Here in the States, ZTE has been content with a kind of quiet success. The Chinese smartphone maker has landed in the top five quarter after quarter (sometimes breaking the top three, according to some analysts), behind household names like Apple, Samsung and LG. Suddenly, however, the company is on everyone’s lips, from cable news to the president’s Twitter account.

It’s the kind of publicity money can’t buy — but it’s happening for one of the worst reasons imaginable. ZTE suddenly finds itself in the eye of a looming trade war between superpowers. Iranian sanctions were violated, fines levied and seven-year international bans were instated.

It’s like a story ripped from the pages of some Cold War thriller, though instead of Jason Bourne, it’s that one budget smartphone company that you’ve maybe heard of, who maybe makes that weird Android phone with two screens.

So, how did we get here?

ZTE began U.S. operations in 1998, a little over a decade after forming in Shenzhen (and a year after going public in China) as Zhongxing Semiconductor Co., Ltd. The change of name to Zhongxing Telecommunications Equipment reflects the newfound focus for the company, which employees around 75,000 and operates in 160 countries.

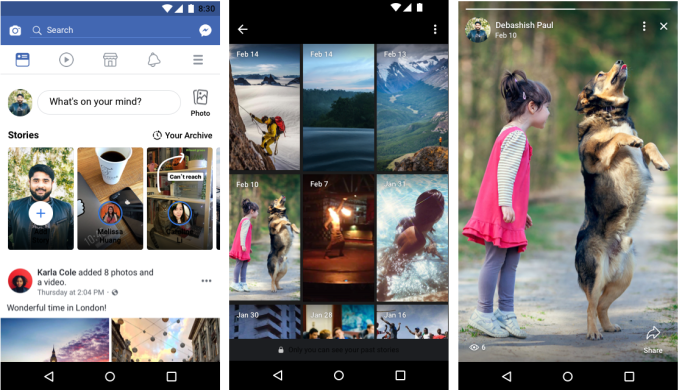

While ZTE has flirted with premium and sometimes bizarre devices, in the smartphone world, the company is primarily known for its budget hardware. It’s no coincidence that the company was tapped by google to be the first to run Android Oreo Go Edition (nee Android Go). The manufacturer has found particular success in the developing world, while making significant gains in the U.S. by releasing dozens of low-cost devices targeted at prepaid users.

In recent years, however, the company has come under increased scrutiny on two fronts. First, there’s the issue of the company’s perceived ties to the Chinese government. It’s the same thing that’s tripped up fellow Chinese handset manufacturer Huawei in its pursuit of the U.S. market.

In Huawei’s case, multiple warnings from top U.S. security agencies has severely hobbled any chance of making significant headway in this country. The company kicked off the year with the one-two punch of having AT&T pull out of a deal last minute, only to have Best Buy stop restocking its product on store shelves. ZTE, on the other hand, has run into less headwind there.

In February, top officials at the FBI, CIA and NSA all warned against buying product from both companies over remote surveillance concerns and later ending their sale at military bases. But after making significant inroads through non-contract carriers like Boost, Cricket and Metro PCS, the warnings appear to have had little impact on the company.

The same, however, can’t be said of a seven-year ban.

In 2016, the U.S. Commerce Department found the company guilty of violating U.S. sanctions. The department disclosed internal documents from the company naming “ongoing projects in all five major embargoed countries — Iran, Sudan, North Korea, Syria and Cuba.” That’s a big issue when selling a product that contains, by some estimates, a quarter of components created by U.S. companies — not to mention all of the Google software.

The following year, the company pleaded guilt and agreed to a $1.19 billion fine, along with the stipulation that it would punish senior management for the transgression. Last month, however, the DOC said ZTE failed to live up to the latter part of the deal, issuing an even steeper fine as a result.

“ZTE misled the Department of Commerce,” the department said in a statement to TechCrunch at the time. “Instead of reprimanding ZTE staff and senior management, ZTE rewarded them. This egregious behavior cannot be ignored.”

The new punishment bans U.S. component manufacturers from selling to ZTE for seven years. A few days later, the company told TechCrunch that the export ban would “severely impact” its chances of survival. And then, last week, the company ceased major operating activities.

“As a result of the Denial Order, the major operating activities of the company have ceased,” it wrote in an exchange filing. “As of now, the company maintains sufficient cash and strictly adheres to its commercial obligations subject in compliance with laws and regulations.”

In the meantime, the company was reportedly meeting with companies like Google in hopes of figuring out a workaround, while China was said to be meeting with U.S. officials to discuss the steep ban. For some, the ZTE ban was seen as a political move amidst a potential trade war, and a major roadblock toward negotiations.

President Xi of China, and I, are working together to give massive Chinese phone company, ZTE, a way to get back into business, fast. Too many jobs in China lost. Commerce Department has been instructed to get it done!

— Donald J. Trump (@realDonaldTrump) May 13, 2018

That leads us to Sunday, when Trump tweeted, “President Xi of China, and I, are working together to give massive Chinese phone company, ZTE, a way to get back into business, fast. Too many jobs in China lost. Commerce Department has been instructed to get it done!”

Job loss in China seems like an odd motivator for any U.S. president, let along Trump, but things make significantly more sense when you consider the sheer size of a company like ZTE. If a U.S. trade ban caused the company to fold, it’s easy to see how that could severely impact already tenuous relations between the two countries.

“The Chinese have suggested that ZTE was a show-stopper,” international studies expert Scott Kennedy succinctly told NPR, “if you kill this company, we’re not going to be able to cooperate with you on anything.”

The Washington Post and CNN have typically written false stories about our trade negotiations with China. Nothing has happened with ZTE except as it pertains to the larger trade deal. Our country has been losing hundreds of billions of dollars a year with China…

— Donald J. Trump (@realDonaldTrump) May 16, 2018

And that brings us to this morning — and other Trump tweet. “The Washington Post and CNN have typically written false stories about our trade negotiations with China,” Trump writes. “Nothing has happened with ZTE except as it pertains to the larger trade deal. Our country has been losing hundreds of billions of dollars a year with China[…]…haven’t even started yet! The U.S. has very little to give, because it has given so much over the years. China has much to give!”

Those tweets, it should be noted, were most likely posted in reaction to bipartisan concern about Trump’s focus. “#China intends to dominate the key industries of the 21st Century not through out innovating us, but by stealing our intellectual property & exploiting our open economy while keeping their own closed,” Marco Rubio tweeted earlier this week. “Why are we helping them achieve this by making a terrible deal on ZTE?”

So things are weird. And it’s 2018, so expect that it will only get weirder from here.

Powered by WPeMatico

Meanwhile, there are plenty of peer-to-peer crypto lending protocols on the Ethereum blockchain, like ETHLend and Dharma. But interest rates, no need for slow matching, flexibility for withdrawing money and dealing with a centralized party could attract users to Compound.

Meanwhile, there are plenty of peer-to-peer crypto lending protocols on the Ethereum blockchain, like ETHLend and Dharma. But interest rates, no need for slow matching, flexibility for withdrawing money and dealing with a centralized party could attract users to Compound.