Japan’s ispace now aims for a lunar landing in 2021, and a Moon rover deployment in 2023

One of the private companies aiming to deliver a commercial lunar lander to the Moon has adjusted the timing for its planned mission, which isn’t all that surprising, given the enormity of the task. Japanese startup ispace is now targeting 2021 for their first lunar landing, and 2023 for a second lunar mission that will also include deploying a rover on the Moon’s surface.

The company’s HAKUTO-R program was originally planned to include a mission in 2020 that would involve sending a lunar orbital vehicle for demonstration purposes without any payloads, but that part of the plan has been scrapped in favor of focusing all efforts on delivering actual payloads for commercial customers by 2021 instead.

This updated focus, the company says, is due mostly to the speeding up of the global market for private launch services and payload delivery, including for things like NASA’s Commercial Lunar Payload Services program, wherein the agency is looking for a growing number of private contractors to support its own needs in terms of getting stuff to the Moon.

Although ispace itself isn’t on the list of nine companies selected in round one of NASA’s program, the Japanese company is supporting American nonprofit Draper in its efforts, which was one of the chosen. The Draper/ispace team-up happened after ispace’s initial commitment to its 2020 orbital demo, so its change in priorities makes sense given the new tie-up.

HAKUTO-R will use SpaceX’s Falcon 9 for its first missions, and the company has also signed partnerships with JAXA, Japan’s space agency, as well as new corporate partners including Suzuki, Sumitomo Corporation, Shogakukan and Citizen Watch.

Powered by WPeMatico

The myth of ‘stage agnostic’ investing

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week we were helmed by Kate Clark, Alex Wilhelm and yet another extra special guest. Unusual Ventures co-founder and partner John Vrionis joined us to talk soil investing (yes, it’s a thing), seed investing, growth investing and all the somewhat meaningless funding stages.

Vrionis was a longtime investor at Lightspeed Venture Partners and has made big bets on a number of companies, including AppDynamics, Heptio and MuleSoft.

It was a great episode that kicked off with some conversation around DoorDash, the food delivery company that continues to make headlines week after week. We’d like to stop talking about the company, but it intrudes regularly into our notes.

This time DoorDash bought a few companies, purchases that appear set to allow the firm to boost its investment and research into self-driving delivery robots. (Kate saw one in the wild recently!)

Next we went deep into the subject of seed. John, of course, has been a seed investor for years and has lots to say on the topic. Mostly, we discussed Kate’s latest piece on mega-funds making an increasing number of deals at the earliest stage. John doesn’t think “stage-agnostic” investing makes any sense. You need experts at each stage making bets on a specific type of company. In his words, “a heart surgeon wouldn’t deliver your baby, right.”

Then we moved on to one of our favorite subjects, namely direct listings, the IPO market and if money is too often left on the table. The question takes on extra import when we see results like Dynatrace’s IPO, which rose around 50% its first day. It seems likely that we’ll see other companies pursue the sort of direct listings that Spotify and Slack managed.

That segued us brilliantly into our final topic: Airbnb and its financial health. The firm, we reckon, is a good candidate for a direct listing itself. We talked over its numbers, and if we were to sum up our perspectives, we’d say that Airbnb is about as impressive as we expected.

All that and we had fun, as usual.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

Ping Identity files for $100M IPO on Nasdaq to trade as ‘PING’

Some eight months after it was reported that Ping Identity’s owners Vista Equity had hired bankers to explore a public listing, today Ping Identity took the plunge: the Colorado-based online ID management company has filed an S-1 form indicating that it plans to raise up to $100 million in an IPO on the Nasdaq exchange under the ticker “Ping.”

While the initial S-1 filing doesn’t have an indication of price range, Ping is said to be looking at a valuation of between $2 billion and $3 billion in this listing.

The company has been around since 2001, founded by Andre Durand (who is still the CEO), and it was acquired by Vista in 2016 for about $600 million — at a time when a clutch of enterprise companies that looked like strong IPO candidates were going the private equity route and staying private instead.

But more recently, there has been a surge in demand for better IT security linked to identity and authentication management, so it seems that Vista Equity is selling up. The PE firm is taking advantage of the fact that the market’s currently very strong for tech IPOs, but there is so much M&A in enterprise right now (just yesterday VMware acquired not one but two companies, Carbon Black for $2.1 billion and Pivotal for $2.7 billion) that I can’t help but wonder if something might move here too.

The S-1 reveals a number of details on the company’s financials, indicating that it’s currently unprofitable but on a steady growth curve. Ping had revenues of $112.9 million in the first six months of 2019, versus $99.5 million in the same period a year before. Its loss has been shrinking in recent years, with a net loss of $3.1 million in the first six months of this year versus $5.8 million a year before (notably in 2017 overall it was profitable with a net income of $19 million. It seems that the change is due to acquisitions and investing for growth).

Its annual run rate, meanwhile, was $198 million for the first six months of the year, compared to $159.6 million in the same period a year ago.

The area of identity and access management has become a cornerstone of enterprise IT, with companies looking for efficient and secure ways to centralise how not just their employees, but their customers, their partners and various connected devices on their networks can be authenticated across their cloud and on-premise applications.

The demand for secure solutions covering all the different aspects of a company’s IT stack has grown rapidly over recent years, spurred not just by an increased move to centralised applications served through the cloud, but also by the drastic rise in breaches where malicious hackers have exploited vulnerabilities and loopholes in companies’ sign-on screens.

Ping has been one of the bigger companies building services in this area and tackling all of those use cases, competing with the likes of Okta, OneLogin, AuthO, Cisco and dozens more off-the-shelf and custom-built solutions.

The company offers its services on an SaaS basis, covering services like secure sign-on, multi-factor authentication, API access security, personalised and unified profile directories, data governance and AI-based security policies. It claims to be the pioneer of “Intelligent Identity,” using AI to help its system analyse user, device and network behavior to better identify potentially malicious activity.

More to come.

Powered by WPeMatico

Silicone 3D printing startup Spectroplast spins out of ETHZ with $1.5M

3D printing has become commonplace in the hardware industry, but because few materials can be used for it easily, the process rarely results in final products. A Swiss startup called Spectroplast hopes to change that with a technique for printing using silicone, opening up all kinds of applications in medicine, robotics and beyond.

Silicone is not very bioreactive, and of course can be made into just about any shape while retaining strength and flexibility. But the process for doing so is generally injection molding, great for mass-producing lots of identical items but not so great when you need a custom job.

And it’s custom jobs that ETH Zurich’s Manuel Schaffner and Petar Stefanov have in mind. Hearts, for instance, are largely similar but the details differ, and if you were going to get a valve replaced, you’d probably prefer yours made to order rather than straight off the shelf.

“Replacement valves currently used are circular, but do not exactly match the shape of the aorta, which is different for each patient,” said Schaffner in a university news release. Not only that, but they may be a mixture of materials, some of which the body may reject.

But with a precise MRI the researchers can create a digital model of the heart under consideration and, using their proprietary 3D printing technique, produce a valve that’s exactly tailored to it — all in a couple of hours.

A 3D-printed silicone heart valve from Spectroplast.

Although they have created these valves and done some initial testing, it’ll be years before anyone gets one installed — this is the kind of medical technique that takes a decade to test. So in the meantime they are working on “life-improving” rather than life-saving applications.

One such case is adjacent to perhaps the most well-known surgical application of silicone: breast augmentation. In Spectroplast’s case, however, they’d be working with women who have undergone mastectomies and would like to have a breast prosthesis that matches the other perfectly.

Another possibility would be anything that needs to fit perfectly to a person’s biology, like a custom hearing aid, the end of a prosthetic leg or some other form of reconstructive surgery. And of course, robots and industry could use one-off silicone parts as well.

![]()

There’s plenty of room to grow, it seems, and although Spectroplast is just starting out, it already has some 200 customers. The main limitation is the speed at which the products can be printed, a process that has to be overseen by the founders, who work in shifts.

Until very recently Schaffner and Stefanov were working on this under a grant from the ETH Pioneer Fellowship and a Swiss national innovation grant. But in deciding to depart from the ETH umbrella they attracted a 1.5 million Swiss franc (about the same as dollars just now) seed round from AM Ventures Holding in Germany. The founders plan to use the money to hire new staff to crew the printers.

Right now Spectroplast is doing all the printing itself, but in the next couple of years it may sell the printers or modifications necessary to adapt existing setups.

You can read the team’s paper showing their process for creating artificial heart valves here.

Powered by WPeMatico

This Thiel Fellow thinks he can help scooters, drones and delivery robots charge themselves with sunlight

From the time he was a high school student, Rohit Kalyanpur thought it was peculiar that although it’s possible to create energy from a solar panel, the panels have long been used almost exclusively on rooftops and as part of industrial-scale solar grids. “I hadn’t seen [anything solar-powered] in the things people use every day other than calculators and lawn lights,” he tells us from him home in Chicago — though he’s moving to the Bay Area next month.

It wasn’t just a passing thought for Kalyanpur. Through research positions in high school, he continued to learn about energy and work on a solar charging prototype — initially to charge his iPhone — while continuing to wonder what other materials might be powered spontaneously just by shining light on it.

What he quickly discovered, he says, is there were no developer tools to build a self-charging project. Unlike with hardware projects, where developers can turn to the open-source electronic prototyping platform Arduino, and to Raspberry Pi, a tiny computer the size of a credit card and was created in 2012 to help students understand how computers work, there was “nothing you could use to optimize a solar product,” he says.

Fast-forward, and Kalyanpur says there is now — and he helped build it.

It’s been several years in the making. After attending the University of Illinois at Urbana-Champaign for two years and befriending a fellow student, Paul Couston, who helped manage and invest the university’s $10 million green fund, the pair dropped out of school to start their now four-person company, Optivolt Labs. Entry into the accelerator program Techstars Chicago was the impetus they needed, and they’ve been gaining momentum since. In fact, Kalyanpur, now 21, was recently given a Thiel Fellowship, a two-year-long program that includes a $100,000 grant to young people who want to build new things, along with a lot of mentorships and key introductions.

Now, the company has closed on a separate $1.75 million round of seed funding from a long list of notable individual investors, including Eventbrite co-founders Kevin & Julia Hartz; TJ Parker, who is the founder and CEO of PillPack (now an Amazon subsidiary); Pinterest COO Francoise Brougher: and Jeff Lutz, a former Google SVP.

What they’re buying into exactly is the promise of a scalable technology stack for solar integration. Though still nascent, Optivolt has already figured out a way to provide efficient power transfer systems, solar developer and simulation tools and cloud-based API’s to enable fleets of machines to self charge in ambient light, says Kalyanpur. Think e-scooters, EVs, drones, sensors and other connected devices.

Asked how it all works on a more granular level, Kalyanpur declines to dive into specifics, but he says the company will begin testing its technology soon with a number of “enterprise fleets” that have already signed on to work with Optivolt in pilot programs.

If it works as planned, it sounds like a pretty big opportunity. Though some companies have begun making smaller solar-powered vehicles, there are presumably many outfits that would prefer to find a way to retrofit the hardware they already have in the world, which Kalyanpur says will be possible.

He says they can use their existing batteries, too — that the solar won’t just power the devices or vehicles in real time but allow them to store some of that energy, too. Optivolt’s technology “seamlessly integrates into everyday products, so you don’t have to change the product design meaningfully,” he insists.

We’ll be curious to see if see if it does what he thinks it can. It sounds like we aren’t the only ones, either.

Asked about Optivolt’s road map, Kalynapur suggests that one is coming together. The company’s top priority, however — beyond hiring more engineering talent with its brand new round — it to see first how it works in the field.

Powered by WPeMatico

DoorDash reveals details of its new tipping model

DoorDash announced last month that it would be changing its controversial tipping model. Today it’s revealing the basics of how the new system will work.

Under the past model, Dashers (DoorDash drivers and other delivery people) were guaranteed a minimum payment per delivery, with DoorDash paying a $1 base, then providing an additional payment boost when a customer’s tip wasn’t enough to meet the minimum — a system that made it seem like tips were being used to subsidize DoorDash payments.

Under the new system, DoorDash will pay a base between $2 and $10 (the amount will depend on things like delivery distance and duration), with additional bonuses from DoorDash.

Most crucially, as CEO Tony Xu put it in a blog post, “Every dollar customers tip will be an extra dollar in their Dasher’s pocket.”

Now, you might think that’s how tips are always supposed to work, but Xu said the old system was developed “in direct response to feedback from Dashers,” while the new one will result in “greater variability in total earnings from order to order” (that variability is one of several reasons why tipping is a flawed compensation model in general).

So why change?

“We thought we were doing the right thing for Dashers by making them whole if a customer left no tip, but the feedback we’ve received recently made clear that some of our customers who were leaving tips felt like their tips didn’t matter,” Xu said. “We realized that we couldn’t continue to do right by Dashers if some customers felt we weren’t also doing right by them. To ensure that all of our users have a great experience on DoorDash, we needed to strike a better balance.”

Plus, he said, “Dashers will [now] earn more money on average — both from DoorDash and overall.”

The company plans to roll out these changes to all Dashers next month.

Powered by WPeMatico

Oracle directors give blessing to shareholder lawsuit against Larry Ellison and Safra Catz

Three years after closing a $9.3 billion deal to acquire NetSuite, several Oracle board members have written an extraordinary letter to the Delaware Court, approving a shareholder lawsuit against company executives Larry Ellison and Safra Catz over the 2016 deal. Reuters broke this story.

According to Reuters’ Alison Frankel, three board members, including former U.S. Defense Secretary Leon Panetta, sent a letter on August 15th to Sam Glasscock III, vice chancellor for the Court of the Chancery in Georgetown, Delaware, approving the suit as members of a special board of directors entity known as the Special Litigation Committee.

The lawsuit is what is called in legal parlance a derivative suit. According to the site Justia, this type of suit is filed in cases like this. “Since shareholders are generally allowed to file a lawsuit in the event that a corporation has refused to file one on its own behalf, many derivative suits are brought against a particular officer or director of the corporation for breach of contract or breach of fiduciary duty,” the Justia site explained.

The letter went on to say there was an attempt to settle this suit, which was originally launched in 2017, through negotiation outside of court, but when that attempt failed, the directors wrote this letter to the court stating that the suit should be allowed to proceed.

As Frankel wrote in her article, the lawsuit, which was originally filed by the Firemen’s Retirement System of St. Louis, could be worth billions:

One of the lead lawyers for the Firemen’s fund, Joel Friedlander of Friedlander & Gorris, said at a hearing in June that shareholders believe the breach-of-duty claims against Oracle and NetSuite executives are worth billions of dollars. So in last week’s letter, Oracle’s board effectively unleashed plaintiffs’ lawyers to seek ten-figure damages against its own members.

It’s worth pointing out, as we reported at the time of the NetSuite acquisition, that Larry Ellison was involved in setting up NetSuite in the late 1990s and was a major shareholder at the time of the deal.

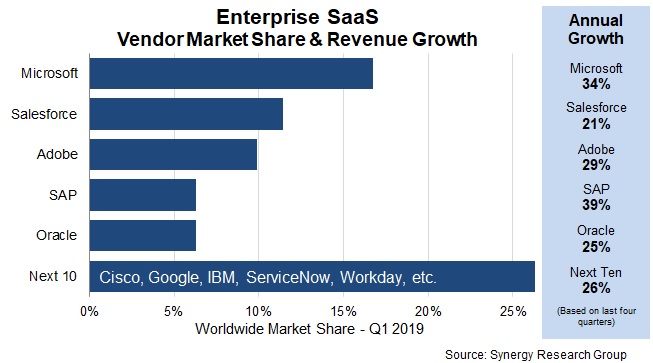

Oracle was struggling to find its cloud footing in 2016, and it was believed that by buying an established SaaS player like NetSuite, it could begin to build out its cloud business much faster than trying to develop something like it internally. A June Synergy Research SaaS marketshare report, while admitting the market was fragmented, still showed Oracle was far behind the pack in spite of that deal three years ago.

While there have been bigger deals in tech M&A history, including Salesforce’s acquisition of Tableau for $15.7 billion earlier this year, it’s still stands with some of the largest.

We reached out to Oracle regarding this story, but it declined to comment.

Powered by WPeMatico

Frontier technologies are moving closer to the center of venture investment

As the technologies that were once considered science fiction become the purview of science, the venture capital firms that were once investing at the industry’s fringes are now finding themselves at the heart of the technology industry.

Investing in the commercialization of technologies like genetic engineering, quantum computing, digital avatars, augmented reality, new human-computer interfaces, machine learning, autonomous vehicles, robots, and space travel that were once considered “frontier” investments are now front-and-center priorities for many venture capital firms and the limited partners that back them.

Earlier this month, Lux Capital raised $1.1 billion across two funds that invest in just these kinds of companies. “[Limited partners] are now more interested in frontier tech than ever before,” said Bilal Zuberi, a partner with the firm.

Lux Capital just closed on a whopping $1 billion in capital, doubling the amount of money it manages

He sees a few factors encouraging limited partners (the investors who provide financing for venture capital funds) to invest in the firms that are financing companies developing technologies that were once considered outside of the mainstream.

Powered by WPeMatico

Pew: Mobile and social media users in emerging markets have more diverse social networks

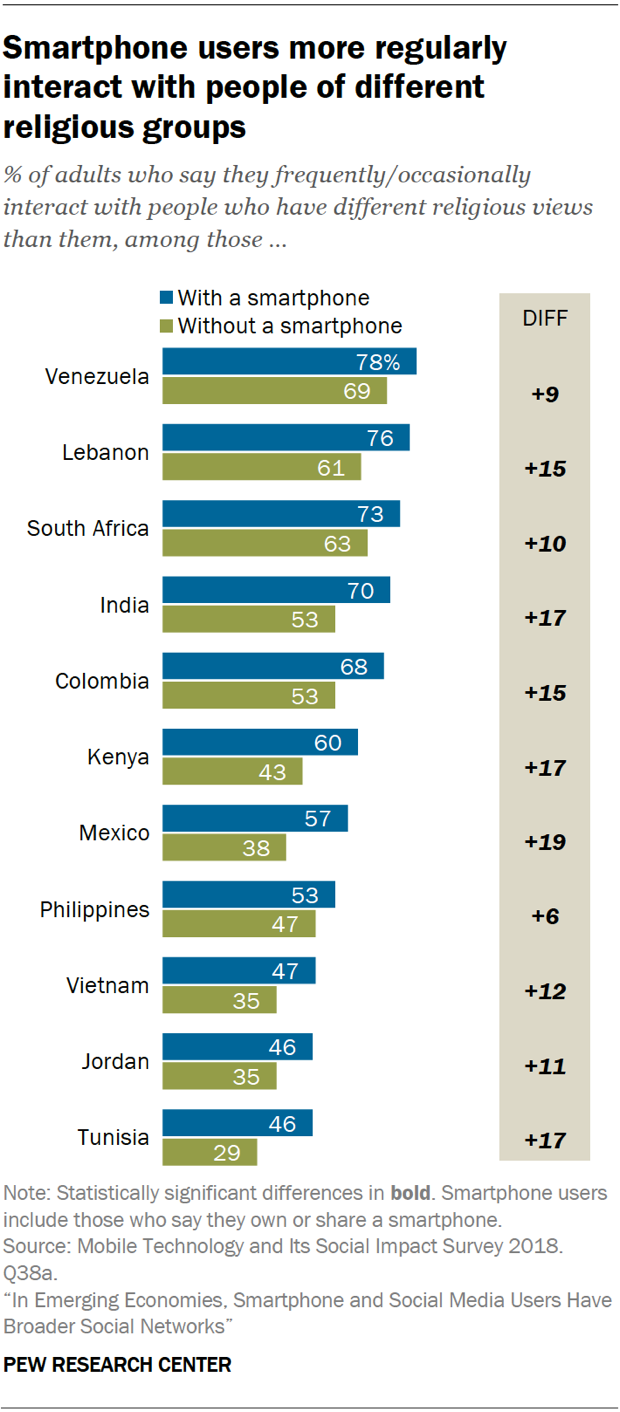

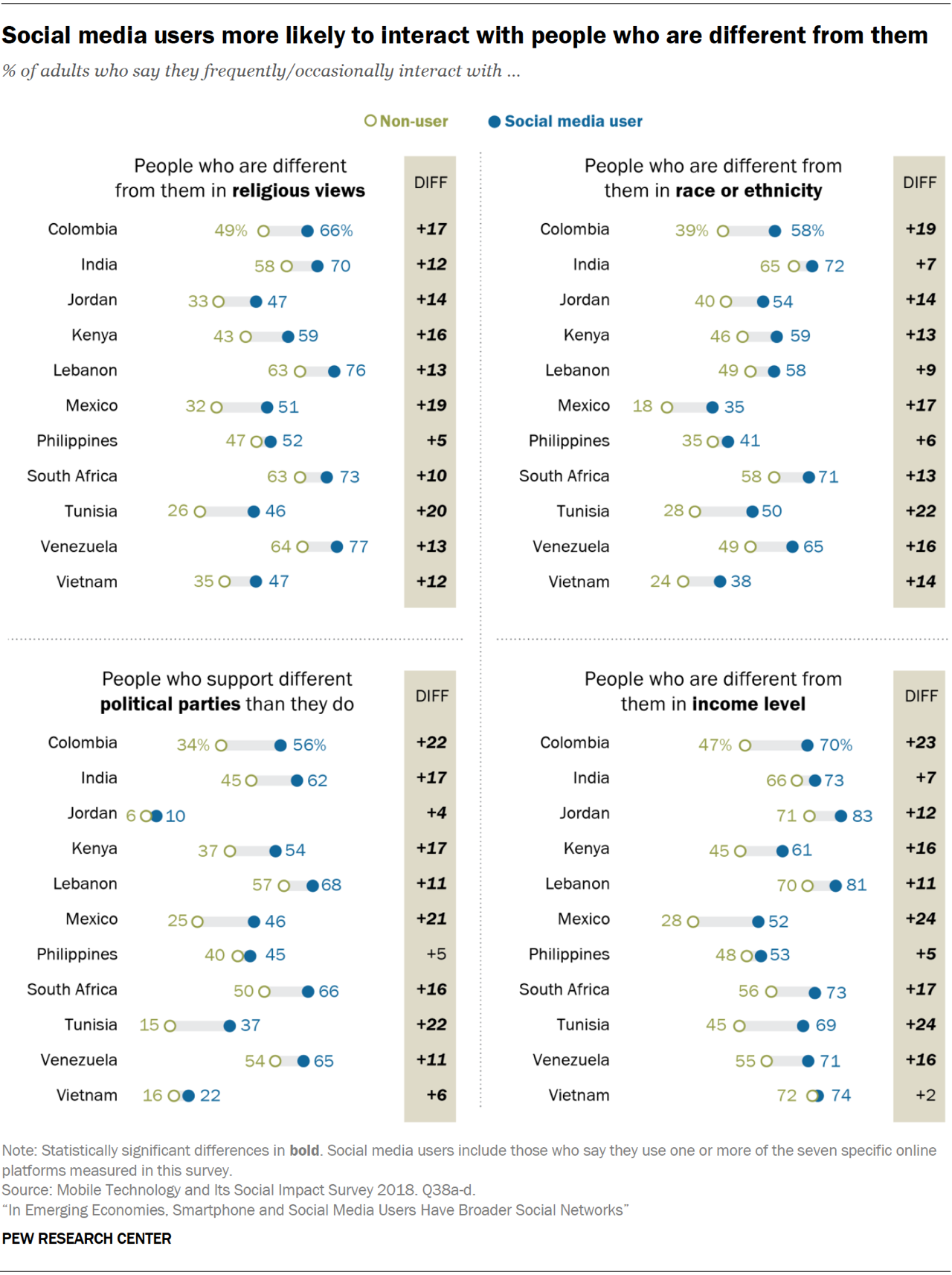

The latest study from Pew Research Center takes a look at the impact mobile technology, including the use of smartphones and social media, is having on the diversity of people’s social network in emerging markets. For the purpose of the study, Pew surveyed mobile users in 11 key markets: Mexico, Venezuela, Colombia, South Africa, Kenya, India, Vietnam, the Philippines, Tunisia, Jordan and Lebanon. It found that users in these markets had broader social networks than those without smartphones and social media.

In the U.S., we’ve been concerned with social media’s ability to create “filter bubbles” — meaning how we surround ourselves online with people who hold the same opinions as us, which is then reinforced by social media’s engagement-focused algorithms. This leads us to believe, sometimes in error, that what we think is the most correct and most popular view.

According to Pew’s study, emerging markets are experiencing a somewhat different phenomenon.

Instead of isolation, the study found that smartphone users in these markets, and particularly those who also used social media, were more regularly exposed to people with different racial and ethnic backgrounds, different religious preferences, different political parties and different income levels, compared to those without a smartphone.

In Mexico, for example, 57% of smartphone owners regularly interacted with people of other religions, while only 38% of those without a smartphone did. And more than half (54%) interact with people who supported different political parties. They were also 24% more likely to interact with people of different income levels, and 17% more likely to interact with people of different ethnic or racial backgrounds.

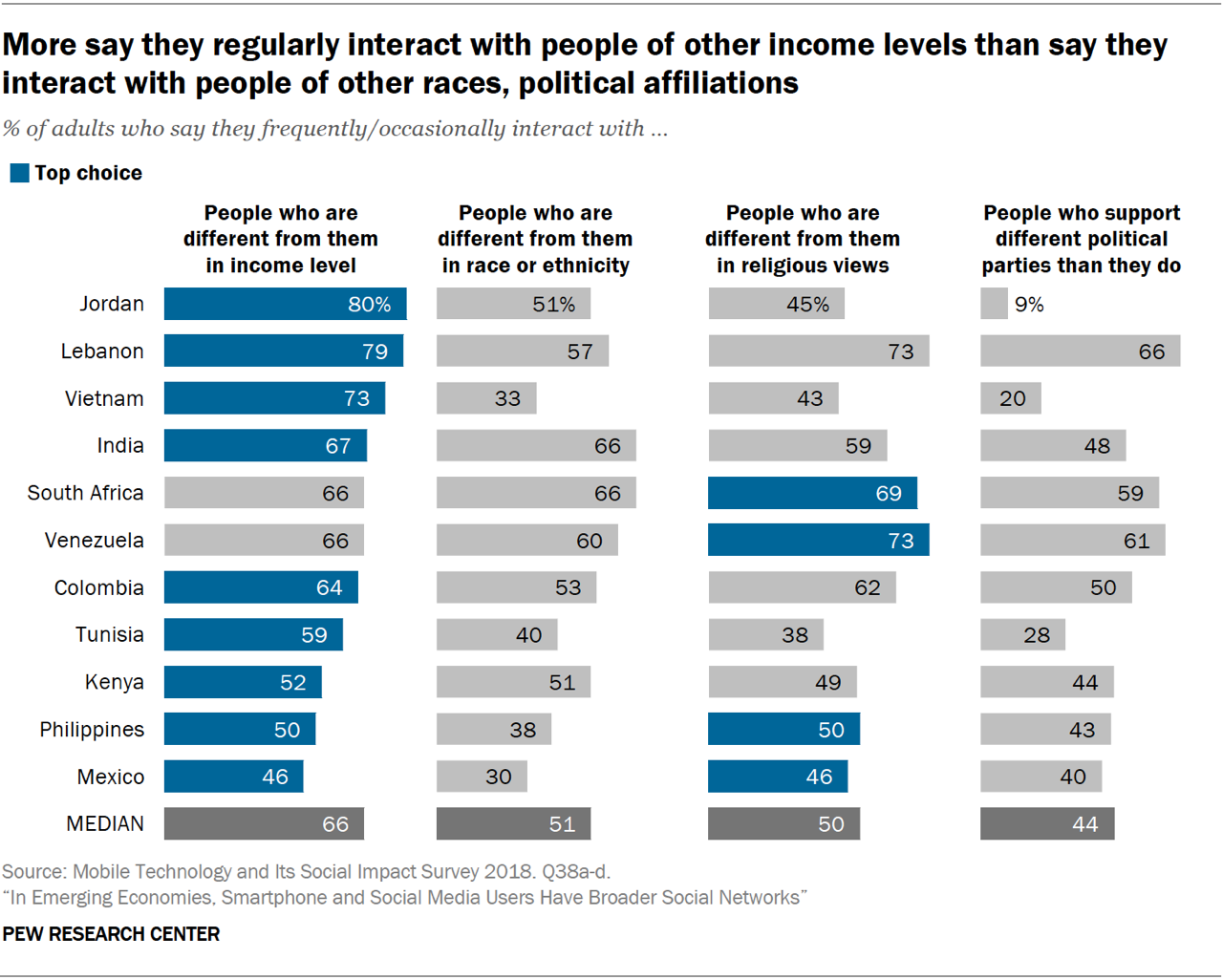

These sorts of trends help up across the nations studied, Pew noted, with a median of 66% saying they interacted with people with different income levels, 51% saying they interacted with a those of different race or ethnicity, 50% saying they interacted with those having different religious views and a median 44% saying they interacted with those who supported a different political party.

The use of social media and messaging apps was found to be a huge contributor here, as it made people more likely to encounter people different from them, the study also said.

The report, however, isn’t claiming that smartphones and the related social media use are the cause of this increase in diversity in these people’s lives. There may be other reasons for that. Smartphone owners, in general, may have more resources and money — they own a smartphone, after all — and this alone could help expose them to a more diverse group of people.

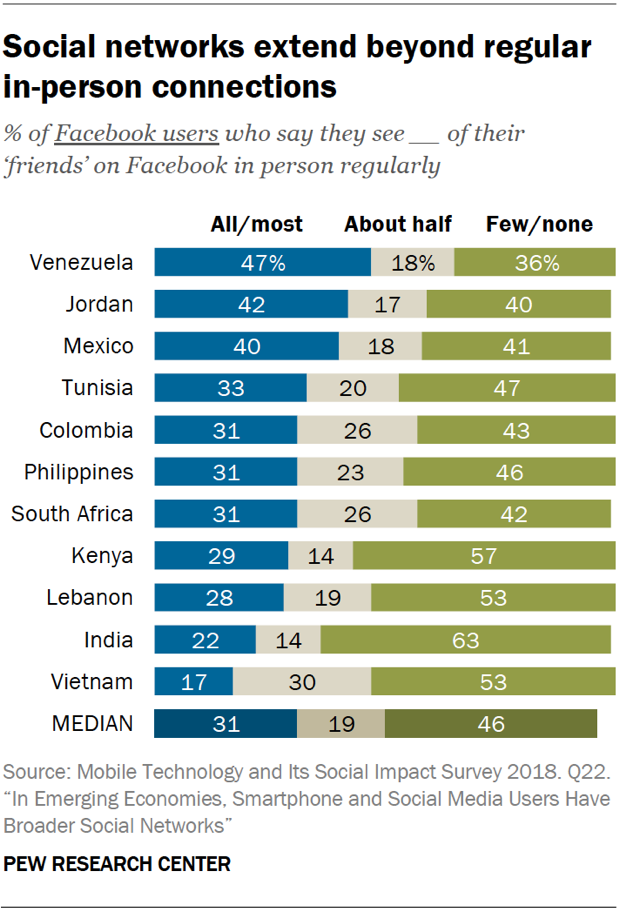

That said, smartphones are helping people stay connected to distant family and friends, and build out online networks of people they don’t ever see in person.

More than half the people in most of the surveyed countries said they only see in person half — or fewer — of the people they call or text. Indeed, 93% said they keep in touch with far-flung contacts. And a median of 46% said they see few or none of their Facebook friends regularly.

All this connecting isn’t seen as being fully positive, however.

An earlier Pew report found that users in these 11 countries believe the internet and social media are making people more divided in their opinions and only sometimes more accepting of different views. Exposure to diversity and acceptance of it are different things.

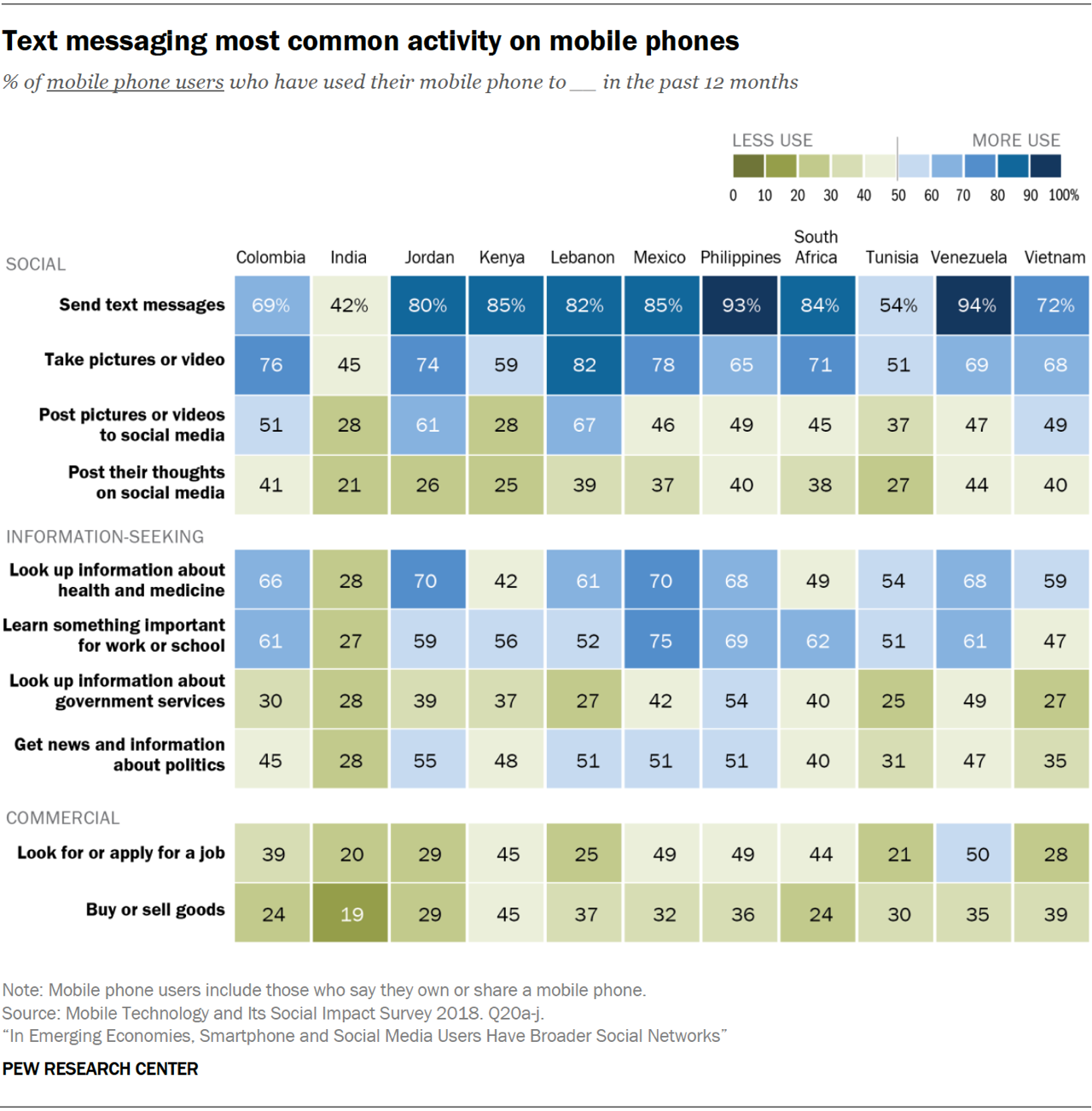

The new report also gets into how smartphones are used. For example, a median of 82% said they texted, 69% took photos or videos, 61% looked up health information, 47% looked up news and political information and 37% looked up information about government resources.

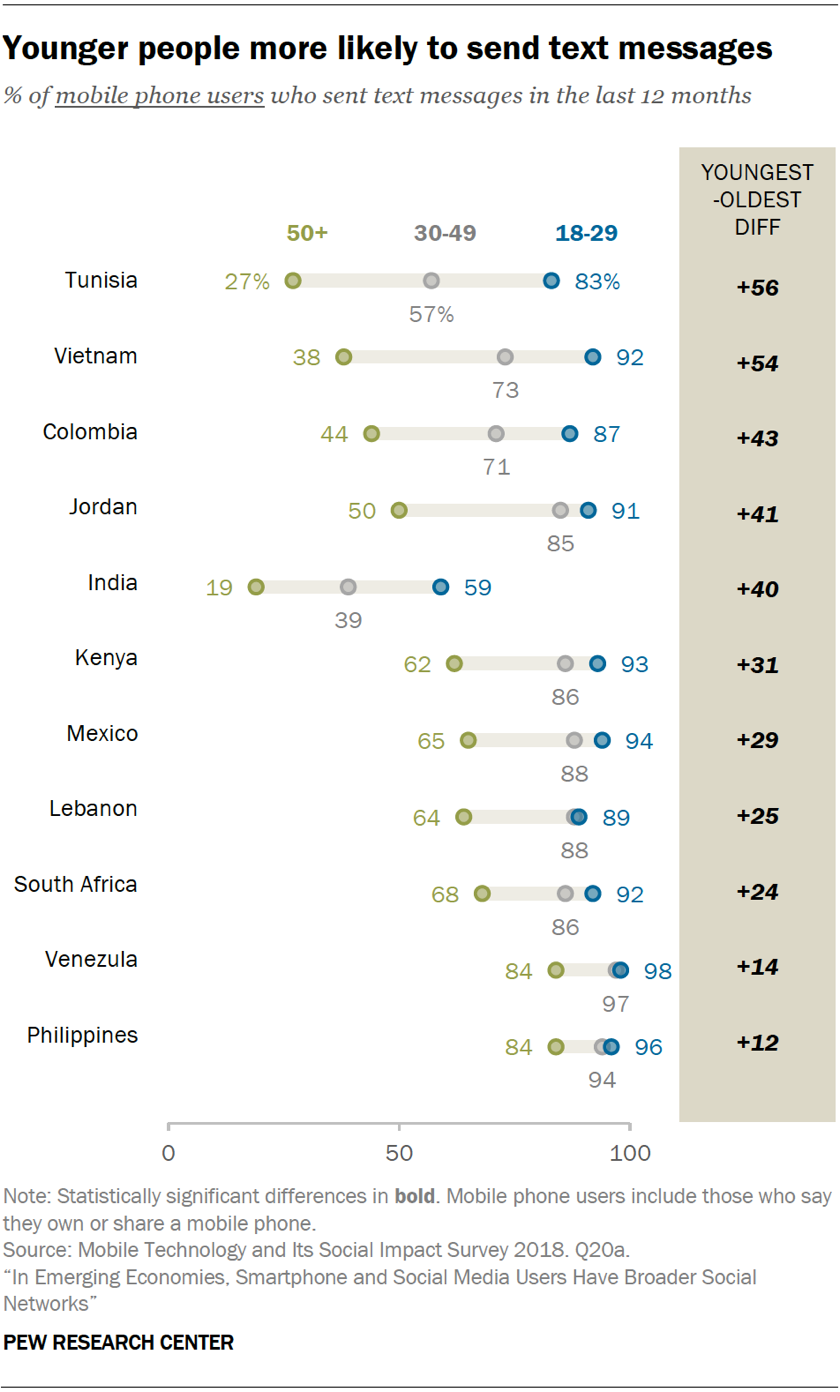

It also examined smartphones’ impact on digital divides, noting that people with access to these devices and social media, as well as younger people, those with higher levels of education and men, were gaining more benefits than others.

The study is based on in-person interviews conducted by D3 Systems, Inc. and the results are based on national samples, notes Pew.

The full report is available here, with deeper dives on activities and data by individual countries.

Powered by WPeMatico

Mobile gaming is a $68.5 billion global business, and investors are buying in

Contributor

By the end of 2019, the global gaming market is estimated to be worth $152 billion, with 45% of that, $68.5 billion, coming directly from mobile games. With this tremendous growth (10.2% YoY to be precise) has come a flurry of investments and acquisitions, everyone wanting a cut of the pie. In fact, over the last 18 months, the global gaming industry has seen $9.6 billion in investments and if investments continue at this current pace, the amount of investment generated in 2018-19 will be higher than the eight previous years combined.

What’s interesting is why everyone is talking about games, and who in the market is responding to this — and how.

The gaming phenomenon

Today, mobile games account for 33% of all app downloads, 74% of consumer spend and 10% of all time spent in-app. It’s predicted that in 2019, 2.4 billion people will play mobile games around the world — that’s almost one-third of the global population. In fact, 50% of mobile app users play games, making this app category as popular as music apps like Spotify and Apple Music, and second only to social media and communications apps in terms of time spent.

In the U.S., time spent on mobile devices has also officially outpaced that of television — with users spending eight more minutes per day on their mobile devices. By 2021, this number is predicted to increase to more than 30 minutes. Apps are the new prime time, and games have grabbed the lion’s share.

Accessibility is the highest it’s ever been as barriers to entry are virtually non-existent. From casual games to the recent rise of the wildly popular hyper-casual genre of games that are quick to download, easy to play and lend themselves to being played in short sessions throughout the day, games are played by almost every demographic stratum of society. Today, the average age of a mobile gamer is 36.3 (compared with 27.7 in 2014), the gender split is 51% female, 49% male, and one-third of all gamers are between the ages of 36-50 — a far cry from the traditional stereotype of a “gamer.”

With these demographic, geographic and consumption sea-changes in the mobile ecosystem and entertainment landscape, it’s no surprise that the game space is getting increased attention and investment, not just from within the industry, but more recently from traditional financial markets and even governments. Let’s look at how the markets have responded to the rise of gaming.

Image courtesy of David Maung/Bloomberg via Getty Images

Games on games

The first substantial investments in mobile gaming came from those who already had a stake in the industry. Tencent invested $90 million in Pocket Gems and$126 million in Glu Mobile (for a 14.6% stake), gaming powerhouse Supercell invested $5 million in mobile game studio Redemption Games, Boom Fantasy raised $2M million from ESPN and the MLB and Gamelynx raised $1.2 million from several investors — one of which was Riot Games. Most recently, Ubisoft acquired a 70% stake in Green Panda Games to bolster its foot in the hyper-casual gaming market.

Additionally, bigger gaming studios began to acquire smaller ones. Zynga bought Gram Games, Ubisoft acquired Ketchapp, Niantic purchased Seismic Games and Tencent bought Supercell (as well as a 40% stake in Epic Games). And the list goes on.

Wall Street wakes up

Beyond the flurry of investments and acquisitions from within the game industry, games are also generating huge amounts of revenue. Since launch, Pokémon GO has generated $2.3 billion in revenue and Fortnite has amassed some 250 million players. This is catching the attention of more traditional financial institutions, like private equity firms and VCs, which are now looking at a variety of investment options in gaming — not just of gaming studios, but all those who have a stake in or support the industry.

In May 2018, hyper-casual mobile gaming studio Voodoo announced a $200 million investment from Goldman Sachs’ private equity investment arm. For the first time ever, a mobile gaming studio attracted the attention of a venerable old financial institution. The explosion of the hyper-casual genre and the scale its titles are capable of achieving, together with the intensely iterative, data-driven business model afforded by the low production costs of games like this, were catching the attention of investors outside of the gaming world, looking for the next big growth opportunity.

The trend continued. In July 2018, private equity firm KKR bought a $400 million minority stake in AppLovin and now, exactly one year later, Blackstone announced their plan to acquire mobile ad-network Vungle for a reported $750 million. Not only is money going into gaming studios, but investments are being made into companies whose technology supports the mobile gaming space. Traditional investors are finally taking notice of the mobile gaming ecosystem as a whole and the explosive growth it has produced in recent years. This year alone mobile games are expected to generate $55 billion in revenue, so this new wave of investment interest should really come as no surprise.

A woman holds up her cell phone as she plays the Pokemon GO game in Lafayette Park in front of the White House in Washington, DC, July 12, 2016. (Photo: JIM WATSON/AFP/Getty Images)

Government intervention

Most recently, governments are realizing the potential and reach of the gaming industry and making their own investment moves. We’re seeing governments establish funds that support local gaming businesses — providing incentives for gaming studios to develop and retain their creatives, technology and employees locally — as well as programs that aim to attract foreign talent.

As uncertainty looms in England surrounding Brexit, France has jumped on the opportunity with “Join the Game.” They’re painting France as an international hub that is already home to many successful gaming studios, and they’re offering tax breaks and plenty of funding options — for everything from R&D to the production of community events. Their website even has an entire page dedicated to “getting settled in France,” in English, with a step-by-step guide on how game developers should prepare for their arrival.

The U.K. Department for International Trade used this year’s Game Developers Conference as a backdrop for the promotion of their games fund — calling the U.K. “one of the most flourishing game developing ecosystems in the world.” The U.K. Games Fund allows for both local and foreign-owned gaming companies with a presence in the U.K. to apply for tax breaks. And ever since France announced their fund, more and more people have begun encouraging the British government to expand their program, saying that the U.K. gaming ecosystem should be “retained and enhanced.” But, not only does the government take gaming seriously, the Queen does as well. In 2008, David Darling, the CEO of hyper-casual game studio Kwalee, was made a Commander of the Order of the British Empire (CBE) for his services to the games industry. CBE is the third-highest honor the Queen can bestow on a British citizen.

Over in Germany, and the government has allocated €50 million of its 2019 budget for the creation of a games fund. In Sweden, the Sweden Game Arena is a public-private partnership that helps students develop games using government-funded offices and equipment. It also links students and startups with established companies and investors. While these numbers dwarf the investment of more commercial or financial players, the sudden uptick in interest governments are paying to the game space indicate just how exciting and lucrative gaming has become.

Support is coming from all levels

The evolution of investment in the gaming space is indicative of the stratospheric growth, massive revenue, strong user engagement and extensive demographic and geographic reach of mobile gaming. With the global games industry projected to be worth a quarter of a trillion dollars by 2023, it comes as no surprise that the diverse players globally have finally realized its true potential and have embraced the gaming ecosystem as a whole.

Powered by WPeMatico