Would you rent out your living room for a few hours? This startup is counting on it

Recharge, a startup that tried convincing hotels to let its customers rent their rooms by the hour and even minute, has revamped and rebranded. Now Globe, the company is hoping to convince guests to sign up for short stays instead in people’s homes so that they can kick back between other commitments, and, if the host allows it, to shower and nap.

It’s at once crazy sounding and intriguing, which is perhaps why the popular accelerator program Y Combinator accepted the company into its most recent class of companies. (It shows off its newest batch of startups next week.) YC was famously early to spy the opportunity that Airbnb could chase, after all. The question is whether Globe, which likens itself to an Airbnb for day breaks, will have anywhere near the same appeal.

Its proposition is certainly similar. Home owner or renter wrings out some extra income by renting out all or part of their home, except that unlike with Airbnb, where the minimum stay is at least one night, with Globe, a host rents out his or her space for smaller increments of time.

In a world where the economic divide continues to grow between the haves and have-nots, it’s easy to see the logic in maximizing an underutilized asset — even one’s living room — in order to live more comfortably. It’s especially easy to see the logic in prohibitively expensive cities like San Francisco and New York.

At the same time, letting in a stranger — even a “businessperson” — for a shorter period of time is not going to be a no-brainer for many people who might otherwise rent their home while away for a weekend. And on the other side of the marketplace, getting enough hosts with nice enough places to become hosts is a high hurdle for Globe to surmount. After all, if someone is looking for an alternative to Starbucks for a few hours, and that individual has to take some form of transportation to get to a host’s couch that may or may not be as nice as pictured, that individual may well go the coffee shop route instead. (The company is also up against startups like Breather that offer hourly or daily “space as a service.”)

Founder Manny Bamfo appreciates the challenge, he says. In fact, after running Recharge for a couple of years, he’s gotten well-acquainted with adversity.

Though he says that Recharge wound up seeing $4 million in revenue from its hotel partners, renting rooms to Recharge customers “wasn’t their number one priority, and that made it hard to provide a consistent experience for our customers.” Bamfo suggests their “unionized cleaning labor” wasn’t excited at the prospect of cleaning rooms more frequently than once daily, either, which is partly why Recharge decided to relaunch as a home-sharing service instead.

It’s not just a branding exercise. Along with the new name, Globe is starting from scratch with a new cap table, though Bamfo says Globe opened up a small round for previous investors that was “oversubscribed instantly.” Recharge had raised $10 million from investors. (One of these backers was Binary Capital, which has since evolved into little more than a tangle of lawsuits. Another backer was the real estate-focused firm Fifth Wall Ventures, which maintains a small stake in the new company, says Bamfo.)

In the meantime, Globe is looking to “do a proper seed round at [YC’s] Demo Day.” And it’s busy spreading the word in an effort to build up its burgeoning new marketplace of homes and apartments for rent, and advertising a rate of $50 per hour to people who host their entire home by the hour and $25 per hour to those who share less room.

Globe keeps 20% of the fee.

Globe is also promising $1 million in general liability insurance and, for now, guests who have been verified and vetted by Bamfo himself. It’s not a scalable solution, he acknowledges, but at the moment, he says, it’s all about building the right community, and he sounds optimistic, of course, about its odds.

“People view it like selling a lamp on Craigslist. ‘If it’s not much work, and it’s another form of income, I’ll do it,’” he says. The reality are a “lot of people with great jobs living in cities that are very expensive — people who are cops, who are teachers, who aren’t quite making six figures, and any extra income is a godsend.”

It all begs the question of why, if it’s such a big opportunity, Airbnb isn’t already it. Bamfo’s answer is that it’s basic time management, as well as a different market. “For any company to do this well, it has to be their number one priority.” Besides, he adds, Airbnb is “a travel company. We’re localized, with the ability to charge on a minute-by-minute basis. It’s a huge engineering undertaking and, for now, it’s part of our moat, too.”

Powered by WPeMatico

Confidence: The currency of acceleration

Contributor

Imagine you’re a billionaire starting a new company. You’re happy to bet your entire fortune on it. As a result, capital is no constraint. How fast should you burn money?

You probably wouldn’t use the generic startup math of dividing your available capital by 18 months and burn $55.5 million a month — though it would be fun. So if capital is no longer the currency that determines how fast you go, what should?

It’s confidence, not capital, that should be the currency of acceleration at a startup — no matter if you have a million dollars or a billion dollars to burn.

Confidence is often misunderstood by those who feign it. It is not bluster or arrogance. It’s not “trusting your gut.” Competitors raising big rounds of funding shouldn’t change your level of confidence one way or the other unless they’re doing exactly what you are. Glowing press coverage helps team morale, but it shouldn’t color your assessment of readiness to scale up.

It’s also important to note that venture capital interest is a terrible proxy for founder confidence. VCs have different structural incentives than founders; in an easy money environment, placing a big bet in a hot category, backed by a good enough team, is a job well done for a VC. Remember that they have a portfolio of companies, you’ve just got the one.

So what should drive you to scale up spend? There’s no perfect answer, but if you consistently see strong customer response to your product, marketing delivering more qualified leads for less money, sales channels becoming better instrumented and more efficient, LTV expanding with product improvements and lower churn thanks to your customer success team, you’re probably in good position to accelerate investment.

Too many startups feel pressure to spend money based on hope, not confidence.

Compounding successes at all levels of the business should provide data points that give you the determination to plan out a more ambitious trajectory. The requirement for confidence shouldn’t be mistaken for conservatism. Startups need to take risks in order to thrive, but they should be calculated, not capricious. There is a limited speed any company should go based on what they’ve learned to date about their market and offering.

If you have a high degree of confidence that you can turn $1 into $2, or $10, you should invest immediately. If you don’t have that confidence, you should spend time, but limited capital, to build it. Unfortunately, too many startups feel pressure to spend money based on hope, not confidence.

Authentic growth

Startups appreciate in value through growth. This isn’t just another VC mantra: even bootstrapped startups or public companies become more valuable when they grow faster. Two $10 million companies where one is growing at 80% and the other 20% will be valued very differently. Even if the slower-growth company is generating some limited cash flow and the high-growth company is burning within reason, the high-growth company will usually be worth much more.

So given that growth drives value, why shouldn’t every startup grow as quickly as it possibly can? With capital in hand, why not spend to generate more growth and therefore more value?

Capital without confidence shouldn’t dictate a startup’s acceleration.

Shattered confidence kills startups

Companies that misuse capital as the driver of acceleration cause irreparable harm to confidence. When a company over-accelerates and misses, it takes a painful amount of time to observe the mistake, admit the mistake, correct the mistake and rebuild confidence with the team and investors that you won’t repeat the mistake. Eventually, the company must undertake the inevitable process of taking a huge step back to try to rebuild that faith. This requires going much slower than a similar company that has never faltered.

If you spend a small amount of money on a pilot and it fails, you’ve helped home in on what your product should be, and you’ve not burnt any credibility with your team or investors. Spend 10 times that amount and you’ll have no more confidence in what to do next, far less credibility and a diminished balance sheet. Worst yet, the next time you want to lean in on a major initiative, the lack of confidence of key stakeholders will likely overwhelm what may well be the right decision.

Three startup currencies: Confidence, credibility and capital

Companies create value by compounding learning and therefore compounding confidence in their future. As confidence grows, companies will earn credibility inside the management team and with investors. Once you have both, it usually gets easier and easier to find the right amount of capital needed to fuel that confidence. Confidence is the most important currency, followed closely by credibility, and only then, cash. By way of contrast, driving up revenue artificially by burning capital with low return on investment is not sustainable and does not create long-term value. This will ultimately damage confidence and credibility.

You can buy confidence with capital, but it’s rate-limited and there’s no benefit to scale

Arguably, there should be little difference between the acceleration of two competitive companies that have the same amount of confidence but radically different capitalizations. If both are early-stage startups and one company has $10 million in cash and the other has $1 billion, they should spend their money with the same principle in mind: what does it cost to build confidence that our most important experiments are working?

Authentic confidence is the only real winning weapon at a startup.

For a company with a million dollars, this may mean hiring a single inside sales rep to test out a direct channel based on some early successes with a specific type of customer. A company with a billion dollars will likely make the mistake to open global offices to meet international demand, without first validating that they can make that single inside sales rep successful. In both cases, the confidence of the management team and their ability to execute should be driving the decision, not the available capital.

Credibility is earned, not purchased

If you spend like you’re headed to $20 million ARR and only hit $10 million ARR, your business is in a very difficult position. Not only because you sustained large losses, but also because you’ve damaged confidence in execution — team members and investors won’t believe in the company’s ability to achieve the target the next time it wants to hit the gas pedal hard.

Conversely, If you confidently hit $10 million in sales and have sight lines to $20 million, you will not struggle to raise more money to achieve your goals. The more the management team meets its goals, the more confidence grows and the pace of acceleration can be increased. Compound confidence and acceleration is boundless.

One of the biggest mistakes of the startup community, fueled by an overcapitalized venture market and an overhyped argument about winner takes all market dynamics, is the belief that capital is a weapon that will win the startup wars.

Authentic confidence is the only real winning weapon at a startup. Capital can fuel that weapon, but when used without confidence, it usually becomes a weapon of self-destruction.

Powered by WPeMatico

Y Combinator bets on a startup building a weed breathalyzer for cops

Y Combinator has kept an eye on cannabis startups over the years, but it’s their latest investment that’s sure to attract the attention of both marijuana users and law enforcement.

SannTek Labs, which is launching with new funding out of Y Combinator’s latest jumbo class of startups, is building a new kind of breathalyzer that can detect blood-alcohol levels but can also determine how much cannabis a person has smoked or otherwise consumed in the past 3-4 hours.

CEO Noah Debrincat say that he wants the startup’s SannTek 315 breath testing device to help officers make stronger “evidence-based decisions” rather than only relying on unsophisticated roadside sobriety tests or blood tests, which can potentially take months to get results for and can lead to false positives by detecting cannabis use that took place several days prior to the test.

The SannTek breathalyzer detects the cannabis molecules in your breath, and gives a police officer a readout that lets them know if you have the drug in your system.

“We are specifically detecting Delta-9 THC, which is the predominant psychoactive component of cannabis,” Debrincat tells TechCrunch. “We understand how that gets into your breath. We understand what it does to you and the impairing side effects. And we know that if people are driving with high concentrations of that in their system, their psycho-motor skills are seriously decreased.”

A young startup building a device that could lead to people being arrested is obviously a pretty high-stakes situation, but Debrincat says they are confident in the tech and there are certifications that they’ll need in order to get the device into law enforcement hands. “The only way that a police officer will buy this is if NHTSA, the National Highway Transportation Safety Association, puts its stamp of approval on it,” Debrincat says, noting that SannTek is already in talks with the agency.

If it’s adopted, the startup’s device will be able to be used pre-arrest to give the officer a number indication of a driver’s impairment, or as SannTek further hones their device, the breathalyzer could be used for post-arrest evidentiary testing back at the precinct in a more controlled environment.

A Canadian startup building a device for U.S. law enforcement isn’t the most popular position, given many of the conversations around systemic discriminatory practices that result in higher police presence in communities of color. But Debrincat hopes that the company’s device can be part of a positive shift due to the greater objectivity it promotes and its tighter window of detection.

“The state of affairs currently is that there’s a bunch of misdemeanor charges for small weed crimes that are happening across America and one way to address that is by federally decriminalizing the drug, sure,” Debrincat says. “But what gives police officers power now is the ability to make a call because there is no [breathalyzer] device.”

There are reasons to be concerned for law enforcement getting a tool that could be used discriminately, but Debrincat says there is also plenty of reason to be concerned for the other drivers that are on the road while cannabis users might be driving impaired. The CEO tells me that drivers are 2x as likely to get into an accident while operating vehicles under the influence of cannabis. Other studies reinforce the risks of driving while high.

The company wants to keep the price of their device low enough that precincts across the U.S. can easily afford them; right now Debrincat says the startup is shooting for the $800-$1,000 range to stay competitive with other options out there.

Powered by WPeMatico

Xiaomi tops Indian smartphone market for eighth straight quarter

Xiaomi has now been India’s top smartphone seller for eight straight quarters. The company has become a constant headache for Samsung in the world’s second largest smartphone market as sales have slowed pretty much everywhere else in the world.

The Chinese electronics giant shipped 10.4 million handsets in the quarter that ended in June, commanding 28.3% of the market, research firm IDC reported Tuesday. Its closest rival, Samsung — which once held the top spot in India — shipped 9.3 million handsets in the nation during the same period, settling for a 25.3% market share.

Overall, 36.9 million handsets were shipped in India during the second quarter of this year, up 9.9% from the same period last year, IDC reported. This was the highest volume of handsets ever shipped in India for Q2, the research firm said.

As smartphone shipments slow or decline in most of the world, India has emerged as an outlier that continues to show strong momentum as tens of millions of people purchase their first handset in the country each quarter.

Research firm Counterpoint told TechCrunch that there are about 450 million smartphone users in India, up from about 350 million late last year and 300 million in late 2017. This growth has made India, home to more than 1.3 billion people, the fastest growing market worldwide.

Globally, meanwhile, smartphone shipments declined by 2.3% year-over-year in Q2 2019, according to IDC.

Chinese phone makers Vivo and Oppo, both of which spent lavishly in marketing during the recent local favorite cricket season in India, also expanded their base in the country. Vivo had 15.1% of the local market share, up from 12.6% in Q2 2018, while Oppo’s share grew from 7.6% to 9.7% during the same period. The market share of Realme, which has gained following after it started to replicate some of Xiaomi’s early models, also shot up, moving from 1.2% in Q2 2018 to 7.7% in Q2 2019.

Samsung showroom demonstrator seen showing the features of new S10 Smartphone during the launching ceremony (Photo by Avishek Das/SOPA Images/LightRocket via Getty Images)

The key to gaining market share in India has remained unchanged over the years: better specs at lower prices. The average selling price of a handset during Q2 was $159 in the quarter that ended in June this year. Seventy-eight percent of the 36.9 million phones that shipped in India during this period sported a sticker price below $200, IDC said.

That’s not to say that phones priced above $200 don’t have a market in India. Per IDC, the fastest growing smartphone segment in the nation was priced between $200 to $300, witnessing a 105.2% growth over the same period last year.

Smartphones priced between $400 and $600 were the second-fastest growing segment in the country, with a 16.1% growth since the same period last year. Chinese phone maker OnePlus assumed 63.6% of this premium segment, followed by Apple (which has less than 2% of the overall local market share) and Samsung.

Feature phones that have maintained a crucial position in India’s handsets market continue to maintain their significant footprint, though their popularity is beginning to wane — 32.4 million feature phones shipped in India during Q2 this year, down 26.3% since the same period last year.

Xiaomi versus Samsung

India has become Xiaomi’s biggest market. It entered the country five years ago, and for the first two, relied mostly on selling handsets online to cut overhead. But the company has since established and expanded its presence in the brick and mortar market, which continues to account for much of the sales in the country.

Earlier this month, the Chinese phone maker said it had set up its 2,000th Mi Home store in India. It is on track to have a presence in 10,000 physical stores in the country by the end of the year, and expects to see half of its sales come from the offline market by that time frame.

Samsung has stepped up its game in India in the last two years, as well. The company, which opened the world’s largest phone factory in the country last year, has ramped up productions of its Galaxy A series of smartphones that are aimed at budget-conscious customers and conceptualized a similar series that includes Galaxy M10, M20 and M30 smartphone models for the Indian market. The Galaxy A series handsets drove much of the growth for the company, IDC said.

Even as it lags behind Xiaomi, Samsung shipped more handsets in Q2 2019 compared to Q2 2018 (9.3 million versus 8 million) and its market share grew from 23.9% to 25.3% during the same period.

“The vendor was also offering attractive channel schemes to clear the stocks of Galaxy J series. Galaxy M series (exclusive online till the end of 2Q19) saw price reductions, which helped retain the 13.5% market share in the online channel in 2Q19 for Samsung,” IDC said.

But the South Korean giant continues to have a tough time passing Xiaomi, which continues to maintain low profit margins (Xiaomi says it only makes 5% profit on any hardware it sells). Xiaomi has also expanded its local production efforts in India and created more than 10,000 jobs in the country, more than 90% of which have been filled by women.

Powered by WPeMatico

The secret of content marketing: avoid high bounce rates

Advice on content marketing always talks about getting people to your blog.

But, what about once they’re there — how do you get them to then buy from you?

That’s the conversion half of content marketing, and that’s what I’ll cover: converting your readers into paying customers.

First, they read. Then, they buy.

When visitors arrive on your blog, three things should happen:

- First, they must start reading — instead of bouncing.

- Next, keep should keep reading until at least halfway through.

- Finally, they should be enticed to read more or convert: sign up, subscribe, purchase, etc.

Demand Curve’s data shows that when readers complete this full chain of events — as opposed to skipping step #2 — they’re more likely to ultimately buy from you.

Why? People trust your brand more after they’ve consumed your content and deemed you to be high quality and authoritative.

We’ve optimized tens of millions of blog impressions, and we have three novel insights to share in this post. Each will hopefully help compel readers to stick around and buy.

Let’s conquer high bounce rates — the bane of content marketers.

Entice visitors to start reading

First, some obvious advice: Getting visitors to read begins with having a strong intro.

A good intro buys goodwill with readers so they keep reading — and tolerate your boring parts.

There are three components to a good intro:

- Have a hook. Read about hooks here.

- Skip self-evident fluff. Read about succinctness here.

- Tease your subtopics to reassure visitors they landed in the right place.

The web’s biggest blogs include tables of contents at the top of their posts to reassure readers. It not only benefits SEO, it also improves read-through rates.

Keep them reading once they’ve started

Once visitors begin reading, you have three tactics to retain them:

- Drop-off optimization.

- A/B testing.

- Exit rate analysis.

This is how we’ll improve our read-through and conversion rates.

Drop-off optimization

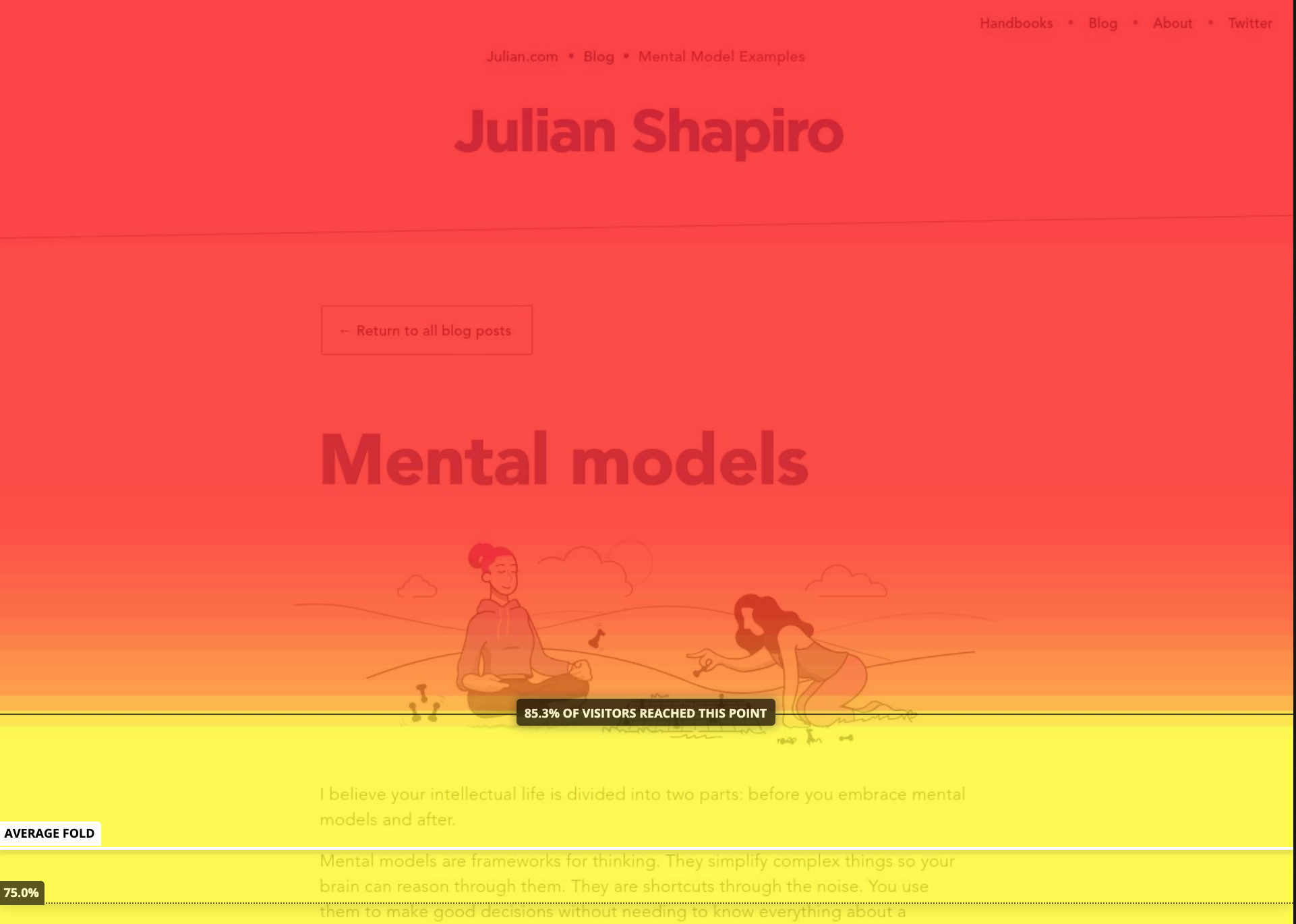

Sometimes, when I write a post on Julian.com, I find few people actually finish reading it. They get halfway through then bounce.

I discover this by looking at my scroll-depth maps using Hotjar.com. These show me how far down a page an average reader gets. Then I pair that data with the average time spent on the page, which I get from Google Analytics.

Whenever I notice poor read completion rates, I spend ten minutes optimizing my content:

- I refer to the heatmaps to see which sections caused people to stop reading.

- Then I rewrite those offending sections to be more enticing.

This routinely achieves 1.5-2x boosts in read-through rates, which can lead to a similar boost in conversion.

You see, I never just publish a blog post then move on.

I treat my posts the same way I treat every other marketing asset: I measure and iterate.

For some reason, even professional content marketers publish their posts then simply move on. That’s crazy. Not spending 10 minutes optimizing can be the difference between people devouring your post or not being able to get halfway through.

Specifically, here’s the process for rewriting a post’s drop-off points to get readers to continue reading.

How to perform drop-off optimization

First, record a scroll heatmap of your blog post. Any heatmap tool will do. I use Hotjar.com.

Next, whenever you see, say, 80% of readers getting midway into your post but only a fraction then make it to the end, you know you have a problem in the back half of your post: it’s verbose, uninsightful, or off-topic.

Your job is to find these drop-off points then rewrite the offending content using four techniques:

- Brevity: Make the section more concise: Cut the filler and switch to a bullet list like the one you’re reading now. Or, delete the section altogether if it’s not interesting.

- Inject insights: Perhaps your content is self-evident and boring. Rewrite it with novel and surprising thoughts.

- Make headlines enticing: Make the next section’s headline more enticing. Perhaps readers bounce because they see that the next section’s title is boring or irrelevant. For example, instead of titling your next section “Wrapping up,” re-write it into something more eyebrow-raising like, “What you still don’t know.”

- Cliffhangers: End sections with a statement like “Everything I just told you is true, but there’s a big exception.” Then withhold the exception until the next section. Keep them reading.

Once you’ve ironed out drop-off points, perhaps 35% of your readers finish the post instead of 15%. This reliably works, and it’s the highest-leverage way to achieve conversion improvements on your posts.

This is so self-evident yet no one does it for some reason.

And we’re only just starting. There’s another, more effective technique for optimizing your content: A/B testing paragraphs. Whereas drop-off optimization irons out the kinks in your article, A/B testing is how you take your read-through rates to a new tier.

Before we begin, follow along

As we explore the tactics below, you’re welcome to visit two blogs that incorporate these techniques:

If you need a primer on SEO before continuing, see my other TechCrunch article on the topic here and this orientation here.

A/B testing content

A/B testing is the process of creating a variation of existing content to see if it will increase conversion.

You want to A/B test the three highest-leverage components of every post:

Powered by WPeMatico

The ClockworkPi GameShell is a super fun DIY spin on portable gaming

Portable consoles are hardly new, and thanks to the Switch, they’re basically the most popular gaming devices in the world. But ClockworkPi’s GameShell is something totally unique, and entirely refreshing when it comes to gaming on the go. This clever DIY console kit provides everything you need to assemble your own pocket gaming machine at home, running Linux-based open-source software and using an open-source hardware design that welcomes future customization.

The GameShell is the result of a successful Kickstarter campaign, which began shipping to its backers last year and is now available to buy either direct from the company or from Amazon. The $159.99 ( on sale for $139.99 as of this writing) includes everything you need to build the console, like the ClockworkPi quad-core Cortex A7 motherboard with integrated Wi-Fi, Bluetooth and 1GB of DDR3 RAM — but it comes unassembled.

You won’t have to get out the soldering iron — the circuit boards come with all components attached. But you will be assembling screen, keypad, CPU, battery and speaker modules, connecting them with included cables and installing them in the slick, GameBoy-esque plastic shell. This might seem like an intimidating task, depending on your level of technical expertise: I know I found myself a bit apprehensive when I opened the various boxes and laid out all the parts in front of me.

But the included instructions, which are just illustrations, like those provided by Lego or Ikea, are super easy to follow and break down the task into very manageable tasks for people of all skill levels. All told, I had mine put together in less than an hour, and even though I did get in there with my teeth at one point (to remove a bit of plastic nubbin when assembling the optional Lightkey component, which adds extra function keys to the console), I never once felt overwhelmed or defeated. The time-lapse below chronicles my entire assembly process, start to finish.

What you get when you’re done is a fully functional portable gaming device, which runs Clockwork OS, a Linux-based open-source OS developed by the company. It includes Cave Story, one of the most celebrated indie games of the past couple of decades, and a number of built-in emulators (use of emulators is ethically and legally questionable, but it does provide an easy way to play some of those NES and SNES games you already own with more portability).

There’s a very active community around the GameShell that includes a number of indie games to play on the console, and tips and tricks for modifications and optimal use. It’s also designed to be a STEM educational resource, providing a great way for kids to see what’s actually happening behind the faceplate of the electronics they use everyday, and even getting started coding themselves to build software to run on the console. Loading software is easy, thanks to an included microSD storage card and the ability to easily connect via Wi-Fi to move over software from Windows and Mac computers.

Everything about the GameShell is programmable, and it features micro HDMI out, a built-in music player and Bluetooth support for headphone connection. It’s at once instantly accessible for people with very limited tech chops, and infinitely expandable and hackable for those who do want to go deeper and dig around with what else it has to offer.

Swappable face and backplates, plus open 3D models of each hardware component, mean that community-developed hardware add-ons and modifications are totally possible, too. The modular nature of the device means it can probably get even more powerful in the future too, with higher capacity battery modules and improved development boards.

I’ve definitely seen and used devices like the GameShell before, but few manage to be as accessible, powerful and customizable all at once. The GameShell is also fast, has great sound and an excellent display, and it seems to be very durable, with decent battery life of around three hours or slightly more of continuous use depending on things like whether you’re using Wi-Fi and screen brightness.

Powered by WPeMatico

Oregon joins lawsuit opposing T-Mobile/Sprint merger

Oregon this week became the 15th state (plus the District of Columbia) to sign onto a lawsuit seeking to stop a T-Mobile/Sprint merger. The suit, co-signed by 16 attorneys general, argues that a merger between the country’s third and fourth largest carriers would greatly reduce competition in the wireless industry.

“It’s important that Oregon join other states in opposing the Sprint -T-Mobile merger,” said Oregon AG Ellen Rosenblum said in a statement. “If left unchallenged, the current plan will result in reduced access to affordable wireless service in Oregon — and higher prices. Neither is acceptable.”

Texas joined the suit earlier this month, marking one of only two Republican AGs who have signed onto the deal. Conservative voices have largely come out in favor of a merger, suggesting that by joining forces the new company (also named T-Mobile) would increase competition for AT&T and Verizon by getting a leg up in the race to implement 5G.

New York State AG Letitia James says the signee has added “momentum” to push against the merger, which was greenlit by the U.S. Department of Justice in late July.

“Oregon’s addition to our lawsuit keeps our momentum going, and ensures that there isn’t a single region of this country that doesn’t oppose this anticompetitive megamerger,” said James. “We welcome Attorney General Rosenblum to our 16-member coalition that now includes states representing almost half of the U.S. population. We remain committed to blocking the merger of T-Mobile and Sprint because it would bad for consumers, bad for workers, and bad for innovation.”

Powered by WPeMatico

How even the best marketplace startups get paralyzed

Over the past 15 years, I’ve seen a pernicious disease infect a number of marketplace startups. I call it Marketplace Paralysis. The root cause of the disease is quite innocent and seemingly harmless. Smart people with good intentions fall victim to it all the time. It starts when a platform has sufficient scale — such that there is a good amount of data on things like performance, quality rankings, purchase rates, and fill ratios. What a platform implements as a result of that data, and how it’s received by their user base, is what can lead to marketplace paralysis.

In this post, I will detail what Marketplace Paralysis is and what startups can do to avoid it. Before I get into the nitty-gritty, here’s a snapshot of the lessons you’ll learn by reading this post:

- Segment and focus on high-value users

- Remember the silent majority

- Modify company goals to include quality components

- Empower small, autonomous teams

The easiest way to explain Marketplace Paralysis is with a hypothetical example. So allow me to introduce you to Labor Marketplace X (LMX).

Equipped with the aforementioned data, the well-intentioned product managers at LMX will think about policies or features to try and improve a KPI, like fill ratio or job success rate. They might craft a policy that would separate users into two tiers.

Tier 1 gets a shiny gold star next to their name, along with extra pay, bonuses, and preferred job access. Tier 2 gets standard pay and standard job access. They’ve done their homework and feel this will benefit the marketplace.

So, they build the feature. They launch it and make an announcement to their users. And then… a revolt!

Powered by WPeMatico

Darren Bechtel (yes, of those Bechtels) has raised $97.5 million for his firm, Brick & Mortar Ventures

Brick & Mortar Ventures, a young, San Francisco-based venture firm that’s focused on startups innovating in or around architecture, engineering, construction and facilities management, has closed with $97.2 million in capital commitments.

The fund is one in a sea of debut funds that have swung open their doors in recent years, though it’s also interesting for numerous reasons, beginning with its founder, Darren Bechtel, who knows a thing or two about the building industry. He’s a scion of the family that built the 120-year-old, privately held company Bechtel into one of the largest construction and engineering firms in the world. In fact, his brother, Brendan, who was named CEO in 2016, represents the fifth generation of Bechtels to lead the company. (Their sister, Katherine, is a project controls manager with the powerhouse outfit.)

Brick & Mortar’s investors are just as notable. They aren’t the typical pension funds and university endowments that many VCs try hard to lock down. Instead, they comprise a long list of companies that are part of the “construction value chain” and so have an interest in the latest and greatest developments in their respective industries. Among the firm’s backers, for example, is the special materials maker Ardex; the software giant Autodesk; the building materials company CEMEX; Ferguson Ventures, which is the venture arm of a huge U.S distributor of plumbing supplies; FMI, a management consulting company to the engineering and construction industry; Obayashi, a major Japanese construction company; Sidewalk Labs, which is Alphabet’s urban innovation organization; and United Rentals, one of the world’s largest equipment rental companies.

Brick & Mortar isn’t the first venture firm to focus on the so-called built world. Other firms that focus largely, if not exclusively, around the same themes include Fifth Wall Ventures, Navitas Capital, Corigin Ventures, Camber Creek, MetaProp, Starwood Capital and Tamarisc Ventures.

In fact, Darren Bechtel has ties to and is an individual investor in Fifth Wall, an LA-based firm that stormed onto the scene in 2017 with an equally impressive, and very different, roster of limited partners in the real estate industry, from which it has already amassed more than $700 million in capital commitments across two funds.

As Bechtel told us on a call late last week, he was going to go into business with Fifth Wall’s founders initially, but they wanted to raise a lot of money, and Bechtel was thinking more conservatively — for a reason. “I’d done five deals on AngelList with [Fifth Wall co-founder] Brendan [Wallace] and we’d started putting together a pitch deck, and as we were thinking through ideal fund structure and size, Brendan said $500 million and I said $50 million,” says Bechtel.

Wallace was thinking big, says Bechtel, because “hospitality already had some massive players — Airbnb, WeWork. It was a far more mature landscape, and Brendan thought that if we were going to own a category, we needed the capital to secure a leadership position in the right deals.”

Bechtel thinks Wallace was right, too. He says he just came to realize that construction tech — which is what really interested him — was in its own league, and it was in its infancy. Though the construction software company PlanGrid took off like gangbusters — Bechtel wrote the largest check during the company’s seed round — it wasn’t so long ago that “there were great, billion-dollar ideas being formed but the rounds were small and the valuations were small,” says Bechtel. Because the “investment community didn’t understand what it was looking at, I had concerns about our ability to generate returns if we had too large a fund.”

In the end, the friends and former Stanford MBA classmates decided to split their respective focus on real estate and hospitality (Fifth Wall) and the actual construction of buildings (Brick & Mortar), and things seem to have gone well since. As Fifth Wall has gained traction, so too has Brick & Mortar, which is now a couple of years in the making. Indeed, though Bechtel is announcing the close of Brick & Mortar’s first fund today, he already works with two principals and two associates, and they’ve collectively sourced and funded 16 startups to date with capital they’ve been raising from investors along the way.

One of those checks went to Fieldwire, a maker of field management software for construction teams. They’ve also backed Serious Labs, which trains workers how to use heavy equipment and tools via virtual reality software, and Curbio, a real estate technology startup that orchestrates turnkey renovations for home sellers, then gets paid back once the home is sold.

Brick & Mortar even has an exit already, having helped fund the construction software platform BuildingConnected, which sold last December to Autodesk. (Bechtel’s earlier investment in PlanGrid, which also sold to Autodesk last year, was a personal investment, one of roughly 40 he made before setting out to create a traditional venture firm.)

As for whether Brick & Mortar ever hunts for companies that Bechtel — the firm founded by Darren’s great-great-grandfather — might like to acquire or otherwise partner with, Darren is quick to note that the firm is not an investor in his venture fund or any or its portfolio companies, and he doesn’t have his finger on the pulse of what’s happening there.

“I don’t work at Bechtel or pretend to know what their intentions are, though my brother is CEO, so you could say I know a guy there.”

More, he notes, he doesn’t think it would make sense to fund a company that “a user would want to acquire. If one user buys [a startup’s tools] because they want exclusivity, they’re limiting the exit value of that company.” To underscore his point, he notes that “Bechtel does around $30 billion a year, but the construction market is an $11 trillion market.” In the end, he says, it’s “better to have a preferred relationship. Maybe you get the next year’s model released early; maybe you get custom colors.” But if you’ve developed a winning product, you want to make it accessible to everyone. “You benefit the most by having a technology adopted by the whole industry.”

Above, the Brick & Mortar Ventures team. From left to right: Austin Yount, senior associate; Alice Leung, associate; Curtis Rodgers, principal; Darren Bechtel, general partner; and Kaustubh Pandya, principal.

Powered by WPeMatico

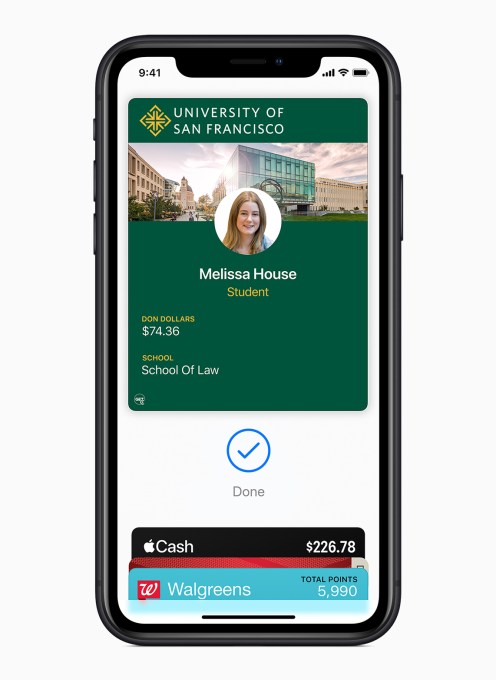

Apple brings contactless student IDs to a dozen more universities

Ahead of the upcoming school year, Apple this morning announced it’s bringing contactless student IDs in Apple Wallet to several more U.S. universities. The expansion will allow more than 100,000 additional college students to carry their student ID on their iPhone or Apple Watch, where it can be used for a variety of tasks, including paying for their meals and snacks and entry into buildings, like the student’s dorm and other campus facilities.

The expanded list of universities includes: Clemson University, Georgetown University, University of Tennessee, University of Kentucky, University of San Francisco, University of Vermont, Arkansas State University, South Dakota State University, Norfolk State University, Louisburg College, University of North Alabama and Chowan University.

These join the previously supported schools: Duke University, University of Oklahoma, University of Alabama, Temple University, Johns Hopkins University, Marshall University and Mercer University.

Apple first announced its plans for contactless student IDs at WWDC 2018, then rolled out to its debut schools last October.

The contactless IDs not only serve as a means of student identification, but also work as a payment mechanism for on-campus transactions — like meals at the cafeteria or textbooks and supplies at the college’s bookstore, for example. Contactless entry into buildings is also now common on college campuses, and these digital IDs can work to open doors, too, as an alternative to swiping an entry card.

Support for college student IDs is only one way that Apple is trying to replace the physical wallet. The company also supports the ability to add your debit and credit cards, transit and loyalty cards, tickets and even paper money through Apple Pay Cash. And now it’s launching its own credit card, too, which rewards you with cashback for shopping Apple and using Apple Pay.

“We’re happy to add to the growing number of schools that are making getting around campus easier than ever with iPhone and Apple Watch,” said Jennifer Bailey, Apple’s vice president of Internet Services, in a statement about the expansion. “We know students love this feature. Our university partners tell us that since launch, students across the country have purchased 1.25 million meals and opened more than 4 million doors across campuses by just tapping their iPhone and Apple Watch.”

Related to this launch, Apple says it’s also adding support for CBORD, Allegion and HID — solution providers for campus credentials and mobile access. With these technologies on board, Apple will be able to reach other schools integrated with these systems in the future.

Powered by WPeMatico