Apple agrees to settlement of up to $500 million from lawsuit alleging it throttled older phones

Apple Inc. has agreed to pay a settlement of up to $500 million, following a lawsuit accusing the company of intentionally slowing down the performance of older phones to encourage customers to buy newer models or fresh batteries.

The preliminary proposed class action lawsuit was disclosed Friday night and would see Apple pay consumers $25 per phone, as reported by Reuters.

Any settlement needs to be approved by U.S. District Judge Edward Davila, who oversaw the case brought in San Jose, Calif.

For consumers, the $25 payout may seem a little low, as a new iPhone can cost anywhere from $649 to $849 (for a lower-end model). The cost may be varied depending on how many people sue, and the company is set to pay at least $310 million under the terms of the settlement.

For its part, Apple is denying wrongdoing in the case and said it was only agreeing to avoid the cost and burden associated with the lawsuit.

Any U.S. owner of the iPhone 6, 6 Plus, 6s, 6s Plus, 7 Plus or SE that ran on iOS 10.2.1 or any of the later operating systems are covered by the settlement. Users of the iPhone 7 and 7 Plus which ran iOS 11.2 or later before Dec. 21, 2017 are also covered by the settlement.

Apple customers said their phone performance slowed down after they installed Apple software updates. The customers contend that Apple’s software updates intentionally degraded the performance of older models to encourage customers to unnecessarily upgrade to newer models or install new batteries.

Lawyers for Apple said that the problems were mainly due to high usage, temperature changes and other issues and that its engineers tried to address the problems as quickly as possible.

In February, Apple was fined $27 million by the French government for the same issue.

As we reported at the time:

A couple of years ago, Apple released an iOS update (10.2.1 and 11.2) that introduced a new feature for older devices. If your battery is getting old, iOS would cap peak performances as your battery might not be able to handle quick peaks of power draw. The result of those peaks is that your iPhone might shut down abruptly.

While that feature is technically fine, Apple failed to inform users that it was capping performances on some devices. The company apologized and introduced a new software feature called “Battery Health,” which lets you check the maximum capacity of your battery and if your iPhone can reach peak performance.

And that’s the issue here. Many users may have noticed that their phone would get slower when they play a game, for instance. But they didn’t know that replacing the battery would fix that. Some users may have bought new phones even though their existing phone was working fine.

Shares of Apple were up more than 9% today in a general market rally.

Powered by WPeMatico

The companies that will shape the upcoming multiverse era of social media

Throughout this series on the rise of multiverse virtual worlds, I have outlined the collision of gaming and social media into a new multiverse era of social media within virtual worlds due to technological and cultural changes. The result will be a healthier ecosystem of social media than what currently exists and the economic development of these virtual worlds such that many people turn to them as sources of income.

The critical question that remains in this final part of the series: Who will be the dominant companies of this multiverse era who build the most popular virtual worlds? Will one virtual world achieve a monopoly or will there be many worlds we hop between on a daily basis? Will the most influential company be the developer of a certain world or an infrastructure layer underpinning many worlds?

(This is the final column in a seven-part series about “multiverse” virtual worlds.)

There are three categories of competitors in position for this new stage: gaming incumbents, social media incumbents and new virtual world startups.

Powered by WPeMatico

Pixel phones updated with new gesture controls, emoji, AR effects & more

One of the benefits of owning a Pixel smartphone is that it improves over time, as Pixels are first to receive updates that deliver the latest fixes and improvements. The first round of new features arrived in December, including a filter for robocalls, more photo controls, improved Duo calls and more. Today Google says Pixel owners are getting a second set of additions, this time including new music controls, new emoji, still more photo and video features, expanded emergency help features, Google Pay improvements and several others.

Last year, Google introduced a new sort of gesture control, called Motion Sense, with the introduction of the Pixel 4. The idea is that you can now control your phone without having to touch it. Instead, the smartphone detects the wave of your hands and translates that into software controls.

Already, Motion Sense allowed Pixel 4 owners to skip forward or go back to a previous song. With today’s update, they’ll also be able to pause and resume music by making a tapping gesture above the phone.

Google suggests this will be an easy way to pause your music when you need to have a conversation. But in reality, it will only be useful if it works consistently — and so far, reviews have said the Motion Sense system was finicky and underdeveloped. That could change in time, of course.

Another improvement today is an update to Pixel 4’s Personal Safety app, which first arrived in October. The app uses the phone’s sensors to detect if you’ve been in a severe car crash and checks with you to see if you need help. It also lets U.S. users call 911 with a tap or voice command. If you’re unresponsive, the phone shares your location and details with emergency responders. Now the feature is coming to users in Australia (000) and the U.K. (999).

The new set of updates also includes added AR effects for Google’s video calling app Duo, which can change with your expression and move around the screen. These aren’t Duo’s first set of effects, but keeping the roster of effects updated is critical for social communication apps.

Meanwhile, the Pixel 4’s selfie camera can now create images with depth, which improves Portrait Blur and color pop, and lets you create 3D photos for Facebook.

Pixel phones will also now receive the emoji version 12.1 update, which hit iPhone with the iOS 3.2 update in October 2019, and which arrived on Twitter in January 2020. The set includes 169 new and more inclusive emoji, offering a wider array of gender and skin tones as well as more couple combinations.

A change to Google Pay will now let you press and hold the power button to swipe through your debit and credit cards, event tickets, boarding passes and other stored items. This is coming first to the U.S., U.K., Canada, Australia, France, Germany, Spain, Italy, Ireland, Taiwan and Singapore.

You can also now take a screenshot of a boarding pass’s barcode, then tap a notification to add it to Google Pay to then receive real-time flight updates as notifications. This is rolling out to all countries with Google Play on Pixel 3, 3a and 4 during March.

You can also now take a screenshot of a boarding pass’s barcode, then tap a notification to add it to Google Pay to then receive real-time flight updates as notifications. This is rolling out to all countries with Google Play on Pixel 3, 3a and 4 during March.

For power users, another useful addition lets you now configure rules based on Wi-Fi or physical location. For example, you can set your phone to automatically silence your ringtone when you arrive at work, or go to Do Not Disturb mode when you get home, among other things.

Other new features include the rollout of Live Caption (automatic captions) to Pixel 2 phones, the ability to schedule when Pixel’s Dark Theme turns off and on, an easier means of accessing emergency contacts and medical info, improved long-press options for getting faster help from your apps and an update to Adaptive brightness to make reading in direct sunlight easier.

Google says the new feature set is rolling out starting today. You may not see it immediately, but should fairly soon.

Powered by WPeMatico

Daily Crunch: Nokia’s CEO is stepping down

Nokia announces a big leadership change, an AT&T streaming service expands and we look at how our jobs may have to evolve during to the coronavirus pandemic. Here’s your Daily Crunch for March 2, 2020.

1. Rajeev Suri to step down as Nokia CEO; Pekka Lundmark to take over

The company, like its rivals Sweden-based Ericsson and Chinese giant Huawei, has shifted its attention in recent years to aggressively build a portfolio of technologies and products for 5G networks.

“After 25 years at Nokia, I have wanted to do something different,” said Rajeev Suri, who will leave his current position on August 31 and continue to serve as an advisor to the Nokia Board until the end of this year. Pekka Lundmark is expected to start in his new role on September 1.

2. Streaming service AT&T TV launches nationwide, but isn’t meant for cord cutters

Not to be confused with AT&T TV Now — AT&T’s over-the-top live TV service aimed at cord-cutters, previously called DirecTV Now — the new service is more of an alternative to AT&T-owned DirecTV. AT&T TV offers hundreds of live TV channels, plus 40,000 on-demand titles, and 500 hours of DVR space on a set-top box.

3. How to work during a pandemic

The world is bracing for the seemingly inevitable proliferation of the COVID-19 coronavirus, which has already paralyzed cities and isolated millions. Devin Coldewey offers some guidelines for CEOs, aspiring founders and tech industry employees on how they can continue working in this environment.

4. mParticle raises $45M to help marketers unify customer data

A whole industry of customer data platforms has sprung up since mParticle was founded back in 2013, all offering tools to help marketers create a single view of their customers by unifying data from various sources.

5. Making money from games: The future of virtual economies

In part six of our series about “multiverse” virtual worlds, we explore the dynamics of games’ virtual economies, the exchange of virtual assets for real money, challenges with money laundering and underage gambling, the compliance infrastructure needed for virtual economies and the challenges in balancing a virtual economy’s monetary supply. (Extra Crunch membership required.)

6. India’s Spinny raises $43.7M to expand its online platform for selling used cars

Niraj Singh, co-founder and chief executive of the startup, told TechCrunch that Spinny brings the trust factor that people are looking for when they are purchasing a car.

7. This week’s TechCrunch podcasts

The latest full-length episode of Equity looks at the stock market’s tumble due the coronavirus pandemic, while the Monday news roundup discusses the continuing trickle of tech IPOs. (Original Content will be back next week!)

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here.

Powered by WPeMatico

Thoma Bravo completes $3.9B Sophos acquisition

Thoma Bravo announced today that it has closed its hefty $3.9 billion acquisition of security firm Sophos, marking yet another private equity deal in the books.

The deal was originally announced in October. Stockholders voted to approve the deal in December.

They were paid $7.40 USD per share for their trouble, according to the company, and it indicated that as part of the closing, the stock had ceased trading on the London Stock Exchange. It also pointed out that investors who got in at the IPO price in June 2015 made a 168% premium on that investment.

Sophos hopes its new owner can help the company continue to modernize the platform. “With Thoma Bravo as a partner, we believe we can accelerate our progress and get to the future even faster, with dramatic benefits for our customers, our partners and our company as a whole,” Sophos CEO Kris Hagerman said in a statement. Whether it will enjoy those benefits or not, time will tell.

As for the buyer, it sees a company with a strong set of channel partners that it can access to generate more revenue moving forward under the Thoma Bravo umbrella. Sophos currently partners with 53,000 resellers and managed service providers, and counts more than 420,000 companies as customers. The platform currently helps protect 100 million users, according to the company. The buyer believes it can help build on these numbers.

The company was founded way back in 1985, and raised over $500 million before going public in 2015, according to PitchBook data. Products include Managed Threat Response, XG Firewall and Intercept X Endpoint.

Powered by WPeMatico

New AngelList data set sheds light on the signaling risks of seed-stage investments

One of the big, ongoing debates in VC and founder circles concerns whether to accept money from top-tier, later-stage venture capitalists during a seed round. Even as their funds reach monstrous sizes, more and more top funds are investing in the earliest stages of a startup’s life, intensifying the question for founders of so-called “signaling risk”: if a later-stage investor in your seed round doesn’t actually do your later-stage rounds, does that negatively signal to other potential investors that they should walk away from your company?

It’s a perennial debate largely because it’s hard to build a quality data set to definitively answer the question. But now, we might have some data that finally sheds light on this signaling risk.

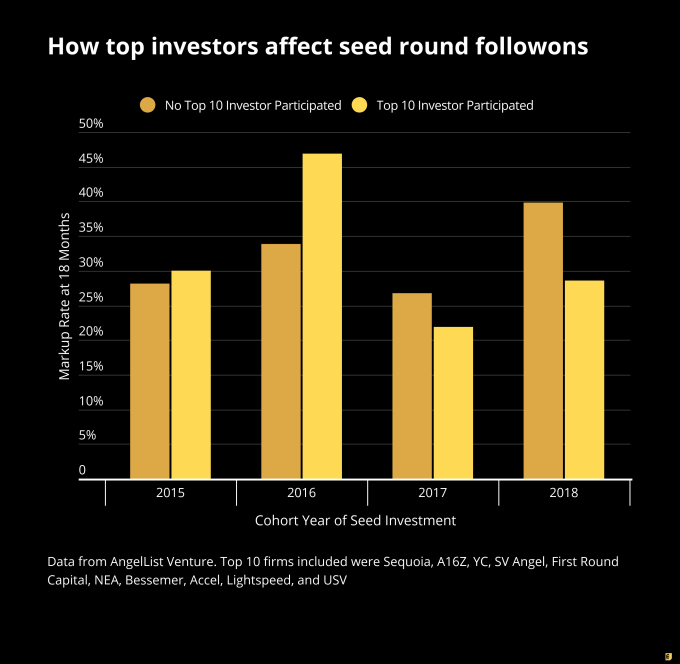

AngelList’s data science team collected information from its Venture portfolio (which includes approximately $1.8 billion assets under management according to the company) to look at how signaling risk has changed over time according to the cohort performance of startups in their portfolio. The essential question was, “Does having a top-10 investor in your seed round improve or hurt your chances of a follow-on round 18 months later, compared to seed rounds without such an investor?” Their work produced this chart:

Two quick and important notes. First, AngelList processed its own data (given the need to protect confidentiality, I wasn’t given direct access to their data set for analysis). Second, AngelList supplied notes on its methodology, which I have attached at the end unedited for those curious how the data set and chart were constructed.

The short summary of the data is that in the 2015 and 2016 cohorts, having a top-10 VC investor in your seed round appeared to improve a startup’s chances to raise a follow-on equity round, particularly in 2016. However, that benefit seemed to reverse itself in the 2017 cohort, and the negative effect was magnified in the 2018 cohort.

The typical caveat emptor applies: correlations are not causations. That said, we know signaling is a real mechanism for VCs to make an investment decision, so there is at least some form of causal path here in the data.

My analysis (and it should be noted this isn’t endorsed by AngelList) is that top-10 investors like Sequoia or a16z have radically expanded their seed investment programs over the past two years in pursuit of more and more cap table access. As VCs scour the universe looking for the next great startup, those firms with the deepest pockets are choosing to invest in any round rather than to try to time their investment into a later round that would more properly fit into the thesis of their massive funds.

So for startups in the 2015 and 2016 cohorts, there was real selectivity (or at least, more selectivity) when it came to getting an investment from a top investor. Those startups may not have gone through the full due diligence process typical of a Series A investment, but they were typically well-vetted, and that sent a strong positive signal to other investors in later rounds.

Perhaps most importantly, and this is based on my own anecdotal data here, but most Series A and later firms that participated in a seed round in those years ended up getting toward the kind of equity ownership they normally target (let’s say 20% as a typical example). So the signaling risk was fairly mute, since if an investor already has their ownership locked in, it’s understandable they wouldn’t necessarily lead the next venture rounds of a company.

All that has changed in the last two years though. Large funds increasingly slosh money through the ecosystem, whether directly as a firm, through seed funds managed by GPs, through scout networks, or indirectly by investing in other seed funds. The exclusivity of these sorts of investments has markedly declined as the capital flood has flowed through the Valley.

Plus, these firms now write ever-smaller checks, and may even join party rounds as well, which means that their ownership post-seed is not nearly as high as it once was. If a top firm does part of your seed and owns 3%, there really is a legitimate question as to why they wouldn’t fund your Series A if they were indeed excited about your prospects and also had information rights to keep track of your startup’s development.

I’ve talked quite extensively about how there are now six stages of seed investing in 2020, and that founders should more carefully identify which stage they truly are in and reach out judiciously to the investors who actually fit those micro-stages.

I think this AngelList data would seem to indicate that big-firm investors can be complicated at the seed stage these days. I’ve generally argued that signaling risk is a relative myth these days, given the competition for deals, but AngelList’s data would seem to indicate that the signaling risk may be more important than I expected.

AngelList’s notes on methodology

We looked at all of the AngelList Venture seed deals (investments by syndicates and funds tagged as “Pre-Seed”, “Seed”, or “Seed+”) that closed in the given year-cohort. Then we looked at whether, after 18 months, those investments had been marked up and had not exited. We believe that is the best proxy in our data for “was an active Series A company”, because the AngelList valuation methodology is to only update valuations on priced equity rounds; companies that raised again with SAFEs would not trigger a markup, even if those SAFEs are at a higher cap. For 2018 deals, we did not consider deals after August 2018 because deals at the end of that year have not had 18 months to season.

After segmenting by year cohort, we further segmented based on whether those deals had the participation of a Top 10 Seed investor. That set of investors was not based on AngelList data but instead used an external data source for which Seed investors have surfaced the most “unicorn” deals. We use the loosest definition of participation: a deal where one of these firms led the seed deal, one of these firms co-led the seed deal, one of these firms wrote a 50k check while a different firm wrote a 500k check, or one or more of these firms participated in a “party round” would all be counted as having the participation of a Top 10 investor.

And adding one more note here that the top-10 investors included in the sample were ultimately Sequoia, a16z, YC, SV Angel, First Round Capital, NEA, Bessemer, Accel, Lightspeed and USV.

Powered by WPeMatico

Podium rolls out payments for its customer-focused local-business SaaS service

Podium, a Utah-based SaaS company focused on small business customer interactions, added payments technology to its product suite today. The move accretes a new income stream to the company’s quickly growing annual recurring revenue (ARR).

While I tend to stay away from product news, Podium’s decision to add payment technology to its service hit a number of themes that we’ve recently explored, like the rise of payments technology players (Finix, for example) and how it is increasingly common to see fintech and finservices solutions find their way into new places.

And Podium is one of SaaS’s fastest-growing companies. Cribbing from some prior reporting, Podium’s ARR reached roughly $30 million at the end of 2017. It expected to reach $60 million by the end of 2018, and had $100 million in its sights for 2019. Those figures, collected in November, are now decidedly out of date. But they illustrate how quickly Podium was growing before it added payments to its arsenal.

Update: Adding a little clarification here. The addition of payments to Podium’s tech allows its customers (the companies using its software) to collect payments from their own customers. This gives Podium customers the ability to charge folks for their goods and services in a manner that is integrated into the rest of the software company’s service.

I wanted to dig into the news, so I emailed with Eric Rea, the company’s CEO. What follows is an email exchange (due to scheduling difficulties). We’ll chat after about what was said.

Context

TechCrunch: Did Podium build out its own payments tech or does it employ third-party tech like Finix?

Podium: Podium has a great relationship with Stripe, a fellow Y Combinator company, which was partnered with our own technology to make it work best for our customers. This was key in order to create a payment tool that actually works in the kinds of businesses we work with. [The] majority of businesses who operate from a physical location, from dentist offices and home services companies to larger retail stores, have very specific needs that haven’t been met by traditional card present or POS systems. As a result, many of them rely on mailing paper invoices or awkward conversations where someone gives their card info over the phone. Putting Podium’s platform technology alongside Stripe’s best-in-class processing tech was able to finally meet this need for the companies that create roughly a third of the US non-farming GDP.

TechCrunch: Does the majority of the economics (profit/margin) from the payments product accrue to the Podium client, or Podium itself?

Podium: The genius behind this product is just how immense the economic impact is for these companies. For many of them, they are able to create a whole new convenient way to serve their customers through conversational commerce, and in doing so, they are able to be more successful.

One of our major furniture retailers that participated in the beta of Payments told me about how there has been a completely new selling motion that has opened up for their stores through this product. One of their biggest leaks was when customers would come in and look at a couch or dresser, but didn’t know if dimensions would work in their home. Once they left, there was a steep drop off getting them back into the store to actually make the purchase.

Now, with Payments, they are able to give all the info to their customer, have them check it out in their home and then text them if it works or not. They can then use Payments to collect payment in the very same text conversation and the delivery crew can complete the purchase all in the same day without having the customer return to the store. So it’s not just shifting where they are processing their payments, but opening up new revenue that they would never have had before they started using Payments.

Then consider the ancient process that businesses are still using who invoice for services, like a dentist or a home services provider. A majority are still using mailed statements and invoices or phone conversations. Believe it or not, the expenses for these are immense. Not only that, but the turnaround and success rates are abysmal, meaning these businesses have to wait weeks to months in order to receive payment, if at all. With Payments, it is as quick as a seamless text.

In our beta, Payments tripled the conversion rates over invoices and reduced employee workload related to payment by 80%. In healthcare, for example, 40% of customers send payment within 48 hours. To get that same level through their legacy operations, it would take 14 days to get to that point. The economic impact on that speed and completion is astounding for these businesses.

On the processing, Podium sees the profit on the transaction cost.

TechCrunch: Does Podium anticipate that payments will provide material revenue over the next 18 months? 36?

Podium: Yes. We see this as being the second major phase of the Podium platform. We have been proud to have created one of the fastest-growing SaaS companies in history through our existing products. We have 43,000 businesses currently using Podium, and one of the biggest things they have all been telling us is how much they need a tool like this. Just in our existing customer base and verticals, they are creating more than $100B in gross processing volume annually in payments that are better suited to be done through this tool.

TechCrunch: How long did it take to build out the tech?

Podium: This product actually took the longest of all of our products to develop, given the unique expectations and requirements it took on the technology side. This product has been about a year in the making. When it comes to the business of making money and us being the facilitator of that, we take it very seriously to ensure the tool is secure and stable.

TechCrunch: What percent of Podium customers are good candidates to use the tech?

Podium: Almost universal. We gave a lot of intention behind making this a tool that would work across market verticals so that our customers could provide a better experience for their customers and get paid faster at the same time.

TechCrunch: What is the fee and cost structure?

Podium: We charge a flat rate for processing, which is intentional to allow transparency and consistency in their fees.

So what?

It’s not a surprise that Podium is taking the economics of the payment processing (with Stripe doing well at the same time). This means that Podium’s business itself will grow thanks to its addition.

At the same time, the clients using Podium’s platform also do well. If the feature can assist as many companies as Podium expects, then it could help a host of small, local firms boost their sales by improving their respective close rates. Even merely faster payments could help smaller shops better manage their cash flow.

So this feels a bit like a win-win. And it goes to show that the addition of payments to other bits of tech is more than hype (Finix will like that). Instead, it feels like adding the ability for transactions to flow directly through one’s platform is going to rise in popularity. Podium is not the first to the trend, and it won’t be the last. But it is a company that could accelerate the trend thanks to its scale and, so far at least, success.

What we’d love to see, frankly, is an S-1 from Podium this year; that would allow us to better dissect its business. Now at least we’ll have one more thing to look for when we do get the document.

Powered by WPeMatico

Unpacking Procore’s S-1 filing

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Today we’re in for a treat, as we get to dig into Procore’s S-1 filing. In case you aren’t familiar, Procore sells software that helps manage construction projects, but it offers more than a single app: Procore’s service allows other apps to plug into it, making it a platform of sorts. The company filed to go public last Friday, meaning that we have endless new numbers to delve into.

Even better for us, Procore is a SaaS company, which means we can understand its numbers.

Procore lists $100 million as its IPO placeholder raise, intends to list on the NYSE as PCOR and its debut is being underwritten by Goldman, J.P. Morgan, Barclays and Jefferies.

Why do we care about this particular IPO? A few reasons. First, Procore filed to go public after the worst week in the stock market since the 2008 crash. That’s either calculated bravery, unbridled hubris or accidental folly. We’ll see. And second, the company’s backers are well-known: Bessemer, Greater Pacific Capital, ICONIQ, Dragoneer and Tiger, according to Crunchbase.

Powered by WPeMatico

Equity Monday: Surprise IPOs, Briza’s $3M round, and are we worried about unicorn liquidity?

Good morning friends, and welcome back to TechCrunch’s Equity Monday, a short-form audio hit to kickstart your week. Regular Equity episodes still drop Friday morning, so if you’ve listened to the show over the years don’t worry — we’re not changing the main show. (Here’s last week’s episode with Danny Crichton, going over the huge Roblox round and what is going on with no-code startups.)

What to say about this Monday other than it feels a bit like last Monday. The markets aren’t doing well, coronavirus is a worry, and we have a cool early-stage round to talk about.

After the stock market took a beating last week, the weekend brought more news concerning the novel coronavirus, with more infections being discovered in the United States. It’s not been the best time to check your 401k if you saving for the long-term.

But in better news, DoorDash’s filing was followed by one from Procore, meaning that IPO season isn’t dead, it’s just glacial, slow, slothful, and far too measured compared to our prior hopes.

This week will see a few sets of earnings that we care about some (JD.com), less, (HPE), and lots (Zoom). When Zoom reports on March 4th it will be carrying the torch for recent, venture-backed IPOs, SaaS companies more broadly, and future-of-work startups specifically. Other than that, no one will be watching what happens to the video conferencing startup that is caught in a rare COVID19 updraft.

Briza

Next, we talked about Briza, a very neat early-stage startup that is working in the commercial insurance API space. Yes, this the fusion of several things I love to write about. Namely insurance-tech and API-infra companies. What would you get if you crossed the insurance marketplaces we’ve been writing about with Plaid? Something like Briza, I reckon.

The 500 Startups-backed company has put together $3 million in capital to date, has 10 people on-staff, is looking to double its personnel, and is heading to the market soon on the back of some notable momentum. With more insurance providers hitting Briza up for inclusion in its product, the startup has good pace heading into its impending Demo Day. And it already has the cash it needs to grow.

Infra is hot because it’s the digital equivalent of selling picks and shovels. And APIs are hot because they are the SaaS of infra.

Infra APIs? So hot right now.

Wrapping

I’m stoked beyond belief that Equity turns three this month. Who would have thought that our little show that started life as a few Facebook Lives with myself, Katie Roof (WSJ) and Matthew Lynley (ex-Brex and now a solo operator) would make it this far. I’m lucky to still be a part of it.

Ok! Back Friday. Stay cool.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

mParticle raises $45M to help marketers unify customer data

mParticle, which helps companies like Spotify, Paypal and Starbucks umanage their customer data, is announcing that it has raised $45 million in Series D funding.

Co-founder and CEO Michael Katz told me that the company has benefited from broader shifts — like new privacy regulation and the shift away from cookie-based browser tracking — that increase brands’ needs for a platform like mParticle that uses “modern data infrastructure” to deliver a personalized experience for customers without running afoul of any regulations.

As result, he said mParticle has nearly quintupled its revenue since it raised a $35 million Series C in 2017. (The company has raised more than $120 million total.)

“The challenges that we solve are universal,” Katz said. “It doesn’t matter if there’s a small company or big company. Data fragmentation, data quality, consistent change in the privacy landscape, consistent change in the technology ecosystem, these are universal challenges.”

Perhaps for that very reason, a whole industry of customer data platforms has sprung up since mParticle was founded back in 2013, all offering tools to help marketers create a single view of their customers by unifying data from various sources. Even big players like Adobe and Salesforce have announced their own CDPs as part of their larger marketing clouds.

When asked about the competition, Katz said, “The market has responded overwhelmingly by saying, ‘I don’t want one vendor to rule everything for me.’ Why be beholden to one suite of tools that’s just an amalgamation of products that were built in the early 2000s?”

Instead, he argued that mParticle customers want “a best-in-breed combination of independent solutions that can be integrated seamlessly.”

Getting back to the new funding — Arrowroot Capital led the round, with the firm’s managing partner Matthew Safaii joining mParticle’s board of directors. Existing investors also participated.

Katz said the funding will be spent in three broad areas: building new products, scaling its global data infrastructure and finding new partners. In fact, the company is also announcing a partnership with LiveRamp, through which mParticle customers can combine their first-party data with the third-party party data from Liveramp.

“We see this partnership with Liveramp as an opportunity to extend the surface area by which our customers can deliver highly personalized, privacy-friendly experiences,” Katz said.

Powered by WPeMatico