Atoms nabs $8.1M for shoes you can buy in quarter sizes for each foot

The direct-to-consumer trend in fashion has been one of the most interesting evolutions in e-commerce in the last several years, and today one of the trailblazers in the world of footwear is picking up some money from a list of illustrious backers to bring its concept to the masses.

Atoms, makers of sleek sneakers that are minimalist in style — “We will make only one shoe design a year, but we want to make that really well,” said co-founder Sidra Qasim — but not in substance — carefully crafted with comfort and durability in mind, sizes come in quarter increments and you can buy different measurements for each foot if your feet are among the millions that are not exactly the same size — has raised $8.1 million.

The company plans to use the funding to invest in further development of its shoes, and to expand its retail and marketing presence. To date, the company has been selling directly to consumers in the U.S. via its website — which at one point had a waiting list of nearly 40,000 people — and the idea will be to fold in other experiences, including selling in physical spaces in the future.

This Series A speaks to a number of interesting investors flocking to the company.

It is being led by Initialized Capital, the investment firm started by Reddit co-founder Alexis Ohanian and Garry Tan (both had first encountered Atoms and its co-founders, Qasim and CEO Waqas Ali — as mentors when the Pakistani husband and wife team were going through Y Combinator with their previous high-end shoe startup, Markhor); with other backers including Kleiner Perkins, Dollar Shave Club CEO Michael Dubin, Acumen founder and CEO Jacqueline Novogratz, LinkedIn CEO Jeff Weiner, TED curator Chris Anderson, the rapper Chamillionaire and previous backers Aatif Awan and Shrug Capital.

Investors have come to the company by way of being customers. “The thing that I love about Atoms is that it isn’t just a different look, it’s a different feel,” said Ohanian in a statement. “When I put on a pair for the first time, it was a totally unique experience. Atoms are more comfortable by an order of magnitude than any other shoe I’ve tried, and they quickly became the go-to shoe in my rotation whenever I was stepping out. That wouldn’t mean anything if the shoes didn’t look great. Luckily, that’s not a problem, I wear my Atoms all the time and even my fashion designer wife is a fan.”

Even before today’s achievement of closing a Series A, the startup has come a long way on a relative shoestring: with just around $560,000 in seed funding and some of the founders’ own savings, Atoms built a supply chain of companies that would make the materials and shoes that it wanted, and developed a gradual but strong marketing pipeline with influential people in tech, fashion and design. (That success no doubt played a big role in securing the Series A to double down and continue to build the company.)

Within the bigger trend of direct-to-consumer retail — where smaller brands are leveraging advances in e-commerce, social media and wider internet usage to build vertically integrated businesses that bypass traditional retailers and bigger e-commerce storefronts to source their customers and sales more directly — there has been a secondary trend disrupting the very products that are being sold by using technology and advances in manufacturing. Third Love is another example in this category: The company has built a huge business selling bras and other undergarments to women by completely rethinking how they are sized, and specifically by focusing on creating as wide a range of sizes as possible.

So while companies like Allbirds — which itself is very well capitalised — may look like direct competitors to Atoms, the company currently stands apart from the pack because of its own very distinctive approach to building a mass-market business, but one that aims to make its product as individualised as possible.

You might think that approaching shoe manufacturers with the idea of creating smaller-size increments and manufacturing shoes as single items rather than pairs would have been a formidable task, but as it turned out, Atoms seemed to come along at the right place and the right time.

“We thought it would be challenging, and it wasn’t unchallenging, but the good thing was that many manufacturers were already starting to think about this,” Ali said. “Think about it, there has been almost no innovation in shoe making in the last 30 or 40 years.” He said they were happy to talk to Atoms because “we were the first and only company looking at shoes this way.” That helped encourage him and Qasim, he added. “We knew we would be able to figure it all out.”

Nevertheless, the pair admit that the upfront costs have been very high (they would not say how high), but given the principle of economies of scale, the more shoes that Atoms sells, the better the economics.

Currently the shoes sell for $179 a pair, which is not cheap and puts them at the high end of the market, so it will be interesting to see how and if price points evolve as it matures as a business, and competitors big and small begin to catch onto the idea of selling their own footwear at a wider range of sizes.

My colleague Josh, who first wrote about Atoms when they launched, is our own in-house tester, and as someone who could have easily moved on to another pair of kicks after he hit publish, he remains a fan:

“My Atoms have held up incredibly well from daily wear for 14 months,” he said. “They’re still my comfiest shoes and make Nikes feel uncomfortable when I try them again. They’ve sustained a tiny bit of wear on the front of the foam sole (the toe just below the fabric) while the bottoms have worn down a little, like any shoes.

“The mesh fabric can pick up dirt or dust if you take them in the wilderness, and the sole isn’t hard enough that you won’t feel point rocks. But throwing them in the wash or a rub with a brush and they practically look new. The elastic laces are incredibly convenient.

“I’ve probably tied them 4 times since first lacing them up. And for a cleaner, more professional look you can tuck the bow of your laces behind the tongue. Their biggest problem is they’re porous and can let water through if you wear them in the rain or puddles.

“Overall, I’ve found them to be my best travel shoes because they’re so versatile. I can walk all day in them, but then go to a fancy dinner or nightclub. I can hike or even hit the gym with them if necessary, and they pack quite flat. With the quarter-sizing and different use cases, they make Allbirds look like restrictive outdoor slippers. For adults who still want to wear sneakers, the monochromatic color schemes and brandless, simple styles make Atoms feel as mature and reliable as you can get.”

Ali said that among those who buy one pair, some 85% have returned and purchased more, and that’s before it has even gone outside the U.S. Qasim said there has been a lot of interest in other regions, but for now it’s still following its original formula of keeping the organisation and business small and tight, with no plans to expand to further countries for the moment.

Powered by WPeMatico

Could Peloton be the next Apple?

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week we were back in the SF studio, with Kate and Alex on hand to chat venture, business, startups, and IPOs with Iris Choi. Choi is a partner at Floodgate, and one of the very few folks who have ever been invited back on the show.

Despite Floodgate being an early-stage firm, Choi was more than willing to dig into the week’s later-stage topics, starting with the Peloton IPO filing. Kate was stoked about the offering (her piece here, Alex’s notes here). Peloton, a fitness, media, hardware (and more) company, is a lot different than your run-of-the-mill enterprise SaaS exits.

Next Alex ran the team through a list of impending IPOs that we care about. There are a number of venture-backed companies looking to go public before the stock market falls apart. More on each when they price.

After the S-1 march, we turned to personnel news, namely that Instacart’s CFO is leaving the firm after about four years with the company. Ravi Gupta is joining Sequoia Capital. We’ll tell you why.

Next, we touched on two rounds. First, a Kleiner deal into Consider, an app that brings power-tooling to email. And then we chatted about Inkitt, another Kleiner deal. Why the pair of early-stage rounds? Because Alex recently went to Kleiner to chat with its new partner team about where they’ll deploy capital in the future.

And that took us comfortably over our time. A big thanks to Choi for joining us, again, and you for sticking with the show. More next week!

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

Final week to buy super early-bird passes to Disrupt Berlin 2019

Die Zeit läuft ab, Leute translates very roughly to “time is running out, people!” You have only one week left to save a fat stack of euros on your pass to Disrupt Berlin 2019. Join us and startuppers from more than 50 countries on 11-12 December for the lowest possible price.

Our super early-bird pricing comes to a grinding halt on 6 September at 11:59 p.m. (CEST). Buy your passes now and save up to €600.

If you want to have a uniquely thrilling experience at Disrupt Berlin, be sure to apply to one or all three major events taking place during the show. You can use this single application to apply to be considered for the TC Top Picks program and/or to compete in the mighty Startup Battlefield. Or, if the TC Hackathon is more your style, apply right here. Here’s more good news: All three programs are free. No application fees, no participation fees, no giving up equity.

If TechCrunch editors choose you to be a TC Top Pick, you’ll receive a free Startup Alley Exhibitor Package and an interview on the Showcase Stage with a TC editor. To qualify for consideration, your early-stage startup must fall into one of these categories: AI/Machine Learning, Biotech/Healthtech, Blockchain, Fintech, Mobility, Privacy/Security, Retail/E-commerce, Robotics/IoT/Hardware, CRM/Enterprise and Education.

Startup Battlefield has launched literally hundreds of startups to the world, and TechCrunch editors will select 15-20 startups to compete for the $50,000 equity-free prize, serious bragging rights and a metric ton of investor and media attention.

Since 2007, 857 companies have launched at Startup Battlefield to great success. Collectively they’ve raised more than $8.9 billion in funding with 112 successful exits (IPOs or acquisitions). If you’re selected, you’ll join the ranks of this alumni community that includes Dropbox, Getaround, SirenCare, Fitbit, Mint.com, Vurb and more.

We’re accepting only 500 people to compete in the TC Hackathon — so don’t wait to apply. TechCrunch will award $5,000 for the best overall hack, and you’ll also compete for cash and prizes from our sponsored hacks — we’ll have more info on those challenges soon, so keep checking back.

There’s so much more to see and do at Disrupt Berlin — speakers, workshops, Q&A Sessions, plus hundreds of early-stage startups exhibiting in Startup Alley. Talk about a place to connect and network with people who can take your business to new heights.

Don’t miss your chance to save up to €600 on passes to Disrupt Berlin 2019. Our super early-bird pricing disappears on 6 September at 11:59 p.m. (CEST). Buy your passes now and save up to €600. Die Zeit läuft ab, Leute!

Is your company interested in sponsoring or exhibiting at Disrupt Berlin 2019? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

What is Andela, the Africa tech talent accelerator?

As someone who covers Africa’s tech scene, I’m frequently asked about Andela . That’s not surprising, given the venture gets more global press (arguably) than any startup in Africa.

I’ve found many Silicon Valley investors have heard of Andela but aren’t exactly sure what it does.

In a bite, Andela is Series D stage startup―backed by $180 million in VC―that trains and connects African software developers to global companies for a fee.

The revenue-focused venture is often misread as a charity. In 2017, Andela CEO Jeremy Johnson described the organization as “a mission-driven for-profit company” ― a model for the concept “that you can actually build businesses that create real impact.”

I asked Johnson recently to clarify the objective behind Andela’s drive. “It’s the exact same mission as when we started, based around our founding principle… that brilliance and talent are distributed equally around the world, but opportunity is not,” he said.

“We’re about breaking down the walls that prevent brilliance and opportunity from connecting to each other.”

A major barrier for Africa’s software engineers, according to Johnson, is simply the fact that the continent has been totally off the network that companies look to for developer talent.

Powered by WPeMatico

2019 tech IPOs: Some thoughts from the public company roller coaster

Contributor

2019 has already been an active year for U.S. tech IPOs. Some highly anticipated unicorns, such as Uber and Lyft, have disappointed investors with their IPO debuts and their first results as public companies. Others, such as Fiverr, Zoom and CrowdStrike, have soared. And food-tech brand Beyond Meat (two words you normally don’t see together) hit a high of $239 from their $25 IPO price.

The first of these 2019 tech IPO companies will soon face a new challenge as the early investor and employee lockups expire — often 180 days after the IPO — allowing them to sell and increasing the number of shares available to trade. Lyft will remain at the front of the 2019 pack when the lockups expire, bringing more of the company’s stock into play on the public market. Regardless of what happens next, it’s amazing to see the trajectory of companies that have built such impressive businesses in such a remarkably short period of time.

I was recently at the New York Stock Exchange (NYSE) to ring the opening bell and celebrate our three- millionth borrower on the platform. It brought back great memories from when our company, LendingClub, entered the public fray in 2014. LendingClub was the largest U.S. tech IPO that year, and is still one of the biggest U.S. tech IPOs of all time. We listed at a $5.4 billion valuation, and our shares surged 67% on the first day of trading. We were thrilled to celebrate the validation of our hard work and excited about the next stage of our growth. However, by the time our lockups expired, we had fallen back to around our IPO valuation of $15 a share.

Since then, despite being the market leader in the fastest-growing sector of consumer credit in the country with double-digit annual growth, the company today is worth less than a fifth of what it was in 2014. Our story is thankfully unique, and I’ll spare you the details here, but suffice to say… we had a rough period. We are back on track now, delivering growth and margin expansion while executing against our vision.

However bespoke our story, there are some observations I’ll share that might be useful for others as they think about life post-IPO. I’m not going to cover the issues around short-termism and the tyranny of quarterly targets (which have been well-documented elsewhere), but rather a few of the implications that sure would have been useful for me to know going in…

Things will be different — really

I’d compare the period leading up to the IPO to the period when you are expecting a baby. Intellectually, you know things will be different when you bring home a newborn. But knowing it and living it are two different things. Going public is a transformational event that permanently changes your company and how the CEO, CFO and board spend their time (with obvious trickle-down effects). From the moment we rang the NYSE bell on December 11, 2014, everything changed.

Making money matters

Investors buying your stock are essentially valuing your future cash flow. At some point, you have to have your “show them the money” moment and become profitable. Amazon famously lost a total of $2.8 billion over 17 straight quarters after their IPO and was the subject of a lot of skepticism and criticism throughout. The company maintained their strategy, delivering top-line growth and investing in their future and, suffice to say, investor patience paid off!

At LendingClub, we have invested millions of dollars to develop products that delight our 3 million+ customers (and, at 78, our NPS is at its highest level in the history of the company) and expand our competitive moat. We are now driving toward adjusted net income profitability.

Like it or not, there is a scoreboard

Once you go public, some people stop thinking of you as a business, and start thinking about you as a stock price. And that stock price is always broadcasting. It broadcasts to your equity investors, your employees, your partners, your board — to everyone who is listening.

You can’t preserve your culture, but you can and must maintain the values your company holds dear.

When the stock is up, everyone feels great. But, in a volatile market or a downturn, there are a lot of people who will be needing to hear your view on what’s happening. Communication to your stakeholders is not in the way of you doing your job, it is a critical part of your job that just got A LOT bigger. You need to stay ahead of it and deliberately carve out the time to make it a priority.

There are others sharing the microphone

When you are starting out, the world is divided into two types of people: those who love you, and those who don’t know/care. When you are a public company, a lot of voices join the conversation. You’ll add a different beat of reporters focused on your financials. You have analysts who are paid to research and think about your company, your strategy, your prospects and your value. These analysts may have never covered a company quite like yours (after all, you are breaking new ground) and you’ll need to spend time together to understand what matters.

You also can attract a whole new kind of investor, a “short” who has a vested interest in your stock going down. All of these voices are speaking to your stakeholders and you need to understand what they are saying and how it should affect your own communications.

Be careful, the microphone is on

Remember those days when everyone attended the “all hands” and you could share the details of your product road map, your corporate strategy, what’s working and what isn’t? Yeah, those are over. The risk of material nonpublic information leaking means you need to find a new balance in transparency with your employees (and your friends and partners for that matter).

It’s a change to behavior and to culture that doesn’t come naturally (at least it didn’t to me). It’s a change that can be frustrating to employees as the necessary opacity can erode trust as people feel out of the loop. At LendingClub, we still regularly communicate as much as we can and trust our employees, but there are places where you have to draw the line.

Your competitors are listening

Ironically enough, while your ability to share key details with employees is limited, you are sharing a lot with your competition. Shareholders and money managers want to know your battle plans and expect a detailed update at your earnings call every quarter. You can expect that your competitors are taking notice and taking notes.

Your scarcest resource

As the above would indicate, being public means that you are inevitably going to be spending less time running the business, and more time focused externally. Not a bad thing, but something you need to plan for so that you have the resources in place underneath you to maintain business momentum. If your management team isn’t materially different as you head to the market than it was a few years ago, I’d be surprised if you have what you need.

Your culture will change, focus on your values

I once asked a senior Google executive advice on how to preserve culture when going through massive periods of transition. She told me that you can’t preserve your culture, but you can and must maintain the values your company holds dear. Her advice, which I have followed and am passing on to you, is to make sure you write them down, hire against them and assess performance against them.

We started this practice years ago and it is remarkable how consistent our values have remained even as the company has evolved and matured. We codified six core values that put the customer at the center of everything we do. We are guided by our No. 1 value — Do What’s Right. You know a LendingClubber when you meet them, and it is part of what makes us great.

Being a public company is not for the faint-hearted, but being public is part of growing up. Being public legitimizes the company, unlocks liquidity to fuel growth and enables you to attract the next generation of talent. We always said that going public would allow us to deliver more value to a greater number of consumers and would lend legitimacy to our growing industry. We have facilitated more than $50 billion in loans and are still at a small percentage of our immediately addressable market. Although challenging at times, we’re seeing our dream to truly help everyday Americans come to life.

We’ve worked hard since our IPO to change the face people associate with finance. We’ve built a diverse team, established strong core values and nurtured a culture that has resulted in the kind of company we want to represent fintech and the tech industry as a whole — both inside and outside Silicon Valley.

So, to the new joiners in the public sphere — life in the spotlight is a wild ride. Congratulations on this step in your journey, and on to the next!

Powered by WPeMatico

Marc Benioff will discuss building a socially responsible and successful startup at TechCrunch Disrupt

Salesforce chairman, co-founder and CEO Marc Benioff took a lot of big chances when he launched the company 20 years ago. For starters, his was one of the earliest enterprise SaaS companies, but he wasn’t just developing a company on top of a new platform, he was building one from scratch with social responsibility built-in.

Fast-forward 20 years and that company is wildly successful. In its most recent earnings report, it announced a $4 billion quarter, putting it on a $16 billion run rate, and making it by far the most successful SaaS company ever.

But at the heart of the company’s DNA is a charitable streak, and it’s not something they bolted on after getting successful. Even before the company had a working product, in the earliest planning documents, Salesforce wanted to be a different kind of company. Early on, it designed the 1-1-1 philanthropic model that set aside 1% of Salesforce’s equity, and 1% of its product and 1% of its employees’ time to the community. As the company has grown, that model has serious financial teeth now, and other startups over the years have also adopted the same approach using Salesforce as a model.

In our coverage of Dreamforce, the company’s enormous annual customer conference, in 2016, Benioff outlined his personal philosophy around giving back:

You are at work, and you have great leadership skills. You can isolate yourselves and say I’m going to put those skills to use in a box at work, or you can say I’m going to have an integrated life. The way I look at the world, I’m going to put those skills to work to make the world a better place.

This year Benioff is coming to TechCrunch Disrupt in San Francisco to discuss with TechCrunch editors how to build a highly successful business, while giving back to the community and the society your business is part of. In fact, he has a book coming out in mid-October called Trailblazer: The Power of Business as the Greatest Platform for Change, in which he writes about how businesses can be a positive social force.

Benioff has received numerous awards over the years for his entrepreneurial and charitable spirit, including Innovator of the Decade from Forbes, one of the World’s 25 Greatest Leaders from Fortune, one of the 10 Best-Performing CEOs from Harvard Business Review, GLAAD, the Billie Jean King Leadership Initiative for his work on equality and the Variety Magazine EmPOWerment Award.

It’s worth noting that in 2018, a group of 618 Salesforce employees presented Benioff with a petition protesting the company’s contract with the Customs and Border Patrol (CBP). Benioff in public comments stated that the tools were being used in recruitment and management, and not helping to separate families at the border. While Salesforce did not cancel the contract, at the time, co-CEO Keith Block stated that the company would donate $1 million to organizations helping separated families, as well as match any internal employee contributions through its charitable arm, Salesforce.org.

Disrupt SF runs October 2 to October 4 at the Moscone Center in the heart of San Francisco. Tickets are available here.

Did you know Extra Crunch annual members get 20% off all TechCrunch event tickets? Head over here to get your annual pass, and then email extracrunch@techcrunch.com to get your 20% discount. Please note that it can take up to 24 hours to issue the discount code.

Powered by WPeMatico

Google to pay security researchers who find Android apps and Chrome extensions misusing user data

Google said it will pay security researchers who find “verifiably and unambiguous evidence” of data abuse using its platforms.

It’s part of the company’s efforts to catch those who misuse user data collected through Android apps or Chrome extensions — and to avoid its own version of a scandal like Cambridge Analytica, which saw millions of Facebook profiles scraped and used to identify undecided voters during the U.S. presidential election in 2016.

Google said anyone who identifies “situations where user data is being used or sold unexpectedly, or repurposed in an illegitimate way without user consent” is eligible for its expanded data abuse bug bounty.

“If data abuse is identified related to an app or Chrome extension, that app or extension will accordingly be removed from Google Play or Google Chrome Web Store,” read a blog post. “In the case of an app developer abusing access to Gmail restricted scopes, their API access will be removed.” The company said abuse of its developer APIs would also fall under the scope of the bug bounty.

Google said it isn’t providing a reward table yet but a single report of data misuse could net $50,000 in bounties.

News of the expanded bounty comes in the wake of the DataSpii scandal, which saw browser extensions scrape and share data from millions of users. These Chrome extensions uploaded web addresses and web page titles of every site a user visited, exposing sensitive data like tax returns, patient data and travel itineraries.

Google was forced to step in and suspend the offending Chrome extensions.

Instagram recently expanded its own bug bounty to include misused user data following a spate of data incidents.

Powered by WPeMatico

Instagram may allow creators to syndicate IGTV videos to Facebook

Following the departure of Instagram’s founders, Facebook is working to more closely integrate the photo-sharing app with its flagship social network. It’s already added its brand name next to Instagram’s, and is working to make both platforms’ messaging products interoperable. Now, Facebook is prototyping a means of syndicating Instagram’s IGTV video to Facebook’s video site, Facebook Watch.

In another find from noted reverse engineer Jane Manchun Wong, Instagram was found to have under development a feature that would allow Instagram users to post their IGTV content to both Instagram as a preview, as well as to Facebook and Watch — the latter by toggling an additional switch labeled “make visible on Facebook.”

Instagram is working on IGTV Series pic.twitter.com/SLOWCnicLJ

— Jane Manchun Wong (@wongmjane) August 28, 2019

Wong says the feature is still in the prototype stage, as the buttons themselves aren’t functional.

This move, should it come to pass, could prompt more video creators to use IGTV, given that it would boost their videos’ distribution by also including Facebook as a destination for their content. The videos could also be part of an ongoing, episodic series, Wong found.

This, in turn, could help IGTV — an app which hasn’t quite taken off as a standalone video platform. Today, IGTV takes inspiration from TikTok and Snapchat’s vertical video. It’s meant to engage Instagram users with longer-form, portrait mode video content both within Instagram and in a separate IGTV app. But IGTV has often been filled with poorly cropped and imported web video, rather than content designed specifically for the platform.

Meanwhile, the IGTV app has struggled to rise to the top of the App Store’s charts the way its parent, Instagram, has. Today, it’s ranked No. 159 in the Photo & Video category on the App Store, and unranked in the Overall top charts.

To address some of the issues that creators have complained about, Instagram this week rolled out a few changes to the upload experience. This included the new ability to select the 1:1 crop of an IGTV thumbnail for the creator’s Profile Cover as well as the ability to edit which 5:4 section of the IGTV video shows in the Feed.

IGTV will also now auto-populate Instagram handles and tags on IGTV titles and descriptions, and will now support the ability to upload longer video from mobile. With the latter change, IGTV has increased the minimum threshold to upload on mobile to one minute, and is allowing mobile uploads up to 15 minutes.

Instagram declined to comment on the possible syndication of IGTV content to Facebook and Facebook Watch.

Powered by WPeMatico

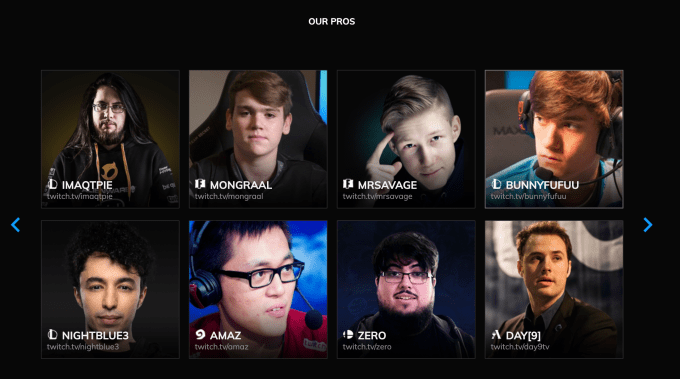

Launching from beta, ProGuides is making money ensuring that gamers never play alone

When ProGuides pulled the covers off of its service earlier this year, the young Los Angeles-based startup intended to give gamers a way to train with professional and semi-pro esports players from around the world.

But as users signed on to the service, it became clear that they weren’t looking for training necessarily… Instead, what players wanted was a ringer.

“After we launched the beta, we found some interesting user behavior,” says Sam Wang. “We found that gamers were experienced already and wanted experienced players who are better than [the matches] the game can provide… At the end of the day you do get to play with someone pretty awesome and is something that I think can make games better.”

That’s right, ProGuides is pitching a marketplace for experienced gamers so that its customers aren’t randomly matched with some noob if they can’t game with their usual partners.

“Our tagline is ‘Play with pros’ now,” says Wang. “We already have over 5,000 sessions that were played in the last two months.”

The professional gamers who list their services on the site charge an average of $10 per session and ProGuides takes about a 25% cut. The company lowers its rates for popular gamers or gamers who are willing to spend more time on the platform either selling their services or actually coaching esports players.

Wang says that pros on the platform are making anywhere from $750 to $2,500 per month and that there are currently 250 coaches on the platform.

A typical session on ProGuides lasts around 45 minutes and players are available for Fortnite, League of Legends, Super Smash Brothers, CS:GO and Hearthstone.

ProGuides raised $1.9 million in pre-seed funding last June. The company is backed by Amplify, an LA-based early-stage investor and company accelerator, Quest Venture Partners, Greycroft Tracker fund and the GFR Fund.

The LA-based company also has some venture-backed competition on the East Coast. Gamer Sensei, which has raised roughly $6 million (according to Crunchbase) has a similar proposition. It’s backed by Accomplice and Advancit Capital.

Powered by WPeMatico

Mews grabs $33M Series B to modernize hotel administration

If you think about the traditional hotel business, there hasn’t been a ton of innovation. You mostly still stand in a line to check in, and sometimes even to check out. You let the staff know about your desire for privacy with a sign on the door. Mews believes it’s time to rethink how hotels work in a more modern digital context, especially on the administrative side, and today it announced a $33 million Series B led by Battery Ventures.

When Mews founder Richard Valtr started his own hotel in Prague in 2012, he wanted to change how hotels have operated traditionally. “I really wanted to change the way that hotel systems are built to make sure that it’s more about the experience that the guest is actually having, rather than facilitating the kind of processes that hotels have built over the last hundred years,” Valtr told TechCrunch.

He said most of the innovation in this space has been in the B2C area, using Airbnb as a prime example. He wants to bring that kind of change to the way hotels operate. “That’s essentially what Mews is trying to do. [We want to shift the focus to] the fundamental things about why we love to travel and why people actually love to stay in hotels, experience hotels, and be cared for by professional staff. We are trying to do that in a way that that actually delivers a really meaningful experience and personalized experience to that one particular customer,” he explained.

For starters, Mews is a cloud-based system that automates a lot of the manual tasks, like room assignments that hotel staff at many hotels often still have to handle as part of their jobs. Valtr believes by freeing the staff from these kinds of tedious activities, it enables them to concentrate more on the guests.

It also offers ways for guests and hotels to customize their stays to get the best experience possible. Valtr says this approach brings a new level of flexibility that allows hotels to create new revenue opportunities, while letting guests choose the kind of stay they want.

From a guest perspective, they could by-pass the check-in process altogether, sharing all of their registration details ahead of time and getting a pass code sent to their phone to get into the room. The system integrates with third-party hotel booking sites like Booking.com and Expedia, as well as other services, through its open hospitality API, which offers lots of opportunities for properties to partner with local businesses.

The company is currently operating at 1,000 properties across 47 countries, but it lacks a presence in the U.S. and wants to use this round to open an office in NYC and expand into this market. “We really want to attack the U.S. market because that’s essentially where most of the decision makers for all of the major chains are. And we’re not going to change the industry if we don’t actually change the thinking of the biggest brands,” Valtr said.

Today, the company has 270 employees spread across 10 offices around the world. Headquarters are in Prague and London, but the company is in the process of opening that NYC office, and the number of employees will expand when that happens.

Powered by WPeMatico