So many fintech eggs in so many baskets

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

The whole crew was present this week: Natasha, Danny and Alex, along with our intrepid producer Chris. And like the last few episodes it was good to have everyone around as there was so very much to get through. Even better there was a lot of good, non-COVID-19 news to cover. Yes, there were bad tidings and some COVID-19 material as well, but, hey, not everything can be fun.

We started with a look at Clearbanc and its runway extension not-a-loan program, which may help startups survive that are running low on cash. Natasha covered it for TechCrunch. Most of us know about Clearbanc’s revenue-based financing model; this is a twist. But it’s good to see companies work to adapt their products to help other startups survive.

Next we chatted about a few rounds that Danny covered, namely Sila’s $7.7 million investment to help build technology that could take on the venerable and vulnerable ACH, and Cadence’s $4 million raise to help with securitization. Even better, per Danny, they are both blockchain-using companies. And they are useful! Blockchain, while you were looking elsewhere, has done some cool stuff at last.

Sticking to our fintech theme — the show wound up being super fintech-heavy, which was an accident — we turned to SoFi’s huge $1.2 billion deal to buy Galileo, a Utah-based payments company that helps power a big piece of UK-based fintech. SoFi is going into the B2B fintech world after first attacking the B2C realm; we reckon that if it can pull the move off, other financial technology companies might follow suit.

Tidying up all the fintech stories is this round up from Natasha and Alex, working to figure out who in fintech is doing poorly, who’s hiding for now, and who is crushing it in the new economic reality.

Next we touched on layoffs generally, layoffs at Toast, AngelList, and not LinkedIn — for now. Per their plans to not have plans to have layoffs. You figure that out.

And then at the end, we capped with good news from Thrive and Index. We didn’t get to Shippo, sadly. Next time!

Equity drops every Monday at 7:00 AM PT and Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Startups, VCs in India request ‘relief package’ from the government to fight coronavirus disruption

More than six dozen startup founders, venture capitalists and lobby groups in India have requested the government to grant them a “robust relief package” to help combat severe disruptions their businesses face due to the coronavirus outbreak.

In a joint letter to India’s Prime Minister Narendra Modi, startups requested the government to bankroll 50% of their workforce’s salaries for six months, provide interest-free loans from banks, waive rent for three months and offer tax benefits among other things.

“Unfortunately, our startup companies across the nation are inherently young, less resilient and most vulnerable. Many of them face likely devastation during this extraordinary economic downturn. At this dire moment, Indian startups need a robust relief package from the government, lest all our collective efforts of the past few years are in vain,” they wrote.

Among those who have signed the letter include Mohit Bhatnagar, a managing director at Sequoia Capital, which is in advanced stages to close a fresh $1.3 billion fund for India and Southeast Asia, Gaurav Agarwal of online medicine store 1mg, Debjani Ghosh of industry body Nasscom, Karthik Reddy of Blume Ventures, Anand Lunia of India Quotient, Deepinder Goyal of Zomato, and Sriharsha Majety of Swiggy.

Some prominent startup founders and VCs including Vijay Shekhar Sharma of Paytm, and Ritesh Agarwal of Oyo, have also held a meeting with Piyush Goyal, the commerce minister in India, for a similar relief.

“We seek your urgent intervention to help ensure India’s startup ecosystem survives this crisis to emerge as a pillar of growth, employment and innovation to help drive India’s recovery. We need the startup ecosystem to survive in order to help the economy bounce back. We have enclosed herewith our submission for your kind consideration and we look forward to your support in this regard,” the joint letter reads.

The request for bailout comes amid a national lockdown in India that has disrupted countless businesses. New Delhi ordered a 21-day lockdown last month in a bid to curtail the spread of Covid-19.

Earlier this month, ten prominent VC and PE funds in India cautioned startups to brace for the “worst” months ahead.

“Assumptions from bull market financings or even from a few weeks ago do not apply. Many investors will move away from thinking about ‘growth at all costs’ to ‘reasonable growth with a path to profitability.’ Adjust your business plan and messaging accordingly,” they said.

As India, where the economy growth has been slowing for several quarters, scrambles to provide for its 1.3 billion citizens, the letter has drawn some criticism from industry figures.

Disappointed to see many startup leaders & investors that I admire add their names to this shameful letter to the govt asking for bailouts – surely at this time the govt has more important things to worry about than pay “50% of salary bills & contract wage bills paid by startups”

— Sumanth Raghavendra (@sumanthr) April 10, 2020

“I can’t fathom how such a list gets made in a country of more than a billion people who are facing a crisis unlike any they’ve seen before. A significant majority of them daily wage earners who have no financial cushion or any idea where their next meal is going to come from. Let’s not even stray into health and the need for medical emergencies; just putting three square meals on the table a day is proving to be impossible for so many,” wrote Ashish K. Mishra in a column on The Morning Context.

“At this very moment, it is they who need the government’s support. Not fat cats with bloated, middling business models and venture capital funds whose begging bowls are now seemingly larger than their risk appetite,” he added.

Companies asking for a bailout is not limited to India. Oil giants have sought similar help from the U.S. President Donald Trump — and VCs and startups are beginning to explore their option. Brent Hoberman, chairman and co-founder of Founders Factory and Firstminute Capital, urged the UK government to provide some relief to startups last month. But the government has yet to do much about it, just ask Deliveroo, Graphcore and other big UK startups.

Powered by WPeMatico

$75M weed giant Caliva ditches Eaze, launches delivery

It’s a brutal time for marijuana startups. I’m hearing some are raising at one-fifth of their 2019 valuation amid rampant competition, tall taxes and slow legalization. The struggles for marijuana’s best-known startup, delivery service Eaze, continue as today it’s losing one of its top partners: $75 million-funded weed brand empire Caliva has dropped Eaze in favor of launching its own delivery system.

By partnering with Hypur banking to solve the marijuana payments legality issue, Caliva will be able to accept contactless mobile payments, unlike Eaze, which usually requires customers to pay in cash. Caliva buyers won’t have to worry about trips to the ATM, especially now during COVID-19 shelter-in-place orders, which the startup expects will boost their average order volume. Combined with verticalizing delivery in-house, plus its retail and wholesale operations, Caliva hopes it can grow its margins and survive this long winter for weed startups.

“Our mission at Caliva has always been to provide safe and easy access to plant-based solutions for health, happiness and healing,” said Caliva CEO Dennis O’Malley. “Together with Hypur, we are proud to offer our customers safe, compliant and convenient cashless payment options to improve and modernize their purchasing experience.” It hasn’t been so easy for Eaze, though.

Back in January, we reported that Eaze was in trouble, having suffered unannounced layoffs and executive departures. It burned cash on billboards, and never launched the services of a startup it acquired. There were questions about data security, and weed brands dropped Eaze due to delayed payments. It was almost out of money and in danger of vaporizing. It luckily managed to secure a $15 million bridge round to keep it alive, plus a $20 million Series D in February just before COVID-19 hit the fan, though I dread to think of the terms of that funding.

The plan for Eaze was to verticalize, buying and developing brands that it could sell through its existing delivery service to up its margins. Now it’s seeing former partner Caliva do the reverse, launching a delivery service to sell its own Fun Uncle, Deli and Caliva brands, as well as distribute other vape, edible and flower brands like Dosist and Kiva. Its menu breadth to attract customers and in-house brands to drive profits could be a winning combo. After limited pilots in SoCal, Caliva delivery is launching in LA and the Bay Area.

Unfortunately, traditional payment processors usually refuse to work with marijuana companies for fear of legal repercussions. That’s why most delivery services can’t accept credit or debit cards, or do so through sketchy legal workarounds that have led payment providers to be sued. Others like CanPay only offer ACH transfers, while Square only works with CBD sellers. “We spent time researching and evaluating all platforms that accept cannabis payments in the U.S., and found that Hypur has the best security, compliance and consumer experience” O’Malley tells me.

Although 400-person Caliva is now trying to raise a Series B, it may experience tough headwinds with shelter-in-place orders in effect in states where marijuana is legal. Stiff taxes on marijuana have meanwhile helped the black market continue to thrive, as California’s $3.1 billion in legal 2019 sales were overshadowed by an estimated $8.7 billion in illegal sales. Faster delivery and simpler payments could help. But enthusiasm for the industry has dwindled following the initial flood of entrants sought to exploit the end of prohibition. Is the Green Rush over?

Powered by WPeMatico

Free tool helps manufacturers map where COVID-19 impacts supply chain

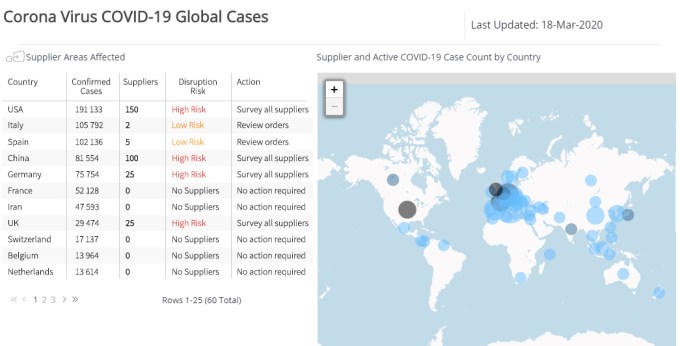

Assent Compliance, a company that helps large manufacturers like GE and Rolls Royce manage complex supply chains through an online data exchange, announced a new tool this week that lets any company, whether they’re a customer or not, upload bills of materials and see on a map where COVID-19 is having an impact on their supply chain.

Company co-founder Matt Whitteker, says the Ottawa startup focuses on supply chain data management, which means it has the data and the tooling to develop a data-driven supply chain map based on WHO data identifying COVID hotspots. He believes that his is the only company to have done this.

“We’re the only ones that have taken supply chain data and applied it to this particular pandemic. And it’s something that’s really native to our platform. We have all that data on hand — we have location data for suppliers. So it’s just a matter of applying that with third-party data sources (like the WHO data), and then extracting valuable business intelligence from it,” he said.

If you want to participate, you simply go to the company website and fill out a form. A customer success employee will contact you and walk you through the process of uploading your data to the platform. Once they have your data, they generate a map showing the parts of the world where your supply chain is most likely to be disrupted, identifying the level of risk based on your individual data.

The company captures supply chain data as part of the act of doing business with 1,000 customers and 500,000 suppliers currently on their platform. “When companies are manufacturing products they have what’s called a bill of materials, kind of like a recipe. And companies upload their bill of materials that basically outlines all their parts, components and commodities, and who they get them from, which basically represents their supply chain,” Whitteker explained.

After the company uploads the bill of materials, Assent opens a portal for the companies to exchange data, which might be tax forms, proof of sourcing or any kind of information and documentation the manufacturer needs to comply with legal and regulatory rules around procurement of a given part.

They decided to start building the COVID-19 map application when they recognized that this was going to have the biggest supply chain disruption the world has seen since World War II. It took about a month to build it. It went into beta last week with customers and over 350 signed up in the first two hours. This week, they made the tool generally available to anyone, even non-customers, for free.

The company was founded in 2016 and has raised $220 million, according to Whitteker.

Powered by WPeMatico

Android gets a built-in Braille keyboard

Android has received a wealth of accessibility features over the last couple of years, but one that has been left to third-party developers is a way for blind users to type using braille. That changes today with Android’s new built-in braille keyboard, which should soon be available as an option on all phones running version 5 and up of the OS.

Braille is a complex topic in the accessibility community, as in many ways it has been supplanted by voice recognition, screen readers and other tools. But many people are already familiar with it and use it regularly — and after all, one can’t always chat out loud.

Third-party braille keyboards are available, but some cost money or are no longer in development. And because the keyboard essentially has access to everything you type, there are security considerations as well. So it’s best for the keyboard you use to be an official one from a reputable company. Google will have to do!

(Apple, it must be said, has had a braille keyboard like this one for years that plugs into its OS’s other accessibility tools. It can be activated using the instructions here.)

The new keyboard, the company writes in a blog post, was created as a collaboration with various users and developers of braille software, and should be familiar to anyone who’s used something like it in the past.

The user holds the phone in landscape mode, with the screen facing away from them, and taps the regions corresponding to each of the six dots that form letters in the braille alphabet. It works with Android’s TalkBack function, which reads off words the user types or selects, so like any other writing method errors can be quickly detected and corrected. There are also some built-in gestures for quickly deleting letters and words or sending the text to the recipient or selected field.

Instructions for activating the braille keyboard are here. Right now it’s only available in English, but more languages will likely be added in the near future.

Powered by WPeMatico

Quibi is the anti-TikTok (that’s a bad thing)

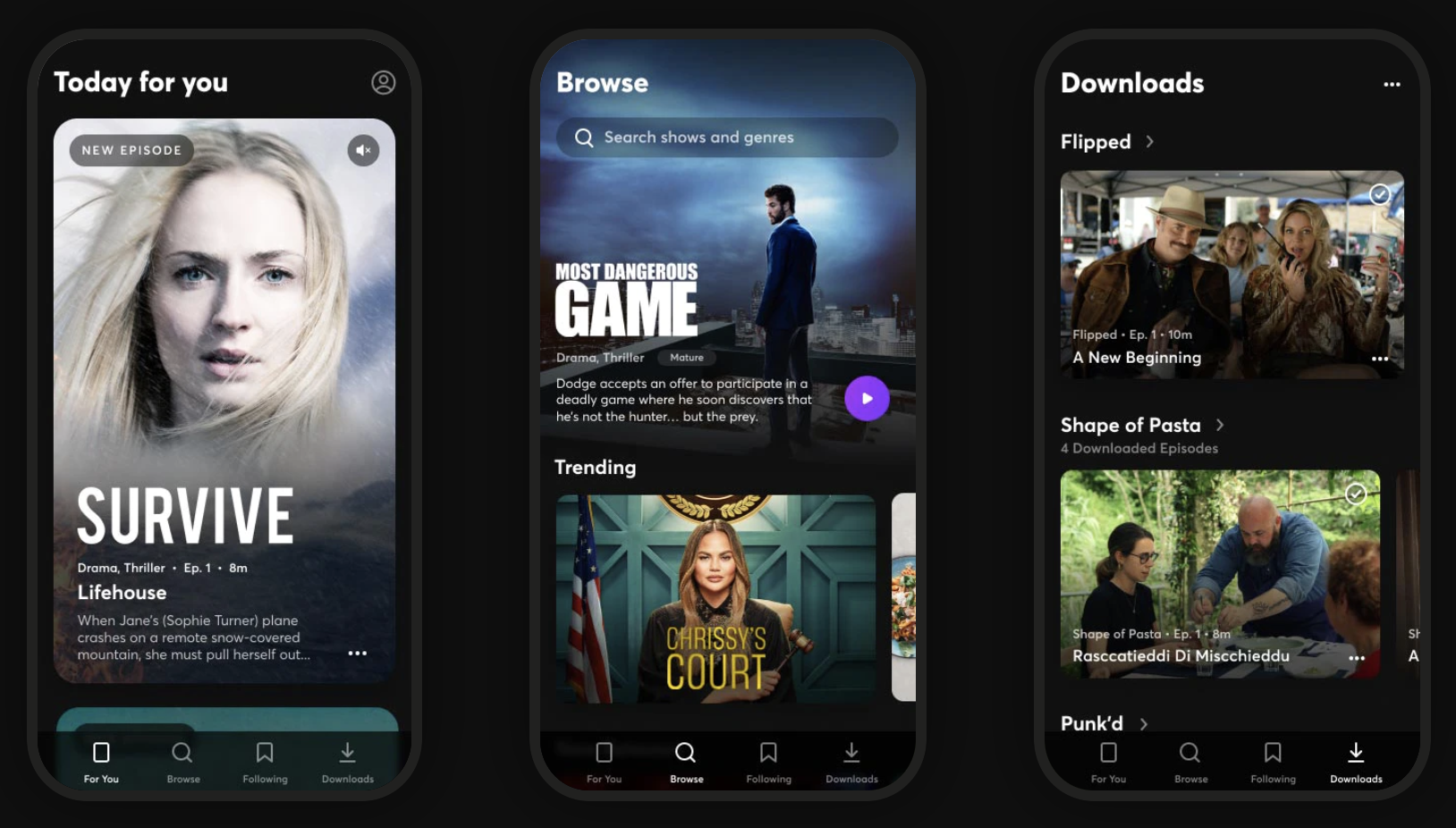

It takes either audacious self-confidence or reckless hubris to build a completely asocial video app in 2020. You can decide which best describes Quibi, Hollywood’s $1.75 billion-funded attempt at a mobile-only Netflix of six to 10-minute micro-TV show episodes. Quibi manages to miss every trend and tactic that could help make its app popular. The company seems to believe it can succeed on only its content (mediocre) and marketing dollars (fewer than it needs).

I appreciate that Quibi is doing something audaciously different than most startups. Rather than iterating toward product-market fit, it spent a fortune developing its slick app and buying fancy content in secret so it could launch with a bang.

Yet Quibi’s bold business strategy is muted by a misguided allegiance to the golden age of television before the internet permeated every entertainment medium. It’s unshareable, prescriptive, sluggish, cumbersome and unfriendly. Quibi’s unwillingness to borrow anything from social networks makes the app feel cold and isolated, like watching reality shows in the vacuum of space.

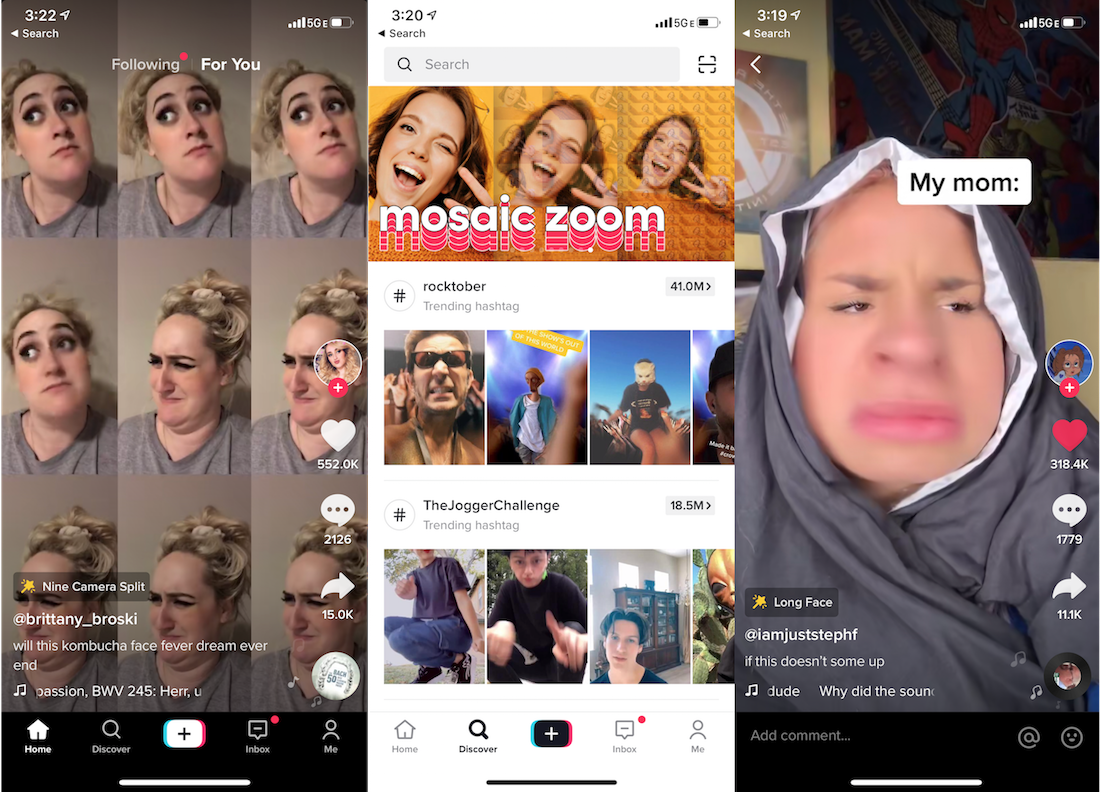

In that sense, Quibi is the inverse of TikTok, which feels fiercely alive. TikTok is designed to immediately immerse you in crowd-vetted content that grabs your attention and inspires you to spread your take on it to friends. That’s why TikTok has almost 2 billion downloads to date, while Quibi picked up just 300,000 on the day of its big splash into market.

Here’s a breakdown of the major missteps by Quibi, why TikTok does it better and how this new streaming app can get with the times.

What Hollywood thinks we want

Quibi feels like some off-brand cable channel, with a mix of convoluted reality shows, scripted dramas and news briefs. Imagine MTV at noon in the mid-2000s. Nothing seemed must-see. There’s no Game of Thrones or Mandalorian here. While the production value is better than what you’ll find on YouTube, the show concepts feel slapdash with novelty that quickly fades.

Chrissy Teigen as a small claims court judge? The tear-jerking “Thanks A Million” does skillfully multiply the “OMG” gratitude moment from makeover programs to happen 4X per episode. But a cooking show where blindfolded chefs have to guess what food was just exploded in their faces…(sigh)

The catalog feels like the product of TV writers being told they have 10 seconds to come up with an idea. “What would those idiots watch?” The shows remind me of old VR games that are barely more than demos, or an app built in a garage without ever asking prospective users what they need. Co-founder Jeffrey Katzenberg may have produced The Lion King and Shrek, but the app’s content feels like it was greenlit by, well, Hewlett Packard Enterprise’s leader Meg Whitman, who indeed is Quibi’s CEO.

Quibi CEO Meg Whitman

Despite being built for a touch-screen interface, there’s little Bandersnatch-style interactive content so far, nor are the creators doing anything special with the six to 10-minute format. The shows feel more like condensed TV programs with episodes ending when there would be a commercial break. There’s no onboarding process that could ask which popular TV shows or genres you’re into. As the catalog expands, that makes it less likely you’ll find something appealing within a few taps.

TikTok comes from the opposite direction. Instead of what Hollywood thinks we want, its content comes straight from its consumers. People record what they think would make them and their friends laugh, surprised or enticed. The result is that with low to zero production budget, random kids and influencers alike make things with millions of Likes. And as elder millennials, Gen Xers and beyond get hooked, they’re creating videos for their peers, as well. The algorithm monitors what you’re hovering over and rapidly adapts its recommendations to your style.

TikTok is fundamentally interactive. Each clip’s audio can be borrowed to produce remixes that personalize a meme for a different demographic or subculture. And because its stars are internet natives, they’re in constant communication with their fan base to tune content to what they want. There’s something for everyone. No niche is too small.

TikTok screenshots

The Fix: Quibi should take a hint from Brat TV, the Disney Channel for the YouTube generation that gives tween social media stars their own premium shows about being a grade school kid to create content with a built-in fan base. [Disclosure: My cousin Darren Lachtman is a Brat co-founder.)

Take the Chrissy’s Court model, and shift it to stars who are 20 years younger. Give TikTok phenoms like Charli D’Amelio or Chase Hudson Quibi shows and let them help conceptualize the content, and they’ll bring their legions of fans. Double-down on choose-your-own-adventures and fan voting game shows that leverage the phone’s interactivity. Fund creators that will differentiate Quibi by making it look like anything other than daytime TV. And ask users directly what they want to see right when they download the app.

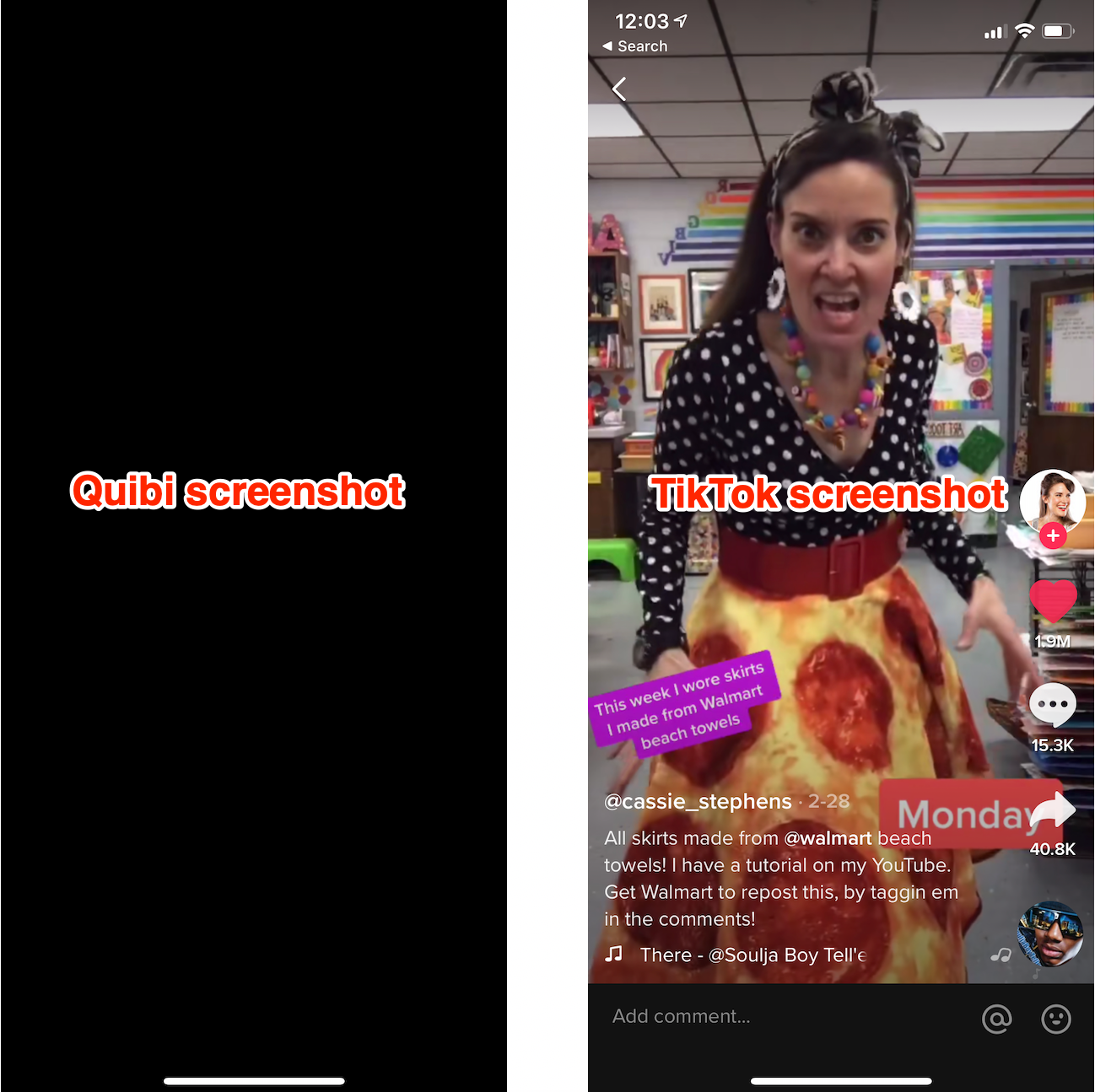

No screenshots

This is frankly insane. Screenshots of Quibi appear as a blank black screen. That means no memes. If people can’t turn Quibi scenes into jokes they’ll share elsewhere, its shows won’t ever become fixtures of the cultural zeitgeist like Netflix’s Tiger King has. Yes, other mobile streaming apps like Netflix and Disney+ also block screenshots, but they have web versions where you can snap and share what you want. Quibi never should have structured its deals to license content from producers in a way that prevented any way to riff on or even let friends preview its content.

TikTok, on the other hand, defaults to letting you download any video and share it wherever you please — with the app’s watermark attached. That’s fueled TikTok’s stellar growth as clips get posted to Twitter and Instagram — and drive viewers back to the app. It has spawned TikTok compilations on YouTube, and a whole culture of remixing that expands and prolongs the popularity of trending jokes and dances.

The Fix: Quibi should allow screenshots. There’s little risk of spoilers or piracy. If its deals prohibit that, then it should offer pre-approved screenshots and video clips/trailers of each episode that you can download and share. Think of it like an in-app press kit. Even if we’re not allowed to set up the perfect screenshot for making a meme, at least then we could coherently discuss the shows on other social networks.

Sluggish pacing

On mobile, you’re always just a swipe away from something more interesting. It’s like if you watched TV with your finger permanently hovering over the change channel button. Ever noticed how movie trailers now often start with a fast-forward collage of their most eye-catching scenes? Quibi seems intent on communicating prestige with its slow-building dramas like The Most Dangerous Game and Survive, which both had me bored and fast-forwarding. And that’s watching Quibi at home on the couch. While on the go, where it was designed to be consumed, slow pacing could push users with a minute or two to spare to open Instagram or TikTok instead.

None of this is helped by Quibi not auto-playing a trailer or the first episode the moment you scroll past a show on the home screen. Instead, you see a static title card for two seconds before it starts playing you an excerpt of the program. That makes it more cumbersome to discover new shows.

Where TikTok wins is in immediacy. Creators know users will swipe right past their video if it’s not immediately entertaining or obviously revving up to a big reveal. They grab you in the first second with smiles, costumes, bold captions or crazy situations. That also makes it easy for viewers to dismiss what’s irrelevant to them and teach the TikTok algorithm what they really want. Plus, you know that you can score a dopamine hit of joy even if you only have 30 seconds. TikTok makes Quick Bites feel like an understaffed sit-down restaurant.

The Fix: Quibi needs to teach creators to hook viewers instantly by previewing why they should want to watch. Since tapping a show’s card on the Quibi homepage instantly plays it, those teasers need to be built into the first episode. Otherwise, Quibi needs a button to view a trailer from its buried dedicated show pages to the preview card most people interact with on the home screen. Otherwise, users may never discover what Quibi shows resonate with them and teach it which to show and make more of.

Anti-social video club

Quibi neglects all its second-screen potential. No screenshotting makes it tough to discuss shows elsewhere, yet there’s no built-in comments or messaging to discuss or spread them in-app. Pasting an episode link into Twitter doesn’t even display the show’s name in the preview box. Nor do shows have their own social accounts to follow to remind you to keep watching.

There’s no way for friends to follow what you’re watching or see your recommendations. No leaderboards of top shows. Certainly no time-stamped, live-stream style crowd annotations. No synced-up co-watching with friends, despite a lack of TV apps preventing you from watching with anyone else in person unless you crowd around one phone.

It all feels like Quibi figured advertising would be enough. It could run contests where winners get a Cameo-esque message or chat with their favorite stars. Quibi could let you share scenes with your face swapped onto actors’ heads, deepfake-style like Snapchat’s (confusingly named) Cameos feature. It could host in-app roundtables with the casts where users could submit questions. It’s like if Web 2.0 never happened.

TikTok, meanwhile, harnesses every conceivable social feature. Follow, Like, comment, message, go Live, duet, remix or download and share any video. It beckons viewers to participate in trending challenges. And even when users aren’t itching to return to TikTok, notifications from these social features will drag them back in, or watermarked clips will follow them to other networks. Every part of the app is designed to make its content the center of popular culture.

The Fix: Quibi needs to understand that just because we’re watching on mobile, doesn’t make video a solo experience. At first, it should add social content discovery options so you can see which friends opt in to share that they’re watching or view a leaderboard of the top programs. Shows, especially ones dripping out new episodes, are more fun when you have someone to chat about them with.

Eventually, Quibi should layer on in-app second-screen features. Create a way to share comments at the end of each episode that people read during the credits so they feel like they’re in a viewing community.

Can Quibi be more?

What’s most disappointing about Quibi is that it has the potential to be something fresh, merging classically produced premium content with the modern ways we use our phones. Yet beyond shows being shot in two widths so you can switch between watching in landscape or portrait mode at any time, it really is just a random cable channel shrunk down.

Youths act in front of a mobile phone camera while making a TikTok video on the terrace of their residence in Hyderabad on February 14, 2020 (Photo by NOAH SEELAM / AFP) (Photo by NOAH SEELAM/AFP via Getty Images)

One of the few redeeming opportunities for Quibi is using the daily episode release schedule to serialize content that benefits from suspense, as Ryan Vinnicombe aka InternetRyan notes. Bingeing via traditional streaming services can burn through thrillers before they can properly build up suspense and fan theories or let late-comers catch up while a show is still in the zeitgeist. Cliffhangers with just a day instead of a week to wait could be Quibi’s killer feature.

Suspense is also one thing TikTok fails at. Within a single video, they’re actually often all about suspense, waiting through build up for a gag or non-sequitur to play out. But creators try to rope in followers by making a multi-minute video and splitting it into parts so people subscribe to them to see the next part. Yet since TikTok doesn’t always show timestamps and surfaces old videos on its home screen, it can often be a chore to find the Part Two, and there’s no good way for creators to link them together. TikTok could stand to learn about multi-episode content from Quibi.

But today, Quibi feels like a minitiaturized and degraded version of what we already get for free on the web or pay for with Netflix. Quibi charging $4.99 per month with ads or $7.99 without seems like a steep ask without delivering any truly must-see shows, novel interactive experience or memory-making social moments.

Quibi’s success may simply be a test of how bad people are at cancelling 90-day free trials (hint: they’re bad at it!). The bull case is that absentminded subscribers among the 300,000 first-day downloads and some diehard fans of the celebs it’s given shows will bring Quibi enough traction to raise more cash and survive long enough to socialize its product and teach creators to exploit the format’s opportunities.

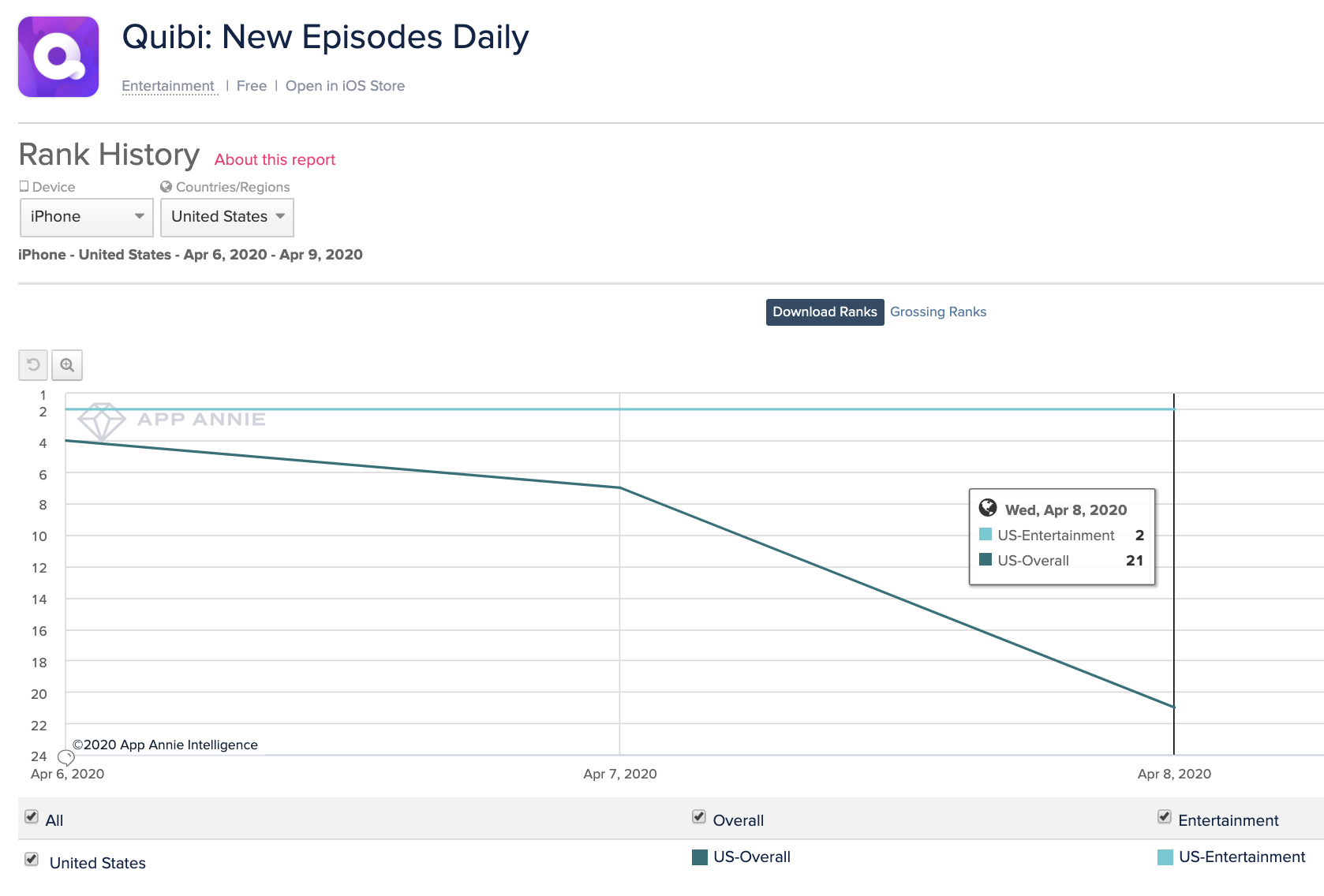

But the bear case is already emerging in Quibi’s rapidly declining App Store rank, which fell from No. 4 overall when it launched Monday to No. 21 yesterday after just 830,000 total downloads according to Sensor Tower. Lackluster content and no virality means it might never become the talk of the town, leading top content producers to slink away or half-ass their contributions, leaving us to dine on short video elsewhere.

Powered by WPeMatico

Esports One launches its fantasy esports platform

Esports One is a startup betting that there’s a big opportunity in bringing a fantasy sports approach to the world of esports — particularly at a time when traditional pro sports are on pause.

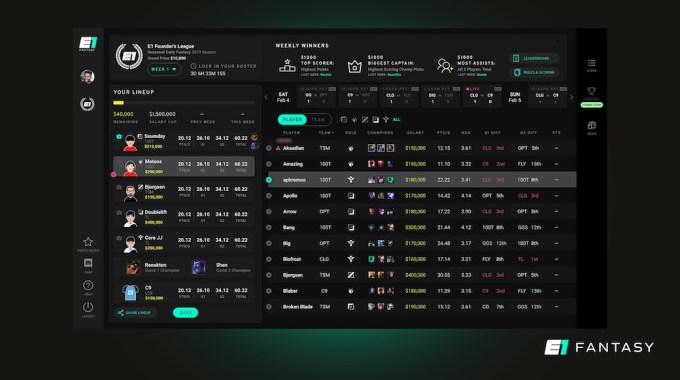

Co-founder and COO Sharon Winter told me that the company’s platform, which is leaving beta testing today, is the first “all-in-one fantasy platform” for esports. In other words, it’s not just a site where you can create a fantasy team to compete with others, but also a place where you can research players, read articles about the latest news and watch live games.

And while Esports One is starting out by supporting the LCS (North American) and LEC (European) regions for League of Legends, the goal is to support a wide range of esports titles.

Co-founder and CEO Matt Gunnin said that when he started Esports One in 2017, the goal was to create “the first and only esports fantasy destination.” And while today’s launch is in many ways the realization of that vision, Esports One has been launching other data and analytics products in the meantime, becoming a data partner for both Acer’s Planet 9 esports platform and League of Legends publisher Riot Games.

Backed by Eniac Ventures and Xseed Capital, the company was also part of the first class of startups to participate in the MIT Play Labs accelerator, and it says it uses computer vision technology developed at MIT and Caltech.

Why does an esports startup need that level of tech? Gunnin compared it to watching pro football on TV, where you can see a virtual yellow line indicating how far a team needs to advance to achieve first down.

“Imagine trying to watch a football game if there isn’t that yellow first-down line,” he said. “What we’ve been trying to build from the early days is the technology to be that first-down line for esports.”

Image Credits: Esports One

More specifically, Gunnin and Winter explained that their computer vision capabilities allow Esports One to track the activity in a game without having to rely on a game publisher’s API — though Gunnin added that when an API is available, they’re happy to use it as “a central source of truth” to start training the company’s algorithms.

Gunnin added that the plan is to keep the basic Esports One platform free, then add premium subscription features over the summer.

“There could be various ways for users to get more insights, more analytics, more research tools, more ways to engage with one another,” he said. “We’re not going into gambling … Users don’t have to buy an advantage when they’re playing against anyone else, [we don’t want users to have an advantage] because they’re paying for monthly subscription access to stats. But we could take some of those stats and make it available in chart form, make it exportable.”

The company said that while in beta, the platform has already pulled in 30,000 active participants — and that’s without advertising spend.

And Gunnin and Winter suggested that there’s an even bigger opportunity to expand the esports audience right now, as traditional fans have nothing to watch and even pro basketball players are turning to video games to compete.

“As people have been staying at home… we’re seeing DMs to our social media accounts from people diving into esports, signing up for Discord accounts,” Winter said. “We’ve ramped up the support to educate the community and expand the esports audience. It’s quickly surpassing mainstream, traditional sports.”

Powered by WPeMatico

Pepper, a platform for restaurants and suppliers, pivots to deliver food to consumers

Though the effects of the coronavirus pandemic on restaurants has been crystal clear, many forget the impact this disease has had on food chain suppliers. With restaurants closed, these suppliers — who still have access to tons upon tons of food — no longer have customers.

Meanwhile, end consumers are dealing with their own stresses around securing food, deciding between venturing out to the grocery store and ordering food through increasingly unreliable grocery delivery services.

That’s where Pepper comes in.

Pepper launched late last year with an enterprise product focused on connecting restaurants with their suppliers. Most restaurants have 6+ different suppliers, and manually placed orders with each of them individually each night either by email, voicemail or text message. Oftentimes, there was no confirmation that the order was received, with employees receiving orders and hoping that everything arrived on time as it was requested.

To digitize the industry, Pepper developed an app that let restaurants input the contact information of suppliers and place orders quickly, and then let those suppliers press a single button to confirm the order was received and in progress.

In the six months since launch, things have changed dramatically for the startup, which has led co-founder and CEO Bowie Cheung to rethink the business.

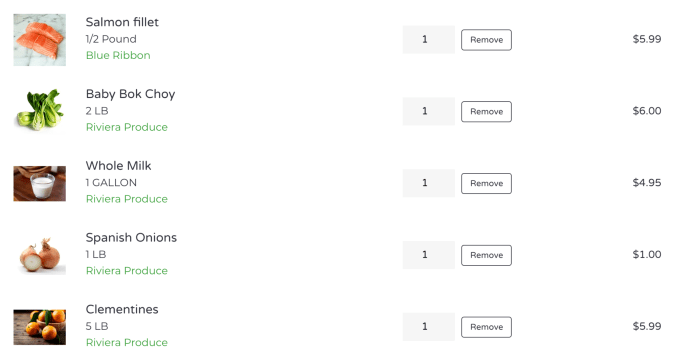

Alongside facilitating orders between restaurants and suppliers, Pepper has now opened up a consumer-facing portal called Pepper Pantry, allowing everyday users to place an order directly with a food supplier.

Folks pay a flat $5 payments processing fee on the platform, and can choose from fresh meats, produce, dairy and other categories to have food delivered directly to their home.

Of course, this involved considerable adaptation on the part of Pepper and their suppliers, who are used to shipping pallets of food rather than bags or boxes. However, it has created some jobs on the supplier side as folks repackage food to amounts that are suitable for families or individuals, rather than businesses.

Cheung says the portions are still ‘bulk’ but more on par with a Sam’s Club or Costco purchase than the types of orders restaurants were placing.

Suppliers are able to choose their minimum order amount, which can range between $0 and $150. Thus far, eight suppliers have signed on to the Pepper Pantry platform, serving the greater NYC area (NYC, NJ, CT) and the greater Boston area.

Pepper declined to disclose its total funding amount, but did share that it has received investment from Greylock’s Mike Duboe and Box Group.

Powered by WPeMatico

Sony invests $400M in Chinese entertainment platform Bilibili

Sony said on Thursday that it is investing $400 million to secure a 4.98% stake in Chinese entertainment giant Bilibili.

10-year old Bilibili started as an animation site, but has expanded to other categories including e-sports, user-generated music videos, documentaries, and games. The service, which has amassed over 130 million users, has attracted several big investors over the years, including Chinese giants Tencent and Alibaba.

The announcement pushed Bilibili’s share up by 7.6% in pre-market trading. Sony has made the investment through its wholly-owned subsidiary Sony Corporation of America.

In a statement, Sony said the company believes China is a key strategic region in the entertainment business. BiliBili says it targets China’s Gen-Z. The vast majority of its users — about 80% — were born between 1990 and 2009.

The two companies have also agreed to pursue collaboration opportunities in the entertainment field in China, including animation and mobile game apps, they said.

You can read more about Bilibili’s business and dominance in China in my colleague Rita Liao’s piece here.

Powered by WPeMatico

German security firm Avira has been acquired by Investcorp at a $180M valuation

Mergers and acquisitions largely grinded to a halt at the end of March, in the wake of the coronavirus pandemic spreading around the world, but today comes news of a deal out of Europe that underscores where pockets of activity are still happening. Avira, a cybersecurity company based out of Germany that provides antivirus, identity management and other tools both to consumers and as a white-label offering from a number of big tech brands, has been snapped up by Investcorp Technology Partners, the PE division of Investcorp Bank. Investcorp’s plan is to help Avira make acquisitions in a wider security consolidation play.

The financial terms of the acquisition are not being disclosed in the companies’ joint announcement, but the CEO of Avira, Travis Witteveen, and ITP’s MD, Gilbert Kamieniecky, both said it gives Avira a total valuation of $180 million. The deal will involve ITP taking a majority ownership in the company, with Avira founder Tjark Auerbach retaining a “significant” stake of the company in the deal, Kamieniecky added.

Avira is not a tech startup in the typical sense. It was founded in 1986 and has been bootstrapped (in that it seems never to have taken any outside investment as it has grown). Witteveen said that it has “tens of millions” of users today of its own-branded products — its anti-virus software has been resold by the likes of Facebook (as part of its now-dormant antivirus marketplace) — and many more via the white-label deals it makes with big names. Strategic partners today include NTT, Deutsche Telekom, IBM, Canonical and more.

He said that the company has had many strategic approaches for acquisition from the ranks of tech companies, and also from more typical investors, but these were not routes that it has wanted to follow, since it wanted to grow as its own business, and needed more of a financial injection to do that than what it could get from more standard VC deals.

“We wanted a partnership where someone could step in and support our organic growth, and the inorganic [acquisition] opportunity,” he said.

The plan will be to make more acquisitions to expand Avira’s footprint, both in terms of products and especially to grow its geographic footprint: today the company is active in Asia, Europe and to a lesser extent in the US, while Investcorp has a business that also extends deep into the Middle East.

Cybersecurity, meanwhile, may never go out of style as an investment and growth opportunity in tech. Not only have cyber threats become more sophisticated and ubiquitous and targeted at individual consumers and businesses over the last several years, but our increasing reliance on technology and internet-connected systems will increase the demand and need to keep these safe from malicious attacks.

That has become no more apparent than in recent weeks, when much of the world’s population has been confined to shelter in place. People have in turn spent unprecedented amounts of time online using their phones, computers and other devices to read news, communicate with their families and friends, entertain themselves, and do critical work that they may have in part done in the past offline.

“In the current market, you can imagine a lot are concerned about the uncertainties of the technology landscape, but this is one that continues to thrive,” said Kamieniecky. “In security, we have seen companies develop quite rapidly and quickly, and here we have an opportunity to do that.”

Avira has been somewhat of a consolidator up to now, buying companies like SocialShield (which provided online security specifically for younger and social media users), while ITP, with Investcorp having some $34 billion under management, has made many acquisitions (and divestments) over the years, with some of the tech deals including Ubisense, Zeta Interactive and Dialogic.

Powered by WPeMatico