Torch & Everwise merge into affordable exec coaching for all

While companies might pay for a CEO coach, lower level employees often get stuck with lame skill-building worksheets or no mentorship at all. Not only does that limit their potential productivity, but it also makes them feel stagnated and undervalued, leading them to jump ship.

Therapy… err… executive coaching is finally becoming destigmatized as entrepreneurs and their teams realize that everyone can’t be crushing it all the time. Building a business is hard. It’s okay to cry sometimes. But the best thing you can do is be vulnerable and seek help.

Torch emerged from stealth last year with $18 million in funding to teach empathy to founders and C-suite execs. Since 2013, Everwise has raised $26 million from Sequoia and others for its peer-to-peer mentorship marketplace that makes workplace guidance accessible to rank-and-file staffers. Tomorrow they’ll official announce their merger under the Torch name to become a full-stack career coach for every level of employee.

“As human beings, we face huge existential challenges in the form of pandemics, climate change, the threats coming down the pipe from automation and AI” says Torch co-founder and CEO Cameron Yarbrough. “We need to create leaders at every single level of an organization and ignite these people with tools and human support in order to level up in the world.”

Startup acquisitions and mergers can often be train wrecks because companies with different values but overlapping products are jammed together. But apparently it’s gone quite smoothly since the products are so complementary, with all 70 employees across the two companies keeping their jobs. “Everwise is much more bottom up whereas Torch is about the upper levels, and it just sort of made sense” says Garry Tan, partner and co-founder of Initialized Capital that funded Torch’s Series A and is also a client of its coaching.

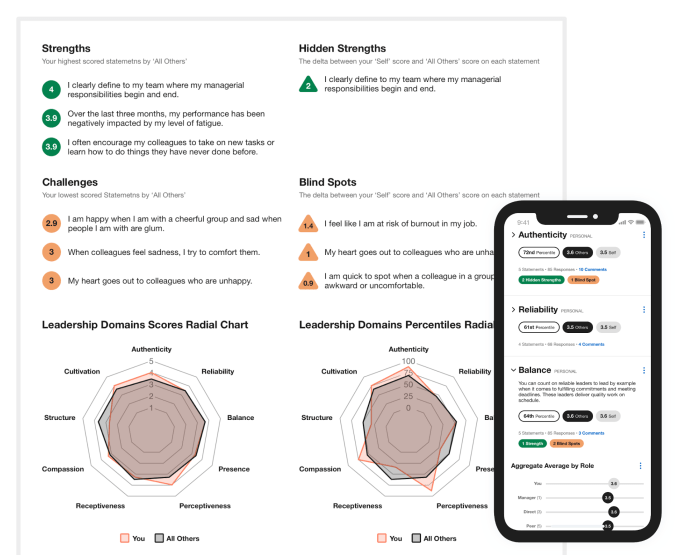

How does each work? Torch goes deep, conducting extensive 360-interviews with an executive as well as their reports, employees, and peers to assess their empathy, communication, vision, conflict resolution, and collaboration. Clients’ executives do extensive 360-interviews. It establishes quantifiable goals that executives work towards through video call sessions with Torch’s coaches. They learn about setting healthy workplace boundaries, staying calm amidst arguments, motivating staff without seeming preachy, and managing their own ego.

This coaching can be exceedingly valuable for the leaders setting a company’s strategy and tone. But the one-on-one sessions are typically too expensive to buy for all levels of employees. That’s where Everwise comes in.

Everwise goes wide, offering a marketplace with 6,000 mentors across different job levels and roles that can provide more affordable personal guidance or group sessions with 10 employees all learning from each other. It also provides a mentorship platform where bigger companies can let their more senior staffers teach junior employees exactly what it takes to succeed. That’s all stitched together with a curated and personalized curriculum of online learning materials. Meanwhile, a company’s HR team can track everyone’s progress and performance through its Academy Builder dashboard.

“We know Gen Z has grown up with mentors by their side from SAT prep” says Torch CMO Cari Jacobs. Everwise lets them stay mentored, even at early stages of their professional life. “As they advance through their career, they might notch up to more executive private coaching.” Post-merger, Torch can keep them sane and ambitious throughout the journey.

“It really allows us to move up market without sacrificing all the traction we’ve built working with startups and mid-market companies,” Yarbrough tells me. Clients have included Reddit and ZenDesk, but also giants like Best Buy, Genentech, and T-Mobile.

The question is whether Everwise’s materials are engaging enough to not become just another employee handbook buried on an HR site that no one ever reads. Otherwise, it could just feel like bloat tacked onto Torch. Meanwhile, scaling up to bigger clients pits Torch against long-standing pillars of the executive coaching industry like Aon and Korn Ferry that have been around for decades and have billions in revenue. Meanwhile, new mental health and coaching platforms are emerging like BetterUp and Sounding Board.

But the market is massive since so few people get great coaching right now. “No one goes to work and is like, ‘Man, I wish my boss was less mindful,’” Tan jokes. When Yarbrough was his coach, the Torch CEO taught the investor that while many startup employees might think they thrive on flexibility, “people really want high love and high structure.” In essence, that’s what Torch is trying to deliver — a sense of emotional camaraderie mixed with a prod in the direction of fulfilling their destiny.

Powered by WPeMatico

Hashicorp soars above $5B valuation in new $175M venture round

The rise of the cloud over the past decade has forced software developers and DevOps engineers to completely rearchitect the modern web application, ensuring scalability, performance, and security. That’s a really painful proposition when done manually, which is where Hashicorp comes in to play. The company’s suite of products helps everyone in the tech workforce from IT admins to software developers operate in the cloud (mostly) effortlessly and natively.

The company’s products have long garnered rave reviews from technical staffs, and now the company is looking at a brand new massive valuation.

The SF-based startup announced today that it has raised $175 million in Series E financing from Franklin Templeton Investments at a scorching $5.1 billion valuation. For context, when we last covered the company back in late 2018, its valuation was only a “paltry” $1.9 billion following a $100 million round led by growth investor IVP.

The company in its release today touted its success in doubling revenues and customers every year for four straight years as the key reason behind the flush valuation. The company is making a (not so) subtle point that David McJannet, who joined the company as CEO in mid-2016 following a stint as an EIR at Greylock, has seen some success in his new role.

Hashicorp CEO David McJannet. Photo via Hashicorp

The company, founded by Mitchell Hashimoto and Armon Dadgar in 2012, is one of the major pioneers in helping companies build high-quality infrastructure that’s a mix of multi-cloud providers, private cloud, and even legacy systems.

It’s most well-known product is Terraform, which allows developers to write repeatable rules around enterprise infrastructure rather than a patchwork of different scripts that might not work as its writers intended. The idea is that with a consistent framework, Hashicorp’s product can help companies reduce costs (by protecting against, say, over-provisioning of resources) while also helping to balance scale and performance. The company’s other products include Consul around network automation, Vault for security, and Nomad for application deployment.

Hashicorp touches on a bunch of competitive products, but its cohesive set of tools and strong outreach to the developer community has set itself apart from the competition in recent years.

Franklin Templeton is a fairly late stage investor that has funded such enterprise companies as Cloudflare, which went public last year, logs management platform SumoLogic, and cybersecurity business Tanium, all according to Crunchbase.

With a hefty $5.1 billion valuation, the company narrowly missed the catastrophic decline of SaaS stocks over the past few weeks, which have been buffeted by the rapidly spreading global pandemic. But with a new war chest and a focus on a popular and growing enterprise market, the company seems poised to continue its growth.

Powered by WPeMatico

TransferWise partners with Alipay for international money transfers

TransferWise, the London-headquartered international money transfer service most recently valued by investors at $3.5 billion, has partnered with China’s Aliplay for international transfers.

The launch enables TransferWise’s now 7 million-plus users to be able to send Chinese yuan from 17 currencies to users of Alipay, which serves more than 1.2 billion people worldwide including via its local e-wallet partners.

Promising “instant” money transfers — under 20 seconds, apparently — TransferWise users simply need the recipient’s name and Alipay ID to initiate a money transfer. The money will then be sent to the bank account linked to the recipient’s Alipay profile.

It could be a potentially smart bit of business by TransferWise, which has sometimes struggled to secure the kind of partnerships that can accelerate its customer base and increase transaction volume. According to a 2019 report, the fintech is citing, China is projected to be one of the top remittance recipient countries in the world, with £54bn expected to be sent back home by Chinese expats and migrants living abroad.

“The partnership is a major expansion for TransferWise as it reaches a new, additional market of people managing their money via the Alipay platform,” says the company.

With that said, Alipay is the second meaningful partnership that TransferWise has announced in the last few months. In November, it joined forces with GoCardless, the London fintech that lets customers pay via recurring bank payments (known as Direct Debits in the U.K.). GoCardless is used by more than 50,000 businesses worldwide, spanning multinational corporations to SMBs, and the partnership sees its own FX functionality powered by TransferWise.

Powered by WPeMatico

To make locks touchless, Proxy bluetooth ID raises $42M

We need to go hands-off in the age of coronavirus. That means touching fewer doors, elevators, and sign-in iPads. But once a building is using phone-based identity for security, there’s opportunities to speed up access to WIFI networks and printers, or personalize conference rooms and video call set-ups. Keyless office entry startup Proxy wants to deliver all of this while keeping your phone in your pocket.

“The door is just a starting point” Proxy co-founder and CEO Denis Mars tells me. “We’re . . . empowering a movement to take back control of our privacy, our sense of self, our humanity, our individuality.”

With the contagion concerns and security risks of people rubbing dirty, cloneable, stealable key cards against their office doors, investors see big potential in Proxy. Today it’s announcing here a $42 million Series B led by Scale Venture Partners with participation from former funders Kleiner Perkins and Y Combinator plus new additions Silicon Valley Bank and West Ventures.

The raise brings Proxy to $58.8 million in funding so it can staff up at offices across the world and speed up deployments of its door sensor hardware and access control software. “We’re spread thin” says Mars. “Part of this funding is to try to grow up as quickly as possible and not grow for growth sake. We’re making sure we’re secure, meeting all the privacy requirements.”

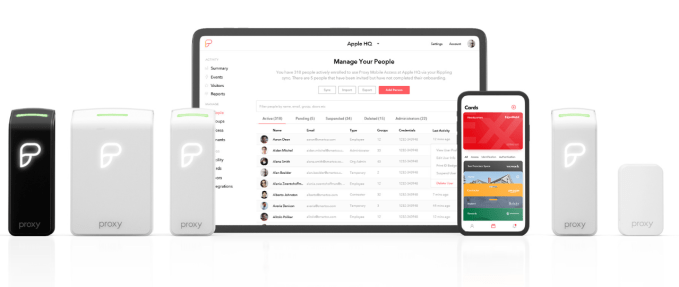

How does Proxy work? Employers get their staff to install an app that knows their identity within the company, including when and where they’re allowed entry. Buildings install Proxy’s signal readers, which can either integrate with existing access control software or the startup’s own management dashboard.

Employees can then open doors, elevators, turnstiles, and garages with a Bluetooth low-energy signal without having to even take their phone out. Bosses can also opt to require a facial scan or fingerprint or a wave of the phone near the sensor. Existing keycards and fobs still work with Proxy’s Pro readers. Proxy costs about $300 to $350 per reader, plus installation and a $30 per month per reader subscription to its management software.

Now the company is expanding access to devices once you’re already in the building thanks to its SDK and APIs. Wifi router-makers are starting to pre-provision their hardware to automatically connect the phones of employees or temporarily allow registered guests with Proxy installed — no need for passwords written on whiteboards. Its new Nano sensors can also be hooked up to printers and vending machines to verify access or charge expense accounts. And food delivery companies can add the Proxy SDK so couriers can be granted the momentary ability to open doors when they arrive with lunch.

Rather than just indiscriminately beaming your identity out into the world, Proxy uses tokenized credentials so only its sensors know who you are. Users have to approve of new networks’ ability to read their tokens, Proxy has SOC-2 security audit certification, and complies with GDPR. “We feel very strongly about where the biometrics are stored . . . they should stay on your phone” says Mars.

Yet despite integrating with the technology for two-factor entry unlocks, Mars says “We’re not big fans of facial recognition. You don’t want every random company having your face in their database. The face becomes the password you were supposed to change every 30 days.”

Keeping your data and identity safe as we see an explosion of Internet Of Things devices was actually the impetus for starting Proxy. Mars had sold his teleconferencing startup Bitplay to Jive Software where he met his eventually co-founder Simon Ratner, who’d joined after his video annotation startup Omnisio was acquired by YouTube. Mars was frustrated about every IoT lightbulb and appliance wanting him to download an app, set up a profile, and give it his data.

The duo founded Proxy in 2016 as a universal identity signal. Today it has over 60 customers. While other apps want you to constantly open them, Proxy’s purpose is to work silently in the background and make people more productive. “We believe the most important technologies in the world don’t seek your attention. They work for you, they empower you, and they get out of the way so you can focus your attention on what matters most — living your life.”

Now Proxy could actually help save lives. “The nature of our product is contactless interactions in commercial buildings and workplaces so there’s a bit of an unintended benefit that helps prevent the spread of the virus” Mars explains. “We have seen an uptick in customers starting to set doors and other experiences in longer-range hands-free mode so that users can walk up to an automated door and not have to touch the handles or badge/reader every time.”

The big challenge facing Proxy is maintaining security and dependability since it’s a mission-critical business. A bug or outage could potentially lock employees out of their workplace (when they eventually return from quarantine). It will have to keep hackers out of employee files. Proxy needs to stay ahead of access control incumbents like ADT and HID as well as smaller direct competitors like $10 million-funded Nexkey and $28 million-funded Openpath.

Luckily, Proxy has found a powerful growth flywheel. First an office in a big building gets set up, then they convince the real estate manager to equip the lobby’s turnstiles and elevators with Proxy. Other tenants in the building start to use it, so they buy Proxy for their office. Then they get their offices in other cities on board…starting the flywheel again. That’s why Proxy is doubling down on sales to commercial real estate owners.

The question is when Proxy will start knocking on consumers’ doors. While leveling up into the enterprise access control software business might be tough for home smartlock companies like August, Proxy could go down market if it built more physical lock hardware. Perhaps we’ll start to get smart homes that know who’s home, and stop having to carry pointy metal sticks in our pockets.

Powered by WPeMatico

Grocery delivery apps see record downloads amid coronavirus outbreak

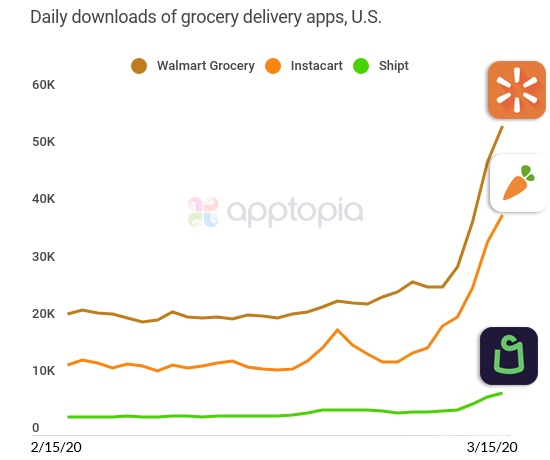

As the COVID-19 pandemic spreads across the U.S., grocery delivery apps have begun seeing record numbers of daily downloads, according to new data from app store intelligence firm Apptopia. On Sunday, online grocery apps, including Instacart, Walmart Grocery and Shipt, hit yet another new record for daily downloads for their respective apps, the firm says.

Comparing the average daily downloads in February to yesterday (Sunday, March 15), Instacart, Walmart Grocery and Shipt have seen their daily downloads surge by 218%, 160% and 124%, respectively.

Typically, these apps (except for Shipt) see tens of thousands to as many as 20,000+ downloads per day. But on Sunday, Instacart saw more than 38,500 downloads and Walmart Grocery saw nearly 54,000 downloads, the firm says. Shipt, though hitting record numbers, saw only 7,285 downloads on Sunday. To some extent, its lower figures could be due to Target’s move to integrate Shipt’s grocery delivery service, which it owns, into its main app.

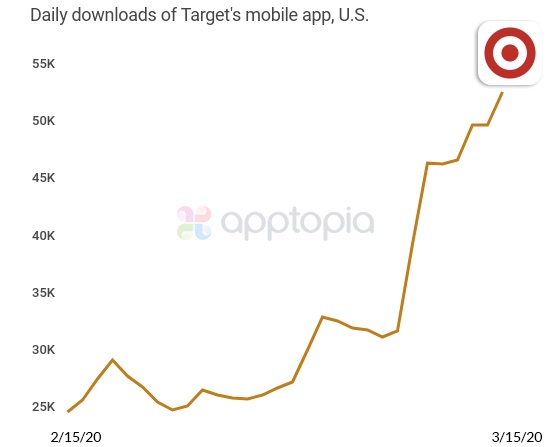

In fact, the Target app has also broken records for daily downloads, the report found. On Sunday, Target’s app saw more than 53,100 daily downloads; a month ago, it was seeing 25,000+.

Walmart very recently announced it would merge its grocery delivery service into its main app, as Target has done. But for now, consumers are still seeking and downloading its standalone grocery app at record levels.

These grocery delivery apps are in demand more than ever during this health crisis.

With government mandates to practice “social distancing,” U.S. consumers have been stocking up for long weeks to be spent at home. Stores were cleared of key supplies, like toilet paper, and several also saw long lines and crowds as panic-buying set in. Grocery delivery and pickup, meanwhile, presents an easier option — as well as one where you could limit your exposure to other people. With grocery pickup, consumers only have to interact with a single store employee from their curbside parking space. And with grocery delivery, most orders can simply be left on the doorstep with no person-to-person contact required.

Several grocery delivery services, including Instacart and others, promoted the fact they would add a “contactless” delivery option, which helps contribute to the huge sales boost. On Thursday, Instacart said its sales growth rates for the week was 10 times higher than the week before, and had increased by as much as 20 times in areas like California, New York, Washington and Oregon.

Apptopia’s report didn’t analyze the impact of the coronavirus outbreak on Amazon’s grocery delivery business, which includes Amazon Fresh and Whole Foods deliveries. This is more difficult to do because Amazon grocery orders aren’t placed inside a dedicated app, as with Instacart. However, Amazon confirmed a technical glitch on Sunday affected online orders through both its grocery delivery services, which the company attributed to the increase in online shopping.

“As COVID-19 has spread, we’ve seen a significant increase in people shopping online for groceries,” an Amazon spokeswoman explained, in a statement shared with Bloomberg. “This resulted in a systems impact affecting our ability to deliver Amazon Fresh and Whole Foods Market orders [on Sunday night]. We’re contacting customers, issuing concessions, and are working around the clock to quickly to resolve the issue,” they added.

Amazon Prime is also expected to experience delays and shortages as consumers stock up on non-grocery household items, the company says.

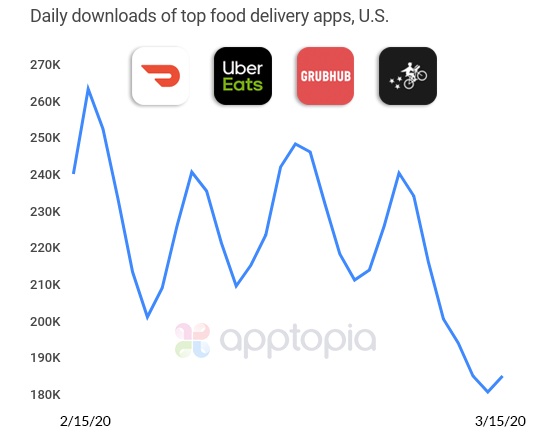

But even as grocery delivery booms, the market for food delivery apps has not seen the same results.

Despite promises for contactless delivery from several providers, including Uber Eats, food delivery apps are not experiencing a similar surge in daily downloads. According to Apptopia, the food delivery market earlier in March was starting to cool off. It later began to pick up but then cooled off again as consumers realized the expense of ordering food compared with home cooking, and because some consumers view restaurant delivery as not being as safe as cooking at home.

Powered by WPeMatico

Kenya turns to M-Pesa mobile-money to stem the spread of COVID-19

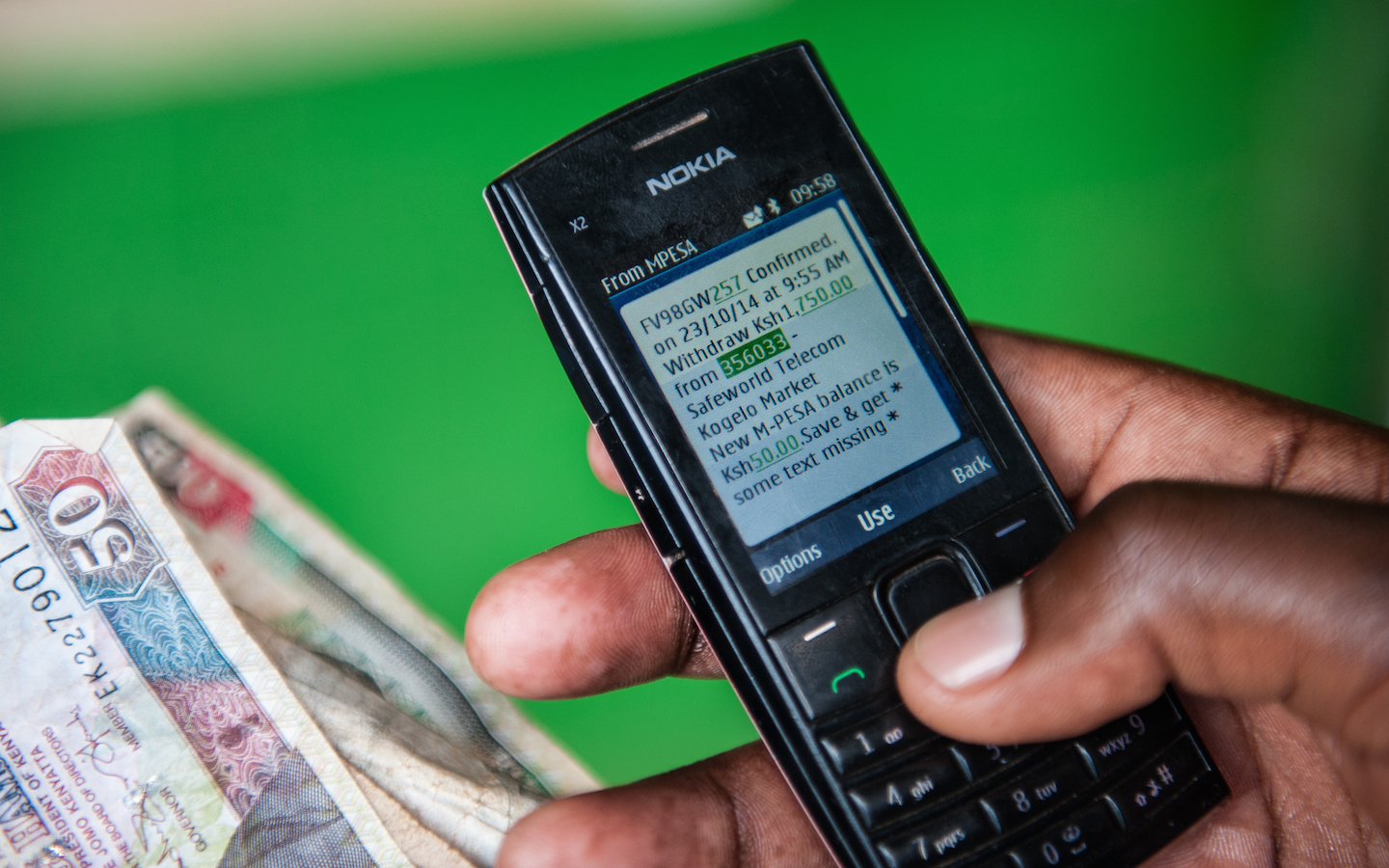

Kenya’s largest teleco, Safaricom, will implement a fee-waiver on East Africa’s leading mobile-money product, M-Pesa, to reduce the physical exchange of currency in response to the COVID-19 outbreak.

The company announced that all person-to-person (P2P) transactions under 1,000 Kenyan Schillings (≈ $10) would be free starting Tuesday for the next 90 days.

The move came after Safaricom met with the country’s Central Bank and per a directive from Kenya’s President Uhuru Kenyatta “to explore ways of deepening mobile-money usage to reduce risk of spreading the virus through physical handling of cash,” according to a release provided to TechCrunch from Safaricom.

To encourage the use of digital payments over cash, the East African telecom will also allow SMEs to increase their daily M-Pesa transaction limits from 70,000 Kenyan Schillings to 150,000 (≈ $700 to $1,500).

The measures represent the ability of the Kenyan government to use digital finance as a lever to influence social distancing and P2P transactions in an infectious health crisis.

M-Pesa has 20.5 million customers across a network of 176,000 agents and generates around one-fourth ($531 million) of Safaricom’s ≈ $2.2 billion annual revenues (2018). The company has held nearly 75% of the mobile-money market share in Kenya for nearly a decade and the country has the highest mobile-money usage rates in Africa.

In some respects, having all that output on one platform represents systemic risks to Kenya’s economy. But in the case of a global health pandemic spread by human contact, the dominance of mobile money in the country provides a policy tool to encourage digital versus physical contact on a wide scale through financial transactions.

Kenya has only three cases of COVID-19 (aka the coronavirus), according to Worldometer, but the country is taking cautionary measures. President Uhuru cancelled two foreign meetings due to the virus, the University of Nairobi shut down classes and a number of companies in the country are encouraging workers to telecommute, according to local sources and press reporting.

Powered by WPeMatico

YC graduate Genecis Bioindustries turns food waste into compostable plastics

Unfortunately, the world doesn’t have a constant quantity of problems, and while governments and most private businesses are focused on tackling the ongoing COVID-19 pandemic, companies like Genecis Bioindustries are working on technologies to solve another major problem: climate change.

For over a decade, sustainability advocates and entrepreneurs have been searching for a way to transform the plastics industry.

While plastics are a building block for modern industry (historically, there’s been a great future in it), they’re also a byproduct of the highly polluting petrochemical business; produce 300 million tons of waste per year (for single use plastic); and production could throw off 1.34 gigatons per year of greenhouse gas emissions over the next decade, according to the NRDC.

That’s why entrepreneurs and investors have sunk hundreds of millions of dollars over the years into companies like NatureWorks, which has raised more than $150 million since its launch in 1997.

Genecis Bioindustries uses bacteria to make compostable bioplastics from food waste. The polymer that the company makes is called PHA, and it works similarly to most plastics. For waste managers, the company can take existing waste off of their hands and plastic manufacturers get a sustainable, biodegradable resin to use. The company already has partnerships with companies like the food services company Sodexo, and has been tapped as a participant in the Innovation Challenge with Novo Nordisk.

Based in Scarborough, Canada, just outside Toronto, Genecis has been developing its technology commercially since 2017 and has filed for at least one patent in the U.S. last year.

The technology at the core of the company’s new PHA manufacturing process is a new species of bacteria that the company evolved. The bacteria converts carbon-based organic waste into organic acids, according to chief executive Luna Yu.

The two-step process is based on two groups of specialized bacteria used throughout the process: The first group digests food waste, producing short-chain carbons as volatile fatty acids, acting as the precursor feed stock for the second group, which eats these carbons and converts them into bioplastics.

Yu and her team initially collected samples by scouring municipal waste facilities to identify where organic material was decomposing really quickly (talk about turning trash into treasure).

“We really try to look at anywhere that has a high turnover rate,” said Yu. That meant going online and searching through databases to look at soil degradation rates in different areas and going to waste facilities to find new strains of bacteria.

Genecis already has a 4,000-square-foot pilot facility where it’s manufacturing roughly one kilogram of PHA per week, and has partnered with the National Research Council of Canada to build out the next scale of its manufacturing plant. That plant, funded with a $1.6 million grant from the Canadian government, will produce between 50 and 70 kilograms of PHA on a weekly basis and process more than two tons of organic waste, Yu said.

By contrast, large scale commercial plastic facilities make between 50 to 100 tons of similar material per day. Yu says that her company can reach those production numbers in a commercial facility.

Not only can they make the compostable plastic, reducing the plastic waste in the environment, but by using food waste as a feed stock Yu said her company can reduce greenhouse gas emissions by 80%.

And its target price point for PHA is roughly 30-40% less than what’s currently available on the market.

For investors who remember the clean technology revolution of the mid-to-late 2000s, this may all sound very familiar, but Yu said there’s a difference between what happened (and failed to happen) over a decade ago.

“Back in the 2000s most companies were using sugars as a feed stock and they were encountering bottlenecks to increase the yield,” she said. The companies also didn’t have access to computational biology and the necessary tools to make true engineering of the microbes work, Yu said.

“A lot of these bottlenecks came because companies were solely focused on engineering bacteria to increase yield,” Yu said. New tools enabling programmable biology mean bacteria can do more to reduce the cost — eliminating more of the mechanical processing steps and letting the biological processes do more of the work, she said.

Yu concedes that the company’s compostable plastics won’t be cost-competitive with commodity petroleum plastics, especially as the price of oil drops to unprecedented lows, but believes there’s still a market in premium foods, 3D filaments and the medical industry.

“The biggest opportunity we saw is the organic acids we could get from food waste that we could turn into specialty chemicals much more effectively and cheaper than using corn or sugarcane,” Yu said. “At the end of the day, our vision is to create sustainable materials using sustainable feed stock.”

Powered by WPeMatico

Microsoft just revealed a ton of new info about the Xbox Series X

There will be no E3 this summer. And quite frankly, the future of just about every conference for the year looks to be in jeopardy, at best. Understandably, Microsoft is releasing most of the Xbox Series X info online in the meantime. A few weeks ago, it offered some key insights into the next-gen console; today it has come out with far and away its deepest dive yet.

A momentary respite, perhaps, from the news of the world, this morning brought four separate blog posts, a hands-on video and a whole lot of information for developers. Bookmark this glossary post in the meantime, if you need to cross-reference any of the information referenced here or in the original post.

At very least, it will help you sound a bit smarter when you explain all of this stuff to a loved one.

Okay, let’s start with the spec breakdown:

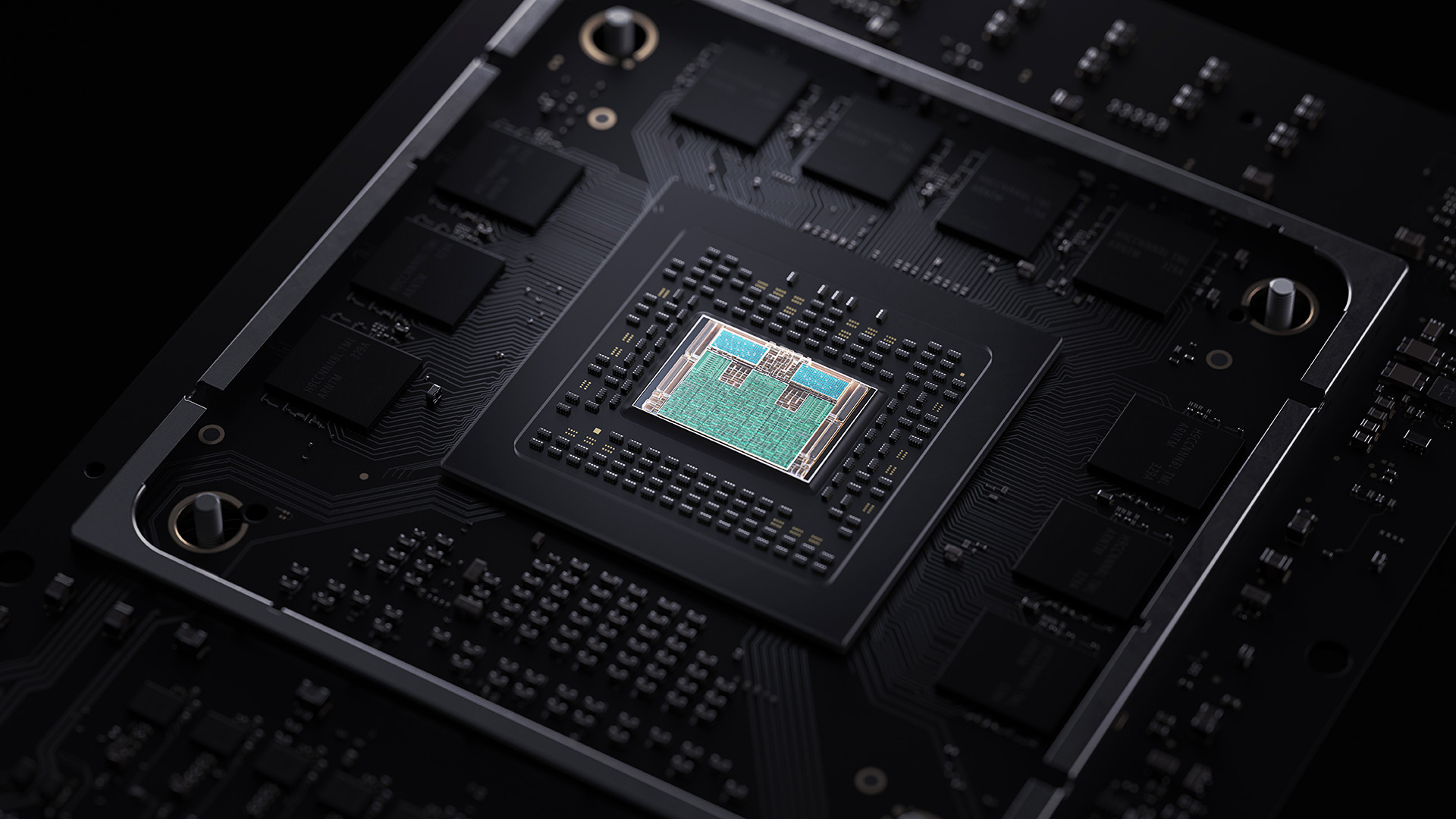

So, a custom 8 core AMD Zen 2 CPU and an RDNA 2-class GPU. “Xbox Series X is the biggest generational leap of SOC and API design that we’ve done with Microsoft, and it’s really an honor for AMD to be a trusted Microsoft partner for this endeavor,” says Corporate VP Sebastien Nussbaum in the post.

Per the Digital Foundry deep dive:

[T]he Series X processor is actually capable of running four Xbox One S game sessions simultaneously on the same chip, and contains an new internal video encoder that is six times as fast as the more latent, external encoder used on current xCloud servers.

That’s coupled with the GPU stuff we already knew about, including the promise of 12 teraflops of processing power, equating to double what the Xbox One X could do and eight times the original Xbox One. There’s Variable Rate Shading (VRS), which allows for the system to focus on given effects on screen and DirectX Raytracing for improved lighting, reflections and other fine touches.

“Without hardware acceleration, this work could have been done in the shaders, but would have consumed over 13 TFLOPs alone,” Xbox system architect Andrew Goossen tells the site. “For the Series X, this work is offloaded onto dedicated hardware and the shader can continue to run in parallel with full performance. In other words, Series X can effectively tap the equivalent of well over 25 TFLOPs of performance while ray tracing.”

Today brought some impressive early gaming demos as well. Gears 5 showcased 60 FPS videos in 4K (double the Xbox One X FPS), improved resolution textures and other details like fog and particles.

There’s a solid-state drive on board with 1TB of storage, coupled with 16GB of RAM and a 4K Blu-ray drive. Around back, there’s what appears to be an HDMI port, Ethernet port, two standard USB ports and an expansion slot. Here’s the Seagate storage expansion module from the aforementioned hands on video:

The controller, too, is getting an overhaul. It ships with a pair of AA batteries (though you can upgrade to rechargeable). Senior Designer Ryan Whitaker says inclusion was a big part of some of the design changes here, as gaming continues to grow with a mainstream audience:

One key area we’re improving is fitting a wider range of hand sizes, especially smaller hands. By accommodating hands similar to those of an average 8-year-old, we found we could improve accessibility and comfort for hundreds of millions more people without negatively affecting the experience for those with larger hands. We did that by rounding the bumpers, slightly reducing and rounding parts around the triggers, and carefully sculpting the grips.

There’s a Share button on board, in an attempt to make it a more social experience, along with design changes focused on making it easier to play older games via xCloud. Microsoft clearly wants to make game play more platform-agnostic, as it moves to more cloud-based experiences.

The Xbox Series X is due out at the end of the year and will go head to head with Sony’s latest offering.

Powered by WPeMatico

This startup got a meeting with Mark Suster by getting clever with Google ads

Startups have done some wild things to get the attention of VCs. In fact, Instacart founder Apoorva Mehta sent YC partner (at the time) Garry Tan a six-pack of beer through the service after missing the deadline for Y Combinator by two months.

Yesterday, the ingenuity of startups struck again.

Tadabase.io, an enterprise startup that offers no-code tools to help businesses automate their processes, has had an ad running that was… well, hyper targeted.

ProductHunt founder and WeekendFund investor Ryan Hoover discovered the ad and shared it on Twitter.

I google’d @msuster’s LinkedIn and this is what I found

pic.twitter.com/ANMZ2dg6AD

— Ryan Hoover (@rrhoover) March 13, 2020

Hoover told TechCrunch he was Googling Mark Suster to facilitate an introduction between Suster and one of Hoover’s portfolio companies. Instead, he found a Google ad directed squarely at Suster from Tadabase.io.

“Mark Suster, you haven’t invested in nocode” read the paid listing. “Therefore, we put this ad here to get your attention. If you’re not Mark, please don’t click here and save us some money.”

I reached out to Suster, managing partner at UpFront Ventures, to see what he thought of the ad. He told me he “loved it” and has already contacted the CEO to set up a call for next week.

Whether this clever Google ad will result in an actual investment is yet to be determined. Also unclear: will Ryan Hoover get in on the deal?

I reached out to Tadabase founder and CEO Moe Levine via email to ask about the ad, how they went about targeting, and how he feels about his upcoming phone call next week. He hasn’t responded yet. I’ll update if/when he does.

Powered by WPeMatico

This Week in Apps: WWDC goes online, coronavirus leads to more cancellations, sneaky spy apps exposed

Welcome back to This Week in Apps, the Extra Crunch series that recaps the latest OS news, the applications they support and the money that flows through it all.

The app industry is as hot as ever, with a record 204 billion downloads in 2019 and $120 billion in consumer spending in 2019, according to App Annie’s recently released “State of Mobile” annual report. People are now spending 3 hours and 40 minutes per day using apps, rivaling TV. Apps aren’t just a way to pass idle hours — they’re a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus.

In this Extra Crunch series, we help you keep up with the latest news from the world of apps, delivered on a weekly basis.

This week we’re taking a look at several stories related to the coronavirus outbreak, including the cancellation of WWDC in San Jose, as well as other app industry events that are going online. We’re also discussing the iOS 14 leak, the exposure of Sensor Tower’s app network, a potential ban on TikTok for government workers and more.

Coronavirus Special Coverage

The impacts of the COVID-19 pandemic are continuing to play out on app stores and across the industry. This week, we’re leading with these stories followed by the other — and yes, still important — news.

Apple finally cancels its WWDC event in San Jose

Powered by WPeMatico