Phones, laptops and game consoles get tariff reprieve until December

Update: Trump confirmed to reporters that the delay is due to timing for the holiday shopping season. “We’re doing this for the Christmas season,” he said. “Just in case some of the tariffs would have an impact on U.S. customers.”

Electronics manufacturers are no doubt breathing a collective sigh of relief this morning at the news that the United States Trade Representative (USTR) has delayed tariffs on a number of categories.

A long list of exports, including livestock, foodstuff and clothing will have the additional 10% tariff imposed on September 1. Others, including “cell phones, laptop computers, video game consoles, certain toys, computer monitors, and certain items of footwear and clothing” have simply been delayed until December 15.

It seems the fees are an inevitability, but many might be able to scrape through just in time for the holidays.

“Certain products are being removed from the tariff list based on health, safety, national security and other factors and will not face additional tariffs of 10 percent,” the USTR writes. “Further, as part of USTR’s public comment and hearing process, it was determined that the tariff should be delayed to December 15 for certain articles.”

That list includes a wide range of electronics, from “telephones for cellular networks or for other wireless networks” to “telephone answering machines” and “cassette players (non‐recording) designed exclusively for motor‐vehicle installation.”

Stock prices for companies like Apple have already seen a positive bump following the news. The White House is expected to have additional trade talks with China next month in Washington, though President Trump has since cast some doubt.

Asked by reporters whether he might cancel the talks, the president answered, “Maybe. We’ll see what happens.”

Powered by WPeMatico

Clumio raises $51M to bring enterprise backup into the 21st century

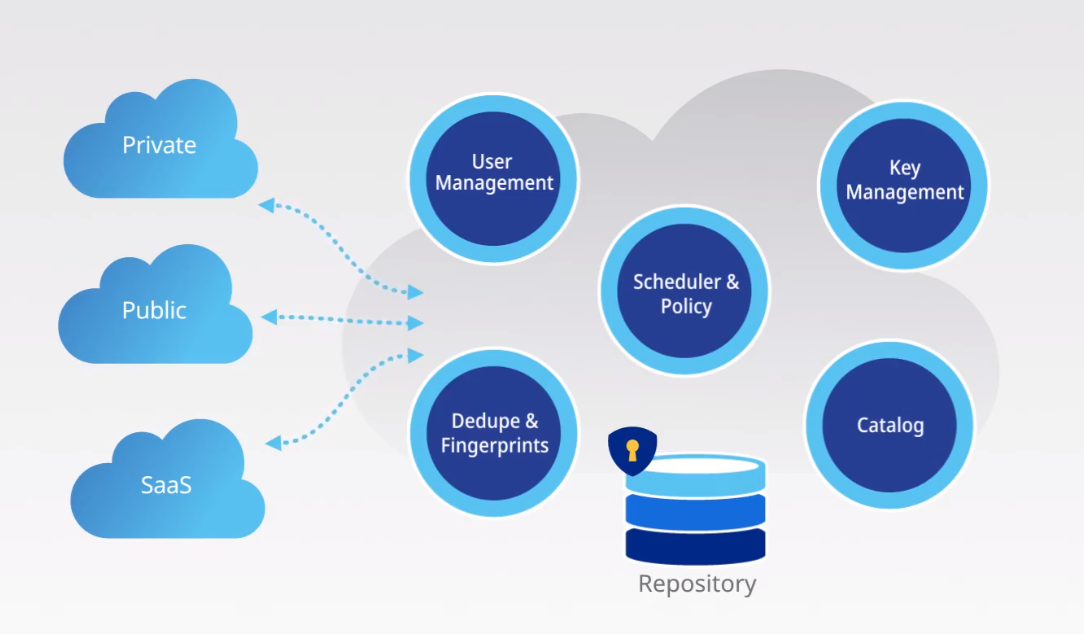

Creating backups for massive enterprise deployments may feel like a solved problem, but for the most part, we’re still talking about complex hardware and software setups. Clumio, which is coming out of stealth today, wants to modernize enterprise data protection by eliminating the on-premise hardware in favor of a flexible, SaaS-style cloud-based backup solution.

For the first time, Clumio also today announced that it has raised a total of $51 million in a Series A and B round since it was founded in 2017. The $11 million Series A round closed in October 2017 and the Series B round in November 2018, Clumio founder and CEO Poojan Kumar told me. Kumar’s previous company, storage startup PernixData, was acquired by Nutanix in 2016. It doesn’t look like the investors made their money back, though.

Clumio is backed by investors like Sutter Hill Ventures, which led the Series A, and Index Ventures, which drove the Series B together with Sutter Hill. Other individual investors include Mark Leslie, founder of Veritas Technologies, and John Thompson, chairman of the board at Microsoft .

“Enterprise workloads are being ‘SaaS-ified’ because IT can no longer afford the time, complexity and expense of building and managing heavy on-prem hardware and software solutions if they are to successfully deliver against their digital transformation initiatives,” said Kumar. “Unlike legacy backup vendors, Clumio SaaS is born in the cloud. We have leveraged the most secure and innovative cloud services available, now and in the future, within our service to ensure that we can meet customer requirements for backup, regardless of where the data is.”

In its current iteration, Clumio can be used to secure data from on-premise, VMware Cloud for AWS and native AWS service workloads. Given this list, it doesn’t come as a surprise that Clumio’s backend, too, makes extensive use of public cloud services.

The company says that it already has several customers, though it didn’t disclose any in today’s announcement.

Powered by WPeMatico

Samsung’s Note 10 game streaming arrives in early September

PlayGalaxy Link got fleetingly little stage time at last week’s Unpacked event. It’s true that Samsung had a lot of information to jam into the hour-long press conference, but the offering was glazed over during a brief segment on mobile gaming — a surprising choice given how big of an industry the category has become.

We got a little more information from the company by way of a quick “hands-on” video served through Samsung’s Korean video channel, but that’s about all we’ve heard. Here’s what we know to date: GamePlay Live is a streaming service that makes it possible to stream PC games to the Note 10.

We can now add that the service will be available as a downloadable app (for Android and Windows 10) at some point during the first two weeks of September. The service is free and leverages technology created by Parsec, a New York-based cloud gaming startup that we covered way back in late 2017. The company’s technology is being used in the PlayGalaxy app, allowing users to stream titles from a Windows PC with limited latency.

“It’s humbling and exciting to us to be the chosen partner to provide the low latency streaming technology that powers the PlayGalaxy Link application,” Parsec’s CEO and co-founder Benjy Boxer says in a release. “This further demonstrates that our market leading technology can form the core of any game streaming product. Providing our ultra low latency high frame rate streaming software and our proprietary networking to other companies furthers our mission to democratize access to games.”

The offering arrives as some of tech’s most prominent names are taking more active — although often distinct — interests in mobile gaming. Apple will be launching its arcade mobile gaming subscription service, while Google is offering full-on remote game streaming through Stadia. Microsoft, which recently announced a major partnership with Samsung, will provide similar console-to-mobile streaming with the Xbox.

Parsec, meanwhile, will be offering developer tools through a newly released SDK.

Powered by WPeMatico

DJI slims down and simplifies its smartphone gimbal

As we noted last month, DJI’s camera stabilizer line began life as an offshoot of the company’s drone offerings. Since then, however, it’s grown into a pretty massive portfolio in its own right, spanning from SLR to standalone pocket offerings.

For obvious reasons, the Osmo Mobile has been one of the more popular models. Designed for smartphone users, the product is among the most accessible DJI offerings, with out of the box operation for both iOS and Android users.

The company says it “went back to the drawing board” for the latest version of the handheld gimbal, but the Osmo Mobile 3 is really more of an evolution. The company took some customer feedback to heart and provided a handful of key changes. The new device is smaller and foldable, so users can much more easily toss it in a backpack. A DJI rep I spoke with suggested that it might fit in a pocket, but that’s a bit ambitious.

The other big piece of the puzzle is that DJI has made it a lot easier to operate the system with one hand. Most of the functions are executed using the back trigger or a combination of the front thumb buttons. There’s a new Quick Roll feature, which switches between landscape and portrait with the click of a button, while triple-clicking the trigger flips it into selfie mode. The trigger is also used to recenter the camera or lock into place.

There’s a bunch of software features borrowed from the company’s drones and the higher-end Ronin line, including Story Mode, Gesture Control, ActiveTrack, TimeLapse and HyperLapse. I didn’t really get much hands-on time with those, but we’ll be getting a review unit into the hands of our video team soon.

All in all, it looks like a nice little update. It’s also a bit cheaper, starting at $119 for the standard version and $139 for a bundle that includes a tripod. The Osmo Mobile 3 is available starting today.

Powered by WPeMatico

Rimeto lands $10M Series A to modernize the corporate directory

The notion of the corporate directory has been around for many years, but in a time of more frequent turnover and shifting responsibilities, the founders of Rimeto, a three-year-old San Francisco startup, wanted to update it to reflect those changes.

Today, the company announced a $10 million Series A investment from USVP, Bow Capital, Floodgate and Ray Dalio, founder of Bridgewater Associates.

Co-founder Ted Zagat says that the founders observed shifting workplace demographics and changes in the way people work. They believed it required a better way to locate people inside large organizations, which typically used homegrown methods or relied on Outlook or other corporate email systems.

“On one hand, we have people being asked to work much more collaboratively and cross-functionally. On the other, is an increasingly fragmented workplace. Employees really need help to be able to understand each other and work together effectively. That’s a real challenge for them,” Zagat explained.

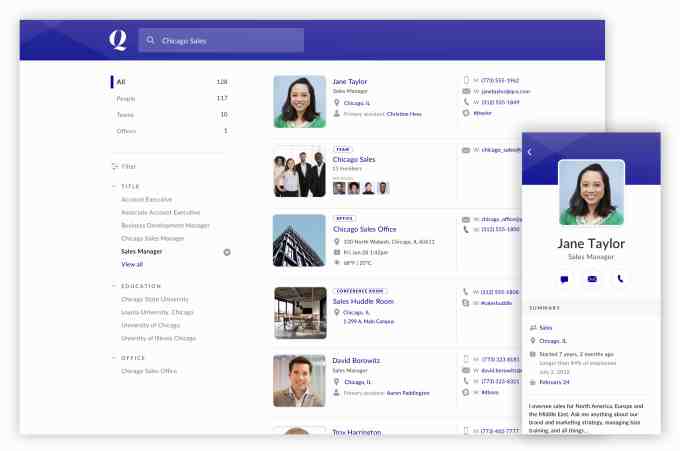

Rimeto has developed a richer directory by sitting between various corporate systems like HR, CRM and other tools that contain additional details about the employee. It of course includes a name, title, email and phone like the basic corporate system, but it goes beyond that to find areas of expertise, projects the person is working on and other details that can help you find the right person when you’re searching the directory.

Rimeto directory on mobile and web (Screenshot: Rimeto)

Zagat says that by connecting to these various corporate systems and layering on a quality search tool with a variety of filters to narrow the search, it can help employees connect to others inside an organization more easily, something that is often difficult to do in large companies.

The tool can be accessed via web or mobile app, or incorporated into a company intranet. It also could be accessed from a tool like Slack or Microsoft Teams.

The three founders — Zagat, Neville Bowers and Maxwell Hayman — all previously worked at Facebook. Unlike a lot of early-stage startups, the company has paying customers (although it won’t share exactly how many) and reports that it’s cash-flow positive. Up to this point, the three founders had bootstrapped the company, but they wanted to go out and raise some capital to begin to expand more rapidly.

Powered by WPeMatico

Blade raises $4.3M from Coinbase, SV Angel to reshape cryptocurrency derivatives trading

Exchanges like Coinbase have ballooned in size by taking the mechanics of equity markets and fitting them to cryptocurrency markets, but as the space expands in its scope and craftiness, new exchanges trading asset classes native to cryptocurrency are taking off and attracting the attention of top Silicon Valley VCs. Oh, and Coinbase, too.

Blade is a new cryptocurrency derivatives exchange launching in three weeks. Prior to starting the company, CEO Jeff Byun and his co-founder Henry Lee founded OrderAhead, a delivery startup platform that was eventually acquired in-part by Square in 2017. The pair’s newest company shares little in common with their previous venture, but they are bringing aboard some of the same investors to support them.

Blade is announcing that they’ve raised $4.3 million in seed funding from a host of investors, including Coinbase, SV Angel, A.Capital, Slow Ventures, Justin Kan and Adam D’Angelo.

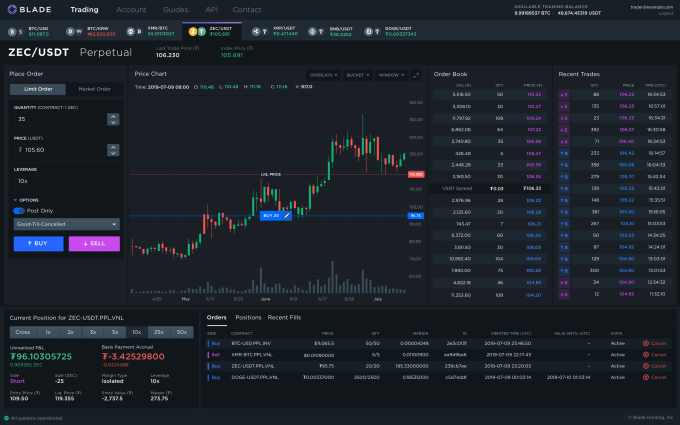

The exchange is tackling perpetual swap contracts.

Perpetuals are a crypto-native trading instrument that Byun says are “arguably the fastest growing segment of cryptocurrency trading.” They allow traders to bet on the future values of cryptocurrencies in relation to another and the instruments have no expiration dates, unlike fixed maturity futures. Traders can bet on how the price of Bitcoin can increase relative to USD, but they can also make bets relative to other altcoins like Monero, DogeCoin, Zcash, Ripple and Binance Coin. Here’s what’s on the Blade menu at the moment.

Blade’s noteworthy spins on perpetuals trading — compared to other exchanges — are that most of the contracts will be set up on simplified vanilla contracts, the perpetuals will also be margined/settled in USD Tether and the company is offering higher leverages (up to 150x on BTC-USD and BTC-KRW) on trades.

Blade is raising funds from Silicon Valley’s VCs, but U.S. investors won’t be legally able to participate in the exchange. U.S. government agencies have been a bit more stringent in regulating cryptocurrencies, so there’s more trading activity taking place on exchanges outside the jurisdiction. Blade itself is an offshore entity with a U.S. subsidiary; its primary market is East Asia.

“It’s kind of a bifurcated market,” Byun tells TechCrunch. “Either you have exchanges like Coinbase or Gemini or Bitrex that cater to the U.S. market that are highly regulated or the exchanges that cater to the non-U.S. market that are much less regulated, but that’s where most of the volume is.”

While the company is still three weeks away from launch, the founders have bold ambitions.

“In the long term, we want to be the CME (Chicago Mercantile Exchange) of crypto,” Byun tells me. “Coinbase and Binance are building this foundational structure for crypto, but I think we are too and in a sense that derivatives are at their core about risk transfer, we want to be building the foundational layer for risk transfer in the crypto markets.”

Powered by WPeMatico

London edtech startup pi-top sees layoffs after major contract loss

London-based edtech startup pi-top has cut a number of staff, TechCrunch has learned.

According to our sources, the company has reduced its headcount in recent weeks, with staff being told cuts are a result of restructuring as it seeks to implement a new strategy.

One source told us pi-top recently lost out on a large education contract.

Another source said sales at pi-top have been much lower than predicted — with all major bids being lost.

Pi-top confirmed to TechCrunch that it has let staff go, saying it has reduced headcount from 72 to 60 people across its offices in London, Austin and Shenzhen.

Our sources suggest the total number of layoffs could be up to a third.

In a statement, pi-top told us:

pi-top has become one of the fastest growing ed-tech companies in the market in 4.5 years. We have a unique vision to increase access to coding and technical education through project based learning to inspire a new generation of makers.

As part of this vision we built up our global team with a view to winning a particularly exciting national project in a developing nation, where we had a previous large scale successful implementation. We were disappointed this tender ultimately fell through due to economic factors in the region and have subsequently made the unfortunate but unavoidable decision to reduce our team size from 72 to 60 people across our offices in London, Austin and Shenzhen.

Moving forward we are focusing on our growth within the USA where we continue to enjoy widespread success. We are rolling out our new learning platform pi-top Further which will enable schools everywhere to access a world of content enhanced by practical hands-on project based learning outcomes. We have recently completed a successful Kickstarter campaign and we look forward to releasing our newest product pi-top [4].

We are also proud to have appointed Stanley Buchesky as our new Executive Chairman. Stanley brings a wealth of experience in the ed-tech sector and will be a great asset to our strategy going forward.

Pi-top sells hardware and software designed for educational use in schools. It’s one of a large number of edtech startups that have sought to tap into the popularity of the “learn to code” movement by piggybacking atop the (also British) low-cost Raspberry Pi microprocessor — which provides the computing power for all pi-top’s products.

Pi-top adds its own OS and additional education-focused software to the Pi, as well as proprietary cases — including a bright green laptop housing with a built-in rail for breadboarding electronics.

Its most recent product, the pi-top 4, which was announced back in January, looks intended to move the company away from its first focus on educational desktop computing to more modular and embeddable hardware hacking that could be used by schools to power a wider variety of robotics and electronics projects.

Despite raising $16M in VC funding just over a year ago, pi-top opted to run a crowdfunding campaign for the pi-top 4 — going on to raise almost $200,000 on Kickstarter from 521 backers.

Pi-top 4 backers have been told to expect the device to ship in November.

Powered by WPeMatico

Postmates to drop IPO filing next month

Postmates plans to make its IPO paperwork public in September, TechCrunch has learned. Despite previous reports indicating the on-demand delivery company is seeking an M&A exit, sources close to the matter say Postmates is on track to go complete an initial public offering this year.

With the S-1 dropping in September, San Francisco-based Postmates is expected to debut on the stock exchange by the end of the third fiscal quarter of 2019. The company has tapped JP Morgan Chase and Bank of America Corp. as lead underwriters, Bloomberg previously reported, though other details of the float, including the size and price range of the proposed offering, have yet to be announced.

“We can’t comment on the IPO process and we don’t comment on rumor or speculation,” a Postmates spokesperson told TechCrunch.

In February, Postmates confidentially filed with the U.S. Securities and Exchange Commission for an IPO. Shortly after, Postmates held M&A talks with DoorDash, another food delivery unicorn, according to people familiar with the matter, but failed to come to mutually favorable terms. DoorDash declined to comment for this story.

Postmates has raised $681 million to date with its latest round coming in earlier this year at a $1.85 billion valuation. DoorDash, on the other hand, reached a $12.6 billion valuation in May with a $600 million Series G.

As Postmates gears up for its IPO, the food delivery business continues to consolidate. DoorDash last week purchased another food delivery service, Caviar, from Square in a deal worth $410 million. Uber is said to have considered buying Caviar, which had been looking for a buyer at least since 2016, according to Bloomberg.

DoorDash has been under heavy scrutiny as of late for the way it pays its drivers. Back in February, we reported how DoorDash offsets the amount it pays drivers with tips from customers. It wasn’t until after much backlash that DoorDash finally said it would change its policies. DoorDash has yet to implement the new policy.

How Postmates will fare on the public markets is up for debate. The billion-dollar company will go head-to-head with other public businesses in the space, including powerhouses Uber and Grubhub.

Uber last week shared disappointing second-quarter earnings. The company’s food delivery unit, UberEats, however, continues to grow at an impressive rate. UberEats did $3.39 billion in gross bookings last quarter with monthly active platform consumers (MAPCs) growing more than 140% year-over-year. Still, the unit is years away from profitability, Uber chief Dara Khosrowshahi told CNBC on Thursday.

Postmates’ updated IPO plans follow a report from Bloomberg that WeWork expects to make its IPO prospectus available in the next week. Eyes will be on both WeWork, which hopes to raise more than $3.5 billion, and Postmates, as the companies occupy two unproven categories.

Postmates follows Uber, Lyft, Pinterest and many others to the public markets in 2019, a year when many of Silicon Valley’s most notable unicorns finally decided to make the transition from private to public.

Postmates, founded in 2011 by Bastian Lehmann, is backed by Spark Capital, Founders Fund, Uncork Capital, Slow Ventures, Tiger Global, Blackrock and others.

Powered by WPeMatico

Polarity raises $8.1M for its AI software that constantly analyzes employee screens and highlights key info

Reference docs and spreadsheets seemingly make the world go ’round, but what if employees could just close those tabs for good without losing that knowledge?

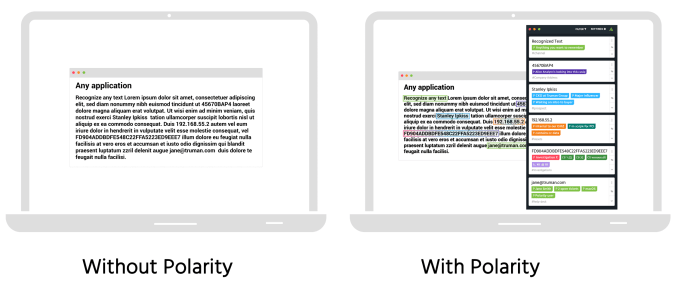

One startup is taking on that complicated challenge. Predictably, the solution is quite complicated, as well, from a tech perspective, involving an AI solution that analyzes everything on your PC screen — all the time — and highlights text onscreen for which you could use a little bit more context. The team at Polarity wants its tech to help teams lower the knowledge barrier to getting stuff done and allow people to focus more on procedure and strategy than memorizing file numbers, IP addresses and jargon.

The Connecticut startup just closed an $8.1 million “AA” round led by TechOperators, with Shasta Ventures, Strategic Cyber Ventures, Gula Tech Adventures and Kaiser Permanente Ventures also participating in the round. The startup closed its $3.5 million Series A in early 2017.

Interestingly, the enterprise-centric startup pitches itself as an AR company, augmenting what’s happening on your laptop screen much like a pair of AR glasses could.

The startup’s computer vision software that uses character recognition to analyze what’s on a user’s screen can be helpful for enterprise teams importing things like a company Rolodex so that bios are always collectively a click away, but the real utility comes from team-wide flagging of things like suspicious IP addresses that will allow entire teams to learn about new threats and issues at the same time without having to constantly check in with their co-workers. The startup’s current product has a big focus on analysts and security teams.

via Polarity

Using character recognition to analyze a screen for specific keywords is useful in itself, but that’s also largely a solved computer vision problem.

Polarity’s big advance has been getting these processes to occur consistently on-device without crushing a device’s CPU. CEO Paul Battista says that for the average customer, Polarity’s software generally eats up about 3-6% of their computer’s processing power, though it can spike much higher if the system is getting fed a ton of new information at once.

“We spent years building the tech to accomplish [efficiency], readjusting how people think of [object character recognition] and then doing it in real time,” Battista tells me. “The more data that you have onscreen, the more power you use. So it does use a significant percentage of the CPU.”

Why bother with all of this AI trickery and CPU efficiency when you could pull this functionality off in certain apps with an API? The whole deliverable here is that it doesn’t matter if you’re working in Chrome, or Excel or pulling up a scanned document, the software is analyzing what’s actually being rendered onscreen, not what the individual app is communicating.

When it comes to a piece of software analyzing everything on your screen at all times, there are certainly some privacy concerns, not only from the employee’s perspective but from a company’s security perspective.

Battista says the intent with this product isn’t to be some piece of corporate spyware, and that it won’t be something running in the background — it’s an app that users will launch. “If [companies] wanted to they could collect all of the data on everybody’s screens, but we don’t have any customers doing that. The software is built to have a user interface for users to interact with so if the user didn’t choose to subscribe or turn on a metric, then [the company] wouldn’t be able to force them to collect it in the current product.”

Battista says that teams at seven Fortune 100 companies are currently paying for Polarity, with many more in pilot programs. The team is currently around 20 people and with this latest fundraise, Battista wants to double the size of the team in the next 18 months as they look to scale to larger rollouts at major companies.

Powered by WPeMatico

Huawei’s new OS isn’t an Android replacement… yet

If making an Android alternative was easy, we’d have a lot more of them. Huawei’s HarmonyOS won’t be replacing the mobile operating system for the company anytime soon, and Huawei has made it pretty clear that it would much rather go back to working with Google than go it alone.

Of course, that might not be an option.

The truth is that Huawei and Google were actually getting pretty chummy. They’d worked together plenty, and according to recent rumors, were getting ready to release a smart speaker in a partnership akin to what Google’s been doing with Lenovo in recent years. That was, of course, before Huawei was added to a U.S. “entity list” that ground those plans to a halt.

Powered by WPeMatico