Sequoia leads $40M investment in mobile messaging startup Attentive

Attentive, a startup helping retailers personalize their mobile messages, is announcing that it has raised $40 million in Series B funding.

The startup was founded by Brian Long and Andrew Jones, who sold their previous startup TapCommerce to Twitter. When they announced Attentive’s $13 million Series A last year, Long told me the startup is all about helping retailers find better ways to communicate with customers, particularly as it’s harder for their individual apps to stand out.

Attentive’s first product allowed for what it calls “two-tap” sign-up, where users can tap on a promotion link from a brand’s website, creating a pre-populated text that opts them in to for SMS messages from that retailer.

Since then, it’s built a broader suite of messaging tools, with support for cart abandonment reminders, A/B testing, subscriber segmentation and other features that allow retailers to get smarter and more targeted in their messaging strategy.

The startup says mobile messages sent through its platform are seeing click-through rates of more than 30%, and that it now works with more than 400 customers, including Sephora, Urban Outfitters, Coach, CB2 and Jack in the Box.

The Series B was led by Sequoia, with participation from new investors IVP and High Alpha, as well as previous backers Bain Capital Ventures, Eniac Ventures and NextView Ventures. The plan for the new funding is to grow the entire team, especially sales and engineering.

“CRM is changing,” Long said in a statement. “Businesses can’t build a relationship with the modern consumer through email alone. Email performance, as measured by how many subscribers click-through on a message, is down 45% over the last five years. Rather than continuing to shout one-way messages at consumers, smart brands will stay relevant by embracing personalized, real-time, two-way communication channels.”

Powered by WPeMatico

Roblox announces new game-creation tools and marketplace, $100M in 2019 developer revenue

A week after gaming platform Roblox announced its new milestone of 100 million monthly users — topping Minecraft — the company said at its fifth annual developer conference that its developer community is on track to earn $100 million in 2019. Roblox also introduced a new set of developer tools for building immersive, more realistic 3D experiences; detailed its plans to make its developer software fully cloud-based; unveiled a new Developer Marketplace where creators can set their development assets and tools to others; and more.

Over the past decade or so, Roblox has grown to become a $2.5 billion company, with roughly half of U.S. children ages 9 through 12 playing on its platform.

The company provides game-creation tools via Roblox Studio, which developers use to build their own games for people to play. Roblox doesn’t pay the developers for their work — rather, the developers generate revenue through virtual purchases, which players buy using the in-game currency Robux.

At its invite-only event, the Roblox Developers Conference, which was held Friday, August 9 through Sunday, August 11, the company announced new tools aimed at enabling small developer teams to work together to build more massive games that can support hundreds of players.

The news follows the growing popularity of Roblox’s larger games, like Adopt Me (180.7K players), Royale High (68.7K players), Welcome to Bloxburg (66.7K players), MeepCity (52.4K players), Murder Mystery 2 (33.7K players), Work at a Pizza Place (32.7K players) and others.

The new toolset will offer developers access to an enhanced lighting system, updated terrain and other visual upgrades, including support for building competitive matchmaking games that will match players of similar skill levels, the company said.

Roblox had earlier discussed its plans for these sorts of visual improvements, which VP of Product Enrico D’Angelo said were prioritized in order to up the quality of the games.

The company said at RDC it’s also on track to bring its creation tools, Roblox Studio, to the cloud by year-end. This will allow developers to collaborate in real time, access their development files online and work across computing platforms to do things like manage permissions, versions and rollbacks.

In addition to monetizing their games, developers also will be able to monetize their development assets and tools through a new Developer Marketplace, where they can sell their plug-ins, vehicles, 3D models, terrain enhancements and other items.

“The Roblox creator community thinks of things we could never imagine, and their continued growth is our future,” said David Baszucki, founder and CEO, Roblox, in a statement about the new tools. “With top Roblox experiences achieving more than 100,000 concurrent users and 1 billion plays, there’s no denying the power of user-generated content. We are committed to supporting our creator community with the tools and resources they need to realize even greater success,” he added.

The company also made note of its improved localization support for Brazilian Portuguese, English, French, German, Japanese, Korean, Simplified and Traditional Chinese and Spanish, and discussed its recent Microsoft partnership in more detail.

Roblox had previously announced a collaboration with Microsoft Azure PlayFab, which made PlayFab’s LiveOps analytics service free to Roblox’s top 10,000 developers. This allows the game creators to track trends in player behavior, purchase history and game telemetry.

Alongside Roblox’s user growth, its creator community has been expanding, as well.

Today, there are more than 2 million Roblox game creators worldwide, ranging from indie developers to studios with teams of 10 or 20 people. Over 500 developers attended the three-day event in San Francisco and the private RDC 2019 viewing party in London.

“We ultimately become more and more inspired and convinced that this is not just the future of gaming, this is really the future of a whole new category,” said Baszucki, during the keynote. “I believe we’re sitting with not just the future of gaming,” he said, addressing the crowd of developers at RDC, “but the future of human co-experience.”

“We have this vision that there’s a new category emerging that’s bigger than gaming,” the CEO continued. “It’s the category that allows people around the world to connect, to not just play together, but to work together, to learn together and to create together.”

TechCrunch’s Extra Crunch recently analyzed Roblox’s history and business in its EC-1, which you can read here (Extra Crunch membership required).

Photo credits: Ian Tuttle/Getty Images for Roblox

Powered by WPeMatico

Lucidworks raises $100M to expand in AI-powered search-as-a-service for organizations

If the sheer amount of information that we can tap into using the internet has made the world our oyster, then the huge success of Google is a testament to how lucrative search can be in helping to light the way through that data maze.

Now, in a sign of the times, a startup called Lucidworks, which has built an AI-based engine to help individual organizations provide personalised search services for their own users, has raised $100 million in funding. Lucidworks believes its approach can produce better and more relevant results than other search services in the market, and it plans to use the funding for its next stage of growth to become, in the words of CEO Will Hayes, “the world’s next important platform.”

The funding is coming from PE firm Francisco Partners and TPG Sixth Street Partners. Existing investors in the company include Top Tier Capital Partners, Shasta Ventures, Granite Ventures and Allegis Cyber.

Lucidworks has raised around $200 million in funding to date, and while it is not disclosing the valuation, the company says it has been doubling revenues each year for the last three and counts companies like Reddit, Red Hat, REI and the U.S. Census among some 400 others of its customers using its flagship product, Fusion. PitchBook notes that its last round in 2018 was at a modest $135 million, and my guess is that is up by quite some way.

The idea of building a business on search, of course, is not at all new, and Lucidworks works is in a very crowded field. The likes of Amazon, Google and Microsoft have built entire empires on search — in Google’s and Microsoft’s case, by selling ads against those search results; in Amazon’s case, by generating sales of items in the search results — and they have subsequently productised that technology, selling it as a service to others.

Alongside that are companies that have been building search-as-a-service from the ground up — like Elastic, Sumo Logic and Splunk (whose founding team, coincidentally, went on to found Lucidworks…) — both for back-office processes as well as for services that are customer-facing.

In an interview, Hayes said that what sets Lucidworks apart is how it uses machine learning and other AI processes to personalise those results after “sorting through mountains of data,” to provide enterprise information to knowledge workers, shopping results on an e-commerce site to consumers, data to wealth managers or whatever it is that is being sought.

Take the case of a shopping experience, he said by way of explanation. “If I’m on REI to buy hiking shoes, I don’t just want to see the highest-rated hiking shoes, or the most expensive,” he said.

The idea is that Lucidworks builds algorithms that bring in other data sources — your past shopping patterns, your location, what kind of walking you might be doing, what other people like you have purchased — to produce a more focused list of products that you are more likely to buy.

“Amazon has no taste,” he concluded, a little playfully.

Today, around half of Lucidworks’ business comes from digital commerce and digital content — searches of the kind described above for products, or monitoring customer search queries sites like Red Hat or Reddit — and half comes from knowledge worker applications inside organizations.

The plan will be to continue that proportion, while also adding other kinds of features — more natural language processing and more semantic search features — to expand the kinds of queries that can be made, and also cues that Fusion can use to produce results.

Interestingly, Hayes said that while it’s come up a number of times, Lucidworks doesn’t see itself ever going head-to-head with a company like Google or Amazon in providing a first-party search platform of its own. Indeed, that may be an area that has, for the time being at least, already been played out. Or it may be that we have turned to a time when walled gardens — or at least more targeted and curated experiences — are coming into their own.

“We still see a lot of runway in this market,” said Jonathan Murphy of Francisco Partners. “We were very attracted to the idea of next-generation search, on one hand serving internet users facing the pain of the broader internet, and on the other enterprises as an enterprise software product.”

Lucidworks, it seems, has also entertained acquisition approaches, although Hayes declined to get specific about that. The longer-term goal, he said, “is to build something special that will stay here for a long time. The likelihood of needing that to be a public company is very high, but we will do what we think is best for the company and investors in the long run. But our focus and intention is to continue growing.”

Powered by WPeMatico

India’s Reliance Jio inks deal with Microsoft to expand Office 365, Azure to more businesses; unveils broadband, blockchain and IoT platforms

India’s Reliance Jio, which has disrupted the local telecom and features phone markets in less than three years of existence, is ready to foray into many more businesses.

In a series of announcements Monday, which included a long-term partnership with global giant Microsoft, Reliance Jio said it will commercially roll out its broadband service next month; an IoT platform with ambitions to power more than a billion devices on January 1 next year; and “one of the world’s biggest blockchain networks” in the next 12 months — all while also scaling its retail and commerce businesses.

The broadband service, called Jio Fiber, is aimed at individual customers, small and medium-sized businesses as well as enterprises, Mukesh Ambani, chairman and managing director of Reliance Industries and Asia’s richest man, said at a shareholders’ meeting today.

The service, which is being initially targeted at 20 million homes and 15 million businesses in 1,600 towns, will start rolling out commercially starting September 5. Ambani said more than half a million customers have already been testing the broadband service, which was first unveiled last year.

The broadband service will come bundled with access to hundreds of TV channels and free calls across India and at discounted rates to the U.S. and Canada, Ambani said. The service, the cheapest tier of which will offer internet speeds of 100Mbps, will be priced at Rs 700 (~$10) a month. The company said it will offer various plans to meet a variety of needs, including those of customers who want access to gigabit internet speeds.

Continuing its tradition to woo users with significant “free stuff,” Jio, which is a subsidiary of India’s largest industrial house (Reliance Industries) said customers who opt for the yearly plan of its fiber broadband will be provided with the set-top box and an HD or 4K TV at no extra charge. Specific details weren’t immediately available. A premium tier, which will be available starting next year, will allow customers to watch many movies on the day of their public release.

The broadband service will bundle games from many popular studios, including Microsoft Game Studios, Riot Games, Tencent Games and Gameloft, Jio said.

Partnership with Microsoft

The company also announced a 10-year partnership with Microsoft to launch new cloud data centers in India to ensure “more of Jio’s customers can access the tools and platforms they need to build their own digital capability,” said Microsoft CEO Satya Nadella in a video appearance Monday.

Microsoft CEO Satya Nadella talks about the company’s partnership with Reliance Jio

“At Microsoft, our mission is to empower every person and every organization on the planet to achieve more. Core to this mission is deep partnerships, like the one we are announcing today with Reliance Jio. Our ambition is to help millions of organizations across India thrive and grow in the era of rapid technological change.”

“Together, we will offer a comprehensive technology solution, from compute to storage, to connectivity and productivity for small and medium-sized businesses everywhere in the country,” he added.

As part of the partnership, Nadella said, Jio and Microsoft will jointly offer Azure, Microsoft 365 and Microsoft AI platforms to more organizations in India, and also bring Azure Cognitive Services to more devices and in 13 Indian languages to businesses in the country. The solutions will be “accessible” to reach as many people and organizations in India as possible, he added. The cloud services will be offered to businesses for as little as Rs 1,500 ($21) per month.

The first two data centers will be set up in Gujarat and Maharashtra by next year. Jio will migrate all of its non-networking apps to the Microsoft Azure platform and promote its adoption among its ecosystem of startups, the two said in a joint statement.

The foray into broadband business and push to court small enterprises come as Reliance Industries, which dominates the telecom and retail spaces in India, attempts to diversify from its marquee oil and gas business. Reliance Jio, the nation’s top telecom operator, has amassed more than 340 million subscribers in less than three years of its commercial operations.

At the meeting, Ambani also unveiled that Saudi Arabia’s state-owned oil producer Aramco was buying a 20% stake in $75 billion worth Reliance Industries’ oil-to-chemicals business.

Like other Silicon Valley companies, Microsoft sees massive potential in India, where tens of millions of users and businesses have come online for the first time in recent years. Cloud services in India are estimated to generate a revenue of $2.4 billion this year, up about 25% from last year, according to research firm Gartner. Microsoft has won several major clients in India in recent years, including insurance giant ICICI Lombard.

Today’s partnership could significantly boost Microsoft’s footprint in India, posing a bigger headache for Amazon and Google.

Ambani also said Reliance Retail, the nation’s largest retailer, is working on a “digital stack” to create a new commerce partnership platform in India to reach tens of millions of merchants, consumers and producers. Ambani said Reliance Industries plans to list both Reliance Retail and Jio publicly in the next years.

“We have received strong interests from strategic and financial investors in our consumer businesses — Jio and Reliance Retail. We will induct leading global partners in these businesses in the next few quarters and move towards listing of both these companies within the next five years,” he said.

The announcement comes weeks after Reliance Industries acquired for $42.3 million a majority stake in Fynd, a Mumbai-based startup that connects brick and mortar retailers with online stores and consumers. Reliance Industries has previously stated plans to launch a new e-commerce firm in the country.

Without revealing specific details, Ambani also said that Jio is building an IoT platform to control at least one billion of the two billion IoT devices in India by next year. He said he sees IoT as a $2.8 billion revenue opportunity for Jio. Similarly, the company also plans to expand its blockchain network across India, he said.

“Using blockchain, we can deliver unprecedented security, trust, automation and efficiency to almost any type of transaction. And using blockchain, we also have an opportunity to invent a brand-new model for data privacy where Indian data, especially customer data is owned and controlled through technology by the Indian people an d not by corporate, especially global corporations,” he added.

Powered by WPeMatico

Vector’s launch business in peril after ‘major change in financing’

Small satellite launch startup Vector has indefinitely shut down operations “in response a major change in financing,” the company confirmed. Co-founder and CEO Jim Cantrell has also been cut loose as part of the upset.

The news comes as a surprise to the space startup community, and apparently to its employees. The company lined up $70 million in funding late last year, and recently was announced as a qualified contestant in DARPA’s Launch Challenge. It even pulled in a multi-million dollar Air Force contract just last week.

That something must have gone awry with this latest funding is manifest. But just what, or who, is unclear. I’m contacting the venture firms in the round (Kodem, Morgan Stanley Alternative Investment Partners, Sequoia, Lightspeed and Shasta Ventures) and will update if anyone has any substantial comment.

The company offered the following statement, as well as confirming that Cantrell is out.

In response to a major change in financing, Vector has had to pause its operations. A core team is now evaluating options to complete the development of the company’s Vector R small launch vehicle while also supporting the Air Force and other government agencies on programs such as the recent ASLON-45 award.

Vector has been working on an orbital launch vehicle, the Vector-R, with a 60 kilogram maximum payload — a small rocket for small satellites, for which there is plenty of demand. A heavier version that could lift 290 kg was also under development.

Plans were to demonstrate an orbital launch by the end of 2019, but as yet that has not occurred; a suborbital launch was also planned for sometime this summer, but that too is yet to happen.

Perhaps the launch delays were the cause of the funding problems, or perhaps the funding problems led to launch delays. I’ll update this story as soon as more details are available.

Powered by WPeMatico

Telegram introduces a feature to prevent users from texting too often in a group

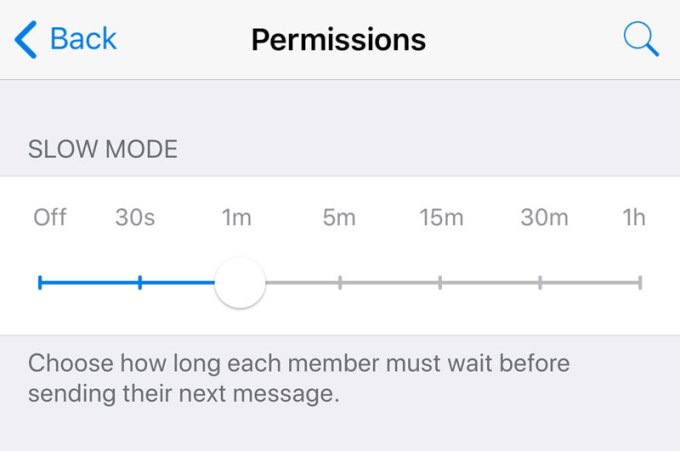

Telegram, a popular instant messaging app, has introduced a new feature to give group admins on the app better control over how members engage, the latest in a series of interesting features it has rolled out in recent months to expand its appeal.

The feature, dubbed Slow Mode, allows a group administrator to dictate how often a member could send a message in the group. If implemented by a group, members who have sent a text will have to wait between 30 seconds to as long as an hour before they can say something again in that group.

The messaging platform, which had more than 200 million monthly active users as of early 2018, said the new feature was aimed at making conversations in groups “more orderly” and raising the “value of each individual message.” It suggested admins to “keep [the feature] on permanently, or toggle as necessary to throttle rush hour traffic.”

Tech platforms including WhatsApp are grappling with containing the spread of misinformation on their messaging services. Though Telegram has largely been immune to such controversies, it has its fair share of issues.

WhatsApp has enforced limits on how often a user could forward a text message and is using machine learning techniques to weed out fraudulent users during the sign up procedure itself.

Shivnath Thukral, Director of Public Policy for Facebook in India and South Asia, said at a conference this month that virality of content has dropped by 25% to 30% on WhatsApp since the messaging platform imposed limits on forwards.

Telegram isn’t marketing the “Slow Mode” as a way to tackle the spread of false information, though. Instead, it says the feature would give users more “peace of mind.” Indeed, unlike WhatsApp, which allows up to 256 users to be part of a group, up to a whopping 200,000 users can join a Telegram group.

this new Telegram groups feature is so interesting pic.twitter.com/763mHGmZ0u

— freia lobo (@freialobo) August 10, 2019

On a similar tone, Telegram has also added an option that will enable users to send a message without invoking a sound notification at the recipient’s end. “Simply hold the Send button to have any message or media delivered without sound,” the app maker said. “Your recipient will get a notification as usual, but their phone won’t make a sound – even if they forgot to enable the Do Not Disturb mode.”

Telegram has also introduced a range of other small features such as the ability for group owners to add custom titles for admins. Videos on the app now display thumbnail previews when a user scrubs through them, making it easier to them to find the right moment. Like YouTube, users on Telegram too can now share a video that jumps directly at a certain timestamp. Users can also animate their emojis now — if they are into that sort of thing.

In June, Telegram introduced a number of location-flavored features to allow users to quickly exchange contact details without needing to type in digits.

Powered by WPeMatico

Startups Weekly: Angel vs. VC

Hello and welcome back to Startups Weekly, a weekend newsletter that dives into the week’s noteworthy startups and venture capital news. Before I jump into today’s topic, let’s catch up a bit. Last week, I wrote about DoorDash’s acquisition of Caviar, which no one saw coming. Before that, I jotted down some notes on SoftBank’s second Vision Fund.

Remember, you can send me tips, suggestions and feedback to kate.clark@techcrunch.com or on Twitter @KateClarkTweets. If you don’t subscribe to Startups Weekly yet, you can do that here.

What’s new?

Alternative funding mechanisms, like Clearbanc’s revenue share model, may be on the rise but most Silicon Valley startups still turn to venture capital to get their company off the ground. As I’ve previously said in this newsletter, VC spending in 2019 is reaching record-highs, already surpassing $62 billion. Angel investment, for its part, also continues to occupy a meaningful portion of private investment. So far this year, individual angels and angel groups in the U.S. have doled out $10 billion to startups.

Angel investors are not traditional venture capitalists bogged down by processes, quotas and fund economics. Rather, they’re deep-pocketed former operators (often) with expansive networks. For some, their capital is superior to VCs; for others, a VC’s ability to write larger checks and participate in additional fundings as their company grows makes VC the only viable option.

So how do early-stage startups decide who’s money to take (if they have that luxury)? Here’s what Jana Messerschmidt, both an investor at Lightspeed Venture Partners and a founding partner of the angel network #ANGELS, had to say: “It’s dependent on who the individual angel is, as well as who the individual partner is. In these frothier times, I encourage founders to interview investors who take a slot on their cap table with the same rigor they would a potential employee.”

What are the advantages and disadvantages of taking money from an established venture capital fund vs. an established angel investor?

— Kate Clark (@KateClarkTweets) August 6, 2019

Ben Ling, an early Facebook executive who spent years angel investing only to launch his own institutional venture capital fund, Bling Capital, tells TechCrunch the plus side of angel investors is that they are oftentimes less sensitive to valuations. Angels, while they can’t usually invest as much capital as a VC, tend to offer better terms and be approving of less rigid deal structures.

But being an investor isn’t an angel’s full-time job, typically. The limited amount of time an angel can give each company may be problematic for a founder seeking mentorship but a non-issue for a more experienced founder, who is simply seeking an individual passionate about her or his vision.

Given the rise in venture capital investment overall, more founders and former operators are running into wealth and opting to try on the VC hat for size. And more and more, those people are becoming professional investors with an appetite for a bigger pool of capital. Ling, as mentioned, decided last year to raise his first institutional fund, a $60 million effort, for example: “I think it’s rare for super angels to ‘beat’ firms for most regular financings but it certainly can happen,” Ling tells TechCrunch.

Presumably, that’s why he and many others (Cyan Banister, Keith Rabois, Ron Conway, James Currier) made the switch to “real” VC — to win over the best deals. As angels turn into VCs, whether your startup’s money came from one person’s wallet or an institutional fund matters a whole lot less. Just make sure you have good people investing in your company, and while you are it, make sure they’re diverse too.

That’s all for now… Onto the news.

WeWork IPO update

Bloomberg reported Friday that WeWork was expected to make its IPO filing available next week. Soon, we can all finally get an inside look at the co-working giant’s financials. A reminder, WeWork was last valued at an eye-popping $47 billion and it wants to raise some $3.5 billion in the IPO. Skeptical? Me too.

#Equitypod

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Equity co-host Alex Wilhelm and I discuss a new trend in venture capital: sperm storage startups. Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast and Spotify.

Big Deals

- FlixMobility is now worth $2B, plans to add cars to its network of buses and trains

- Proterra, the Tesla of electric buses, nears $1B valuation

- Klarna raises $460M, looks to expand its payment presence in the U.S.

- Cybereason nabs $200M for its enterprise security platform

- LanzaTech gets $72M to expand its carbon capture tech

Little Deals

- Keith Rabois, BoxGroup back New York-based Brex competitor

- Squad, the ‘anti-bro startup,’ lands $5M from First Round Capital

- Statespace picks up $2.5M to help gamers train

- Glow raises $2.3M to help podcasters make money

- Spaceflow, the tenant experience platform, scores $1.8M

M&A

Airbnb announced its acquisition of Urbandoor, a platform that offers extended stays to corporate clients, earlier this week. The terms of the deal were not disclosed, though an SEC filing connected with the deal emerged Friday, indicating the deal was worth more than $80 million in what’s likely a combination of cash and stock. We’ve got all the details on the deal here.

Healthtech & VC

Now it’s time for your weekly reminder to sign up for Extra Crunch. For a low price, you can learn more about the startups and venture capital ecosystem through exclusive deep dives, Q&As, newsletters, resources and recommendations and fundamental startup how-to guides. Here’s a passage from my personal favorite EC post of the week:

“Why is tech still aiming for the healthcare industry? It seems full of endless regulatory hurdles or stories of misguided founders with no knowledge of the space, running headlong into it, only to fall on their faces. Theranos is a prime example of a founder with zero health background or understanding of the industry — and just look what happened there! The company folded not long after founder Elizabeth Holmes came under criminal investigation and was barred from operating in her own labs for carelessly handling sensitive health data and test results…”

Read the rest of Sarah Buhr’s piece, ‘What leading healthtech VCs are interested in,’ here.

Just For Fun

- This charming little camera prints instantly to receipt paper [TechCrunch]

- How VCs Win Deals: Comic Books, Big Meals and Baked Goods [The Information]

- Sex And The Subway Ad [The New York Times]

- Car-sharing’s seedier side: Criminal activity linked to LimePods in Seattle [GeekWire]

Powered by WPeMatico

How a Swedish saxophonist built Kobalt, the world’s next music unicorn

You may not have heard of Kobalt before, but you probably engage with the music it oversees every day, if not almost every hour. Combining a technology platform to better track ownership rights and royalties of songs with a new approach to representing musicians in their careers, Kobalt has risen from the ashes of the 2000 dot-com bubble to become a major player in the streaming music era. It is the leading alternative to incumbent music publishers (who represent songwriters) and is building a new model record label for the growing “middle class’ of musicians around the world who are stars within niche audiences.

Having predicted music’s digital upheaval early, Kobalt has taken off as streaming music has gone mainstream across the US, Europe, and East Asia. In the final quarter of last year, it represented the artists behind 38 of the top 100 songs on U.S. radio.

Along the way, it has secured more than $200 million in venture funding from investors like GV, Balderton, and Michael Dell, and its valuation was last pegged at $800 million. It confirmed in April that it is raising another $100 million to boot. Kobalt Music Group now employs over 700 people in 14 offices, and GV partner Avid Larizadeh Duggan even left her firm to become Kobalt’s COO.

How did a Swedish saxophonist from the 1980s transform into a leading entrepreneur in music’s digital transformation? Why are top technology VCs pouring money into a company that represents a roster of musicians? And how has the rise of music streaming created an opening for Kobalt to architect a new approach to the way the industry works?

Gaining an understanding of Kobalt and its future prospects is a vehicle for understanding the massive change underway across the global music industry right now and the opportunities that is and isn’t creating for entrepreneurs.

This article is Part 1 of the Kobalt EC-1, focused on the company’s origin story and growth. Part 2 will look at the company’s journey to create a new model for representing songwriters and tracking their ownership interests through the complex world of music royalties. Part 3 will look at Kobalt’s thesis about the rise of a massive new middle class of popular musicians and the record label alternative it is scaling to serve them.

Table of Contents

- Early lessons on the tough road of entrepreneurship

- From band leader to music label founder

- Leaving music behind… but not for long

- So what exactly is Kobalt?

- The wind (finally) in Kobalt’s sails: music is booming again

- What Kobalt is today

- How I’ll assess Kobalt over the next two posts

Early lessons on the tough road of entrepreneurship

It’s tough to imagine a worse year to launch a music company than 2000. Willard Ahdritz, a Swede living in London, left his corporate consulting job and sold his home for £200,000 to fully commit to his idea of a startup collecting royalties for musicians. In hindsight, his timing was less than impeccable: he launched Kobalt just as Napster and music piracy exploded onto the mainstream and mere months before the dot-com crash would wipe out much of the technology industry.

The situation was dire, and even his main seed investor told him he was doomed once the market crashed. “Eating an egg and ham sandwich…have you heard this saying? The chicken is contributing but the pig is committed,” Ahdritz said when we first spoke this past April (he has an endless supply of sayings). “I believe in that — to lose is not an option.”

Entrepreneurial hardship though is something that Ahdritz had early experience with. Born in Örebro, a city of 100,000 people in the middle of Sweden, Ahdritz spent a lot of time as a kid playing in the woods, which also holding dual interests in music and engineering. The intersection of those two converged in the synthesizer revolution of early electronic music, and he was fascinated by bands like Kraftwerk.

Powered by WPeMatico

Adobe’s Amit Ahuja will be talking customer experience at TechCrunch Sessions: Enterprise

As companies collect increasingly large amounts of data about customers, the end game is about improving the customer experience. It’s a term we’re hearing a lot of these days, and we are going to be discussing that very topic with Amit Ahuja, Adobe’s vice president of ecosystem development, next month at TechCrunch Sessions: Enterprise in San Francisco. Grab your early-bird tickets right now — $100 savings ends today!

Customer experience covers a broad array of enterprise software and includes data collection, analytics and software. Adobe deals with all of this, including the Adobe Experience Platform for data collection, Adobe Analytics for visualization and understanding and Adobe Experience Cloud for building applications.

The idea is to begin to build an understanding of your customers through the various interactions you have with them, and then build applications to give them a positive experience. There is a lot of talk about “delighting” customers, but it’s really about using the digital realm to help them achieve what they want as efficiently as possible, whatever that means to your business.

Ahuja will be joining TechCrunch’s editors, along with Qualtrics chief experience officer Julie Larson-Green and Segment CEO Peter Reinhardt to discuss the finer points of what it means to build a customer experience, and how software can help drive that.

Ahuja has been with Adobe since 2005 when he joined as part of the $3.4 billion Macromedia acquisition. His primary role today involves building and managing strategic partnerships and initiatives. Prior to this, he was the head of Emerging Businesses and the GM of Adobe’s Data Management Platform business, which focuses on advertisers. He also spent seven years in Adobe’s Corporate Development Group, where he helped complete the acquisitions of Omniture, Scene7, Efficient Frontier, Demdex and Auditude.

Amit will be joining us on September 5 in San Francisco, along with some of the biggest influencers in enterprise, including Bill McDermott from SAP, Scott Farquhar from Atlassian, Aparna Sinha from Google, Wendy Nather from Duo Security, Aaron Levie from Box and Andrew Ng from Landing AI.

Early-bird savings end today, August 9. Book your tickets today and you’ll save $100 before prices go up.

Bringing a group? Book our 4+ group tickets and you’ll save 20% on the early-bird rate. Bring the whole squad here.

Powered by WPeMatico

Biotech researchers venture into the wild to start their own business

Much of Silicon Valley mythology is centered on the founder-as-hero narrative. But historically, scientific founders leading the charge for bio companies have been far less common.

Developing new drugs is slow, risky and expensive. Big clinical failures are all too common. As such, bio requires incredibly specialized knowledge and experience. But at the same time, the potential for value creation is enormous today more than ever with breakthrough new medicines like engineered cell, gene and digital therapies.

What these breakthroughs are bringing along with them are entirely new models — of founders, of company creation, of the businesses themselves — that will require scientists, entrepreneurs and investors to reimagine and reinvent how they create bio companies.

In the past, biotech VC firms handled this combination of specialized knowledge + binary risk + outsized opportunity with a unique “company creation” model. In this model, there are scientific founders, yes; but the VC firm essentially founded and built the company itself — all the way from matching a scientific advance with an unmet medical need, to licensing IP, to having partners take on key roles such as CEO in the early stages, to then recruiting a seasoned management team to execute on the vision.

Image: PASIEKA/SCIENCE PHOTO LIBRARY/Getty Images

You could call this the startup equivalent of being born and bred in captivity — where great care and feeding early in life helps ensure that the company is able to thrive. Here the scientific founders tend to play more of an advisory role (usually keeping day jobs in academia to create new knowledge and frontiers), while experienced “drug hunters” operate the machinery of bringing new discoveries to the patient’s bedside. This model’s core purpose is to bring the right expertise to the table to de-risk these incredibly challenging enterprises — nobody is born knowing how to make a medicine.

But the ecosystem this model evolved from is evolving itself. Emerging fields like computational biology and biological engineering have created a new breed of founder, native to biology, engineering and computer science, that are already, by definition, the leading experts in their fledgling fields. Their advances are helping change the industry, shifting drug discovery away from a highly bespoke process — where little knowledge carries over from the success or failure of one drug to the next — to a more iterative, building-block approach like engineering.

Take gene therapy: once we learn how to deliver a gene to a specific cell in a given disease, it is significantly more likely we will be able to deliver a different gene to a different cell for another disease. Which means there’s an opportunity not only for novel therapies but also the potential for new business models. Imagine a company that provides gene delivery capability to an entire industry — GaaS: gene-delivery as a service!

Once a founder has an idea, the costs of testing it out have changed too. The days of having to set up an entire lab before you could run your first experiments are gone. In the same way that AWS made starting a tech company vastly faster and easier, innovations like shared lab spaces and wetlab accelerators have dramatically reduced the cost and speed required to get a bio startup off the ground. Today it costs thousands, not millions, for a “killer experiment” that will give a founding team (and investors) early conviction.

What all this amounts to is scientific founders now have the option of launching bio companies without relying on VCs to create them on their behalf. And many are. The new generation of bio companies being launched by these founders are more akin to being born in the wild. It isn’t easy; in fact, it’s a jungle out there, so you need to make mistakes, learn quickly, hone your instincts, and be well-equipped for survival. On the other hand, given the transformative potential of engineering-based bio platforms, the cubs that do survive can grow into lions.

Image via Getty Images / KTSDESIGN/SCIENCE PHOTO LIBRARY

So, which is better for a bio startup today: to be born in the wild — with all the risk and reward that entails — or to be raised in captivity

The “bred in captivity” model promises sureness, safety, security. A VC-created bio company has cache and credibility right off the bat. Launch capital is essentially guaranteed. It attracts all-star scientists, executives and advisors — drawn by the balance of an innovative, agile environment and a well-funded, well-connected support network. I was fortunate enough to be an early executive in one of these companies, giving me the opportunity to work alongside industry luminaries and benefit from their well-versed knowledge of how to build a world-class bio company with all its complex component parts: basic, translational, clinical research, from scratch. But this all comes at a price.

Because it’s a heavy lift for the VCs, scientific founders are usually left with a relatively small slug of equity — even founding CEOs can end up with ~5% ownership. While these companies often launch with headline-grabbing funding rounds of $50m or above, the capital is tranched — meaning money is doled out as planned milestones are achieved. But the problem is, things rarely go according to plan. Tranched capital can be a safety net, but you can get tangled in that net if you miss a milestone.

Being born in the wild, on the other hand, trades safety for freedom. No one is building the company on your behalf; you’re in charge, and you bear the risk. As a recent graduate, I co-founded a company with Harvard geneticist George Church. The company was bootstrapped — a funding strategy that was more famine than feast — but we were at liberty to try new things and run (un)controlled experiments like sequencing heavy metal wildman Ozzy Osbourne.

It was the early, Wild West days of the genomics revolution and many of the earliest biotech companies mirrored that experience — they weren’t incepted by VCs; they were created by scrappy entrepreneurs and scientists-turned-CEO. Take Joshua Boger, organic chemist and founder of Vertex Pharmaceuticals: starting in 1989 his efforts to will into existence a new way to develop drugs, thrillingly captured in Barry Werth’s The Billion-Dollar Molecule and its sequel The Antidote in all its warts and nail-biting glory, ultimately transformed how we treat HIV, hepatitis C and cystic fibrosis.

Today we’re in a back-to-the-future moment and the industry is being increasingly pushed forward by this new breed of scientist-entrepreneur. Students-turned-founder like Diego Rey of in vitro diagnostics company GeneWEAVE and Ramji Srinivasan of clinical laboratory Counsyl helped transform how we diagnose disease and each led their companies to successful acquisitions by larger rivals.

Popular accelerators like Y Combinator and IndieBio are filled with bio companies driven by this founder phenotype. Ginkgo Bioworks, the first bio company in Y Combinator and today a unicorn, was founded by Jason Kelly and three of his MIT biological engineering classmates, along with former MIT professor and synthetic biology legend Tom Knight. The company is not only innovating new ways to program biology in order to disrupt a broad range of industries, but it’s also pioneering an innovative conglomerate business model it has dubbed the “Berkshire for biotech.”

Like the Ginkgo founders, Alec Nielsen and Raja Srinivas launched their startup Asimov, an ambitious effort to program cells using genetic circuits, shortly after receiving their PhDs in biological engineering from MIT. And, like Boger, renowned machine learning Stanford professor Daphne Koller is working to once again transform drug discovery as the founder and CEO of Instiro.

Just like making a medicine, no one is born knowing how to build a company. But in this new world, these technical founders with deep domain expertise may even be more capable of traversing the idea maze than seasoned operators. Engineering-based platforms have the potential to create entirely new applications with unprecedented productivity, creating opportunities for new breakthroughs, novel business models, and new ways to build bio companies. The well-worn playbooks may be out of date.

Founders that choose to create their own companies still need investors to scrub in and contribute to the arduous labor of company-building — but via support, guidance, and with access to networks instead. And like this new generation of founders, bio investors today need to rethink (and re-value) the promise of the new, and still appreciate the hard-earned wisdom of the old. In other words, bio investors also need to be multidisciplinary. And they need to be comfortable with a different kind of risk: backing an unproven founder in a new, emerging space. As a founder, if you’re willing to take your chances in the wild, you should have an investor that understands you, believes in you, can support you and, importantly, is willing to dream big with you.

Powered by WPeMatico