Mark Cuban backs ChatableApps, developer of a hearing assist app that removes background noise

ChatableApps, a U.K. startup commercialising the work of auditory neural signal processing researcher Dr. Andy Simpson, has quietly picked up seed money from Mark Cuban. The company has built a smartphone app that provides hearing assistance by removing background noise in near real-time.

Alongside Simpson, the company’s co-founders are Brendan O’Driscoll, Aidan Sliney and George Boyle — the original team behind the music discovery app Soundwave (acquired by Spotify) — and later joined by CEO Giles Tongue, formerly of wearable tech startup NURVV, who has been tasked with taking the business forward.

“Dr Andy Simpson is our CSO [chief science officer] and inventor,” Tongue tells me. “He brings together the auditory neuroscience, auditory perception, neural signal processing and artificial Intelligence, is an AI maverick and contrarian thinker, and this unusual intersection are what has led to the creation of our proprietary ground up neuroscience-led AI. His prolific research had over 400 citations before he went into stealth mode.”

Since then, the team has been busy (although largely flying under the radar). Chatable’s hearing assistant app is available in the Play Store in open beta but is still considered “pre-launch.”

“We’re in a constant cycle of pre-clinical validation, which is going amazingly,” says Tongue. “We’ve heard ‘life changing,’ and had tears in the eyes… of early adopters.”

Chatable’s O’Driscoll says the company’s technology and approach is “completely unique” because it doesn’t use noise filtering or other DSP techniques. “It’s actually a deep learning neural net approach to speech and noise separation that doesn’t apply filters to the original audio but rather it listens and re-prints a brand new audio stream in near real-time which is a mimic of just the vocal components of the original audio,” he tells me.

Describing Chatable as a “click and go” universal hearing aid, O’Driscoll says the app has been engineered to work on any modern day £100 smartphone and with regular ear buds. “The app produces a clear and loud voice so is easy for the user to hear a conversation, and features two sliders, one to turn up volume, the other to control background noise,” he explains.

More broadly, Tongue believes the “global hearing epidemic” is the biggest health issue at scale that AI can solve, and that Chatable has an opportunity to help millions of people in a life changing way. According to the World Health Organisation there are 466 million people with disabling hearing loss. “I believe Chatable has the power to be the first app able to address a global health epidemic using an everyday smartphone,” he says.

Meanwhile, Chatable plans to generate revenue on a subscription basis, charging £9.99 per month. This is certainly designed to ensure the startup is sustainable and can continue to invest in its product for the long term. (For example, an iPhone version of the app is currently in private beta. However, I hope the price can be brought down over time so that it becomes truly affordable to everybody that needs it.)

Powered by WPeMatico

Spindrift, maker of fizzy drinks, has raised $29.8 million

Spindrift, maker of fizzy soda and sparkling water, has raised $29.8 million in a funding round, per an SEC filing. The Charlestown, Mass. company was founded by Bill Creelman and has raised $70 million in known venture capital funding to date, per Crunchbase data.

The company did not immediately respond to request for comment.

Previous investors in the fizzy drink company include Almanac Insights, KarpReilly, Prolong Ventures, VMG Partners and more. Spindrift, founded in 2010, is up against big players, like the beloved and decades-old LaCroix, another sparkling water brand. Spindrift differentiates itself by emphasizing “real fruit” in its drinks. Think cucumbers from Michigan, strawberries from California and Alfonso mangoes from India. A day prior to the filing, Spindrift launched its pineapple flavor.

(In a quick aside looped up with a word we haven’t heard in a while: The company also offered a Golden Pineapple sweepstakes, where 13 winners will get a year’s-supply of free Spindrift and a custom mini-fridge).

Now, it’s worth mentioning that in San Francisco’s Marina district is another fruit-infused direct to consumer brand, sans the bubbles. Hint, founded in 2005 by Kara Goldin, has raised $26.5 million to date from The Perkins Fund and Verlinvest to produce naturally flavored fruit-essence water.

Today, Spindrift raised more than Hint’s total funding in one fell swoop, and both brands, alongside the age-old LaCroix, are synonymous with startup culture and recycling bins. And that tells us that at least according to investors, the future of water is far from, ahem, drying up.

Powered by WPeMatico

Mobile banking app Empower Finance just closed a $20 million Series A round

Another afternoon, another round of funding for a mobile banking app. This time, it’s Empower Finance, a San Francisco-based company that’s headed up by former Sequoia Capital partner Warren Hogarth and which just closed on $20 million in Series A funding from Icon Ventures and Defy Ventures.

David Velez, who is the founder and CEO of Nubank, the largest fintech in Latin America, also joined the round.

We’d first written about the company in 2017, when Hogarth was just getting the business off the ground. Fast-forward a bit and Empower now employs 35 people and has attracted more than 600,000 active users to its platform, says Hogarth. What has drawn them in: the company’s promise of combining AI and actual human financial planners to help millennials in particular accrue some wealth, including, more newly, through its own checking account product and through a savings account that’s currently promising 1.60% in annual percentage yield with no minimums, no overdraft fees and unlimited withdrawals.

It’s all part of an overall offering that crunches through account holders’ bank and credit card accounts, and recommends how much they save into which account, how much they should spend given their overall picture, various ways they can cut costs and where and when they’ve surpassed their pre-configured budgets.

Of course, the company has so much competition it’s dizzying, but like the various upstarts against which it’s battling for mindshare, the opportunity that Empower is chasing is enormous, too. Though companies like Chime can seem overpriced given how fast investors have marked up their rounds — Chime’s newest financing, announced in December, was done at a $5.8 billion post-money valuation, which was four times more than the company was worth at the outset of 2019 — digital banks are still tiny fish in an ocean of institutional financial services, representing something like 3% of the market.

They’re gaining more market share by the day, too, including by charging far lower fees for much more.

In Empower’s case, users pay $6 a month, but Hogarth says they also save $300 a year in additional fees they would pay a brick-and-mortar bank. He insists that on average, it also helps them save $1,300 more annually, too.

As for all those other companies — Mint, Acorns, the list goes on — Hogarth sounds surprisingly sanguine. “If you look at it from the outside, it looks crowded. But the consumer financial services in the U.S. is a $2 trillion business, and we haven’t had a fundamental shift since maybe Schwab came along 30 years ago.”

Indeed, says Hogarth, because Empower and its rivals are mobile and branchless and don’t have legacy software to contend with, they’re able to take 60 to 70% of the cost structure out of the business.

What that means on an individual company level is that even if each upstart can attract 2 to 3 million customers, they can get to a multibillion-dollar market cap. At least, that kind of math is “why there’s so much interest in this space,” says Hogarth.

It’s also why people like Nubank’s Velez, who have seen this story play out in Europe and Latin America and who are seeing the early phases of it in the U.S., are apparently keeping the money spigot open for now.

Empower had earlier raised an undisclosed amount of seed funding from Sequoia, followed by a $4.5 million round led by Initialized Capital.

Powered by WPeMatico

Nvidia acquires data storage and management platform SwiftStack

Nvidia today announced that it has acquired SwiftStack, a software-centric data storage and management platform that supports public cloud, on-premises and edge deployments.

The company’s recent launches focused on improving its support for AI, high-performance computing and accelerated computing workloads, which is surely what Nvidia is most interested in here.

“Building AI supercomputers is exciting to the entire SwiftStack team,” says the company’s co-founder and CPO Joe Arnold in today’s announcement. “We couldn’t be more thrilled to work with the talented folks at NVIDIA and look forward to contributing to its world-leading accelerated computing solutions.”

The two companies did not disclose the price of the acquisition, but SwiftStack had previously raised about $23.6 million in Series A and B rounds led by Mayfield Fund and OpenView Venture Partners. Other investors include Storm Ventures and UMC Capital.

SwiftStack, which was founded in 2011, placed an early bet on OpenStack, the massive open-source project that aimed to give enterprises an AWS-like management experience in their own data centers. The company was one of the largest contributors to OpenStack’s Swift object storage platform and offered a number of services around this, though it seems like in recent years it has downplayed the OpenStack relationship as that platform’s popularity has fizzled in many verticals.

SwiftStack lists the likes of PayPal, Rogers, data center provider DC Blox, Snapfish and Verizon (TechCrunch’s parent company) on its customer page. Nvidia, too, is a customer.

SwiftStack notes that it team will continue to maintain an existing set of open source tools like Swift, ProxyFS, 1space and Controller.

“SwiftStack’s technology is already a key part of NVIDIA’s GPU-powered AI infrastructure, and this acquisition will strengthen what we do for you,” says Arnold.

Powered by WPeMatico

Etsy’s 2-year migration to the cloud brought flexibility to the online marketplace

Founded in 2005, Etsy was born before cloud infrastructure was even a thing.

As the company expanded, it managed all of its operations in the same way startups did in those days — using private data centers. But a couple of years ago, the online marketplace for crafts and vintage items decided to modernize and began its journey to the cloud.

That decision coincided with the arrival of CTO Mike Fisher in July 2017. He was originally brought in as a consultant to look at the impact of running data centers on Etsy’s ability to innovate. As you might expect, he concluded that it was having an adverse impact and began a process that would lead to him being hired to lead a long-term migration to the cloud.

That process concluded last month. This is the story of how a company born in data centers made the switch to the cloud, and the lessons it offers.

Stuck in a hardware refresh loop

When Fisher walked through the door, Etsy operated out of private data centers. It was not even taking advantage of a virtualization layer to maximize the capacity of each machine. The approach meant IT spent an inordinate amount of time on resource planning.

Powered by WPeMatico

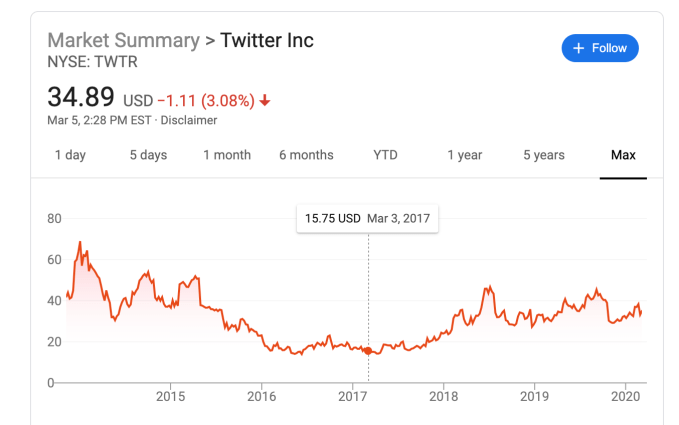

Twitter CEO’s weak argument why investors shouldn’t fire him

Twitter CEO Jack Dorsey might not spend six months a year in Africa, claims the real product development is under the hood and gives an excuse for deleting Vine before it could become TikTok. Today he tweeted, via Twitter’s investor relations account, a multi-pronged defense of his leadership and the company’s progress.

The proclamations come as notorious activist investor Elliott Management prepares to pressure Twitter into a slew of reforms, potentially including replacing Dorsey with a new CEO, Bloomberg reported last week. Sources confirmed to TechCrunch that Elliott has taken a 4% to 5% stake in Twitter. Elliott has previously bullied eBay, AT&T and other major corporations into making changes and triggered CEO departures.

…Focusing on one job and increasing accountability has made a huge difference for us. One of our core jobs is to keep people informed. We want to be a service that people turn to… to see what’s happening, to be a credible source that people learn from.

— Twitter Investor Relations (@TwitterIR) March 5, 2020

Specifically, Elliott is seeking change because of Twitter’s weak market performance, which as of last month had fallen 6.2% since July 2015, while Facebook had grown 121%. The corporate raider reportedly takes issue with Dorsey also running fintech giant Square, and having planned to spend up to six months a year in Africa. Dorsey tweeted that “Africa will define the future (especially the bitcoin one!),” despite cryptocurrency having little to do with Twitter.

Rapid executive turnover is another sore spot. Finally, Twitter is seen as moving glacially slow on product development, with little about its core service changing in the past five years beyond a move from 140 to 280 characters per tweet. Competing social apps like Facebook and Snapchat have made landmark acquisitions and launched significant new products like Marketplace, Stories and Discover.

Dorsey spoke today at the Morgan Stanley investor conference, though apparently didn’t field questions about Elliott’s incursion. The CEO did take to his platform to lay out an argument for why Twitter is doing better than it looks, though without mentioning the activist investor directly. That type of response, without mentioning to whom it’s directed, is popularly known as a subtweet. Here’s what he outlined:

On democracy: Twitter has prioritized healthy conversation and now “the #1 initiative is the integrity of the conversation around the elections” around the world, which it’s learning from. It’s now using humans and machine learning to weed out misinformation, yet Twitter still hasn’t rolled out labels on false news despite Facebook launching them in late 2016.

On revenue: Twitter expects to complete a rebuild of its core ad server in the first half of 2020, and it’s improving the experience of mobile app install ads so it can court more performance ad dollars. This comes seven years late to Facebook’s big push around app install ads.

On shutting down products: Dorsey claims that “5 years ago we had to do a really hard reset and that takes time to build from… we had been a company that was trying to do too many things…” But was it? Other than Moments, which largely flopped, and the move to the algorithmic feed ranking, Twitter sure didn’t seem to be doing too much and was already being criticized for slow product evolution as it tried to avoid disturbing its most hardcore users.

On stagnation: “Some people talk about the slow pace of development at Twitter. The expectation is to see surface level changes, but the most impactful changes are happening below the surface,” Dorsey claims, citing using machine learning to improve feed and notification relevance.

Yet it seems telling that Twitter suddenly announced yesterday that it was testing Instagram Stories-esque feature Fleets in Brazil. No launch event. No U.S. beta. No indication of when it might roll out elsewhere. It seems like hasty and suspiciously convenient timing for a reveal that might convince investors it is actually building new things.

On talent: Twitter is apparently hiring top engineers “that maybe we couldn’t get 3 years ago.” 2017 was also Twitter’s share price low point of $14 compared to $34 today, so it’s not much of an accomplishment that hiring is easier now. Dorsey claims that “Engineering is my main focus. Everything else follows from that.” Yet it’s been years since fail whales were prevalent, and the core concern now is that there’s not enough to do on Twitter, rather than what it does offer doesn’t function well.

On Jack himself: Dorsey says he should have added more context “about my intention to spend a few months in Africa this year,” including its growing population that’s still getting online. Yet the “Huge opportunity especially for young people to join Twitter” seemed far from his mind as he focused on how crypto trading was driving adoption of Square’s Cash App.

“I need to reevaluate” the plan to work from Africa “in light of COVID-19 and everything else going on.” That makes coronavirus a nice scapegoat for the decision while the phrase “everything else” is doing some very heavy lifting in the face of Elliott’s activist investing.

Photographer: Cole Burston/Bloomberg via Getty Images

On fighting harassment: Nothing. The fact that Twitter’s most severe ongoing problem doesn’t even get a mention should clue you in to how many troubles have stacked up in front of Dorsey.

Running Twitter is a big job. So big it’s seen a slew of leaders ranging from founders like Ev Williams to hired guns like Dick Costolo peel off after mediocre performance. If Dorsey wants to stay CEO, that should be his full-time, work-from-headquarters gig.

This isn’t just another business. Twitter is a crucial communications utility for the world. Its absence of innovation, failure to defend vulnerable users and an inability to deliver financially has massive repercussions for society. It means Twitter hasn’t had the products or kept the users to earn the profits to be able to invest in solving its problems. Making Twitter live up to its potential is no side hustle.

Powered by WPeMatico

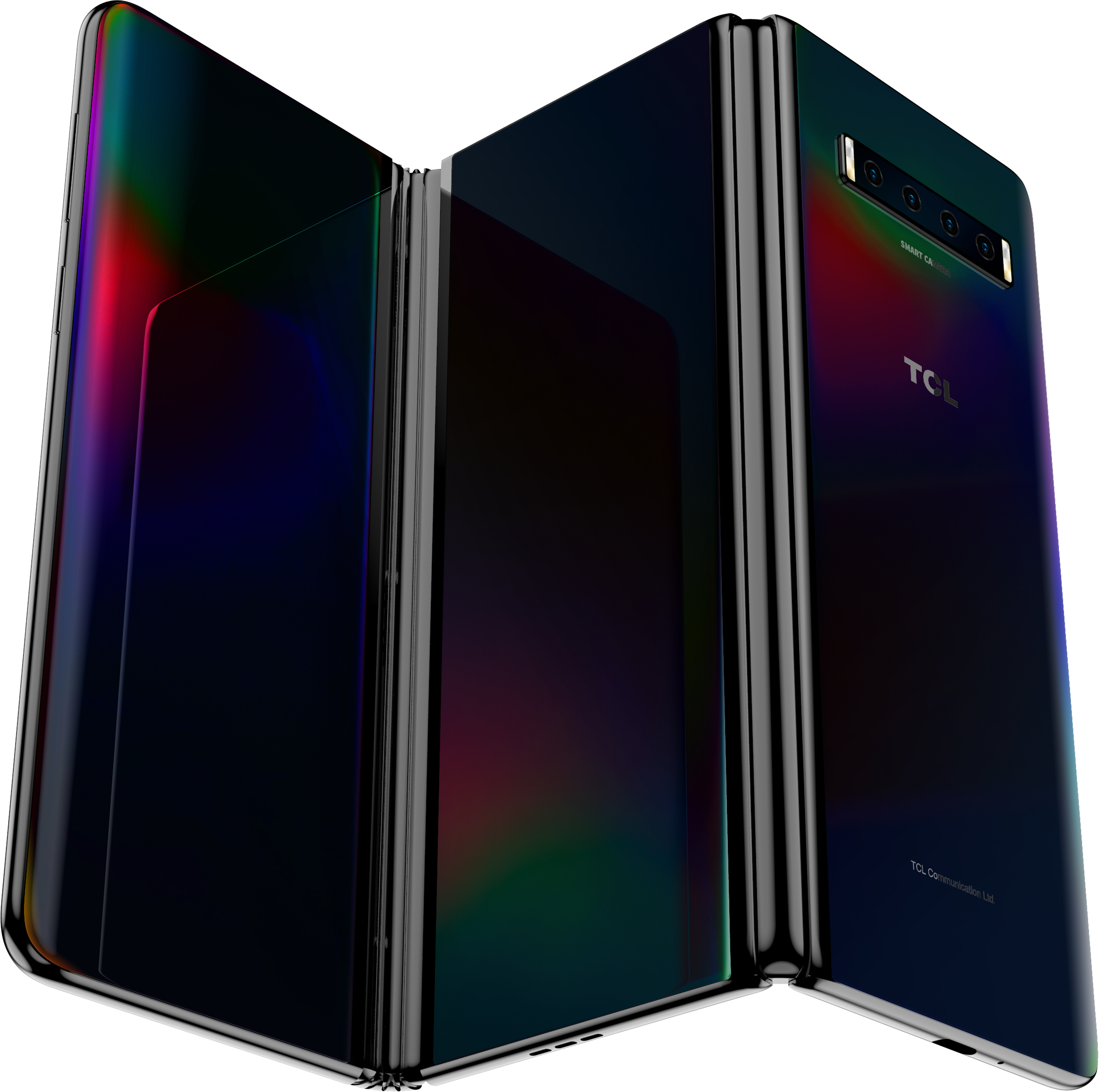

TCL riffs on the foldable format with a pair of prototypes

Those TCL concept phones that were set for Mobile World Congress have finally arrived in prototype form. The Chinese hardware maker showcased a pair of devices this week, including one that saw a brief unveiling during a CES event.

The usual concept caveat certainly applies here. As with concept cars, TCL is clearly gauging consumer interest in certain design elements for the product. And while I’m usually not a fan of dead-end concept devices, there’s something to be said for approaching the foldable category with the same sort of caution you would use to open and close the original Galaxy Fold.

The tri-fold is the product we caught a glimpse of back in January. The name betrays the concept a bit. The device has three screens and two folding mechanisms. That makes for a pretty massively beefy phone when closed, but a luxurious (dual-creased) 10-inch tablet when unfurled.

There’s already some skepticism around how eager users will ultimately be in adopting this technology, and I don’t see effectively double the footprint (and, for that matter, the potential points of failure) as a particularly engaging solution, as nice as it might be to stick a 10-inch tablet in my pocket.

The slide-out device is nothing if not more compelling, allowing the user to essentially pull out the screen for more real estate. That addresses, certainly, hinge and crease issues, but it’s impossible to see if it’s any more robust.

There’s apparently a working unit somewhere in a lab on the other side of the world, but we’re all understandably skeptical until we can get one in our hands.

Powered by WPeMatico

App Store Guidelines ban police-spotting apps, raise bar on dating apps and more

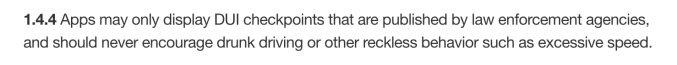

Apple this week alerted developers to a new set of App Store Review Guidelines that detail which apps will be accepted or rejected, and what apps are allowed to do. The changes to the guidelines impact reviews, push notifications, Sign in with Apple, data collection and storage, mobile device management and more, the company says. Some of the more high-profile changes include the ability for apps to now use notifications for ads, stricter rules for dating and fortune-telling apps and a new rule that allows Apple to reject apps that help users evade law enforcement, among other things.

This latter change to police-spotting apps, surprisingly, didn’t get as much attention as push ads or changes to dating apps — though it’s among the most notable of the new rules.

A previous version of the App Store Review Guidelines (seen in a snapshot here from January 2020) stated that apps could only display DUI checkpoints that were published by law enforcement agencies, and noted that apps shouldn’t encourage activities like “drunk driving” or “excessive speed.” These were reasonable concerns.

The revised rule (section 1.4.4.) now says that Apple will reject apps “used to commit or attempt to commit crimes of any kind by helping users evade law enforcement,” in addition to the existing language.

As you may recall, Apple last year got into hot water over its decision to reject a crowdsourced mapping app, HKmap, that was being used by Hong Kong pro-democracy protestors to evade police. Initially, the app had been approved, but was pulled a day after Apple was criticized by Chinese state media who said the app allowed “rioters…to go on violent acts.”

The app had allowed users to crowdsource information like the location of police, the use of tear gas and other details about the protests, which were added to a regularly updated map. In a statement, Apple said it removed the app when it learned it was used to “target and ambush police.”

Above: Section 1.4.4, before and after

The new App Store Review Guidelines now put into writing Apple’s final decision over this sort of app. Effectively, it bans apps that help users evade law enforcement. Arguably, avoiding police isn’t always about wanting to “commit crimes,” as the guidelines state, however. Amnesty International, for example, documented cases of police brutality, including beatings and torture of people in police detention during the Hong Kong protests. The HKmap may have also allowed users to bypass police for their own safety.

Apple’s rule, therefore, is vague enough that it still allows the company itself to make the ultimate call over how an app is being used before deciding to reject or ban it.

Other worthy-of-note changes to the guidelines include an update (section 4.5.4) that allows app developers to send marketing messages (aka ads) in their push notifications. Before, these were banned. This change was immediately hit with user outcry, but it may not be as bad as it first seems.

Clearly, many apps were already spamming their users with ads, despite the prior ban. Now, they’re being required to get customer consent within their app’s user interface and to provide an opt-out mechanism in their app that lets users turn off the push notification ads. This change will at least force reviewers to look for mechanisms and opt-outs in apps offering in-app purchases or that rely on sales to generate revenues.

“Abuse of these services may result in revocation of your privileges,” Apple also warns.

Another change adds “fortune-telling” and “dating” apps to the list of apps that are considered spam if they’re not providing a “unique, high-quality” experience. The relevant section (4.3) warns developers about the app categories that Apple thinks are oversaturated, and where it will be more critical with its reviews.

The guidelines also now include a section (5.6.1) that instruct developers on how to respond to App Store reviews, reminding them to “treat customers with respect when responding to their comments” and not include irrelevant information, personal information, spam, and marketing in their messages. The section also notes that developers must use Apple’s own API to solicit reviews, instead of other mechanisms. This will allow users to toggle off App Store review prompts across all apps from the iOS settings. This language was in the guidelines before, but was moved to 5.6.1 from 1.1.7.

Finally, Apple reminded developers that all apps going forward, including app updates, will need to use the iOS 13 SDK as of April 30, 2020. Apps will need to support the “Sign in with Apple” login/sign-up option as of that date, too.

Correction, 2/5/20, 3:20 PM ET: Clarified that section 5.6.1 is actually a relocated section 1.1.7, instead of a new addition.

Powered by WPeMatico

YC-backed Turing uses AI to help speed up the formulation of new consumer packaged goods

One of the more interesting and useful applications of artificial intelligence technology has been in the world of biotechnology and medicine, where now more than 220 startups (not to mention universities and bigger pharma companies) are using AI to accelerate drug discovery by using it to play out the many permutations resulting from drug and chemical combinations, DNA and other factors.

Now, a startup called Turing — which is part of the current cohort at Y Combinator due to present in the next Demo Day on March 22 — is taking a similar principle but applying it to the world of building (and “discovering”) new consumer packaged goods products.

Using machine learning to simulate different combinations of ingredients plus desired outcomes to figure out optimal formulations for different goods (hence the “Turing” name, a reference to Alan Turing’s mathematical model, referred to as the Turing machine), Turing is initially addressing the creation of products in home care (e.g. detergents), beauty and food and beverage.

Turing’s founders claim that it is able to save companies millions of dollars by reducing the average time it takes to formulate and test new products, from an average of 12 to 24 months down to a matter of weeks.

Specifically, the aim is to reduce all the time it takes to test combinations, giving R&D teams more time to be creative.

“Right now, they are spending more time managing experiments than they are innovating,” Manmit Shrimali, Turing’s co-founder and CEO, said.

Turing is in theory coming out of stealth today, but in fact it has already amassed an impressive customer list. It is already generating revenues by working with eight brands owned by one of the world’s biggest CPG companies, and it is also being trialed by another major CPG behemoth (Turing is not disclosing their names publicly, but suffice it to say, they and their brands are household names).

Turing is co-founded by Shrimali and Ajith Govind, two specialists in data science that worked together on a previous startup called Dextro Analytics. Dextro had set out to help businesses use AI and other kinds of business analytics to help with identifying trends and decision making around marketing, business strategy and other operational areas.

While there, they identified a very specific use case for the same principles that was perhaps even more acute: the research and development divisions of CPG companies, which have (ironically, given their focus on the future) often been behind the curve when it comes to the “digital transformation” that has swept up a lot of other corporate departments.

“We were consulting for product companies and realised that they were struggling,” Shrimali said. Add to that the fact that CPG is precisely the kind of legacy industry that is not natively a tech company but can most definitely benefit from implementing better technology, and that spells out an interesting opportunity for how (and where) to introduce artificial intelligence into the mix.

R&D labs play a specific and critical role in the world of CPG.

Before eventually being shipped into production, this is where products are discovered; tested; tweaked in response to input from customers, marketing, budgetary and manufacturing departments and others; then tested again; then tweaked again; and so on. One of the big clients that Turing works with spends close to $400 million in testing alone.

But R&D is under a lot of pressure these days. While these departments are seeing their budgets getting cut, they continue to have a lot of demands. They are still expected to meet timelines in producing new products (or often more likely, extensions of products) to keep consumers interested. There are a new host of environmental and health concerns around goods with huge lists of unintelligible ingredients, meaning they have to figure out how to simplify and improve the composition of mass-market products. And smaller direct-to-consumer brands are undercutting their larger competitors by getting to market faster with competitive offerings that have met new consumer tastes and preferences.

“In the CPG world, everyone was focused on marketing, and R&D was a blind spot,” Shrimali said, referring to the extensive investments that CPG companies have made into figuring out how to use digital to track and connect with users, and also how better to distribute their products. “To address how to use technology better in R&D, people need strong domain knowledge, and we are the first in the market to do that.”

Turing’s focus is to speed up the formulation and testing aspects that go into product creation to cut down on some of the extensive overhead that goes into putting new products into the market.

Part of the reason why it can take upwards of years to create a new product is because of all the permutations that go into building something and making sure it works as consistently as a consumer would expect it to (which still being consistent in production and coming in within budget).

“If just one ingredient is changed in a formulation, it can change everything,” Shrimali noted. And so in the case of something like a laundry detergent, this means running hundreds of tests on hundreds of loads of laundry to make sure that it works as it should.

The Turing platform brings in historical data from across a number of past permutations and tests to essentially virtualise all of this: It suggests optimal mixes and outcomes from them without the need to run the costly physical tests, and in turn this teaches the Turing platform to address future tests and formulations. Shrimali said that the Turing platform has already saved one of the brands some $7 million in testing costs.

Turing’s place in working with R&D gives the company some interesting insights into some of the shifts that the wider industry is undergoing. Currently, Shrimali said one of the biggest priorities for CPG giants include addressing the demand for more traceable, natural and organic formulations.

While no single DTC brand will ever fully eat into the market share of any CPG brand, collectively their presence and resonance with consumers is clearly causing a shift. Sometimes that will lead to acquisitions of the smaller brands, but more generally it reflects a change in consumer demands that the CPG companies are trying to meet.

Longer term, the plan is for Turing to apply its platform to other aspects that are touched by R&D beyond the formulations of products. The thinking is that changing consumer preferences will also lead to a demand for better “formulations” for the wider product, including more sustainable production and packaging. And that, in turn, represents two areas into which Turing can expand, introducing potentially other kinds of AI technology (such as computer vision) into the mix to help optimise how companies build their next generation of consumer goods.

Powered by WPeMatico

Emma, the personal finance tracker, scores $2.5M seed led by Connect Ventures

Emma, the personal finance management app that bills itself as your best “financial friend,” has raised $2.5 million in seed funding.

Connect Ventures led the round, with participation from Ithaca Investments, Tiny.vc and existing investor, Aglaé Ventures. The fintech previously raised $700,000 in angel funding in June 2018.

Launched in the U.K. in early 2018 — and most recently expanding to the U.S. and Canada — the Emma app connects to your bank accounts (and crypto wallets) to help you budget, track spending and save money.

It aims to let you understand how much money you have left to spend until payday, track and find wasteful subscriptions or alert you when you are paying over the odds on utility bills, and preemptively help you avoid going into your bank’s overdraft.

For those who like to be more hands-on with tracking their finances, Emma also offers a paid subscription version of its app dubbed “Emma Pro”. It lets you do additional things like create custom categories, add emojis to custom categories, export your data between specified time ranges, create manual accounts in any currency, create manual transactions, and split transactions,

“In a world where 70% of mental health issues are derived by financial problems, Emma is defining a new category, financial therapy,” says Emma founder and CEO Edoardo Moreni. “Our mission is to remove anxiety regarding money matters and bring instant gratification whenever our users interact with money regardless of their financial situation”.

Noteworthy, Connect Ventures is also an investor in open banking platform TrueLayer, which Emma uses to power its account aggregation in the U.K. (it uses Plaid in the U.S.). Describing TrueLayer as the “infrastructure layer,” Connect’s Rory Stirling says Emma represents investing in the “application layer” – perhaps as it is just the kind of app open banking promised.

“The team at Emma have built a product people love and as a result they have the highest engagement and retention we’ve seen in this category,” he says in a statement. “That’s really exciting to us – better tools for financial education and empowerment are only valuable if people engage with them”. (Users open the app on average five times a week, twice a day).

“We have about 200,000 users now and are growing pretty fast in the U.S., Canada and U.K.,” Moreni tells me. “We’ll be launching in every english speaking country and we’ll raise our Series A in the next 12 months. If you think about it, every single generation in history had a tracker. At Emma, we want to become the abacus for the modern world”.

Powered by WPeMatico