Verified Expert Growth Marketing Agency: We Are Off The Record

Unlike most agencies, We Are Off The Record’s (WAOTR) mission is to advise and train in-house growth teams to scale their business. CEO and founder Bas Prass prides his team’s “train and transfer method” because it has allowed them to work with tech startups and giant corporations from all around the world. WAOTR is based in the Netherlands, but learn more about their approach to growth, agency values, and more.

Image via We Are Off the Record

WAOTR’s unique approach to growth:

“As far as I know, we’re still the only growth bureau in Europe with our approach to growth — we help startups from within. We work with their in-house teams, which means we are literally in the same room as our clients. We want to lead by example. I don’t believe in any other approach anymore because growth has to come from within the business itself.”

“WAOTR walks the talk: they actually do growth instead of solely advising.” Rutger Planken, Rotterdam, The Netherlands, Director & Founder, FoodServicehub

WAOTR’s ideal client:

“Our ideal clients are the ones that understand that growth takes time and doesn’t happen overnight. They understand that we need to touch multiple domains within their business and that growth isn’t only in the marketing or product department but in the entire culture of the company. This is also the reason we insist to work with founders and/or want involvement from C-level positions.”

Below, you’ll find the rest of the founder reviews, the full interview, and more details like pricing and fee structures. This profile is part of our ongoing series covering startup growth marketing agencies with whom founders love to work, based on this survey and our own research. The survey is open indefinitely, so please fill it out if you haven’t already.

Q&A with We Are Off The Record Founder & CEO Bas Prass

Yvonne Leow: How did you become a growth marketer and start working with tech startups?

Bas Prass: I started designing websites and building websites at the age of twelve and quickly figured out how to survive in the digital jungle. I learned by doing and was pretty active within online communities.

Powered by WPeMatico

Crossbeam gets $12.5M Series A to help companies organize their partnerships

When Crossbeam CEO and co-founder Bob Moore was working at previous startups, he noticed a problem around sharing information with potential partners. In fact, it was so acute he decided to create a startup to solve that problem, and today, Crossbeam announced a $12.5 million Series A round led by FirstMark Capital, with participation from existing investors Uncork Capital and Slack Fund.

Moore says that in his previous jobs, he was encountering issues with getting partners integrated and answering basic questions like how many customers do we have in common or are my sales reps currently selling to any of the same people that your sales reps are selling to, and so forth.

“We eventually realized the reason these questions were hard to answer was that you can’t draw a Venn diagram of all the data unless you have all of the data in both of the circles,” Moore told TechCrunch. In other words, each company has only half of the picture, what they already know, and it’s hard to make data-driven decisions without more information.

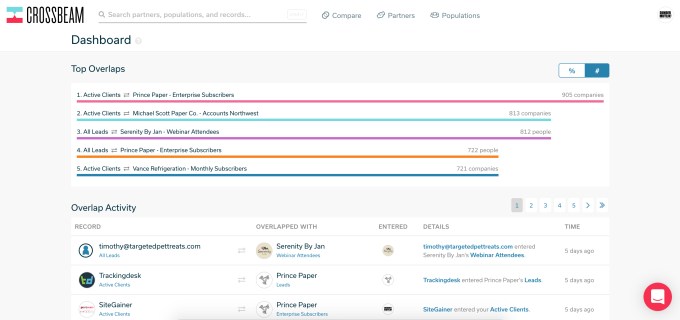

Crossbeam Summary Dashboard (Screenshot: Crossbeam)

He added that there is danger in the age of GDPR and the upcoming California Consumer Privacy Act (CCPA) in oversharing of data, but at the other extreme is not sharing at all. Moore said he created Crossbeam to deal with this. “It seemed like the solution would be to build something that could almost function as an escrow service for data, which could sit between companies that are partnering with each other, and allow them to combine their data sets and identify that when certain conditions are met — like an overlapping need, or an overlapping customer — to take very specific precise actions as a result of that overlap,” Moore explained.

The product works by sharing data from tools like Salesforce, HubSpot or even a .csv file and comparing that data inside of Crossbeam. Partners can see the overlap and where it makes sense for them to work together. Sometimes that may involve customer names, but other times it may be common sales reps across accounts. He says that many companies start with highly trusted partners to get comfortable with the product before branching out.

The company, which was founded in July 2018, has 15 employees and is based in Philadelphia. It previously received a $3.3 million seed round at the end of 2018.

Powered by WPeMatico

Only 3 days left: Get your 2-for-1 passes to Disrupt Berlin 2019

Holy sonderangebot, startup fans — yet another special offer you don’t want to miss! You’ve got just three days left to take advantage of our a 2-for-1 summer flash sale on passes to Disrupt Berlin 2019. Imagine scoring two Innovator, Founder or Investor passes for the price of one. That’s some mighty big ROI.

Don’t delay, because this deep 2-for-1 discount offer disappears August 23 at precisely 11:59 p.m. (CEST). Buy your 2-for-1 passes right here.

You’ll get the full Disrupt experience at half the price. Sweet! Come and hear some of the startup world’s most innovative thinkers, founders and investors. They’ll join TechCrunch editors on the Disrupt Main Stage and discuss crucial tech and investor topics affecting startups of every stripe.

Want to delve deeper into one topic or have the chance to ask follow-up questions in a smaller, more personal setting? Then be sure to attend the Q&A Sessions. These audience-interactive discussions — moderated by TC editors — feature subject-matter experts answering your burning questions related to Disrupt Berlin’s category tracks — Artificial Intelligence/Machine Learning, Biotech/Healthtech, Blockchain, Fintech, Gaming, Investor Topics, Media, Mobility, Privacy/Security, Retail/E-commerce, Robotics/IoT/Hardware, SaaS, Space and Social Impact & Education.

The only way to benefit is to be there in person because we don’t record or stream these sessions — or allow media to attend (except for the moderating TC editors). Show up early, because seating is limited.

Networking is a major event at any Disrupt, and we’re making it easier than ever for you to find the right people — you know, the ones who align with your goals and can help you move forward. CrunchMatch — our free business-matching platform — cuts through the noise to help you zero in on the connections that matter most to you and your business.

We’ll notify all pass holders when CrunchMatch goes live. Then simply create a profile listing your specific criteria, goals and interests. CrunchMatch (powered by Brella) works a bit of algorithmic magic to find like-minded startuppers and will suggest matches and, subject to your approval, propose meeting times and send meeting requests.

You’ll be fully prepped and ready to explore the hundreds of early-stage startups in Startup Alley with a tool that helps you connect with just the right opportunities.

That’s only a taste of what Disrupt Berlin 2019 has to offer, and now you can get it — and a whole lot more — for a whole lot less. This special offer disappears on August 23 at 11:59 p.m. (CEST). Buy your 2-for-1 passes today. Sonderangebot!

Is your company interested in sponsoring or exhibiting at Disrupt Berlin 2019? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Andrew Ng’s AI companies expand to Medellin, Colombia

After his tenure as chief scientist at Baidu, Andrew Ng, the founder of the Google Brain project and former CEO of Coursera, set up a number of different projects that all focus on making AI more approachable. These include the education startup Deeplearning.ai, the AI Fund startup studio for building AI companies and Landing.ai, which helps enterprises (and especially manufacturing companies) use AI. Today, Ng announced he has opened a second office for these projects in Medellin, Colombia.

At first, Medellin may seem like an odd choice. But today’s Medellin is very different from the one you may have seen on Narcos (and a lot safer). It’s home to a number of universities and, over the course of the last few years, it’s a hub for Colombia’s startup scene thanks to incubators like Ruta N and others.

Ng told me that he chose Medellin after looking at a wide range of cities in Europe, Asia and Latin America. Medellin, he believes, offers a strong talent pool, educational system and business ecosystem. It also helps that the Colombia government has made tech a focus in recent years.

“I see early signs of momentum for Colombia being a talent magnet both regionally and globally,” he told me. Indeed, the company was able to hire team members from Poland, Bangladesh, Egypt and Chile for its offices in Medellin, which now has just under 50 people. Over the course of the next two years, Ng plans to expand this team to between 150 and 200 employees.

It’s important, Ng argues, that we set up AI hubs outside of Silicon Valley and China, in part, because they’ll provide a different perspective. “We are able to share our AI ecosystem and Silicon Valley know-how with Medellín,” he writes in today’s announcement. “We’re equally thrilled for our Silicon Valley team to be learning from the Medellín community. Local knowledge and innovation shared with a global community is what will catapult the technology forward.”

The teams in Medellin will work on all of Ng’s projects, including four unannounced stealth portfolio companies that are looking into using AI in sectors like healthcare, education and customer support. In total, the teams in Medellin are working on about a dozen projects right now. And that’s very much Ng’s approach to AI — and for Landing.ai in particular: build lots of specialized components for various verticals that can then be generalized. “AI isn’t some piece of SaaS software that everybody can just swipe their credit card and use,” he said.

Andrew Ng will also join us for our first TechCrunch Sessions: Enterprise event in San Francisco on September 5 to talk about Landing.ai and the future of AI in general. You can find more information about the event (and buy tickets) here.

Powered by WPeMatico

Cosi raises €5M for its ‘full-stack’ hospitality alternative to boutique hotels

Cosi, a new Berlin-based startup operating in the hospitality space with an alternative to boutique hotels and managed short-stay apartments, has picked up €5 million in seed funding pre-launch.

Leading the round are venture capital firms Cherry Ventures and e.ventures, with participation from a number of travel, real estate and hospitality entrepreneurs and experts. They include Nils Regge (founder of HomeToGo and Dreamlines), Gleb Tritus (MD Lufthansa Innovation Hub), Manuel Stotz (founder of Kingsway Capital), Mato Peric (founder of Immo), Andreas Brehmke, Loric Ventures, and Lions Venture.

That’s quite a lineup for a company that won’t launch for another few months, but is no doubt based in part on the track record of Cosi’s founders.

They are Christian Gaiser, the startup’s CEO, who preciously founded Bonial.com, the local shopping platform sold to Axel Springer in 2011; Dimitri Chandogin, who co-founded Doc+, a prominent digital healthcare provider in Russia; and CTO Gerhard Maringer, who has a background in fintech and previously built ForexFix, an FX hedging platform.

“More and more guests prefer to stay in a unique apartment versus a boring hotel, i.e. travelers tend to book their stay at a private host via Airbnb. [However], the experience can be frustrating though due to lack of quality and service: long check-in/check-out times, poor interior design, lack of cleanliness, not enough linen, no service hotline in case of questions, to name a few examples,” Gaiser tells TechCrunch.

“Many guests, therefore, decide not to stay in a unique home for quality reasons. Cosi solves this problem as a full-stack hospitality brand: We control the entire guest journey from end-to-end.”

To offer a “full-stack” hospitality service that hopes to compete with well-run boutique hotels or traditional local managed apartments, Gaiser says the company signs long-term leases with property owners, and then furnishes those apartments itself to “control” the interior design experience. “On top of that, we offer a digital service along the entire guest journey from initial contact to loyalty. Finally, we rent out our apartments short-term as a hotel replacement,” he explains.

That requires technology to drive “the entire value chain,” and Gaiser points out that the tech guests experience directly is only the tip of the iceberg. “Running a hospitality business requires a lot of tools in the background for housekeeping, maintenance, yield management, to name a few, that will create an efficiency edge for us,” says the Cosi co-founder.

With regards to target customers, Cosi broadly covers travelers that want the quality assurance of a hotel but appreciate the unique design and “coziness” of a personal home. More specifically, the company has two main target groups in mind: tourists that spend a few days in Berlin to immerse themselves in the local culture and history (“live like a real Berliner”), and business travelers that need to stay several weeks or months and are fed up with the traditional hotel experience.

“Cosi creates a new category, but the closest direct competitors include smaller boutique hotels or traditional local serviced apartment operators for tourists,” says Gaiser. “In a broader sense, we also compete with the big hotel companies like Marriott or Hilton in business travel.”

There are potential U.S. competitors, too, with Sonder and Lyric operating a similar model. “They might also look into Europe,” concedes Gaiser, “[but] it will be challenging for them to comply with local regulations and to establish real estate relationships. It is a very local game.”

Powered by WPeMatico

Box introduces Box Shield with increased security controls and threat protection

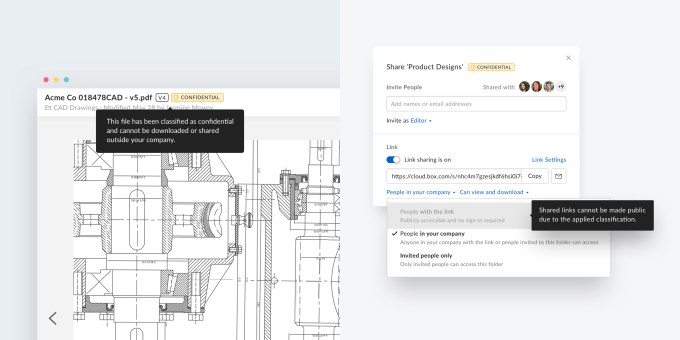

Box has always had to balance the idea of sharing content broadly while protecting it as it moved through the world, but the more you share, the more likely something can go wrong, such as misconfigured shared links that surfaced earlier this year. In an effort to make the system more secure, the company announced Box Shield today in Beta, a set of tools to help employees sharing Box content better understand who they are sharing with, while helping the security team see when content is being misused.

Link sharing is a natural part of what companies do with Box, and as Chief Product and Chief Strategy Officer Jeetu Patel says, you don’t want to change the way people use Box. Instead, he says it’s his job to make it easier to make it secure and that is the goal with today’s announcement.

“We’ve introduced Box Shield, which embeds these content controls and protects the content in a way that doesn’t compromise user experience, while ensuring safety for the administrator and the company, so their intellectual property is protected,” Patel explained.

He says this involves two components. The first is about raising user awareness and helping them understand what they’re sharing. In fact, sometimes companies use Box as a content management backend to distribute files like documentation on the internet on purpose. They want them to be indexed in Google. Other times, however, it’s through misuse of the file-sharing component, and Box wants to fix that with this release by making it clear who they are sharing with and what that means.

They’ve updated the experience on the web and mobile products to make it much clearer through messaging and interface design what the sharing level they have chosen means. Of course, some users will ignore all these messages, so there is a second component to give administrators more control.

Box Shield access controls (Photo: Box)

This involves helping customers build guardrails into the product to prevent leakage of an entire category of documents that you would never want leaked, like internal business plans, salary lists or financial documents, or even to granularly protect particular files or folders. “The second thing we’re trying to do is make sure that Box itself has some built-in security guardrails and boundary conditions that can help people reduce the risk around employee negligence or inadvertent disclosures, and then make sure that you have some very precision-based, granular security controls that can be applied to classifications that you’ve set on content,” he explained.

In addition, the company wants to help customers detect when employees are abusing content, perhaps sharing sensitive data like customer lists with a personal account, and flag these for the security team. This involves flagging anomalous downloads, suspicious sessions or unusual locations inside Box.

The tool also can work with existing security products already in place, so that whatever classification has been applied in Box travels with a file, and anomalies or misuse can be captured by the company’s security apparatus before the file leaves the company’s boundaries.

While Patel acknowledges there is no way to prevent user misuse or abuse in all cases, by implementing Box Shield, the company is attempting to provide customers with a set of tools to help them reduce the possibility of it going undetected. Box Shield is in private beta today and will be released in the fall.

Powered by WPeMatico

PayPal-backed money lender Tala raises $110M to enter India

Tala, a Santa Monica, Calif.-headquartered startup that creates a credit profile to provide uncollateralized loans to millions of people in emerging markets, has raised $110 million in a new financing round to enter India’s burgeoning fintech space.

The Series D financing for the five-year-old startup was led by RPS Ventures, with GGV Capital and previous investors IVP, Revolution Growth, Lowercase Capital, Data Collective VC, ThomVest Ventures and PayPal Ventures also participating in the round.

The new round, which takes the startup’s total fundraising to more than $215 million, valued it above $750 million, a person familiar with the matter told TechCrunch. Tala has also raised an additional $100 million in debt, including a $50 million facility led by Colchis in the last year.

Tala looks at a customer’s texts and calls logs, merchant transactions, overall app usage and other behavioral data through its Android app to build their credit profile. Based on these pieces of information, its machine learning algorithms evaluate the individual risk and provide instant loans in the range of $10 to $500 to customers.

This model is different from how banks and most other online lenders assess a person’s eligibility for a loan. Banks look at a user’s credit score while most online lenders check the financial history.

Tala is also much faster. It approves loans within minutes and disburses the money via mobile payment platforms. The startup has lent over $1 billion to more than 4 million customers to date — up from issuing $300 million in loans to 1.3 million customers last year, Shivani Siroya, founder and CEO of Tala, told TechCrunch in an interview.

The startup, which employs more than 550 people, will use the new capital to enter India, said Siroya, who built Tala after interviewing thousands of small and micro-businesses.

In the run up to launch in India, Tala began a 12-month pilot program in the country last year to conduct user research and understand the market. It has also set up a technology hub in Bangalore, she said.

Shivani Siroya (Tala CEO) at TechCrunch Disrupt NY 2017

“The opportunity is very massive in India, so we spent some time customizing our service for the local market,” she said.

According to World Bank, more than 2 billion people globally have limited access to financial services and working capital. For these people, many of whom live in India, securing a small size loan is extremely challenging as they don’t have a credit score.

In recent years, several major digital payment platforms in India, including Paytm and MobiKwik, have started to offer small-sized loans to users. Traditional banks are still lagging to serve this segment, industry executives say. (Outside India, Tala competes with Branch, a five-year-old San Francisco-based startup that has raised more than $170 million to date and earlier this year inked a deal with Visa.)

Tala goes a step further and takes liability for any unpaid returns, Siroya said. More than 90% of Tala users pay back their loan in 20 to 30 days and are recurring customers, she added.

The startup also forwards the positive credit history and rankings to the local credit bureaus to help people secure bigger and long-term loans in the future, she added.

Tala, which charges a one-time fee that is as low as 5% for each loan, relies on referrals, and some marketing through radio and television to acquire new customers. “But a lot of these users come because they heard about us from their friends,” Siryoa said.

As part of the new financing round, Kabir Misra, founding general partner of RPS Ventures, has joined Tala’s board of directors, the startup said.

Tala said it will use a portion of its new fund to expand its footprint and team in its existing markets — East Africa, Mexico and the Philippines — and also build new solutions.

Siroya said the startup has identified some more markets that it wishes to serve. She did not disclose the names, but said she is eyeing more countries in South Asia and Latin America.

Powered by WPeMatico

Fresh out of Y Combinator, Tandem lands millions from Andreessen Horowitz

Tandem, one of the most sought after companies to graduate from Y Combinator’s summer batch, will emerge from the accelerator program with a supersized seed round and an uncharacteristically high valuation.

The months-old business, which is developing communication software for remote teams after pivoting from crypto, is raising a $7.5 million seed financing at a valuation north of $30 million, sources tell TechCrunch. Airbnb investor Andreessen Horowitz is leading the round.

Tandem and a16z declined to comment for this story. The round has yet to close, which means the deal size is subject to change. Y Combinator startups raise capital using SAFE agreements, or simple agreements for future equity, which allow investors to buy shares in a future priced round at a previously agreed-upon valuation.

We’re told several top venture capital firms were vying for a stake in Tandem. One firm even gifted the founders a tandem bike, sources tell TechCrunch, resorting to amusing measures to sway the Tandem team. But it was A16z — which has an established interest in the growing future of work sector, evidenced by its recent investment in the popular email app Superhuman — that ultimately won the coveted lead investor spot.

Tandem provides a virtual office for remote teams, complete with video-chatting and messaging capabilities, as well as integrations with top enterprise tools including Notion, GitHub and Trello. The service launched one month ago and has signed contracts with Airbnb, Dropbox and others. The company claims to be growing 50% week-over-week.

“Every company is a remote company,” Tandem chief executive officer Rajiv Ayyangar said during his pitch to investors on day two of Y Combinator Demo Days this week. “You have salespeople in the field, [companies with] multiple offices, people working from home. Tandem isn’t just building the future of remote work, it’s building the future of work.”

Ayyangar was previously a data scientist at Yahoo before joining Yakit, a startup seeking to simplify ecommerce delivery, as the director of product. Co-founders Bernat Fortet Unanue and Tim Su are also Yahoo alums.

We’re told Tandem’s fundraise was nearly complete before it pitched to investors Tuesday afternoon. Startups that participate in YC are often flooded with offers from VCs throughout the three-month program. Firms are hungry for the batch’s Airbnb, Dropbox or Stripe — graduates of the program — and will pay premiums on startup equity for their chance to invest in a future ‘unicorn.’

As a result, the median seed deal for U.S. startups in 2018 was roughly $2 million — a record high — with typical pre-money valuations hovering north of $10 million. Tandem’s seed financing represents both a trend of swelling seed deals and valuations, as well as a tendency for VCs to dole out more cash to fresh-from-YC companies amid heightened competition amongst their peers.

The previous YC batch, which wrapped up in March, included ZeroDown, Overview.AI and Catch, a trio of companies that pocketed venture capital ahead of demo day. ZeroDown, a financing solution for real estate purchases in the Bay Area, raised upwards of $10 million at a $75 million valuation before demo day, sources told TechCrunch at the time (months after demo day, Zero Down announced a whopping $30 million financing). ZeroDown was an outlier, of course, as the company’s founders had previously co-founded the billion-dollar HR software company Zenefits.

As for the summer batch, we’re told Actiondesk, Taskade and Tandem are amongst the startups to garner the most hype from investors. Some even forwent the demo day pitch altogether. BraveCare, which is creating urgent care clinics intended just for kids, raised $4.1 million ahead of demo day, we’re told. The company opted not to pitch to additional investors this week.

You can read about all the company’s that pitched during demo day one here and demo day two here.

Powered by WPeMatico

Here are the 82 startups from day 2 of Y Combinator’s S19 Demo Days

Team TechCrunch was back for Day 2 of Y Combinator’s Summer 2019 Demo Days where we heard from another massive chunk of startups that are taking disruption very seriously, even if they’re aiming to upend companies that only launched in Y Combinator a few classes ago.

The total class of on-record Demo Days launches came to 166 startups, after 82 presentations today. If you missed out on our tireless coverage yesterday, check that out too. We also picked our 11 favorites from yesterday’s batch here.

Here’s what we all saw today:

- Asher Bio: Starting off YC Day 2, this startup is trying to help your body stave off cancer. Asher Bio is building immuno-therapy drugs that ramp up your immune system to take on cancer cells. Existing therapies can lead to severe side effects, but the ex-Pfizer co-founders claim their early tests on mice have shown that they are “close to solving” the problem with 1,000x more precision than existing solutions.

- Talar: No more grocery shopping or grocery placing — Talar delivers grocery and meal-kits directly to customers. Dubbing itself a “last-meter delivery” business, the company actually delivers groceries directly into customer’s fridges. The company charges a $10 delivery fee as well as a 10% mark-up on each product it delivers. Talar has launched in San Francisco and has 90 customers today.

- spotLESS Materials: This startup created a liquid-infused coating designed to keep surfaces clean and repel anything, from water to poop. The coating itself is a super slippery surface that virtually nothing can attach to. spotLESS launched just two weeks ago and already has contracts and pilots in place worth $166,000. Some partners include the U.S. Navy and Pennsylvania State, which is using it in their bathrooms.

- Vendr.com: With so many SaaS companies saturating Silicon Valley, there’s a need for another SaaS company that will manage your other SaaS subscriptions. Purchasing software is a broken system, in that different customers pay different prices for the same software. Vendr created a self-serve process to help companies purchase, renew and manage their software subscriptions, and they’re targeting high-growth early-stage companies as early customers in what they say is a $10 billion market.

- Trella: Trella connects shippers to truck drivers in the Middle East to improve efficiency and increase transparency. The company says that shipping costs 3x as much in the Middle East as it does in the U.S.

- Business Score: Business Score is helping companies automate background checks on other businesses. The startup is looking to stamp out tired manual processes that largely mean picking up the phone and scouring documents. The single API taps data sources across the web to build out real-time profiles that can help customers scan businesses in an effort to prevent fraud, qualify leads and onboard new clients.

- Fit to Form: For women that struggle to find clothes that fit, Fit to Form has created an online shopping platform for locating clothes that fit women according to their exact measurements. The startup, like many in the batch, is founded and led by a pair of Stanford computer science graduates. Fit to Form says there are 52 million women in the U.S. that spend $660 per year online shopping — a big opportunity to solve the “online shopping industry’s biggest challenge.”

- Shiru: Shiru creates protein designed to replace dairy and eggs. Shiru leverages computational design to make new versions of the core ingredients that go into the food products we consume daily. Already, Shiru has identified seven viable protein candidates and has three letters of intent from major food and ingredient companies.

- Coco: Most money transferred from Venezuelan migrants back to their families goes toward food. Coco allows Venezuelan migrants to send food home rather than money. Coco says it is already making $10,000 in monthly revenue. The startup partners with mini markets to make food purchases and takes a 20% cut of their sales, allowing a commission-free outcome for customers. Coco’s founding team built the first bitcoin exchange in Venezuela.

- Arpeggio Bio: This startup provides an RNA-profiling technology for watching how medications work within the body. They call it a “debugger for cell biology.” With $750K in revenue this year, the company says they’re working with four of the top 10 pharma companies, including Novartis.

- Canix: The cannabis industry is growing rapidly, but unsurprisingly the farmers and government regulators are still figuring out how to navigate compliance smoothly. Today, farmers are having to manually tag every single marijuana plant they grow. Canix is building compliance software that helps farmers easily scan bar codes and send data to the government.

- Gen1E Lifesciences: One of several biotech startups to pitch Tuesday morning, Gen1E claims to cure inflammatory diseases. The company uses computational chemistry to identify drugs that work for specific illnesses. The company is launching with a focus on ARDS, which currently has no treatment. Gen1E says they are targeting a $100 billion market for inflammatory and age-related diseases.

- Embrace: Designed to help developers push better code, Embrace makes it easy for mobile developers to identify bad code and fix bugs faster. Already, companies like Wish, Goat, OkCupid, Headspace and Boxed use Embrace. The company has grown to $1 million in annual recurring revenue.

- Microverse: This company calls itself a Lambda school for software developers in emerging countries. The Microverse model doesn’t employ teachers, but uses a peer-to-peer learning model to prepare its student-engineers for the professional world. The company makes money with an income-share agreement, in which students pay 15% of their salary to the startup (although it did not specify for how long). The founder says that 50,000 people have applied to Microverse since it launched in January 2019, and 100% of its first cohort graduated with a job and is now paying them back. Microverse says it’s making an average of $6,000 per student. Because there are no teachers to pay, the founders are claiming 90% margins.

- Wingman: Wingman is a bot for phone sales representatives. It listens to sales calls and generates cue cards in real time to suggest possible answers/responses. Charging $80-$100 per month per rep, they’re currently seeing $5K in monthly recurring revenue, with 55% month-over-month growth.

- Kraftful: Kraftful is aiming to help the companies making smart home devices make apps that are less awful. The startup was founded by former IFTTT team members and is looking to makes “white label” apps that can offer uniform UIs with regular updates. They are working with IoT companies on a SaaS pricing model and say they already have a $300K LOI from one firm.

- Encellin: This biotech startup has developed what it calls a “shark cage” to protect sells. The company, led by two PhD founders, will enter the clinic next year with a human trial focused initially on diabetes treatment. Ultimately, Encellin will go after all chronic disease with technology that treats missing, damaged or diseased cells with next generation cell transplants.

- Proof Trading: This is an institutional equities broker that aims to get investors better prices. Already, Proof has letters of intent from six top-tier funds. The total addressable market is $7.4 billion per year.

- Mudafy: This tech-enabled real estate startup considers itself the “Compass for Latin America.” In LatAm, selling and renting homes is a broken system, and an innovative solution could prove to be a $20 billion opportunity. Buyers and renters are hindered by bureaucratic policies that enforce high interest fees and expensive deposits. Mudafy wants to improve the renting and buying process with its software operations platform.

- Globe: Globe provides Airbnb-style home rentals, done by the hour. As an example use case, they mention traveling professionals that need private/quiet locations to work or take calls. The company says its current customers book an average of 2x a week.

- Cuboh: Restaurants have kind of been bombarded by the app-ordering economy and have a handful of tablets dedicated to each delivery app. Cuboh is building an app that integrates the order volumes from these apps into a single experience so that restaurants don’t need multiple employees approving multiple orders on multiple tablets.

- Lucid Drone Technologies: Lucid builds drones that spray buildings with cleaning liquids and leases them out to cleaning companies for around $3K per month. They’ve currently signed contracts worth about $33K in monthly recurring revenue.

- MyPetrolPump: This refueling service delivers gas to cars, trucks and generators for B2B customers in India. Since launch, MyPetrolPump has become profitable and grown to a monthly gross merchandise volume of $500K across its 1,400 B2B customers.

- Narrator: Narrator is a full-service data team for startups of any size. The team behind Narrator built WeWork’s data infrastructure, and wants to target more startups as early customers. The company says they’re generating $91,000 per month with this business model, but they aren’t stopping there. Narrator wants to build as a cross-company universal standard for data and grow out this library of shared analyses. This strategy allows the company to repurpose the analyses they produce and offer it to new customers.

- GitStart: GitStart allows you to send small coding tasks (from JIRA, etc.) to its global network of developers. They charge a fee for each task — but if the developer does a good enough job that you’d like to hire them more permanently, GitStart also makes a commission.

- Hey Healthcare: More and more Americans are gaining insurance coverage for mental health services, but nearly half of therapist offices don’t take insurance, according to the team at Hey Healthcare, which is building automated medical billing software for therapists. The startup helps therapists get registered and bill insurers, they have already helped process $100K in insurance claims with early customers.

- PayMongo: This FinTech startup targets the Philippines. Specifically, the company is bringing innovation to the payments infrastructure in the country, where the technology is years behind. Companies integrate directly to PayMongo’s APIs or, they can use their pre-built checkout forms, shareable via URLs. The company has signed up 900 merchants since it launched in June.

- KubeSail: This cloud-hosting provider wants to be as powerful as AWS and as easy as Heroku. KubeSail is a deployment platform built on top of Kubernetes that’s experiencing 23% month-over-month growth. Today, about 3,200 developers have launched cloud applications on KubeSail.

- Zenith: This company is building a new virtual world that blends AI, VR and its backend tech to immerse users in new lives online. Zenith, which raised $120,000 on Kickstarter in one week, is the first cross platform world to exist on VR desktop and console. Essentially every screen you own is a window into their world. The company plans to monetize by taking cuts of every item bought or sold on their platform, like property and clothing. The founders have worked at Google and Unity, and co-produced with Oculus.

- Multis: Multis is a bank to help companies use cryptocurrencies (for things like recurring payments to remote workers) and earn interest on their savings. Twelve weeks after launch, the company says they’re managing more than $2.8 million in crypto. They charge a 1% fee on every transaction, and $900 per year.

- Vahan: The competing entities of the on-demand economy have some pretty major recruitment needs. Vahan is tackling the issue in India, helping companies like Uber and Zomato reach out to potential recruits via a WhatsApp bot. The startup is earning $20 per successful hire they recruit for their customers.

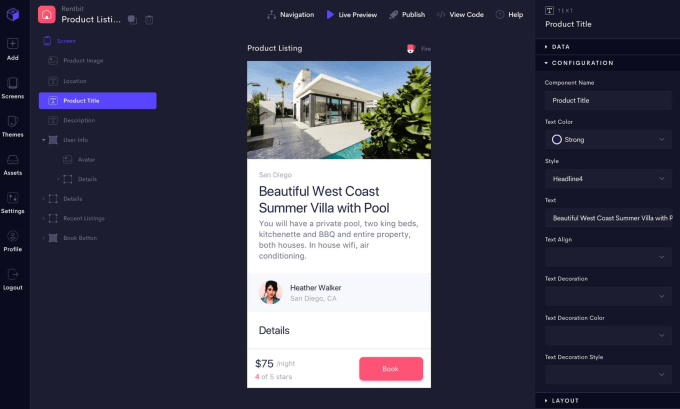

- Draftbit: This tool is for building apps that are high quality and built from scratch, the company said. Using Draftbit you can build apps visually with production-ready source code. The tool entered beta in February and has worked with 5,000 teams since. The idea is that by using Draftbit, software developers can build apps more collaboratively.

- Rejuvenation Technologies: If this startup gets its way, it’ll make it so we all live longer. Through extending the protective cap of DNA that functions as an aging clock, called telomeres, Rejuvenation Technologies aims to reverse aging. Rejuvenation’s drug extends telomeres and is already testing in animals, and says that one dose given to a mouse appeared to turn back the clock the equivalent of five years in humans. The founders envision a world where people take the drug to extend their healthspan and lifespans.

- Carve: Carve is a marketplace where people rent cars from dealerships. Right now, 12 million cars are idly sitting at dealerships, depreciating in value. Car sales have declined by 30% since 2014, and if dealerships want to stay alive, they’ll need to find new creative ways to make money. Carve’s founders also believe the rental car industry as it stands doesn’t need to exist, creating a $12 billion opportunity.

- Apurata: Apurata provides small loans for Latin America. They did 1,488 loans in July, earning an average of $21 per loan. The company’s founders say that banks in Latin America approve only 9% of loans, whereas Apurata is currently approving around 26% of applicants.

- TrustedFor: LinkedIn is just such an awful platform that there’s space for a startup to disrupt it by just remaking it. TrustedFor is building “LinkedIn 2.0,” a platform for professional profiles that is centered around recommendations from people that the users have actually worked alongside. The startup is leveraging the YC network pretty heavily to get associated companies on board.

- Data Mechanics: Claiming to be “the new Hadoop,” Data Mechanics is a tool for engineers. Their solutions automate performance tuning and other maintenance work for Apache Spark, an open-source computing framework. Ultimately, they plan to expand to provide an end-to-end platform in which data engineers write code and they run it for them. The service is currently live.

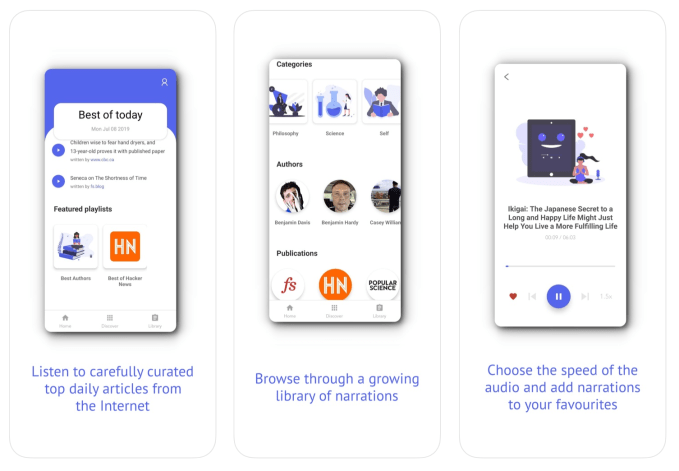

- Listle: Listle is a platform to listen to audio versions of stories on the internet. Listle, which launched in July 2019, has created a library of 900 audio articles. For customers, it costs $8.99 per month.

- Digi-Prex: This monthly medication delivery platform says it is up to 15% cheaper than local pharmacies. The company is targeting patients with chronic diseases in India and using WhatsApp to acquire its customers, of which it now has 5,000. With 60 million Indians spending $150 per month on prescription medications, the company identifies a $9 billion opportunity.

- Cloosiv: A Starbucks-style mobile ordering experience for smaller coffee shops, aggregating many indie shops into one app, Cloosiv currently has more than 250 coffee shops, and is adding roughly three new shops per day. We wrote about Cloosiv here.

- Figments: Figments is looking to take the eSports market by storm with a network of virtual influencers that the team hopes can become the “WWE for eSports.” The team is creating characters with fictional storylines and is bringing custom voice acting to tailor the characters to different users around the globe.

- Vouch: Vouch provides business insurance to startups because “bad things happen to good startups,” the founder explained. Using Vouch, the insurance process starts at $200 per year which is apparently much cheaper than most products available on the market. Vouch also has risk management tools so companies can focus on company-building. Vouch has launched in Utah and will be in 10 states by the end of the year.

- Tandem: Tandem is a virtual office for remote teams that lets people see who is online, what they’re working on and who is available to talk. The software takes a Discord-like approach to letting users see what work apps their co-workers are in. Currently, Tandem has more than 450 active teams using the product and is seeing 50% weekly growth. Already, companies like Airbnb, Spotify, Dropbox and WeWork use Tandem.

- The Custom Movement: This company wants to make custom sneakers at more accessible price points. “If you’re rich or poor, you should be able to afford cool sneakers that you love,” says the founder. The Custom Movement wants to build out the world’s first marketplace for custom sneakers made by independent artists, following the assertion that “Nike is evil.” Within a few weeks of launch, Custom Movement has 70 artists selling 7,000 sneakers on its platform, and has brought in $26,000 in sales.

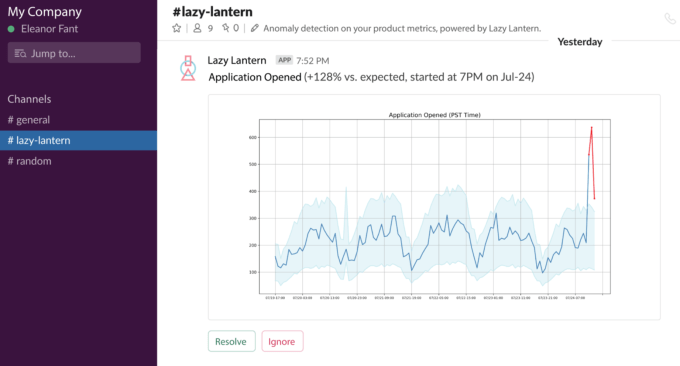

- Lazy Lantern: The startup analyzes your historical web app analytics and uses that knowledge to alert you if something unexpected happens (like traffic to a certain page suddenly spiking). You plug it into your existing analytics systems, and it’ll notify you via Slack if it detects an abnormality. They’re currently working 40 companies, and say they’ve received a letter of intent from Snap.

- Vitau: The online pharmacy craze is still in its infancy even after high profile M&A in the space, and Vitau is looking to get at the forefront of that market in Mexico. The startup is launching a subscription pharmacy for patients with chronic diseases. Just by approaching their first target market of those prescribed diabetes medications, they say they’re entering what could be a $12B market.

- Wren: This greentech startup helps people take action against climate change. Here’s how it works: users sign up on Wren and begin tracking their carbon footprint. Then, the company plants trees to make up for its users’ carbon footprint on a monthly basis. The company launched two months ago and has recently launched Wren as an employee benefit.

- Sequence Bio: Sequence Bio is a genome project looking to leverage genetic data to discover new drugs. The company says the best data comes from genetically isolated populations and those with uniform medical records — Newfoundland has both. So far, Sequence Bio has collected over 800 samples and is working with pharma and biotech companies to license data for drug development.

- Curtsy: Curtsy is targeting Gen Z clothing buyers with its mobile marketplace for resale items. The founder says that Gen Z shoppers have different buying habits than previous generations, in that they seek fashion built for rotation. Buyers want to sell last week’s outfit to fund next week’s outfit, and need a marketplace to rotate out items. Cutsy believes it can offer this service and eventually make $2 billion in the U.S.

- Refinery Labs: The startup is building a drag-and-drop interface system for deploying new features using linkable code blocks. Refinery says the functionality it adds is automatically scalable, secure, and stable. 2 weeks after launching, they have 43 paying companies onboard.

- TradeID: Yesterday, we saw a Robinhood clone for India, today we’re seeing that same model built for Indonesia. It’s also using fractional shares so that people can get skin in the game with minimal buy-in. The team says they’re live and compliant in Indonesia and have logged $500k in transactions since launch.

- Lofty AI Lofty AI is building what they claim to be the first reliable method for tracking neighborhood demand to help real estate investors make more informed investment decisions. Lofty AI recommends properties to investors and if the investors decide to purchase, they enter into a contract that gives them 20% of the profit. However, if the value of a property goes down, Lofty says they will cover all of the investors losses.

- Z Imaging: This startup is creating augmented reality guided tools for surgical procedures. The aim is to make surgery easier and more accurate by providing surgeons with an internal view of the body. So far, Z Imaging has received letters of intent from leading hospitals worth about $360,000. For hospitals, Z Imaging charges $15,000 per month. Z Imaging is in the pre-FDA submission phase but expects to conduct a clinical study this January, and hopes to receive FDA approval by the end of next year.

- Tensil: This startup turns machine learning models into custom chips that can replace GPUs. AI companies depend on machine learning, and are spending $3 billion on GPUs. This company produces auto-generated chips that it says are 50% smaller, 10 times faster and 20 times more energy efficient than GPUs.

- FeaturePeek: FeaturePeek is working on a tool to help developers/designers get feedback earlier in the development cycle. They build a test environment for every GitHub branch/pull request. Users can comment directly on the page, and use the built-in tools to take screenshots. They are looking to charge users $16-19 per user per month. We wrote about FeaturePeek here.

- Khabri: The podcast platform wave has washed over plenty of internet-immersed markets, but platforms like Apple Podcasts and Spotify lack traction in India. Many users are stuck with YouTube audio but Khabri is looking to build up a network of exclusive podcasts with 2,500 creators. The team already has 60,000 DAUs who use the app an average of 20 minutes per day.

- Mindset Health: This startup founded built by two brothers is seeking to treat IBS using hypnotherapy. Mindset Health says they’ve already helped over 280 people improve their IBS, earning $5,600 in monthly recurring revenue. They claim IBS is a $3 billion market in the U.S. Mindset plans to scale its service to provide treatments for other issues, including anxiety and chronic pain.

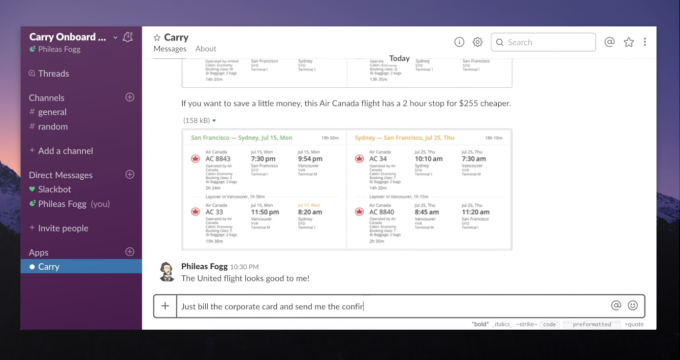

- Carry: Carry is a corporate travel assistant that helps you plan, book and offer support — all via Slack, but using real humans. This month, Carry has booked $160,000 worth of corporate travel. Current customers include Segment, Orthly, Stanford Graduate School of Business and others.

- Treble.ai: A customer support platform that lets companies get feedback from users through SMS and WhatsApp. The company describes itself as similar to Qualtrics and Zendesk, but with one big difference: Qualtrics and Zendesk were built for desktop web and email. Treble is built for mobile-first, chat-based communication. Treble says there are 100,000 companies that serve their users through mobile apps, and it wants to be the startup that manages their customer support. The startup scored Colombian logistics unicorn Rappi as their largest customer, and is seeing $16,000 in MRR.

- AudioFocus: This team helps users hear their friends in noisy environments like restaurants and conferences. Their app builds a fingerprint of your friend’s voice (or “voice prints” as they call them) based on a few minutes of recorded speech, then filters out other sounds and voices that don’t match this fingerprint and plays this edited audio stream to the user through headphones.

- Mighty Health: Mighty Health is creating an app that replicates some of the experiences of cardiac rehab centers. Insurance companies are paying for people who have suffered from heart problems to get healthier and avoid further hospital trips, but many patients complain about the cardiac rehab programs being too far away or too inconvenient to access. There’s an app for that.

- Asayer: Asayer’s software shows video of everything a company’s customers do on its software to identify bugs. It’s like looking over your user’s shoulder, the company’s founder explains, making it much easier for teams to instantly identify where the problems in their code are. Asayer’s vision is to go after the $10 billion market of people developing web apps. Asayer launched in June and says it has tripled its revenue since then.

- Gmelius: Gmelius is a Gmail tool built to help teams manage projects, operate a help desk and automate daily processes. The team aims to replace Mailchimp, Asana, Trello, Zendex and many more by integrating with your Gmail inbox. Gmelius currently has 100,000 daily active users taking with $180,000 of monthly recurring revenue.

- Mipos.dev: This team is building a restaurant operating system for Latin America-based businesses. The Latin America point-of-sale market for businesses is worth $2 billion. Online ordering apps represent 20% of restaurant sales in Latin America, but restaurants don’t have passable hardware or software options to manage this growing demand. Multiple tablets are needed for multiple services and there’s no centralized software to help businesses manage online ordering. mipOS wants to be a one-stop-shop management system for restaurants.

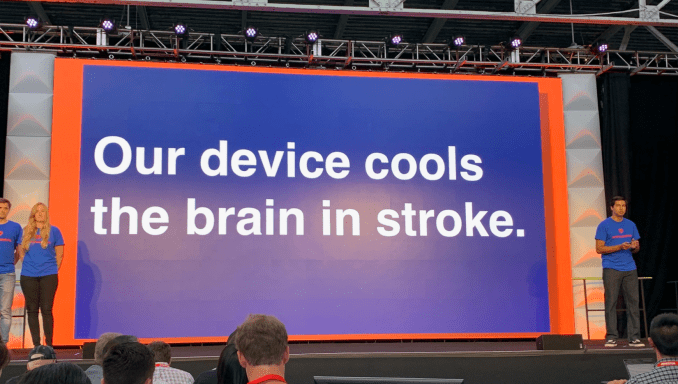

- Voyage Biomedical: Voyage Biomedical is creating a system which the company says limits brain damage during an ischemic stroke — where a clot prevents blood flow to the brain — by quickly cooling the brain until doctors are able to remove the blockage. They’ve tested the device on a pig while stopping blood flow to the brain; they say the pig survived, and made a full recovery. Co-founder Robert Schultz is a cardiac surgeon.

- LineLeap: What OpenTable is for restaurants, LineLeap wants to be for bars and nightclubs. The company is the app experience for alcohol, people can pre-order drinks or pay to skip the line at a particularly packed bar. The teams says that they’ve amassed $30k in MRR and helped 1 customer earn an extra $25k per month just by letting customers pay to skip lines.

- ReverCare: This company has created a platform for helping people care for their aging parents. ReverCare connects families to social workers, who in turn connect them to eldercare services and help with senior living and care logistics. The company says they are going after a $13 billion market.

- Hutsy: Hutsy is a real estate brokerage that aims to make it easier to buy houses through an online experience. Since launching four weeks ago, Hutsy has closed on three homes. Instead of hiring more real estate agents, Hutsy scales through its automation software.

- Eden Farm: Eden Farm delivers fruits and vegetables to restaurants in Indonesia. Restaurants are still purchasing poor-quality produce, and Eden Farm thinks it can replace the local middle-man in this equation while simultaneously helping local farmers. The platform provides a way for farmers to forecast the market demand for their produce. This isn’t a new idea; EdenFarm wants to be the Sysco for Indonesia and eventually expand to neighboring areas in Asia. Eden Farms pegs the market opportunity at $30 billion.

- Beacons AI: Beacons AI is letting users further monetize their fandom. It’s a payments platform for influencers that allows users to pay to ask these influencers questions and receive short video responses. Beacons takes 25% of every transaction.

- Monaru People are lightly connected to lots of people on Facebook, Monaru is aiming to help customers foster closer bonds with a few close friends or family members. Monaru is building a virtual assistant for people’s personal relationships. The company’s app prompts people to connect with their closest friends and helps them reach their personal goals for their friendships.

- Shift Health: Subscription-based revenue cycle technology tailored for the healthcare industry. The business is the second from the founders, who claim to have built the best accounts receivable software for hospitals and clinics.

- DirectShifts: Connects doctors to hospitals for short-term shift work, with 51 hospitals on board so far. DirectShifts uses technology to decrease the hiring onboarding process to two weeks and makes $5,000 per doctor per month. DirectShifts currently brings in $65,000 in net revenue per month and has a GMV of $435,000.

- Flux This startup enables Latin America-based merchants to accept payments with mobile wallets. Rappi gives people digital wallets, Flux makes it possible for merchants to accept these payments. They are able to process payments without intermediaries like Visa or MasterCard, signifying its intention to grow into not only a service, but a payments network. Flux’s tech is live in 32 restaurants a few weeks after its launch, and the founders say that 800 more are about to go live.

- Midtype: Midtype is building backend engineering as a service, meant to allow frontend developers build more without the need for backend engineers. The founders say that 80% of backend features needed by most apps (the databases, payment systems, etc) are the same, so they provide it or make it easily addable.

- Waves: Waves is creating a dating app with a focus on matching users with specific sexual fetishes. The company launched a few days ago and already has signed up 750 users. The company says that their market opportunity could be 15 times the size of Grindr.

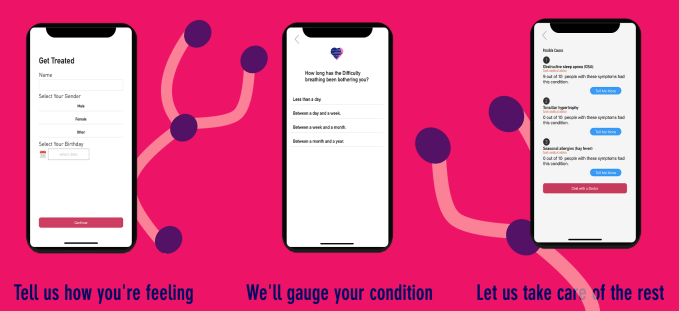

- Symplex: The team is developing an AI-based doctor that can diagnose you using your smartphone. The startup says they’ve signed up 15 doctors in the first few weeks, with a goal of expanding into a $2.6 billion market. Here’s how it works: first, you tell Symplex how you’re feeling, then, the company’s machine learning algorithm gauges your condition and provides a detailed initial diagnosis, which is then stored and saved.

- Boost Biomes: Boost Biomes has a spray treatment for crops that prevents mold for up to 11 days. Currently, Boost Biomes has more than $1 million worth of letters of intent with customers who will be able to either use the product in the field or after harvest.

- Percept.AI: This startup is creating an AI support agent that immediately resolves common customer support tickets. Other solutions can take over 3 weeks of onboarding, quality is often insufficient and the AIs only end up resolving between 10-30% of tickets. Percept.AI says their tech could work to identify 1.2 billion support tickets that go outstanding. They say they can immediately resolve up to 50% of tickets without human intervention, what it describes as an exciting $22 billion market.

- Covela: Covela is an online insurance broker for small/medium businesses in Latin America. The company says it saves customers 40% over competition in the region.

- Stoic: Stoic is an emotional tracking app that checks in with users twice per day to better understand how they are feeling and what obstacles they’re up against. The app guides its “thousands” of users on how to de-stress, feel less angry and improve relationships. Stoic, which charges $70 upfront for an entire year, says its revenue is growing 52% month over month, citing 40% retention rates.

- Dover: Dover is a hiring platform that is entirely automated. The software is designed to understand the skillsets your company is looking for and then engages in outbound recruiting. Dover’s candidate sourcing tech has cut humans out of the process, which the company says improves margins. Dover currently has 18 paying customers and is doing $68,000 a month in revenue.

And that’s a wrap!

Thanks for reading through the full list, we’ll be scouring through our top picks for a post coming soon and we’ll be back at Y Combinator Demo Days next year for their winter 2020 class.

Powered by WPeMatico

Why are revenue-based VCs investing in so many women and underrepresented founders?

This guest post was written by David Teten, Venture Partner, HOF Capital. You can follow him at teten.com and @dteten. This is part of an ongoing series on revenue-based investing VC that will hit on:

- Revenue-based investing: A new option for founders who care about control

- Who are the major revenue-based investing VCs?

- Should your new VC fund use revenue-based investing?

- Why are revenue-based VCs investing in so many women and underrepresented founders?

- Should you raise equity venture capital or revenue-based investing VC?

A new wave of revenue-based investors are emerging who are using creative investing structures with some of the upside of traditional VC, but some of the downside protection of debt.

I’ve been a traditional equity VC for 8 years, and I’m researching new business models in venture capital. As I’ve learned about this model, I’ve been impressed by how these venture capitalists are accomplishing a major social impact goal… without even trying to.

Many are reporting that they’re seeing a more diverse pool of applicants than traditional equity VCs — even though virtually none have a particular focus on women or underrepresented founders. In addition, their portfolios look far more diverse than VC industry norms.

For context, revenue-based investing (“RBI”) is a new form of VC financing, distinct from the preferred equity structure most VCs use. RBI normally requires founders to pay back their investors with a fixed percentage of revenue until they have finished providing the investor with a fixed return on capital, which they agree upon in advance. For more background, see “Revenue-based investing: A new option for founders who care about control“.

I contacted every RBI venture capital investor I could identify, and learned:

- John Borchers, Co-founder and Managing Partner of Decathlon Capital, reports that “37% of our portfolio companies would be considered ‘impact’ qualified companies. This includes companies that would meet most institutional definitions for impact investing (women, minority, and veteran owned/run businesses, including LMI (“Low to Moderate Income”) and CRA (“Community Reinvestment Act”) qualified companies. While we do lots of work in these areas due to the attractive opportunity set, we are not an impact investor, and impact qualification is not a criterion that we use in evaluating or funding companies. On an organic basis, 13% of our portfolio companies are women-owned or run businesses, while 19% of the companies we work with are minority-owned or run. When you look at the composition of the entire founding or executive teams, the number of companies with either a woman or minority in management jumps even higher and is north of 50%.”

- Indie.VC reports, “…50% of the teams we’ve funded are led by female founders and nearly 20% are led by black founders.”

- Lighter Capital reports that they’ve funded companies in 30 states, including well established startup hubs and less mature ecosystems.

- According to Derek Manuge, CEO of Corl, in the past 12 months, 500+ companies have applied to Corl for funding. Of the ones who received capital, “30% were led by women, and 40% were led by executives of non-Caucasian or of mixed ethnic origin.”

- Feenix Partners reports that “35% of our portfolio companies have either a female or minority (non-Caucasian) CEO or Owner.”

- Michelle Romanow, co-founder and CEO of Clearbanc, says that “We have funded eight times more women than the venture capital industry average – probably because we’re not doing meetings, which is an amazing accomplishment, and that’s not because we do different sourcing or anything else. It was just because we looked at data.” (Note that Clearbanc has a somewhat different business model than the RBI VCs I list here.)

- Founders First Capital is the only RBI VC I’ve identified with a specific focus on underrepresented founders. Kim Folsom, Co-Founder, reports that as of August 2019, Founders First’s portfolio was 80% women and 55% women of color; 70% people of color; 20% military veterans; and 71% located in low/moderate income areas. 85% of their companies have under $1m in annual revenues. I can also announce exclusively that according to Kim Folsom, “Founders First Capital Partner (F1stcp) has just secured a $100M credit facility commitment from a major institutional impact investor. This positions F1stcp to be the largest revenue-based investor platform addressing the funding gap for service-based, small businesses led by underserved and underrepresented founders.”

By contrast, according to PitchBook Data, since the beginning of 2016, companies with women founders have received only 4.4% of venture capital deals. Those companies have garnered only about 2% of all capital invested. This is despite the fact that the data says that in fact you’re better off investing in women.

Paul Graham href=”http://www.paulgraham.com/bias.html”> observes, “many suspect that venture capital firms are biased against female founders. This would be easy to detect: among their portfolio companies, do startups with female founders outperform those without?

A couple months ago, one VC firm (almost certainly unintentionally) published a study showing bias of this type. First Round Capital found that among its portfolio companies, startups with female founders outperformed those without by 63%.”

Why are RBI investors investing disproportionately in women & underrepresented founders, and vice versa: why do these founders approach RBI investors?

I’d argue it’s not that RBI is so unbiased and attractive; it’s that traditional equity VC is biased structurally against some women and underrepresented founders.

The Boston Consulting Group and MassChallenge, a US-based global network of accelerators, partnered to study why “women-owned startups are a better bet”. Through their analysis and interviews, BCG identified three primary reasons why female founders are less likely to receive VC funds.

The study used multivariate regression analysis to control for education levels and pitch quality to conclude that gender was a statistically significant factor. I argue that these 3 reasons are much less applicable for RBI investors than for conventional VCs.

- Less need for a belief in breakthrough technology. From the study: “More than men, women founders and their presentations are subject to challenges and pushback. For example, more women report being asked during their presentations to establish that they understand basic technical knowledge. And often, investors simply presume that the women founders don’t have that knowledge.” However, companies with a focus on early profitability are less likely to require an investor to believe in complex, hard-to-predict new technology which is hard to diligence. Instead, the company can pitch itself based on a credible financial projection.

- Realistic projections. “Male founders are more likely to make bold projections and assumptions in their pitches,” BCG observes, while, “Women, by contrast, are generally more conservative in their projections and may simply be asking for less than men.” However, to raise RBI a woman founder does not need to promise a valuation of $1 billion within 5 years. Rent the Runway co-founder and CEO Jennifer Hyman said in a recent interview with CNBC’s Julia Boorstin, “I haven’t been given the permission or privilege to lose a billion every quarter… I’ve had to bring my company towards profitability…”

- Concentration in consumer/branded products startups. BCG reports that, “Many male investors have little familiarity with the products and services that women-founded businesses market to other women”—especially in categories such as childcare or beauty. However, RBI investors report that they see a lot of proposals for ecommerce and consumer packaged goods geared to mothers. Meghan Cross Breeden, Cofounder of Amplifyher Ventures, observes, “Personal customer attachment shouldn’t be a factor in investing; the early investors in Snapchat and Facebook weren’t the Gen Z target demo. Rather, I would imagine that one explanation of women garnering rev-share modes of financing is the prevalence of women-led companies in the consumer/branded goods field, which systemically is more tangible and revenue driven. Therefore, there’s more revenue to share – as opposed to the typical venture business, which requires capital upfront before a J curve of growth.”

Traditional equity VCs are looking for high-risk, high-reward, “swing for the fences” models. The founders of such companies inherently are taking financial risk, reputational risk, and career risk.

Paul Graham, co-founder of Y Combinator, said, “few successful founders grew up desperately poor.” Ricky Yean, a serial founder, agrees: “building and sustaining a company that is “designed to grow fast” is especially hard if you grew up desperately poor”.

Most of the founders of the paradigmatic VC home runs were privileged: male, cisgender, well-educated, from affluent families, etc. Think Bill Gates and Mark Zuckerberg .

That privilege makes it easier for them to take very high risk. The average person, worried about students loans and long term employability, quite rationally is less likely to take the huge risk of founding a company. It’s far safer to just get a job.

Investors who back diverse teams can win much higher returns than the industry norm. Both RBI investors and the founders they back will hopefully benefit from this pattern.

For further reading

- Why are venture capitalists (76% white men) ignoring the future?

- Don’t hire people you know!

- Getting Rid of Gender Bias in Venture Capital

- Gender diversity as a driver of sustainable profitability

- Companies with more female executives make more money—here’s why

- Why women-run startups produce more revenue

- Diversity In Venture Capital: In the U.S., It May Be Getting Worse

Note that none of the lawyers quoted or I are rendering legal advice in this article, and you should not rely on our counsel herein for your own decisions. I am not a lawyer. Thanks to the experts quoted for their thoughtful feedback.

Powered by WPeMatico