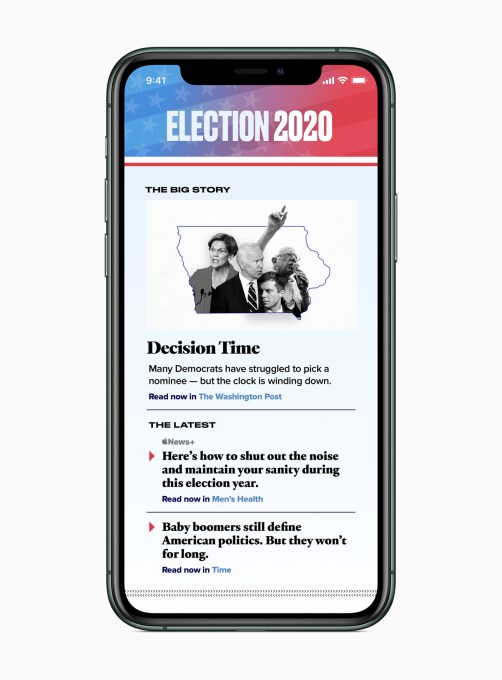

Apple News adds coverage of 2020 US presidential election, including guides to candidates, issues & news literacy

As it has done in previous election years, Apple today has added special coverage of the 2020 US presidential election to its Apple News app. The coverage includes curated news, information, and data related to the election from ABC News, CBS News, CNN, FiveThirtyEight, Fox News, NBC News, ProPublica, Reuters, The Los Angeles Times, The New York Times, The Wall Street Journal, The Washington Post, TIME, USA Today and others.

The Apple News editorial team has also put together a series of curated guides, special features and other resources for readers from both sides of the political spectrum, Apple says. The app will be updated with election information throughout the year and will track major election moments, including the debates, Super Tuesday, Democratic and Republican conventions, election night, and the 2021 presidential inauguration in real-time.

Apple had announced in December it was working in close partnership with ABC News on 2020 presidential election coverage within the Apple News app, which it said would begin on Feb. 7, 2020, with a live stream of the Democratic primary debate. It also said it would feature ABC News videos, live streams, and FiveThirtyEight polling data, infographics, and analysis during key moments of the 2020 election. It wasn’t clear at the time if Apple was working exclusively with ABC for this year’s election coverage, but today’s announcement indicates it is not.

Apple confirms today that ABC’s coverage will begin on Feb. 7, as promised, with live-streaming video, starting with the debate, plus FiveThirtyEight’s analysis, and real-time updates from various outlets. The Feb. 7 debate will also be live-streamed through the Apple TV app, available for iPhone, iPad, iPod touch, Mac, Apple TV, Amazon Fire TV, Roku and select Samsung and LG smart TVs.

In the Apple News app starting today, users will be able to track real-time election results from the Associated Press for each state primary, giving county-by-county results, a national map tracking candidate wins by state, and a delegate tracker that shows candidates’ progress toward securing the nomination.

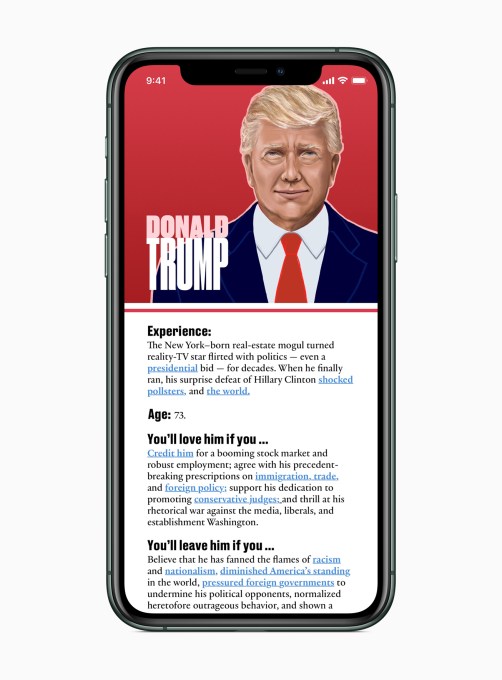

As before, Apple News offers a guide to each presidential candidate, which includes their biography, experience, notable moments and quotes, and their current position on key issues. These guides will also include photos, videos and links to recent media coverage.

In addition, the Apple News team has put together dedicated guides to important topics and issues, including foreign affairs, income inequality, trade, immigration, education, health care and others, as well as a news literacy guide that help readers identify misinformation online. This guide, developed in partnership with the News Literacy Project, will provide tips about how to seek out accurate and reliable information.

Apple has been developing guides to U.S. elections for several years now. The company began to push its own election coverage after the 2016 election controversies that saw large tech companies, including Google, Twitter and Facebook, facing congressional inquiries and investigations regarding Russian interference with elections that took place across their networks. Since then, Apple News rolled out its own guide to the U.S. midterms, followed by a real-time election results hub on November 6, 2018. It also added a guide to the 2020 Democratic candidates and debates.

To access the new 2020 election coverage available via the Today tab in Apple News in the U.S., users will need to update to iOS 13.3, iPadOS 13.3 or macOS 10.15.2.

Powered by WPeMatico

The case for cooperative tech startups

When Uber and Lyft went public, it wasn’t the drivers who got rich — it was the executives, investors and some early employees. In an era when it has become clear that tech executives and investors are frequently the only ones who’ll reap rewards for a company’s success, cooperative startups are getting more attention.

Depending on how it’s set up, a cooperative model offers workers and users true ownership and control in a company; any profits that are generated are returned to the members or reinvested in the company.

Co-ops aren’t new: The nation’s longest-running example is The Philadelphia Contributionship, a mutually owned insurance company founded by Benjamin Franklin in 1752. In 1895, the International Co-operative Alliance formed to serve as a way to unite cooperatives across the world. Some colleges have student-run housing co-ops where cleaning, food preparation and other responsibilities are shared. Today, there are many well-known large-scale co-ops, including outdoor recreation store REI, Arizmendi Bakery in San Francisco and Blue Diamond Growers, one of the world’s largest tree-nut processors.

What’s novel, however, is applying the co-op model to technology startups. Start.coop, an accelerator for cooperative startups, is just one group trying to facilitate that practice.

Powered by WPeMatico

Justin Kan opens up (Part 2)

Justin Kan was talking about the systems in his life. The serial entrepreneur/founder, who recently announced a pivot and significant layoffs at Atrium, his latest venture, came to speak at last fall’s TechCrunch Disrupt in high-fashion black sweats and an extremely colorful pair of Nikes.

After Kan wrapped up his panel, we sat down for a wide-ranging and philosophical interview. And as we left off in part one of our conversation, Kan was explaining his self-described Buddhist philosophy of life.

But in the second part of our interview, I wanted to focus more on Kan’s thoughts about systems in society as a whole. There’s a difference, after all, between working mindfully to change oneself and doing so to change society. As we’ve seen with Adam Neumann, among others, there is a certain class of “spiritual” Silicon Valley entrepreneurs who use their platform in tech to assuage their own inner suffering — and perhaps gain influence by helping similarly influential people alleviate their own. WeWork, for example, cultivated associations with everything from Kabbalah to Deepak Chopra to mindful eating before the company melted under the heat of its own ethical challenges.

I don’t know that there is evidence to place Kan in the above category; maybe he is better understood as a legitimate, if unconventional, Big Thinker. But either way, it would be important to ask: What good is it when tech leaders like Kan seek a Buddhist alleviation of suffering, if the industries that sustain them are, at scale, currently creating enormous and very tangible suffering for countless millions of less fortunate people?

Powered by WPeMatico

Ginni Rometty leaves complex legacy as she steps away as IBM CEO

When Ginni Rometty steps down as CEO at IBM in April and her replacement Arvind Krishna takes the helm, more than eight years will have passed since she took the reins at Big Blue. The executive helped lead a massive transformation, but IBM has had a bumpy financial ride throughout her tenure — at one time recording an astonishing 22 straight quarters of declining revenue.

To be fair, Rometty took over at a tumultuous time when technology was shifting from on-prem software stacks to the cloud. She saw what was coming and used the company’s considerable cash position to buy what she needed to make that switch while taking advantage of IBM’s extensive R&D to build other pieces in-house. But the transition took time, which resulted in some financial missteps.

She deserves credit for trying to move the battleship in a new direction — culminating with the $34 billion purchase of Red Hat — even if the results were ultimately mixed.

Leading the way

Rometty was the first woman to lead IBM in an industry where female CEOs are scarce. When she came on board in 2012, there were just 21 women running Fortune 500 companies; last year, that number had risen to 33, still a paltry 6.6%. Along with Safra Catz at Oracle and Lisa Su of Advanced Micro Devices, Rometty has been part of a small group of female CEOs at large technology companies.

Powered by WPeMatico

Startups Weekly: One Medical IPO raises unicorn hopes

Maybe ‘tech-enabled’ is good enough for public markets?

Everybody’s talking about revenues after WeWork, but maybe you still don’t need to have all the right numbers in place to achieve a strong IPO? That’s the initial takeaway Alex Wilhelm has after One Medical’s successful debut this week. One might think it looks like a tech-enabled unicorn, that doesn’t generate the recurring revenue and margins of a true tech-powered business.

But, the doctor-services provider closed up almost 40% on a somewhat ambitious price of $14 per share. It had raised $532.1 million during its time as a private company, with a fairly recent valuation of $1.71 billion. With its closing value of $19.50 per share today, One Medical is now worth $2.38 billion.

That’s despite gross margins under the 50% mark, deeply minority recurring revenue and 30% revenue growth in 2019 at best, as Alex noted on Extra Crunch Friday. It is now worth about 8.5x its trailing revenues.

“There are cash-generating SaaS companies that are growing only a bit more slowly that are trading for lower multiples,” he has previously observed. “I cannot see what makes the company — an unprofitable, only moderately growing upstart with non-recurring revenue — worth a SaaS multiple. Especially as its gross margins aren’t great and aren’t improving.”

Meanwhile, mattress-seller Casper, which also filed new information about its IPO plans this week, has numbers that aren’t all that different. But it’s just hoping to not take too big of a haircut on its last private valuation, Alex separately noted on EC.

Maybe public investors still care about a great story, despite the rough debuts of Blue Apron, SmileDirect, WeWork and a range of others? Certainly, One Medical’s work to improve medical care is laudable regardless of these questions (in fact, it won the Best Healthcare Startup Crunchie in 2013).

Stay tuned for more.

How acquirers look at your company

Let’s say the public markets are not for you, though, and instead you want to get acquired. Ed Byrne of Scaleworks looks at this both as a startup investor and, through a separate part of his company, as an acquirer, and has kindly provided a detailed explainer on Extra Crunch for startup founders.

Here are his key deciders from the purchaser perspective:

- Downside protection: Are we confident we are not going to lose money?

- Median: If we work hard, focus on good business operations and execute the low-hanging fruit, will we be able to grow this business enough to make a solid return (solid return being an increased valuation multiple from a higher revenue base)?

- Upside: If one of our category creation ideas pans out, and we succeed in winning a very targeted segment of the market, is there an opportunity for this business to be a real winner and provide outsized returns?

Buying and taking on someone else’s business is always a scary proposition — the unknown unknowns — but if you get comfortable with the fundamental of the company, acquisitions can be a real accelerator compared to the epic effort — and high risk — of starting from scratch.

Where top VCs are investing in travel, tourism and hospitality tech

Want to build the next Airbnb? In this week’s investor survey, Arman Tabatabai spoke to some of the most active and successful investors in travel-oriented industries today — the general mood is pretty positive, with M&A expected to help incumbents boost consumer-facing service quality, and new technologies cracking open more possibilities for companies of all sizes.

Respondents include:

- Bonny Simi, JetBlue Technology Ventures

- Pete Flint, NFX

- Tige Savage, Revolution Ventures

- Brad Greiwe, Fifth Wall

- Prashant Fonseka, Tuesday Capital

A conversation with ‘the most ambitious female VC in Europe’

Starting a company in Europe? Want to? Here’s how Blossom Capital cofounder and long-time investor Ophelia Brown explains the opportunities in the region to Steve O’Hear.

Having now been in this ecosystem for so long, I think the inflection point is the number of successful high-growth companies that we’ve produced from Europe, be it Adyen, Spotify, Farfetch, Elastic and Klarna, where my [Blossom] partner Louise was as well, I think what it has really shown to people is that you can take risk at the early stage and build meaningful businesses from Europe. And I think that’s really encouraged a new next generation of entrepreneur. And Europe is changing its mindset that it’s okay to fail.

And I think the other shift is that now people are saying, “okay, well, I’m not going to move to the valley and trying to build my teams because talent is so competitive and so expensive over there, I want to build in Europe.” And then finally, the great engineering, design, product talent here and then being helped by funds like us to scale it at the beginning and early stages, and then going on to produce some really interesting things. I don’t think U.S. funds are coming over here because they see cheaper pricing and lower valuations. They’re coming over here because they are looking at markets and industries and finding the potential next best thing over in Europe.

Around the horn

SoftBank wants its on-demand portfolio to stop losing so much money (TC)

Tracking corporate venture capital’s rise over the past decade (EC)

True product-market fit is a minimum viable company (TC)

Gauging email success, invite-only app launches and other growth tactics (EC)

All eyes are on the next liquidity event when it comes to space startups (TC)

Essential advice for securing your small startup (EC)

Adding India to your business (TC)

#EquityPod

This week’s episode features Alex along with co-host Danny Crichton talking about:

- Kleiner Perkins’ fast investment of a recent $600m round

- Free Agency’s tech play for talent management

- The huge round for “Ring for enterprise” Verdaka

- Insurance startup funding trends

- Updates on the on-demand wars

- The latest in tech IPOs

Get Startups Weekly in your inbox every Saturday morning, just sign up here.

Powered by WPeMatico

Justin Kan opens up (Part 1)

I am a chaplain trying to understand the tech world, and to me, that means I need to understand people like Justin Kan.

Who, after all, most “represents tech?” There are the obvious answers: secular deities like Bill Gates, Elon Musk or the late Steve Jobs. Or there are the often-marginalized figures on whom I’ve often preferred to focus in writing this column: the immigrant women of color who built the industry’s physical infrastructure; social workers and feminist philosophers who study how tech really works on a subconscious level, and how to fix it; or the next generation of leaders who represent the future of tech even as they worry about the inequalities they themselves embody.

But you can’t understand what has come to be the power and mystique of tech without also understanding the minds of its enigmatic founders. Justin Kan is a serial entrepreneur and founder who, whether you appreciate his public voice or not, certainly stands out as one of the most interesting examples of that classic Silicon Valley archetype: a tech entrepreneur ostensibly doing much more than just selling technology.

Kan famously started his business career not long after he graduated from Yale in 2005 by creating Justin.tv, a tech platform from which he broadcast his own life 24/7. Fifteen years later, Kan’s original idea seems quaint, given the level of self-promotion and oversharing that’s become commonplace. And yet, as he was arguably the first person to turn surveillance capitalism into not only overt performance art but also a noteworthy career in startups and venture capital, one can’t help but take the idea of Justin Kan seriously, at the very least as a harbinger of what is to come.

Powered by WPeMatico

What Nutanix got right (and wrong) in its IPO roadshow

Back in 2016, Nutanix decided to take the big step of going public. Part of that process was creating a pitch deck and presenting it during its roadshow, a coming-out party when a company goes on tour prior to its IPO and pitches itself to investors of all stripes.

It’s a huge moment in the life of any company, and after talking to CEO Dheeraj Pandey and CFO Duston Williams, one we better understood. They spoke about how every detail helped define their company and demonstrate its long-term investment value to investors who might not have been entirely familiar with the startup or its technology.

Pandey and Williams reported going through more than 100 versions of the deck before they finished the one they took on the road. Pandey said they had a data room checking every fact, every number — which they then checked yet again.

In a separate Extra Crunch post, we looked at the process of building that deck. Today, we’re looking more closely at the content of the deck itself, especially the numbers Nutanix presented to the world. We want to see what investors did more than three years ago and what’s happened since — did the company live up to its promises?

Plan of attack

Powered by WPeMatico

Customer feedback is a development opportunity

Online commerce accounted for nearly $518 billion in revenue in the United States alone last year. The growing number of online marketplaces like Amazon and eBay will command 40% of the global retail market in 2020. As the number of digital offerings — not only marketplaces but also online storefronts and company websites — available to consumers continues to grow, the primary challenge for any online platform lies in setting itself apart.

The central question for how to accomplish this: Where does differentiation matter most?

A customer’s ability to easily (and accurately) find a specific product or service with minimal barriers helps ensure they feel satisfied and confident with their choice of purchase. This ultimately becomes the differentiator that sets an online platform apart. It’s about coupling a stellar product with an exceptional experience. Often, that takes the form of simple, searchable access to a wide variety of products and services. Sometimes, it’s about surfacing a brand that meets an individual consumer’s needs or price point. In both cases, platforms are in a position to help customers avoid having to chase down a product or service through multiple clicks while offering a better way of comparing apples to apples.

To be successful, a company should adopt a consumer-first philosophy that informs its product ideation and development process. A successful consumer-first development resides in a company’s ability to expediently deliver fresh features that customers actually respond to, rather than prioritize the update that seems most profitable. The best way to inform both elements is to consistently collect and learn from customer feedback in a timely way — and sometimes, this will mean making decisions for the benefit of consumers versus what is in the best interest of companies.

Powered by WPeMatico

Legacy, a sperm testing and freezing service, just raised $3.5 million to send the message to men: get checked

Legacy, a male fertility startup, has just raised a fresh, $3.5 million in funding from Bill Maris’s San Diego-based venture firm, Section 32, along with Y Combinator and Bain Capital Ventures, which led a $1.5 million seed round for the Boston startup last year.

We talked earlier today with Legacy’s founder and CEO Khaled Kteily about his now two-year-old, five-person startup and its big ambitions to become the world’s preeminent male fertility center. Our biggest question was how Legacy and similar startups convince men — who are generally less concerned with their fertility than women — that they need the company’s at-home testing kits and services in the first place.

“They should be worried about [their fertility],” said Kteily, a former healthcare and life sciences consultant with a master’s degree in public policy from the Harvard Kennedy School. “Sperm counts have gone down 50 to 60% over the last 40 years.” More from our chat with Legacy, a former TechCrunch Battlefield winner, follows; it has been edited lightly for length.

TC: Why start this company?

KK: I didn’t grow up wanting to be the king of sperm [laughs]. But I had a pretty bad accident — a second-degree burn on my legs after having four hot Starbucks teas spill on my lap in a car — and between that and a colleague at the Kennedy School who’d been diagnosed with cancer and whose doctor suggested he freeze his sperm ahead of his radiation treatments, it just clicked for me that maybe I should also save my sperm. When I went into Cambridge to do this, the place was right next to the restaurant Dumpling House and it was just very awkward and expensive and I thought, there must be a better way of doing this.

TC: How do you get started on something like this?

KK: This was before Ro and Hims began taking off, but people were increasingly comfortable doing things from their own homes, so I started doing research around the idea. I joined the American Society of Reproductive Medicine. I started taking continuing education classes about sperm…

TC: Women are under so much pressure from the time they turn 30 to monitor their fertility. Aside from extreme circumstances, as with your friend, do men really think about testing their sperm?

KK: Men should be worried about it, and they should be taking responsibility for it. What a lot of folks don’t know is for every one in seven couples that are actively trying to get pregnant, the man is equally responsible [for their fertility struggles]. Women are taught about their fertility but men aren’t, yet the quality of their sperm is degrading over the years. Sperm counts have gone down by 50 to 60% over the last 40 years, too.

TC: Wait, what? Why?

KK: [Likely culprits are] chemicals in plastics, chemicals in what we eat eat and drink, changes in lifestyle; we move less and eat more, and sperm health relates to overall health. I also think mobile phones are causing it. I will caveat this by saying there’s been mixed research, but I’m convinced that cell phones are the new smoking in that it wasn’t clear that smoking was as dangerous as it is when the research was being conducted by companies that benefited by [perpetuating cigarette use]. There’s also a generational decline in sperm quality [to consider]; it poses increased risk to the mother but also the child, as the risk of gestational diabetes goes up, as well as the rate of autism and other congenital conditions.

TC: You’re selling directly to consumers. Are you also working with companies to incorporate your tests in their overall wellness offerings?

KK: We’re investing heavily in business-to-business and expect that to be a huge acquisition channel for us. We can’t share any names yet, but we just signed a big company last week and have a few more in the works. These are mostly Bay Area companies right now; it’s an area where our experience as a YC alum was valuable because of the founders who’ve gone through and now run large companies of their own.

TC: When you’re talking with investors, how do you describe the market size?

KK: There are four million couples that are facing fertility challenges and in all cases, we believe the man should be tested. So do [their significant others]. Almost half of purchases [of our kits] are by a female partner. We also see men in the military freezing their sperm before being deployed, same-sex couples who plan to use a surrogate at some point and transgender patients who are looking at a life-changing [moment] and want to preserve their fertility before they start the process. But we see this as something that every man might do as they go off to college, and investors see that bigger picture.

TC: How much do the kits and storage cost?

KK: The kit costs $195 up front, and if they choose to store their sperm, $145 a year. We offer different packages. You can also spend $1,995 for two deposits and 10 years of storage.

TC: Is one or two samples effective? According to the Mayo Clinic, sperm counts fluctuate meaningfully from one sample to the next, so they suggest semen analysis tests over a period of time to ensure accurate results.

KK: We encourage our clients to make multiple deposits. The scores will be variable, but they’ll gather around an average.

TC: But they are charged for these deposits separately?

KK: Yes.

TC: And what are you looking for?

KK: Volume, count, concentration, motility and morphology [meaning the shape of the sperm].

TC: Who, exactly, is doing the analysis and handling the storage?

KK: We partner with Andrology Labs in Chicago on analysis; it’s one of the top fertility labs in the country. For storage, we partner with a couple of cryo-storage providers in different geographies. We divide the samples into four, then store them in two different tanks within each of two locations. We want to make sure we’re never in a position where [the samples are accidentally destroyed, as has happened at clinics elsewhere].

TC: I can imagine fears about these samples being mishandled. How can you assure customers this won’t happen?

KK: Trust and legitimacy are core factors and a huge area of focus for us. We’re CPPA and HIPAA compliant. All [related data] is encrypted and anonymized and every customer receives a unique ID [which is a series of digits so that even the storage facilities don’t know whose sperm they are handling]. We have extreme redundancies and processes in place to ensure that we’re handling [samples] in the most scientifically rigorous way possible, as well as ensuring the safety and privacy of each [specimen].

TC: How long can sperm be frozen?

KK: Indefinitely.

TC: How will you use all the data you’ll be collecting?

KK: I could see us entering into partnerships with research institutions. What we won’t do is sell it like 23andMe.

Powered by WPeMatico

True product-market fit is a minimum viable company

Hi, I’m Ann.

I was one of the first investors in Lyft, Refinery29 and Xamarin. I’ve been on the Midas List for the past three years and was recently named on The New York Times’ list of The Top 20 Venture Capitalists. In 2008, I co-founded Floodgate, one of the first seed-stage VC funds in Silicon Valley. Unlike most funds, we invest exclusively in seed, making us experts in finding product-market fit and building a minimum viable company. Seed is fundamentally different from later stages, so we’ve made it more than a specialty: It’s all we do. Each of our partners sees thousands of companies every year before electing to invest in only the top three or four.

For the past 11 years, I’ve invested at the inception phase of startups. We’ve seen startups go wildly right (Lyft, Refinery29, Twitch, Xamarin) and wildly wrong. When I reflect on the failures, the root cause inevitably stems from misconceptions around the nature of product-market fit.

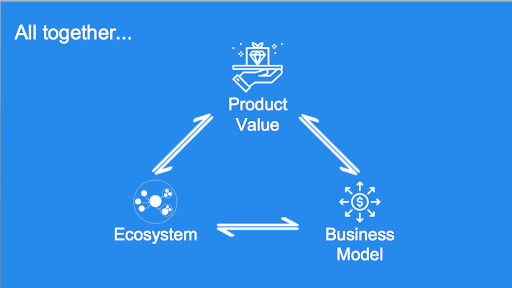

True product-market fit is a minimum viable company

Before attempting to scale your minimum viable product, you should focus on cultivating your minimum viable company. Nail down your value proposition, find your place in the broader ecosystem and craft a business model that adds up. In other words, true product-market fit is actually the magical moment when three elements click together:

To have built a minimum viable company, these three elements must work in concert together:

- People must value your product enough to be willing to pay for it. This value also determines how you package your product to the world (freemium versus free to pay versus enterprise sales).

- Your business model and pricing must fit your ecosystem. They must also generate enough sales volume and revenue to sustain your business.

- Your product’s value must satisfy the needs of the ecosystem and the ecosystem needs to accept your product.

Many entrepreneurs conceptualize product-market fit as the point where some subset of customers love their product’s features. This conceptualization is dangerous. Many failing companies have features that customers loved. Some even have multiple beloved features! Great features constitute only one-half of one-third of the whole puzzle. To have created a minimum viable company, a company needs all three of these elements — value propositions, business model and ecosystem — working in concert.

So founders take heed…

Moving into “growth mode” while missing any of these elements is building your company on an unsound foundation.

Founders who tune out the latest tweet cycle on “the secrets to raising Series A” and focus instead on the intricacies of their own business will find that product-market fit is a predictable, achievable phenomenon. On the other hand, founders who prematurely focus on growth without knowing the basic ingredients of their minimum viable company often fuel an addictive and destructive cycle around their business’ fake growth, acquiring non-optimal users that contribute to their company’s destruction.

Read an extended version of this article on Extra Crunch.

Powered by WPeMatico