Y Combinator graduate PredictLeads helps VCs hunt for unicorns

The Slovenian founders behind PredictLeads, another recent Y Combinator graduate, applied to the prestigious accelerator five times before they were admitted.

Their business, which helps venture capital firms and sales teams identify high-growth companies, i.e. potential investments and potential customers, had come a long way since it was founded in 2016. And earlier this year — finally — YC gave them the green light to complete its three-month accelerator program.

“We almost ran out of money in 2017 and then I took a loan from my mother because the bank wouldn’t give me the loan at that point,” PredictLeads chief executive officer Roq Xever tells TechCrunch. “But by then, the data was getting much better and we were able to make higher-value sells and that got us to profitability.”

You read that right. Unlike most of today’s tech startups, PredictLeads is profitable, though, only out of pure necessity: “We didn’t know we would ever get into YC to raise the money we needed, so we structured the company to make more money than we spent.”

Xever leads the small PredictLeads team alongside marketing chief Miha Stanovnik and chief technology officer Matic Perovsek. Xever tells TechCrunch it wasn’t until they realized the opportunity to sell their product to VCs that YC became interested. Today, PredictLeads has eight venture firms as customers, the names of which they were not able to disclose.

The tool helps investors track companies they’ve considered in the past. PredictLeads notifies users if certain companies start getting traction so they can reevaluate the deal and helps investors become aware of startups they may not have otherwise heard of.

More and more venture capital firms are turning to third-party tools to help them make sense of and leverage data in the investment and company-tracking process, leading to the birth of new data-focused companies. Social Capital co-founder Chamath Palihapitiya is spinning out a company from his venture capital fund-turned-family-office, TechCrunch learned earlier this year. The new entity, temporarily dubbed CaaS (short for capital-as-a-service) Technologies, will focus on providing data-driven insights to VC firms, for example.

Startups have also realized the importance of data. Narrator, another recent YC graduate, is betting big on this trend. The startup wants to become the operating system for data science by providing companies software that claims to fulfill the same service as a data team for the price of an analyst.

PredictLeads, for its part, collects data from websites, press releases, news articles, blogs and career sites, then uses supervised machine learning to extract and structure the data. The startup tracks 20 million public and private companies.

Now that it’s a graduate of YC, the team is in the process of moving its headquarters to the U.S. Either New York or San Francisco, says Xever, who’s currently navigating the difficult visa application process.

The startup is today raising a $1.5 million seed financing at a $10 million valuation. They plan to use the capital to expand their service to cater to quant funds, build a Salesforce app to better support sales teams and, of course, expand their small team.

Powered by WPeMatico

Oracle files new appeal over Pentagon’s $10B JEDI cloud contract RFP process

You really have to give Oracle a lot of points for persistence, especially where the $10 billion JEDI cloud contract procurement process is concerned. For more than a year, the company has been complaining across every legal and government channel it can think of. In spite of every attempt to find some issue with the process, it has failed every time. That did not stop it today from filing a fresh appeal of last month’s federal court decision that found against the company.

Oracle refuses to go quietly into that good night, not when there are $10 billion federal dollars on the line, and today the company announced it was appealing Federal Claims Court Senior Judge Eric Bruggink’s decision. This time they are going back to that old chestnut that the single-award nature of the JEDI procurement process is illegal:

“The Court of Federal Claims opinion in the JEDI bid protest describes the JEDI procurement as unlawful, notwithstanding dismissal of the protest solely on the legal technicality of Oracle’s purported lack of standing. Federal procurement laws specifically bar single award procurements such as JEDI absent satisfying specific, mandatory requirements, and the Court in its opinion clearly found DoD did not satisfy these requirements. The opinion also acknowledges that the procurement suffers from many significant conflicts of interest. These conflicts violate the law and undermine the public trust. As a threshold matter, we believe that the determination of no standing is wrong as a matter of law, and the very analysis in the opinion compels a determination that the procurement was unlawful on several grounds,” Oracle’s General Counsel Dorian Daley said in a statement.

In December, Oracle sued the government for $10 billion, at the time focusing mostly on a perceived conflict of interest involving a former Amazon employee named Deap Ubhi. He worked for Amazon prior to joining the DOD, where he worked on a committee of people writing the RFP requirements, and then returned to Amazon later. The DOD investigated this issue twice, and found no evidence he violated federal conflict of interest of laws.

The court ultimately agreed with the DOD’s finding last month, ruling that Oracle had failed to provide evidence of a conflict, or that it had impact on the procurement process. Judge Bruggink wrote at the time:

We conclude as well that the contracting officer’s findings that an organizational conflict of interest does not exist and that individual conflicts of interest did not impact the procurement, were not arbitrary, capricious, an abuse of discretion, or otherwise not in accordance with law. Plaintiff’s motion for judgment on the administrative record is therefore denied.

The company started complaining and cajoling even before the JEDI RFP process started. The Washington Post reported that Oracle’s Safra Catz met with the president in April, 2018 to complain that the process was unfairly stacked in favor of Amazon, which happens to be the cloud market share leader by a significant margin, with more than double that of its next closest rival, Microsoft.

Later, the company filed an appeal with the Government Accountability Office, which found no issue with the RFP process. The DOD, which has insisted all along there was no conflict in the process, also did in an internal investigation and found no wrong-doing.

The president got involved last month when he ordered Defense Secretary Mark T. Esper to look into the idea that, once again, the process has favored Amazon. That investigation is ongoing. The DOD did name two finalists, Amazon and Microsoft, in April, but has yet to name the winner as the protests, court cases and investigations continue.

The controversy in part involves the nature of the contract itself. It is potentially a decade-long undertaking to build the cloud infrastructure for the DOD, involves the award of a single vendor (although there are several opt-out clauses throughout the term of the contract) and involves $10 billion and the potential for much more government work. That every tech company is salivating for that contract is hardly surprising, but Oracle alone continues to protest at every turn.

The winner was supposed to be announced this month, but with the Pentagon investigation in progress, and another court case underway, it could be some time before we hear who the winner is.

Powered by WPeMatico

How to use Amazon and advertising to build a D2C startup

Contributor

Entrepreneurship in consumer packaged goods (CPG) is being democratized. Every step of the value channel has been compressed and made more affordable (and thereby accessible).

At VMG Ignite, we have worked with dozens of direct-to-consumer startups trying to both find product-market fit and achieve scale through Amazon and online advertising.

This article focuses on customer acquisition, particularly Amazon and online advertising, for the direct-to-consumer (D2C) CPG venture. Selling on Amazon, specifically third-party (3P), has become an increasingly important component of the D2C playbook. About 46% of product searches start on Amazon, which makes it a compelling source of sales even for early-stage ventures.

Table of contents

- How to find product-market fit

- How to get started with Amazon

- Maximizing sales on Amazon

- Getting started with Facebook ads

- Growing sales after you have product-market fit

- What tools and technology to use for your D2C business

How to find product-market fit

People say that ideas are a dime a dozen. They aren’t valuable. But finding product-market fit? Now, that’s hard. The gap between an unexecuted idea and proven product-market fit can seem vast. Yet it’s a critical first step because, ultimately, marketing amplifies your product and value proposition.

If they aren’t compelling, marketing will fail. If they’re compelling, even mediocre marketing can often be successful. So start with a great product that people love.

How do you create a great product, you ask? A/B test your product configuration like you A/B test your landing page, copy, and design. Your product is a variable, not a constant. Build, ship, get feedback. Build, ship, get feedback. Turn detractors into your customer panel for testing.

Early-stage D2C companies typically get their first customers through three channels:

- Begging your friends and family to buy and promote your product.

- List it on Amazon as a 3P seller. Figure out the platform and start selling!

- Advertise on Facebook. Start with a daily budget of 10x your price point to get started and start tinkering with creative, audiences, and settings to minimize cost per order.

The companies that succeed are often the ones that iterate the fastest. In his book Creative Confidence, IDEO founder David Kelley and his co-author (and brother) Tom relay a story of a pottery class that was split into two groups.

The first group was told they would each be graded on the single best piece of pottery they each produced. The second group was told they would each be graded based on the sheer volume of pottery they produced.

Naturally, the first group labored to craft the perfect piece while the second group churned through pottery with reckless abandon. Perhaps not so intuitive, at the end of the class, all the best pottery came from the second group! Iteration was a more effective driver of quality than intentionality.

Don’t know how to manage Amazon or Facebook? Here are some best practices:

How to get started with Amazon

Powered by WPeMatico

AT&T’s CEO of Communications, John Donovan, to retire in October

John Donovan, CEO of AT&T Communications, announced today his plans to retire effective October 1, 2019. Donovan has for the past two years led AT&T’s largest business unit, which services 100 million mobile, broadband and pay-TV customers in the U.S., as well as millions of business customers, including nearly all the Fortune 1000.

The news comes amid several big changes in that business unit itself, and more in the broader telecom industry.

For starters, AT&T had just rebranded its over-the-top streaming service DIRECTV NOW to AT&T TV NOW, and just last week rolled out a brand-new TV service, AT&T TV, in 10 test markets.

While DIRECTV NOW (aka AT&T TV NOW) is meant to compete with other over-the-top streaming services like Dish’s Sling TV, Hulu with Live TV, YouTube TV and others, the new AT&T TV is a more conventional — though still “over-the-top” — option that can work with any broadband connection.

However, it locks in customers to two-year contracts, requires a set-top box and has packages that range from $60-$80 per month, much like a traditional TV subscription.

Elsewhere at AT&T, its WarnerMedia division is working a streaming service of its own, HBO Max, which is meant to battle more directly with premium offerings, like Disney+ or Apple TV+, for example. AT&T also operates a low-cost streaming service, Watch TV.

And the company continues to offer pay-TV offerings like DIRECTV (satellite service) and U-verse (cable).

It seems AT&T is due to consolidate these efforts at some point, and Donovan’s departure could signal some changes on that front, perhaps. Plus, as The WSJ reported, Donovan and WarnerMedia head John Stankey had a strained relationship at times. That could because HBO Max will end up competing with other AT&T offerings and services, the report suggested.

In addition to its various streaming ambitions, AT&T is also starting to roll out 5G, a move Donovan spearheaded. The company is also preparing for competition from new players, including what arises from a T-Mobile/Sprint merger, and from Dish’s plans to enter the wireless market.

Donovan had been CEO of AT&T Communications for two years, after having joined the company as CTO in 2008. Prior to his CEO role starting in July 2017, he had been promoted to AT&T’s chief strategy officer and group president — AT&T Technology and Operations.

He previously worked at Verisign, Deloitte Consulting and InCode Telecom Group.

Donovan, 58, was nearing the company’s retirement age of 60, but his departure was still unexpected, The WSJ also said.

“It’s been my honor to lead AT&T Communications during a period of unprecedented innovation and investment in new technology that is revolutionizing how people connect with their worlds,” said John Donovan, in a statement. “All that we’ve accomplished is a credit to the talented women and men of AT&T, and their passion for serving our customers. I’m looking forward to the future – spending more time with my family and watching with pride as the AT&T team continues to set the pace for the industry.”

“JD is a terrific leader and a tech visionary who helped drive AT&T’s leadership in connecting customers, from our 5G, fiber and FirstNet buildouts, to new products and platforms, to setting the global standard for software-defined networks,” added Randall Stephenson, AT&T’s chairman and CEO. “He led the way in encouraging his team to continuously innovate and develop their skill sets for the future. We greatly appreciate his many contributions to our company’s success and his untiring dedication to serving customers and making our communities better. JD is a good friend, and I wish him and his family all the best in the years ahead.”

Disclosure: TechCrunch is owned by Verizon by way of Verizon Media Services. This does not influence our reporting.

Powered by WPeMatico

India’s 9-month-old CRED raises $120M to help people improve their financial behavior

Many Silicon Valley companies and fintech startups in India today share a common mission: They all want to bring their financial services to the next billion users. Dozens of fintech startups that we have spoken to in recent months have told us that they all want to address much of India, one of the last great growth markets globally, in the next few years.

So you can imagine our excitement when we learned there is at least one startup that is going after just a few million users in the immediate future. We’re talking about CRED, a nine-month-old, Bangalore-based startup that is building solutions to incentivize credit card users in India to become more responsible with money and thereby improve their credit score.

CRED has raised $120 million in a Series B financing round, Kunal Shah, founder and CEO of the startup, told TechCrunch on Monday. He declined to share more information. The startup, which has raised about $145 million to date, is now valued between $430 million to $450 million, a person familiar with the matter told TechCrunch.

According to a regulatory filing, existing investors Sequoia Capital, Ribbit Capital and DST Global’s Gemini Investments led the round, with participation from Tiger Global, Hillhouse Capital, General Catalyst, Greenoaks Capital and Dragoneer.

Hundreds of millions of Indians today don’t have a credit score because they have never taken a loan from a recognized entity nor owned a credit card. According to the government’s official figures, fewer than 50 million credit cards are in circulation in India currently, with industry reports suggesting that the actual number of unique credit card holders is about half of that.

“Nobody taught us about how to use money,” Shah told TechCrunch in a recent interview. “This has created a huge trust gap in India. If you look at developed markets, systematic trust is very high between all the entities. Members don’t have to rely on third-parties. In India, even if you wanted to rent a flat, you look for brokers, for instance.”

You can build that trust when you know how someone handles their money, and how they have handled it in recent history. “Our aim is to create a big membership community with high credit worthiness, therefore open up more opportunities for them,” Shah explained.

Shah is not going after the masses. He wants to focus on just the credit card users for now, and if he could win the trust of just half of those plastic card holders in India, he would consider it a success.

“Instead of chasing the mythological mass customers who are currently useful only on paper if you wanted to boast about your daily active user or monthly active user metric, our goal is to serve the existing users,” he said.

On CRED, users are offered a range of features, including the ability to better track their spending, get reminders and check their credit score, but more importantly, access to a range of lofty offers such as membership to a gym at a discounted price, access to good restaurants at low prices and subscription to various services at little to no charge. Users can access these features by earning points, which they can secure every time they pay their credit card bills on time.

Varun Krishnan, editor of technology news site FoneArena, told TechCrunch that he has found CRED useful in getting reminders to pay his bills and likes that he can pay them through a range of payment options, including UPI apps and debit cards. “I have several cards and it is hard to track amounts and due dates of payment for each one. They send all these alerts on WhatsApp, which is a blessing,” he said.

These are the reasons that attracted many people like Krishnan to join CRED. That, and some incentive to pay his bills — though he hopes that CRED expands the range of offers it currently provides to customers.

That wish may soon come true. In the coming months, CRED will enable these highly sought-after customers to access some financial services from banks in a single-click. Additionally, it is also exploring expansion to some international markets, the aforementioned source said.

CRED does not charge users any money for joining its platform, nor for availing any of the features it offers. But it is generating revenue from some of the partners that are supplying offers on the app.

It’s not a surprise that Shah, an industry veteran known for speaking the uncomfortable truths at conferences, has won the trust of so many investors already. He built one of the biggest payment apps in India, Freecharge, and sold it to e-commerce giant Snapdeal for a whopping $400 million in one of the increasingly rare exits that India’s fintech market has seen to date.

Powered by WPeMatico

Daily Crunch: A big funding round for Boll & Branch

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here.

1. Bedding startup Boll & Branch raises $100M

The company sells sustainably sourced sheets, pillows, mattresses and towels. Until now, it had only raised $12 million in outside capital.

This new funding comes from L Catterton. CEO Scott Tannen compared Boll & Branch to the firm’s previous investments The Honest Company and Peloton — companies that “have become the winner in the startup competition” and are ready to “really become household names.”

2. Nvidia and VMware team up to make GPU virtualization easier

Nvidia today announced that it has been working with VMware to bring its virtual GPU technology to VMware’s vSphere and VMware Cloud on AWS.

Founded by three Tsinghua University graduates in 2011, Megvii is among China’s leading AI startups, with its peers (and rivals) including SenseTime and Yitu. Its clients include Alibaba, Ant Financial, Lenovo, China Mobile and Chinese government entities.

4. Watch the first look at ‘Star Wars: The Rise of Skywalker’ from Disney’s big fan event

This video goes really heavy on the nostalgia.

5. Experimental US Air Force space plane breaks previous record for orbital spaceflight

The Boeing-built X-37B space plane commissioned and operated by the U.S. Air Force has now broken its own record for time spent in space. Its latest mission has lasted 719 days as of today.

6. Is Knotel poised to turn WeWork from a Unicorn into an Icarus?

Knotel has reversed the WeWork “co-working” model. Instead of “WeWork” branding everywhere, Knotel simply leases buildings, takes a small office for its staff and then kits out the space in a way where a company can just move straight in and call it their own. (Extra Crunch membership required.)

7. This week’s TechCrunch podcasts

John Vrionis of Unusual Ventures joins Equity to talk about why he thinks “stage-agnostic” investing doesn’t make any sense. And on Original Content, we review the Netflix movie “The Red Sea Diving Resort.”

Powered by WPeMatico

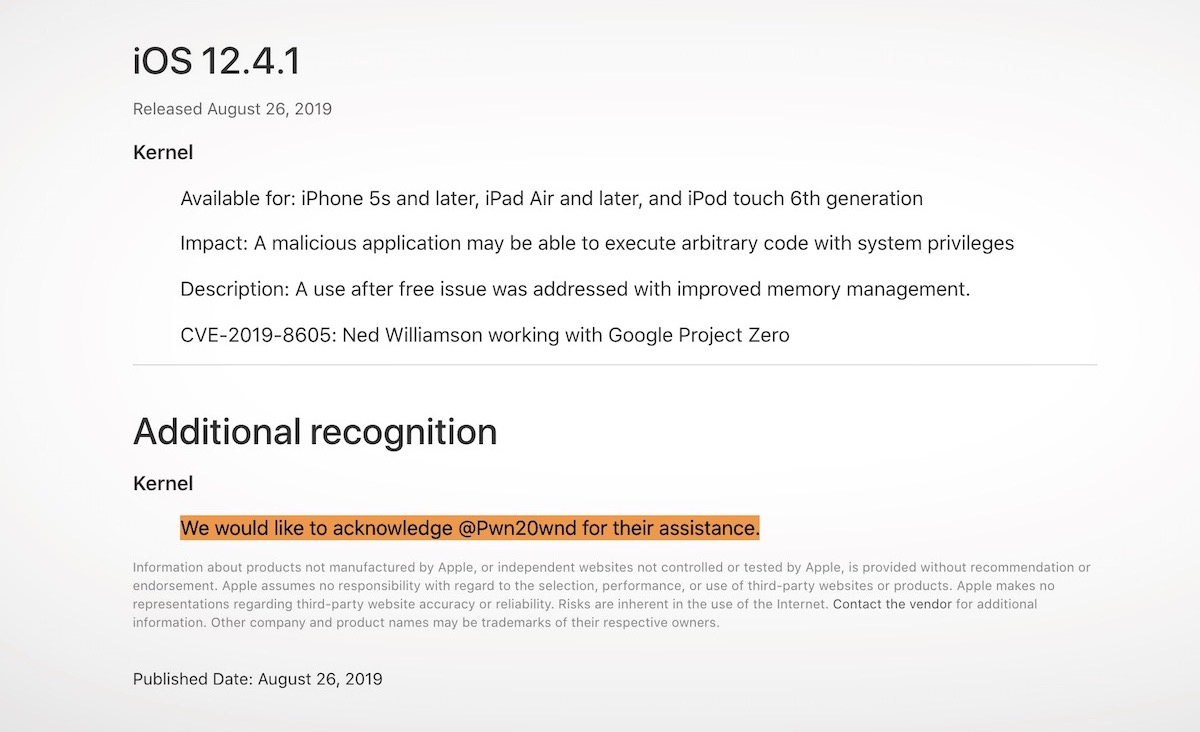

Apple patches previously fixed security bug that allowed iPhone jailbreak

Apple has fixed a security flaw for a second time after it accidentally reintroduced an old bug in a recent software update.

Released Monday, iOS 12.4.1 contains a security fix that was first patched months earlier in iOS 12.3. Apple rolled out a fix in May, but accidentally undid the security patch in its latest update, iOS 12.4, in July.

In a brief security advisory published after the software’s release, Apple said it fixed a kernel vulnerability that could have allowed an attacker to execute code on an iPhone or iPad with the highest level of privileges.

Apple’s latest security advisory for iOS 12.4.1

Those privileges, also known as system or root privileges, can open up a device to running apps that are not normally allowed by Apple’s strict rules. Known as jailbreaking, apps can access parts of a device that are normally off-limits. On one hand that allows users to extensively customize their devices, but it can also expose the device to malicious software, like malware or spyware apps.

Spyware apps often rely on undisclosed jailbreak exploits to get access to a user’s messages, track their location and listen to their calls without their knowledge. Nation states are known to hire mobile spyware makers to remotely install malware on the devices of activists, dissidents and journalists. Washington Post journalist Jamal Khashoggi, who was murdered by agents of the Saudi regime, is believed to have been targeted by mobile spyware, according to reports. The company accused of supplying the spyware, Israel-based NSO Group, has denied any involvement.

Apple confirmed it pushed out a fix in its security notes, which included a short acknowledgement to Pwn20wnd, the team that confirmed last week that its jailbreak was working again.

The same kernel vulnerability was fixed in a supplemental update for macOS 10.14.6.

Powered by WPeMatico

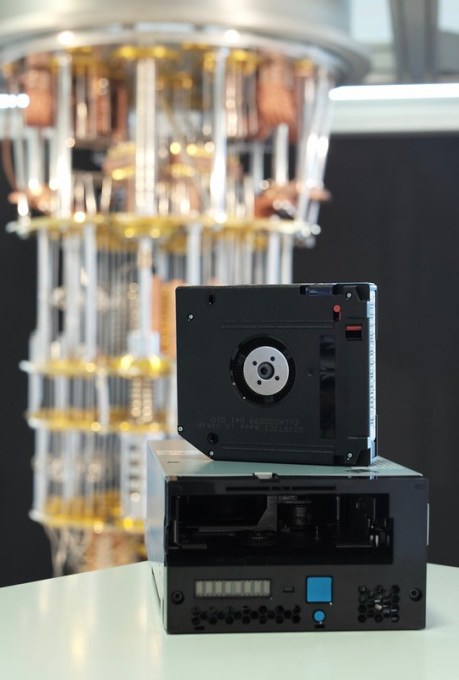

IBM’s quantum-resistant magnetic tape storage is not actually snake oil

Usually when someone in tech says the word “quantum,” I put my hands on my ears and sing until they go away. But while IBM’s “quantum computing safe tape drive” nearly drove me to song, when I thought about it, it actually made a lot of sense.

First of all, it’s a bit of a misleading lede. The tape is not resistant to quantum computing at all. The problem isn’t that qubits are going to escape their cryogenic prisons and go interfere with tape drives in the basement of some data center or HQ. The problem is what these quantum computers may be able to accomplish when they’re finally put to use.

Without going too deep down the quantum rabbit hole, it’s generally acknowledged that quantum computers and classical computers (like the one you’re using) are good at different things — to the point where in some cases, a problem that might take incalculable time on a traditional supercomputer could be done in a flash on quantum. Don’t ask me how — I said we’re not going down the hole!

One of the things quantum is potentially very good at is certain types of cryptography: It’s theorized that quantum computers could absolutely smash through many currently used encryption techniques. In the worst-case scenario, that means that if someone got hold of a large cache of encrypted data that today would be useless without the key, a future adversary may be able to force the lock. Considering how many breaches there have been where the only reason your entire life wasn’t stolen was because it was encrypted, this is a serious threat.

IBM and others are thinking ahead. Quantum computing isn’t a threat right now, right?  It isn’t being seriously used by anyone, let alone hackers. But what if you buy a tape drive for long-term data storage today, and then a decade from now a hack hits and everything is exposed because it was using “industry standard” encryption?

It isn’t being seriously used by anyone, let alone hackers. But what if you buy a tape drive for long-term data storage today, and then a decade from now a hack hits and everything is exposed because it was using “industry standard” encryption?

To prevent that from happening, IBM is migrating its tape storage over to encryption algorithms that are resistant to state of the art quantum decryption techniques — specifically lattice cryptography (another rabbit hole — go ahead). Because these devices are meant to be used for decades if possible, during which time the entire computing landscape can change. It will be hard to predict exactly what quantum methods will emerge in the future, but at the very least you can try not to be among the low-hanging fruit favored by hackers.

The tape itself is just regular tape. In fact, the whole system is pretty much the same as you’d have bought a week ago. All the changes are in the firmware, meaning earlier drives can be retrofitted with this quantum-resistant tech.

Quantum computing may not be relevant to many applications today, but next year who knows? And in 10 years, it might be commonplace. So it behooves companies like IBM that plan to be part of the enterprise world for decades to come to plan for it today.

Powered by WPeMatico

Amazon’s free streaming service IMDb TV comes to mobile devices

IMDb TV, the free ad-supported streaming service launched by Amazon-owned IMDb at the beginning of the year (originally called Freedive), is today arriving on mobile devices. With the updated version of iOS and Android IMDb app rolling out now, users can stream from the app’s growing library of free movies and TV series.

Prior to IMDb TV’s launch, the movie website had experimented with video content in the form of trailers, celebrity interviews and other short-form series. But consumers today are more interested in services where they can stream premium content for free, without a subscription — as they can on IMDb TV competitors like Walmart-owned Vudu’s “Movies on Us,” Tubi or The Roku Channel, for example.

At launch, IMDb TV offered a collection of TV shows like Fringe, Heroes, The Bachelor and Without a Trace, as well as Hollywood movies like Awakenings, Foxcatcher, Memento, Monster, Run Lola Run, The Illusionist, The Last Samurai, True Romance and others.

This summer, it expanded its lineup through new deals with Warner Bros., Sony Pictures Entertainment and MGM Studios.

This brought movies like Captain Fantastic and La La Land to the service, the latter which has since become one of the service’s most-streamed movies this summer. Other popular titles included Jerry Maguire, Practical Magic, A Knight’s Tale, Drive, Max, Step Dogs, Zookeeper, Paddington and The Neverending Story.

More recent deals with Paramount and Lionsgate have also brought new content to IMDb TV, like Silver Linings Playbook, Age of Adaline, In the Heart of the Sea and the TV show, The Middle.

The company hasn’t said how many customers IMDb TV has, but the service has benefited from integrations with Amazon’s Fire TV.

Earlier this year, Marc Whitten, vice president of Fire TV, noted that Fire TV customers’ use of free, ad-supported apps had increased by more than 300% during the last year. IMDb TV is expected to contribute to that, with its placement on the “Your Apps & Channels” row on Fire TV and its availability as a free channel within the Prime Video app.

The updated iOS and Android IMDb app is rolling out starting today, the company says.

Powered by WPeMatico

Satellite internet startup Astranis books first commercial launch on SpaceX Falcon 9

Y Combinator-backed startup Astranis is now set to launch its first commercial telecommunication satellite aboard a Falcon 9 rocket, with a launch time frame currently set for sometime starting in the fourth quarter of next year. Astranis aims to address the market of people who don’t currently have broadband internet access, which is still a huge number globally, and they hope to do so using low-cost satellites that massively undercut the price of existing global telecommunications hardware, which can be built and launched much faster than existing spacecraft, too.

Astranis satellites are much more cost-efficient because they’re smaller and easier to make, which changes the economics of deployment for potential carrier and connectivity provider partners. Its approach has already attracted the partnership of Microcom subsidiary Pacific Dataport, an Anchorage company that was formed to expand satellite broadband access in Alaska. This will be the goal of the company’s first launch with SpaceX, to deliver a single satellite to geostationary orbit that will add more than 7.5 Gbps of capacity to the internet provider’s network in Alaska, tripling capacity and potentially reducing costs by “up to three times,” according to Astranis.

This isn’t the first-ever satellite that Astranis has sent up to space — it launched a demonstration satellite in 2018 to show that its tech could work as advertised. Astranis’ approach is distinct from others attempting to offer satellite-based connectivity, including SpaceX’s own Starlink project, because it focuses on building satellites that remain in a fixed orbital position relative to the area on the ground where they’re providing service, as opposed to using a large constellation of low Earth orbit satellites that offer coverage because one or more are bound to be over the coverage area at any given time as they orbit the Earth, handing off connections from one to the next.

Powered by WPeMatico