Apple Music for Artists comes out of beta with an iOS app and Shazam data

Apple Music launched its data dashboard for musicians more than a year ago. Today, the company is taking that product — Apple Music for Artists — out of beta, and adding some new features in the process.

For one thing, it’s no longer a web-only product, because Apple is releasing an iPhone app. On both web and iOS, Apple Music for Artists allows musicians and their teams to see how often a song has been played, how many listeners it’s reaching and how many times it’s been purchased.

There’s also an “insights” section designed to highlight noteworthy data at any given moment, like how the first week of a new song compares to the first weeks of previous songs, or when the popularity of a song is spiking, or if they’ve hit a big milestone like 1 million plays.

Apple also is introducing data from Shazam, the music-recognition app it acquired last year. The idea is to capture listener behavior that’s very different from seeking out an artist or a specific song — it’s more about a moment of spontaneous connection, when you hear a song and think, “Whoa, what’s this?” (This also provides a window to behavior beyond Apple Music listeners.)

One of the goals is to give musicians the data they need to actually guide their decisions. For example, they might see that a song doesn’t have many plays compared to their big singles, but it’s doing surprisingly well on Shazam — so maybe it’s time to shift promotion.

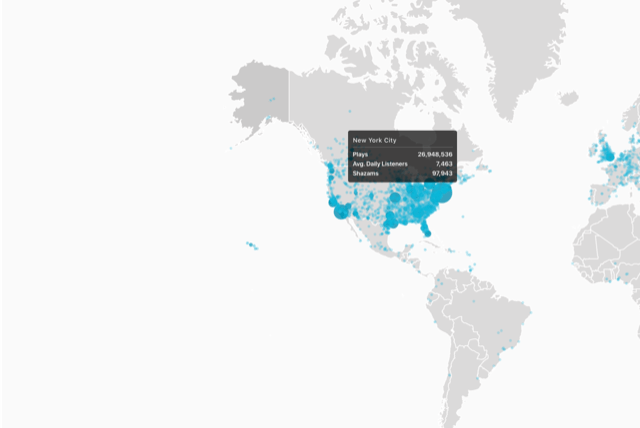

And the data is also browsable by city, on a map. So if someone’s planning a tour, they can use this to data to choose which cities to visit, or to find the correct venue size in a given market.

Apple says all the data (including Shazam data) goes back to the launch of Apple Music in 2015. Any artist can claim their account for free.

Powered by WPeMatico

Only 24 hours left to save $100 on TC Sessions: Enterprise 2019

Heads up all you enterprising enterprise software startuppers. You have only 24 hours before the price goes up on tickets to TC Sessions: Enterprise 2019. Save $100 and join us in San Francisco on September 5 — along with some of the industry’s top founders, CEOs, investors and technologists. Buy your early-bird ticket before 11:59 p.m. (PT) on August 9.

Enterprise is, without doubt, Silicon Valley’s 800-pound gorilla. No other startup category is as large, rich or competitive. In this day-long conference, we tackle the big topics and separate hype from reality. Artificial intelligence? Check. Cloud, Kubernetes, security and privacy, marketing automation, quantum? Yes. Investors, founders, and acquisition-hungry big enterprise companies? Tons of opportunity to network efficiently via CrunchMatch? Yeah, all that and more in 20 main-stage sessions — plus separate speaker Q&As and breakout sessions. Check out the day’s agenda.

Here’s a quick example of the type of programming you can expect.

Does the recent Capital One data breach have you up nights worried about the cost and consequences of cyberattacks? Don’t miss TechCrunch editor Zack Whittaker’s interview with Martin Casado (Andreessen Horowitz), Emily Heath (United Airlines) and Wendy Nather (Duo Security) in a session called, Keeping the Enterprise Secure.

Enterprises face a litany of threats from both inside and outside the firewall. Now more than ever, companies — especially startups — have to put security first. From preventing data from leaking to keeping bad actors out of your network, enterprises have it tough. How can you secure the enterprise without slowing growth? We’ll discuss the role of a modern CISO and how to move fast… without breaking things.

Looking for more ways to save or boost your ROI? Look no further. Buy four or more tickets at once and save 20% with the group discount. And, with every ticket you buy to TC Sessions: Enterprise, you’ll score a free Expo Only pass to TechCrunch Disrupt SF on October 2-4.

TC Sessions: Enterprise takes place on September 5, and if you want to save $100, you have just 24 hours left to act. The $249 early-bird ticket price remains in play until 11:59 p.m. (PT) on August 9. Buy your ticket now and save.

Is your company interested in sponsoring or exhibiting at TC Sessions: Enterprise 2019? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Statespace picks up $2.5M to help gamers train

Gaming continues to grow in popularity, with esports revenue growing 23% from last year to top $1 billion in 2019.

But the metrics by which talent is evaluated in gaming, and the methods by which gamers can train to better hone their craft, are varied and at times non-existent. That’s where Statespace, and specifically the company’s gaming arm Klutch, come into play.

In 2017, Statespace launched out of stealth with their first product, Aim Lab. Aim Lab is meant to mimic the physical rules of a game to give gamers a practice space where they can improve their skills. Moreover, Aim Lab identifies weaknesses in a player’s gameplay — one person might struggle with their visual acuity in the top-left quadrant of the screen, while another might have trouble spotting or aiming at targets on the bottom-right side of the screen — and allows gamers to focus in on their weaknesses to get better.

Today, the company has announced a $2.5 million seed funding round led by FirstMark Capital, with participation from Expa, Lux Capital and WndrCo. This brings the company’s total funding to $4 million.

Alongside growing Aim Lab, which is on track to soon reach 1 million users, one of the company’s main goals is to create a standardized metric by which gamers’ skills can be measured. In football, college athletes and NFL coaches have the Scouting Combine to make decisions around recruiting. This doesn’t necessarily take into account stats like yardage or touchdowns, but rather the raw skills of a player, such as 40-yard sprint speed.

In fact, Statespace has partnered with the Pro Football Hall of Fame for “The Cognitive Combine,” becoming the official integrative medicine program cognitive assessment partner of the organization. Statespace wants to create a similar “combine” for gaming.

The hope is that the company can offer this metric to publishers, colleges and esports orgs, giving them the ability to not only evaluate talent, but to better serve casual users through improved matchmaking and cheat detection.

“We want to go a level beyond your kill:death ratio,” said co-founder and CEO Dr. Wayne Mackey. Those metrics greatly depend on factors like who you’re playing with. You won’t always be matched against players who are on an even keel with you. So we want to look at fundamental skills like hand-eye coordination, visual acuity, spatial processing skills and working memory capacity.”

Klutch has partnered with the National Championship Series as the official FPS training partner for 2019. NCS has majors for both CS:Go and Overwatch, two of the biggest competitive FPS games in the world. The company is also partnering with top Twitch streamers and Masterclass to create The Academy.

Academy users will be able to get advanced tutorials from streamers like KingGeorge (Rainbox Six Siege), SypherPK (Fortnite), Valkia (Overwatch), Drift0r (CoD) and Launders (CS:GO).

Obviously, gaming is a major part of Statespace’s business model. But the skeleton of the technology has a number of different applications, particularly in medicine. Statespace is currently in the research phase of rolling out an Aim Lab product that is specifically focused on helping people who have had strokes recover and rehabilitate.

Statespace wants to use the funding to build out the team and expand the Klutch Aim Lab platform beyond Steam to mobile and eventually console, with Xbox prioritized over PlayStation, as well as launching the Academy.

Powered by WPeMatico

Opsani helps optimize cloud applications with AI

Opsani, a Redwood City, Calif. startup, wants to go beyond performance monitoring to continually optimizing cloud applications, using artificial intelligence to help the software learn what is the optimal state.

“We have come up with a machine learning technique centered around reinforcement learning to tune the performance of applications in the cloud,” company co-founder and CEO Ross Schibler told TechCrunch.

Schibler says each company has its own unique metrics and that’s what they try to optimize around. “We’re modifying these parameters around the resource, and we’re looking at the performance of the application. So in real time, what is the key business metric that the application is producing as a service? So it might be the number of transactions or it might be latency, but if it’s important to the business, then we use that,” he explained.

He claims that what separates Opsani from a monitoring tool like New Relic or AppDynamics is that they watch performance and then provide feedback for admins, but Opsani actually changes the parameters to improve the application performance in real time, based on what it knows about the application and what the developers want to optimize for.

It is also somewhat similar to a company like Spotinst, which optimizes for the cheapest cloud resources, but instead of simply trying to find the best price, Opsani is actually tuning the application.

The company recently announced a $10 million Series A investment led by Redpoint Ventures. Previous investors Zetta Ventures and Bain Capital also participated.

For now, it’s still early days for the startup. It has a dozen employees and a handful of customers, according to Schibler. With the recent $10 million round of funding, it should be able to hire more employees and continue refining the product.

Powered by WPeMatico

Google launches ‘Live View’ AR walking directions for Google Maps

Google is launching a beta of its augmented reality walking directions feature for Google Maps, with a broader launch that will be available to all iOS and Android devices that have system-level support for AR. On iOS, that means ARKit-compatible devices, and on Android, that means any smartphones that support Google’s ARcore, so long as “Street View” is also available where you are.

Google is launching a beta of its augmented reality walking directions feature for Google Maps, with a broader launch that will be available to all iOS and Android devices that have system-level support for AR. On iOS, that means ARKit-compatible devices, and on Android, that means any smartphones that support Google’s ARcore, so long as “Street View” is also available where you are.

Originally revealed earlier this year, Google Maps’ augmented reality feature has been available in an early alpha mode to both Google Pixel users and to Google Maps Local Guides, but starting today it’ll be rolling out to everyone (this might take a couple of weeks depending on when you actually get pushed the update). We took a look at some of the features available with the early version in March, and it sounds like the version today should be pretty similar, including the ability to just tap on any location nearby in Maps, tap the “Directions” button and then navigating to “Walking,” then tapping “Live View” which should appear near the bottom of the screen. The Live View feature isn’t designed with the idea that you’ll hold up your phone continually as you walk — instead, in provides quick, easy and super-useful orientation by showing you arrows and big, readable street markers overlaid on the real scene in front of you. That makes it much, much easier to orient yourself in unfamiliar settings, which is hugely beneficial when traveling in unfamiliar territory.

The Live View feature isn’t designed with the idea that you’ll hold up your phone continually as you walk — instead, in provides quick, easy and super-useful orientation by showing you arrows and big, readable street markers overlaid on the real scene in front of you. That makes it much, much easier to orient yourself in unfamiliar settings, which is hugely beneficial when traveling in unfamiliar territory.

Google Maps is also getting a number of other upgrades, including a one-stop “Reservations” tab in Maps for all your stored flights, hotel stays and more — plus it’s backed up offline. This, and a new redesigned Timeline, which is airing on Android devices only for now, should also be rolling out to everyone over the next few weeks.

Powered by WPeMatico

Japan’s mobile payments app PayPay reaches 10 million users

Paytm, India’s biggest mobile payments firm, now has 10 million customers in Japan, the company said as it pushes to expand its reach in international markets. Paytm entered Japan last October after forming a joint venture with SoftBank and Yahoo Japan called PayPay.

In addition to 10 million users, PayPay is now supported by 1 million merchant partners and local stores in Japan, Vijay Shekhar Sharma, founder and CEO of Paytm said Thursday. The mobile payments app has clocked more than 100 million transactions to date in the nation, he claimed. In June, PayPay had 8 million users.

“Thank you India  for your inspiration and giving us chance to build world class tech…,” he posted in a tweet.

for your inspiration and giving us chance to build world class tech…,” he posted in a tweet.

Like in India, cash also dominates much of the daily transactions in Japan. Large medical clinics and supermarkets often refuse to accept plastic cards and instead ask for cash. This encouraged Paytm, which also has presence in Canada, to explore the Japanese market.

And it has the experience, capital and tech chops to achieve it. The mobile payments app has amassed more than 250 million registered users in India. Most of these customers signed up after the Indian government invalidated much of the cash in the nation in late 2016.

PayPay competes with a handful of local players in Japan. Its biggest competition is Line, an instant messaging app that has followed China’s WeChat model to aggressively expand its offerings in recent years.

Like PayPay, Line also has no shortage of money. Earlier this year, it announced a ¥30 billion ($282 million) reward campaign to boost usage of its payments service. Line has more than 80 million users in Japan, 32 million of whom used its payments service as of February this year. There are about 120 million internet users in Japan.

PayPay maintains a ¥10 billion ($94 million) marketing campaign of its own, as part of which customers who make a certain number of transactions and participate in referral programs earn some money. In a statement, PayPay said Thursday that moving forward it “will strive to create a society where people can buy anything through cashless payments in every corner of the country with a safe and secured service for our users.”

Powered by WPeMatico

Google and Twitter are using AMD’s new EPYC Rome processors in their data centers

Google and Twitter are among the companies now using EPYC Rome processors, AMD announced today during a launch event for the 7nm chips. The release of EPYC Rome marks a major step in AMD’s processor war with Intel, which said last month that its own 7nm chips, Ice Lake, won’t be available until 2021 (though it is expected to release its 10nm node this year).

Intel is still the biggest data center processor maker by far, however, and also counts Google and Twitter among its customers. But AMD’s latest releases and its strategy of undercutting competitors with lower pricing have quickly transformed it into a formidable rival.

Google has used other AMD chips before, including in its “Millionth Server,” built in 2008, and says it is now the first company to use second-generation EPYC chips in its data centers. Later this year, Google will also make available to Google Cloud customers virtual machines that run on the chips.

In a press statement, Bart Sano, Google vice president of engineering, said “AMD 2nd Gen Epyc processors will help us continue to do what we do best in our datacenters: innovate. Its scalable compute, memory and I/O performance will expand out ability to drive innovation forward in our infrastructure and will give Google Cloud customers the flexibility to choose the best VM for their workloads.”

Twitter plans to begin using EPYC Rome in its data center infrastructure later this year. Its senior director of engineering, Jennifer Fraser, said the chips will reduce the energy consumption of its data centers. “Using the AMD EPYC 7702 processor, we can scale out our compute clusters with more cores in less space using less power, which translates to 25% lower [total cost of ownership] for Twitter.”

In a comparison test between 2-socket Intel Xeon 6242 and AMD EPYC 7702P processors, AMD claimed that its chips were able to reduce total cost of ownership by up to 50% across “numerous workloads.” AMD EPYC Rome’s flagship is the 64-core, 128-thread 7742 chip, with a 2.25 base frequency, 225 default TDP and 256MB of total cache, starts at $6,950.

Powered by WPeMatico

Africa’s top mobile phone seller Transsion to list in Chinese IPO

Chinese mobile-phone and device maker Transsion will list in an IPO on Shanghai’s STAR Market, Transsion confirmed to TechCrunch.

The company — which has a robust Africa sales network — could raise up to 3 billion yuan (or $426 million).

“The company’s listing-related work is running smoothly. The registration application and issuance process is still underway, with the specific timetable yet to be confirmed by the CSRC and Shanghai Stock Exchange,” a spokesperson for Transsion’s Office of the Secretary to the Chairman told TechCrunch via email.

Transsion’s IPO prospectus is downloadable (in Chinese) and its STAR Market listing application available on the Shanghai Stock Exchange’s website.

STAR is the Shanghai Stock Exchange’s new Nasdaq-style board for tech stocks that also went live in July with some 25 companies going public.

Headquartered in Shenzhen — where African e-commerce unicorn Jumia also has a logistics supply-chain facility — Transsion is a top-seller of smartphones in Africa under its Tecno brand.

The company has a manufacturing facility in Ethiopia and recently expanded its presence in India.

Transsion plans to spend the bulk of its STAR Market raise (1.6 billion yuan or $227 million) on building more phone assembly hubs and around 430 million yuan ($62 million) on research and development, including a mobile phone R&D center in Shanghai, a company spokesperson said.

Transsion recently announced a larger commitment to capturing market share in India, including building an industrial park in the country for manufacture of phones to Africa.

The IPO comes after Transsion announced its intent to go public and filed its first docs with the Shanghai Stock Exchange in April.

Listing on the STAR Market will put Transsion on the freshly minted exchange seen as an extension of Beijing’s ambition to become a hub for high-potential tech startups to raise public capital. Chinese regulators lowered profitability requirements for the exchange, which means pre-profit ventures can list.

Transsion’s IPO process comes when the company is actually in the black. The firm generated 22.6 billion yuan ($3.29 billion) in revenue in 2018, up from 20 billion yuan a year earlier. Net profit for the year slid to 654 million yuan, down from 677 million yuan in 2017, according to the firm’s prospectus.

Transsion sold 124 million phones globally in 2018, per company data. In Africa, Transsion holds 54% of the feature phone market — through its brands Tecno, Infinix and Itel — and in smartphone sales is second to Samsung and before Huawei, according to International Data Corporation stats.

Transsion has R&D centers in Nigeria and Kenya and its sales network in Africa includes retail shops in Nigeria, Kenya, Tanzania, Ethiopia and Egypt. The company also attracted attention for being one of the first known device makers to optimize its camera phones for African complexions.

Transsion has R&D centers in Nigeria and Kenya and its sales network in Africa includes retail shops in Nigeria, Kenya, Tanzania, Ethiopia and Egypt. The company also attracted attention for being one of the first known device makers to optimize its camera phones for African complexions.

On a recent research trip to Addis Ababa, TechCrunch learned the top entry-level Tecno smartphone was the W3, which lists for 3,600 Ethiopian Birr, or roughly $125.

In Africa, Transsion’s ability to build market share and find a sweet spot with consumers on price and features gives it prominence in the continent’s booming tech scene.

Africa already has strong mobile-phone penetration, but continues to undergo a conversion from basic USSD phones, to feature phones, to smartphones.

Smartphone adoption on the continent is low, at 34%, but expected to grow to 67% by 2025, according to GSMA.

This, added to an improving internet profile, is key to Africa’s tech scene. In top markets for VC and startup origination — such as Nigeria, Kenya, and South Africa — thousands of ventures are building business models around mobile-based products and digital applications.

If Transsion’s IPO enables higher smartphone conversion on the continent, that could enable more startups and startup opportunities — from fintech to VOD apps.

Another interesting facet to Transsion’s IPO is its potential to create greater influence from China in African tech, in particular if the Shenzhen company moves strongly toward venture investing.

China’s engagement with African startups has been light compared to China’s deal-making on infrastructure and commodities — further boosted in recent years as Beijing pushes its Belt and Road plan.

Transsion’s IPO move is the second recent event — after Chinese owned Opera’s big venture spending in Nigeria — to reflect greater Chinese influence and investment in the continent’s digital scene.

So in coming years, China could be less known for building roads and bridges in Africa and more for selling smartphones and providing VC for African startups.

Powered by WPeMatico

Postmates lands first-ever permit to test sidewalk delivery robots in San Francisco

On-demand delivery business Postmates says it’s been granted the first-ever permit for sidewalk robotics operations in the city of San Francisco.

According to San Francisco Public Works, the permits are active for 180 days and authorize the testing of up to three autonomous delivery devices. We’ve reached out to the Public Works department for comment.

Postmates has since 2017 been working alongside San Francisco supervisor Norman Yee and labor and advocacy groups to develop a framework for sidewalk robotics. The issuance of the permit makes San Francisco one of the first cities to formally allow companies to test autonomous delivery robots under a new pilot program.

Previously, companies were testing autonomous robots in various San Francisco streets sans permits, until the city voted to ban street robots from testing without official government permits, akin to the electric-scooter saga of 2018.

“We’ve been eager to work directly with cities to seek a collaborative and inclusive approach to robotic deployment that respects our public rights of way, includes community input, and allows cities to develop thoughtful regulatory regimes,” a representative of Postmates said in a statement provided to TechCrunch.

Postmates semi-autonomous sidewalk rover, Serve, was unveiled in December. Using cameras and lidar to navigate sidewalks, Serve can carry 50 pounds for up to 25 miles after one charge. Postmates has a human pilot remotely monitoring the Serve fleets and each rover has a “Help” button, touchscreen and video chat display for customers or passers-by to use if necessary. The company originally said they planned to roll out the bots in 2019, though no pilots have been officially announced yet.

Postmates semi-autonomous delivery robot, Serve

Postmates says they’ve made a number of changes to Serve in recent months, including implementing new lidar tech that’s smaller, more lightweight and durable, with zero-emission capabilities. Under Ken Kocienda, an Apple veteran that joined Postmates recently, the Serve team has also developed a new scripting language for animating Serve’s “eyes.”

“We are spending a lot of time going in and refining and inventing new ways that Serve can communicate,” Kocienda told TechCrunch in an interview earlier this year. “We want to make it socially intelligent. We want people, when they see Serve going down the street, to smile at it and to be happy to see it there.”

According to documents provided by Postmates, another autonomous delivery company, Marble, was not granted a permit after labor union Teamsters said the startup lacked an adequate Labor Dispute statement in its permit application. Marble is a last-mile logistics business based in San Francisco. Last year, the company closed a $10 million round with support from Tencent, CrunchFund and others.

Postmates, for its part, is expected to go public later this year in a highly anticipated initial public offering. The business filed confidentially for its offering in February after lining up a $100 million pre-IPO financing that valued the business at $1.85 billion. Postmates is said to be simultaneously exploring an M&A exit, according to Recode, which recently wrote that Posmates has discussed a merger with DoorDash, another top food delivery provider.

In June, Postmates announced Google’s vice president of finance, Kristin Reinke, had joined its board of directors, a sign it was sticking to IPO plans.

Postmates is backed by Tiger Global, BlackRock, Spark Capital, Uncork Capital, Founders Fund, Slow Ventures and others.

Powered by WPeMatico

Salesforce is acquiring ClickSoftware for $1.35B

Another day, another Salesforce acquisition. Just days after closing the hefty $15.7 billion Tableau deal, the company opened its wallet again, this time announcing it has bought field service software company ClickSoftware for a tidy $1.35 billion.

This one could help beef up the company’s field service offering, which falls under the Service Cloud umbrella. In its June earnings report, the company reported that Service Cloud crossed the $1 billion revenue threshold for the first time. This acquisition is designed to keep those numbers growing.

“Our acquisition of ClickSoftware will not only accelerate the growth of Service Cloud, but drive further innovation with Field Service Lightning to better meet the needs of our customers,” Bill Patterson, EVP and GM of Salesforce Service Cloud said in a statement announcing the deal.

ClickSoftware is actually older than Salesforce having been founded in 1997. The company went public in 2000, and remained listed until it went private again in 2015 in a deal with private equity company Francisco Partners, which bought it for $438 million. Francisco did alright for itself, holding on to the company for four years before more than doubling its money.

The deal is expected to close in the fall and is subject to the normal regulatory approval process.

Powered by WPeMatico