India’s mobile payments firm MobiKwik reaches rare key profit milestone

Indian mobile payments firm MobiKwik has reached a milestone very few of its local rivals can even contemplate: not burning money. The 10-year-old Gurgaon-headquartered firm said Tuesday it is now generating a profit excluding interest, taxes, depreciation and amortization.

“We have been in an ecosystem where we have seen a lot of high-growth and several regulatory changes in the payments domain. But what we realized was that payments alone is likely not going to be a very profitable business,” Bipin Singh, co-founder and CEO of MobiKwik, told TechCrunch in an interview.

To get to the path of profitability, MobiKwik has made a number of significant changes to its business in recent years. It stopped participating in the race to aggressively acquire users and fighting with heavily backed firms such as Paytm, which has raised more than $2 billion to date.

Paytm remains unprofitable and an analysis of its financial performance shows that this is not going to change anytime soon. Google, which also offers a payments service in India, has no shortage of cash, either. MobiKwik has raised about $118 million to date from Sequoia Capital, American Express and Cisco Investments, among others.

Upasana Taku, co-founder and COO of MobiKwik, said the company has taken inspiration from Kotak and ICICI banks, both of which have about 15 million to 20 million customers — a fraction of many digital payment apps — but are profitable. MobiKwik, which employs 400 people, has 110 million users, she said.

In the last two and a half years, MobiKwik has cut down on cashbacks it bandies out to users — a practice followed by every company offering a payments solution in India — and focused on building financial services on top of its wallet app to retain customers and find additional sources of revenue.

The company continues to focus on its mobile wallet and payments processing businesses that account for about 75% of its revenue, but its growing suite of financial services, such as providing credits and insurance to customers, is already bringing the rest of the revenue, she said.

That’s not surprising, as India remains alarmingly under served. Fewer than 50 million credit cards are in circulation in the nation currently, and for people with limited income, getting a loan of any size remains a major challenge.

“Even the population that has access to smartphones and cheap internet data can’t get a credit card in India. We found it a good match for the growth of our payments app. We started serving these users who have the discipline to repay money and have certain kind of income,” the couple said, who are now also donning the role of angel investors.

MobiKwik works with banks and other lenders to finance loans between Rs 5,000 ($69) to Rs 100,000 ($1,380). In the 18 months since it started offering this, MobiKwik has provided 800,000 loans and disbursed $100 million.

In late 2018, the company launched “sachet-sized” insurance plans to provide protection from cyber fraud, fire, accident and hospitalization. These sachets start at as little as Rs 20 (28 cents) and thousands of users buy these everyday. Similarly, it also allows users to buy mutual funds for as little as $1.30.

MobiKwik expects its revenue to hit $69 million in the financial year that ends in March next year, up from $28 million a year earlier. The company, which expects to turn fully profitable by fiscal year 2021, plans to go public in four to five years, Taku said.

MobiKwik competes with a number of players, many of which are increasingly adding financial services, such as loans, to their platforms. Since these digital platforms are able to process loans without the need of salespeople and support staff, it becomes feasible for banks to chase customers with weak financial power.

India’s overall retail credit demand is expected to grow 60% to $771 billion over the next four years, according to the Digital Lenders Association of India.

Powered by WPeMatico

OpenGov raises $51M to boost its cloud-based IT services for government and civic organizations

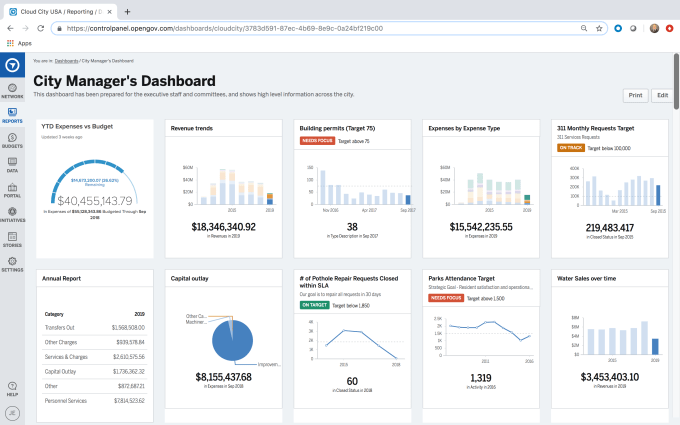

OpenGov, the firm co-founded by Palantir’s Joe Lonsdale that helps government and other civic organizations organise, analyse and present financial and other data using cloud-based architecture, has raised another big round of funding to continue expanding its business. The startup has picked up an additional $51 million in a Series D round led by Weatherford Capital and 8VC (Lonsdale’s investment firm), with participation from existing investor Andreessen Horowitz.

The funding brings the total raised by the company to $140 million, with previous investors in the firm including JC2 Ventures, Emerson Collective, Founders Fund and a number of others. The company is not disclosing its valuation — although we are asking — but for some context, PitchBook noted it was around $190 million in its last disclosed round — although that was in 2017 and has likely increased in the interim, not least because of the startup’s links in high places, and its growth.

On the first of these, the company says that its board of directors includes, in addition to Lonsdale (who is now the chairman of the company); Katherine August-deWilde, Co-Founder and Vice-Chair of First Republic Bank; John Chambers, Founder and CEO of JC2 Ventures and Former Chairman and CEO of Cisco Systems; Marc Andreessen, Co-Founder and General Partner of Andreessen Horowitz; and Zac Bookman, Co-Founder and CEO of OpenGov .

And in terms of its growth, OpenGov says today it counts more than 2,000 governments as customers, with recent additions to the list including the State of West Virginia, the State of Oklahoma, the Idaho State Controller’s Office, the City of Minneapolis MN, and Suffolk County NY. For comparison, when we wrote in 2017 about the boost the company had seen since Trump’s election (which has apparently seen a push for more transparency and security of data), the company noted 1,400 government customers.

Government data is generally associated with legacy systems and cripplingly slow bureaucratic processes, and that has spelled opportunity to some startups, who are leveraging the growth of cloud services to present solutions tailored to the needs of civic organizations and the people who work in them, from city planners to finance specialists. In the case of OpenGov, it packages its services in a platform it calls the OpenGov Cloud.

“OpenGov’s mission to power more effective and accountable government is driving innovation and transformation for the public sector at high speed,” said OpenGov CEO Zac Bookman in a statement. “This new investment validates OpenGov’s position as the leader in enterprise cloud solutions for government, and it fuels our ability to build, sell, and deploy new mission-critical technology that is the safe and trusted choice for government executives.”

It’s also, it seems, a trusted choice for government executives who have left public service and moved into investing, leveraging some of the links they still have into those who manage procurement for public services. Weatherford Capital, one of the lead investors, is led in part by managing partner Will Weatherford, who is the former Speaker of the House for the State of Florida.

“OpenGov’s innovative technology, accomplished personnel, market leadership, and mission-first approach precisely address the growing challenges inherent in public administration,” he said in a statement. “We are thrilled at the opportunity to partner with OpenGov to accelerate its growth and continue modernizing how this important sector operates.”

It will be interesting to see how and if the company uses the funding to consolidate in its particular area of enterprise technology. There are other firms like LiveStories that have also been building services to help better present civic data to the public that you could see as complementary to what OpenGov is doing. OpenGov has made acquisitions in the past, such as Ontodia to bring more open-source data and technology into its platform.

Powered by WPeMatico

Revolut ramps up customer support with plans to hire 400 people in Porto

Fintech startup Revolut has been growing like crazy and now has 6 million customers. The company has to scale its support team accordingly. That’s why Revolut just announced plans to open a customer operations centre in Porto, Portugal.

There are already 70 people working for Revolut in Porto. Eventually, Revolut plans to hire 400 people in the country. They’ll work on customer support, complaints, investigations and compliance.

And Revolut has been quite successful in Portugal so far. There are currently 250,000 Revolut customers in Portugal, and the company is adding 1,000 new customers per day in the country.

It should help when it comes to hiring local talent. The company is also hiring a growth manager, a communication and PR lead and a community manager in Portugal. Ricardo Macieira, the new growth manager, is the former country manager for Airbnb in Portugal. Rebeca Venâncio, the communication and PR lead, has worked for Microsoft in Portugal. And Miguel Costa, the community manager, has worked for Mog and Nomad Tech.

Earlier this summer, Revolut also announced plans to open a tech hub in Berlin. Originally founded in London, Revolut is slowly building multiple offices across the U.K. and Europe in order to attract local talent.

Powered by WPeMatico

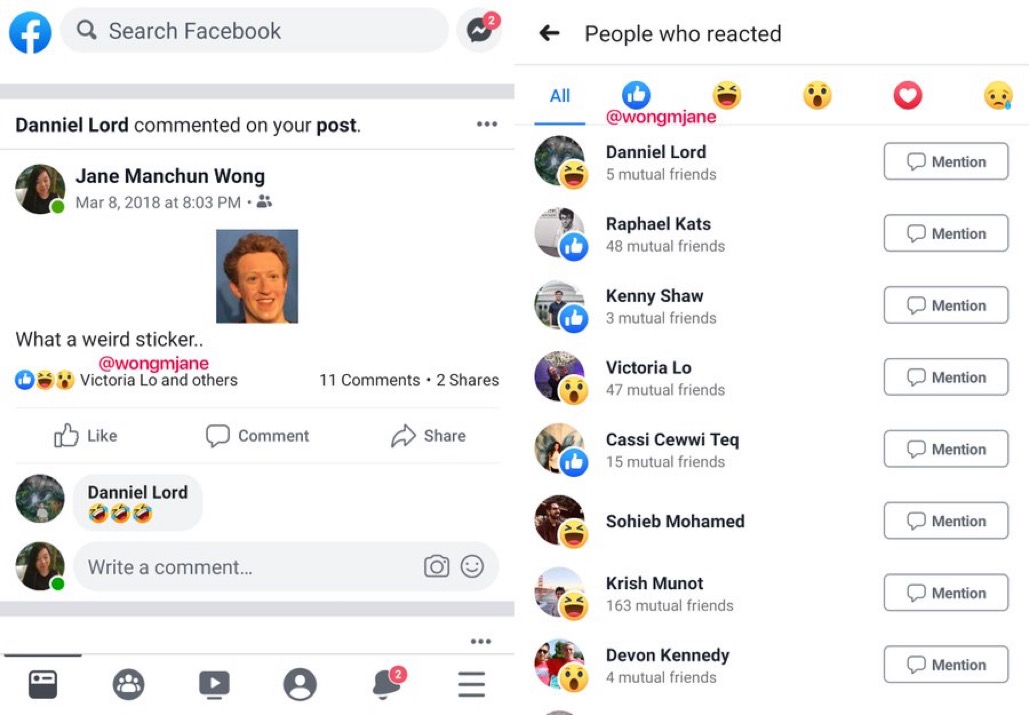

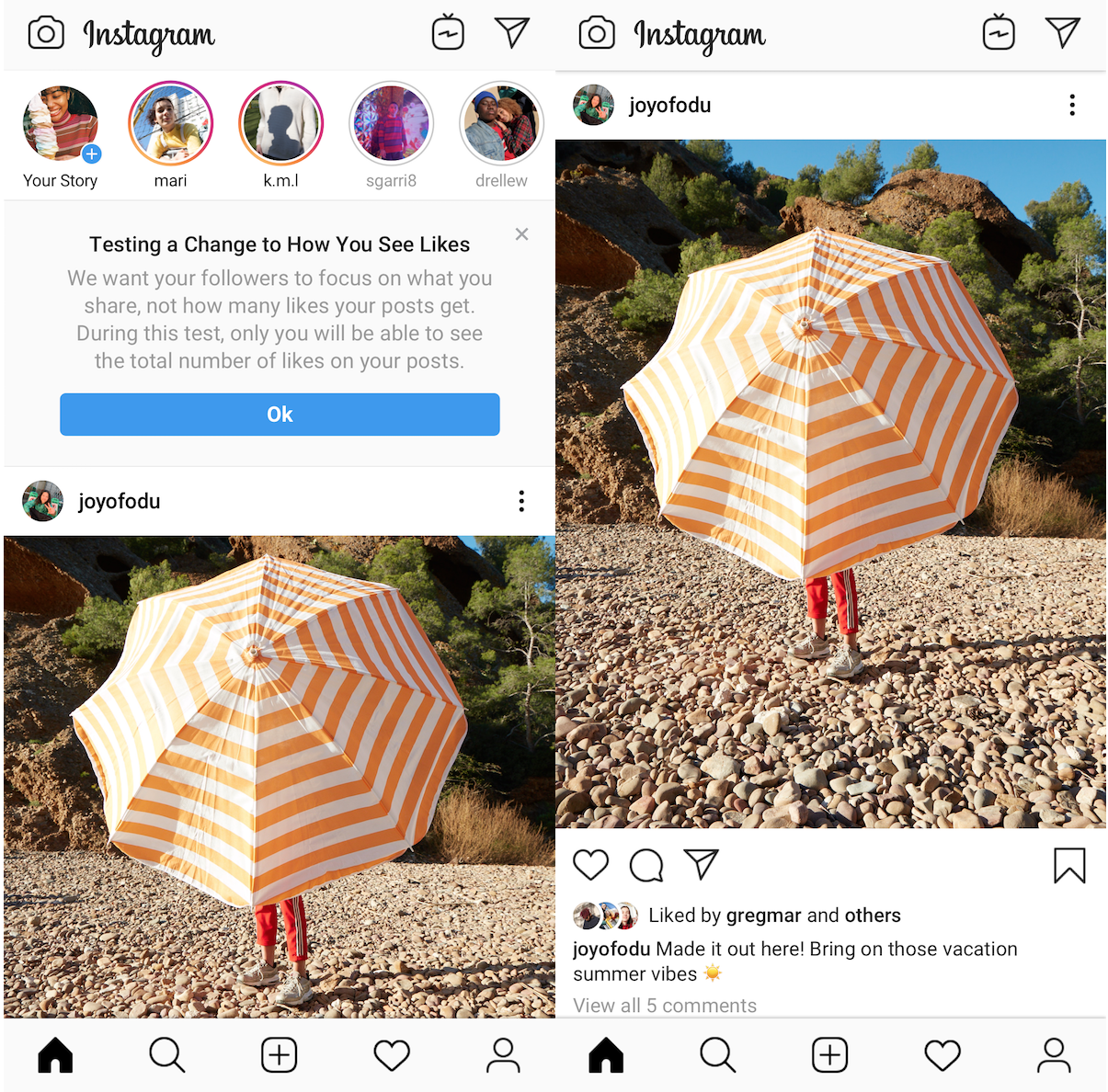

Now Facebook says it may remove Like counts

Facebook could soon start hiding the Like counter on News Feed posts to protect users’ from envy and dissuade them from self-censorship. Instagram is already testing this in 7 countries including Canada and Brazil, showing a post’s audience just a few names of mutual friends who’ve Liked it instead of the total number. The idea is to prevent users from destructively comparing themselves to others and possibly feeling inadequate if their posts don’t get as many Likes. It could also stop users from deleting posts they think aren’t getting enough Likes or not sharing in the first place.

Facebook prototypes hiding like counts [via Jane Manchun Wong]

Reverse engineering master Jane Manchun Wong spotted Facebook prototyping the hidden Like counts in its Android app. When we asked Facebook, the company confirmed to TechCrunch that it’s considering testing removal of Like counts. However it’s not live for users yet. Facebook declined to share results from the Instagram Like hiding tests, its exact motives, or any schedule for starting testing. If it does decide to go ahead with a test, Facebook would likely do so gradually and pull back if it significantly hurts usage or ad revenue.

Still, the prototype might indicate positive results from hiding Like tallies in Instagram, which we first reported in April after it was spotted by Wong there as well. After beginning testing in Canada later that month. Instagram added Brazil, Australia, New Zealand, Italy, Ireland, and Japan to the test in July. There, a post’s author can still see the Like total, but everyone else can’t. The expansion of that Instagram test and Facebook potentially trying it in its own app signals that it might have positive or negligible impacts on sharing while aiding mental health, or at least be worth a slight drop in engagement.

Instagram is already testing hiding Like counts and Facebook may soon do the same.

Facebook has gradually been relegated to the place for sharing showy life events like marriages or new jobs while Instagram and Snapchat take over for day-to-day sharing. The problem is that people have so many fewer of those big moments, and the large Like counts they attract can make other users self-conscious of their of own lives and content. That’s all problematic for Facebook’s ad views. Facebook wants to avoid scenarios such as “Look how many Likes they get. My life is lame in comparison” or “why even share if it’s not going to get as many Likes as her post and people will think I’m unpopular”.

Removing Like counts could put less pressure on users and encourage them to share more freely and frequently, as I wrote in 2017. It could also obscure Facebook’s own potential decline in popularity as users switch to other apps. Posts not getting as many Likes as they used to could hasten the exodus.

Come see my interview with Snapchat CEO Evan Spiegel at TechCrunch Disrupt SF (Oct 2nd-4th — tickets here) to learn more about how social networks are adapting to growing mental health concerns.

Powered by WPeMatico

India’s Oyo acquires Copenhagen-based data science firm Danamica for $10M

India’s Oyo said on Monday it has acquired Copenhagen-based data science firm Danamica as the fast-growing lodging startup works to expand its business in Europe.

Neither of the parties disclosed financial terms of the deal, but a source familiar with the matter told TechCrunch that Oyo paid about $10 million to acquire the Danish firm.

Danamica, which was founded in 2016, has built machine learning tools and “business intelligence capabilities” to specialize in dynamic pricing of rental properties. The firm’s algorithm analyzes 144,000 data points every hour and makes 60 million price changes every day with a prediction accuracy of 97% to help hotels boost their revenue, Oyo said. The Indian startup said Danamica would help it scale its technical expertise as it expands its footprint in overseas markets.

Oyo, which is the largest hotel chain in India, is rapidly expanding in other countries. It has already established presence in 80 countries, the six-year old startup said. About half of its 1 million rooms are in China, where it launched last year.

Today’s announcement comes weeks after Oyo said it planned to invest €300 million in its vacation rental business in Europe, and $300 million toward U.S. expansion over the coming years. In May this year, Oyo bought Amsterdam-based holiday rental company Leisure from Axel Springer for $415 million.

In a prepared statement, Maninder Gulati, Global Head of OYO Vacation and Urban Homes and Chief Strategy Officer of OYO Hotels & Homes, said, “We are delighted to announce our acquisition of Danamica, a Europe based, machine learning and business intelligence company specialized in dynamic pricing, that will help us be more accurate with pricing, leading to higher efficiencies and yield for our real estate owners and value for money for our millions of global guests, both everyday travellers and city dwellers, that choose an OYO Vacation Homes as their abode.”

In July this year, Oyo entered co-working spaces market with the launch of Oyo Workspaces. At a media conference in New Delhi, startup executives said they aim to make Oyo Workspaces the largest business in its category in Asia by end of next year. To immediately capture some market share, Oyo said it had acquired Indian co-working spaces startup Innov8. Sources told TechCrunch then that Oyo had paid about $30 million to acquire Innov8.

In the same month, 25-year-old Ritesh Agarwal (pictured above), founder of SoftBank-backed Oyo, invested $2 billion to triple his stake in the company as early investors Lightspeed and Sequoia partly cashed out. The deal pushed Oyo’s valuation to $10 billion.

Powered by WPeMatico

We want you: Apply to Startup Battlefield at Disrupt Berlin 2019

You’ve worked hard to build your dream to this point, and now it’s time to launch your early-stage startup on a world-class stage and shift your momentum into high gear. If that description fits, we want you to apply to compete in the Startup Battlefield at Disrupt Berlin 2019.

Our early-stage startup pitch competition is the most effective way to place your startup in front of the investors, tech leaders and media outlets that can change the trajectory of your business in the best way possible. Oh, and the winning founders also receive $50,000. Sweet!

What’s more, applying to and participating in Startup Battlefield is absolutely free — no fees, no equity, no nothing.

Applying is easy, but the selection process is extremely competitive. TechCrunch editors with a keen eye for potential will vet every application and then select 15-20 companies to compete. Founders of those startups will receive six rigorous weeks of pitch coaching — you’ll work hard to craft your pitch, prepare your demo and be ready to strut your stuff with confidence.

When the big day finally arrives, each team will have six minutes to pitch to a world-class panel of judges — followed by a six-minute Q&A session. The founders who make it through to the second round will present again to a fresh set of judges. It’s a lather, rinse, repeat scenario.

One startup will emerge victorious, raise the Disrupt Cup and take home the $50,000 prize. The event takes place in front of a huge audience filled with investors, media and tech icons — and we record and live-stream the whole shooting match around the world.

Not only that, all Startup Battlefield competitors get to exhibit in Startup Alley for the entire show. Even if you don’t win the top prize, you still benefit from the exposure. Plus, you’ll join the ranks of the Startup Battlefield alumni community — now there’s an impressive group.

Since 2007, 857 startups have launched their dreams on the Startup Battlefield stage and gone on to collectively raise $8.9 billion while producing 112 exits. This alumni community includes companies like Vurb, Dropbox, Mint, Yammer and many more. You’ll be among their ranks…let the networking begin!

The Startup Battlefield takes place at Disrupt Berlin 2019 on 11-12 December. You’ve worked hard to build your dream — now take it to the next level. Apply to Startup Battlefield today.

Pro Tip: If you’re not quite ready to compete in the Battlefield, there’s more than one way to receive the VIP treatment at Disrupt. Use the same application and apply for the TC Top Picks program. If you make the cut, you’ll receive a free Startup Alley Exhibitor Package and stand in a bright spotlight of media and investor attention.

Is your company interested in sponsoring or exhibiting at Disrupt Berlin 2019? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Only 5 days left for super early bird savings at Disrupt Berlin 2019

Our super early bird countdown continues startup fans. If you don’t have your pass to Disrupt Berlin 2019 yet, it’s time to mach schnell — make it quick! Buy your pass now before the deadline strikes on 6 September at 11:59 p.m. (CEST), and you’ll save up to €600. Just five days left, friends. What are you waiting for?

You can save even more money with our group discounts. Buy in bulk, bring your whole team and leave no startup entrepreneur behind. You’ll save 20% when you buy five or more Innovator passes at once. Buy two or more Founder or Investor passes at once and enjoy a 10% savings.

We love Disrupt Berlin’s international diversity. More than 3,000 attendees from more than 50 countries gather to learn about and showcase the latest tech innovations and to connect, collaborate and move their business forward. Disrupt is the crossroad of now and future tech.

You’ll hear from an impressive array of tech leaders, makers, founders and investors on a range of hot topics. One example is Nigel Toon, the co-founder and CEO of Graphcore — a company that’s designing its own dedicated AI chipset. The company has raised more than $300 million from top investors, such as Sequoia Capital, BMW, Microsoft and Samsung. Pretty impressive, but even crazier — the tiny startup competes directly with giant chip companies, such as Nvidia, AMD, Intel and Qualcomm. It’s a race to see who can create the most efficient AI chip.

Director Roxanne Varza will be on hand to give us an update on Station F, the world’s biggest campus for startups. Housed in an historic monument (a beautiful building constructed in 1929), Station F is also a high-tech building and a cornerstone of the French tech ecosystem. Companies like Facebook, Naver (Line), Ubisoft, Microsoft and a host of others run incubators out of Station F, and its also home to more than 1,000 startups.

You can’t talk European success stories without talking UiPath. Currently valued at $7 billion, the company’s wild success comes from creating enterprise software that focuses on repetitive tasks and helps customers automate as many actions as possible. We can’t wait to talk with founder and CEO Daniel Dines — who started the company 15 years ago — about his automation journey.

There’s so much more to do at Disrupt Berlin 2019 and you can do it all for a whole lot less if you buy your pass before the super early bird price vanishes in just five days at 11:59 p.m. (CEST) on 6 September. Mach schnell!

Is your company interested in sponsoring or exhibiting at Disrupt Berlin 2019? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Urban, the on-demand wellness platform, adds physiotherapy to its roster of on-demand services

Urban, the London-headquartered company that lets you book a growing range of “wellness” services on demand — spanning massage, osteopathy, to various beauty treatments — is adding physiotherapy to its roster in a bid to become a “one-stop-shop” for physical wellbeing.

The new pay-as-you-go physiotherapy offering will let you book a HCPC-registered physio via the Urban app or website for treatment in your home. With NHS wait times several weeks if not months for access to physiotherapy, Urban thinks it has spotted a gap in the market for people that need ongoing treatment or a quick appraisal for a recently sustained injury — and are willing to pay “out of pocket” for the privilege.

In a call with Urban founder Jack Tang and the company’s general manager for physical wellbeing, Joe Jarman, the pair explained that the new service aims to provide access to a private physiotherapist with as little as two hours’ notice, available seven days per week. It will initially be available in London, with a focus on central London where demand (and, presumably, ability to pay) is highest, followed by Manchester and Birmingham.

With that said, pricing is competitive with physiotherapy that is typically offered at a private clinic, and compared to arranging a home visit from a private clinic, it is considerably cheaper. That’s because, claims Jarman, Urban is able to cut down on travel time by clustering nearby bookings via its app in order to maximise potential sessions per day, similar to what it does for other existing Urban wellbeing services. Of course, it doesn’t have the same brick ‘n’ mortar overheads, either.

Jarman says that many of Urban’s physiotherapists work in the NHS during the day but are looking to earn additional income in the evenings and at weekends or want to transition into private practice.

Asked if a service like Urban could place more pressure on the NHS by stretching an already scare resource, he says that the sector as a whole is growing. This has seen a 22% increase in the number of physiotherapists since 2015. In addition, Jarman says one in every three GP consultations relates to MSK issues, and early access to an Urban physiotherapist could help lessen this.

Either way, it’s certainly true that at present and within its current funding and organisational structure, the NHS isn’t very well-positioned to provide speedy MSK-related advice or treatment. Physiotherapy is also an obvious extension to Urban’s existing osteopathy and sports massage treatments.

“We see physiotherapy as the final vital piece so that we can offer a complete package to attain good physical health,” adds Jarman in a statement. “If someone has a problem with their body, we make sure they get the right treatment plan – and they get to choose the time and place”.

Meanwhile, Tang says that now Urban has completed its suite for physical wellbeing, the startup’s attention now turns to “doubling down” on its beauty and body confidence category with more news to share “very soon”.

Powered by WPeMatico

Spotawheel picks up €5M for its online used car dealership

Spotawheel, a startup operating in Greece and Poland with a car dealership model quite similar to Carvana in the U.S., has picked up €5 million in new funding. Backing the online used car dealership is VentureFriends, which led the round, with participation from Velocity Partners and unnamed “strategic” investors.

The investment includes both equity and debt financing, since part of Spotawheel’s business includes purchasing used cars upfront. It brings total raised by the Athens-headquartered startup to €8 million since launching in 2016.

“Used cars is one of the largest markets in value worldwide growing at a 5-7% rate annually, operating still primarily offline in a notoriously non-transparent way,” says Charis Arvanitis, Spotawheel co-founder and CEO.

This sees potential buyers fear buying a “lemon,” coupled with over-complicated processes, hidden-fees, and fragmented supply. The latter is largely a combination of private sellers via classified ads, and traditional offline used car dealerships.

“The lack of centralized control on the industry’s hugely fragmented seller structure, has prevented any meaningful innovation over the past 20 years, when the typical online classified ads emerged,” says Arvanitis. “That problem is even more evident in Europe, where car trade flows between countries make it much harder to control quality and trace cars history”.

To address this, Spotawheel offers an online B2C platform for used cars that Arvanitis says has redesigned the buy-sell process from scratch to create a “frictionless” and trusted buying experience. The idea is to bring e-commerce levels of convenience and protection to purchasing a used car.

“Customers can opt in for a test drive or have the car delivered countrywide under a 7-day return policy, while enjoying up to 5 years of limited warranty, the largest in Europe,” he says. This is underpinned by Spotawheel’s “predictive analytics” covering the condition and expected failures on a per car basis.

In addition, Arvanitis explains Spotawheel’s car sourcing model combines both debt-financed and marketplace practices, allowing the startup to source the best cars from private owners and B2B resellers across Europe. This includes deploying working capital purchasing vehicles upfront or via a commission-basis agreement.

Powered by WPeMatico

Startups Weekly: Peloton’s 29 secret weapons

Hello and welcome back to Startups Weekly, a weekend newsletter that dives into the week’s noteworthy startups and venture capital news. Before I jump into today’s topic, let’s catch up a bit. Last week, I wrote about a new e-commerce startup, Pietra. Before that, I wrote about the flurry of IPO filings.

Remember, you can send me tips, suggestions and feedback to kate.clark@techcrunch.com or on Twitter @KateClarkTweets. If you don’t subscribe to Startups Weekly yet, you can do that here.

What’s new?

Peloton revealed its S-1 this week, taking a big step toward an IPO expected later this year. The filing was packed with interesting tidbits, including that the company, which manufacturers internet-connected stationary bikes and sells an affiliated subscription to its growing library of on-demand fitness content, is raking in more than $900 million in annual revenue. Sure, it’s not profitable, and it’s losing an increasing amount of money to sales and marketing efforts, but for a company that many people wrote off from the very beginning, it’s an impressive feat.

Despite being a hardware, media, interactive software, product design, social connection, apparel and logistics company, according to its S-1, the future of Peloton relies on its talent. Not the employees developing the bikes and software but the 29 instructors teaching its digital fitness courses. Ally Love, Alex Toussaint and the 27 other teachers have developed cult followings, fans who will happily pay Peloton’s steep $39 per month content subscription to get their daily dose of Ben or Christine.

“To create Peloton, we needed to build what we believed to be the best indoor bike on the market, recruit the best instructors in the world, and engineer a state-of-the-art software platform to tie it all together,” founder and CEO John Foley writes in the IPO prospectus. “Against prevailing conventional wisdom, and despite countless investor conference rooms full of very smart skeptics, we were determined for Peloton to build a vertically integrated platform to deliver a seamless end-to-end experience as physically rewarding and addictive as attending a live, in-studio class.”

Peloton succeeded in poaching the best of the best. The question is, can they keep them? Will competition in the fast-growing fitness technology sector swoop in and scoop Peloton’s stars?

In other news

Last week I published a long feature on the state of seed investing in the Bay Area. The TL;DR? Mega-funds are increasingly battling seed-stage investors for access to the hottest companies. As a result, seed investors are getting a little more creative about how they source deals. It’s a dog-eat-dog world out there, and everyone wants a stake in The Next Big Thing. Read the story here.

Rounds of the week

- ThoughtSpot hauled in a $248M round at a $1.95B valuation

- Bedding startup Boll & Branch raised $100M

- Credit Sesame, a platform for managing loans, picked up $43M

- Mews grabbed a $33M Series B to modernize hotel administration

- Koru Kids closed a £10M Series A for its childcare platform

- Urbvan raised $9M for its private shuttle service in Mexico

- The popular shoe brand (among VCs) Atoms nabbed $8.1M

- Consider, an email service for startups, raised $5M from Kleiner Perkins

Time to Disrupt

Don’t miss out on our flagship Disrupt, which takes place October 2-4. It’s the quintessential tech conference for anyone focused on early-stage startups. Join more than 10,000 attendees — including over 1,200 exhibiting startups — for three jam-packed days of programming. We’re talking four different stages with interactive workshops, Q&A sessions and interviews with some of the industry’s top tech titans, founders, investors, movers and shakers. Check out our list of speakers and the Disrupt agenda. I will be there interviewing a bunch of tech leaders, including Bastian Lehmann and Charles Hudson. Buy tickets here.

Listen

This week on Equity, TechCrunch’s venture capital-focused podcast, we had Floodgate’s Iris Choi on to discuss Peloton’s upcoming IPO. You can listen to it here. Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast and Spotify.

Learn

We published a number of new deep dives on Extra Crunch, our paid subscription product, this week. Here’s a quick look at the top stories:

- How Pivotal got bailed out by fellow Dell family member, VMware by Ron Miller

- How to use Amazon and advertising to build a D2C startup by Matt Altman and Tyler Elliston

- Customer success isn’t an add-on — Start early to win later. By Dale Chang and Jay Nathan.

Powered by WPeMatico