Slack introduces simplified interface as usage moves deeper into companies

When Slack first launched in 2013, the product was quickly embraced by developers, and the early product reflected that. To get at advanced tools, you used a slash (/) command, but the company recognizes that as it moves deeper into the enterprise, it needed to simplify the interface.

Today, the company introduced a newly designed interface aimed at easing the user experience, making Slack more of an accessible enterprise communications hub.

Jaime DeLanghe, director of product management at Slack, says that the messaging application has become a central place for people to communicate about work, which has grown even more important as many of us have begun working from home as a result of COVID-19.

But DeLanghe says usage was up even before the recent work from home trend began taking off. “People are connected to Slack, on average, about nine hours a day and they’re using Slack actively for almost 90 minutes,” she told TechCrunch.

To that end, she says her team has been working hard to update the interface.

“From my team’s perspective, we want to make sure that the experience is as simple to understand and get on-boarded as possible,” she said. That also means surfacing more advanced tooling, which has been hidden behind those slash commands in previous versions of the tool.

She said that the company has been trying to address the needs of the changing audience over the years by adding many new features, but admits that has resulted in some interface clutter. Today’s redesign is meant to address that.

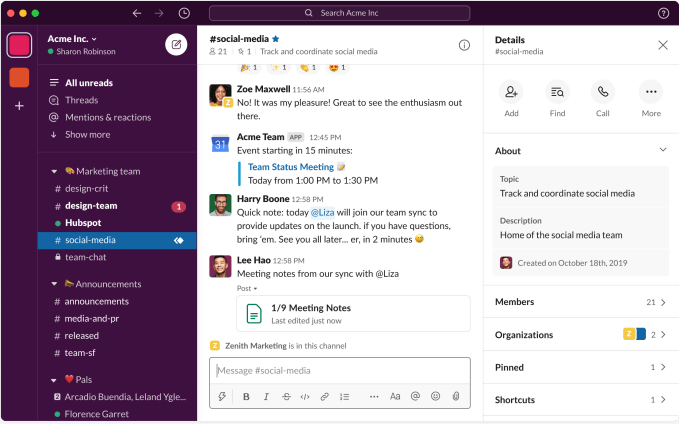

New Slack interface. Screenshot: Slack

Among the new features, besides the overall cleaner look, many people will welcome the new ability to nest channels to organize them better in the Channel sidebar. As your channels proliferate, it becomes harder to navigate them all. Starting today, users can organize their channels into logical groupings with labels.

New nested channel labels in Slack. Screenshot: Slack

DeLanghe is careful to point out that this channel organization is personal, and cannot be done at an administrative level. “The channels don’t actually live inside of another channel. You’re creating a label for them, so that you can organize them in the sidebar for just yourself, not for everybody,” she explained.

Other new features include an improved navigation bar at the top of the window, a centralized search and help tool also located at the top of the window and a universal compose button in the Sidebar.

All of these new features are designed to help make Slack more accessible to users, as more employees start using it across an organization.

Powered by WPeMatico

Israel passes emergency law to use mobile data for COVID-19 contact tracing

Israel has passed an emergency law to use mobile phone data for tracking people infected with COVID-19 including to identify and quarantine others they have come into contact with and may have infected.

The BBC reports that the emergency law was passed during an overnight sitting of the cabinet, bypassing parliamentary approval.

Israel also said it will step up testing substantially as part of its respond to the pandemic crisis.

In a statement posted to Facebook, prime minister Benjamin Netanyahu wrote: “We will dramatically increase the ability to locate and quarantine those who have been infected. Today, we started using digital technology to locate people who have been in contact with those stricken by the Corona. We will inform these people that they must go into quarantine for 14 days. These are expected to be large – even very large – numbers and we will announce this in the coming days. Going into quarantine will not be a recommendation but a requirement and we will enforce it without compromise. This is a critical step in slowing the spread of the epidemic.”

“I have instructed the Health Ministry to significantly increase the number of tests to 3,000 a day at least,” he added. “It is very likely that we will reach a higher figure, even up to 5,000 a day. To the best of my knowledge, relative to population, this is the highest number of tests in the world, even higher than South Korea. In South Korea, there are around 15,000 tests a day for a population five or six times larger than ours.”

On Monday an Israeli parliamentary subcommittee on intelligence and secret services discussed a government request to authorize Israel’s Shin Bet security service to assist in a national campaign to stop the spread of the novel coronavirus — but declined to vote on the request, arguing more time is needed to assess it.

Civil liberties campaigners have warned the move to monitor citizens’ movements sets a dangerous precedent.

Netanyahu’s announcement that he intends to bypass parliamentary oversight and implement emergency regulations that authorize the Shin Bet to locate Corona patients actualizes this danger.

— ACRI (@acri_online) March 16, 2020

According to WHO data, Israel had 200 confirmed cases of the coronavirus as of yesterday morning. Today the country’s health ministry reported cases had risen to 427.

Details of exactly how the tracking will work have not been released — but, per the BBC, the location data of people’s mobile devices will be collected from telcos by Israel’s domestic security agency and shared with health officials.

It also reports the health ministry will be involved in monitoring the location of infected people to ensure they are complying with quarantine rules — saying it can also send text messages to people who have come into contact with someone with COVID-19 to instruct them to self isolate.

In recent days Netanyahu has expressed frustration that Israel citizens have not been paying enough mind to calls to combat the spread of the virus via voluntary social distancing.

“This is not child’s play. This is not a vacation. This is a matter of life and death,” he wrote on Facebook. “There are many among you who still do not understand the magnitude of the danger. I see the crowds on the beaches, people having fun. They think this is a vacation.”

“According to the instructions that we issued yesterday, I ask you not leave your homes and stay inside as much as possible. At the moment, I say this as a recommendation. It is still not a directive but that can change,” he added.

Since the Israeli government’s intent behind the emergency mobile tracking powers is to combat the spread of COVID-19 by enabling state agencies to identify people whose movements need to be restricted to avoid them passing the virus to others, it seems likely law enforcement agencies will also be involved in enacting the measures.

That will mean citizens’ smartphones being not just a tool of mass surveillance but also a conduit for targeted containment — raising questions about the impact such intrusive measures might have on people’s willingness to carry mobile devices everywhere they go, even during a pandemic.

Yesterday the Wall Street Journal reported that the US government is considering similar location-tracking technology measures in a bid to check the spread of COVID-19 — with discussions ongoing between tech giants, startups and White House officials on measures that could be taken to monitor the disease.

Last week the UK government also held a meeting with tech companies to ask for their help in combating the coronavirus. Per Wired some tech firms offered to share data with the state to help with contact tracing — although, at the time, the government was not pursuing a strategy of mass restrictions on public movement. It has since shifted position.

Powered by WPeMatico

Salesforce hires former banker Arundhati Bhattacharya as chairperson and CEO of India business

Salesforce, the global giant in CRM, said on Wednesday that former banker Arundhati Bhattacharya will be joining the company on April 20 as chairperson and chief executive of its India division.

The San Francisco-headquartered firm said Bhattacharya, who served as the chairperson of the state-run State Bank of India for nearly four decades and oversees financial services group SWIFT India, will be tasked with helping the global giant scale rapidly in India, one of its fastest growing overseas markets.

Arundhati will report to Ulrik Nehammer, General Manager of Salesforce in the APAC region. “Arundhati is an incredible business leader, and we are delighted to welcome her to Salesforce as chairperson and CEO India,” said Gavin Patterson, President and CEO of Salesforce International, in a statement.

“India is an important growth market for Salesforce and a world-class innovation and talent hub and Arundhati’s leadership will guide our next phase of growth, customer success and investment in the region,” he said.

Salesforce offers a range of cloud services to customers in India, where it has over 1 million developers and more Trailhead users than in any other market outside of the U.S. The company, which competes with local players Zoho and Freshworks, counts Indian firms redBus, Franklin Templeton and CEAT as some of its clients.

The company said it expects to add 3,000 jobs in India in the next three years and turn the nation into a “leading global talent and innovation hub” for the company. Sunil Jose, who joined the firm in 2017, oversaw some of the company’s India operations previously.

“I could not be more excited to join the Salesforce team to ensure we capture this tremendous opportunity and contribute to India’s development and growth story in a meaningful way,” said Bhattacharya in a statement.

According to research firm IDC, Salesforce and its ecosystem of customers and partners in India are expected to create over $67 billion in business revenues and create more than 540,000 jobs by 2024.

Powered by WPeMatico

Revolut launches Revolut Junior to help you manage allowance

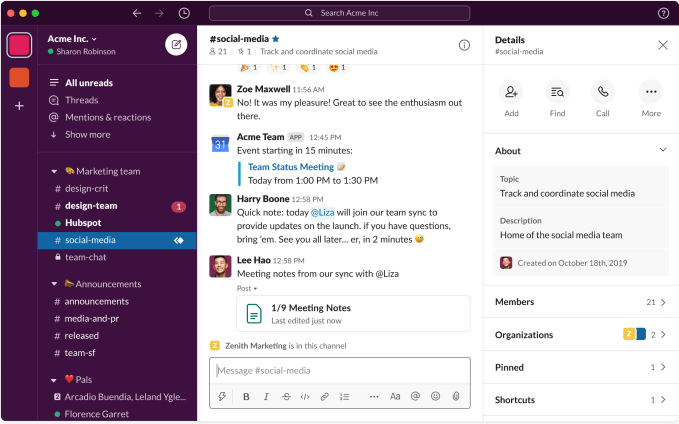

Revolut is introducing a new product specifically targeted toward kids aged 7-17 years old — Revolut Junior. Revolut Junior is a new app and service that integrates directly with the main Revolut app on the parent’s side.

Parents or legal gardians who are also Revolut users can create a Revolut Junior account for their kid. After that, your kid can download the Revolut Junior app and get a Revolut Junior card.

The new app offers a limited set of features with an interface divided in two tabs — Account and Profile. Kids can see a list of transactions in real time in the Account tab. They can configure card settings in the Profile tab. And that’s about it.

On the other end, parents can control their kids’ spending from Revolut. They can transfer money to a Revolut Junior account instantly. Parents can also access balances and transactions as well as disable some card features, such as online payments. They can also choose to receive notifications when a child is using their card.

The reason why Revolut Junior can attract a ton of users is that Revolut itself already has over 10 million users. It’s going to be easier to convince existing Revolut customers to use Revolut Junior over a custom-made challenger bank for teens, such as Kard or Step. Arguably, the biggest competitor of challenger banks for teens is still cash.

As kids grow up, chances are they’ll switch to a full-fledged Revolut account if they’ve been using Revolut Junior for years. Revolut Junior represents a great acquisition funnel as well.

Revolut Junior is only available to Premium and Metal customers in the U.K. for now. The company will eventually roll it out to more users and more countries.

Revolut plans to add more features to Revolut Junior in the future. For instance, parents will be able to set a regular allowance and financial goals. Kids will get savings options, spending reports, spending limits and more.

Powered by WPeMatico

Where top VCs are investing in remote events

The novel coronavirus pandemic has rapidly moved companies into a remote-first world.

Nearly all of the world’s largest events have been canceled, put on pause or pivoted to online-only. In the tech world, event cancellations thus far have included SXSW, GDC, Mobile World Congress, Google I/O, Facebook F8, E3 and others.

As more and more hosts consider staging fully remote events as possible alternatives, we decided to take a deeper look into the venture-backed startups focused on supporting large-scale virtual gatherings, like Hopin and Run The World. To further understand the impact of COVID-19, we asked five leading VCs who have invested in or have knowledge of startups focused on remote events to update us on the state of the market and to share where they see opportunity in the sector:

- Sarah Cannon, Index Ventures

- Connie Chan, Andreessen Horowitz

- Andrei Brasoveanu, Accel Partners

- Ryan Kuder, Techstars Anywhere

- Paul Murphy, Northzone

Sarah Cannon, Index Ventures

Which trends in remote events/conferencing excite you the most from an investing perspective?

Powered by WPeMatico

Join TC tomorrow at 9 am PT for a chat about the latest YC startup batch

Hello TechCrunch friends and family, tomorrow morning at 9 am Pacific Time we’re gathering on Zoom for an in-depth chat about our favorite startups from the latest Y Combinator Demo Day. This year’s installment of the twice-yearly startup event happened yesterday, a week early and online only.

Like many other things, Demo Day was adapted to a new format in the face of COVID-19 disruptions. Despite that, TechCrunch wrote a host of posts on the companies that presented (you can see our notes here), dug into a number of the startups individually (here and here, for example), and sat down with Y Combinator’s CEO for an interview.

We’re wrapping all of that with a group chat about the entire affair. We’d host this from the office in more regular years, but, it’s 2020, and so we’re all gathering on Zoom which means that everyone is invited to listen in.

Here are the details:

- What? TechCrunch team chat about YC 2020 and all the coolest companies

- When? 9 am Pacific Time

- How long? About 30 minutes, give or take

- Where? Here, on Zoom

- Should I not mute myself and annoy everyone tuned in? No, please mute yourself

We’re recording the chat, and plan to make it available to Extra Crunch subscribers shortly after we’re done. But the main call is open to everyone, so add it to your calendar and we’ll see you there.

Powered by WPeMatico

Dear Sophie: How do I get visas for my team to work from home?

Here’s another edition of “Dear Sophie,” the advice column that answers immigration-related questions about working at technology companies.

“Your questions are vital to the spread of knowledge that allows people all over the world to rise above borders and pursue their dreams,” says Sophie Alcorn, a Silicon Valley immigration attorney. “Whether you’re in people ops, a founder or seeking a job in Silicon Valley, I would love to answer your questions in my next column.”

“Dear Sophie” columns are accessible for Extra Crunch subscribers; use promo code ALCORN to purchase a one or two-year subscription for 50% off.

Dear Sophie:

I sent my startup team home to work remotely for several weeks. We have several folks on visas and work permits — am I supposed to do anything special for them? Can I proactively get visas for future employees to primarily work from home?

— Burrowing in Burlingame

Dear Burrowing,

Powered by WPeMatico

CO2-based vodka startup Air Co. fully redirects its tech to making hand sanitizer for donation

A NYC-based startup that developed technology that extracts carbon dioxide from the air and combines it with water to create vodka has redirected its entire production capacity toward producing hand sanitizer, every bottle of which will be donated through collaboration with NYC officials, and potentially to local restaurants who employ delivery personnel providing critical service as social distancing and isolation measures continue.

Air Co. launched its vodka just last year, using a process it developed (which has received awards from NASA and XPrize) that is actually net carbon-negative. It involves pulling around one pound of carbon dioxide from the air which is then combined with water and turned into pure ethanol using solar-based renewable energy. Ethanol also happens to be the key active ingredient in hand sanitizer, which is generally between 60% and 95% alcohol in its most effective iterations.

Air Co.’s CEO and co-founder Gregory Constantine told me via email that because the company was founded on the basis of fulfilling a mission of social good, the startup wanted to find some way to help with community efforts to counter the ongoing coronavirus pandemic. It naturally turned to producing hand sanitizer made up 70% ethanol, its technology’s primary output.

The company isn’t looking to cash in on the current (ill-advised) panic-buying trends, which see supplies of hand sanitizer sold out or dwindling across major retailers and Amazon . Instead, even though it’s now directing 100% of its production capacity to making hand sanitizer, it’s also donating all of the volume it produces.

While Constantine says that initially they’ve been producing smaller volumes than they’d like, and are looking at ramping production by shifting their methods, they’ve still managed to put out more than 1,000 50mL bottles, and will “continue to make 1,000 bottles per week and push supply as much as our technology allows us to.”

I asked Constantine how they’re figuring out who receives the hand sanitizer they’re donating, given the many possible parties who would appreciate this kind of charitable action.

“We’re going to be directly supplying all donations at the advice of the city,” he said. “We are also looking to work with local restaurants to have them provide food delivery drivers with our sanitizer given that bars and restaurants have had to shut their doors to patrons, leaving delivery services at the forefront of food services here in New York City.”

Given that they have shifted production away from their revenue-generating business for this effort, I also asked Constantine how long they plan to keep this up. Despite uncertainty about how long the need will exist, he said, they’re going to try to continue producing the sanitizer “for as long as [they] can.”

“We have shifted our production and are running on a very limited team to ensure that we are not furthering the spread of the virus in our efforts,” he added. “Every small piece of help from any person or business goes a long way in a time of need like this, and we plan to help however we can.”

Powered by WPeMatico

Lightspeed-backed WorkOS launches to help startup services become enterprise-ready

With the explosive popularity of B2B services startups, it was only natural that a B2B startup would come along that’s offering a service to help startups become enterprise services themselves.

WorkOS, which is launching out of stealth with seed funding from Lightspeed Venture Partners and others, is building a toolkit to help startups meet the requirements for bringing on enterprise clients. The company aims to get startups set up with an API for single sign-on, directory sync, audit trails, role-based access controls and other key services.

As more startups look to approach enterprise from a bottom-up capacity and focus on creating individual use cases, quickly meeting IT administrators’ expectations can become a shortcut to higher-margin customers. The inspiration for WorkOS came from its founder’s previous email startup, which tried to make a play for enterprise adoption and clients but couldn’t cross what he calls “the enterprise chasm.”

“The feedback I got was, this is a great app but we can’t buy this as a company because you’re not enterprise-ready,” CEO Michael Grinich told TechCrunch in an interview. “Even if you focus on the end user experience, there’s a different buyer at the end of that tunnel with a different set of needs.”

Becoming enterprise-ready means meeting the same compliance requirements that IT administrators need to adhere to, something that can obviously be an issue for a small startup that’s light on resources. On the security side, Grinich says that WorkOS is currently in its SOC-2 Type 2 observation period and should receive certification in Q2 of this year.

These are uncertain times to be a startup launching publicly, but Grinich’s description of his company as a “highway onramp to get into [enterprise] ecosystems,” seems apt for startups seeking to quickly build out new revenue streams. Right now, WorkOS operates across a few pricing structures, with a free tier that brings users single sign-on support, as well as a $99/mo developer tier and $499/mo corporate tier that scale up WorkOS’s offered functionality substantially.

First Round, SV Angel, Abstract Ventures, Tuesday Capital and Work Life Ventures are also backers.

Powered by WPeMatico

All the companies from Y Combinator’s W20 Demo Day, Part IV: Healthcare, Biotech, Fintech and Nonprofits

Y Combinator’s Demo Day was a bit different this time around.

As concerns grew over the spread of COVID-19, Y Combinator shifted the event format away from the two-day gathering in San Francisco we’ve gotten used to, instead opting to have its entire class debut to invited investors and media via YC’s Demo Day website.

In a bit of a surprise twist, YC also moved Demo Day forward one week citing accelerated pacing from investors. Alas, this meant switching up its plan for each company to have a recorded pitch on the Demo Day website; instead, each company pitched via slides, a few paragraphs outlining what they’re doing and the traction they’re seeing, and team bios. It’s unclear so far how this new format — in combination with the rapidly evolving investment climate — will impact this class.

As we do with each class, we’ve collected our notes on each company based on information gathered from their pitches, websites and, in some cases, our earlier coverage of them.

To make things a bit easier to read, we’ve split things up by category rather than have it be one huge wall of text. These are the healthcare, biotech, fintech and nonprofit companies. You can find the other categories (such as B2B, consumer and robotics) here.

Healthcare and Biotech

Simple Stripes: Aims to make glucose testing cheaper and more accessible by making strips that can be read by any smartphone camera, rather than requiring a dedicated glucose meter. The company says it expects to submit its strips for FDA approval in June.

nplex biosciences: A faster, cheaper way to do the protein panels required in the development of new medications. The company says it has over $4 million in letters-of-intent in the works, including one from a major pharma company.

Healthlane: An app meant to help users in Africa communicate with their doctors, make appointments and track lab results. The company says it has already reached profitability, with a retention rate of 98%.

Breathe Well-being: A 16-week program meant to help users in India with chronic conditions (such as diabetes) in their efforts to lose weight. The company offers a one-on-one diabetes coach who helps the user with tracking things like weight/meals/activity and trains them in cognitive behavioral therapy techniques meant to reduce stress. Currently seeing an $11.2K MRR.

Dropprint Genomics: “Single cell genomics” software meant to reduce the time/financial cost of analyzing individual cell activity to enable better drug discovery. They’ve signed over $1 million in LOIs in two months.

Newman’s: A digital health clinic for men in Indonesia. They’re focusing on problems that are often seen as either embarrassing (hair loss, erectile dysfunction) or are often abandoned (quitting smoking) by making doctor visits easier, cheaper and more private by way of remote consultation. Find our previous coverage of Newman’s here.

Loop Health: Loop Health says that most health insurance in India covers “only hospital stays, not doctor visits.” They’re looking to improve this by offering unlimited access to their designated Loop Health clinics, along with app-based telemedicine.

Synapsica Healthcare: An “AI reporting assistant.” Currently focusing on spinal MRIs, the company says it saves radiologists 80% of their reporting time by automatically annotating measurements and characterizing disc degeneration. The company says it’s currently in a $100K pilot program with a radiology practice tapped by 250 chiropractic clinics.

Volumetric: Volumetric makes 3D bioprinters that create vascularized human tissue. Founded by two PhDs, Volumetric sells its photoactive tissue to pharmaceutical companies and scientists. It’s using the proceeds to move toward building bioprinters and bioinks that can generate functional tissue and even organs. Find our previous coverage of Volumetric here.

Ophelia: Ophelia replaces rehab with telemedicine for America’s 3 million opioid addicts. It lets patients do teleconferenced doctor visits, get prescribed and delivered medications like Buprenorphine and Naloxone, and access therapy without the stigma. The founder started the company after a longtime girlfriend died from opioid addiction, and Ophelia has now treated 40 patients.

Lilia: Claiming that “in the future, women will freeze their eggs upon graduation,” Lilia is an egg-freezing concierge service. The startup charges $500 for concierge, and gets another $500 when somebody is placed in a clinic. Lilia says its total addressable market is $33 billion.

Equator Therapeutics: Equator Therapeutics is developing a drug to help users burn calories without exercise. Founded by a duo of PhDs and a data scientist who worked at a company developing an anti-aging drug, Equator Therapeutics is targeting people dealing with obesity and type 2 diabetes.

Altay Therapeutics: Located inside the Bayer Collaborator in San Francisco, Altay Therapeutics has developed small molecule therapies that block disease-causing DNA-binding proteins (or transcriptional regulators). The company’s initial therapies are focused on arthritis, fibrosis, ulcerative colitis and liver cancer.

Tambua Health: Tambua Health uses an “acoustic” stethoscope and proprietary software to provide advanced imaging for lung imaging without the radiation of an x-ray.

Abalone Bio: Founded by serial life sciences entrepreneurs, Abalone Bio is using libraries of yeast cells expressing billions of antibody variants to grow specific antibodies that can activate or inhibit a drug target. Using gene sequencing, machine learning and synthetic biology, the company makes recombinant protein versions of its antibodies and confirms their efficacy in human cell assays. The company’s initial targets are drugs for pain, inflammatory diseases, rare cancer and rare kidney disease.

Felix Biotechnology: Founded by the famous Yale University researcher Paul Turner, Felix Biotechnologies is developing treatments to address antibiotic-resistant strains of bacteria and fungi. These pathogens cause more than 2.8 million infections and 35,000 deaths in the United States alone each year, according to the company. On average, someone in the U.S. dies from an antibiotic-resistant infection every 15 minutes. Researchers have warned that more people will die from antibiotic resistance than from cancer by the year 2050.

Genecis Bioindustries: Genecis Bioindustries is turning food waste into compostable plastics. Find our previous coverage on Genecis here.

Candid Health: Candid Health has developed automated billing software for the healthcare industry that follows up with insurance companies and automatically appeals denied claims. It takes a 5% cut of each payment.

Ochre Bio: Ochre says that most donated livers are discarded — despite there being a shortage — due to them containing too much fat for a successful transplant. They’re aiming to “rejuvenate livers outside the body” by finding ways to treat them prior to transplant.

Fintech

Facio: Brazil has a banking problem. An oligarchy of five banks manage the Brazilian market, and they’re slow, have terrible customer service, high APR and don’t serve SMBs. Facio wants to keep workers from falling victim to predatory debt and instead gain financial freedom with a low-priced payroll loan to employees. It integrates with the employer, deducting loans right from their payroll.

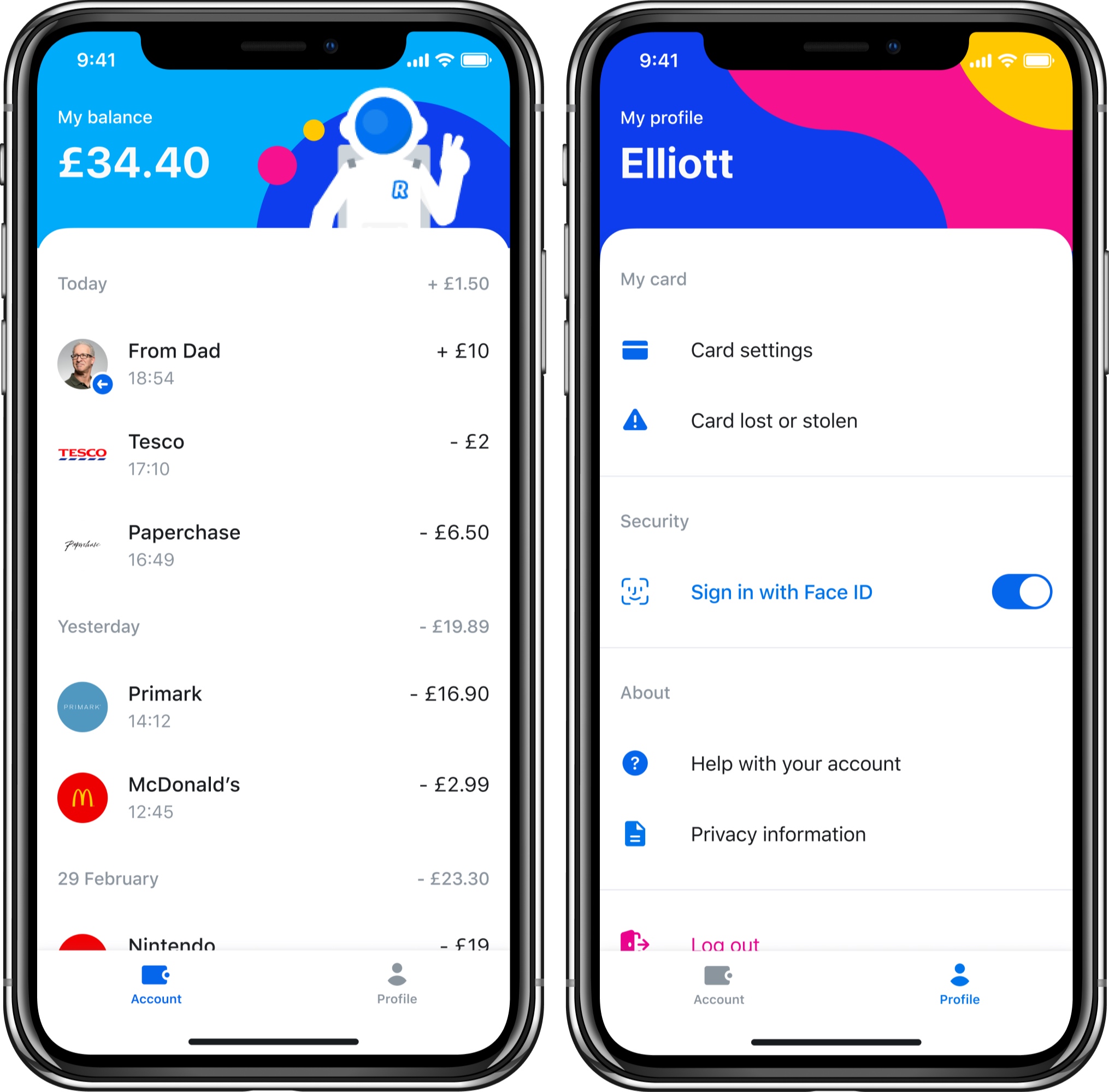

delt.ai: Delt.ai is a digital bank that handles payments, invoicing and corporate cards for poorly served SMEs and freelancers in Mexico. The startup is targeting the $50 billion+ market of business deposits in Latin America. Think of Delt.ai is a Brex or a Mercury, but focused on Latin America.

Nexu: Like many other personal financing operations in Latin America, car financing is an expensive, low-tech, arduous process. Nexu, a financing platform for Latin American car dealerships, uses dynamic credit scoring to give car buyers an approval with a turnaround of a few seconds. The founding team met as Wharton MBA candidates.

Fondeadora: Fondeadora is joining Mexico’s saturated fintech scene, with its alternative neobanking debit card. The company offers a fully mobile digital savings account run within its app. Fondeadora says it has 65,000 users and $6.5 million monthly transactions. Albo, another Mexico-focused debit card, currently owns the market share with 200,000 monthly active customers who are spending and making transactions in its platform and $26 million in capital raised. But the banking problem in Mexico is big enough that multiple startups can thrive. Out of the 130 million population of Mexico, 45% are underbanked, meaning they lack deep financial products designed to help them compound wealth through lending and savings features.

Jenfi: Loans money to small businesses in Asia — typically about $10,000 to $100,000 — based on the business’ revenue. We wrote about Jenfi previously here.

yBANQ: A collections and reconciliation system for large B2B companies in India. The company says it has found 18 customers since launching in late January, reaching a GMV of around $18K.

ZeFi: A savings account that converts USD deposits to/from “stablecoin” cryptocurrencies behind the scenes, with ZeFi lending these funds out to borrowers to gain interest.

Grain: Grain hooks your existing debit card to a “responsible” amount of credit (currently capped at $500, and based on your income/cash low), hopefully helping those with minimal/bad credit build up their credit report over time. In the three months since launch, the company says it has signed up 1,000 customers, and expects to make around $80 per customer per year.

CrowdForce: Lets local merchants in Africa act as bank branches, serving as an intermediary on transactions when a bank is too far away. The company says it made $70K in net revenue last month, making an average of $20 per year per customer.

Stark Bank: A banking API to handle B2B transactions for tech companies in Brazil. A little over a year after launch, the company says it’s seeing $12 million in monthly gross volume.

Bamboo: An online brokerage for high-wealth individuals in Africa to buy securities from around the world. The company says it already has over 2,100 investors who have traded over $1.6 million on the platform since launching roughly five months ago, currently accounting for over $10,000 in monthly revenue.

Swipe: Pitching itself as “Brex for Africa,” Swipe gives African SMBs a credit card to help cover payroll and expenses. They onboard businesses by providing them with free expensing/billing tools, then offer credit accordingly. The company says it’s currently working with 30 companies, with $200K in credit deployed.

goDutch: A payments card for splitting costs amongst groups that often share bills, such as roommates. Focusing on India. Charges are put onto one card and deducted from each group member’s account automatically.

Paymobil: Uses stablecoin cryptocurrencies to transfer money across the globe through a Venmo-style app. The founder, Daniel Nordh, notes that he previously led consumer design at Coinbase.

Karat: Karat offers banking, loans and credit cards to influencers. By using data on their popularity to manage risk, Karat has achieved 40% APR on its loans with an average repayment time of 45 days. Thanks to its founders’ experience building influencer tools at Instagram and structuring debt at Goldman Sachs, it’s already signing up stars with over 10 million followers.

Homestead: Homestead helps home owners convert their garages into rental properties at no upfront cost. Homestead pays for all the construction, tenant search and management, and then splits the rent income with the home owner. A new California law allows the state’s 8 million garages to be rented out as living spaces, creating an enormous market opportunity. Homestead’s founders met at MIT’s graduate school of architecture and city planning, and the startup has already done $1 million in sales.

Benepass: Benepass offers a benefits card for startups and small businesses. Using the Benepass debit card, employees can pay for tax-advantaged benefits and wellness perks like flexible spending accounts, childcare, commuting, fitness and education while an app tracks their buying. Free for employers, Benepass has a 6% take rate but can save thousands on income and payroll taxes. With startups desperate to compete with tech giants for top talent, Benepass could ensure employees feel supported.

GAS POS: U.S. gas station owners are racing to upgrade outside pumps with EMV technology, a global standard for credit cards equipped with computer chips. GAS POS was founded to deliver a modern point-of-sale system that will help North America’s 180,000 gas stations comply with EMV and make transactions more secure. The company has several sources of revenue, a 3% fee on processed payments, SaaS free for equipment and an offer to customers to provide next-day funding.

YearEnd: YearEnd is building tax software for the paper rich, helping startup employees file their taxes while optimizing for their equity. The startup charges $330 per year for individual users and is hoping to sell to businesses that can add YearEnd as an employee benefit.

GIGI Benefits: India’s GIGI Benefits is looking to be the benefits provider for the nation’s gig economy workers. The business takes a page from companies like last year’s hottest Y Combinator startup, Catch, or the venture-backed Trupo, to provide things like health insurance and retirement investment accounts to gig economy workers.

Easyplan: Easyplan is the Qapital or Digit for India, allowing users to seamlessly save money for certain specific goals.

Haven: Haven is a next-gen platform for servicing home mortgages, offering more modern customer interfaces, better payment modeling for lenders and more.

WorkPay: WorkPay describes itself as “Gusto for Africa” — next-gen payroll and related services targeting small and medium businesses in the region.

Spenny: Spenny is a savings tool for Indian consumers that lets customers start banking money away by rounding up their purchases.

Kosh: Kosh is an algorithmically enhanced savings and investment platform for India, allowing those with good credit to effectively vouch for friends with limited credit to help them borrow.

Nonprofit

Potential: Potential is a nonprofit that wants to connect the formerly incarcerated to jobs and resources. The company works with detention centers and employment organizations to make a more friendly hiring environment.

Powered by WPeMatico