CloudTrucks raises $6.1 million to help truckers run their businesses

After selling autonomous driving startup Scotty Labs to DoorDash just five months ago, entrepreneur Tobenna Arodiogbu is back with a new startup. This time, he’s focused solely on truck drivers and their businesses. CloudTrucks, which aims to help truck drivers earn more money, has closed a $6.1 million round led by Craft Ventures with participation from Khosla Ventures, Kindred Ventures and Abstract Ventures.

Described as a “business in a box,” CloudTrucks is designed to make it easier for truck owners and operators to run their businesses. Through software and data science, CloudTrucks aims to reduce operating costs for truck drivers and improve revenue, cash-flow and costs.

In the U.S., about 91% of fleets are small businesses, operating six or fewer trucks, according to the American Trucking Associations. Last year, almost 800 trucking businesses went bankrupt in the U.S. Analysts attribute that to a rise in insurance costs and excess supply, which drove shipping rates down. Additionally, operators are tasked with managing safety programs, invoicing and other paperwork. This is where CloudTrucks comes in.

“CloudTrucks focuses on the owner-operator and small trucking companies because they are the lifeblood of the industry and facing the largest pressures with fast-rising insurance rates, predatory factoring options and a quickly changing landscape,” Arodiogbu told TechCrunch.

Already, CloudTrucks has a small number of early customers to fine-tune the platform. The startup is accepting new customers on a case-by-case basis.

Prior to CloudTrucks, Arodiogbu co-founded Scotty Labs to enable humans to virtually control cars and trucks. The idea was to assist drivers in long-haul trips. Before DoorDash’s acquisition of the startup, Scotty Labs had raised $6 million in funding. Now, Arodiogbu serves as an advisor to DoorDash.

“Tobenna is a proven entrepreneur and product thinker with a clear vision of the problem CloudTrucks intends to solve,” Craft co-founder and general partner David Sacks said in a statement to TechCrunch. “Trucking is at the heart of the American economy and yet technology still plays a very small role. We are excited to support the entire CloudTrucks team as they build the platform that will increase revenue and efficiency for thousands of owner-operator truck drivers.”

Powered by WPeMatico

The don’ts of debt for fast-growing startups

I work every day with company founders who are grappling with the challenges of driving business growth while keeping their finances on an even keel. One topic we often discuss is how to take advantage of debt to drive business growth — without it turning into a problem.

In my experience, debt can serve as a valuable piece of a company’s capital structure. The key is to use debt for the right purposes and to understand the implications of doing so. For example, short-term loans (one to two-year terms) are useful for financing receivables and inventory to help manage cash flow. These working capital facilities have attractive interest rates (often in the 5% range) and are well understood by the lending community.

By contrast, mezzanine loans (usually three to five-year terms) are better suited to provide the flexibility and runway needed to prove out certain initiatives prior to securing an equity investment or a liquidity event. These loans tend to have limited covenants, are not secured by specific working capital assets and are junior to the working capital loans. Given their higher-risk profile, they are more expensive than short-term loans, with lenders typically targeting a return of 15% to 20%, split between a current pay interest rate of 10%+ and expected stock appreciation from the receipt of warrant coverage.

Regardless of the type of debt a company takes on, there are certain principles to consider to keep the debt from threatening the success of the business. Should you decide to take on debt, understand the implications and consider the following five rules:

Powered by WPeMatico

Hyperledger Fabric, the open-source distributed ledger, reaches release 2.0

The open-source Hyperledger Foundation announced the release of Hyperledger Fabric 2.0 today, the first such project to reach a 2.0 release.

It’s a notable milestone. The blockchain as a business tool has certainly had a rocky road over the last few years, but there is still plenty to like about smart contracts that have automated compliance checks built-in. Hyperledger Fabric 2.0 has lots of new features with that in mind.

The biggest updates involve forcing agreement among the parties before any new data can be added to the ledger, known as decentralized governance of the smart contracts. In practice, it means that the system will prevent any entity from writing to the ledger until there is consensus among the parties involved in the transaction, a basic blockchain tenet.

This is a requirement because the beauty and the curse of the distributed ledger is that it is an immutable record. Once you have written something in the ledger, it becomes very difficult to change it without the agreement of all those involved in the contract. You want to make sure you get it right before you commit something to the ledger.

Along those same lines, developers can build in automated checks along the way. As they say, this ensures the parties can “validate additional information before endorsing a transaction proposal.”

Brian Behlendorf, executive director at Hyperledger and a big advocate of open-source distributed ledger technology, says this is a big milestone for the project and the organization as it looks to help organizations adopt distributed ledger technology.

“Fabric 2.0 is a new generation framework developed by and for the enterprises that are building distributed ledger capabilities into the core of their businesses. This new release reflects both the development and deployment experience of the Fabric community and confirms the arrival of the production era for enterprise blockchain,” Behlendorf said in a statement.

That remains to be seen. The rise of blockchain in business has moved at a slow pace, but this release shows that the open-source community is still committed to building enterprise-grade distributed ledger technology. Today’s announcement is another step in that direction.

Powered by WPeMatico

Medloop secures €6M from Kamet Ventures and AXA for self-service patient app

Medloop, which allows patients to manage healthcare needs and providers, has secured €6 million from Kamet Ventures and AXA.

The cash will be used to enhance its product offering and continue expansion across Germany and the U.K. Medloop is also developing an evidence-based medical rule engine embedded on the Electronic Medical Record (EMR) of patients.

Medloop offers patients what it calls “intuitive” self-service features in an app that enables them to navigate their own healthcare, including online appointment bookings, electronic medical results and prescription refills, as well as chatting in-app with healthcare providers.

Founded in 2018 by Berlin-based entrepreneur Shishir Singhee, some medical practices in Germany use the Medloop doctor system to run their entire practice, using it to give an overview of their patient population.

Singhee, said: “Healthcare today has become increasingly impersonalized as ever-growing patient registers have made it challenging for doctors to treat patients in a bespoke way. Medloop strives to bridge this critical gap, by employing technology to empower patients and help doctors deliver proactive and holistic care.“

Stephane Guinet, CEO of Kamet Ventures, said: “It is no secret how overstretched doctors are in terms of the time and care they can offer each patient. Medloop’s offering is a novel solution to this challenge and we are very excited to be part of Medloop’s growth story given how critical its offering is to the U.K. market and beyond.”

Medloop achieved compatibility with EMIS last summer, enabling its entry into the U.K. market.

In Germany, its main competitors are the incumbents that were built in the early 1990s, such as Medatix and Medistar. In the U.K. it is up against patient management tools such as QMasters.

Powered by WPeMatico

Haus raises $4.5 million to replace your wine club membership

Millennials are tired of being drunk, but are locked into a culture that puts alcohol at the center of professional events and outside-of-work gatherings. Twenty-somethings in New York and San Francisco don’t want to spend $17 on a gin and tonic at a compulsory happy hour. That’s why Haus, a new direct-to-consumer aperitif startup, is debuting its membership program.

Co-founders Helena Price Hambrecht and Woody Hambrecht, who are married, have also secured $4.5 million in seed funding to fuel their bid for a more laid back and less alcohol-centric way to party, starting with a 15% ABV (alcohol by volume) citrus and flower-flavored aperitif. For comparison, most hard liquors are between 35 and 45% alcohol. Wine averages at 11.6%.

Members across the U.S. can now sign up for a monthly shipment of either six bottles per month for $144, two bottles per month for $63 or one bottle per month for $35. Unlike most wine clubs, it’s free to join. Haus will also begin a wholesale initiative with bars and restaurants in New York, San Francisco, Portland, Seattle and Denver.

The genesis for Haus was the founders’ idea to create a transparent alcohol brand, or a “Glossier for alcohol,” notes Helena, a Silicon Valley branding veteran. Woody, an experienced winemaker, identified a loophole that allows distributors to ship alcohol direct-to-consumer if the product is made mostly from grapes and is under 24% alcohol. Not only could a beverage be distributed straight to buyers, but it can be done with transparency, including ingredients and nutrition facts. This will allow Haus to collect user data that big alcohol companies just don’t have.

“Antiquated liquor laws have stunted innovation in the spirits space since prohibition, despite the fact that today’s drinkers are desperate for something different,” says Price Hambrecht. “Selling directly to the drinker means we can build relationships with our customers, iterate quickly based on their feedback and ultimately create the products they want.” So, Haus was born.

Co-founders and co-CEOs Helena Price Hambrecht and Woody Hambrecht.

Haus saw fundraising as a chance to grow not only an early community of stakeholders, but customers. Helena equates their fundraising process to more of a crowdfunding approach than a traditional VC round, with over 10 funds and 100 individual investors contributing. Raising capital meant crowdsourcing a community of people who believed in what they were building and were willing to seed it into their own networks. Some angels included Casey Neistat, former CEO and chairman of Campari Gerry Ruvo, Away co-founder Jen Rubio, Superhuman founder Rahul Vohra and Yelp co-founder Russell Simmons.

Contributing funds include Combine, Haystack Ventures, Homebrew, Shrug Capital, Resolute Venture Partners, Coatue, Dream Machine and Work Life Ventures, among others.

Subscriptions work when customers form habits. Haus plans to retain its community around its trendy party beverage with discounts and events, bolstered by editorial content in the future. What the founders are really pitching, however, is a lifestyle change.

In “The Art of the Gathering,” Priya Parker argues that in our modern society, we’ve lost our ability to finesse purposeful events. We end up gathering in ways that don’t actually serve us, and we aren’t connecting in the ways we ought to. Whether it’s a boring dinner party that isn’t focused on the guests, or a dreaded happy hour after a long work day.

It has yet to be determined if aperitifs could win over wine and liquor lovers at a macro scale. But Haus thinks that with a trendy product and hyper-engaged community, they can leverage this loophole to change the way we gather. Starting with how we drink.

Powered by WPeMatico

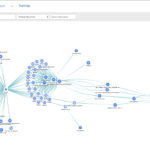

OpsRamp raises $37.5M for its hybrid IT operations platform

OpsRamp, a service that helps IT teams discover, monitor, manage and — maybe most importantly — automate their hybrid environments, today announced that it has closed a $37.5 million funding round led by Morgan Stanley Expansion Capital, with participation from existing investor Sapphire Ventures and new investor Hewlett Packard Enterprise.

OpsRamp last raised funding in 2017, when Sapphire led its $20 million Series A round.

At the core of OpsRamp’s services is its AIOps platform. Using machine learning and other techniques, this service aims to help IT teams manage increasingly complex infrastructure deployments, provide intelligent alerting and eventually automate more of their tasks. The company’s overall product portfolio also includes tools for cloud monitoring and incident management.

The company says its annual recurrent revenue increased by 300% in 2019 (though we obviously don’t know what number it started 2019 with). In total, OpsRamp says it now has 1,400 customers on its platform and alliances with AWS, ServiceNow, Google Cloud Platform and Microsoft Azure.

The company says its annual recurrent revenue increased by 300% in 2019 (though we obviously don’t know what number it started 2019 with). In total, OpsRamp says it now has 1,400 customers on its platform and alliances with AWS, ServiceNow, Google Cloud Platform and Microsoft Azure.

According to OpsRamp co-founder and CEO Varma Kunaparaju, most of the company’s customers are mid to large enterprises. “These IT teams have large, complex, hybrid IT environments and need help to simplify and consolidate an incredibly fragmented, distributed and overwhelming technology and infrastructure stack,” he said. “The company is also seeing success in the ability of our partners to help us reach global enterprises and Fortune 5000 customers.”

Kunaparaju told me that the company plans to use the new funding to expand its go-to-market efforts and product offerings. “The company will be using the money in a few different areas, including expanding our go-to-market motion and new pursuits in EMEA and APAC, in addition to expanding our North American presence,” he said. “We’ll also be doubling-down on product development on a variety of fronts.”

Given that hybrid clouds only increase the workload for IT organizations and introduce additional tools, it’s maybe no surprise that investors are now interested in companies that offer services that rein in this complexity. If anything, we’ll likely see more deals like this one in the coming months.

“As more of our customers transition to hybrid infrastructure, we find the OpsRamp platform to be a differentiated IT operations management offering that aligns well with the core strategies of HPE,” said Paul Glaser, vice president and head of Hewlett Packard Pathfinder. “With OpsRamp’s product vision and customer traction, we felt it was the right time to invest in the growth and scale of their business.”

Powered by WPeMatico

Scopely lands a triple-word score with launch of new Scrabble game

Los Angeles-based mobile gaming company Scopely unveiled its newest game, Scrabble GO, now available for pre-order on Android and coming to iOS later this year.

Working with Hasbro in North America and Mattel globally, the launch of Scopely’s new Scrabble game was two years in the making.

Building on the success Scopely has found with another Hasbro property — Yahtzee — Scopely first reached out to the gaming company to see if they’d be open to working with the relatively young gaming firm on a new title.

Then Scopely had to talk to Mattel and current rights-holder Electronic Arts about moving players of the game over to Scrabble’s new home.

Under the auspices of Electronic Arts, which had developed the earlier versions of Scrabble for mobile phones, hundreds of thousands of users had signed up to play the popular word game.

“We negotiated a deal and a partnership with EA,” says Scopely chief revenue officer, Tim O’Brien. “We wanted the players in the core scrabble game that EA has today and come over.”

The deal represents a new relationship between Scopely and Mattel and reflects the game development studio’s increasingly international footprint.

“We are always looking for new ways for consumers to experience the Mattel brands they know and love, and digital gaming is a key part of that strategy,” said Janet Hsu, chief franchise officer at Mattel. “Scrabble is a beloved and iconic game with a dedicated fan following. In partnership with Scopely, we look forward to bringing a best-in-class gameplay experience to an international audience.”

Players from the previous versions of Scrabble for mobile will be able to move over to Scopely’s new gaming platform through the partnership with Electronic Arts — and global players can expect to see some expanded features, according to O’Brien.

The new version will include official dictionaries in localized languages that Scopely has licensed and will be incorporating into the gameplay, he said. The new game will also have new social features, including regional tournaments, daily and weekly events and player leaderboards. There’s also a matchmaking system to connect with both friends and other players on the platform of a similar skill-level. A new “dueling” feature puts time limits on how long a player can take to make a word.

“We want to build core Scrabble, but we need to build Scrabble for today’s market,” says O’Brien. “We did something that worked really well with Yahtzee… and we make substantially more money on the mobile game then they do on the board game.”

The LA-based gaming company has been on a bit of an acquisition tear since raising $200 million financing, which values the company at a whopping $1.7 billion.

Published globally by Scopely, the new Scrabble GO game was developed in partnership with PierPlay game studio and joins a gaming portfolio that has amassed more than $1 billion in lifetime revenue. Games in the company’s portfolio include: Looney Tunes World of Mayhem and Star Trek Fleet Command, created with the recently acquired DIGIT Game Studios.

Powered by WPeMatico

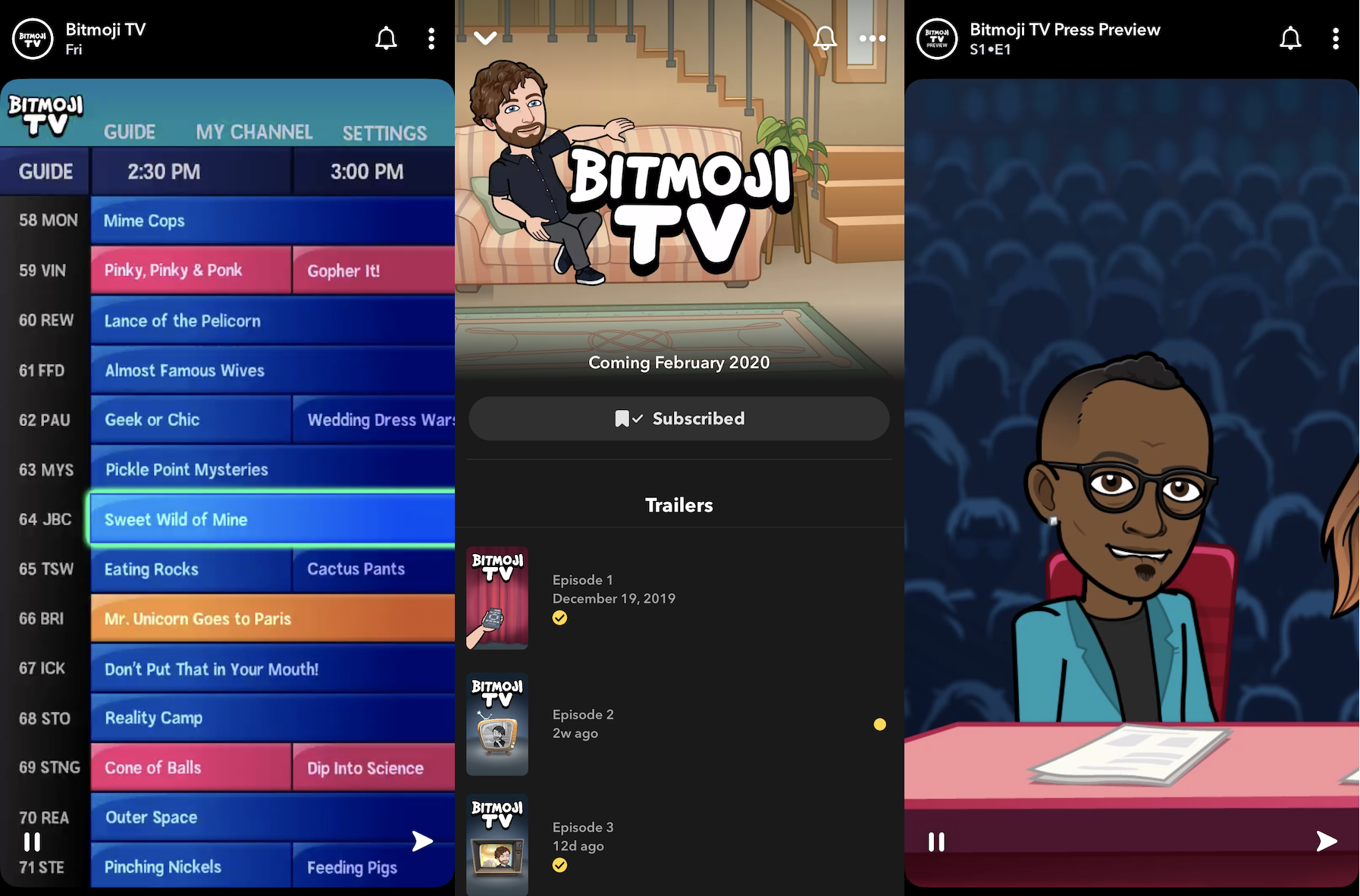

Snapchat launches Bitmoji TV: zany 4-min cartoons of your avatar

If you were the star of every show, would you watch more mobile television? Snapchat is betting that narcissism drives resonance for its new weekly videos that put you and your friends’ customizable Bitmoji avatars into a flurry of silly animated situations. Bitmoji TV premieres on Saturday morning, and it’s remarkably funny, exciting and addictive. Think cartoon SNL on fast-forward, with you playing a secret agent, a zombie president or a Moonlympics athlete.

It’s a style of content only Snapchat could pull off that relies on ubiquitous personalized avatars only Snapchat owns. The company says 70% of its daily active users, or 147 million of its 210 million, have made themselves a Bitmoji. Snapchat bought Bitmoji’s parent company Bitstrips in 2016 for a steal at $62.5 million, and it’s paying off. Amidst a sea of premium video and haphazard Stories that blur together across streaming services and social apps, Snapchat finally found something Facebook can’t copy.

“We really believe that we have invented a new category of entertainment. It’s scripted but it’s personalized. You could take that in a million directions,” says Bitmoji co-founder and CEO Ba Blackstock, who wrote and directed Bitmoji TV. “First and foremost, I hope that everyone who watches this has kind of a mind-blowing experience that they’ve never had before.”

Bitmoji TV, which TechCrunch was first to report Snapchat was building last month, will have its own Snapchat Show page where users can subscribe to get notifications and see new episodes on the Discover Page. Users can visit this page on mobile or tap and hold on the Snapcode below while pointing at it with the Snapchat camera to open Bitmoji TV.

The show is designed to be PG-13, with some bleeped out swearing and a little bloody violence. The shows are made out of Bitmoji’s Toronto office and are based on North American TV, film and advertising. Each episode cuts away and back to a main story, with the first two centered around an America’s Best Bitmoji game show and a Mime Cops hostage negotiation. Interspersed are “channel flips” between shorter single-gag clips that take your avatar into sit-coms, soap operas, action movies and infomercials.

The gags are ridiculous. At the basketball “Moonlympics,” a player jumps up for a dunk, but low gravity causes him to crash through the glass dome and suck all the other players into space. At Cannibal High, an school announcement says “Attention students, we’re all deeply saddened by the sudden passing of Vice Principal Schneider. To honor his legacy, today the cafeteria will be serving Vice Principal Schneider.”

You’re not alone it Bitmoji TV. There’ll be occasional celebrity guests like Randy Jackson, Andy Richter and Jon Lovitz. But your co-star in these segments is the Bitmoji of whichever person you last interacted with on Snapchat. That lets you control whether you want your best friend, your significant other or some rando alongside you. That decision will change the way you interpret the jokes and scenes. Your Bitmoji won’t talk, but their’s will.

Getting philosophical, Blackstock explains that “When you say words to me, it’s not just your words in a vacuum. They’re coming from you. You’re the medium . . . In any narrative fiction you learn about the characters, they have a back story, they have relationships that exist under the story that color it.” Who you make your supporting actor lends personal subtext that enriches each story. That’s one reason you can’t download or easily share clips of your version of Bitmoji TV, and Snap instead just lets you share a link to watch the real thing. Blackstock says it just doesn’t have the same effect if you’re not in the spotlight.

One thing you won’t find in Bitmoji TV, at least at first, are advertisements. The initial 10-episode season won’t have them. But that does seem to be the plan. When I asked Blackstock about monetizing the show, he said, “You can imagine. Discover has a business model of showing ads.” Since it make Bitmoji TV, Snapchat would get to keep that ad money rather than paying it out with revenue shares to partners or by buying content. Just as we’ve seen music and video streaming apps move to cut royalty expenses by creating content in-house, Snap seems to have the same idea.

Snapchat has yet to monetize Bitmoji directly beyond its merchandise store where you can get yours on t-shirts and mugs. Surprisingly, it doesn’t sell premium or branded clothes and looks for Bitmoji, nor does it allow brands to pay to have their apparel featured.

Snap did recently start letting people mix-and-match clothes for their Bitmoji, and when asked if that could foreshadow a revenue opportunity, Blackstock said, “You gotta build the store before you start selling the clothes . . . this was a foundational evolution designed to not only improve the experience for users but to set the stage for things to come.” You and your friends seeing your avatar’s fresh outfit on Bitmoji TV might make people care more about what their digital mini-mes wear.

![]()

Having watched the first three episodes, I’m pretty certain Bitmoji TV is going to be a hit. The show embodies the whimsy of Snapchat and the youth culture of the community who uses it. It’s rare to see something so premium but so unabashedly kooky. It’s reminiscent of the Rick and Morty “Interdimensional Cable” episodes that similarly feature rapid-fire snippets of fake and absurd TV shows.

Yet “the idea for Bitmoji TV actually precedes Bitmoji. It’s something I’ve been thinking about since those days [before Snapchat acquired it]. In a way it precedes Bitstrips. I’ve been making comics and cartoons since I was a little kid,” Blackstock tells me. “How I met two of the co-founders of Bitstrips was passing them comics in class. Even after school when we had jobs I would draw comics of my co-founder that were very compromising and I would fax them to his office to try to get him fired,” he recalls with a hearty laugh. Now he has the budget to make them TV-worthy, but just as crazy.

Snapchat has a good hunch it’s going to work because it’s been testing a comic-stripped down version called Bitmoji Stories. These still or lightly animated slideshows use the same idea of starring the avatars of you and your friends, but without full-motion video or constant audio. Indeed, 130 million people have watched Bitmoji Stories since they launched in late 2018.

As Blackstock tells me, “They were easier to make at a high volume and release ongoingly, which we could put out as a prelude to get our audience ready for personalized content — but also for us to learn from and see how people responded and figure out our own processes in terms of production.” Snapchat had animators and engineers work hand in hand to build a rendering system for Bitmoji Stories and TV. That helps it rapidly produce the personalizable content that can flex to accommodate any shaped avatar without them clipping into their surroundings.

Tonight, Bitmoji TV will receive an in-person “silent disco-style” premiere at Los Angeles’ Soho House. Guests will scan a code on the big screen, don headphones and each watch on their own phone with themselves as the star.

Snapchat’s head of original content Sean Mills tells me that “New technology will unlock new kinds of storytelling,” citing “the power of bringing a user into the experience with their best friends.” Bitmoji TV has certainly found a way to turn vanity into engagement. It’s more compelling than the mediocre originals on Facebook Watch. And it’s technologically innovative, unlike the planned lineup for Quibi.

If the modern era of visual communication began with the selfie, Snap honed it into a messaging tool. A few words were more interesting with a friend’s face behind it. The original Bitmoji chat stickers let your face say whatever you wanted even without having to get on camera. Snapchat’s new Cameo feature grafts your face into GIFs to express even more complex feelings. And now with Bitmoji TV, an animated version of your face can live out your wildest fantasies or weirdest dreams. That’s something worth tuning into.

Powered by WPeMatico

All eyes are on the next liquidity event when it comes to space startups

At the FAA’s 23rd Annual Commercial Commercial Space Transportation Conference in Washington, DC on Wednesday, a panel dedicated to the topic of trends in VC around space startups touched on public vs. private funding, the right kinds of space companies that should even be considering venture funding, and, perhaps most notably, the big L: Liquidity.

Moderator Tess Hatch, Vice President at Bessemer Venture Partners, addressed the topic in response to an audience question that noted while we’ve heard a lot about how much money will flow into space-related startups from the VC community, we haven’t actually et seen much in the way of liquidity events that prove out the validity of these investments.

“In 2008, a company called Skybox was created and a handful of years later Google acquired the company for $500 million,” Hatch said. “Every venture capitalist’s ears perked up and they thought ‘Hey, that’s pretty good ROI in a short amount of time – maybe the space thing is an investable area’ and then a ton of venture capital investments flooded into space startups, and all of these venture capitalists made one, or maybe two investments in the area. Since then, there have not been many — if any – liquidity events: Perhaps Virgin Galactic going public via the SPAC (special uprose vehicle) on the New York Stock Exchange late last year would be the second. So we’re still waiting; we’re still waiting for those exits, we are still waiting for companies to pave the path for the 400+ startups in the ecosystem to return our investment.”

Hatch added that she’s looking at a number of companies who have the potential to break this somewhat prolonged exit drought in 2020, including five who are either quite mature in terms of their development, naming SpaceX, Rocket Lab, Planet and Spire as all likely candidates to have some kind of liquidity event in 2020, with the mostly likely being an IPO.

Space as an industry was described to me recently as a ‘maturing’ startup market by Space Angels CEO Chad Anderson, by virtue of the distribution of activity in terms of the overall investment rounds in the sector. There is indeed a lot of activity with early stage companies and seed rounds, but the fact remains that there hasn’t been much in the way of exits, and it’s also worth pointing out that corporate VCs haven’t been as acquisitive in space as some of their consumer and enterprise technology counterparts.

The panel touched on a lot more apart from liquidity, which actually only came up towards the end of the discussion, which included panelists Astranis CEO and co-founder John Gedmark; Capella Space CEO and founder Payam Banazadeh and Rocket Lab VP of Global Commercial Launch Services Shane Fleming. Both Gedmark and Banazadeh addressed aspects of the risks and benefits of seeking VC as a space technology company.

“Not every space business is a venture-backable business,” said Banazadeh earlier in the conversation. “But there are a lot of space businesses that are specifically going after raising venture money, and that’s dangerous for everyone – because at the end of the day venture is looking at high risk, high return. The ‘high return’ comes from being able to get substantial amount of revenue in a market that’s big

enough for those revenues to be coming from. But if your idea is to go build, maybe, some very specific part in a satellite, then you have to make the case of why you’ll be able to make those returns for the investors, and in a lot of cases, that’s just not possible.”

Banazadeh also concedes that doing any kind of space technology development is expensive, and the money has to come from somewhere. Gedmark talked about one popular source, government funding and grants, and why that often isn’t as obviously a positive thing for startups as it might seem.

“Small government grants can be great, and obviously a fantastic source of non dilutive capital,” Gedmark said. “But there is a little bit of a trick there, or something to be aware of: I think people are often surprised how much time is spent in the early days of a startup refining the exact idea and the product, and if you’re not certain that you have the that product market fit […] then, the government grant can be extremely dangerous, because they will fund you to do something that is sort of similar to what to what you’re doing, but it really prevents you changing your approach later; you’re going to end up spending time executing on the specific project of the program manager on the government side and you’re executing on what they want.”

VC funds, on the other hand, come with the built-in expectation that you’re going to refine and potentially even change direction altogether, Gedmark says. Depending on the terms of the public funding you’re seeking, that flexibility may not be part of the arrangement, which ultimately could be more important than a bit of equity dilution.

Powered by WPeMatico

Facebook hits 2.5B users in Q4 but shares sink from slow profits

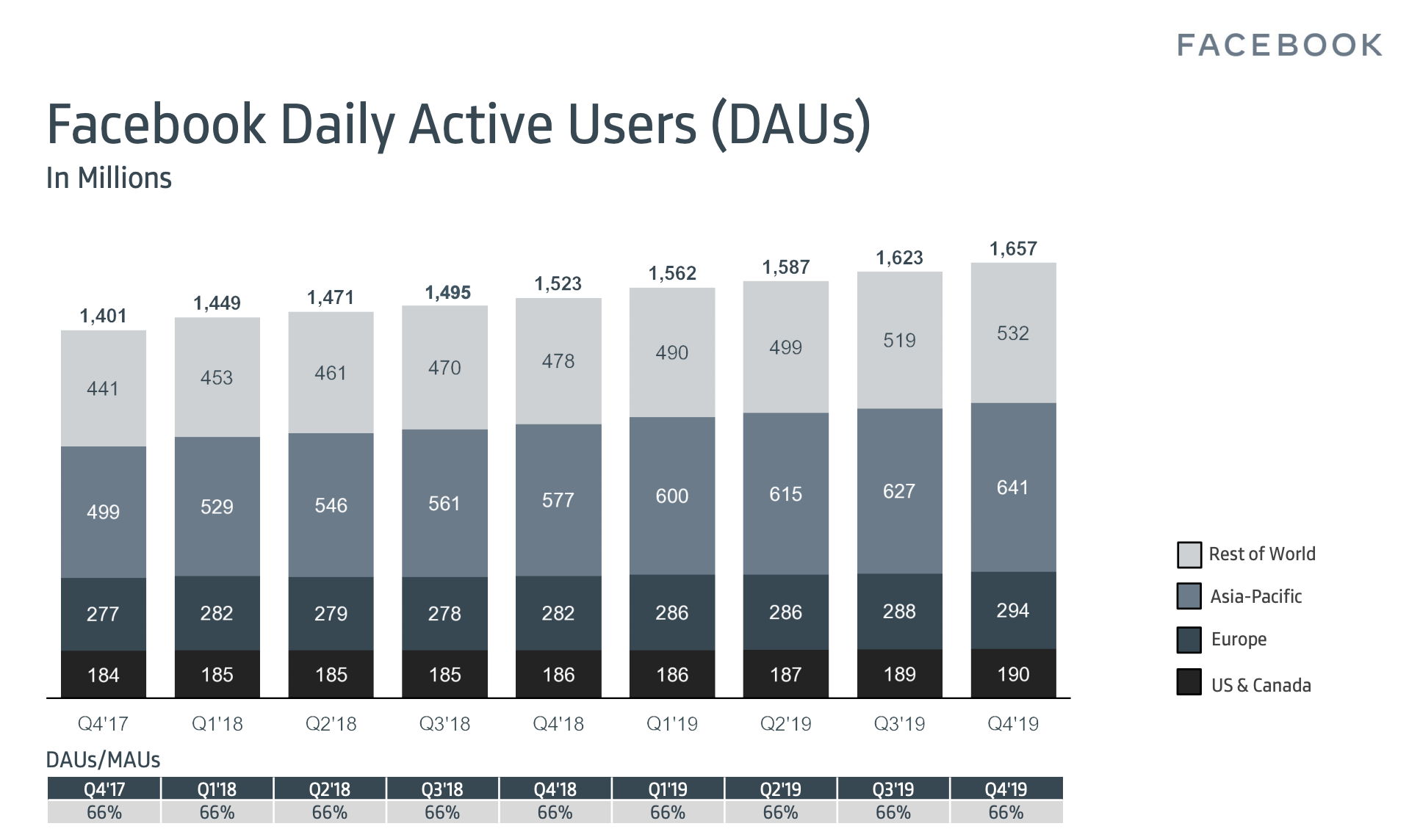

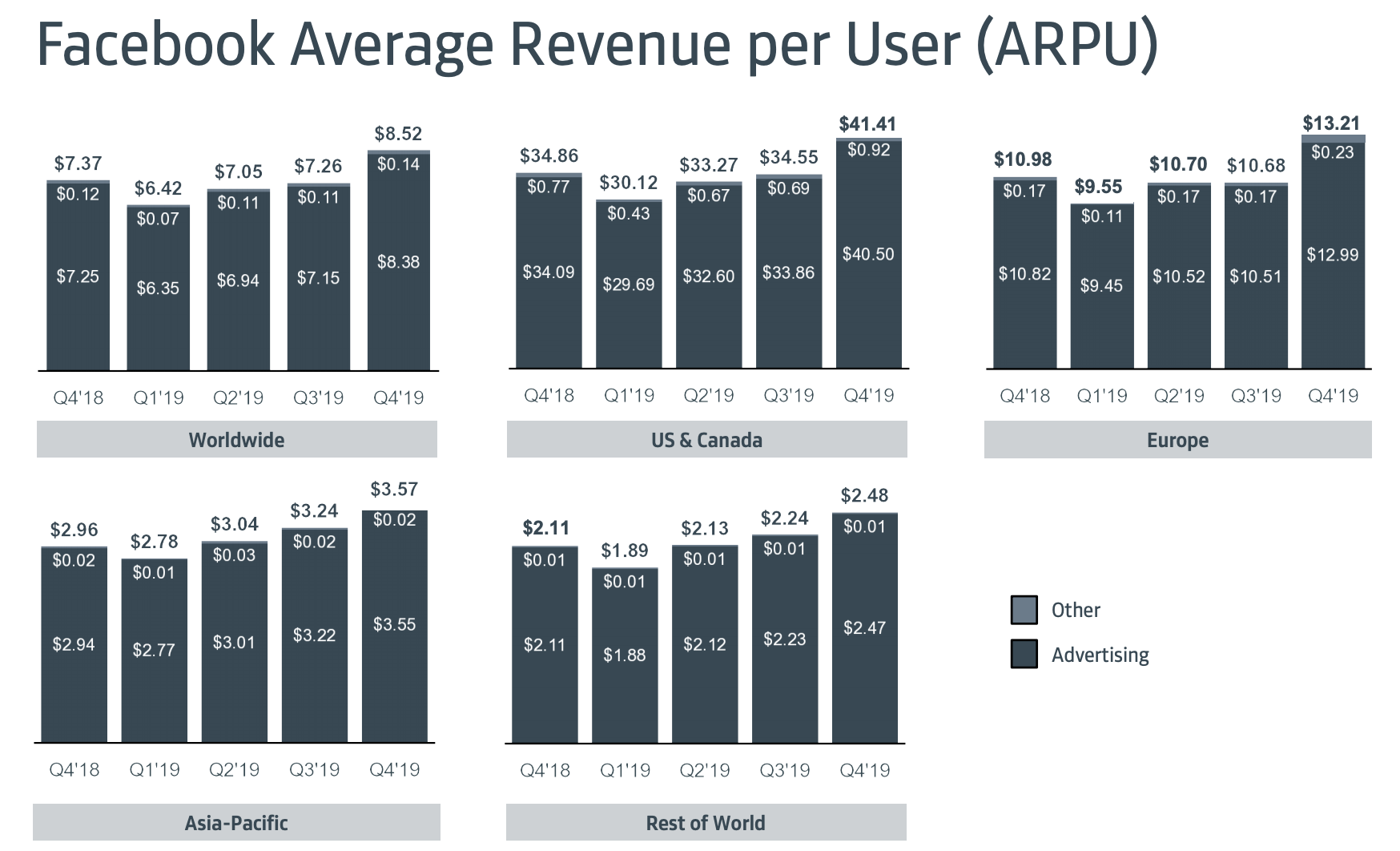

Facebook beat Wall Street estimates in Q4 but slowing profit growth beat up the share price. Facebook reached 2.5 billion monthly users, up 2%, from 2.45 billion in Q3 2019 when it grew 1.65%, and it now has 1.66 billion daily active users, up 2.4% from 1.62 billion last quarter when it grew 2%. Facebook brought in $21.08 billion in revenue, up 25% year-over-year, with $2.56 in earnings per share.

But net income was just $7.3 billion, up only 7% year-over-year compared to 61% growth over 2018. Meanwhile, operating margins fell from 45% over 2018 to 34% for 2019. Expenses grew to $12.2 billion for Q4 2019, up a whopping 34% from Q4 2018. For the year, Facebook’s $46 billion in expenses are up 51% vs 2018. One big source of those expenses? Headcount grew 26% year-over-year to 44,942, and Facebook now has over 1000 engineers working on privacy.

While Facebook’s user base keeps growing rather steadily, it’s having trouble squeezing more and more cash out of them with as much efficiency.

Facebook’s Q4 2019 earnings beat expectations compared to Zack’s consensus estimates of $20.87 billion in revenue and $2.51 earnings per share. Facebook shares fell over 7% in after-hours trading following the earnings announcement after closing up 2.5% at a peak $223.23 today. Still, Facebook remains near its previous share price high before this month.

Facebook CEO Mark Zuckerberg had previously warned that addressing hate speech, election interference, and other content moderation and safety issues would be costly. Still, expenses grew and profits shrunk faster than Wall Street seems to have expected. Facebook will have to hope its promise of using scalable AI to handle more of these jobs comes to fruition soon.

But some might see today as the proper reckoning for Facebook — penance for years of neglecting safety in favor of growth. Facebook’s CFO David Wehner confirms it has also just agreed to pay $550 million in a settlement over its violation of the Illinois Biometric Information Privacy Act. The class action suit stems from Facebook collecting users’ facial recognition data to power its Tag Suggestions feature that recommends friends tag you in photos in which you appear. The record-breaking settlement still falls far short of the $35 billion in potential penalties Facebook could have received.

Facebook’s executives are apparently bullish on its value despite the share price being at a peak, as today Facebook announced plans to grow its share-repurchase program by $10 billion, adding to its previous authorization of buying back up to $24 billion worth.

Facebook managed to add 1 million daily users in the U.S. & Canada region where it earns the most money after returning to growth there last quarter following a year of slow or no growth. Facebook’s stickiness, or daily to monthly active user ratio remained at 66% amidst competition from apps like TikTok and a resurgent Snapchat.

Masking The Shift To Instagram

Facebook notes that there are now 2.26 billion users that open either Facebook, Messenger, Instagram, or WhatsApp each day, up from 2.2 billion last quarter. The family of apps sees 2.89 billion total monthly users, up 9% year-over-year.

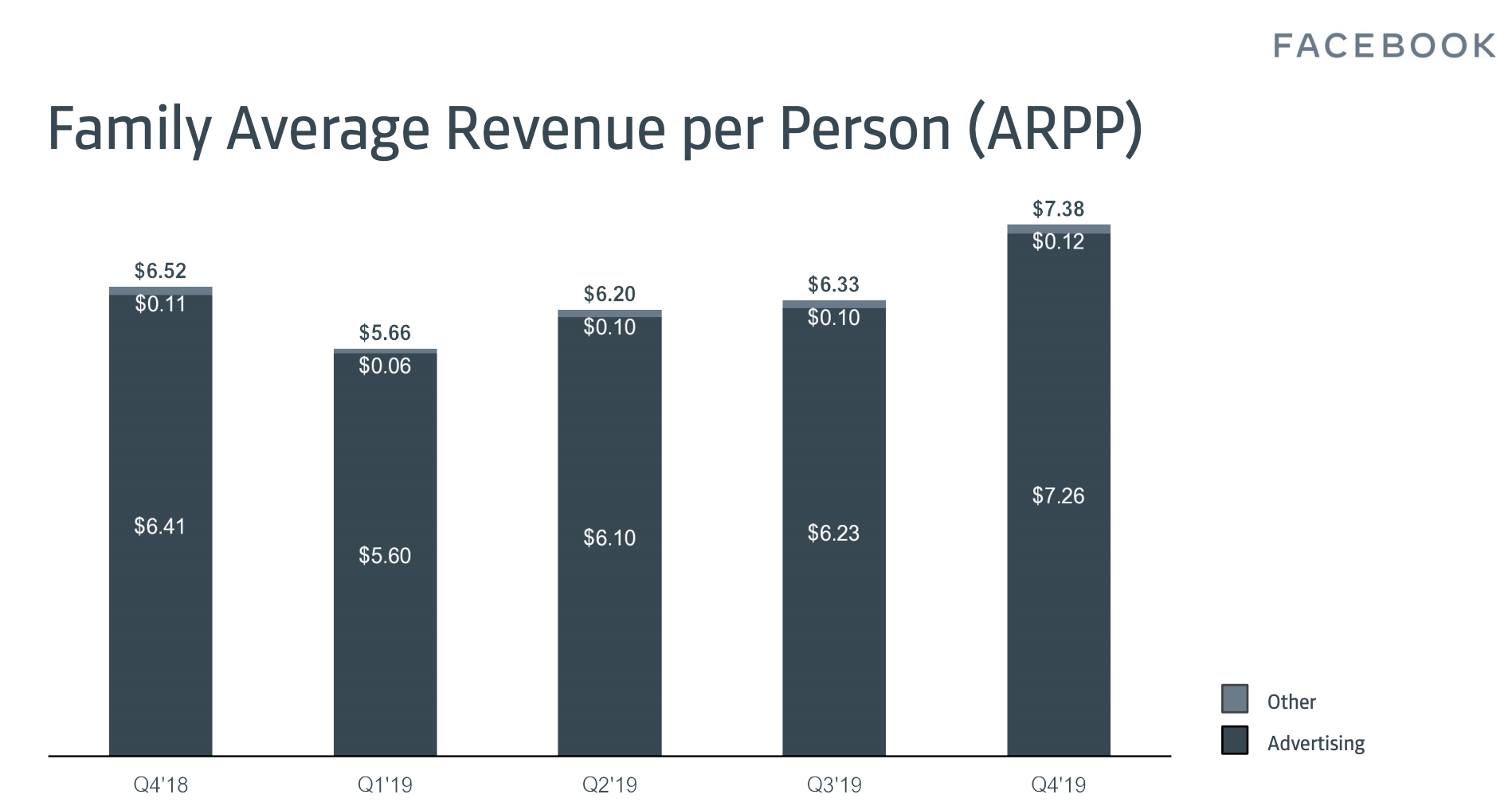

Facebook released a new stat with this earnings report: Family Average Revenue Per Person. That’s essentially the company’s total revenue divided by total users on Facebook, Messenger, Instagram, and WhatsApp. Clearly, the company is trying to use Instagram’s growing ad revenue to make the rest of the company look stronger. This might help mask changes in the Facebook app’s own revenue as teens look to more youthful content feeds. Wehner confirmed the company will cease sharing Facebook-only stats in favor of Family Of Apps stats in late 2020.

Sadly Facebook’s isn’t calling this metric FARPP

Earnings Call Highlights

Zuckerberg stressed Facebook’s need to stay focused on addressing social issues and consequences of the company’s growth during the earnings call. He said Facebook will continue to make its apps more private and secure.

As for product updates, Zuckerberg seized on opportunities in commerce. Facebook is building out WhatsApp Pay, and he says “I expect this to start rolling out in a number of countries and for us to make a lot of progress here in the next six months.” 140 million small businesses now use its tools. People bought almost $5 million in content on the Oculus Store on Christmas Day, which Zuckerberg called a milestone. He says Facebook’s Spark AR platform is most used of its kind by developers, with hundreds of millions of people experiencing face filters built with it.

Regarding plans to integrate the family’s chat interfaces, Zuckerberg says Messenger, Instagram, and WhatsApp will retain their brands. He also noted they’re already quite integrated on the backend…which could be an attempt to persuade regulators it might be difficult to break up the company.

For guidance, Wehner said “we expect our year-over-year total reported revenue growth rate in Q1 to decelerate by low-to-mid single digit percentage points as compared to our Q4 growth rate. “Factors driving this deceleration include the maturity of our business, as well as the increasing impact from global privacy regulation and other ad targeting related headwinds.”

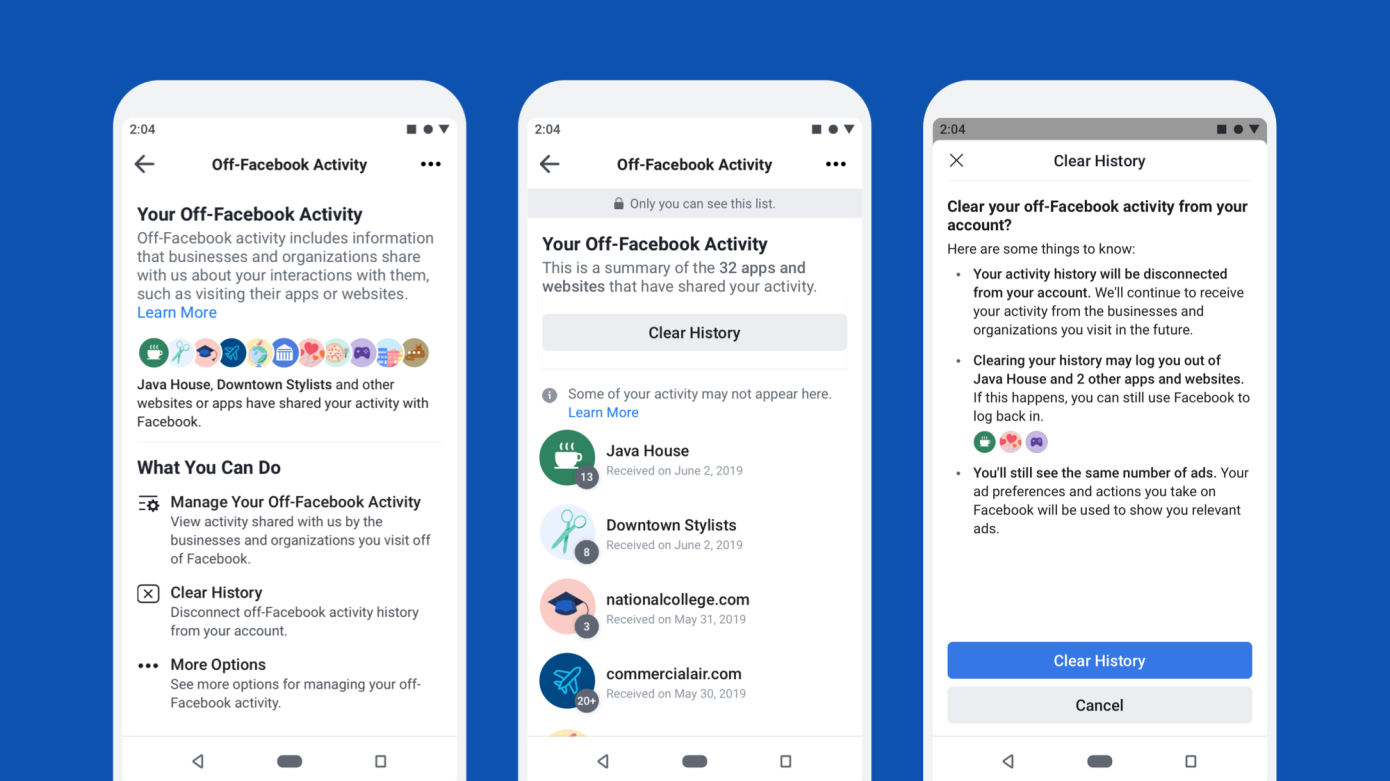

Wehner says to expect that the worst of these privacy headwinds are still to come due to regulatory initiatives like GDPR and CCPA, mobile operating systems and browser providers like Apple and Google limiting access to ad targeting singals, and Facebook’s own product changes like the new way to disconnect off-Facebook data from your acccount.

On Facebook’s perception issues, Zuckerberg said “We’re also focused on communicating more clearly what we stand for. One critique of our approach for much of the last decade was that, because we wanted to be liked, we didn’t always communicate our views as clearly because we were worried about offending people. So this led to some positive but shallow sentiments towards us and towards the company. And my goal for this next decade isn’t to be liked, but to be understood, because in order to be trusted, people need to know what you stand for.”

Building Despite Scrutiny

The business aside, Facebook had another tough quarter under the scrutiny of journalists and regulators. Democratic presidential candidates have railed against Zuckerberg’s decision to continuing allowing misinformation in political ads. The company dropped out of the top 10 places to work, and pledged $130 million to fund an Oversight Board for its content policies.

The CEO was grilled on Capitol Hill about Facebook’s cryptocurrency Libra that seems stuck in its tracks as major partners like Visa and Stripe dropped out. Facebook took heat for how its treats content moderators and how it tried to cut off competitors from its developer platform. The FTC continued its anti-trust investigation and weighed an injunction that would halt Facebook intermingling its messaging app infrastructure.

But those headwinds didn’t stop Facebook’s march forward. Its four main apps took the top four spots amongst the most downloaded apps of the 2010s. It moved deeper into hardware sales with its new Portal TV attachable camera. It acquired gaming companies like Playgiga and the studio behind VR hit Beat Saber, while signing exclusive game streaming deals with influencers like Disguised Toast. It launched Facebook News, Facebook Pay, its dating feature in the US, and it tested a meme-making app called Whale.

Facebook’s share price remains near an all-time high despite today’s tumble. While the world may be increasingly uncomfortable with Facebook’s access to private data, there’s no debate about how incredibly valuable that data is.

Powered by WPeMatico