Healthcare startups Nurx and Carbon Health ship at-home COVID-19 test sample kits

Efforts to get at-home test kits for the COVID-19 coronavirus are ramping up quickly, and two more health industry startups are bringing their own products to market, with both Carbon Health and Nurx starting to ship their own in-home sample collection kits.

Both of these new offerings are the same in terms of approach to testing: They deliver swab-based sample collection hardware that people can use at home to collect a mucus sample, which they then ship back using included, safety approved, projective packaging to be tested by one of the existing FDA-approved commercial labs across the country.

These tests follow the PCR-based method, which tests for the genetic presence of the COVID-19 virus in a patient. These have a high degree of accuracy, at least when performed in a controlled setting and administered by a medical professional, and are the same tests that are available via drive-through testing stations being set up by state agencies.

At-home use is relatively new to market, and could introduce some potential for error in the collection part of the process, but both Carbon Health and Nurx are offering consultation with medical professionals to help ensure that samples are collected properly, and that results, when available, are correctly interpreted and provided with guidance on next steps for those taking the tests.

None of these tests are free — the Carbon Health test costs $167.50, and the Nurx test costs $181, including shipping and assessment. These are in line with other offerings, including the one from Everlywell we covered earlier this week, which retails for $135. These are described as essentially at-cost prices, and all parties say they are subject to coverage by FSA or HSA money, or potentially by insurers depending on a person’s plan.

One big question around these types of tests is how much supply will be available. Nasopharyngeal swabs used for the in-person type of testing are already reportedly in short supply in some regions, and testing needs are only growing. Carbon is using different swabs to collect a simple saliva sample, which it notes are not in as short supply as the nasopharyngeal version. Other types of tests, including a “serological” one being developed by startup Scanwell, instead work by analyzing a patient’s blood, and could provide some relief for the swab-based tests, especially now that the FDA has expanded its emergency guidance to include their use.

Nurx, which also offers at-home HPV screening, says that it will have 10,000 kits available to patients “over the coming weeks,” and hopes to expand to cover “over 100,000 patients” in the “near future.” Carbon Health CEO and co-founder Eren Bali tells me that it should ramp to around “10,000 per day capacity in about two weeks,” through its medical device partner Curative Inc., and that it can do 50 per day today, with an estimated increase to 150 per day by Monday and 1,000 per day by end of week.

All of these tests are gated by a screening and assessment questionnaire, and the round-trip time is likely to take a few days even with round-trip shipping due to testing times. It may seem like a lot of these are popping up, but these startups at least have proven track records in healthcare services, and there will be a need for very widespread testing in order for any broad attempt to flatten the curve of the virus to prove successful, so expect more of these providers to come on line.

Powered by WPeMatico

AWS, IBM launch programs to encourage developers solving COVID-19 problems

As society comes to grips with the growing worldwide crisis related to the COVID-19 virus, many companies are stepping up in different ways. Today, two major tech companies — Amazon and IBM — each announced programs to encourage developers to find solutions to a variety of problems related to the pandemic.

For starters, AWS, Amazon’s cloud arm, announced the AWS Diagnostic Development Initiative. It has set aside $20 million, which it will distribute in the form of AWS credits and technical support. The program is designed to assist and encourage teams working on COVID-19 diagnostic issues with the goal of developing better diagnostic tooling.

“In our Amazon Web Services (AWS) business, one area where we have heard an urgent need is in the research and development of diagnostics, which consist of rapid, accurate detection and testing of COVID-19. Better diagnostics will help accelerate treatment and containment, and in time, shorten the course of this epidemic,” Teresa Carlson wrote in the company’s Day One blog today.

The program aims to help customers who are working on building diagnostics solutions to bring products to market more quickly, and also encourage teams working on related problems to work together.

The company also announced it was forming an advisory group made up of scientists and health policy experts to assist companies involved with initiative.

Meanwhile, IBM is refocusing its 2020 Call for Code Global Challenge developer contest on not only solving problems related to global climate change, which was this year’s original charter, but also solving issues around the growing virus crisis by building open-source tooling.

“In a very short period of time, COVID-19 has revealed the limits of the systems we take for granted. The 2020 Call for Code Global Challenge will arm you with resources […] to build open source technology solutions that address three main COVID-19 areas: crisis communication during an emergency, ways to improve remote learning, and how to inspire cooperative local communities,” the company wrote in a blog post.

All of these areas are being taxed as more people are forced to stay indoors as we to try to contain the virus. The company hopes to incentivize developers working on these issues to help solve some of these problems.

During a time of extreme social and economic upheaval when all aspects of society are being affected, businesses, academia and governments need to work together to solve the myriad problems related to the virus. These are just a couple of examples of that.

Powered by WPeMatico

Google cancels I/O developer conference in light of COVID-19 crisis

Google announced on Twitter today that it was cancelling its annual I/O developer conference out of concern for the health and safety of all involved. It will not be holding any online conference in its place either.

“Out of concern for the health and safety of our developers, employees, and local communities — and in line with recent ‘shelter in place’ orders by the local Bay Area counties — we sadly will not be holding I/O in any capacity this year,” the company tweeted.

This is not a small deal, as Google uses this, and the Google Cloud Next conference, which it has also canceled, to let developers, customers, partners and other interested parties know about what new features, products and services they will be introducing in the coming year.

Without a major venue to announce these new tools, it will be harder for the company to get the word out about them or gain the power of human networking that these conferences provide. All of that is taking a backseat this year over concerns about the virus.

The company made clear that it does not intend to reschedule these events in person or in a virtual capacity at all this year, and will look for other ways to inform the community of changes, updates and new services in the coming months.

“Right now, the most important thing all of us can do is focus our attention on helping people with the new challenges we all face. Please know that we remain committed to finding other ways to share platform updates with you through our developer blogs and community forums,” the company wrote.

Powered by WPeMatico

Hospital droid Diligent Robotics raises $10M to assist nurses

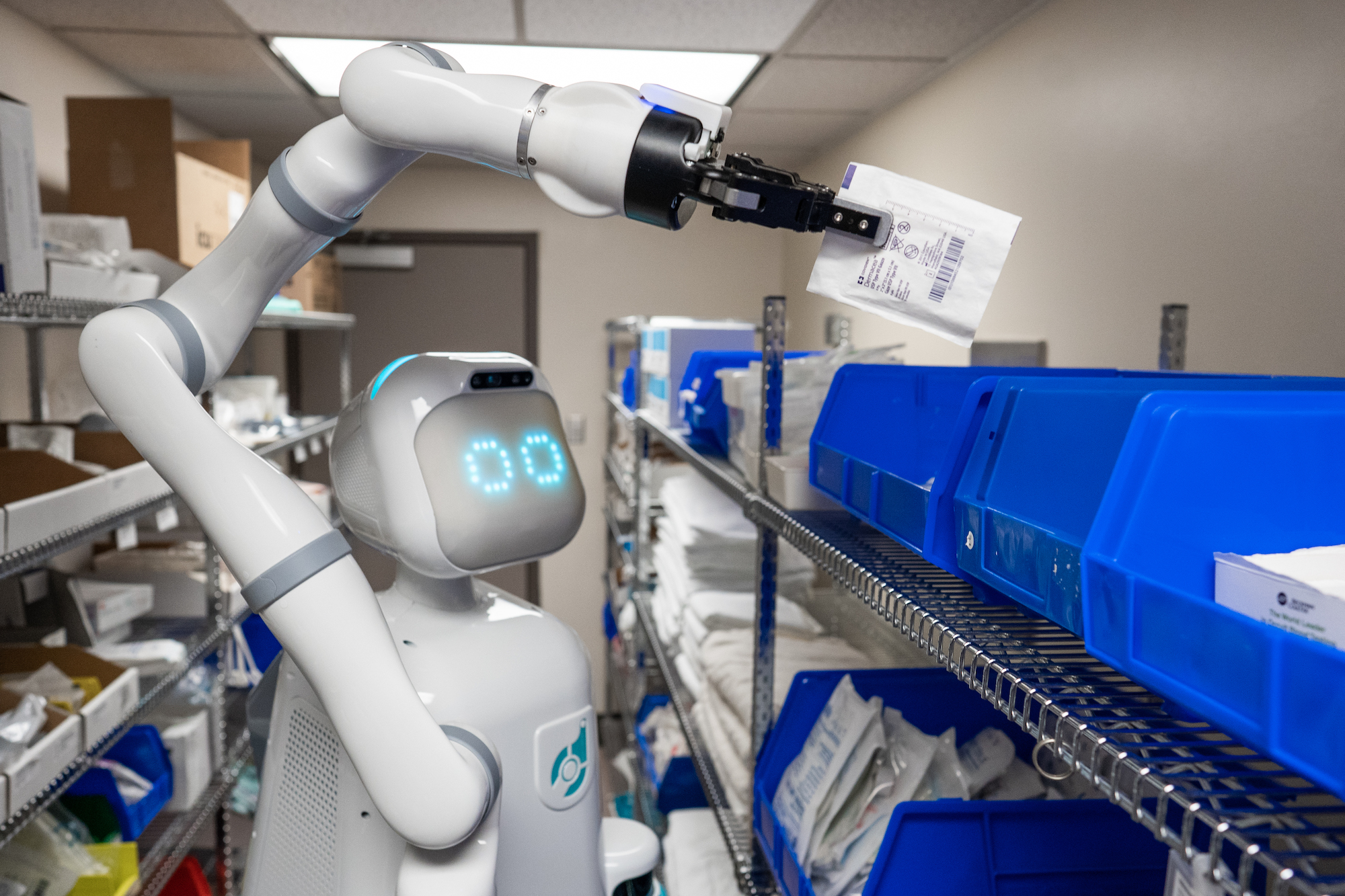

Twenty-eight percent of a nurse’s time is wasted on low-skilled tasks like fetching medical tools. We need them focused on the complex and compassionate work of treating patients, especially amid the coronavirus outbreak. Diligent Robotics wants to give them a helper droid that can run errands for them around the hospital. The startup’s bot Moxi is equipped with a flexible arm, gripper hand and full mobility so it can hunt down lightweight medical resources, navigate a clinic’s hallways and drop them off for the nurse.

With the world facing a critical shortage of medical care professionals, Moxi could help healthcare centers use their staffs as efficiently as possible. And because robots can’t be infected by COVID-19, they’re one less potential carrier interacting with vulnerable populations.

Today, Diligent Robotics announces its $10 million Series A that will help it scale up to deliver “more robots to more hospitals,” CEO Andrea Thomaz tells me. “We’ve been designing our product, Moxi, side by side with hospital customers because we don’t just want to give them an automation solution for their materials management problems. We want to give them a robot that frontline staff are delighted to work with and feels like a part of the team.”

The round, led by DNX Ventures, brings Diligent Robotics to $15.75 million in total funding that’s propelled it to the fifth generation of its Moxi robot. It currently has two deployed in Dallas, Texas, but is already working with two of the three top hospital networks in the U.S. “As the current pandemic and circumstance has shown, the real heroes are our healthcare providers,” says Q Motiwala, partner at DNX Ventures. The new cash from DNX, True Ventures, Ubiquity Ventures, Next Coast Ventures, Grit Ventures, E14 Fund and Promus Ventures will help Diligent Robotics expand Moxi’s use cases and seamlessly complement nurses’ workflows to help alleviate the talent crunch.

The round, led by DNX Ventures, brings Diligent Robotics to $15.75 million in total funding that’s propelled it to the fifth generation of its Moxi robot. It currently has two deployed in Dallas, Texas, but is already working with two of the three top hospital networks in the U.S. “As the current pandemic and circumstance has shown, the real heroes are our healthcare providers,” says Q Motiwala, partner at DNX Ventures. The new cash from DNX, True Ventures, Ubiquity Ventures, Next Coast Ventures, Grit Ventures, E14 Fund and Promus Ventures will help Diligent Robotics expand Moxi’s use cases and seamlessly complement nurses’ workflows to help alleviate the talent crunch.

Thomaz came up with the idea for a hospital droid after doing her PhD in social robotics at the MIT Media lab. Her co-founder and CTO Vivian Chu had done a master’s at UPenn on how to give robots a sense of touch, and then came to work with Thomaz at Georgia Tech. They were inspired by a study revealing how nurses spent so much time acting as hospital gofers, so in 2016 they applied for and won a National Science Foundation grant of $750,000 that funded a six-month sprint to build a prototype of Moxi.

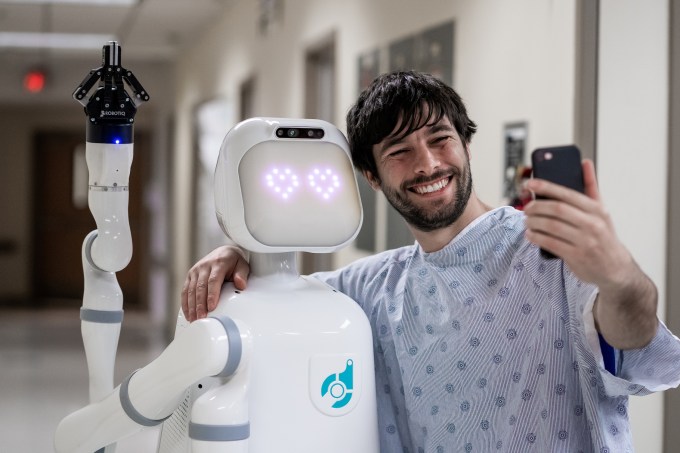

Since then, 18-person Diligent Robotics has worked with hundreds of nurses to learn about exactly what they need from an autonomous assistant. “Today you will go about your day, and you probably won’t interact with any robots….we want to change that,” Thomaz tells me. “The only way you can really bring robots out of the warehouses, off of the factory floors, is to build a robot that can work in our dynamic and messy everyday human environments.” The startup’s intention isn’t to fully replace humans, which it doesn’t think is possible, but to let them focus on the most human elements of their jobs.

Moxi is about the size of a human, but designed to look like an ’80s movie robot so as not to engender an uncanny valley cyborg weirdness. Its head and eyes can move to signal intent, like which direction it’s about to move, while sounds let it communicate with nurses and acknowledge their commands. A moving pillar lets it adjust its height, while its gripper hand and arm can pick and put down smaller pieces of hospital equipment. Its round shape and courteous navigation makes sure it can politely share crowded hallways and travel via elevator.

Diligent Robotics’ solution engineers work with hospitals to teach Moxi how to get around and what they need. The company hopes to eventually build the ability to learn and adapt right into the bot so nurses can teach it new tasks on the fly. “The team continues to demonstrate unmatched robotics-specific innovation by combining social intelligence and human-guided learning capabilities,” says True Ventures partner and Diligent board member Rohit Sharma.

Hospitals pay an upfront fee to buy Moxi robots, and then there’s a monthly fee for the software, services and maintenance. Thomaz admits that “Hospitals are naturally risk-averse, and can be wary to take up new technology,” so the startup is taking a slow and steady approach to deployment so it can convince buyers that Moxi is worth the learning curve.

Diligent Robotics will be competing with companies like Aethon’s TUG bot for pulling laundry and pharmacy carts. Other players in the hospital tech space include Xenex’s machine that disinfects rooms with light, and surgical bots like those from Johnson & Johnson’s Auris and Intuitive Surgical.

Diligent Robotics hopes to differentiate itself by building social intelligence into Moxi so it feels more like an intern than a gadget. “Time and again, we hear from our hospital partners that Moxi not only returns time back to their day but also brings a smile to their face,” says Thomaz. The company wants to evolve Moxi for other dull, dirty or dangerous service jobs.

Eventually, Diligent Robotics hopes to bring Moxi into people’s homes. “While we don’t see robots replacing the companionship and the human connection, we do dream of a time that robots could make nursing homes more pleasant by offsetting the often staggering numbers of caretakers to bed ratios (as bad as 30:1),” Thomaz concludes. That way, Moxi could “help people age with dignity and hold onto their independence for as long as possible.”

Powered by WPeMatico

Crowd-lending platform October hits pause on loan repayments

French startup October wants to reduce the pressure on small and medium companies going through the coronavirus crisis. In order to give them some headroom, companies that have borrowed money on October won’t have to pay back their loans for the next three months.

October works with small companies in France, Spain, Italy, Netherlands and Germany that need a credit line. One of the company’s key advantages compared to borrowing money from a bank is that it’s much faster. You can apply to a credit line and get an answer just a few days later. Usually, companies pay back their loans over time, with monthly repayments over three months to seven years.

October evaluates risk before handing out loans. It works with many institutional partners to raise funds and deploy capital in those loans. Some retail customers also invest on October directly on a company-by-company basis.

But many small European companies that have borrowed money on October won’t generate revenue for a little while. They could face cash flow issues and they could have issues repaying those loans.

That’s why October has decided with its institutional partners that it is postponing all outstanding loans for the next three months. Companies won’t have to pay a huge sum of money after that; October is also postponing the end date of the loans by three months.

October then asked retail investors to vote whether they are in favor or against postponing loans; 99.42% of retail investors who voted followed October’s move.

October is also waving its own fees for the next three months, but companies will still have to pay interest on outstanding capital.

This way, fewer companies should go bankrupt over the next three months. It should minimize the impact of the current economic crisis on the overall default rate of October loans.

Powered by WPeMatico

Coterie raises $8.5M to build ‘commercial insurance as a service’

Ohio-based Coterie, a startup working on in the commercial insurance space, has announced today it has raised $8.5 million Series A. The company had previously raised a little over $3 million in early investments, bringing its equity capital raised to nearly $12 million to date; the firm also told TechCrunch that it has raised $2.5 million in available venture debt as part of its current round.

In an uncertain market, Coterie is better capitalized than it ever has been, thanks to Intercept, and The Hartford, and RPM Ventures , which led its latest round.

Coterie operates in insurtech, a space we’ve covered extensively in recent months. But it’s not MetroMile or Lemonade, both of which selling consumer insurance. Nor is it akin to The Zebra, Policygenius, Gabi, or Insurify, helping consumers link to third-party insurance products. It’s closest private market comp, looking at our recent coverage, is Briza, which produces APIs linking small businesses to small business insurance products.

But what Coterie does is slightly different if we’re grokking its model correctly: It offers what it calls “commercial insurance as a service,” according to an interview with TechCrunch. Let’s explore.

Model

In a call with TechCrunch about its latest funding event, Coterie explained that, using APIs, it connects “places that have some commercial insurance requirement, or service customers who need commercial insurance, and we simply pass that information into our system and we quote and bind automatically.”

While Coterie does partner with external insurance entities (more on that in a second), it handles a lot of the work in-house: “We actually have the underwriting control, so we don’t we don’t ship it off to 10 different carriers. We actually say yes, we will bind this policy, or no, we won’t,” said Coterie CEO David McFarland, adding that “most of the time we have a pretty broad appetite so we can write a good bit of business.”

Helping it in this process are some partners in the insurance market that help with “the licenses and the capital requirements,” the company said.

What makes Coterie interesting isn’t that is a digital take on a previously paper business, but that it’s product allows it to insure freelancers (Coterie partners with freelance marketplaces, allowing it access to a potential customer base and helping the marketplace itself provide insured providers) for even small increments of time; that’s something that wasn’t economically attractive under old models, if even possible.

According to the firm, it offers general and professional liability insurance, along with business owners policies. Coterie has eyes on various types of data to power its model (and make good policy pricing choices), highlighting information like business payment flows to vet company health, to pick an example.

Coterie only started selling its products in September of 2019, but noted to TechCrunch that it saw “pretty good growth” from from the jump, and “pretty steady growth” since then. But as Coterie noted in our call, insurance is a somewhat low-margin business, meaning that policy growth, while good, needs to be pretty steep for the gross margin generated to stack up too high.

But with $8.5 million in new equity capital and total access to over $10 million in funds, the startup now has more money than ever to pursue its model. And if it’s like the rest of the insurtech space, it has a good shot at quick growth.

Update: The first version of this post included an incorrect investor; it has since been corrected.

Powered by WPeMatico

Scanwell aims to launch at-home 15-minute coronavirus test, but it still needs FDA approval

At-home diagnostics startup Scanwell, which produces smartphone-based testing for UTIs, is working on getting at-home testing for the novel coronavirus into the hands of U.S. residents. The technology, which was developed by Chinese diagnostic technology company INNOVITA and has already been approved by China’s equivalent of the FDA and used by “millions” in China, can be taken at home in 15 minutes with the guidance of a medical professional via telehealth, and produces results in just hours.

Scanwell’s test will require FDA clearance, but the company tells me that it’s in the process of securing approval through the FDA’s accelerated emergency certification program. The FDA guidance says that this approval process should take 6-8 weeks (though that “could be faster,” Scanwell says), and Scanwell is aiming to be ready to go with shipping these as soon as it receives that approval. While the U.S. drug regulatory agency previously had only included PCR tests in its protocols, it updated that guidance to include serological tests earlier this week. Scanwell further says they “don’t anticipate any issues with FDA approval.”

The test that Scanwell is aiming to launch uses what’s called a ‘serological’ technique, which looks for antibodies in a patient’s blood. These are only present if someone has been exposed to the SARS-CoV-2 virus, since as of right now researchers haven’t found any evidence that natural antibodies to this particular virus exist without exposure. By contrast, the types of tests that are currently in use in the U.S. are “PCR” tests, which use a molecular-based approach to determine if the virus is present genetically in a mucus sample.

The PCR type of test is technically more accurate than the serological variety, but the serological version is much easier to administer, and produces results more quickly. It’s also still very accurate on the whole, and is much cheaper to produce than the PCR version. Plus, it could help expand efforts beyond testing only the most severe cases with symptoms present, and do a much better job of illuminating the full extent of the presence of the virus, including among people with mild cases who have already recovered at home, and those who are asymptomatic but carrying the virus with the possibility of infecting others.

Also, while other, PCR-based at-home testing options already exist, like one from Everlywell that will start going out on Monday, require round-tripping test samples, adding time, complexity and cost and relying on testing materials like swabs that are in short supply globally.

Once the test is available, people deemed eligible via Scanwell’s screening process in their Scanwell Health app will be sent the test via next-day delivery. They’ll be guided by telehealth partner Lemonaid‘s licensed doctors and nurse practitioners, and they’ll then receive results and further guidance about those results via the app within a few hours. The whole testing process will cost $70, which Scanwell says just covers its costs (it’s also looking at ways to provide free service to those who need it), and will be deployed first in Washington, California and New York, as well as other areas depending on the severity of their coronavirus situation.

That the tests will take potentially 6-8 weeks to come to market seems like a long time, given the current state of the rapidly evolving COVID-19 situation and testing. But we’ll likely still be very much in need of testing options at that time, especially ones that can serve people who aren’t necessarily meeting the criteria for other available testing resources.

Powered by WPeMatico

Raising in a recession

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week’s episode was a testament to making do, as we’ve had to cancel some trips, juggle a few guests, and get up and running as a podcast that have guests dial in without losing our stride. So, this week Danny and Natasha and Alex were joined by Unshackled VC’s Manan Mehta.

And it went pretty ok, aside from a hiccup or two, expect Equity to still feature guests as often as it makes sense, even if we’re currently locked out of our own studio. Anyhoo, a combo of local recording, remote video setups, and Chris handling the dials meant that we were able to talk over all the good stuff:

- Hashicorp raises $175 million at a $5 billion valuation. It was nice to see a round so large take place when the rest of the sky in tech was busy falling onto itself.

- Deepgram raises $12 million. Alex covered this company’s funding, winding up pretty excited about the technology itself.

- Edtech startup Teachable exits after good GMV growth. Nice exit for this New York City-based startup, and we chatted about the early-stage edtech market, which was good fun.

- VC firms offer group therapy for founders due to the COVID-19 outbreak. It marks another data point in the small, but growing, cohort of venture capitalists thinking about mental health services beyond an investment opportunity.

- Remote Year, which helps you work while traveling the world, lays off 50% of staff. It’s one of an incoming flurry of layoffs we’re expecting to see from travel-related startups.

- Danny advised founders to announce their rounds now to reassure their employees and customers that they are ready for the coming recession

- And finally, what’s up with Airbnb’s direct listing timing? We tried to sort that out before we ran short of time.

All told there were some laughs, and we spent a good few minutes before mentioning COVID-19. It was good fun to have the crew on for a classic Equity episode, and a big thanks to Manan for coming aboard under less-than-optimal circumstances.

Equity drops every Monday at 7:00 AM PT and Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Claimer raises seed backing to make it easier for UK startups to claim R&D tax credits

Claimer, a London-based startup that makes it easy for companies to claim R&D tax credits in the U.K., has raised £300,000 in seed funding.

Backing the already revenue-generating company is Ben Holmes (who was previously at Index Ventures), Nick Telson and Andrew Webster (the founders of DesignMyNight, which recently exited), Rupert Loman (founder of Gamer Network), and TrueSight Ventures.

Founded by Adam McCann in January 2018 and then launched in April 2019, Claimer streamlines the process of claiming R&D tax credits, which is a U.K. government subsidy popular with tech startups that is designed to encourage innovation. The startup claims its product is approximately 10x faster and up to 6x cheaper than using a tax consultant.

“Claimer is fixing the R&D tax relief space with tech,” McCann tells me. “If you’re not familiar with the scheme, it’s run by HMRC and allows U.K. businesses to claim back up to 33% of their research & development costs as a cash payment in any industry, such as software and hardware development, manufacturing, textiles, biotechnology, foodtech, and many others.”

“Most accountants don’t have the in-house expertise to process claims, so they refer clients to R&D tax specialists. For many companies, the process is slow, expensive, and frustrating, because these specialists charge very high fees, often taking weeks to process claims.”

In contrast, McCann says Claimer’s platform makes it easy for businesses to reliably complete their R&D relief claims without any prior tax knowledge. After you upload a claim to the platform, which includes the ability to pull numbers from your accounting software, Claimer’s in-house tax specialists check and optimise it before it is submitted to HMRC.

“We’ve processed claims ranging from £1,000 to over £2 million with a 100% success rate (i.e. no rejections or reductions). Our customers have also awarded us 5 stars on TrustPilot,” he adds.

To that end, Claimer’s success is aligned with that of its customers. The startup charges a fee of 5% or less of the saving/credit received in R&D tax credits, capped to £10,000. McCann says this is much less than the typical uncapped 20-30% usually charged by specialists, “often with undesirable terms such as multi-year lock-in contracts, hidden costs, and large minimum fees”.

Meanwhile, Claimer plans to use the seed funding to grow its engineering team and build version two of the product, which McCann says will utilise open data and machine learning, making it possible for claims to be created automatically.

“And yes, we’ll be claiming R&D tax credits for developing our R&D tax credits platform,” quips the Claimer founder.

Powered by WPeMatico

Wag! CEO Garrett Smallwood explains his firm’s ‘radically different path to profitability’

Wag!, the petcare company known for connecting pet owners with local dog walkers, has recently undergone a series of sweeping changes.

In late November, after I was named the new CEO, my management team and I began plotting a radically different path to profitability. We began by assessing our relationship with users. First and foremost, we recognized that Wag! needed to improve the way we supported the community, including pet parents, pet caregivers and their pets.

Next, we examined the company’s financial health and analyzed the competitive climate, investment community and direction in which the tech industry appeared headed. The time has come to share how this influenced our decisions.

Late in 2019, a lot of smart people began to note a philosophical shift taking place in the capital markets. Investors had begun to lose patience with startups that spent massive sums on acquiring market share, but had demonstrated little to no ability at creating lasting businesses.

We concluded that funding in some sectors would quickly dry up. Based on our analysis, we expect a growing number of startups will be forced to hew out self-sustaining business niches to survive. This assessment is partly what led us to conclude that accepting another funding round wouldn’t necessarily benefit the company in the area that matters most: providing value to customers.

A consensus formed after we took control, and found a constant drumbeat of bills coming in and payments going out, notably to Amazon (Web Services), Google (to help extend our brand), Facebook (to reach customers) and for our office space. These costs were growing faster than revenue.

Powered by WPeMatico