TechCrunch’s favorite companies from 500 Startups’ latest demo day

Today 500 Startups hosted a virtual demo day for its 26th batch of startups, a group of companies that TechCrunch covered back in February.

500 is not the only accelerator that moved its traditional investor pitch event online; Y Combinator made a similar move after efforts to flatten the spread of COVID-19 required changes that made its traditional demo day setup temporarily impossible.

In addition to hosting a few dozen startup pitches today, 500 also explained changes to its own format and provided notes on the current state of the venture market.

Regarding how 500 Startups is shaking up how it handles its accelerator, the group intends to pivot to a rolling-admissions setup that will give participants more flexibility; the group will still hold two demo days each year — TechCrunch has more on the changes here.

Regarding the venture market, 500 Startups said venture capital’s investment pace could slow for several months. This seems likely, given how the economy has taken body blows in recent weeks as huge swaths of the world’s economy shut down. What advice did 500 have in the face of the new world? What you’d expect: startups should cut burn and focus on customers.

Got all that? OK, let’s talk about our favorite companies from the current 500 cohort.

Our faves

Powered by WPeMatico

Leading VCs discuss how COVID-19 is impacting real estate & proptech

Several months ago, we surveyed more than 20 leading real estate VCs to learn about what was exciting them most in the real estate tech sector and hear their opinions on proptech trends like co-working, flexible office space and remote office space.

Since we published our survey, COVID-19 has flipped the real estate sector on its head as more companies move toward mandatory remote work, retail businesses are forced to temporarily shut their doors and high-traffic properties thin out. Suddenly, the traditionally predictable world of real estate is more chaotic and unclear than ever.

What are the short and long-term impacts of pandemic-induced volatility? Does this open up opportunities for proptech startups or shutter them? What does this mean from an investing point of view? We asked several of the VCs that participated in our last survey to update us on how COVID-19 is impacting real estate startups, non-proptech companies in general and the broader real estate market overall:

- Christopher Yip, RET Ventures

- Nima Wedlake, Thomvest Ventures

- Merritt Hummer, Bain Capital Ventures

- Micah Kotch, Urban-X

- Andrew Ackerman, Dreamit Ventures

- Stonly Baptiste, Urban Us

Christopher Yip, RET Ventures

Despite its banner year in 2019, proptech will not be immune to the pressures venture-backed companies face in a market pullback, and we are preparing ourselves and our portfolio companies for a bumpy year.

Powered by WPeMatico

Tech giants should let startups defer cloud payments

Google, Amazon and Microsoft are the landlords. Amidst the coronavirus economic crisis, startups need a break from paying rent. They’re in a cash crunch. Revenue has stopped flowing in, capital markets like venture debt are hesitant and startups and small-to-medium sized businesses are at risk of either having to lay off huge numbers of employees and/or shut down.

Meanwhile, the tech giants are cash rich. Their success this decade means they’re able to weather the storm for a few months. Their customers cannot.

Cloud infrastructure costs area amongst many startups’ top expense besides payroll. The option to pay these cloud bills later could save some from going out of business or axing huge parts of their staff. Both would hurt the tech industry, the economy and the individuals laid off. But most worryingly for the giants, it could destroy their customer base.

The mass layoffs have already begun. Soon we’re sure to start hearing about sizable companies shutting down, upended by COVID-19. But there’s still an opportunity to stop a larger bloodbath from ensuing.

That’s why I have a proposal: cloud relief.

The platform giants should let startups and small businesses defer their cloud infrastructure payments for three to six months until they can pay them back in installments. Amazon AWS, Google Cloud, Microsoft Azure, these companies’ additional infrastructure products, and other platform providers should let customers pause payment until the worst of the first wave of the COVID-19 economic disruption passes. Profitable SaaS providers like Salesforce could give customers an extension too.

There are plenty of altruistic reasons to do this. They have the resources to help businesses in need. We all need to support each other in these tough times. This could protect tons of families. Some of these startups are providing important services to the public and even discounting them, thereby ramping up their bills while decreasing revenue.

Then there are the PR reasons. After years of techlash and anti-trust scrutiny, here’s the chance for the giants to prove their size can be beneficial to the world. Recruiters could use it as a talking point. “We’re the company that helped save Silicon Valley.” There’s an explanation for them squirreling away so much cash: the rainy day has finally arrived.

But the capitalistic truth and the story they could sell to Wall Street is that it’s not good for our business if our customers go out of business. Look at what happened to infrastructure providers in the dot-com crash. When tons of startups vaporized, so did the profits for those selling them hosting and tools. Any government stimulus for businesses would be better spent by them paying employees than paying the cloud companies that aren’t in danger. Saving one future Netflix from shutting down could cover any short-term loss from helping 100 other businesses.

This isn’t a handout. These startups will still owe the money. They’d just be able to pay it a little later, spread out over their monthly bills for a year or so. Once mass shelter-in-place orders subside, businesses can operate at least a little closer to normal, investors can get less cautious and customers will have the cash they need to pay their dues. Plus interest, if necessary.

Meanwhile, they’ll be locked in and loyal customers for the foreseeable future. Cloud vendors could gate the deferment to only customers that have been with them for X amount of months or that have already spent Y amount on the platform. The vendors also could offer the deferment on the condition that customers add a year or more to their existing contracts. Founders will remember who gave them the benefit of the doubt.

Consider it a marketing expense. Platforms often offer discounts or free trials to new customers. Now it’s existing customers that need a reprieve. Instead of airport ads, the giants could spend the money ensuring they’ll still have plenty of developers building atop them by the end of 2020.

Beyond deferred payment, platforms could just push the due date on all outstanding bills to three or six months from now. Alternatively, they could offer a deep discount such as 50% off for three months if they didn’t want to deal with accruing debt and then servicing it. Customers with multi-year contracts could offered the opportunity to downgrade or renegotiate their contracts without penalties. Any of these might require giving sales quota forgiveness to their account executives.

It would likely be far too complicated and risky to accept equity in lieu of cash, a cut of revenue going forward or to provide loans or credit lines to customers. The clearest and simplest solution is to let startups skip a few payments, then pay more every month later until they clear their debt. When asked for comment or about whether they’re considering payment deferment options, Microsoft declined, and Amazon and Google did not respond.

To be clear, administering payment deferment won’t be simple or free. There are sure to be holes that cloud economists can poke in this proposal, but my goal is to get the conversation started. It could require the giants to change their earnings guidance. Rewriting deals with significantly sized customers will take work on both ends, and there’s a chance of breach of contract disputes. Giants would face the threat of customers recklessly using cloud resources before shutting down or skipping town.

Most taxing would be determining and enforcing the criteria of who’s eligible. The vendors would need to lay out which customers are too big so they don’t accidentally give a cloud-intensive but healthy media company a deferment they don’t need. Businesses that get questionably excluded could make a stink in public. Executing on the plan will require staff when giants are stretched thin trying to handle logistics disruptions, misinformation and accelerating work-from-home usage.

Still, this is the moment when the fortunate need to lend a hand to the vulnerable. Not a hand out, but a hand up. Companies with billions in cash in their coffers could save those struggling to pay salaries. All the fundraisers and info centers and hackathons are great, but this is how the tech giants can live up to their lofty mission statements.

We all live in the cloud now. Don’t evict us. #CloudRelief

—

Thanks to Falon Fatemi, Corey Quinn, Ilya Fushman, Jason Kim, Ilya Sukhar and Michael Campbell for their ideas and feedback on this proposal.

Powered by WPeMatico

Salesforce’s Benioff pledges no ‘significant’ layoffs for 90 days

In a Twitter thread on Tuesday, Salesforce CEO Marc Benioff outlined an eight-step plan to keep people safe and find treatments and a vaccine for the COVID-19 virus, all while working to find a way to get people back to work safely. He also asked that all CEOs take a 90-day “no lay off” pledge to help everyone get through the crisis.

6.Release workers who are ok.Develop plan for this with antibody titers to be on front line exposure positions.

7.Every ceo take a 90 day “no lay off” pledge.https://t.co/hwC6xme1QT everyoneThanks @DavidAgus for editing!

— Marc Benioff (@Benioff) March 25, 2020

The same day, he posted another tweet pledging to not make any “significant” layoffs for 90 days. When TechCrunch asked Salesforce to comment on the difference between the two tweets, the company chose not to comment any further on the matter and let the tweets stand on their own.

Salesforce is pledging to its workforce Ohana not to conduct any significant lay offs over the next 90 days. We will continue to pay our hourly workers while our offices are closed. We encourage our Ohana to pay their own personal hourly workers like housekeepers & dog walkers.

— Marc Benioff (@Benioff) March 25, 2020

It sounds like Benioff’s second tweet, which also asked employees to consider paying their own hourly workers like housekeepers and dog walkers throughout the layoff period, whether they were working or not, was designed to give the CEO some wiggle room for at least some layoffs.

Salesforce has almost 50,000 employees worldwide. Even if the company were to lay off just 1% of employees it would equal 500 people without jobs, though it’s not clear if that would count as “significant.” Perhaps more likely, the company might make some cuts to staff for performance or HR-related reasons, but not broad cuts, and thus make both of its CEO’s claims essentially true.

Salesforce is a wildly successful company. It celebrated its 20th anniversary last fall and has grown from a pesky startup to a software behemoth with a projected revenue of over $20 billion for FY2021. It currently has almost $8 billion in cash and equivalents on hand. Certainly companies that use Salesforce’s products will continue to need them, even with the workforce at home.

While it could have an impact on that projection for FY2021 and its ability to land new customers this quarter, it seems like it has the money and revenue to ride out the situation for the short term without making any moves to reduce headcount at this critical time.

Powered by WPeMatico

Microsoft acquires 5G specialist Affirmed Networks

Microsoft today announced that it has acquired Affirmed Networks, a company that specializes in fully virtualized, cloud-native networking solutions for telecom operators.

With its focus on 5G and edge computing, Affirmed looks like the ideal acquisition target for a large cloud provider looking to get deeper into the telco business. According to Crunchbase, Affirmed raised a total of $155 million before this acquisition, and the company’s more than 100 enterprise customers include the likes of AT&T, Orange, Vodafone, Telus, Turkcell and STC.

“As we’ve seen with other technology transformations, we believe that software can play an important role in helping advance 5G and deliver new network solutions that offer step-change advancements in speed, cost and security,” writes Yousef Khalidi, Microsoft’s corporate vice president for Azure Networking. “There is a significant opportunity for both incumbents and new players across the industry to innovate, collaborate and create new markets, serving the networking and edge computing needs of our mutual customers.”

With its customer base, Affirmed gives Microsoft another entry point into the telecom industry. Previously, the telcos would often build their own data centers and stuff it with costly proprietary hardware (and the software to manage it). But thanks to today’s virtualization technologies, the large cloud platforms are now able to offer the same capabilities and reliability without any of the cost. And unsurprisingly, a new technology like 5G, with its promise of new and expanded markets, makes for a good moment to push forward with these new technologies.

Google recently made some moves in this direction with its Anthos for Telecom and Global Mobile Edge Cloud, too. Chances are we will see all of the large cloud providers continue to go after this market in the coming months.

In a somewhat odd move, only yesterday Affirmed announced a new CEO and president, Anand Krishnamurthy. It’s not often that we see these kinds of executive moves hours before a company announces its acquisition.

The announcement doesn’t feature a single hint at today’s news and includes all of the usual cliches we’ve come to expect from a press release that announces a new CEO. “We are thankful to Hassan for his vision and commitment in guiding the company through this extraordinary journey and positioning us for tremendous success in the future,” Krishnamurthy wrote at the time. “It is my honor to lead Affirmed as we continue to drive this incredible transformation in our industry.”

We asked Affirmed for some more background about this and will update this post if we hear more. Update: an Affirmed spokesperson told us that this was “part of a succession plan that had been determined previously. So it was not related [to] any specific event.”

Powered by WPeMatico

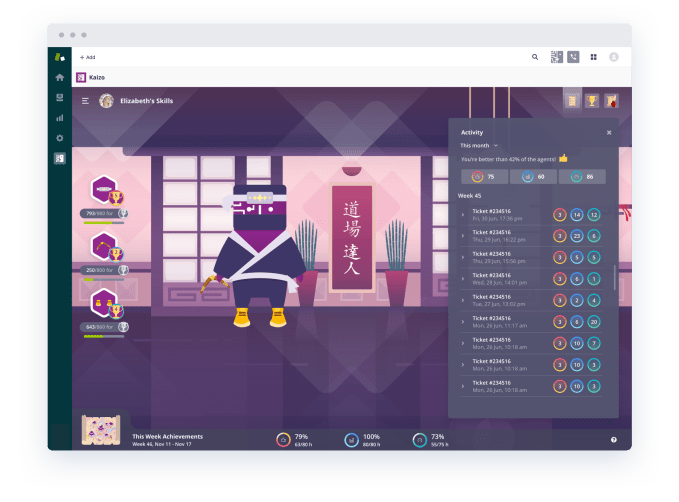

Kaizo raises $3M for its AI-based tools to improve customer service support teams

CRM has for years been primarily a story of software to manage customer contacts, data to help agents do their jobs, and tools to manage incoming requests and outreach strategies. Now to add to that we’re starting to see a new theme: apps to help agents track how they work and to work better.

Today comes the latest startup in that category, a Dutch company called Kaizo, which uses AI and gamification to provide feedback on agents’ work, tips on what to do differently, and tools to set and work to goals — all of which can be used remotely, in the cloud. Today, it is announcing $3 million in a seed round of funding co-led by Gradient — Google’s AI venture fund — and French VC Partech.

And along with the seed round, Kaizo (which rebranded last week from its former name, Ticketless) is announcing that Christoph Auer-Welsbach, a former partner at IBM Ventures, is joining the company as a co-founder, alongside founder Dominik Blattner.

Although this is just a seed round, it’s coming after a period of strong growth for the company. Kaizo has already 500 companies including Truecaller, SimpleSurance, Miro, CreditRepairCloud, Justpark, Festicket and Nmbrs are using its software, covering “thousands” of customer support agents, which use a mixture of free and paid tools that integrate with established CRM software from the likes of Salesforce, Zendesk and more.

Customer service, and the idea of gamifying it to motivate employees, might feel like the last thing on people’s minds at the moment, but it is actually timely and relevant to our current state in responding to and living with the coronavirus.

People are spending much more time at home, and are turning to the internet and remote services to get what they need, and in many cases are finding that their best-laid plans are now in freefall. Both of these are driving a lot of traffic to sites and primarily customer support centers, which are getting overwhelmed with people reaching out for help.

And that’s before you consider how customer support teams might be impacted by coronavirus and the many mandates we’ve had to stay away from work, and the stresses they may be under.

“In our current social climate, customer support is an integral part of a company’s stability and growth that has embraced remote work to meet the demands of a globalized customer-base,” said Dominik Blattner, founder of Kaizo, in a statement. “With the rise of support teams utilizing a digital workplace, providing standards to measure an agent’s performance has never been more important. KPIs provide these standards, quantifying the success, achievement and contribution of each team member.”

On a more general level, Kaizo is also changing the conversation around how to improve one’s productivity. There has been a larger push for “quantified self” platforms, which has very much played out both in workplaces and in our personal lives, but a lot of services to track performance have focused on both managers and employees leaning in with a lot of input. That means if they don’t set aside the time to do that, the platforms never quite work the way they should.

This is where the AI element of Kaizo plays a key role, by taking on the need to proactively report into a system.

“This is how we’re distinct,” Auer-Welsbach said in an interview. “Normally KPIs are top-down. They are about people setting goals and then reporting they’ve done something. This is a bottom-up approach. We’re not trying to change employees’ behaviour. We plug into whatever environment they are using, and then our tool monitors. The employee doesn’t have to report or measure anything. We track clicks on the CRM, ticketing, and more, and we analyse all that.” He notes that Kaizo is looking at up to 50 datapoints in its analysis.

“We’re excited about Kaizo’s novel approach to applying AI to existing ticket data from platforms like Zendesk and Salesforce to optimize the customer support workflow,” said Darian Shirazi, General Partner at Gradient Ventures, in a statement. “Using machine learning, Kaizo understands which behaviors in customer service tickets lead to better outcomes for customers and then guides agents to replicate that using ongoing game mechanics. Customer support and service platforms today are failing to leverage data in the right way to make the life of agents easier and more effective. The demand Kaizo has seen since they launched on the Zendesk Marketplace shows agents have been waiting for such a solution for some time.”

Kaizo is not the only startup to have identified the area of building new services to improve the performance of customer support teams. Assembled earlier this month also raised $3.1 million led by Stripe for what it describes as the “operating system” for customer support.

Powered by WPeMatico

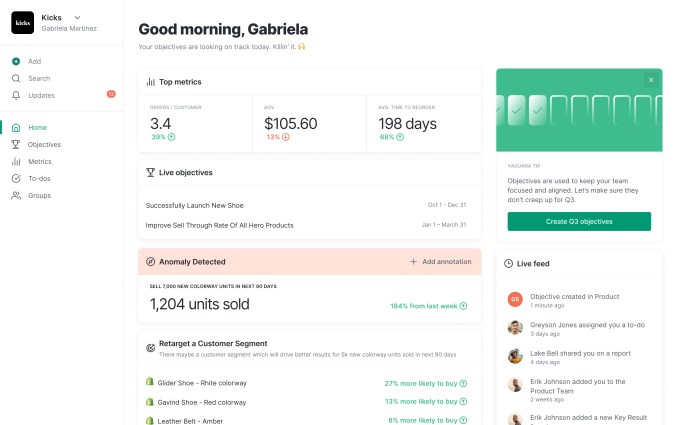

Yaguara nabs $7.2M seed to help e-commerce companies understand customers better

Yaguara, a Denver-based startup that wants to help e-commerce companies understand their customers better to deliver more meaningful experiences, announced a $7.2 million seed investment today.

The round was led by Foundation Capital with participation from Gradient Ventures, Rainfall Ventures and Zelkova. It also had help from some e-commerce heavy hitters including Warby Parker, Harry’s and Allbirds.

Yaguara CEO Jonathan Smalley was working at an agency building specialized cloud tools for online businesses when he recognized there was a need to pull data together into a single place and help companies understand their customer’s behavior better.

“Yaguara is based on integrating data and having all their data in the right place. For us, it started with several dozen tools from performance marketing to your actual e-commerce data to your fulfillment and unit economic data — bringing that all into one place letting them see their data in real time.”

“Then our platform serves predictive and prescriptive insights and recommendations to individual users across your teams, so they can drive specific outcomes across the organization based on that unified data set,” Smalley explained.

Screenshot: Yaguara

They build that data set by connecting to a variety of popular tools to help understand what’s happening across the customer lifecycle, whether that’s customer acquisition through Facebook or Google ads or understanding shopping cart abandonment data or how often the customer has returned to buy again, all of which help build a better picture of the customer.

While this may sound like a customer data platform (CDP), Smalley says it’s actually more than that. While the CDP provides the pipeline to your data sources like Yaguara, it doesn’t stop there. He says it reduces the complexity of helping front-line marketing personnel access and query that data without having to know SQL or R or have a technical intermediary to understand the data.

While the company is young it already has 250 e-commerce customers using the platform. With the new infusion of cash, it should be able to bring in more employees, build more data connectors and continue working to build out the platform.

Powered by WPeMatico

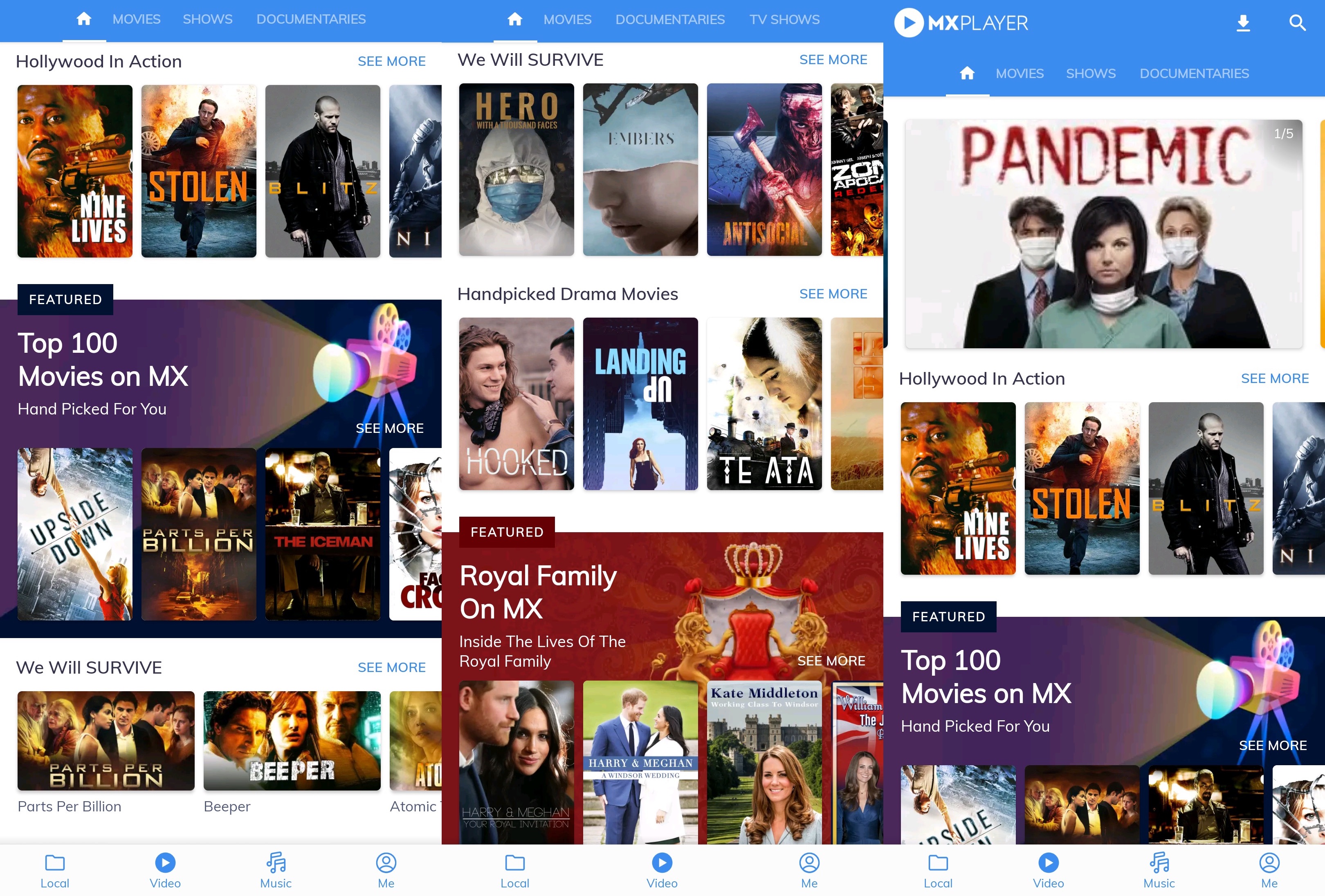

India’s MX Player expands to US, UK and other markets in international push

MX Player, the on-demand video streaming service owned by India’s conglomerate Times Internet, is expanding to more than half a dozen new international markets including the U.S. and the U.K. to supply more entertainment content to millions of people trapped in their homes.

The Singapore-headquartered on-demand video streaming service, which raised $111 million in a round led by Tencent last year, said it has expanded to Canada, Australia, New Zealand, Bangladesh and Nepal in addition to the U.S. and the UK.

Like in India, MX Player will offer its catalog at no charge to users in the international markets and monetize through ads, Karan Bedi, chief executive of the service, told TechCrunch in an interview.

The streaming service, which has amassed over 175 million monthly active users in India, is offering locally relevant titles in each market, he said. This is notably different from Disney’s Hotstar expansion into select international markets, where it has largely aimed to cater to the Indian diaspora.

MX Player is not currently offering any originally produced titles in any international market — instead offering movies and shows it has licensed from global and local studios — but the streamer plans to change that in the coming months, said Bedi.

Even as the expansion comes at a time when the world is grappling with containing and fighting the coronavirus outbreak, Bedi said MX Player had already been testing the service in several markets for a few months.

“We believe in meeting this rapidly rising demand from discerning entertainment lovers with stories that strike a chord. To that end, we have collaborated with some of the best talent and content partners globally who will help bring us a step closer to becoming the go-to destination for entertainment across the world,” said Nakul Kapur, Business Head for International markets at MX Player, in a statement.

Times Internet acquired MX Player, an app popular for efficiently playing a plethora of locally-stored media files on entry-level Android smartphones, in 2018 for about $140 million. In the years since, Times Internet has introduced video streaming service to it, and then live TV channels in India.

MX Player has also bundled free music streaming (through Gaana, another property owned by Times Internet) and has introduced in-app casual games for users in the country.

Bedi said the company is working on bringing these additional services to international markets, and also looking to enter additional regions including the Middle East and South Asia.

Powered by WPeMatico

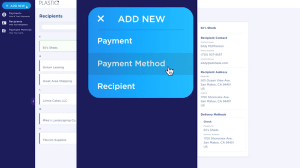

Plastiq raises $75M to help small businesses use credit cards more

When Eliot Buchanan tried to use his credit card to pay his Harvard tuition bill, the payment was rejected because the university said it doesn’t accept credit. Realizing the same problem exists for thousands of different transactions like board, rent and vendor payments, he launched Plastiq. Plastiq helps people use credit cards to pay, or get paid, for anything.

Plastiq today announced that it has raised $75 million in venture capital in a Series D round led by B Capital Group. Kleiner Perkins, Khosla Ventures, Accomplice and Top Tier Capital Partners also participated in the round. The round brings the company’s total known venture capital raised to more than $140 million.

To use Plastiq, users enter their credit card information on Plastiq’s platform. In return, Plastiq will charge you a 2.5% fee and get your bills paid. While Plastiq was started with consumers in mind, SMBs have now accounted for 90% of the revenue, according to Buchanan. The new financing round will invest in building out features to give SMBs faster services around payments and processing.

Plastiq provides a way for SMBs and consumers to pay their bills and make sure they have reliable cash flow. For example, restaurants sometimes have a drop in revenue due to seasonality or, as we’re experiencing now with COVID-19, pandemic lockdowns. Or tourism companies for cities that are struggling to attract visitors. Those companies still need cash flow, and using Plastiq’s service, they can use credit cards to pay suppliers even in an off season.

There is no shortage of competition from other companies also trying to solve pain points in small-business cash flow. According to Buchanan, Plastiq’s biggest competitors are traditional lenders, as well as companies like Kabbage and Fundbox. Similar claims could be made about Brex, which offers a credit card for startups to access capital faster.

Kabbage provides funding to SMBs through automated business loans. The SoftBank-backed company landed $200 million in a revolving credit line back in July, fresh off of landing strong partnerships with banks and giants like Alibaba to access more customers. Kabbage loans out roughly $2-3 billion to SMBs every year.

Plastiq, according to its release, is also on track to make more than $2 billion in transactions. But unlike Kabagge, Plastiq doesn’t issue loans or credit, it just unlocks a payment opportunity.

“SMBs don’t need to be burdened with additional debt or additional loans,” Buchanan said. “So rather than trying to reinvent the wheel, let’s use a behavior they have already earned.”

Buchanan would not disclose Plastiq’s current valuation or revenue, but he did say that it’s not too far away from $100 million in revenue run rate. The company’s revenue has grown 150% from 2018 to 2019.

The company also noted that it has surpassed “well over 1 million users,” up 150% in unique new users from 2018 to 2019.

In terms of profitability, Buchanan said that “we could be profitable if we wanted to be,” noting that Plastiq’s revenue and margins could lead them toward profitability if they wanted to focus less on growth. But he added they don’t plan to “slow down” the growth engine any time soon — especially in the wake of the COVID-19 pandemic.

Because the Series D round closed at the end of 2019, Buchanan said the pandemic did not impact the deal. However, the company had planned to time the announcement with tax season. Now, as small businesses struggle to secure capital and stay afloat due to lockdowns across the country, Plastiq’s new raise feels more fitting.

“Our customers are more thankful for solutions like ours as traditional sources of lending are drying up and not as easy to access” Buchanan said. “Hopefully, we can measure how many businesses make it through this because of us.”

The 140-person company is currently hiring across product and engineering roles.

Powered by WPeMatico

Monday.com surpassed $130M ARR before the remote-work boom

As efforts to flatten the spread of COVID-19 pushes employees from their offices, remote work is undergoing a surge in popularity.

Well-known remote-work-friendly companies like Zoom have seen a rise in usage, while Slack has already reported that it is successfully converting new users into paying customers, which is pushing up its growth rate.

The pandemic is creating economic and social upheaval, but for a specific cohort of software companies that help distributed teams work together, it’s proven useful in business terms. But even before the outbreak of the novel coronavirus, execs from a standout project management company swung by TechCrunch HQ to chat with the Equity crew about their business and growth: Monday.com.

What does an interview with Monday.com’s Eran Zinman (co-founder and CTO) and Roy Mann (CEO) have to do with COVID-19? Well, if remote-productivity-friendly services Slack and Zoom are seeing usage spikes amidst the changes, Monday.com is likely benefiting from similar gains. And during our chat with the company’s brass, the pair told TechCrunch that their company had crossed the $130 million annual recurring revenue (ARR) mark by mid-February. Add in a COVID-19 usage boost and perhaps Monday.com (which doesn’t have a free tier) is seeing its growth accelerate.

Previously, Monday.com announced that it had reached the $120 million ARR mark, and TechCrunch had inducted it into the $100 million ARR club earlier this year.

Revenue expansion was not our only topic. We also chatted with the pair of execs about customer acquisition costs and how to a run a SaaS business without terrifying burn. The Monday.com crew had more news up their sleeve, like when they expect the unicorn to become cash-flow positive.

We’ve excised a larger-than-usual chunk of the interview for sharing, as there’s a lot to take in:

After the jump, we dig a bit deeper into the obvious IPO candidate

Powered by WPeMatico