Clear gets $13M Series A to build high-volume transaction system on the blockchain

Clear is an early-stage startup with a big ambition. It wants to build a blockchain for high-volume transaction systems like payments between telcos. Today it announced a $13 million Series A investment.

The round was led by Eight Roads with participation from Telefónica Innovation Ventures, Telekom Innovation Pool of Deutsche Telekom, HKT and Singtel Innov8.

That the strategic investors were telcos is not a coincidence. The early use case for Clear’s blockchain transaction network involves moving payments between worldwide telcos, a system that today is highly manual and prone to errors.

Clear co-founder Gal Hochberg says what his company does is to take commercial contracts and turn them into digital representations, often known in digital ledger terms as a smart contract.

“What that lets us do is create a trusted view of the true status of the relationship within the company’s business partners because they’re now looking at the same pricing and usage. They can find any issues in real time, either in commercial information or in service delivery, and they can even actually resolve those inside our platform,” Hochberg explained.

By putting these high-volume, cross-border transactions onto the blockchain with these smart contracts to act as automated enforcer of the terms, it means that instead of waiting until the end of the month to find errors and begin a resolution process, this can be done in real time, reducing time to payment and speeding up conflict resolution.

“We use blockchain technology to create those interactions in ways that it is auditable, cryptographically secure and ensures that both sides are synced and seeing the same information,” Hochberg said.

For starters, the company is working with worldwide telco companies because the number of transactions, and the way they cross borders make this a good test case, but Hochberg says this is only the starting point. They are not in full-blown production yet, but he says they have proven they can process hundreds of millions of billable events.

The money should help the company get into full carrier-grade production some time in the first half of this year, and then begin to expand into other verticals beyond telcos with the help of today’s investment.

Powered by WPeMatico

[Updated] LG withdraws from MWC due to coronavirus-related concerns

This story has been edited to reflect a new statement by ZTE that it will attend MWC as planned.

LG Electronics has cancelled its plan to participate in MWC later this month in Barcelona, Spain, because of coronavirus-related concerns, while Xiaomi has cancelled its trip for Chinese media but will still attend the event.

In a statement on its site, LG said it will skip MWC, the world’s largest mobile trade show, and launch this year’s releases at separate events “in the near future” instead.

“With the safety of its employees, partners and customers foremost in mind, LG has decided to withdraw from exhibiting and participating in MWC 2020 later this month in Barcelona, Spain,” the statement from LG, headquartered in Seoul, South Korea, read. “This decision removes the risk of exposing hundreds of LG employees to international travel which has already become more restrictive as the virus continues to spread across borders.”

A Xiaomi spokesperson told TechCrunch the company is “paying close attention to the situation. Xiaomi is still attending this year’s event and will make necessary adjustment accordingly.”

Earlier The Verge reported that ZTE had cancelled its press conference because of travel and visa delays, according to a company spokesperson, but also because “[we] tend to be an overly courteous company, and simply don’t want to make people uncomfortable.” But the company later tweeted that it plans to attend MWC as planned.

#ZTE will participate in #MWC20 Barcelona as planned, showcasing comprehensive #5G end-to-end solutions and a wide variety of 5G devices. ZTE’s booth is in 3F30, Hall 3, FIRA GRAN VIA. pic.twitter.com/vB9S4IpyZP

— ZTE Corporation (@ZTEPress) February 5, 2020

The coronavirus outbreak has disrupted travel and supply chains around the world. While the vast majority of cases reported have been inside China, the outbreak has also led to a wave of open racism and xenophobia targeted at people of Asian descent around the world.

In a statement posted on its site today, MWC organizers GSMA said it “continues to monitor and assess the potential impact of the coronavirus on its MWC20 events held annually in Barcelona, Shanghai and Los Angeles and as well as the Mobile 360 Series of regional conferences. The GSMA confirms that there is minimal impact on the event thus far.”

All Barcelona events taking place February 24 to 27 will go on as scheduled. GSMA previously announced the measures it is taking to prevent the spread of the virus, including increased cleaning and disinfection of high-traffic areas, including catering areas, handrails, bathrooms, entrances and exits and touchscreens and more onsite medical support. It also said it will have a “mic change protocol” for speakers, and advise all attendees to “adopt a ‘no-handshake’ policy.”

Powered by WPeMatico

Layoffs hit another Softbank co as $3.2B Flexport cuts 50

Fearing weak fundraising options in the wake of the WeWork implosion, late stage startups are tightening their belts. The latest is another Softbank-funded company, joining Zume Pizza (80% of staff laid off), Wag (80%+), Fair (40%), Getaround (25%), Rappi (6%), and Oyo (5%) that have all cut staff to slow their burn rate and reduce their funding needs. Freight forwarding startup Flexport that is laying off 3% of its global staff.

“We’re restructuring some parts of our organization to move faster and with greater clarity and purpose. With that came the difficult decision to part ways with around 50 employees” a Flexport spokesperson tells TechCrunch after we asked today if it had seen layoffs like its peers.

Flexport CEO Ryan Petersen

Flexport had raised a $1 billion Series D led by SoftBank at a $3.2 billion valuation a year ago, bringing it to $1.3 billion in funding. The company helps move shipping containers full of goods between manufacturers and retailers using digital tools unlike its old-school competitors.

“We underinvested in areas that help us serve clients efficiently, and we over-invested in scaling our existing process, when we actually needed to be agile and adaptable to best serve our clients, especially in a year of unprecedented volatility in global trade” the spokesperson explained.

Flexport still had a record year, working with 10,000 clients to finance and transport goods. The shipping industry is so huge that it’s still only the seventh largest freight forwarder on its top Trans-Pacific Eastbound leg. The massive headroom for growth plus its use of software to coordinate supply chains and optimize routing is what attracted SoftBank.

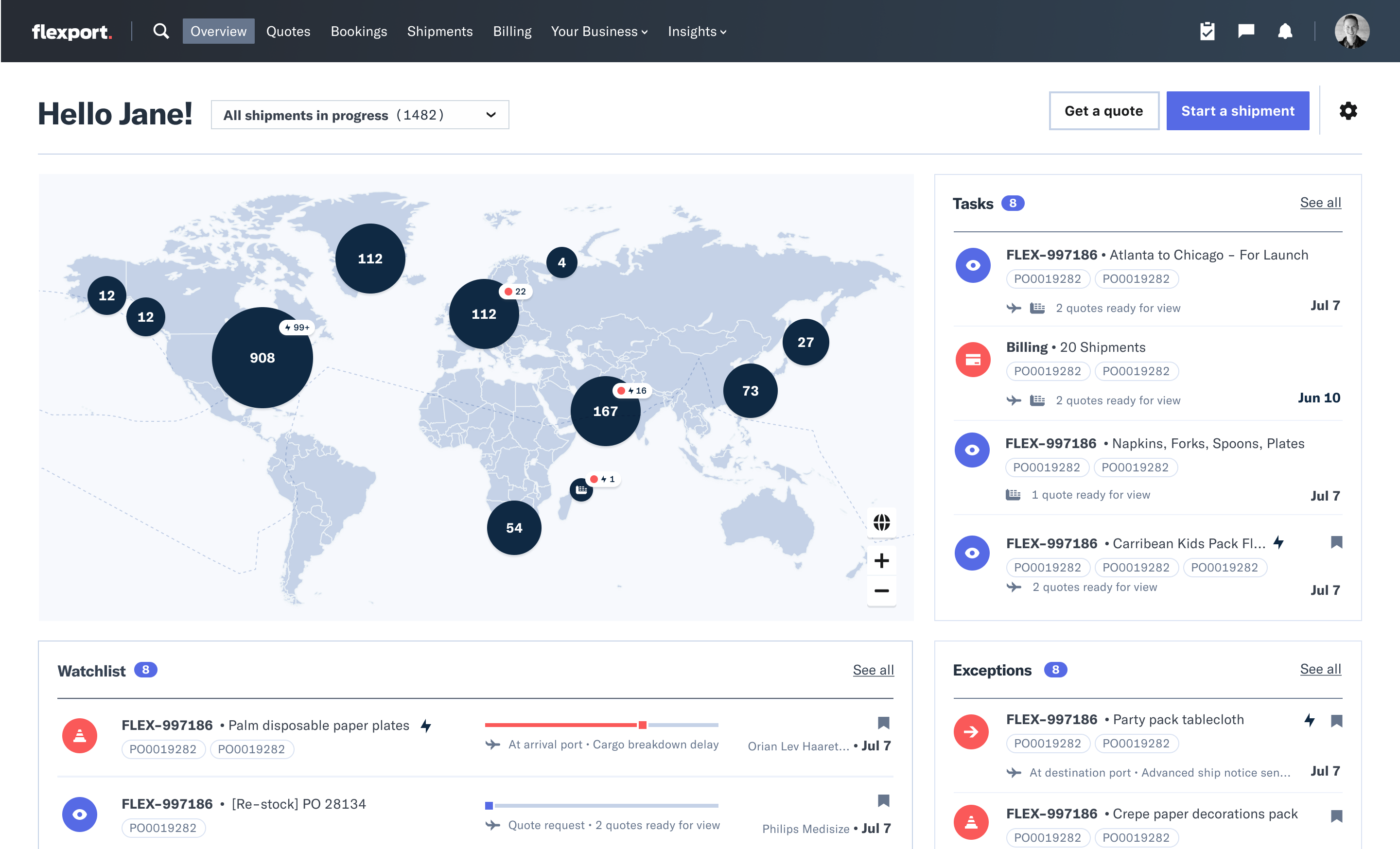

The Flexboard Platform dashboard offers maps, notifications, task lists, and chat for Flexport clients and their factory suppliers.

But many late-stage startups are worried about where they’ll get their next round after taking huge sums of cash from SoftBank at tall valuations. As of November, SoftBank had only managed to raise about $2 billion for its Vision Fund 2 despite plans for a total of $108 billion, Bloomberg reported. LPs were partially spooked by SoftBank’s reckless investment in WeWork. Further layoffs at its portfolio companies could further stoke concerns about entrusting it with more cash.

Unless growth stage startups can cobble together enough institutional investors to build big rounds, or other huge capital sources like sovereign wealth funds materialize for them, they might not be able to raise enough to keep rapidly burning. Those that can’t reach profitability or find an exit may face down-rounds that can come with onerous terms, trigger talent exodus death spirals, or just not provide enough money.

Flexport has managed to escape with just 3% layoffs for now. Being proactive about cuts to reach sustainability may be smarter than gambling that one’s business or the funding climate with suddenly improve. But while other SoftBank startups had to spend tons to edge out direct competitors or make up for weak on-demand service margins, Flexport at least has a tried and true business where incumbents have been asleep at the wheel.

Powered by WPeMatico

Snapchat hits 218M users but big Q4 losses sink share price

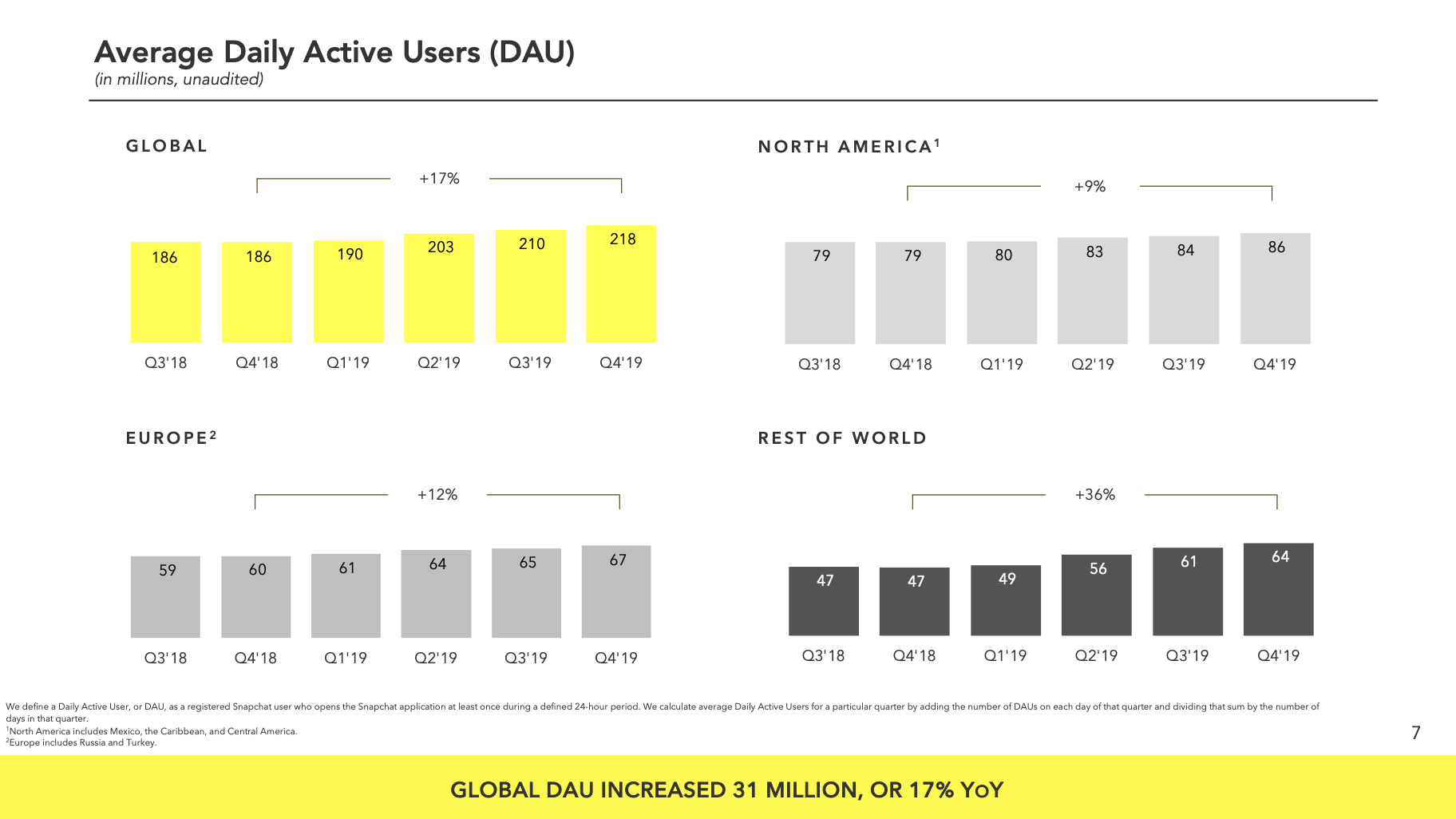

Snapchat still isn’t profitable nearly two years after its IPO. In Q4 2019, Snap lost $241 million on $560.8 million in revenue; that’s up 44% year-over-year and an EPS of $0.03. That comes from adding 8 million daily users to reach a total of 218 million up 3.8% this quarter from 210 million and 17% year-over-year.

The big problem was a one-time $100 million legal settlement that pushed it to lose $49 million more in Q4 2019 than Q4 2018. That comes from a shareholder lawsuit claiming Snap didn’t adequately disclose the impact of competition from Facebook on its business. The IPO was soured by weak user growth as people shifted from Snapchat Stories to Instagram Stories.

A rough Q4

Snapchat had a mixed quarter compared to estimates, exceeding the EPS predictions but falling short on revenue. FactSet’s consensus predicted $563 million in revenue and a loss of $0.12 EPS. Estimize’s consensus came in at $568 million in revenue and an EPS gain of $0.02.

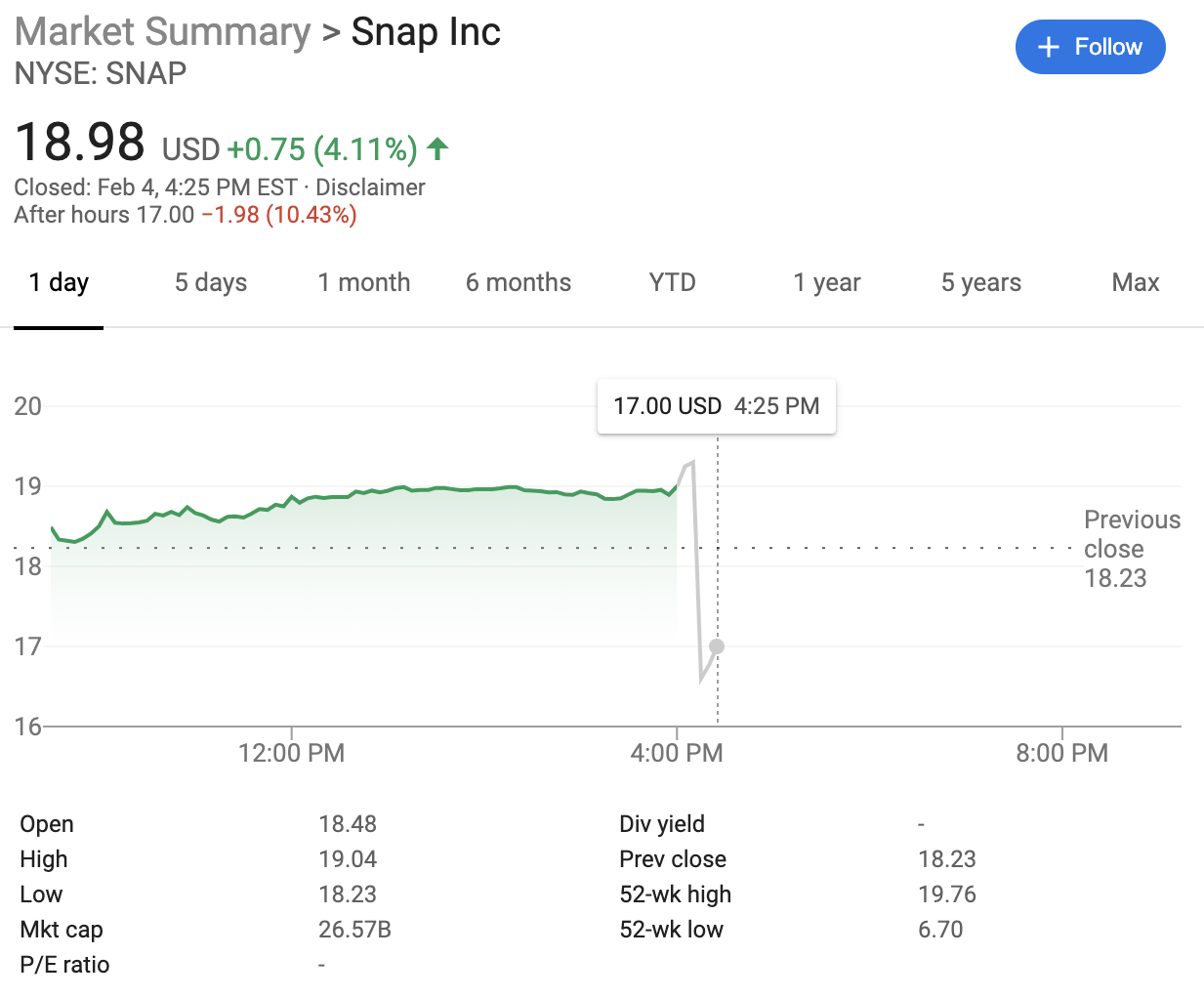

Snapchat shares plunged over 11% in after-hours trading following the announcement. Shares had closed up 4.17% at $18.99 today. That’s up from a low of $4.99 in December 2018 when its user count was shrinking under competition from Instagram Stories. It’s now hovering around its $17 IPO price, but it’s still under its post-IPO pop to $27.09.

Snap gave stronger than expected revenue guidance for Q1 2020 of $450 million to $470 million, and 224 million to 225 million users. The company’s CFO Derek Anderson says that “Q4 marked our first quarter of Adjusted EBITDA profitability at $42 million for the quarter, an improvement of $93 million over the prior year.” Still, he predicts an Adjusted EBITDA in Q1 of negative $90 million to negative $70 million. That’s manageable for Snap without raising more money, since it now has $2.1 billion in cash and marketable securities, down $148 million quarter-after-quarter.

Snapchat 2020

“Throughout the course of 2019, we added 31 million daily active users, largely driven by investments in our core product and improvements to our Android application,” said Snapchat CEO Evan Spiegel . “We’ve recently completed our 2020 strategic planning process and have aligned our teams and resources around our goals of supporting real friendships on Snapchat, expanding our service to a broader global community, investing in our AR and content platforms, and scaling revenue while achieving profitability in order to self-fund our investments in the future.”

Some other highlights:

- 1.3 trillion Snaps were created in 2019

- The average Snapchat user engages for 30 minutes per day

- Snapchat reaches 90% of U.S. 13 to 24-year-olds and over 75% of 13 to 34-year-olds

- Total daily time spent by Snapchatters watching Discover increased by 35% year-over-year, and it’s up 60% for users over the age of 25

- Over 50 Snapchat shows reached a monthly audience of 10 million viewers or more

- 75% of users engage with augmented reality per day

- 20% of Snaps sent with an AR lens were made with commununity-developed lenses

- 5X more users open the Lens Explorer now versus a year ago, and 10% of users open it every day

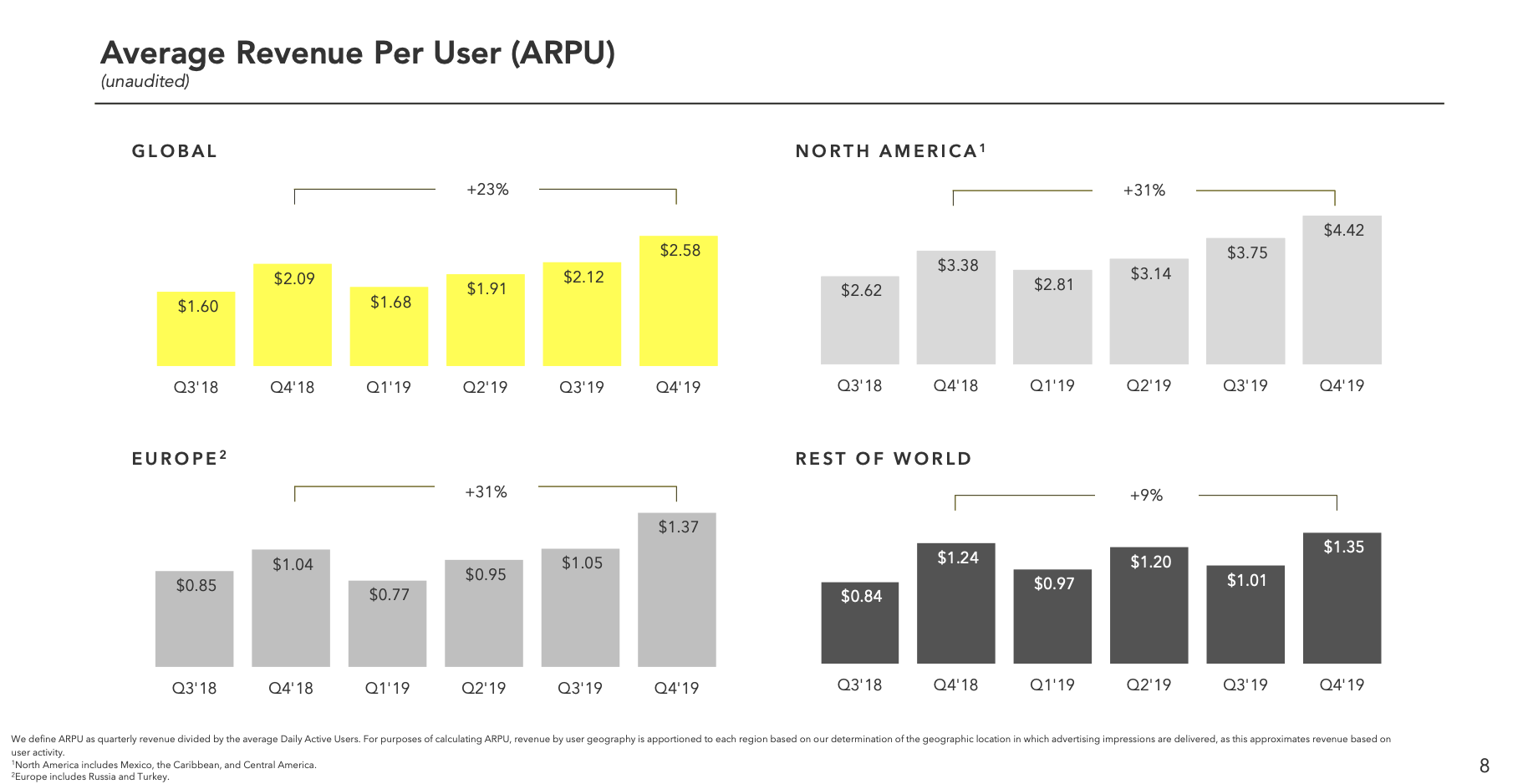

Snapchat’s user growth has been on a tear thanks to international penetration, especially in India, after it re-engineered its Android app for developing markets. It gained users in all markets. Crucially, it raised its average revenue per user 23% from $2.09 in Q4 2018 to $2.58, though only from $1.24 to $1.35 in the Rest of World region, where it’s growing user count the fastest. Snap will need to figure out how to squeeze more cash out of the international market to offset the costs of streaming tons of video to these users.

Q4 saw Snapchat readying several new products that could help boost engagement and therefore ad views. Cameos, first reported by TechCrunch, lets users graft their face onto an actor in an animated GIF like a lightweight deepfake. Bitmoji TV, which won’t run ads initially but could drive attention to Snapchat Discover, offers zany four-minute cartoons that star your Bitmoji avatar. We could see a bump to engagement from these starting in Q1 2020.

To retain its augmented reality filter creators, Snapchat has pledged $750,000 in payouts in 2020. It also expanded the use of product catalog ads, and now lets advertisers buy longer skippable ads.

Outside of the legal settlement, Snapchat is inching closer to profitability, but still has a ways to go. It has managed to develop a strong synergy between its popular chat feature that’s tougher to monetize, and the Stories and Discover content where it can inject ads. The big question is whether Facebook Messenger, Instagram and WhatsApp will get more serious about ephemeral messaging that’s at the core of Snapchat. If it can hold onto the market and maintain its place as where teens talk, it could ride out its costs and build revenue until it’s sustainable for the long-term.

Powered by WPeMatico

Google’s Glass dreams live on with the arrival of enterprise hardware

Google Glass was ahead of its time. That’s not to say that the people who wore it out in public didn’t look like giant dorks, of course, but in hindsight it seems safe to say that the world just wasn’t ready for wearable augmented reality. The phenomenon has, however, seen a resurgence among enterprise applications, courtesy of companies like Epson and Microsoft.

Google’s ready to ride that wave. In May, the company announced the arrival of the second version of its Enterprise Edition of Glass. Today, the headset is available for developers as a direct purchase from a handful of resellers. The Android-based device, which graduated from Google X mid last year, looks remarkably like the earliest versions of Glass, albeit with a slightly refined design.

Seven years after the arrival of the original model, the Glass Enterprise 2 isn’t cheap, either. It runs $1,000 from partner sites. There are a few suggestions for potential applications, including card text, imaging samples and QR scanning.

As Lucas noted in his initial write-up, the Glass system is much more limited than the likes of the latest HoloLens, which is focused on a more XR experience. Google, instead, is focused on lightweight usability — which could certainly serve as an advantage in certain settings. Key applications for the product include settings like construction sites, where contextual environmental information can otherwise be difficult to access.

Powered by WPeMatico

Quibi links up with FaZe Clan for a game show that would let winners join the FaZe team

Quibi has linked up with the popular esports team FaZe Clan on a new game show that would let six subscribers for the new short-form streaming service compete for a slot on the FaZe roster.

The show is called “FaZe Up” and it’s an example of the new types of entertainment and game shows Quibi’s looking to try to appeal to younger demographics.

For FaZe Clan, one of the dominant esports franchises in popular culture, the game show is a chance to find new talent and extend the reach of its entertainment studio, gaming teams and fashion line onto another platform. For Quibi, bribery is certainly one way to win an audience.

WndrCo, the parent company for Quibi, is keeping the production in its family of portfolio companies, as the show is being produced by the WndrCo-backed entertainment and sports media company, Whistle Sports.

“We have had an incredible partnership with FaZe and couldn’t be more excited to take it to new heights with this show, especially on a unique platform like Quibi,” said Michael Cohen, president of Whistle. “Whistle is all about incorporating our fans into our content and so the fact that the Quibi audience gets the ability to participate and immerse themselves in this experience is a truly perfect fit.”

Quibi describes the show as part contest, part competition show “and 100% FaZe.” Six contestants, chosen from Quibi’s audience of subscribers, will get the chance to win money and a slot in the FaZe Clan roster.

Directed by William Silva Reddington and produced by FaZe Clan, Nathan Gaines, Dennis Lisberger and Mike Basone, with showrunner Harrison Nalévansky, the new show will use voting tools from Quibi and FaZe Clan’s key members to select contestants for eligible slots to compete and eventually join FaZe Clan.

The six winners will then be flown to the FaZe Clan mansion to live at the house and compete in gaming and reality show-style events to determine who deserves a slot on the team.

“Over the past 10 years, FaZe Clan has not only contributed to the growth of the gaming lifestyle and the esports community, but we have broken barriers and are not afraid to disrupt the status quo,” said FaZe Clan Head of Content Oluwafemi Okusanya. “In 2020, we plan to do the same with content creation and media distribution. The ‘FaZe Up’ show represents our next chapter in content creation with our first premium production effort and in collaboration with innovative partners like Whistle and Quibi.”

The addition of FaZe to the roster of creative talent that Quibi has amassed puts a different spin on the company’s pitch of high-end, short-form content. The company has already attracted Jennifer Lopez, Liam Hemsworth, Catherine Hardwicke and Antoine Fuqua, who are all attached to projects slated to debut on the platform.

Quibi doesn’t debut until April, but it’s teasing updates and information about what’s to come — including more news about “FaZe Up” at Quibi Insider, its newsletter about all things Quibi.

Powered by WPeMatico

Nvidia officially launches cloud gaming service GeForce Now for $5 per month

After a lengthy beta phase, Nvidia is launching its cloud gaming service GeForce Now. Unlike Google’s Stadia, GeForce Now isn’t trying to build a console-like experience with its own lineup of games. Nvidia connects with your Steam, Epic or Battle.net account so you can play games you purchased on those third-party platforms. It works a bit more like Shadow, for instance.

But GeForce Now isn’t a free service. Customers basically rent a gaming PC in a data center near them. Right now, it costs $5 per month to access the Founders edition, which lets you play whenever you want and for as long as you want. But the company says that it plans to raise the subscription fee at some point.

You can try the service by creating a free account, as well. If there are too many people connected to the service, you may have to wait to launch a game. You’re also limited to one-hour sessions and less powerful hardware.

You’ll have to download an app that works on macOS, Windows and Android devices, including the Nvidia Shield TV. GeForce Now isn’t available from anywhere in the world, as you have to be near a data center to reduce latency. The company currently has nine data centers in the U.S., five in Europe, one in Korea and two in Japan.

Nvidia is optimizing games for the platform one at a time. So it’s possible that you own a game but that it doesn’t appear in the list of compatible games. Yes, that’s a long list of restrictions. But it could be the future of gaming, maybe.

Behind the scene, the company uses Nvidia graphics cards (duh) that support ray tracing. Nvidia doesn’t share more details beyond that. I’d recommend testing the service with a free account first to see if your connection is stable enough to support game streaming.

Powered by WPeMatico

Does Asana’s planned direct listing reveal the company’s true value?

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Asana, a well-known workplace productivity company, announced yesterday it has filed privately to go public. The San Francisco-based company is well-funded, having raised more than $200 million; well-known, due in part to its tech-famous founding duo; and valuable, having last raised at a $1.5 billion valuation.

Each of those factors — plus the fact that Asana is going public — makes the company worth exploring, but its plans to offer a direct listing instead of a traditional initial public offering make it irresistible.

Today, we’ll rewind through Asana’s fundraising and valuation history. Then, we’ll mix in what we know about its financial performance, growth rates and capital efficiency to see how much we can tell about the company as we count down to its public S-1 filing. The Asana flotation is going to be big news, so let’s get all our facts and figures straightened out.

Valuations and revenue

Powered by WPeMatico

Chargebee offers free subscription billing to Extra Crunch members for up to $100K in revenue

Extra Crunch is excited to announce a new community perk from automated subscription billing startup Chargebee. Starting today, annual and two-year members of Extra Crunch can receive free subscription invoicing until $100,000 in revenue is reached. You must be new to Chargebee to claim this offer.

Chargebee helps you succeed with subscription billing. Chargebee replaces in-house billing systems and spreadsheets by giving teams the ability to set up subscription plans and trials, run pricing experiments at scale, analyze accurate subscription analytics and much more, out of the box.

Chargebee integrates with payment gateways like Stripe, Braintree and PayPal and business applications such as Xero, QuickBooks and Salesforce. You can learn more about the benefits of Chargebee here.

You can sign up for Extra Crunch and claim this deal here.

Extra Crunch is a membership program from TechCrunch that features how-tos and interviews on company building, intelligence on the most disruptive opportunities for startups, an experience on TechCrunch.com that’s free of banner ads, discounts on TechCrunch events, and several community perks like the one mentioned in this article. Our goal is to democratize information for startups, and we’d love to have you join our community.

Sign up for Extra Crunch here.

New annual and two-year Extra Crunch members will receive details on how to claim the perk in the welcome email. The welcome email is sent after signing up for Extra Crunch. If you are already an annual or two-year Extra Crunch member, you will receive an email with the offer at some point over the next 24 hours. If you are currently a monthly Extra Crunch subscriber and want to upgrade to annual in order to claim this deal, head over to the “account” section on TechCrunch.com and click the “upgrade” button.

This is one of several community perks we’ve launched for annual Extra Crunch members. Other community perks include a 20% discount on TechCrunch events, 100,000 Brex rewards points upon credit card sign up and an opportunity to claim $1,000 in AWS credits. For a full list of perks from partners, head here.

If there are other community perks you want to see us add, please let us know by emailing travis@techcrunch.com.

Sign up for an annual Extra Crunch membership today to claim this community perk. You can purchase an annual Extra Crunch membership here.

Disclosure:

This offer is provided as a partnership between TechCrunch and Chargebee, but it is not an endorsement from the TechCrunch editorial team. TechCrunch’s business operations remain separate to ensure editorial integrity.

Powered by WPeMatico

Koch Industries acquires Infor in deal pegged at nearly $13B

Infor announced today that Koch Industries has bought the company in a deal sources peg at close to $13 billion.

Infor, which makes large-scale cloud ERP software, has been around since 2002 and counts Koch as both a customer and an investor, so the deal makes sense on that level. Koch was lead investor last year in a $1.5 billion investment, wherein the company indicated that it was a step before going public.

It’s not clear if that is still the goal, as sources suggested that staying private might provide the company with more capital flexibility in the future. Daniel Newman, founder and principal analyst at Futurum Research, says staying private longer could benefit Infor in the long run.

“There have been thoughts of an IPO, but remaining private should give the company flexibility without the quarterly pressure to refine its strategy, make necessary investments in the platform and achieve the growth rates that would make the company more of an exciting IPO,” he said.

Under the terms of the deal, Koch will be buying out the remaining equity stake in Golden Gate Capital, a secondary investor in last year’s investment. The company’s management team will remain in place and Infor will act as a standalone subsidiary of Koch.

Company CEO Kevin Samuelson, as you would expect, saw the deal as a positive move that allowed the company to operate with a well capitalized parent behind it. “As a subsidiary of a $110 billion+ revenue company that re-invests 90% of earnings back into its businesses, we will be in the unique position to drive digital transformation in the markets we serve,” he said in a statement.

Jim Hannan, executive vice president and CEO of enterprises for Koch Industries, saw it similarly, with Koch’s deep pockets helping to propel Infor in the future. “As a global organization spanning multiple industries across 60 countries, Koch has the resources, knowledge and relationships to help Infor continue to expand its transformative capabilities,” he said in a statement.

Holger Mueller, an analyst at Constellation Research, says it’s a strange deal on its face, but if Koch leaves Infor alone, it might work out. “When you think you have seen it all, something new comes along: A regular enterprise buys a top-five ERP vendor. Now [we’ll have to see] if Koch can ensure Infor keeps building market leading software, using Koch as showcase, or becomes the Koch software affiliate.

“The latter would be an unfortunate outcome. On the positive side, enterprise software built from real user validation, that can also serve as a reference, can be very powerful,” Mueller told TechCrunch. He said it could work out great, but also has the potential to go very wrong, depending on how Koch manages a software asset.

Infor is a huge company. As we reported last year at the time of its investment:

Infor may be the largest company you never heard of, with more than 17,000 employees and 68,000 customers in more than 100 countries worldwide. All of those customers generated $3 billion in revenue in 2018. That’s a significant presence.

Powered by WPeMatico