Amid concerns that startups could be left out of COVID-19 bailout, investors step up lobbying

The massive bailout package that the U.S. government passed last week to stave off an economic collapse from measures put in place to mitigate the spread of the COVID-19 epidemic is giving out billions to American small businesses. But startups that received venture capital money could be left out.

So the nation’s investment organizations and lobbying firms are stepping up their efforts to get clarification around the specifics of the loan programs established under the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Their efforts could mean the difference between some of those billions in loans for small businesses going to startup companies or a whole swath of companies left falling through the cracks.

There appear to be two issues for startup entrepreneurs with the different types of loans that companies can receive.

The first is the “Affiliation Rules” that the Small Business Administration (SBA) uses to determine who is eligible for loans. Under the rules, companies could be required to count all of the employees at every company their investors have backed as part of their employee count — pushing the individual companies above the employee size threshold.

“Regardless of the purpose of these rules for traditional 7(a) loans, allowing the rules to exclude some of our country’s most innovative startups in this new loan program is manifestly contrary to the intent of the legislation: to help small businesses keep their lights on and their employees working despite the double financial squeeze created by the economic and financial market downturns,” according to a letter sent to Treasury Secretary Steve Mnuchin and SBA Administrator Jovita Carranza by the NVCA and other startup investment organizations. “Without clear guidance enabling startups and small businesses supported by equity investment to access the loan facility, many of these startups may be rendered ineligible.”

These issues around affiliation and 7(a) loans aren’t the only ones with which startups may contend. Startups could also be eligible for Economic Injury Disaster Loans (EIDL). These loans are part of a $10 billion program within the CARES Act that is also overseen by the SBA. However, these loans have to come with a personal guarantee if they’re over $200,000. And that requirement may be too onerous for startups.

EIDLs less than $200,000 don’t require a personal guarantee, nor do they require real estate as collateral, and will take a general security interest in business property, according to an article in Forbes. Borrowers for EIDLs can take an emergency cash grant of $10,000 that can be forgiven if spent on things like paid leave, maintaining payroll, increased costs due to supply chain disruptions, mortgage or lease payments or repaying obligations that cannot be met due to revenue loss, according to Forbes.

These loans apply to sole proprietors and independent contractors and employee stock ownership plans with fewer than 500 employees, Forbes wrote. The emergency loans are available to companies that don’t qualify for additional funds — and are based on self-certification and a basic credit score, Alex Contreras, director of Preparedness, Communication, & Coordination at the Office of Disaster Assistance for the SBA told Forbes.

While the EIDLs may be interesting, the biggest issue is the lack of clarity around affiliation rules, Justin Field, NVCA’s senior vice president of government affairs, tells me.

“These rules will make it more difficult for small businesses with equity investors to even understand if they can access the program,” he says. “It’s a tough situation… If you have these non-bright-lined rules it’s going to be tough for anybody that has a company that has minority investors.”

There could be significant implications for the U.S. economy if these startups are ineligible for loans, the NVCA wrote. Companies backed by venture investors are involved in the development of technologies of strategic interest to the U.S. in the long term and are currently working on tools to diagnose, track, monitor and mitigate the spread of COVID-19 in the short term.

“Bottom line: not providing this critical support to startups now will cause both short-term pain and long-term consequences that linger for years,” the organizations wrote. “In 2019 alone, 2.27 million jobs were created in the U.S. by startups across our nation. According to the job site Indeed, 98 percent of firms have fewer than 100 employees and between small and medium sized companies, they jointly employ 55 percent of employees. When implementing the CARES Act, we urge the SBA to issue guidance that makes clear affiliation rules do not arbitrarily exclude our most innovative startups.”

Powered by WPeMatico

Experience Disrupt SF online with the Disrupt Digital Pro Pass

Earlier this month we announced the launch of the Disrupt Digital Pass for TechCrunch’s flagship Disrupt SF event (September 14-16) as a way to help ensure that, no matter what, TechCrunch fans everywhere would be able to enjoy the big interviews at the show. We also hinted that we were working on a Pro edition of the Digital Pass for people who really want to engage as fully as possible with Disrupt SF, including all the programming on the four primary stages and lots of real-time interaction with fellow attendees, founders in Startup Alley, engaging Q&A sessions and our all important exhibitors and partners. That was trickier to figure out, but we’re there.

Today we’re happy to unveil the Disrupt Digital Pro Pass that we’ve been working hard to finalize. Here’s what you get with your Disrupt Digital Pro Pass, starting at $245:

- Live stream and VOD (video-on-demand) from the Extra Crunch Stage. Live and on-demand access to TechCrunch editors’ discussions with top experts — growth marketers, lawyers, investors, technologists, recruiters — on topics critical to founders’ success. Pass holders, in-person and virtual, may submit questions in real time to the moderator onstage.

- Live stream and VOD from the Q&A Stage. Virtual pass holders can submit questions during live Q&A sessions with speakers after they have appeared with TechCrunch editors on the Disrupt and Extra Crunch stages.

- VOD from the Showcase Stage. Watch top founders exhibiting in Startup Alley pitch and take questions from TechCrunch editors.

- Interact with early-stage startups in Startup Alley virtually. Browse the hundreds of exhibiting startups, organized by category, and watch their product demos on demand. Digital Pro pass holders can arrange 1:1 meetings with founders whether they be virtual or exhibiting on the show floor in-person.

- Video conference networking with CrunchMatch. TechCrunch’s hugely popular platform to connect like-minded attendees will be accessible to Digital Pro pass holders as well as in-person attendees. Find attendees, request a meeting and connect via a private video conference.

- Virtual sponsor engagements. We love our sponsors, and they will be front and center for Digital Pro pass holders, whether that’s opportunities to set up 1:1 meetings virtually with sponsor reps or watch sponsors’ presentations.

In addition, of course, Pro pass holders also have access to the features of the free Disrupt Digital Pass:

- Live stream and VOD from the Disrupt Stage. Live and on-demand access to all the great interviews TechCrunch’s editors conduct with the biggest names in tech.

You can expect to see the TechCrunch team at San Francisco’s Moscone Center during Disrupt, but now attendees can join us in person and/or virtually.

Innovator, Founder, Investor and Startup Alley pass holders (except Expo Only passes) will also have access to all the Disrupt Digital Pro Pass features, as well as the opportunity to be present with us in San Francisco.

Sign up for Disrupt SF today. 2020 marks the 10th anniversary of Disrupt SF, and we hope you will join us to celebrate, online or at Moscone. We would love to have you, either way.

Powered by WPeMatico

Compete in Startup Battlefield and Launch at Disrupt SF 2020

Early-stage founders: Don’t miss your chance to follow in the footsteps of tech giants. We know COVID-19 has created challenges for startup founders, but fear not. Disrupt SF is still proceeding as scheduled, with a Disrupt Digital Pass Virtual option. Launch your startup in the world’s most famous pitch competition, Startup Battlefield. The smackdown goes down live on the Main Stage at Disrupt San Francisco 2020 on September 14-16. Want a shot at $100,000 and the Disrupt Cup? Fill out your application to compete right here.

Companies such as Fitbit, Cloudflare, Mint.com, Dropbox, Vurb, Yammer and Getaround — to name but a few — trace their origins to the Battlefield competition. The Startup Battlefield Alumni Community — 902 companies strong and counting — has collectively raised $9 billion and produced more than 115 successful exits (IPOs or acquisitions). That’s some impressive company to keep. Why not join their ranks?

Here’s how Startup Battlefield works. First, you apply. (Pro tip: Applying and competing in the Battlefield is free and TechCrunch does not take any equity). Next, TechCrunch’s Battlefield-savvy editorial team pours over every application looking for approximately 20 startups to pitch on the Main Stage.

The TechCrunch team will put all participants through rigorous, weeks-long training to hone pitches, business models, presentation skills and any other startup issues that require tightening. You’ll be in fighting trim and ready to step out onto the Main Stage.

Teams have just six minutes to pitch and present a live demo to a panel of expert judges. After each pitch, the judges (we’re talking folks like Cyan Banister, Kirsten Green, Aileen Lee, Alfred Lin and Roelof Botha) will put each team through a Q&A. No flop-sweat here, thanks to all those weeks of pitch coaching.

The judges will select anywhere from four to six teams to advance to the finals. And that means another pitch and Q&A in front of a fresh set of judges. The winning team takes home $100,000, the coveted Disrupt Cup and they bask in a spotlight of media and investor attention. Startup Battlefield can be a life-changing experience for all competitors — not just the ultimate winner.

The action takes place in front of an enthusiastic audience of thousands. Plus, we live-stream the entire event on TechCrunch.com, once you sign up for the digital pass. If all that’s not enough, consider this. Startup Battlefield competitors receive a VIP Disrupt experience.

You’ll have access to private VIP events like the Startup Battlefield Reception, and each team receives four complimentary event tickets. You get to exhibit at the show for all three days, and you’ll have access to CrunchMatch, TC’s investor-founder networking platform. And you also get a complimentary ticket to all future TC events and free subscriptions to Extra Crunch.

Whew. That’s a whole lot of opportunity and exposure. So, what are you waiting for? Disrupt San Francisco 2020 takes place on September 14-16. Apply to compete in Startup Battlefield for a shot at launching your dream to the world.

TechCrunch is mindful of the COVID-19 issue and its impact on live events. You can follow our updates here.

Is your company interested in sponsoring or exhibiting at Disrupt San Francisco 2020? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

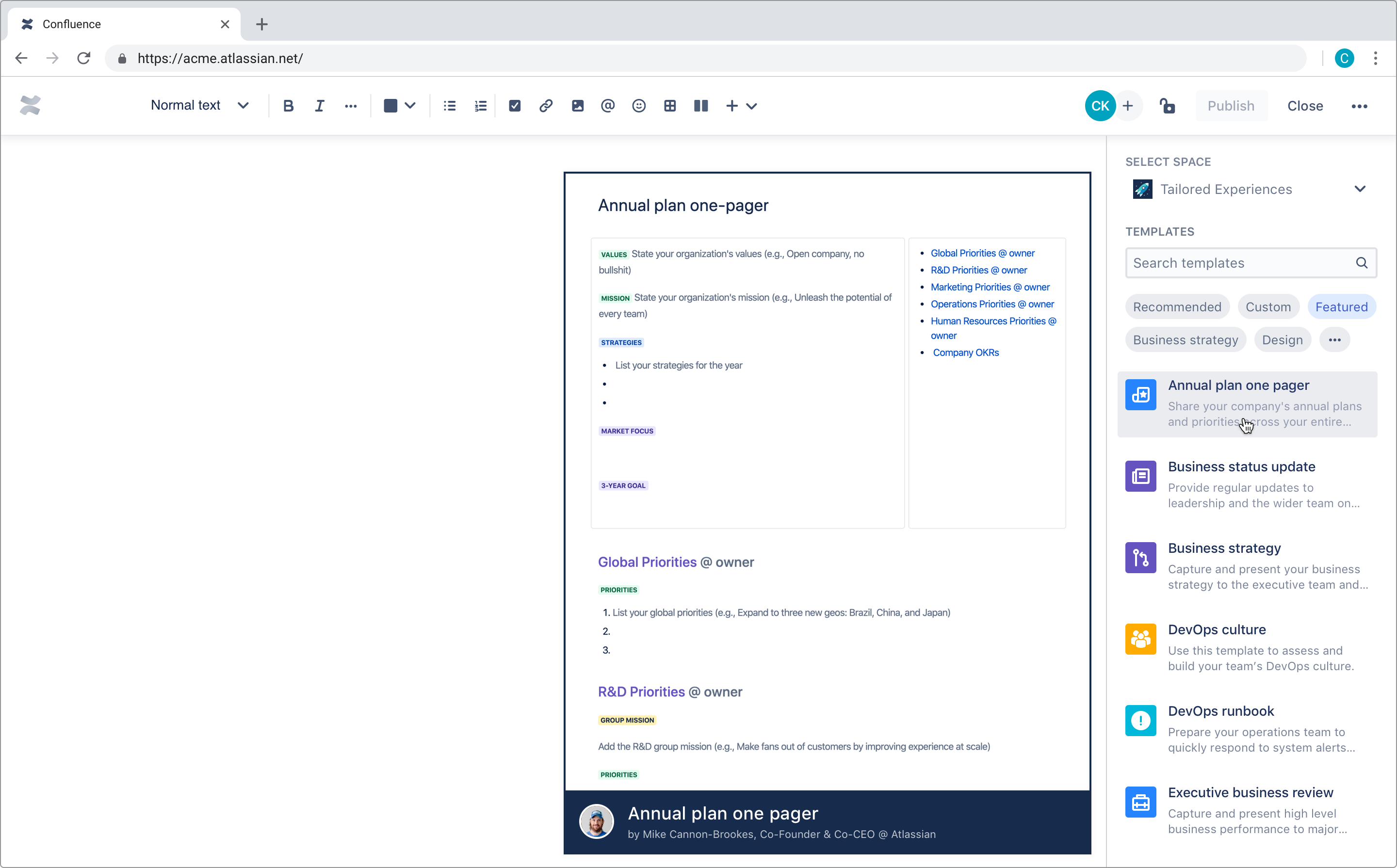

Atlassian’s Confluence gets a new template gallery

Confluence, Atlassian’s content-centric collaboration tool for teams, is making it easier for new users to get started with the launch of an updated template gallery and 75 new templates. They incorporate what the company has learned from its customers and partners since it first launched the service back in 2004.

About a year ago, Atlassian gave Confluence a major makeover, with an updated editor and advanced analytics. Today’s update isn’t quite as dramatic, but goes to show that Confluence has evolved from a niche wiki for technical documentation teams to a tool that is often used across organizations today.

About 60,000 customers are using Confluence daily, and the new templates reflect the different needs of these companies. The new template gallery will make it easier to find the specific template that makes sense for your business, with new search tools, filters and previews that you can find in the right-hand panel of your Confluence site.

The updated gallery features new templates for design, marketing and HR teams, for example. Working with partners, Atlassian also added templates like a job description guide from Indeed and a design system template from InVision, as well as similar use case-specific templates from HubSpot, Optimizely and others. Because most tasks take more than one template, Atlassian is also launching collections of templates for accomplishing more complex tasks around developing marketing strategies, HR workflows, product development and more.

Powered by WPeMatico

SMB loans platform Kabbage to furlough a ‘significant’ number of staff, close office in Bangalore

Another tech unicorn is feeling the pinch of doing business during the coronavirus pandemic. Today, Kabbage, the SoftBank-backed lending startup that uses machine learning to evaluate loan applications for small and medium businesses, is furloughing a “significant number” of its U.S. team of 500 employees, according to a memo sent to staff and seen by TechCrunch, in the wake of drastically changed business conditions for the company. It is also completely closing down its office in Bangalore, India, and executive staff is taking a “considerable” pay cut.

The announcement is effective immediately and was made to staff earlier today by way of a video conference call, as the whole company is currently remote working in the current conditions.

Kabbage is not disclosing the full number of staff that are being affected by the news (if you know, you can contact us anonymously). It’s also not putting a time frame on how long the furlough will last, but it’s going to continue providing benefits to affected employees. The intention is to bring them back on when things shift again.

“We realize this is a shock to everyone. No business in the world could have prepared for what has transpired these past few weeks and everyone has been impacted,” co-founder and CEO Rob Frohwein wrote in the memo. “The economic fallout of this virus has rattled the small business community to which Kabbage is directly linked. It’s painful to say goodbye to our friends and colleagues in Bangalore and to furlough a number of U.S. team members. While the duration of the furlough remains uncertain, please bear in mind that the full intention of furloughing is temporary. We simply have no clear idea of how long quarantining or its reverberations in the economy will last.”

Kabbage’s predicament underscores the complicated and stressful calculus faced by tech companies built around providing services to SMBs, or fintech (or both, as in the case of Kabbage).

SMBs are struggling right now in the U.S.: many operate on very short terms when it comes to finances, and closing their businesses (or seeing a drastic reduction in custom) means they will not have the cash to last 10 days without revenue, “and we’re already well past that window,” Frohwein noted in his memo.

In Kabbage’s case, that means not only are SMBs not able to be evaluated and approved for normal loans at the moment, but SMBs that already have loans out are likely facing delinquencies.

The decision to furlough is hard but in relative terms it’s good news: it was made at the eleventh hour after a period when Kabbage was considering layoffs instead.

The company has raised hundreds of millions of dollars in equity and debt, and it was in a healthy state before the coronavirus outbreak. The memo notes that the “board and our top investors are aware of the challenges we are facing and have committed to helping us through this period,” although it doesn’t specify what that means in terms of financial support for the business, and whether that support would have been there for the business as-is.

The shift to furlough from layoffs came in the wake of an announcement yesterday by Steven Mnuchin, the U.S. Secretary of the Treasury, who clarified that “any FDIC bank, any credit union, any fintech lender will be authorized” to make loans to small businesses as a part of the U.S. government’s CARE Act, the giant stimulus package that included nearly $350 billion in loan guarantees for small businesses.

While that provides much-needed relief for these businesses, the implementation of it — the Small Business Administration has already received nearly 1 million claims for disaster-relief loans since the crisis started — has been and is going to be a challenge.

That effectively opens up an opportunity for Kabbage and companies like it to revive and reorient some of its business. (Its USP was always that the AI it uses, which draws on a number of different sources of online data for the business, means a more creative, faster and more accurate assessment of loan applications than what traditional banks typically provide.) Kabbage said it is in “deep discussions” with the Treasury Department, the White House and the Small Business Administration to help expedite applications for aid.

While loans still make up the majority of Kabbage’s business, the company has been making a move to diversify its services, and in recent times it has made acquisitions and launched new services around market intelligence insights and payments services. While there has certainly been a jump in e-commerce, overall the tightening economy will have a chilling effect on the wider market, and it will be worth seeing what happens with other tech companies that focus on loans, as well as adjacent financial services.

Powered by WPeMatico

Anorak’s Greg Castle on early-stage investing during a crisis

As the venture landscape adjusts to the COVID-19 pandemic and seismic shifts in public markets, early-stage VCs are reassessing which bets they’re making, along with questions they’re asking of founders who are exploring bleeding-edge technology.

Anorak’s Greg Castle

Anorak Ventures is a small seed-investment firm that bets on emerging tech like AR/VR, machine learning and robotics. I recently hopped on a Zoom call with founder Greg Castle to talk about what he’s seen recently in seed investing and how the sector is responding to the crisis. Castle was an early investor in Oculus; his other bets at Anorak include Against Gravity, 6D.ai and Anduril.

Our conversation has been edited for length and clarity.

TechCrunch: Has this pandemic affected the types of companies that you’re looking at?

Greg Castle: From my experience as an investor thus far, being reactive as an investor and looking at “hot” areas has a lot of pitfalls to be mindful of. I think a lot of the areas that excite me as an investor could benefit from what’s going on here, those areas including robotics, automation, immersive entertainment and immersive computing.

Just generally, do you feel like a recession is likely to negatively impact emerging tech more so than other areas?

Powered by WPeMatico

Turbo Systems hires former Looker CMO Jen Grant as CEO

Turbo Systems, a three-year old, no-code mobile app startup, announced today it has brought on industry veteran Jen Grant to be CEO.

Grant, who was previously vice president of marketing at Box and chief marketing officer at Elastic and Looker, brings more than 15 years of tech company experience to the young startup.

She says that when Looker got acquired by Google last June for $2.6 billion, she began looking for her next opportunity. She had done a stint with Google as a product manager earlier in her career and was looking for something new.

She saw Looker as a model for the kind of company she wanted to join, one that had a founder focused on product and engineering, who hired an outside CEO early on to run the business, as Looker had done. She found that in Turbo where founder Hari Subramanian was taking on that type of role. Subramanian was also a successful entrepreneur, having previously founded ServiceMax before selling it to GE in 2016.

“The first thing that really drew me to Turbo was this partnership with Hari,” Grant told TechCrunch. While that relationship was a key component for her, she says even with that, before she decided to join, she spoke to customers and she saw an enthusiasm there that drew her to the company.

“I love products that actually help people. And so Box is helping people collaborate and share files and work together. Looker is about getting data to everyone in the organization so that everyone could be making great decisions, and at Turbo we’re making it easy for anyone to create a mobile app that helps run their business,” she said.

Grant has been on the job for just 30 days, joining the company in the middle of a global pandemic. So it’s even more challenging than the typical early days for any new CEO, but she is looking forward and trying to help her 36 employees navigate this situation.

“You know, I didn’t know that this is what would happen in my first 30 days, but what inspires me, what’s a big part of it is that I can help by growing this company, by being successful and by being able to hire more and more people, and contribute to getting our economy back on track,” Grant said.

She also recognizes that there is a lack of diversity in her new CEO role, and she hopes to be a role model. “I have been fortunate to get to a position where I know I can do this job and do it well. And it’s my responsibility to do this work, my responsibility to show it can be done and shouldn’t be an anomaly.”

Turbo Systems was founded in 2017 and has raised $8 million, according to Crunchbase. It helps companies build mobile apps without coding, connecting to 140 different data sources such as Salesforce, SAP and Oracle.

Powered by WPeMatico

This Week in Apps: Apple launches a COVID-19 app, the outbreak’s impact on social and video apps and more

Welcome back to This Week in Apps, the Extra Crunch series that recaps the latest OS news, the applications they support and the money that flows through it all.

The app industry saw a record 204 billion downloads and $120 billion in consumer spending in 2019, according to App Annie’s “State of Mobile” annual report. People are now spending 3 hours and 40 minutes per day using apps, rivaling TV. Apps aren’t just a way to pass idle hours — they’re a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus.

In this Extra Crunch series, we help you keep up with the latest news from the world of apps, delivered on a weekly basis.

This week, we’re continuing our special coverage of how the COVID-19 outbreak is impacting apps and the wider mobile app industry as more COVID-19 apps appear — including one from Apple built in partnership with the CDC, among others. We also take a look at the gains made by social and video apps in recent weeks as people struggle to stay connected while stuck at home in quarantine. In other headlines, we dig into Instagram’s co-watching feature, the Google for Games conference news, Apple’s latest releases and updates, Epic Games expansion into publishing and more.

Coronavirus Special Coverage

Social video apps are exploding due to the COVID-19 pandemic

Powered by WPeMatico

John Borthwick & Matt Hartman of betaworks discuss coronavirus adaptation strategies

Yesterday, I had the pleasure of hopping on Zoom with betaworks’ John Borthwick and Matt Hartman to discuss the tech world’s adaptation to this new locked-down world, the future of new media and answer questions from the audience.

We discussed whether new media companies can raise capital right now, and touched on emerging trends around audio, voice, AR, live events, travel-related companies and many other topics.

It was a delight, and I’m excited to do more of these in the future.

For those of you who missed the Zoom, here’s a rundown of what we discussed (audio embed below).

Powered by WPeMatico

Rocket startup Skyrora shifts production to hand sanitizer and face masks for coronavirus response

One of the newer companies attempting to join the rarified group of private space launch startups actually flying payloads to orbit has redirected its entire UK-based manufacturing capacity towards COVID-19 response. Skyrora, which is based in Edinburgh, Scotland, is answering the call of the UK government and the NHS to manufacturers to do what they can to provide much-needed healthcare equipment for frontline responders amid the coronavirus crisis.

Skyrorary says that the entirety of its UK operations, including all human resources and its working capital are now dedicated to COVID-19 response. The startup, which was founded in 2017, had been working towards test flights of its first spacecraft, making progress including an early successful engine test using its experimental, more eco-friendly rocket fuel that was completed in February.

For now, though, Skyrora will be focusing full on building hand sanitizer, its first effort to support the COVID-19 response. The company has already produce their initial batch using WHO guidelines and requirements, and now aims to scale up its production efforts to the point where it can manufacture the sanitizer at a rate of over 10,000 250 ml bottles per week.

There’s actually a pretty close link between rocketry and hand sanitizer: Ethanol, the form of alcohol that provides the fundamental disinfecting ingredient for hand sanitizer, has been used in early rocket fuel. Skyrora’s ‘Ecosene’ fuel is a type of kerosene, however, which is a much more common modern aviation and rocket fuel.

In addition to sanitizer, Skyrora is now in talks with the Scottish Government to see where 3D-printed protective face masks might have a beneficial impact on ensuring health worker safety. It’s testing initial prototypes now, and will look to mass produce the protective equipment after those tests verify its output.

Plenty of companies are pitching in where they can, including by shifting their production lines and manufacturing capacity towards areas of greatest need. It’s definitely an ‘all-hands-on-deck’ moment, but there’s definitely a question of what happens to businesses that shift their focus this dramatically once the emergency passes, especially for young startups in emerging industries.

Powered by WPeMatico