Local governments are forcing the scooter industry to grow up fast

Gone are the days when tech companies can deploy their services in cities without any regard for rules and regulations. Before the rise of electric scooters, cities had already become hip to tech’s status quo (thanks to the likes of Uber and Lyft) and were ready to regulate. We explored some of this in “The uncertain future of shared scooters,” but since then, new challenges have emerged for scooter startups.

And for scooter startups, city regulations can make or break their businesses across nearly every aspect of operations, especially two major ones: ridership growth and ability to attract investor dollars. From issuing permits to determining how many scooters any one company can operate at any one time to enforcing low-income plans and impacting product roadmaps, the ball is really in the city’s court.

Powered by WPeMatico

How about earning crypto tokens to carbon-offset your Uber rides?

Most of us, by now, are aware that all sorts of crazy stuff is happening to the planet’s climate, and the blame is pretty much universally recognized as lying with humans pumping more and more carbon into the atmosphere. Scientists are now saying tree planting, for instance, has to happen very, very quickly if we are to avert disaster.

A few startups, such as Changers, have tried to incentivize us to do things like walk instead of taking the car, with mixed results.

Now a blockchain startup thinks it may have the making of one solution, rewarding us with crypto tokens for making the right choices for the planet. Now, before you roll your eyes, hear me out…

Imagine rewarding people for taking the bus instead of their car — and them exchanging that token to offset their carbon by planting a tree? Or incentivizing passengers for sharing their travel data — helping companies to improve their experience in the future? That’s the big idea here.

Here’s how it works: The DOVU platform offers a token, wallet and marketplace and allows users to earn tokens and spend them to carbon-offset their activity and on rewards within the mobility ecosystem, starting with their Uber rides.

Users link their Uber account to their DOVU wallet, enabling them to earn DOV tokens for every journey taken. The startup has connected to Uber APIs, meaning that, once authenticated, the user has to do nothing other than take the journey.

The DOVU CO2 calculator then automatically rewards the value of tokens depending on the length of the journey. The DOV tokens can then be spent within the DOVU Action, and the user can choose the project to back or the user can ask DOVU to choose the project on their behalf to ensure the carbon offsetting happens.

The platform can connect to any published API, meaning it is in a notional position to have an immediate impact on all the new mobility solutions globally.

With Jaguar Land Rover as shareholders, DOVU potentially has the backing to try to make this happen.

Mobility-related organizations often have a need to reward, incentivize or nudge their users to do the right thing. It might be sharing their data for better service planning, taking an alternate route to help ease traffic congestion or charging electric batteries at times that are best for the grid. Whether it’s influencing consumer behavior or encouraging data sharing, the DOVU platform could, in theory, provide a solution that meets the needs of both the mobility provider and the end user. That at least is their pitch.

Hell, given the state of the planet, it might be worth a shot…

Powered by WPeMatico

How Facebook does IT

If you have ever worked at any sizable company, the word “IT” probably doesn’t conjure up many warm feelings. If you’re working for an old, traditional enterprise company, you probably don’t expect anything else, though. If you’re working for a modern tech company, though, chances are your expectations are a bit higher. And once you’re at the scale of a company like Facebook, a lot of the third-party services that work for smaller companies simply don’t work anymore.

To discuss how Facebook thinks about its IT strategy and why it now builds most of its IT tools in-house, I sat down with the company’s CIO, Atish Banerjea, at its Menlo Park headquarter.

Before joining Facebook in 2016 to head up what it now calls its “Enterprise Engineering” organization, Banerjea was the CIO or CTO at companies like NBCUniversal, Dex One and Pearson.

“If you think about Facebook 10 years ago, we were very much a traditional IT shop at that point,” he told me. “We were responsible for just core IT services, responsible for compliance and responsible for change management. But basically, if you think about the trajectory of the company, were probably about 2,000 employees around the end of 2010. But at the end of last year, we were close to 37,000 employees.”

Traditionally, IT organizations rely on third-party tools and software, but as Facebook grew to this current size, many third-party solutions simply weren’t able to scale with it. At that point, the team decided to take matters into its own hands and go from being a traditional IT organization to one that could build tools in-house. Today, the company is pretty much self-sufficient when it comes to running its IT operations, but getting to this point took a while.

“We had to pretty much reinvent ourselves into a true engineering product organization and went to a full ‘build’ mindset,” said Banerjea. That’s not something every organization is obviously able to do, but, as Banerjea joked, one of the reasons why this works at Facebook “is because we can — we have that benefit of the talent pool that is here at Facebook.”

The company then took this talent and basically replicated the kind of team it would help on the customer side to build out its IT tools, with engineers, designers, product managers, content strategies, people and research. “We also made the decision at that point that we will hold the same bar and we will hold the same standards so that the products we create internally will be as world-class as the products we’re rolling out externally.”

One of the tools that wasn’t up to Facebook’s scaling challenges was video conferencing. The company was using a third-party tool for that, but that just wasn’t working anymore. In 2018, Facebook was consuming about 20 million conference minutes per month. In 2019, the company is now at 40 million per month.

Besides the obvious scaling challenge, Facebook is also doing this to be able to offer its employees custom software that fits their workflows. It’s one thing to adapt existing third-party tools, after all, and another to build custom tools to support a company’s business processes.

Banerjea told me that creating this new structure was a relatively easy sell inside the company. Every transformation comes with its own challenges, though. For Facebook’s Enterprise Engineering team, that included having to recruit new skill sets into the organization. The first few months of this process were painful, Banerjea admitted, as the company had to up-level the skills of many existing employees and shed a significant number of contractors. “There are certain areas where we really felt that we had to have Facebook DNA in order to make sure that we were actually building things the right way,” he explained.

Facebook’s structure creates an additional challenge for the team. When you’re joining Facebook as a new employee, you have plenty of teams to choose from, after all, and if you have the choice of working on Instagram or WhatsApp or the core Facebook app — all of which touch millions of people — working on internal tools with fewer than 40,000 users doesn’t sound all that exciting.

“When young kids who come straight from college and they come into Facebook, they don’t know any better. So they think this is how the world is,” Banerjea said. “But when we have experienced people come in who have worked at other companies, the first thing I hear is ‘oh my goodness, we’ve never seen internal tools of this caliber before.’ The way we recruit, the way we do performance management, the way we do learning and development — every facet of how that employee works has been touched in terms of their life cycle here.”

Facebook first started building these internal tools around 2012, though it wasn’t until Banerjea joined in 2016 that it rebranded the organization and set up today’s structure. He also noted that some of those original tools were good, but not up to the caliber employees would expect from the company.

“The really big change that we went through was up-leveling our building skills to really become at the same caliber as if we were to build those products for an external customer. We want to have the same experience for people internally.”

The company went as far as replacing and rebuilding the commercial Enterprise Resource Planning (ERP) system it had been using for years. If there’s one thing that big companies rely on, it’s their ERP systems, given they often handle everything from finance and HR to supply chain management and manufacturing. That’s basically what all of their backend tools rely on (and what companies like SAP, Oracle and others charge a lot of money for). “In that 2016/2017 time frame, we realized that that was not a very good strategy,” Banerjea said. In Facebook’s case, the old ERP handled the inventory management for its data centers, among many other things. When that old system went down, the company couldn’t ship parts to its data centers.

“So what we started doing was we started peeling off all the business logic from our backend ERP and we started rewriting it ourselves on our own platform,” he explained. “Today, for our ERP, the backend is just the database, but all the business logic, all of the functionality is actually all custom written by us on our own platform. So we’ve completely rewritten our ERP, so to speak.”

In practice, all of this means that ideally, Facebook’s employees face far less friction when they join the company, for example, or when they need to replace a broken laptop, get a new phone to test features or simply order a new screen for their desk.

One classic use case is onboarding, where new employees get their company laptop, mobile phones and access to all of their systems, for example. At Facebook, that’s also the start of a six-week bootcamp that gets new engineers up to speed with how things work at Facebook. Back in 2016, when new classes tended to still have less than 200 new employees, that was still mostly a manual task. Today, with far more incoming employees, the Enterprise Engineering team has automated most of that — and that includes managing the supply chain that ensures the laptops and phones for these new employees are actually available.

But the team also built the backend that powers the company’s more traditional IT help desks, where employees can walk up and get their issues fixed (and passwords reset).

To talk more about how Facebook handles the logistics of that, I sat down with Koshambi Shah, who heads up the company’s Enterprise Supply Chain organization, which pretty much handles every piece of hardware and software the company delivers and deploys to its employees around the world (and that global nature of the company brings its own challenges and additional complexity). The team, which has fewer than 30 people, is made up of employees with experience in manufacturing, retail and consumer supply chains.

Typically, enterprises offer their employees a minimal set of choices when it comes to the laptops and phones they issue to their employees, and the operating systems that can run on them tend to be limited. Facebook’s engineers have to be able to test new features on a wide range of devices and operating systems. There are, after all, still users on the iPhone 4s or BlackBerry that the company wants to support. To do this, Shah’s organization actually makes thousands of SKUs available to employees and is able to deliver 98% of them within three days or less. It’s not just sending a laptop via FedEx, though. “We do the budgeting, the financial planning, the forecasting, the supply/demand balancing,” Shah said. “We do the asset management. We make sure the asset — what is needed, when it’s needed, where it’s needed — is there consistently.”

In many large companies, every asset request is double guessed. Facebook, on the other hand, places a lot of trust in its employees, it seems. There’s a self-service portal, the Enterprise Store, that allows employees to easily request phones, laptops, chargers (which get lost a lot) and other accessories as needed, without having to wait for approval (though if you request a laptop every week, somebody will surely want to have a word with you). Everything is obviously tracked in detail, but the overall experience is closer to shopping at an online retailer than using an enterprise asset management system. The Enterprise Store will tell you where a device is available, for example, so you can pick it up yourself (but you can always have it delivered to your desk, too, because this is, after all, a Silicon Valley company).

For accessories, Facebook also offers self-service vending machines, and employees can walk up to the help desk.

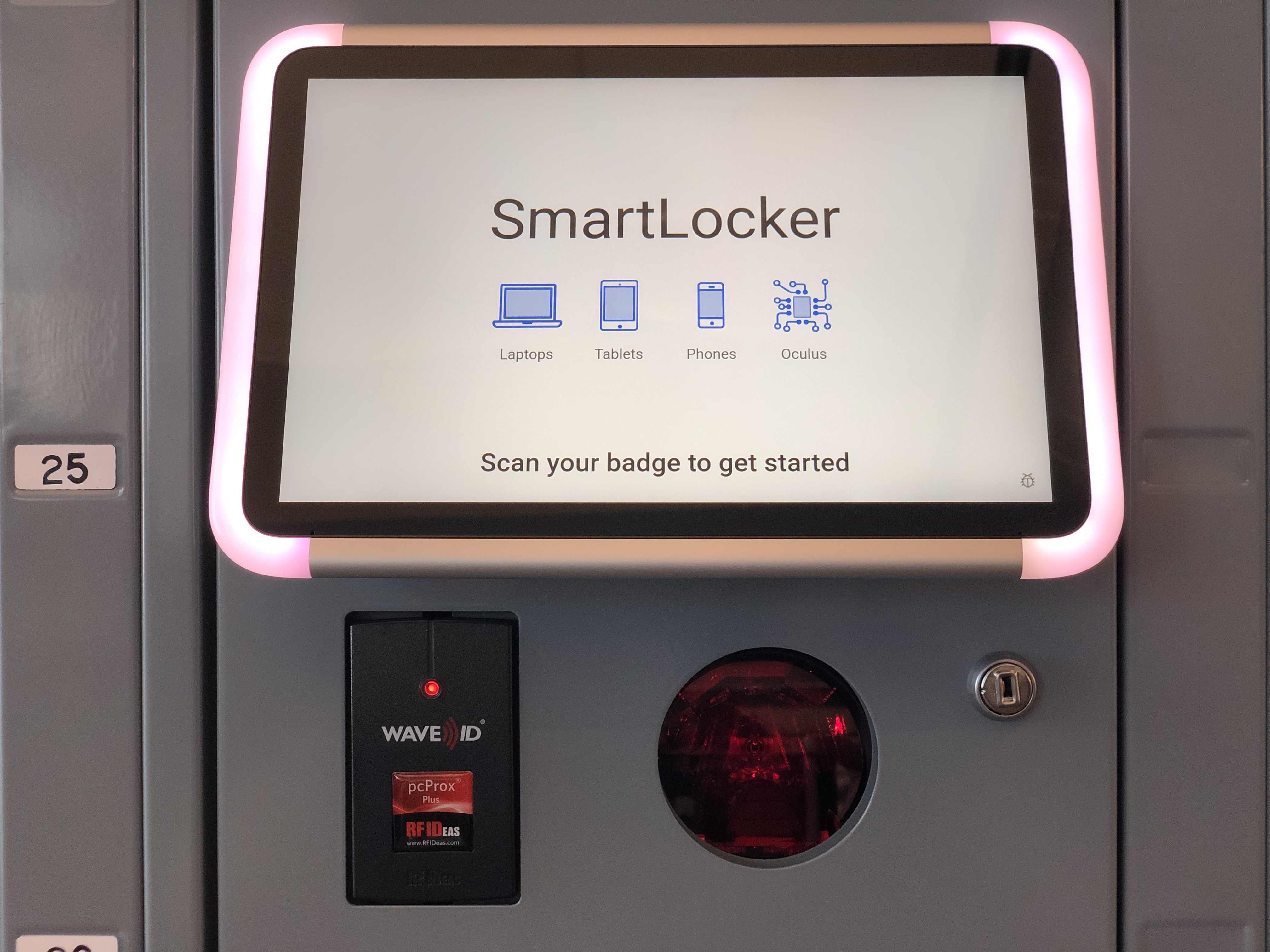

The company also recently introduced an Amazon Locker-style setup that allows employees to check out devices as needed. At these smart lockers, employees simply have to scan their badge, choose a device and, once the appropriate door has opened, pick up the phone, tablet, laptop or VR devices they were looking for and move on. Once they are done with it, they can come back and check the device back in. No questions asked. “We trust that people make the right decision for the good of the company,” Shah said. For laptops and other accessories, the company does show the employee the price of those items, though, so it’s clear how much a certain request costs the company. “We empower you with the data for you to make the best decision for your company.”

Talking about cost, Shah told me the Supply Chain organization tracks a number of metrics. One of those is obviously cost. “We do give back about 4% year-over-year, that’s our commitment back to the businesses in terms of the efficiencies we build for every user we support. So we measure ourselves in terms of cost per supported user. And we give back 4% on an annualized basis in the efficiencies.”

Unsurprisingly, the company has by now gathered enough data about employee requests (Shah said the team fulfills about half a million transactions per year) that it can use machine learning to understand trends and be proactive about replacing devices, for example.

Facebooks’ Enterprise Engineering group doesn’t just support internal customers, though. Another interesting aspect to Facebook’s Enterprise Engineering group is that it also runs the company’s internal and external events, including the likes of F8, the company’s annual developer conference. To do this, the company built out conference rooms that can seat thousands of people, with all of the logistics that go with that.

The company also showed me one of its newest meeting rooms where there are dozens of microphones and speakers hanging from the ceiling that make it easier for everybody in the room to participate in a meeting and be heard by everybody else. That’s part of what the organization’s “New Builds” team is responsible for, and something that’s possible because the company also takes a very hands-on approach to building and managing its offices.

Facebook also runs a number of small studios in its Menlo Park and New York offices, where both employees and the occasional external VIP can host Facebook Live videos.

Indeed, live video, it seems, is one of the cornerstones of how Facebook employees collaborate and help employees who work from home. Typically, you’d just use the camera on your laptop or maybe a webcam connected to your desktop to do so. But because Facebook actually produces its own camera system with the consumer-oriented Portal, Banerjea’s team decided to use that.

“What we have done is we have actually re-engineered the Portal,” he told me. “We have connected with all of our video conferencing systems in the rooms. So if I have a Portal at home, I can dial into my video conferencing platform and have a conference call just like I’m sitting in any other conference room here in Facebook. And all that software, all the engineering on the portal, that has been done by our teams — some in partnership with our production teams, but a lot of it has been done with Enterprise Engineering.”

Unsurprisingly, there are also groups that manage some of the core infrastructure and security for the company’s internal tools and networks. All of those tools run in the same data centers as Facebook’s consumer-facing applications, though they are obviously sandboxed and isolated from them.

It’s one thing to build all of these tools for internal use, but now, the company is also starting to think about how it can bring some of these tools it built for internal use to some of its external customers. You may not think of Facebook as an enterprise company, but with its Workplace collaboration tool, it has an enterprise service that it sells externally, too. Last year, for the first time, Workplace added a new feature that was incubated inside of Enterprise Engineering. That feature was a version of Facebook’s public Safety Check that the Enterprise Engineering team had originally adapted to the company’s own internal use.

“Many of these things that we are building for Facebook, because we are now very close partners with our Workplace team — they are in the enterprise software business and we are the enterprise software group for Facebook — and many [features] we are building for Facebook are of interest to Workplace customers.”

As Workplace hit the market, Banerjea ended up talking to the CIOs of potential users, including the likes of Delta Air Lines, about how Facebook itself used Workplace internally. But as companies started to adopt Workplace, they realized that they needed integrations with existing third-party services like ERP platforms and Salesforce. Those companies then asked Facebook if it could build those integrations or work with partners to make them available. But at the same time, those customers got exposed to some of the tools that Facebook itself was building internally.

“Safety Check was the first one,” Banerjea said. “We are actually working on three more products this year.” He wouldn’t say what these are, of course, but there is clearly a pipeline of tools that Facebook has built for internal use that it is now looking to commercialize. That’s pretty unusual for any IT organization, which, after all, tends to only focus on internal customers. I don’t expect Facebook to pivot to an enterprise software company anytime soon, but initiatives like this are clearly important to the company and, in some ways, to the morale of the team.

This creates a bit of friction, too, though, given that the Enterprise Engineering group’s mission is to build internal tools for Facebook. “We are now figuring out the deployment model,” Banerjea said. Who, for example, is going to support the external tools the team built? Is it the Enterprise Engineering group or the Workplace team?

Chances are then, that Facebook will bring some of the tools it built for internal use to more enterprises in the long run. That definitely puts a different spin on the idea of the consumerization of enterprise tech. Clearly, not every company operates at the scale of Facebook and needs to build its own tools — and even some companies that could benefit from it don’t have the resources to do so. For Facebook, though, that move seems to have paid off and the tools I saw while talking to the team definitely looked more user-friendly than any off-the-shelf enterprise tools I’ve seen at other large companies.

Powered by WPeMatico

Alibaba cloud biz is on a run rate over $4B

Alibaba announced its earnings today, and the Chinese e-commerce giant got a nice lift from its cloud business, which grew 66% to more than $1.1 billion, or a run rate surpassing $4 billion.

It’s not exactly on par with Amazon, which reported cloud revenue of $8.381 billion last quarter, more than double Alibaba’s yearly run rate, but it’s been a steady rise for the company, which really began taking the cloud seriously as a side business in 2015.

At that time, Alibaba Cloud’s president Simon Hu boasted to Reuters that his company would overtake Amazon in four years. It is not even close to doing that, but it has done well to get to more than a billion a quarter in just four years.

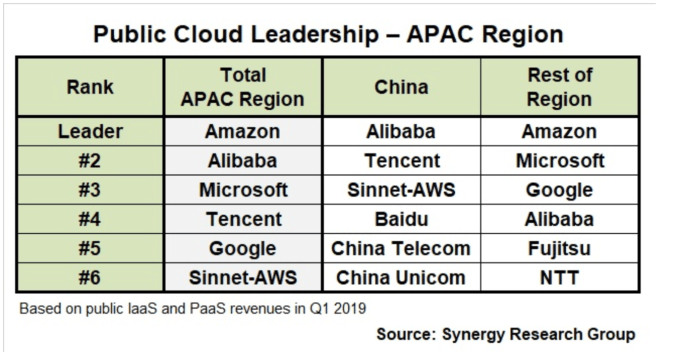

In fact, in its most recent data for the Asia-Pacific region, Synergy Research, a firm that closely tracks the public cloud market, found that Amazon was still number one overall in the region. Alibaba was first in China, but fourth in the region outside of China, with the market’s Big 3 — Amazon, Microsoft and Google — coming in ahead of it. These numbers were based on Q1 data before today’s numbers were known, but they provide a sense of where the market is in the region.

Synergy’s John Dinsdale says the company’s growth has been impressive, outpacing the market growth rate overall. “Alibaba’s share of the worldwide cloud infrastructure services market was 5% in Q2 — up by almost a percentage point from Q2 of last year, which is a big deal in terms of absolute growth, especially in a market that is growing so rapidly,” Dinsdale told TechCrunch.

He added, “The great majority of its revenue does indeed come from China (and Hong Kong), but it is also making inroads in a range of other APAC country markets — Indonesia, Malaysia, Singapore, India, Australia, Japan and South Korea. While numbers are relatively small, it has also got a foothold in EMEA and some operations in the U.S.”

The company was busy last quarter adding more than 300 new products and features in the period ending June 30th (and reported today). That included changes and updates to core cloud offerings, security, data intelligence and AI applications, according to the company.

While the cloud business still isn’t a serious threat to the industry’s Big Three, especially outside its core Asia-Pacific market, it’s still growing steadily and accounted for almost 7% of Alibaba’s total of $16.74 billion in revenue for the quarter — and that’s not bad at all.

Powered by WPeMatico

Incorta raises $30M Series C for ETL-free data processing solution

Incorta, a startup founded by former Oracle executives who want to change the way we process large amounts of data, announced a $30 million Series C today led by Sorenson Capital.

Other investors participating in the round included GV (formerly Google Ventures), Kleiner Perkins, M12 (formerly Microsoft Ventures), Telstra Ventures and Ron Wohl. Today’s investment brings the total raised to $75 million, according to the company.

Incorta CEO and co-founder Osama Elkady says he and his co-founders were compelled to start Incorta because they saw so many companies spending big bucks for data projects that were doomed to fail. “The reason that drove me and three other guys to leave Oracle and start Incorta is because we found out with all the investment that companies were making around data warehousing and implementing advanced projects, very few of these projects succeeded,” Elkady told TechCrunch.

A typical data project involves ETL (extract, transform, load). It’s a process that takes data out of one database, changes the data to make it compatible with the target database and adds it to the target database.

It takes time to do all of that, and Incorta is trying to make access to the data much faster by stripping out this step. Elkady says that this allows customers to make use of the data much more quickly, claiming they are reducing the process from one that took hours to one that takes just seconds. That kind of performance enhancement is garnering attention.

Rob Rueckert, managing director for lead investor Sorenson Capital, sees a company that’s innovating in a mature space. “Incorta is poised to upend the data warehousing market with innovative technology that will end 30 years of archaic and slow data warehouse infrastructure,” he said in a statement.

The company says revenue is growing by leaps and bounds, reporting 284% year over year growth (although they did not share specific numbers). Customers include Starbucks, Shutterfly and Broadcom.

The startup, which launched in 2013, currently has 250 employees, with developers in Egypt and main operations in San Mateo, Calif. They recently also added offices in Chicago, Dubai and Bangalore.

Powered by WPeMatico

Huawei pushes back launch of 5G foldable, the Mate X

If you were desperately ripping days off of your calendar until you could get your hands on Huawei’s $2,600 5G foldable, the Mate X — which was originally slated to launch next month — it sounds like you’re going to have to wait a bit longer, per TechRadar which attended a press event at Huawei’s Shenzhen headquarters today.

It reports being told there is no possibility of a September launch. Instead Huawei is now aiming for November. But the company would only profess itself certain its first smartphone that folds out to a (square) tablet will launch before 2020. So it seems Mate X buyers may need to wait until circa Christmas to fondle this foldable.

It’s not clear exactly why the launch is being delayed. But — speculating wildly — we imagine it’s something to do with the fact that the screen, er, folds.

We’ve reached out to Huawei for official comment on the delay.

Huawei’s Mate X date slippage suggests Samsung will still be first to market with its (previously) delayed Galaxy Fold — which was itself delayed after a bunch of review units broke (because, well, did we tell you the screen folds?).

Last we heard, the Galaxy Fold is slated for a September release — Samsung seemingly confident it’s fixed the problem of how to make a foldable phone survive actual use.

Of course survival in the wild very much remains to be seen with any of these foldable. So expect TC’s in house hardware guru, Brian Heater, to put all of these expensively hinged touchscreens through their paces.

Returning to Huawei’s Mate X, potential buyers may not be entirely reassured to learn the company appeared to dangle rather more information about a planned sequel in front of reporters at the press event.

A sequel which may or may not have even more screens, as Huawei is apparently considering putting glass on the back. Yes, glass. (The gen-one Mate X will have a steel back.) Glass panels which it says could double as touchscreens. On the back. As well as the front. We have no idea if that means the price-tag will double too.

This theoretical quad (?) screen foldable follow-up to the still unreleased Mate X might even be released as soon as next year, according to TechRadar’s reportage. Or — again speculating wildly — it might never be released. Because, frankly, it sounds mental. But that’s the wacky world of foldables for ya.

There may be method in this madness too. Because, since smartphones turned into all-screen devices — making it almost impossible to tell one touch-sensitive slab from another — plucky Android device makers are trying to find a way to put more screen on the slab so you can see more.

If they can pull that off it might be great. However sticking a hinge right through the middle of a smartphone’s primary feature and function without that simultaneously causing problems is certainly a major engineering challenge.

Powered by WPeMatico

Energy Vault raises $110 million from SoftBank Vision Fund as energy storage grabs headlines

Imagine a moving tower made of huge cement bricks weighing 35 metric tons. The movement of these massive blocks is powered by wind or solar power plants and is a way to store the energy those plants generate. Software controls the movement of the blocks automatically, responding to changes in power availability across an electric grid to charge and discharge the power that’s being generated.

The development of this technology is the culmination of years of work at Idealab, the Pasadena, Calif.-based startup incubator, and Energy Vault, the company it spun out to commercialize the technology, has just raised $110 million from SoftBank Vision Fund to take its next steps in the world.

Energy storage remains one of the largest obstacles to the large-scale rollout of renewable energy technologies on utility grids, but utilities, development agencies and private companies are investing billions to bring new energy storage capabilities to market as the technology to store energy improves.

The investment in Energy Vault is just one indicator of the massive market that investors see coming as power companies spend billions on renewables and storage. As The Wall Street Journal reported over the weekend, ScottishPower, the U.K.-based utility, is committing to spending $7.2 billion on renewable energy, grid upgrades and storage technologies between 2018 and 2022.

Meanwhile, out in the wilds of Utah, the American subsidiary of Japan’s Mitsubishi Hitachi Power Systems is working on a joint venture that would create the world’s largest clean energy storage facility. That 1 gigawatt storage would go a long way toward providing renewable power to the Western U.S. power grid and is going to be based on compressed air energy storage, large flow batteries, solid oxide fuel cells and renewable hydrogen storage.

“For 20 years, we’ve been reducing carbon emissions of the U.S. power grid using natural gas in combination with renewable power to replace retiring coal-fired power generation. In California and other states in the western United States, which will soon have retired all of their coal-fired power generation, we need the next step in decarbonization. Mixing natural gas and storage, and eventually using 100% renewable storage, is that next step,” said Paul Browning, president and CEO of MHPS Americas.

Energy Vault’s technology could also be used in these kinds of remote locations, according to chief executive Robert Piconi.

Energy Vault’s storage technology certainly isn’t going to be ubiquitous in highly populated areas, but the company’s towers of blocks can work well in remote locations and have a lower cost than chemical storage options, Piconi said.

“What you’re seeing there on some of the battery side is the need in the market for a mobile solution that isn’t tied to topography,” Piconi said. “We obviously aren’t putting these systems in urban areas or the middle of cities.”

For areas that need larger-scale storage that’s a bit more flexible there are storage solutions like Tesla’s new Megapack.

The Megapack comes fully assembled — including battery modules, bi-directional inverters, a thermal management system, an AC breaker and controls — and can store up to 3 megawatt-hours of energy with a 1.5 megawatt inverter capacity.

The Energy Vault storage system is made for much, much larger storage capacity. Each tower can store between 20 and 80 megawatt hours at a cost of 6 cents per kilowatt hour (on a levelized cost basis), according to Piconi.

The first facility that Energy Vault is developing is a 35 megawatt-hour system in Northern Italy, and there are other undisclosed contracts with an undisclosed number of customers on four continents, according to the company.

One place where Piconi sees particular applicability for Energy Vault’s technology is around desalination plants in places like sub-Saharan Africa or desert areas.

Backing Energy Vault’s new storage technology are a clutch of investors, including Neotribe Ventures, Cemex Ventures, Idealab and SoftBank.

Powered by WPeMatico

VMware says it’s looking to acquire Pivotal

VMware today confirmed that it is in talks to acquire software development platform Pivotal Software, the service best known for commercializing the open-source Cloud Foundry platform. The proposed transaction would see VMware acquire all outstanding Pivotal Class A stock for $15 per share, a significant markup over Pivotal’s current share price (which unsurprisingly shot up right after the announcement).

Pivotal’s shares have struggled since the company’s IPO in April 2018. The company was originally spun out of EMC Corporation (now DellEMC) and VMware in 2012 to focus on Cloud Foundry, an open-source software development platform that is currently in use by the majority of Fortune 500 companies. A lot of these enterprises are working with Pivotal to support their Cloud Foundry efforts. Dell itself continues to own the majority of VMware and Pivotal, and VMware also owns an interest in Pivotal already and sells Pivotal’s services to its customers, as well. It’s a bit of an ouroboros of a transaction.

Pivotal Cloud Foundry was always the company’s main product, but it also offered additional consulting services on top of that. Despite improving its execution since going public, Pivotal still lost $31.7 million in its last financial quarter as its stock price traded at just over half of the IPO price. Indeed, the $15 per share VMware is offering is identical to Pivotal’s IPO price.

An acquisition by VMware would bring Pivotal’s journey full circle, though this is surely not the journey the Pivotal team expected. VMware is a Cloud Foundry Foundation platinum member, together with Pivotal, DellEMC, IBM, SAP and Suse, so I wouldn’t expect any major changes in VMware’s support of the overall open-source ecosystem behind Pivotal’s core platform.

It remains to be seen whether the acquisition will indeed happen, though. In a press release, VMware acknowledged the discussion between the two companies but noted that “there can be no assurance that any such agreement regarding the potential transaction will occur, and VMware does not intend to communicate further on this matter unless and until a definitive agreement is reached.” That’s the kind of sentence lawyers like to write. I would be quite surprised if this deal didn’t happen, though.

Buying Pivotal would also make sense in the grand scheme of VMware’s recent acquisitions. Earlier this year, the company acquired Bitnami, and last year it acquired Heptio, the startup founded by two of the three co-founders of the Kubernetes project, which now forms the basis of many new enterprise cloud deployments and, most recently, Pivotal Cloud Foundry.

Powered by WPeMatico

TransferWise’s debit card launches in Australia and New Zealand, with Singapore to follow

International money transfer startup TransferWise’s debit card is now available in Australia and New Zealand, with a Singapore launch expected by the end of this year as the company expands its presence in the Asia-Pacific region. TransferWise’s debit card, which features low, transparent fees and exchange rates, first launched in the United Kingdom and Europe last year before arriving in the United States in June. Since its launch, the company claims the debit card has been used for 15 million transactions.

Australian and New Zealand customers will have access to the TransferWise Platinum debit Mastercard (a business debit card is also available). Cards are linked to TransferWise accounts, which give holders bank account numbers and details in multiple countries, making it easier and cheaper to send and receive multiple currencies. The company says that over the past year, customers have deposited more than $10 billion in their accounts.

TransferWise’s debit cards allow users to spend in more than 40 currencies at real exchange rates. In an email, co-founder and CEO Kristo Käärmann told TechCrunch that TransferWise decided to launch its debit card in Australia and New Zealand because its business there has already been growing quickly. “In addition to responding to customer demand, launching the card in Australia and New Zealand was also driven by the fact that Aussies and Kiwis are being overcharged by banks for using their own money abroad. It is expensive to use debit, travel and credit cards for spending or withdrawals,” he said.

Käärmann added that “independent research conducted by Capital Economics showed that Australians lost $2.14 billion last year alone just for using their bank-issued card abroad. This is because banks and other providers charge transaction fees every time someone uses their card abroad, plus an inflated exchange rate. Similarly, in New Zealand, Kiwis lost $1 billion simply for using their card abroad.”

One of TransferWise’s competitive advantages is that unlike most legacy banking and money transfer services, its accounts and cards were designed from the start to be used internationally. “While there are existing multi-currency cards that exist in Australia and New Zealand, they are prohibitively expensive to use. For example in Australia, the TransferWise Platinum debit Mastercard is on average 11 times cheaper than most travel, debit, prepaid and credit cards,” Käärmann said.

TransferWise cards don’t have transaction fees or exchange rate markups and cardholders are allowed to withdraw up to AUD $350 every 30 days for free at any ATM in the world.

The company is currently talking to regulators in several Asian countries, a process that can take up to two years, Käärmann said. It was recently granted a remittance license in Malaysia, and plans to make its remittance service available there by the end of this year.

Powered by WPeMatico

Flatfair, the ‘deposit-free’ renting platform, raises $11M led by Index Ventures

Flatfair, a London-based fintech that lets landlords offer “deposit-free” renting to tenants, has raised $11 million in funding.

The Series A round is led by Index Ventures, with participation from Revolt Ventures, Adevinta, Greg Marsh (founder of Onefinestay), Jeremy Helbsy (former Savills CEO) and Taavet Hinrikus (TransferWise co-founder).

With the new capital, Flatfair says it plans to hire a “significant” number of product engineers, data scientists and business development specialists.

The startup will also invest in building out new features as it looks to expand its platform with “a focus on making renting fairer and more transparent for landlords and tenants.”

“With the average deposit of £1,110 across England and Wales being just shy of the national living wage, tenants struggle to pay expensive deposits when moving into their new home, often paying double deposits in between tenancies,” Flatfair co-founder and CEO Franz Doerr tells me when asked to frame the problem the startup has set out to solve.

“This creates cash flow issues for tenants, in particular for those with families. Some tenants end up financing the deposit through friends and family or even accrue expensive credit card debt. The latter can have a negative impact on the tenant’s credit rating, further restricting important access to credit for things that really matter in a tenant’s life.”

To remedy this, Fatfair’s “insurance-backed” payment technology provides tenants with the option to pay a per-tenancy membership fee instead of a full deposit. They do this by authorising their bank account via debit card with Flatfair, and when it is time to move out, any end-of-tenancy charges are handled via the Flatfair portal, including dispute resolution.

So, for example, rather than having to find a rental deposit equivalent to a month’s rent, which in theory you would get back once you move out sans any end-of-tenancy charges, with Fatfair you pay about a quarter of that as a non-refundable fee.

Of course, there are pros and cons to both, but for tenants that are cashflow restricted, the startup’s model at least offers an alternative financing option.

In addition, tenants registered with Flatfair are given a “trust score” that can go up over time, helping them move tenancy more easily in the future. The company is also trialing the use of Open Banking to help with credit checks by analysing transaction history to verify that you have paid rent regularly and on time in the past.

Landlords are said to like the model. Current Flatfair clients include major property owners and agents, such as Greystar, Places for People and CBRE. “Before Flatfair, deposits were the only form of tenancy security that landlords trusted,” claims Doerr.

In the event of a dispute over end-of-tenancy charges, both landlords and tenants are asked to upload evidence to the Flatfair platform and to try to settle the disagreement amicably. If they can’t, the case is referred by Flatfair to an independent adjudicator via mydeposits, a U.K. government-backed deposit scheme with which the company is partnering.

“In such a case, all the evidence is submitted to mydeposits and they come back with a decision within 24 hours,” explains Doerr. “[If] the adjudicator says that the tenant owes money, we invoice the tenant who then has five days to pay. If the tenant doesn’t pay, we charge their bank account… What’s key here is having the evidence. People are generally happy to pay if the costs are fair and where clear evidence exists, there’s less to argue about.”

More broadly, Doerr says there’s significant scope for digitisation across the buy-to-let sector and that the big vision for Flatfair is to create an “operating system” for rentals.

“The fundamental idea is to streamline processes around the tenancy to create revenue and savings opportunities for landlords and agents, whilst promoting a better customer experience, affordability and fairness for tenants,” he says.

“We’re working on a host of exciting new features that we’ll be able to talk about in the coming months, but we see opportunities to automate more functions within the life cycle of a tenancy and think there are a number of big efficiency savings to be made by unifying old systems, dumping old paper systems and streamlining cumbersome admin. Offering a scoring system for tenants is a great way of encouraging better behaviour and, given housing represents most people’s biggest expense, it’s only right renters should be able to build up their credit score and benefit from paying on time.”

Powered by WPeMatico