You need a minimum viable company, not a minimum viable product

Hi, I’m Ann.

I was one of the first investors in Lyft, Refinery29 and Xamarin. I’ve been on the Midas List for the past three years and was recently named on The New York Times’ list of The Top 20 Venture Capitalists. In 2008, I co-founded Floodgate, one of the first seed-stage VC funds in Silicon Valley. Unlike most funds, we invest exclusively in seed, making us experts in finding product-market fit and building a minimum viable company. Seed is fundamentally different from later stages, so we’ve made it more than a specialty: It’s all we do. Each of our partners sees thousands of companies every year before electing to invest in only the top three or four.

For the past 11 years, I’ve invested at the inception phase of startups. We’ve seen startups go wildly right (Lyft, Refinery29, Twitch, Xamarin) and wildly wrong. When I reflect on the failures, the root cause inevitably stems from misconceptions around the nature of product-market fit.

The magic of product-market fit

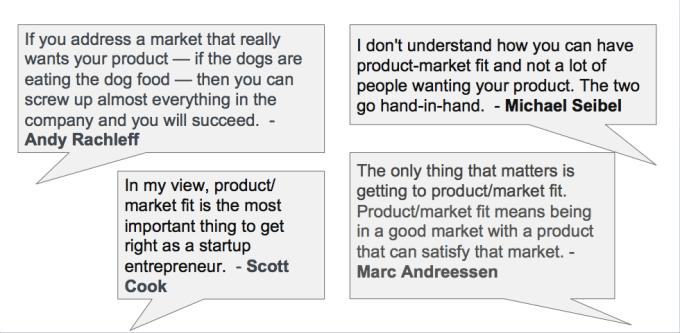

Most successful entrepreneurs and VCs agree that product-market fit is the defining quality of an early-stage startup. Getting to product-market fit allows you to succeed even if you aren’t optimized on other fronts.

Most entrepreneurs conceptualize product-market fit as the point where some subset of customers love their product’s features. At Floodgate, we forensically analyzed companies that died and concluded this conceptualization is wrong. Many failing companies had features that customers loved. Some of these companies even had multiple beloved features! We discovered that having customers love the product is merely a part of product-market fit, not the entire thing. This raises the question: What were they lacking?

Powered by WPeMatico

Carriers ‘violated federal law’ by selling your location data, FCC tells Congress

More than a year and a half after wireless carriers were caught red-handed selling the real-time location data of their customers to anyone willing to pay for it, the FCC has determined that they committed a crime. An official documentation of exactly how these companies violated the law is forthcoming.

FCC Chairman Ajit Pai shared his finding in a letter to Congressman Frank Pallone (D-NJ), who chairs the Energy and Commerce Committee that oversees the agency, and others in the House. Rep. Pallone and his colleagues have been active on this and prodded the FCC for updates throughout last year, eventually prompting today’s letter.

“I wish to inform you that the FCC’s Enforcement Bureau has completed its extensive investigation and that it has concluded that one or more wireless carriers apparently violated federal law,” Pai wrote.

Extensive it must have been, since we first heard of this egregious breach of privacy in May of 2018, when multiple reports showed that every major carrier (including TechCrunch’s parent company Verizon) was selling precise location data wholesale to resellers who then either resold it or gave it away. It took nearly a year for the carriers to follow through on their promises to stop the practice. And now, 18 months later, we get the first real indication that regulators took notice.

“It’s a shame that it took so long for the FCC to reach a conclusion that was so obvious,” said Commissioner Jessica Rosenworcel in a statement issued alongside the chairman’s letter. She has repeatedly brought up the issue in the interim, seemingly baffled that such a large-scale and obvious violation was going almost completely unacknowledged by the agency.

Commissioner Brendan Starks echoed her sentiment in his own statement: “These pay-to-track schemes violated consumers’ privacy rights and endangered their safety. I’m glad we may finally act on these egregious allegations. My question is: what took so long?”

Chairman Pai’s letter explains that “in the coming days” he will be proposing a “Notice of Apparent Liability for Forfeiture,” for several of them. This complicated-sounding document is basically the official declaration, with evidence and legal standing, that someone has violated FCC rules and may be subject to a “forfeiture,” essentially a fine.

Right now that is all the information anyone has, including the other commissioners, but the arrival of the notice will no doubt make things much clearer — and may help show exactly how seriously the agency took this problem and when it began to take action.

Representative Pallone issued the following statement after receiving the letter:

Following our longstanding calls to take action, the FCC finally informed the Committee today that one or more wireless carriers apparently violated federal privacy protections by turning a blind eye to the widespread disclosure of consumers’ real-time location data. This is certainly a step in the right direction, but I’ll be watching to make sure the FCC doesn’t just let these lawbreakers off the hook with a slap on the wrist.

Disclosure: TechCrunch is owned by Verizon Media, a subsidiary of Verizon Wireless, but this has no effect on our coverage.

Powered by WPeMatico

Unicorn fever as One Medical’s IPO pops 40% after conservative pricing

Shares of One Medical are worth $19.50 this morning after the venture-backed unicorn priced its IPO at $14 per share last night. The company opened at $18 before rising further, according to Yahoo Finance data. At its current price, One Medical is worth about 40% more than its IPO price, a strong debut for the company.

The result is a boon for One Medical, which raised $532.1 million during its time as a private company. At $14 per share, the company was worth $1.71 billion. At 19.50, One Medical is worth $2.38 billion, a winning result for a company said to be worth around $1.5 billion as a private company.

For investors The Carlyle Group, J.P. Morgan, Redmile Group, GV and Benchmark (among others), the debut is a success, pricing their stakes in the company higher once again. For other unicorns, the news is even better. One Medical, a company with gross margins under the 50% mark, deeply minority recurring revenue and 30% revenue growth in 2019 at best is now worth about 8.5x its trailing revenues.

That is about as good a signal as one could imagine for venture-backed companies that aren’t in as good shape as Slack or Zoom were letting them know that now is the time to go public.

Unicorn directions

It’s possible to read One Medical’s new revenue multiple in a few ways. You can be positive, saying that its valuation and resulting metrics are signs of investor optimism for the medical service company. Or you could go negative and assume that its pricing looks like a case of the market being more excited about a brand than a set of accounting results.

Powered by WPeMatico

Daily Crunch: IBM names new CEO

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here.

1. Arvind Krishna will replace Ginni Rometty as IBM CEO in April

Krishna, IBM’s senior vice president for cloud and cognitive software, will take over on April 6 after a couple months of transition. Rometty will remain with the company as chairman of the board.

Krishna reportedly drove the massive $34 billion acquisition of Red Hat at the end of 2018, and there was some speculation at the time that Red Hat CEO Jim Whitehurst was the heir apparent. Instead, the board went with a more seasoned IBM insider for the job, while naming Whitehurst as president.

2. Apple’s redesigned Maps app is available across the US, adds real-time transit for Miami

The redesigned app will include more accurate information overall as well as comprehensive views of roads, buildings, parks, airports, malls and other public places. It will also bring Look Around to more cities and real-time transit to Miami.

3. Social media boosting service exposed thousands of Instagram passwords

The company, Social Captain, says it helps thousands of users to grow their Instagram follower counts by connecting their accounts to its platform. But TechCrunch learned this week Social Captain was storing the passwords of linked Instagram accounts in unencrypted plaintext.

4. Elon Musk just dropped an EDM track on SoundCloud

That is a real headline and I probably don’t need to say much else. Listen to the track, or don’t.

5. Being a child actress prepared me for a career in venture capital

Crystal McKellar played Becky Slater on “The Wonder Years,” and she writes about how that experience prepared her to be a managing partner at Anathem Ventures. (Extra Crunch membership required.)

6. Moda Operandi, an online marketplace for high-end fashion, raises $100M led by NEA and Apax

High-end fashion might not be the first thing that comes to mind when you think about online shopping, but it has actually been a ripe market for the e-commerce industry.

7. Why Sony’s PlayStation Vue failed

Vue launched in March 2015, offering live and on-demand content from more than 85 channels, including many local broadcast stations. But it failed to catch on with a broader audience, despite — or perhaps, because of — its integration with Sony’s PS3 and PS4 devices, and it shut down this week. (Extra Crunch membership required.)

Powered by WPeMatico

Last day for early-bird tickets to TC Sessions: Robotics + AI 2020

Today’s your last day to score early-bird pricing on tickets to TC Sessions: Robotics + AI 2020, which takes place on March 3. If you want to keep $150 in your wallet, beat the deadline and buy your ticket here before the clock strikes 11:59 p.m. (PT) tonight!

Our one-day conference dedicated to robotics and AI — the good, the bad and the challenging — features interviews, panel discussions, Q&As, workshops and demos. Join roughly 1,500 experts, visionaries, creators, founders, investors, researchers and engineers. Rub elbows, network and engage with current and aspiring leaders, as well as students poised to drive future innovation.

We have a stellar line up, and just because we’re biased doesn’t mean we’re wrong. I mean come on — assistive robots, ethics and AI, the state of VC investment and robot demos. And that’s just for starters. Here are a couple of specific examples (peruse the full agenda right here):

- Cultivating Intelligence in Agricultural Robots: The benefits of robotics in agriculture are undeniable, yet at the same time only getting started. Lewis Anderson (Traptic) and Sebastien Boyer (FarmWise) will compare notes on the rigors of developing industrial-grade robots that both pick crops and weed fields, respectively. Pyka’s Michael Norcia will discuss taking flight over those fields with an autonomous crop-spraying drone.

- Building the Robots that Build: Join Daniel Blank (Toggle), Tessa Lau (Dusty Robotics) and Noah Ready-Campbell (Built Robotics) as they discuss whether robots can help us build structures faster, smarter and cheaper. Built Robotics makes a self-driving excavator. Toggle is developing a new fabrication of rebar for reinforced concrete and Dusty Robotics builds robot-powered tools. We’ll talk with the founders to learn how and when robots will become a part of the construction crew.

And in case you haven’t heard, we’ve added Pitch Night, a mini pitch-off, into the mix this year. We’re accepting applications until tomorrow, February 1. This is no time for fence-sitting! Apply to compete in Pitch Night now. TechCrunch editors will review the applications and choose 10 startups to pitch at a private event the night before the conference. A panel of VC judges will select five teams as finalists. Those founders will pitch again the next day — live from the Main Stage. It’s awesome exposure that could take your startup to the next level.

If you love robots, you need to be at TC Sessions: Robotics + AI 2020 on March 3. And there’s no point paying more than necessary. Today’s the last day to buy an early-bird ticket. Buy yours before the deadline expires at 11:59 p.m. (PT) and save $150.

Is your company interested in sponsoring or exhibiting at TC Sessions: Robotics + AI 2020? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Even as Microsoft Azure revenue grows, AWS’s market share lead stays strong

When analyzing the cloud market, there are many ways to look at the numbers; revenue, year-over-year or quarter-over-quarter growth — or lack of it — or market share. Each of these numbers tells a story, but in the cloud market, where aggregate growth remains high and Azure’s healthy expansions continues, it’s still struggling to gain meaningful ground on AWS’s lead.

This has to be frustrating to Microsoft CEO Satya Nadella, who has managed to take his company from cloud wannabe to a strong second place in the IaaS/PaaS market, yet still finds his company miles behind the cloud leader. He’s done everything right to get his company to this point, but sometimes the math just isn’t in your favor.

Numbers don’t lie

John Dinsdale, chief analyst at Synergy Research, says Microsoft’s growth rate is higher overall than Amazon’s, but AWS still has a big lead in market share. “In absolute dollar terms, it usually has larger increments in revenue numbers and that makes Amazon hard to catch,” he says, adding “what I can say is that this is a very tough gap to close and mathematically it could not happen any time soon, whatever the quarterly performance of Microsoft and AWS.”

The thing to remember with the cloud market is that it’s not even close to being a fixed pie. In fact, it’s growing rapidly and there’s still plenty of market share left to win. As of today, before Amazon has reported, it has a substantial lead, no matter how you choose to measure it.

Powered by WPeMatico

How Dubsmash revived itself as #2 to TikTok

Lip-syncing app Dubsmash was on the brink of death. After a brief moment of virality in 2015 alongside Vine (R.I.P), Dubsmash was bleeding users faster than it could recruit them. The app let you choose an audio track like a rap song or movie quote and shoot a video of you pretending to say the words. But there was nowhere in the app to post the videos. It was a creation tool like Hipstamatic, not a network like Instagram. There’s a reason we’re only using one of those today.

So in 2017, Dubsmash‘s three executives burned down the 30-person company and rebuilt something social from the ashes with the rest of the $15.4 million it’d raised from Lowercase Capital, Index Ventures and Raine. They ditched its Berlin headquarters and resettled in Brooklyn, closer to the one demographic still pushing Dubsmashes to the Instagram Explore page: African-American teenagers posting dances and lip-syncs to indie hip-hop songs on the rise.

Dubsmash stretched its funding to rehire a whole new team of 15. They spent a year coding a new version of Dubsmash centered around Following and Trending feeds, desperately trying to match the core features of Musically, which by then had been bought by China’s ByteDance. It’s got chat but still lacks the augmented reality filters, cut transitions and photo slideshows of TikTok. But Dubsmash has the critical remix option for soundtracking your clip with the audio of any other video that sets it apart from Instagram and Snapchat.

Few social apps have ever pulled off a real comeback. Even Snapchat had only lost 5 million of its 191 million users before it started growing again. But in the case of Dubsmash, its biggest competitor was also its savior.

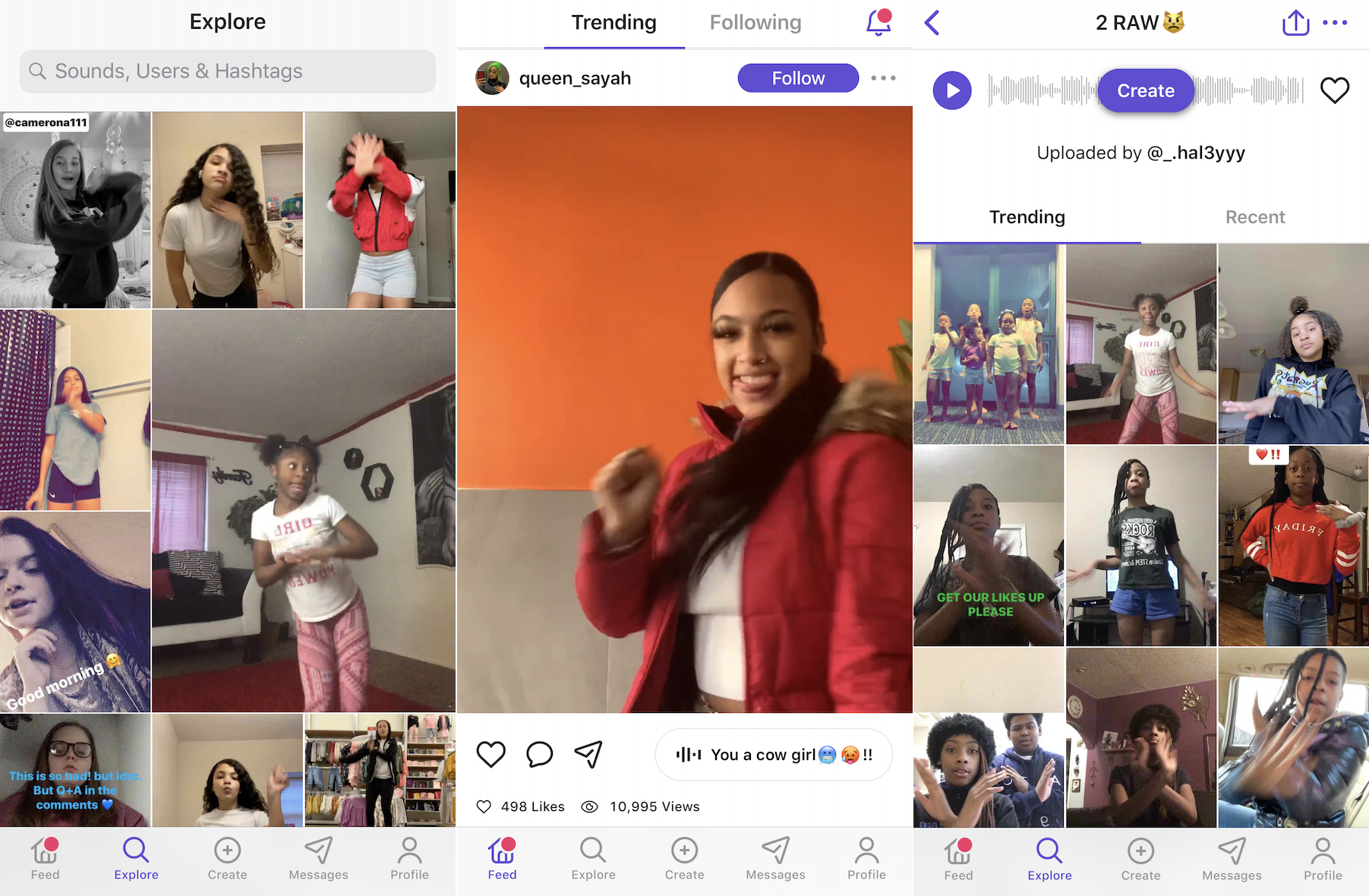

The pre-relaunch version of Dubsmash

In August 2018, ByteDance merged Musically into TikTok to form a micro-entertainment phenomenon. Instead of haphazardly sharing auto-biographical Stories shot with little forethought, people began storyboarding skits and practicing dances. The resulting videos were denser and more compelling than content on Snapchat and Instagram. The new Dubsmash, launched two months later, rode along with the surge of interest in short-form video like a Lilliputian in a giant’s shirt pocket. The momentum helped Dubsmash raise a secret round of funding last year to keep up the chase.

Now Dubsmash has 1 billion video views per month.

Dubsmash rebuilt its app and revived its usage

“The turnaround that we executed hasn’t been done in recent memory by a consumer app in such a competitive marketplace. Most of them fade to oblivion or shut down,” Dubsmash co-founder and president Suchit Dash tells me. “By moving the company to the United States, hiring a brand new all-star team and relaunching the product, we gave this company and product a second life. Through that journey, we obsessed only on one metric: retention.”

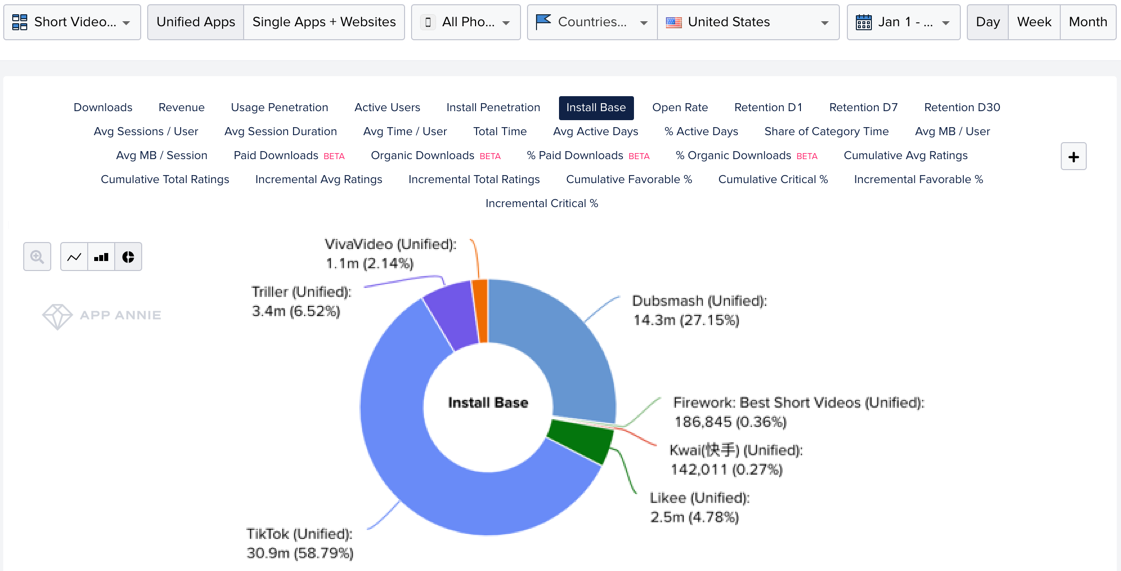

Now the app has pulled 27% of the U.S. short-form video market share by installs, second only to TikTok’s 59%, according to App Annie. Sensor Tower tells TechCrunch that TikTok has about 3X as many U.S. lifetime installs as Dubsmash, and 11X more between when Musically became TikTok in August 2018 and now. [Note: These statistics are based on polling methods and TechCrunch cannot confirm their exact accuracy.]

In terms of active users outside of TikTok, Dubsmash has 73% of the U.S. market, compared to just 23% on Triller, 3.6% on Firework and an embarrassing 0% on Facebook’s Lasso. And while Triller began surpassing Dubsmash in downloads per month in October, Dubsmash has 3X as many active users and saw 38% more first-time downloads in 2018 than 2019. Dubsmash now sees 30% retention after a month, and 30% of its daily users are creating content.

It’s that stellar rate of participation that’s brought Dubsmash back to life. It also attracted a previously unannounced round of $6.75 million in the spring of 2019, largely from existing investors. While TikTok’s superstars and huge visibility could be scaring some users away from shooting videos while a long-tail of recent downloaders watch passively, Dubsmash has managed to make people feel comfortable on camera.

“Dubsmash is ground zero for culture creation in America — it’s where the newest, most popular hip-hop and dance challenges on the internet originate,” Dash declares. “Members of the community are developing content that will make them the superstars of tomorrow.”

Being No. 2 might not be so bad, given how mobile video viewing is growing massively thanks to better cameras, bigger screens, faster networks and cheaper data. Right now, Dubsmash doesn’t make any money. It hopes to one day generate revenue while helping its creators earn a living too, perhaps through ad revenue shares, tipping, subscriptions, merchandise or offline meetups.

One advantage of not being TikTok is that the app feels less crowded by semi-pro creators and influencers. That gives users the vibe that they’re more likely to hit the Trending or Explore page on Dubsmash. The Trending page is dominated by hot new songs and flashy dances, even if they’re shot with a lower production quality that feels accessible.

Dubsmash tries to stoke that sense of opportunity by making Explore about discovering accounts and all the content they’ve made rather than specific videos. While popular clips might have tens of thousands of views rather than the hundred-thousand or multi-million counts on TikTok’s top content, there’s enough visibility to make shooting Dubsmashes worth it.

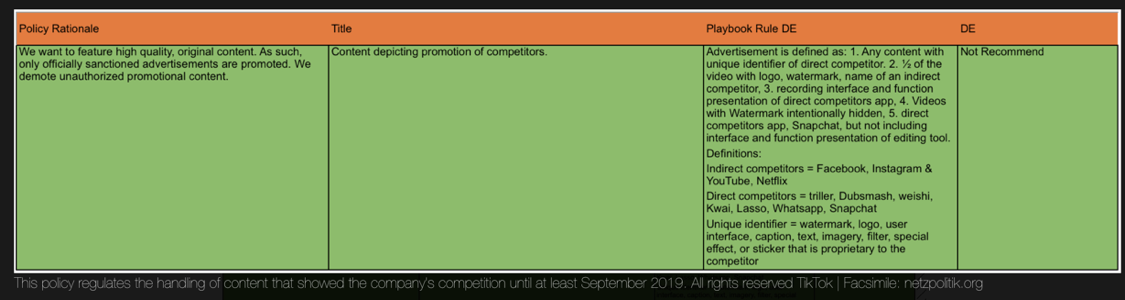

TikTok has already taken notice. Shown in a leak of its moderation guidelines from Netzpolitik, the company’s policy is to downrank the visibility of any video referencing or including a watermark from direct competitors, including Dubsmash, Triller, Lasso, Snapchat and WhatsApp. That keeps Dubsmash videos, which you can save to your camera roll, from going viral on TikTok and luring users away.

TikTok’s content moderation guidelines show it downranks content featuring the watermarks of competitors like Dubsmash

TikTok also continues to aggressively buy users via ads on competing apps like Facebook thanks to the billions in funding raked in by its parent ByteDance. In contrast, Dash says Dubsmash has never spent a dollar on user acquisition, influencer marketing or any other source of growth. That makes it achieving even half to a third of as many installs as TikTok in the U.S. an impressive fete.

Why would creators choose Dubsmash over TikTok? Dash clinically explains that it’s a “decoupled audio and video platform that enables producers and tastemakers to upload fresh, original tracks that are utilized by creators and influencers alike,” but that it’s also about “its role as a welcoming home for a community that’s underrepresented on social platforms.”

If Dubsmash keeps growing, though, it will encounter the inevitable content moderation problems that come with scale. It’s already doing a solid job of requiring users to sign up with their birth date to watch or post videos, and it blocks those under 13. Only users who follow each other can chat.

Any piece of content that’s flagged by users is hidden from the network until it passes a review by its human moderation team that works around the clock, and it does proactive takedowns too. However, brigading and malicious takedown reports could be used by trolls to silence their enemies. Dubsmash is working off of a common sense model of what’s allowed rather than firm guidelines, which will be tough to keep consistent at scale.

“Being a social media app in 2020 means you need to take greater responsibility for the well-being of the community,” says Dash. “We decided upon relaunch to take a strict perspective. Our goal is to be intentional and proactive early, and invest in safety and healthy growth rather than growth at all costs. This may not be the most popular approach amongst the market, but we believe this is the most effective way to build a social platform.”

Dubsmash proves that short-form video is so compelling to teens that the market can sustain multiple apps. That will have to be the case, given Instagram is preparing to release its TikTok clone, Reels, and Vine’s co-founder Dom Hofmann just launched his successor, Byte. The breakdown could look like:

- TikTok: A slightly longer-form combo of comedy, dance and absurdity

- Dubsmash: Mid-length dance and music videos with a diverse community

- Byte: Super short-form comedy featuring slightly older ex-Vine stars

- Triller: Mid-length life blogging clips from Hollywood celebrities

- Instagram Reels: International influencers making videos for a mainstream audience

Perhaps we’ll eventually see consolidation in the market, with giants like TikTok and Instagram acquiring smaller players to grow their content network effect with more fodder for remixes. But fragmentation could breed creativity. Different tools and audiences beg for different types of videos. Make something special, and there’s an app out there to enter you into pop culture cannon.

For more on the short-form video wars and the future of micro-entertainment, read:

Powered by WPeMatico

Moda Operandi, an online marketplace for high-end fashion, raises $100M led by NEA and Apax

Moda Operandi, an online marketplace that specialises in right-off-the-runway luxury fashion, accessories and home decor, is today announcing a high-priced event of its own: it’s raised $100 million, a mix of equity and debt that it will use to invest in its platform and technology as well as to continue growing business overall. Founded in 2010, it offers products from some 1,000 brands and designers and ships to 125 countries.

“For the past eight years, Moda has disrupted the way people shop for luxury fashion,” said Moda Operandi CEO Ganesh Srivats in a statement. “This investment will enable us to build on that innovation, investing further in the client and designer experience and connecting more of the world’s best fashion to more people.”

The financing is being co-led by NEA and Apax Partners, both previous investors in Moda Operandi, with participation also from the Santo Domingo family (connected to Lauren Santo Domingo, who co-founded Moda with Aslaug Magnusdottir), Comerica Bank, TriplePoint Capital and other unnamed investors.

The company’s valuation is not being disclosed, but in its last round, in 2017, Moda Operandi had a post-money valuation of $650 million, according to data from PitchBook. It has raised $345 million to date.

High-end fashion might not be the first thing that comes to mind when you think about online shopping, but it has actually been a ripe market for the e-commerce industry.

While those in the know (and in the money) might attend catwalk shows, and bijou boutiques in swish locales are likely to be around for many years to come, there is a massive population of people who have the income and inclination to shop for luxury fashion, but might not be in the right place, or have the time, to do so.

For these shoppers, websites, mobile apps and, most recently, new channels like Instagram and messaging services have become a key route to browsing and buying, leading to the rise of huge businesses like Farfetch, Net-a-Porter and more.

That trend has helped to buffer Moda Operandi up to now, but it’s also the one that will be interesting to watch down the line.

We’ve written about the rise of direct-to-consumer brands and how that has played out specifically in the world of fashion, which in turn becomes a new group of competitors to aggregating marketplaces like Moda Operandi.

Similarly, the growing trend of targeting consumers wherever they happen to be also represents a rival business model, with some fashion retailers now foregoing websites altogether in favor of using third-party messaging apps to reach their target customers. Will Moda Operandi change with the times to do more of this kind of selling, too? Like fashion, what’s in today might be out tomorrow, so even the best channels are moving targets.

In any case, Moda Operandi has most definitely shown that it’s prepared to evolve and upset the status quo. The company got its start in 2010 as part out of an aha-moment from Santo Domingo, a socialite, former model and former editor at Vogue.

As someone who had worked for years in the luxury fashion industry, fully immersed as a consumer to boot, she knew that only a small, rarefied group of people ever got full access to a designer’s runway collection.

Moda Operandi was her solution — a platform to broaden that out, giving access to a full trunkshows (as the runway collections are called) to a wider selection of possible buyers and improving revenues for designers and brands in the process, as they no longer had to rely just on more traditional channels, namely buyers for retailers. The site had some catches — for example, as we pointed out at the time, you could shop a runway look, but still had to wait months for the piece to actually arrive, as those items would have yet to be made; but it caught on with a loyal following.

Over the years, the site’s basic remit has expanded, covering not only runway collections but also extending into jewelry, accessories and home decor. (We asked what size the business is today, and whether Moda Operandi can share any details on how that has changed over time, but a spokesperson said the company would not be sharing these or other financial details today.)

In any case, it has remained a compelling enough business to have brought in a hefty round of growth funding from its previous backers.

“We continue to be impressed with the power of Moda’s brand and its positioning in the luxury market,” said Dan O’Keefe, managing partner of Apax Digital, in a statement. “Moda has been enhancing its technology capabilities as a world leading platform for fashion discovery and is led by a world-class team. We look forward to continuing to support their expansion.”

“Moda Operandi has really disrupted the traditional ecommerce model, using technology to give people unprecedented access to fashion,” added Tony Florence, general partner and head of technology investing at NEA, in a statement. “It was a really big idea when we led the Series A, and today Ganesh and the team are executing on that data-enabled retail model at scale. We are thrilled to continue supporting the company in this latest round.”

Powered by WPeMatico

How to blow through capital at an incredible rate

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

It was yet another jam-packed week full of big news, IPO happenings and venture activity. As always, we’ve done our best to deliver the gist on what’s been going on. We had Alex Wilhelm and Danny Crichton on hand to handle it all, which went medium-good. In other Equity news, we’re back with guests over the next few weeks, so if you miss us having a venture capitalist along for the ride, fear not, their return is just around the corner.

Up top this week was Jon Shieber’s report that Kleiner Perkins has rapidly deployed its most recent fund, a $600 million vehicle. While the news felt surprising, digging back through our archives we were reminded that the firm had indicated it might put its capital to work quickly. Still, as Danny pointed out, it’s rare that venture capitalists have to go out raising from LPs on an annual basis.

After that, we turned to some funding rounds that held our attention, including the Free Agency round that is working to bring talent management to the technology industry similar to the sports and entertainment worlds.

The concept makes some sense, as compensation packages for top talent in the industry can extend into the seven-figures (Free Agency takes a 5-10% cut of an employee’s income using the increasingly popular income-share agreements). Also, this round felt a bit like a reminder that the labor market is tight at the moment.

We then moved on to Josh Constine’s story about “Ring for enterprise” startup Verkada, which raised a massive $80 million round at a $1.6 billion valuation. That’s eye-popping, since the extremely small dilution implied with those numbers (5%) is very rare in the venture world.

After that we turned to a few rounds that Alex has had his eye on, namely the somewhat-recent Insurify round, the pretty-recent Gabi round and the most-recent Policygenius. All told, they sum to $150 million, which made us ask the question, why are venture capitalists so into insurance marketplace startups?

Finally, we touched on the latest from the intra-SoftBank delivery war between DoorDash and Uber Eats, including who is impacted, and what it means for future consolidation in the on-demand world. Or more precisely, why hasn’t there been more?

Finally, don’t forget that IPO season is upon us. Are you caught up?

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

How Bykea is winning Pakistan’s ride-hailing and delivery market

Increasingly, the streets of Karachi and Lahore are being flooded with men riding bikes and wearing green T-shirts, a writer friend recently told me. In a sense, these men represent the emergence of Pakistan’s tech startups.

India now has more than 25,000 startups and raised a record $14.5 billion last year, according to government figures. But not all Asian countries are as large as India or have such a thriving startup ecosystem. Long overdue, things are beginning to change in bordering Pakistan.

Bykea, a three-year-old ride-hailing and delivery service, today has more than 500,000 bikes registered on its platform. It operates in some of Pakistan’s most populated cities, such as Karachi, Lahore and Islamabad, Muneeb Maayr, Bykea founder and CEO, told TechCrunch.

Maayr is one of the most recognized startup founders in Pakistan, and previously worked for Rocket Internet, helping the giant run fashion e-commerce platform Daraz in the country. While leading Daraz, he expanded the platform to cater to categories beyond fashion; Daraz was later sold to Alibaba.

Powered by WPeMatico