fret, we’ll be following the Uber IPO for weeks — probably months — to come.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

Uber is dishing out ‘appreciation awards’ up to $10K to let prolific drivers buy stock

As Uber gears up for its highly anticipated public debut, the company is setting aside some dough for drivers that have logged some serious rides on the platform as a reward for sticking with the service. The company follows Lyft, which also rewarded drivers with one-time cash bonuses during its public offering.

The company is setting aside a number of shares of common stock at the initial IPO price that drivers who earn this “appreciation award” will be able to purchase.

Drivers will get $100, $500, $1,000 or $10,000 for completing 2,500, 5,000, 10,000 or 20,000 lifetime trips, respectively. The caveat being that drivers will need to have also completed at least one ride in 2019 as of April 7 and be “in good standing.” We’ve reached out to Uber about what exactly that means.

Uber’s “driver appreciation awards” are pretty identical to what Lyft did for its public offering, which awarded drivers with 10,000 and 20,000 rides with $1,000 and $10,000 respectively. The key difference being Uber has some nice smaller cash bonuses for less-prolific drivers. Uber detailed that for drivers outside of the United States, the appreciation award “may be adjusted on a region-by-region basis to account for differences in average hourly earnings by region.”

Powered by WPeMatico

CEO Jennifer Tejada just took PagerDuty public; we talked about the roadshow, the IPO and what comes next

PagerDuty debuted on the New York Stock Exchange today, and as we type, shares of the nine-year-old, San Francisco-based incident response software company are trading at nearly $39.

That’s up more than 60 percent above their IPO range of $24 per share, which was itself adjusted from the range of $21 to $23 that had been expected earlier and gives the company a valuation of close to $3 billion. That’s an awful lot for a company whose software helps technical teams at 11,000 companies spot problems with applications and respond to incidents. Though it’s growing quickly — revenue was up 48 percent last year — it still pulled in just $117.8 million in 2018. Meanwhile, its net loss widened last year, to $40.7 million from $38.1 million in 2017.

Certainly, its performance has to make the company’s investors — who last assigned the company a valuation of $1.3 billion back in September — very happy. Some of the VCs poised to win big if PagerDuty’s shares continue flying high include Andreessen Horowitz, which owned 18.4 percent of PagerDuty’s shares sailing into the IPO; Accel, which owned 12.3 percent; and Bessemer, which owned 12.2 percent. Other winners include Baseline Ventures (6.7 percent) and Harrison Metal (5.3 percent).

It’s also exciting for CEO Jennifer Tejada, a proven operator who was brought in to lead PagerDuty in 2016 and now becomes part of a small — but growing — club of women CEOs to take their tech companies public, including Katrina Lake of Stitch Fix and Julia Hartz of Eventbrite.

We talked with Tejada earlier today about the company’s big day. In addition to crediting company co-founders (and shareholders) Andrew Miklas and Baskar Puvanathasan, both of whom have since left the company, Tejada thanked PagerDuty co-founder Alex Solomon, who remains the company’s CTO. She also told us a little bit about what today has been like, and how the IPO changes things — and doesn’t. Our chat has been edited for length.

TC: First and foremost, how are you feeling?

JT: It’s been an incredible day. It’s been an incredible several months. You have to enjoy it when it’s going well.

TC: How does the vision for the company change now that it’s public? Have you been thinking ahead to possible acquisitions?

JT: The vision doesn’t change. We intend to do exactly what we’ve been doing, which is to provide the best real-time operations platform available to companies as they undergo digital transformation to meet the growing demands of their customers. We think we’re [facing] an early and very large opportunity that will be available to us for a long time. So our job continues to be to build great products, stay close to our customers, expand regionally and continue doing what has allowed us to be a successful private company.

TC: You and I had talked about the challenges of retaining employees in San Francisco when we sat down together in November. It’s a battle for every local company. How do you keep employees beyond the lock-up period? How do you ensure they stay focused on performance and not your share price?

JT: I think that mindset of, ‘It’s all over when you go public,’ is kind of a Silicon Valley fable. If you look at the most successful SaaS companies on the planet, they’ve gained 10x, 20x, 30x their value post their IPO. I also think what employees look for ahead of their financial success is career success. Am I being developed and recognized and can I build my career at this company? And we’ve worked really hard to create those career opportunities for our employees who [I think see, as I do] the IPO like a racing boat pushing off the dock, across the starting line, and into the open ocean, where the next adventure awaits.

In the meantime, we’ve already lessened our reliance on [overheated job markets] by opening offices in Toronto and Atlanta and Seattle and London and Sydney, even while we’re still hiring in San Francisco and Seattle.

TC: Obviously, Lyft’s shares have been up and down, owing to short sellers. Have you been monitoring short interest? Are you at all concerned about investors driving the price sky high, then selling it on the way down?

JT: I haven’t even looked at the stock price in the last several hours . . . There are a lot of things outside of my control, and the free market is one of them.

TC: PagerDuty is rare in that is doesn’t have a dual-class structure, which can greatly empower leaders over everyone else associated with a company. Presumably, this is a great relief to your investors; I just wonder whether it was ever a consideration?

JT: I’m a little bit of a traditionalist. I’ve been around long enough to know how checks and balances work, and a single-class structure made sense for PagerDuty. Also, dual-class structures tend to emerge more when you have deeply involved founders, and though Alex is still very much a part of the business, PagerDuty’s other two founders have worked outside of the business for some time.

TC: You have plenty of operating experience, including previously running Keynote Systems, but you’ve never taken a company public. Were there ways in which you found the roadshow experience surprising?

JT: I was surprised by how fun it was! [Laughs.] When you have a great story, and a great partner helping you tell it — in my case that’s [PagerDuty CFO] Howard Wilson, who I’ve worked with for 10 years — it’s great. We had a great reception from investors. I loved our IPO team; our Top were both led by women and whenever I had a question, they [had the answer]. I also had this cocoon of experience surrounding me thanks to our board. If anyone tells you that [in this position] they are super comfortable, they’re either lying or [clueless] but I was very lucky. I also have a whole bunch of buddies who are CEOs [and other executives] in SaaS and I’ve been shaking them down for advice for months, so I felt well-prepared.

TC: What was some of the advice you received from those friends about how your life is about to change?

JT: Some of it was about the need to keep people focused and not get distracted, to remind everyone that this is a milestone, not the goal. [Some centered on] surrounding yourself with a great team and the importance of great investor relations, a function you don’t have as a private company but that can create huge value and provide support and understanding of the market.

One CEO said to just make sure you keep having fun, to try and stay “you,” to find joy in the same things as before. There will be stressful moments and tough questions — that’s true of any company that’s scaling — but I heard a lot of advice about just taking care of myself, including on the roadshow. In fact, there were a lot of really supportive notes and private tweets that, in a job that can feel lonely, made me feel not alone, and I’m very appreciative of that.

TC: People call IPOs just another funding event, but that’s kind of baloney, isn’t it? If you had to list the most meaningful moments in your life on a scale from 1 to 10, 1 being the most important, where might today fall? Would today be up there on that list?

JT: When I think of most meaningful moments, I think of the day my daughter was born, and my wedding. Another day that was very meaningful to me was when I approved our pledge to donate one percent [of PagerDuty’s equity, one percent of its product and one percent of employees’ time] to social impact. We did it a lot later in the game than some companies; our equity was already valuable. But we knew that it was going to create meaningful impact over time.

But yes, it is a gratifying day, especially for the co-founders who were pulling the idea together for PagerDuty a couple of years before they even launched it, and for employees who’ve been with the company for nearly as long and who turned down safer and higher-paying jobs along the way. Seeing their joy today — that is a memory that will be in my top 10 for sure.

Powered by WPeMatico

Founders meet with Salesforce Ventures at TechCrunch Include’s April Office Hours

TechCrunch Include is partnering with Salesforce Ventures to host this month’s Include Office Hours on April 30th. From 2:00pm – 4:00pm, Salesforce Ventures investors Matt Garratt, Phoebe Peronto, Spencer Chavez, and Claudine Emeott will meet with founders one on one, for 20 minutes, to offer guidance, advice and product feedback. You can apply here.

TechCrunch launched the Include program in 2014 to connect underserved and underrepresented founders in tech to our vast network and facilitate opportunities. The Include Office Hours program is one such initiative. TechCrunch partners with a VC firm a few times a year to give diverse founders a unique opportunity to meet privately with investors to get advice on building and developing their startups.

Underserved and underrepresented founders are invited to apply. Diverse founders include, but are not limited to, female founders, veterans, Latino/a, Black, LGBTQ and founders with disabilities.

Salesforce Ventures will be hosting office hours on April 30th from 2:00pm – 4:00pm. Salesforce Ventures is interested in meeting with founders from the following categories: B2B SaaS & Enterprise Technology Startups across multiple sectors including retail, fintech, digital health, manufacturing, impact (education, sustainability, diversity & inclusion) in addition to AI/ML, developer tools and blockchain. Founded in 2009, the firm’s portfolio consists of 300+ investments in more than 20 countries. Companies in the Salesforce Ventures portfolio typically receive funding, access to one of the world’s largest cloud systems and guidance from the company’s execs. Connect with Salesforce Ventures here.

Let’s meet the investors:

Matt Garratt, Managing Partner, Salesforce Ventures

Matt Garratt is the managing partner of Salesforce Ventures. Matt has completed investments in leading enterprise SaaS companies, including companies such as DocuSign, MuleSoft and Twilio. Prior to joining Salesforce Ventures, he was a vice president at Battery Ventures, where he invested in early-stage enterprise software and GreenIT companies. Matt was also a vice president of Plymouth Ventures, a late-stage investment fund based in Ann Arbor, Michigan. He has also worked for GE in their corporate strategy group and has spent time in Africa monitoring energy and infrastructure investments for E+Co, a public-purpose investment.

Matt Garratt is the managing partner of Salesforce Ventures. Matt has completed investments in leading enterprise SaaS companies, including companies such as DocuSign, MuleSoft and Twilio. Prior to joining Salesforce Ventures, he was a vice president at Battery Ventures, where he invested in early-stage enterprise software and GreenIT companies. Matt was also a vice president of Plymouth Ventures, a late-stage investment fund based in Ann Arbor, Michigan. He has also worked for GE in their corporate strategy group and has spent time in Africa monitoring energy and infrastructure investments for E+Co, a public-purpose investment.

Phoebe Peronto, Principal, Salesforce Ventures

Phoebe Peronto is a principal at Salesforce Ventures, where she focuses on investing in enterprise SaaS companies in various industry sectors, including retail/commerce, developer tools and emerging technologies (AI/ML, blockchain). She joined Salesforce by way of the investing team at GV, and operational roles at both Google Inc. and Rocket Internet. Phoebe holds a dual degree from UC Berkeley in Political Science and Business Administration and graduated with high distinction as a George Baker Scholar from Harvard Business School. Based in San Francisco, Phoebe has become one of those crazy obsessed coffee people.

Spencer Chavez, Principal, Salesforce Ventures

Spencer Chavez is a principal at Salesforce Ventures, where he is responsible for both sourcing and executing investments in enterprise software companies, with a recent focus on companies in the fintech, AI/ML and digital health spaces. Prior to joining Salesforce Ventures, Spencer was on the investment team at JMI Equity, where he focused on making growth equity investments in enterprise software companies. Earlier in his career, Spencer worked in the investment banking divisions at both Citigroup and Needham & Company, where he helped advise the firms’ technology clients on M&A and capital-raising initiatives. Spencer graduated from Santa Clara University with a B.S. in Commerce, majoring in finance and minoring in economics.

Claudine Emeott, Senior Director of Impact Investing, Salesforce

Claudine Emeott leads the Salesforce Impact Fund and is looking to invest in mission-driven enterprise technology companies in education, sustainability, diversity + inclusion, and enabling technology for the social sector. Prior to Salesforce, Claudine led impact investing at Kiva, developing a new funding model for social enterprises and spearheading a new impact framework. Before moving to the Bay Area, Claudine spent the first half of her career in economic development consulting and has lived in Beijing, Chicago and Kathmandu. Claudine holds a B.A. from Harvard and a master’s from MIT.

If you are a partner/managing director of a firm and are interested in supporting underserved and underrepresented founders, email neesha@techcrunch.com.

Powered by WPeMatico

Sharp goes clamshell with its folding phone concept

The beauty of the foldable in 2019 is that there’s no consensus yet on the “right” way to do things. We’ve seen a number of different takes on the space as the year has progressed, and no two are exactly the same.

Keep in mind that this device from Sharp is still very much a concept. And even if it does come to market, it’s still going to be tough to get your hands on the product here in the States, as Sharp has a virtually non-existent mobile footprint. Still, it’s nice to see someone going full clamshell.

速報です。シャープが曲がる折りたたみスマホ向け有機EL展示。三重工場と堺工場で製造した「純日本製」パネルとなります。

https://t.co/cqi5Pi0Imr pic.twitter.com/uYt8lrK6s1— 小口貴宏 / EngadgetJP (@TKoguchi787) April 10, 2019

So far, the Motorola RAZR patent and one of several TCL concepts are the closest we’ve seen. Ultimately the form factor is less about maximizing screen space than it is minimizing pocket real estate, with the unfolded prototype measuring a not-crazy 6.18 inches. There’s also a nice bit of nostalgia baked in for those of us who remember the days before every phone was a smart one.

Sharp certainly knows how to make a display, and while I don’t expect any phone from the company to set the world on fire, there’s probably something in the return of the clamshell, after all.

Powered by WPeMatico

WTF is Baillie Gifford?

The SoftBank Vision Fund has been screaming from the venture headlines the last few months, driven by eye-popping rounds (and valuations!) into some of the most notable startups around the world. Yet, SoftBank isn’t the only player rapidly buying up the cap tables of top startups. Indeed, another firm, more than a century old, has been fighting for that late-stage equity crown.

… Who the what?

When our fintech contributor Gregg Schoenberg interviewed Charles Plowden, the firm’s joint senior partner, about the firm’s prodigious investing, we realized that we have never gone in-depth on one of the most influential investors in Silicon Valley. So here goes.

Baillie Gifford is a 110-year-old asset management firm based out of Edinburgh, Scotland, and has long had a penchant for pre-IPO tech companies. The firm was an early investor into some of the world’s most valuable private and public tech companies, boasting a roster of portfolio companies that includes unicorns from nearly all generations in modern tech, including everything from Amazon, Google and Salesforce to Tesla, Airbnb, Spotify, newly public Lyft, Palantir and even SpaceX.

Baillie Gifford’s reach stretches way beyond the 280/101 corridor. The firm has an extensive history of investing across geographies, with one of its first and most successful investments coming from an early entry into Chinese e-commerce titan Alibaba. More recently, Baillie Gifford even held a stake in recently IPO’d Chinese electric autonomous vehicle manufacturer NIO, and one the firm’s largest current holdings is South African internet conglomerate Naspers — which itself is an active investor and developer of emerging market tech infrastructure.

The firm’s low profile belies its aggressive capital deployment strategy. According to data from PitchBook, Baillie Gifford was involved in roughly 20 deals in 2018 and was involved as a lead or participant in transactions worth over $21 billion in aggregate total deal size — beating out behemoth Tiger Global, which tallied roughly $13.25 billion on the same metric.

The firm has about $2 billion focused on private companies, so while it is aggressive in getting into later-stage rounds, it is not nearly operating at the scale of say the Vision Fund or Tiger Global. While the asset manager primarily focuses on public-equity investing, the firm has participated in investment rounds as early as Series A, according to PitchBook and Crunchbase data.

Overall, the firm manages $221 billion in assets under management as of January 2019.

As one of the earliest asset managers to invest in pre-IPO tech companies, Baillie Gifford has sourced investments through its longstanding reputation as an investor. The firm first began really diving into private tech investing in the wake of the dot-com bubble. The firm doubled down on the tech sector at a time when few others were investing and sifted through the blood bath to find cheap entryways into companies that are now amongst the world’s largest.

Today, however, the landscape is undoubtedly much different. Tech companies now make up four of the top five largest companies in the world by market cap, and seven out of the top 10. Now, everyone wants a piece of the pie and there seem to be more checks being thrown at founders than most can even fit in their wallets.

With more capital at their fingertips than ever before, founders are opting to keep their startups private for longer in order to avoid the stress of having to deal with short-term public market investors who are more often than not looking for the first opportunity to cash out. So why, amongst so much choice, do companies continue to partner with Baillie Gifford?

Plowden has some insights on that front in our interview, but the summary is that Baillie Gifford just sees itself as a partner. Unlike its peers and most investment managers, Baillie Gifford has no outside shareholder owners to report to. As a partnership, wholly owned and run by just 44 partners, the firm doesn’t face the organizational constraints that beset most firms that manage billions and billions in assets.

The result? In short, Baillie Gifford has quietly been making a killing, and probably drinking some good Scotch along the way, as well.

Powered by WPeMatico

Baillie Gifford’s Charles Plowden on 110 years of investing

“It is our contention that the investment industry may be experiencing a peak of its own, in this case the point of the maximum rate at which it extracts value from its clients’ assets. Let’s call it Peak Gravy.” That’s a recent quote from Tom Coutts, who is one of a few dozen partners at Baillie Gifford (See Arman Tabatabai’s profile here). It’s also typical of the provocative sentiments offered by this band of fund managers who are based in Edinburgh, but scour the world looking for opportunities.

In an effort to distinguish its world view, the firm has introduced the somewhat eyebrow-raising tagline, “We’re actual investors.” For many US technology observers, though, Baillie Gifford is known for its investments in unicorns. But as Extra Crunch’s executive editor Danny Crichton and I found out in a recent conversation with Charles Plowden (one of two senior partners and the overseer of the firm’s investment departments), there’s a lot more to the story and motivations behind this unique 110-year-old partnership that’s still going strong.

Powered by WPeMatico

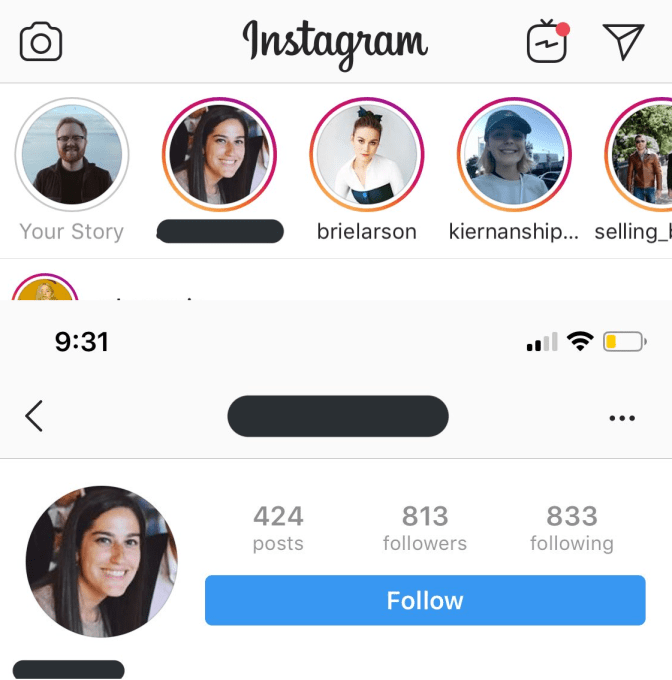

Instagram bug showed Stories to the wrong people

Today in “Facebook apps are too big to manage,” a glitch caused some users’ Instagram Stories trays to show Stories from people they don’t follow.

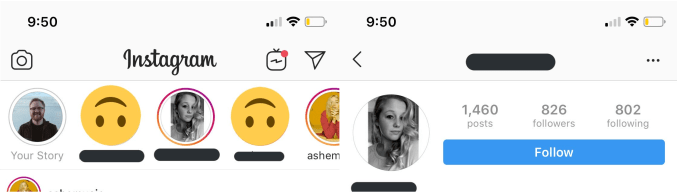

TechCrunch first received word of the problem from Twitter user InternetRyan who was confused about seeing strangers in his Stories Tray and tagged me in to investigate. The screenshots below show people in his Stories tray whom he doesn’t follow, as proven by the active Follow buttons on their profiles. TechCrunch inquired about the issue, and the next day Instagram confirmed that a bug was responsible and it had been fixed.

Instagram is still looking into the cause of the bug but says it was solved within hours of being brought to its attention. Luckily, if users clicked on the profile pic of someone they didn’t follow in Stories, Instagram’s privacy controls kicked it and wouldn’t display the content. Facebook Stories wasn’t impacted. But the whole situation shakes faith in the Facebook corporation’s ability to properly route and safeguard our data, including that of the 500 million people using Instagram Stories each day.

An Instagram spokesperson provided this statement: “We’re aware of an issue that caused a small number of people’s Instagram Stories trays to show accounts they don’t follow. If your account is private, your Stories were not seen by people who don’t follow you. This was caused by a bug that we have resolved.”

The problem comes after a rough year for Facebook’s privacy and security teams. Outside of all its scrambling to fight false news and election interference, Facebook and Instagram have experienced an onslaught of technical troubles. A Facebook bug changed the status update composer privacy setting of 14 million users, while another exposed up to 6.8 million users’ unposted photos. Instagram bugs have screwed up follower accounts, and made the feed scroll horizontally. And Facebook was struck by its largest outage ever last month, after its largest data breach ever late last year exposed tons of info on 50 million users.

Facebook and Instagram’s unprecedented scale make them extremely capital efficient and profitable. But that size also leaves tons of surfaces susceptible to problems that can instantly impact huge swaths of the population. Once Facebook has a handle on misinformation, its technical systems could use an audit.

Powered by WPeMatico