As the messaging app Telegram continues to try to evade Russian authorities by switching up its IP addresses, Russia’s regulator Roskomnadzor (RKN) has continued its game of whack-a-mole to try to lock it down by knocking out complete swathes of IP address. The resulting chase how now ballooned to nearly 19 million IP addresses at the time of writing, as tracked by unofficial RKN observer RKNSHOWTIME (updated on a Telegram channel with stats accessible on the web via Phil Kulin’s site).

As a result, there have been a number of high-profile services also knocked oput in the crossfire, with people in Russia reporting dozens of sites affected including Twitch, Slack, Soundcloud, Viber, Spotify, Fifa, Nintendo, as well as Amazon and Google. (A full list of nearly forty addresses is listed below.)

What’s notable is that Google and Amazon themselves seem still not to be buckling under pressure. As we reported earlier this week, a similar — but far smaller — instance happened in the case of Zello, which had also devised a technique to hop around IP addresses when its own IP addresses were shut down by Russian regulators.

Zello’s circumventing lasted for nearly a year, until it seemed the regulator started to use a more blanket approach of blocking entire subnets — a move that ultimately led to Google and Amazon asking Zello to cease its activities.

After that, Zello’s main access point for its Russian users was via VPN proxies — one of the key ways that users in one country can effectively appear as if they are in another, allowing them to circumvent geoblocking and geofencing, either by the companies themselves, or those that have been banned by a state.

It’s important to note that the domain fronting that Google is in the process of shutting down is not the same as IP hopping — although, more generally, it will mean that there is now one less route for those globally whose traffic is getting blocked through censorship to wiggle around that. The IP hopping that has led to 19 million addresses getting blocked in Russia is another kind of circumvention. (I’m pointing this out because several people I’ve spoken to assumed they were the same.)

Pavel Durov, Telegram’s founder and CEO, has made several public calls on Telegram and also third-party sites like Twitter to praise how steadfast the big internet companies have been. And others like the ACLU have also waded into the story to call on Amazon, Apple, Google and Microsoft to hold strong and continue to allow Telegram to IP hop.

But what could happen next?

I’ve contacted Google, Amazon and Telegram now several times to ask this question and for more details on what is going on. As of yet I’ve had no replies. However, Alexey Gavrilov, the CTO and founder of Zello, provided a little more potential insight:

He said that ultimately they might ask Telegram to stop — something that might become increasingly hard not to do as more services get affected — and if that doesn’t work they can suspend Telegram’s account.

“Each cloud provider has provisions, which let them do it if your use interferes with other customers using their service,” Gavrilov notes. “The interpretation of this rule may be not trivial in case when the harm is caused by third party (i.e RKN in this case) so I think there are some legal risks for Amazon / Google. Plus that would likely cause a PR issue for them.”

Another question is whether there are bigger fish to fry in this story. Some have floated the idea that just as Zello preceded Telegram, RKN’s battles with the latter might lead to how it negotiates with Facebook.

As we have reported before, Facebook notably has never moved to house Russian Facebook data in Russia. Local hosting has been one of the key requirements that the regulator has enforced against a number of other companies as part of its “data protection” rules, and over the last couple of years while some high-profile companies have run afoul of the these regulations, others (including Apple and Google) have reportedly complied.

Regardless, there’s been one ironic silver lining in this story. Since RKN shifted its focus to waging a war on Telegram, Gavrilov tells me that Zello service has been restored in Russia. Here’s to weathering the storm.

Bill Moore, Zello’s CEO, believes that there is a fight to keep fighting here. “We are small,” he said. “Technology leaders like Amazon, Google, Apple and Facebook can cooperate with each other to avoid becoming a tool governments use to control speech. We hope Amazon and Google stay firm even if the short term cost is real.”

We’ll update this post as and when we get responses from the big players. A more complete list of sites that people have reported as affected by the 19 million address block is below, via Telegram channel Нецифровая экономика (“Non-digital economy”). Some of these have been disputed, so take this with a grain of salt:

1. Sberbank (disputed)

2. Alfa Bank (disputed)

3. VTB

4. Mastercard

5. Some Microsoft services

6. Video agency RT Ruptly

7. Games like Fortnite, PUBG, Guild Wars 2, Vainglory, Guns of Boom, World of Warships Blitz, Lineage 2 Mobile and Total War: Arena

8. Twitch

9. Google

10. Amazon

11. Russian food retailer Dixy (disupted)

12. Odnoklassniki (the social network, ok,ru)

13. Viber

14. Дилеры Volvo

15. Gett Taxi

16. BattleNet

17. SoundCloud

18. DevianArt

19. Coursera

20. Realtimeboard

21. Trello

22. Slack

23. Evernote

24. Skyeng (online English language school)

25. Part of the Playstation Network

26. Ivideon

27. ResearchGate

28. Gitter

29. eLama

30. Behance

31. Nintendo

32. Codeacademy

33. Lifehacker

34. Spotify

35. FIFA

36. And it seems like some of RKN’s site itself

Powered by WPeMatico

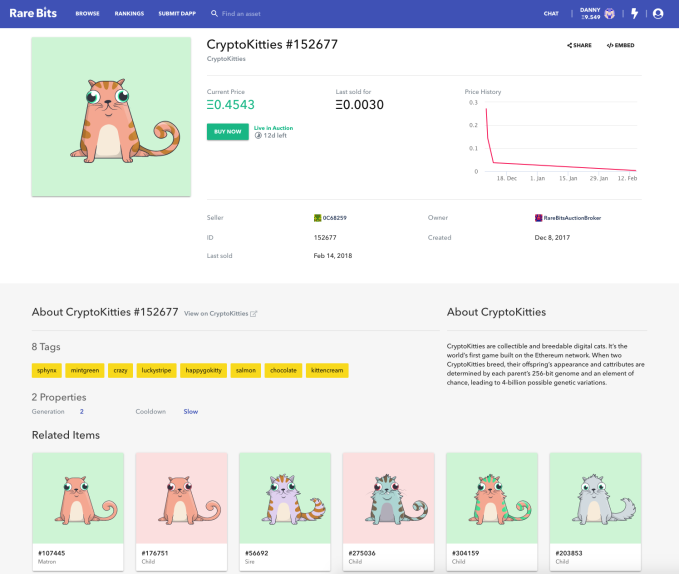

For now, Rare Bits isn’t slapping any extra fees on its marketplace, compared to paying up to 1 percent on other marketplaces like Open Sea, or even more elsewhere. Instead, if a crypto-item developer charges a fee on secondary sales, say 5 percent, they’ll split that with Rare Bits for arranging the transaction.

For now, Rare Bits isn’t slapping any extra fees on its marketplace, compared to paying up to 1 percent on other marketplaces like Open Sea, or even more elsewhere. Instead, if a crypto-item developer charges a fee on secondary sales, say 5 percent, they’ll split that with Rare Bits for arranging the transaction.