Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Rapper 2 Milly is suing Epic Games over Fortnite’s use of his dance move, the Milly Rock.

The lawsuit claims direct infringement of copyright, contributory infringement of copyright and violation of the Right of Publicity under California Common Law, among other things.

From the filing:

Defendants capitalized on the Milly Rock’s popularity, particularly with its younger fans, by selling the Milly Rock dance as an in-game purchase in Fortnite under the name “Swipe It,” which players can buy to customize their avatars for use in the game. This dance was immediately recognized by players and media worldwide as the Milly Rock. Although identical to the dance created, popularized, and demonstrated by Ferguson, Epic did not credit Ferguson nor seek his consent to use, display, reproduce, sell, or create a derivative work based upon Ferguson’s Milly Rock dance or likeness.

Unless you live under a rock, you’ve seen the Milly Rock. Rock dwellers can check it out below:

On Fortnite, the dance is called the Swipe It, and it looks like this:

Back in July, around the time that Fortnite unveiled the Swipe It dance, Chance the Rapper pointed out that Epic Games tends to use in the game dance moves popularized by famous artists. These emotes cost money, and heavily contribute to the hundreds of millions in revenue that Epic Games pulls in on a monthly basis via its free-to-play game.

Fortnite should put the actual rap songs behind the dances that make so much money as Emotes. Black creatives created and popularized these dances but never monetized them. Imagine the money people are spending on these Emotes being shared with the artists that made them

— Chance The Rapper (@chancetherapper) July 13, 2018

Moreover, the default emote on Fortnite is the relatively famous little routine from actor Donald Faison on the show Scrubs.

Dear fortnite… I’m flattered? Though part of me thinks I should talk to a lawyer…

— Donald Faison (@donald_faison) April 1, 2018

This lawsuit is particularly complicated considering that it’s over a dance move, which is difficult to lock down with copyright. The Verge reported that this lawsuit is the first of its kind, in that it challenges the gaming industry’s use of pop culture as for-profit virtual items. NPR reports that the U.S. Copyright Office “can’t register short dance routines consisting of only a few movements or steps with minor linear or spatial variations, even if a routine is novel or distinctive.”

That doesn’t mean there is no way to protect choreographic works. Those works, however, must be defined as “a series of dance movements or patterns organized into an integrated, coherent, and expressive compositional whole,” according to NPR.

Concluding the 22-page filing is a request for injunctive relief, which would bar Epic Games from using 2 Milly’s likeness in the game, as well as financial compensation for the use of the Milly Rock dance.

We reached out to Epic Games and will update the story if/when we hear back.

Powered by WPeMatico

Nigerian trucking logistics startup Kobo360 has raised $6 million to upgrade its platform and expand operations to Ghana, Togo and Cote D’Ivoire.

The company — with an Uber -like app that connects truckers and companies with freight needs — gained the equity financing in an IFC-led investment. The funding saw participation from others, including TLcom Capital and Y Combinator.

With the investment, Kobo360 aims to become more than a trucking transit app.

“We started off as an app, but our goal is to build a global logistics operating system. We’re no longer an app, we’re a platform,” founder Obi Ozor told TechCrunch.

In addition to connecting truckers, producers and distributors, the company is building that platform to offer supply chain management tools for enterprise customers.

“Large enterprises are asking us for very specific features related to movement, tracking and sales of their goods. We either integrate other services, like SAP, into Kobo or we build those solutions into our platform directly,” said Ozor.

Kobo360 will start by developing its API and opening it up to large enterprise customers.

“We want clients to be able to use our Kobo dashboard for everything; moving goods, tracking, sales and accounting…and tackling their challenges,” said Ozor.

Kobo360 will also build more physical presence throughout Nigeria to service its business. “We’ll open 100 hubs before the end of 2019…to be able to help operations collect proof of delivery, to monitor trucks on the roads and have closer access to truck owners for vehicle inspection and training,” said Ozor.

Kobo360 will add more warehousing capabilities, “to support our reverse logistics business” — one of the ways the company brings prices down by matching trucks with return freight after they drop their loads, rather than returning empty, according to Ozor.

Kobo360 will also use its $6 million investment to expand programs and services for its drivers, something Ozor sees as a strategic priority.

“The day you neglect your drivers you are not going to have a company, only issues. If Uber were more driver-focused it would be a trillion-dollar company today,” he said.

The startup offers drivers training and group programs on insurance, discounted petrol and vehicle financing (KoboWin). Drivers on the Kobo360 app earn on average of approximately $5,000 per month, according to Ozor.

Under KoboCare, Kobo360 has also created an HMO for drivers and an incentive-based program to pay for education. “We give school fee support, a 5,000 Naira bonus per trip for drivers toward educational expenses for their kids,” said Ozor.

Kobo360 will complete limited expansion into new markets Ghana, Togo and Cote D’Ivoire in 2019. “The expansion will be with existing customers, one in the port operations business, one in FMCG and another in agriculture,” said Ozor.

Ozor thinks the startup’s asset-free, digital platform and business model can outpace traditional long-haul 3PL providers in Nigeria by handling more volume at cheaper prices.

“Owning trucks is just too difficult to manage. The best scalable model is to aggregate trucks,” he told TechCrunch in a previous interview.

With the latest investment, IFC’s regional head for Africa Wale Ayeni and TLcom senior partner Omobola Johnson will join Kobo360’s board. “There’s a lot of inefficiencies in long-haul freight in Africa…and they’re building a platform that can help a lot of these issues,” said Ayeni of Kobo360’s appeal as an investment.

The company has served 900 businesses, aggregated a fleet of 8,000 drivers and moved 155 million kilograms, per company stats. Top clients include Honeywell, Olam, Unilever, Dangote and DHL.

MarketLine estimated the value of Nigeria’s transportation sector in 2016 at $6 billion, with 99.4 percent comprising road freight.

Logistics has become an active space in Africa’s tech sector, with startup entrepreneurs connecting digital to delivery models. In Nigeria, Jumia founder Tunde Kehinde departed and founded Africa Courier Express. Startup Max.ng is wrapping an app around motorcycles as an e-delivery platform. Nairobi-based Lori Systems has moved into digital coordination of trucking in East Africa. And U.S.-based Zipline — which launched drone delivery of commercial medical supplies in partnership with the government of Rwanda and support of UPS — is in “process of expanding to several other countries,” according to a spokesperson.

Kobo360 has plans for broader Africa expansion but would not name additional countries yet.

Ozor said the company is profitable, though the startup does not release financial results. Wale Ayeni also wouldn’t divulge revenue figures, but confirmed IFC’s did full “legal and financial due diligence on Kobo’s stats,” as part of the investment.

Ozor named Lori Systems as Kobo360’s closest African startup competitor.

On the biggest challenge to revenue generation, it’s all about service delivery and execution, according to Ozor.

“We already have volume and demand in the market. The biggest threat to revenues is if Kobo360’s platform doesn’t succeed in solving our client’s problems and bringing reliability to their needs,” he said.

Powered by WPeMatico

Contentful, a Berlin- and San Francisco-based startup that provides content management infrastructure for companies like Spotify, Nike, Lyft and others, today announced that it has raised a $33.5 million Series D funding round led by Sapphire Ventures, with participation from OMERS Ventures and Salesforce Ventures, as well as existing investors General Catalyst, Benchmark, Balderton Capital and Hercules. In total, the company has now raised $78.3 million.

It’s been less than a year since the company raised its Series C round and, as Contentful co-founder and CEO Sascha Konietzke told me, the company didn’t really need to raise right now. “We had just raised our last round about a year ago. We still had plenty of cash in our bank account and we didn’t need to raise as of now,” said Konietzke. “But we saw a lot of economic uncertainty, so we thought it might be a good moment in time to recharge. And at the same time, we already had some interesting conversations ongoing with Sapphire [formerly SAP Ventures] and Salesforce. So we saw the opportunity to add more funding and also start getting into a tight relationship with both of these players.”

It’s been less than a year since the company raised its Series C round and, as Contentful co-founder and CEO Sascha Konietzke told me, the company didn’t really need to raise right now. “We had just raised our last round about a year ago. We still had plenty of cash in our bank account and we didn’t need to raise as of now,” said Konietzke. “But we saw a lot of economic uncertainty, so we thought it might be a good moment in time to recharge. And at the same time, we already had some interesting conversations ongoing with Sapphire [formerly SAP Ventures] and Salesforce. So we saw the opportunity to add more funding and also start getting into a tight relationship with both of these players.”

The original plan for Contentful was to focus almost explicitly on mobile. As it turns out, though, the company’s customers also wanted to use the service to handle its web-based applications and these days, Contentful happily supports both. “What we’re seeing is that everything is becoming an application,” he told me. “We started with native mobile application, but even the websites nowadays are often an application.”

In its early days, Contentful focused only on developers. Now, however, that’s changing, and having these connections to large enterprise players like SAP and Salesforce surely isn’t going to hurt the company as it looks to bring on larger enterprise accounts.

Currently, the company’s focus is very much on Europe and North America, which account for about 80 percent of its customers. For now, Contentful plans to continue to focus on these regions, though it obviously supports customers anywhere in the world.

Contentful only exists as a hosted platform. As of now, the company doesn’t have any plans for offering a self-hosted version, though Konietzke noted that he does occasionally get requests for this.

What the company is planning to do in the near future, though, is to enable more integrations with existing enterprise tools. “Customers are asking for deeper integrations into their enterprise stack,” Konietzke said. “And that’s what we’re beginning to focus on and where we’re building a lot of capabilities around that.” In addition, support for GraphQL and an expanded rich text editing experience is coming up. The company also recently launched a new editing experience.

Powered by WPeMatico

LeanIX, the Software-as-a-Service for “Enterprise Architecture Management,” has closed $30 million in Series C funding.

The round is led by Insight Venture Partners, with participation from previous investors Deutsche Telekom Capital Partners (DTCP), Capnamic Ventures and Iris Capital. It brings LeanIX’s total funding to nearly $40 million since the German company was founded in 2012.

Operating in the enterprise architecture space, previously the domain of a company’s IT team only, LeanIX’s SaaS might well be described as a “Google Maps for IT architectures.”

The software lets enterprises map out all of the legacy software or modern SaaS that the organisation is run on, including creating meta data on things like what business process it is used for or capable of supporting, what tech (and version) powers it, what teams are using or have access to it, who is responsible for it, as well as how the different architecture fits together.

From this vantage point, enterprises can not only keep a better handle on all of the software from different vendors they are buying in, including how that differs or might be better utilised across distributed teams, but also act in a more nimble way in terms of how they adopt new solutions or decommission legacy ones.

In a call with André Christ, co-founder and CEO, he described LeanIX as providing a “single source of truth” for an enterprise’s architecture. He also explained that the SaaS takes a semi-automatic approach to how it maps out that data. A lot of the initial data entry will need to be done manually, but this is designed to be done collaboratively across an organisation and supported by an “easy-to-use UX,” while LeanIX also extracts some data automatically via integrations with ServiceNow (e.g. scanning software on servers) or Signavio (e.g. how IT Systems are used in Business Processes).

More broadly, Christ tells me that the need for a solution like LeanIX is only increasing, as enterprise architecture has shifted away from monolithic vendors and software to the use of a sprawling array of cloud or on-premise software where each typically does one job or business process really well, rather than many.

“With the rising adoption of SaaS, multi-cloud and microservices, an agile management of the Enterprise Architecture is harder to achieve but more important than ever before,” he says. “Any company in any industry using more than a hundred applications is facing this challenge. That’s why the opportunity is huge for LeanIX to define and own this category.”

To that end, LeanIX says the investment will be used to accelerate growth in the U.S. and for continued product innovation. Meanwhile, the company says that in 2018 it achieved several major milestones, including doubling its global customer base, launching operations in Boston and expanding its global headcount with the appointment of several senior-level executives. Enterprises using LeanIX include Adidas, DHL, Merck and Santander, with strategic partnerships with Deloitte, ServiceNow and PwC, among others.

“For businesses today, effective enterprise architecture management is critical for driving digital transformation, and requires robust tools that enable collaboration and agility,” said Teddie Wardi, principal at Insight Venture Partners, in a statement. “LeanIX is a pioneer in the space of next-generation EA tools, achieved staggering growth over the last year, and is the trusted partner for some of today’s largest and most complex organizations. We look forward to supporting its continued growth and success as one of the world’s leading software solutions for the modernization of IT architectures.”

Powered by WPeMatico

Video won’t start rolling on Meg Whitman and Jeffrey Katzenberg’s new bite-sized streaming service with the billion-dollar backing until the end of 2019, but talent keeps signing up to come along for their ride into the future of serialization.

The latest marquee director to sign on the dotted line with Quibi is Catherine Hardwicke, who will be helming a story around the creation of an artificial intelligence with the working title “How They Made Her,” according to an announcement from Katzenberg onstage at the Variety Innovate summit.

Hardwicke, who directed “Thirteen,” “Lords of Dogtown” and, most famously, “Twilight,” is joining Antoine Fuqua, Guillermo del Toro, Sam Raimi and Lena Waithe in an attempt to answer the question of whether Whitman and Katzenberg’s gamble on premium (up to $6 million per episode) short-form storytelling is a quixotic quest or a quintessential viewing experience for a new generation of media consumers.

Katzenberg also revealed in a LinkedIn post that Quibi would be working on a basketball-related series with Steph Curry’s production company. He wrote:

I announced a new docu-series by Whistle called “Benedict Men” coming exclusively to Quibi. “Benedict Men” will be executive produced by Stephen Curry’s Unanimous Media and will give viewers an inside look at one of the most unique high school basketball teams in America at St. Benedict’s Prep in Newark, New Jersey.

St. Benedict’s Prep is an all-boys secondary school founded on the core belief ‘What Hurts My Brother Hurts Me,’ and aims to foster a legacy of strong character, community, leadership, and faith. As one of the top athletic high schools with a storied basketball program and the highest graduation rate in New Jersey, the series will follow the brotherhood of young men who seek to balance life in complicated surroundings.

In some ways, the big adventure backed by Katzenberg, the former chairman of Walt Disney Studios and founder of WndrCo, and every major Hollywood studio — including Disney, 21st Century Fox, Entertainment One, NBCUniversal, Sony Pictures Entertainment and Alibaba Goldman Sachs — is the latest in an everything old is new again refrain.

If blogs reinvented printed media, and podcasts and music streaming reinvented radio, why can’t Quibi reinvent serialized storytelling.

Again and again, Whitman and Katzenberg returned to an analogy from the early days of the cable revolution. “We’re not short form, we’re Quibi,” said Whitman, echoing the tagline that HBO made famous in its early advertising blitzes. That Whitman and Katzenberg’s project to take what HBO did for premium television and apply that to mobile media is ambitious. Now industry-watchers will have to wait until 2019 at the earliest to see if it’s also successful.

In the interview onstage at a Variety event on artificial intelligence in media, Katzenberg cited Dan Brown’s “The Da Vinci Code” as something of an inspiration — noting that the book had more than 100 chapters for its 500 pages of text. But Katzenberg could have gone back even further to the days of Dickens and his serialized entertainments.

And right now for the entertainment business it really is the best of times and the worst of times. Traditional Hollywood studios are seeing new players like Netflix, Amazon, Apple and others all trying to drink their milkshake. And, for the most part, these studios and their new telecom owners are woefully ill-equipped to fight these big technology platforms at their own game.

Taking the long view of entertainment history, Katzenberg is hoping to win networks with not just a new skin for the old ceremony of watching entertainment but with a throwback to old style deal-making. The term serialization here takes on greater meaning.

Quibi is offering its production partners a sweetheart deal. After seven years the production company behind the Quibi shows will own their intellectual property, and after two years those producers will be able to repackage the Quibi content back into long-form series and pitch them for distribution to other platforms. Not only that, but Quibi is fronting the money for over 100 percent of the production.

Katzenberg said that it “will create the most powerful syndicated marketplace” Hollywood has seen in decades. It’s a sort of anti-Netflix model where Katzenberg and Whitman view Quibi as a platform where creators and talent will want to come. “We are betting on the success of the platform — and by the way, it worked brilliantly in the ’60s and ’70s and ’80s.” Katzenberg said. “Hundreds of TV shows were tremendous successes and [like the networks then] we don’t want to compete with our suppliers.”

In addition to the business model innovations (or throwbacks, depending on how one looks at it), Quibi is being built from the ground up with a technology stack that will leverage new technologies like 5G broadband, and big data and analytics, according to Whitman.

Indeed, launching the first platform built without an existing stable of content means that Quibi is preparing 5,000 unique pieces of content to go up when it pulls the curtains back on its service in late 2019 or early 2020, Whitman said.

And the company is looking to big telecommunications companies like Verizon (my corporate overlord’s corporate overlord) and AT&T as partners to help it get to market. Since those networks need something to do with all the 5G capacity they’re building out, high-quality streaming content that’s replete with meta-tags to monitor and manage how an audience is spending their time is a compelling proposition.

“We want to work to have video that looks good on mobile [and] ramp up content in terms of quantity and quality,” Whitman said. That quality extends to things like the user interface, search features and analytics.

“We have to have a different search and find metaphor,” Whitman said. “It takes eight minutes to find what you’re looking for on Netflix… We will be able to instrument this with data on what people are watching and using that in our recommendation engine.”

Questions remain about the service’s viability. Like what role will the telcos actually play in distribution and development? Can Quibi avoid the Hulu problem where the various investors are able to overcome their own entrenched interests to work for the viability of the platform? And do consumers even want a premium experience on mobile given the new kinds of stars that are made through the immediacy and accessibility that technology platforms like YouTube, Instagram and Snap offer?

“Where the fish are today is a phenomenal environment,” Katzenberg said of the current short-form content market. “But it is an ocean. We need to find a place where there are these premium services.”

Powered by WPeMatico

First some notes on SoftBank’s rumored expansion into China and its weird fund math, then Foxconn and then quick notes on tech depression, Huawei and more.

TechCrunch is experimenting with new content forms. This is a rough draft of something new — provide your feedback directly to the author (Danny at danny@techcrunch.com) if you like or hate something here.

Kane Wu at Reuters reported overnight that SoftBank is looking to open an office and hire an investment team in China, which Wu says will be based in Shanghai. That’s following the fund’s recent global expansion with new targeted offices in Saudi Arabia and India.

When I saw this, I sort of did a double-take: SoftBank doesn’t have a presence in China? The fund has reportedly been seeking investments in some of China’s leading unicorn stars, including controversial face recognition startup SenseTime, and leading edtech startup Zuoyebang (作业帮, which literally translates as “school assignment help”). (Hat-tips to Selina Wang at Bloomberg, who seems to just be sitting in Vision Fund partner meetings). And of course, it dumped a pretty penny into WeWork China, where it was part of a $500 million syndicate, and is a huge investor in Didi.

It’s sort of obvious that SoftBank would expand to China. What will be interesting though is to see how the fund structures itself long-term. As far as I know, the Vision Fund is a singular “fund” that invests worldwide (send me an email if I am wrong on this count). China has a thicket of regulations on funds and companies, which is one of several reasons we see specifically China-focused vehicles (such as Lightspeed and Lightspeed China or Sequoia and Sequoia China). If the Vision Fund continues to be a unified fund, that would be a notable strategy shift that might be cloned by other trans-Pacific funds.

Rajeev Misra, board director of SoftBank Group and CEO of SoftBank Investment Advisors. Photo by Drew Angerer/Getty Images.

When it first closed the Vision Fund, SoftBank explained they had raised just over $93 billion in committed capital or, more precisely, around $93.15-$93.2 billion, according to the initial investor presentations and its annual Form D filings. In those docs, SoftBank said that the fund was financed with $28 billion from SoftBank and $65 billion from third-party investors.

On top of the $93 billion raised for the Vision Fund, SoftBank detailed that it had committed $4.5 billion of its own capital to a separate “Delta Fund,” which was used to alleviate conflicts around SoftBank’s Didi investment. Thus, SoftBank’s total VC funding aggregates to around $97.7 billion.

To add a complication, SoftBank later shifted $1.6 billion of the Vision Fund’s previously disclosed $65 billion in third-party capital over to the Delta Fund. In current disclosures, SoftBank shows $91.7 billion of committed capital for the Vision Fund ($28.1 billion from SoftBank and $63.6 billion from third-party investors). For the Delta Fund, SoftBank shows $6 billion in committed capital ($4.5 billion SoftBank contribution and $1.6 billion from third-party investors).

Here is where it gets even more complicated. In its latest filings, SoftBank also notes that it completed the interim closing of an additional $5 billion for the Vision Fund in mid-October, “intended for the installment of an incentive scheme for operations of SoftBank Vision Fund.” That additional cash would bring Vision Fund’s total committed capital to $96.7 billion, and $102.7 billion together with the Delta Fund.

While it wouldn’t be included in the committed equity capital total, SoftBank is also rumored to be raising a $4 billion credit facility to help finance additional acquisitions.

So, it’s probably best to say that the Vision Fund — as constituted right now — is $97 billion or $96.7 billion with precision, assuming this $5 billion reaches a final close.

We have, of course, covered SoftBank quite obsessively, particularly its debt situation (Part 1, Part 2, Part 3, Part 4 and Part 5). What we haven’t covered more recently are the latest developments in SoftBank’s IPO, which is slated for December 19th and expected to bring in a haul of $21 billion. More to come on that front in the coming days.

U.S. President Donald Trump and Foxconn Chairman Terry Gou. BRENDAN SMIALOWSKI/AFP/Getty Images

The South China Morning Post reported yesterday that Foxconn is investigating expanding its factories to Vietnam in order to avoid tariffs. Makes sense, and I have some calls this week and next trying to suss out how much hardware supply chains have really changed in response to the trade conflict.

That decision though isn’t just about the trade conflict, but also about the quickly increasing wages of Chinese laborers, as well as political interference from Beijing. The Trump administration’s trade policies are just the excuse Foxconn needs to (at least partially) extricate itself from China, while saving face in the process.

What’s interesting is that Foxconn is also dealing with a massive brush fire in Wisconsin, where it received one of the largest economic development incentives ever offered by an American government, a whopping $3 billion package that was expected to drive manufacturing employment in the state.

Overnight, Republicans in the state legislature passed a bill that would place large restrictions on incoming Democratic governor Tony Evers. Jessie Opoien for the (Madison) Cap Times:

Under the bill, legislators would have increased influence over the Wisconsin Economic Development Corporation, and the WEDC board, not the governor, would appoint the job creation agency’s CEO. However, the governor’s power to appoint a CEO would be restored in September 2019.

That is the agency that provided the Foxconn funding, which has become a political football in Wisconsin politics. Republicans are trying to protect one of the major economic legacies of outgoing governor Scott Walker, as well as what they believe is the future direction of manufacturing work in the state. Democrats smell a boondoggle in the making.

If that wasn’t all, rumored skimpy sales for iPhones is putting enormous pressure on Foxconn’s bottom line. Debby Wu at Bloomberg reported two weeks ago that:

The contract manufacturer aims to cut 20 billion yuan ($2.9 billion) from expenses in 2019 as it faces “a very difficult and competitive year,” according to an internal document obtained by Bloomberg. The company’s spending in the past 12 months is about NT$206 billion ($6.7 billion).

Foxconn is a very dynamic organization that has weathered repeated crises over the years. It is pretty much unique in what it does today: very few other companies can scale up and down hundreds of thousands of workers to meet iPhone and other device demands with such alacrity.

But, the fundamentals of the mobile device market have apparently changed dramatically this year, and Foxconn is likely to be the company most harmed as the assembler of those devices. That could destroy not just the Chinese dream of leading in manufacturing, but also the Vietnam and Wisconsin dreams as well.

Also: If you haven’t read it, this poetry by a Foxconn worker who committed suicide really resonated with me. Foxconn’s suicide problem is well-documented, but we often don’t hear from the individuals themselves.

Blind, the anonymous enterprise chatting app that has taken the tech world by storm, published survey results asking tech employees “I believe I am depressed.” Roughly 40 percent of employees responded yes. Interestingly, there wasn’t too much variation between companies. Amazon had the highest rate at 43 percent and Apple had the lowest rate at 30 percent. It’s an informal survey, probably without high scientific validation, but it is a reminder for all of us in the community that mental health and burnout is very real in the startup and tech ecosystems and we should be vigilant in helping each other when times are rough.

This is one of those stories that we are just going to keep hearing about. After bans in Australia and New Zealand, British Telecom has announced they will not just ban Huawei’s 5G equipment, but also its 3G and 4G equipment. Britain, like Aus/NZ, Canada and the U.S., is part of the Five Eyes intelligence network, and national security officials have been leading the crusade against Huawei infrastructure. What’s interesting is not just the rapidity of the bans, but also that the bans haven’t (from what I have seen) migrated outside the Five Eyes community yet.

Raleigh skyline. Photo by James Willamor used under Creative Commons via Flickr.

Pendo is a digital product management platform that has had quite a bit of success with customers and has raised more than $100 million in VC funding, most recently a Series D from Sapphire. The company announced that they have received a grant from home state North Carolina’s economic development department to grow in the Raleigh region. Pendo is committing $34.5 million to its headquarters (with the potential of creating 590 jobs), while the state will offer around $8.8 million in potential reimbursements over the next 12 years.

Given what I wrote yesterday about Wes McKinney leaving NYC and heading to Nashville and the work Chattanooga is doing to aid startups, it’s great to see other hotspots like Raleigh, NC invest to build out their ecosystems in a compelling way.

Todd Olson, CEO of Pendo, explained to me by email that, “Office rents in our downtown are a fraction of the cost of operating in other cities, and the cost of living is appealing to our employees. They can afford to buy a house here. In some markets around the country, that is becoming more difficult. It’s also just a nice place to live and work.”

Creative work is increasingly going to have to find a lower-cost home.

I am still obsessing about next-gen semiconductors. If you have thoughts there, give me a ring: danny@techcrunch.com.

The LP Anti-Portfolio – Great short read. Lindel Eakman, former managing director at UTIMCO, the University of Texas/Texas A&M endowment, gives a list of funds that he passed on that he now regrets. Unfortunately, this is pretty rare coming from an LP, albeit a former one. It would be great to get more public discussion on which funds were missed and why by LP investors.

Hopefully more reading time tomorrow.

What I’m reading (or at least, trying to read)

Powered by WPeMatico

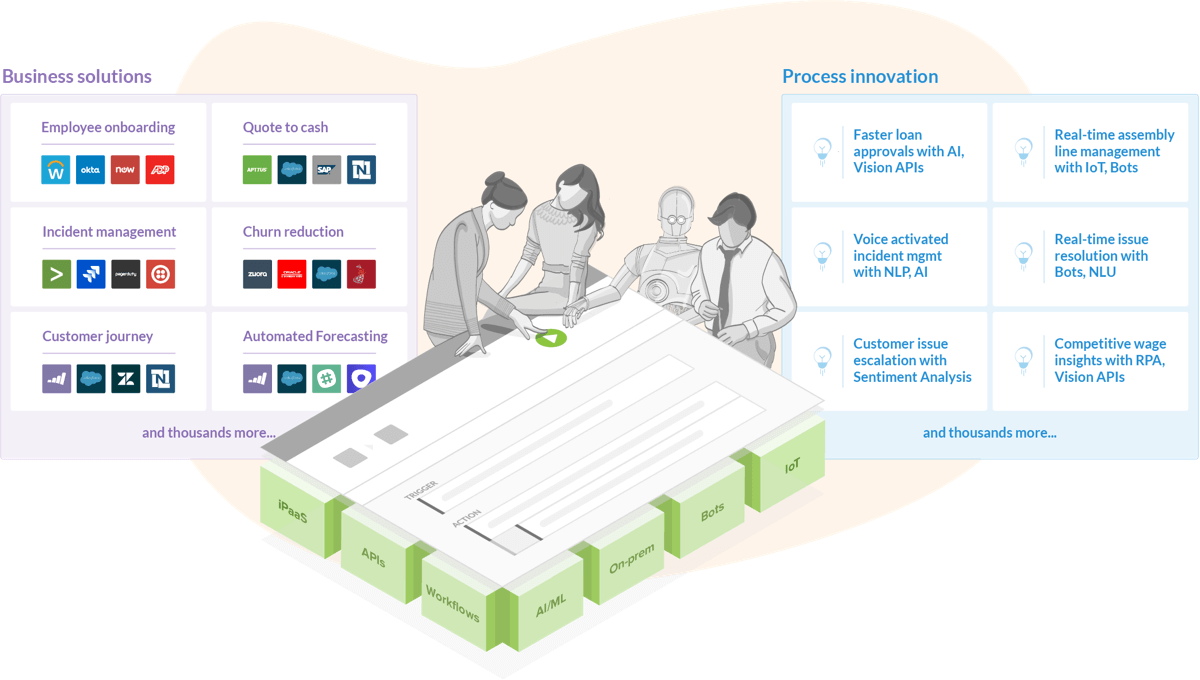

Workato, a startup that offers an integration and automation platform for businesses that competes with the likes of MuleSoft, SnapLogic and Microsoft’s Logic Apps, today announced that it has raised a $25 million Series B funding round from Battery Ventures, Storm Ventures, ServiceNow and Workday Ventures. Combined with its previous rounds, the company has now received investments from some of the largest SaaS players, including Salesforce, which participated in an earlier round.

At its core, Workato’s service isn’t that different from other integration services (you can think of them as IFTTT for the enterprise), in that it helps you to connect disparate systems and services, set up triggers to kick off certain actions (if somebody signs a contract on DocuSign, send a message to Slack and create an invoice). Like its competitors, it connects to virtually any SaaS tool that a company would use, no matter whether that’s Marketo and Salesforce, or Slack and Twitter. And like some of its competitors, all of this can be done with a drag-and-drop interface.

What’s different, Workato founder and CEO Vijay Tella tells me, is that the service was built for business users, not IT admins. “Other enterprise integration platforms require people who are technical to build and manage them,” he said. “With the explosion in SaaS with lines of business buying them — the IT team gets backlogged with the various integration needs. Further, they are not able to handle all the workflow automation needs that businesses require to streamline and innovate on the operations.”

Battery Ventures’ general partner Neeraj Agrawal also echoed this. “As we’ve all seen, the number of SaaS applications run by companies is growing at a very rapid clip,” he said. “This has created a huge need to engage team members with less technical skill-sets in integrating all these applications. These types of users are closer to the actual business workflows that are ripe for automation, and we found Workato’s ability to empower everyday business users super compelling.”

Tella also stressed that Workato makes extensive use of AI/ML to make building integrations and automations easier. The company calls this Recipe Q. “Leveraging the tens of billions of events processed, hundreds of millions of metadata elements inspected and hundreds of thousands of automations that people have built on our platform — we leverage ML to guide users to build the most effective integration/automation by recommending next steps as they build these automations,” he explained. “It recommends the next set of actions to take, fields to map, auto-validates mappings, etc. The great thing with this is that as people build more automations — it learns from them and continues to make the automation smarter.”

The AI/ML system also handles errors and offers features like sentiment analysis to analyze emails and detect their intent, with the ability to route them depending on the results of that analysis.

As part of today’s announcement, the company is also launching a new AI-enabled feature: Automation Editions for sales, marketing and HR (with editions for finance and support coming in the future). The idea here is to give those departments a kit with pre-built workflows that helps them to get started with the service without having to bring in IT.

Powered by WPeMatico

As the fight against climate change heats up, Cove.Tool is looking to help tackle carbon emissions one building at a time.

The Atlanta-based startup provides an automated big-data platform that helps architects, engineers and contractors identify the most cost-effective ways to make buildings compliant with energy efficiency requirements. After raising an initial round earlier this year, the company completed the final close of a $750,000 seed round. Since the initial announcement of the round earlier this month, Urban Us, the early-stage fund focused on companies transforming city life, has joined the syndicate comprised of Tech Square Labs and Knoll Ventures.

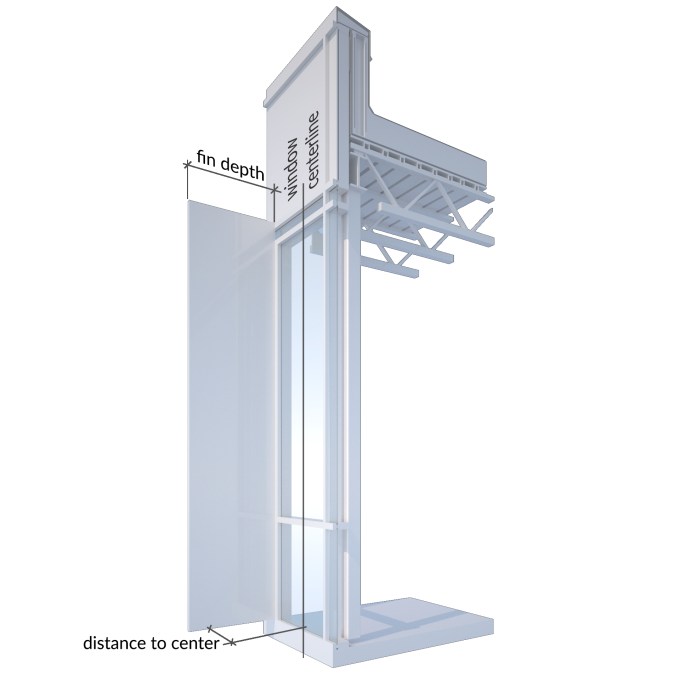

Cove.Tool software allows building designers and managers to plug in a variety of building conditions, energy options, and zoning specifications to get to the most cost-effective method of hitting building energy efficiency requirements (Cove.Tool Press Image / Cove.Tool / https://covetool.com).

In the US, the buildings we live and work in contribute more carbon emissions than any other sector. Governments across the country are now looking to improve energy consumption habits by implementing new building codes that set higher energy efficiency requirements for buildings.

However, figuring out the best ways to meet changing energy standards has become an increasingly difficult task for designers. For one, buildings are subject to differing federal, state and city codes that are all frequently updated and overlaid on one another. Therefore, the specific efficiency requirements for a building can be hard to understand, geographically unique and immensely variable from project to project.

Architects, engineers and contractors also have more options for managing energy consumption than ever before – equipped with tools like connected devices, real-time energy-management software and more-affordable renewable energy resources. And the effectiveness and cost of each resource are also impacted by variables distinct to each project and each location, such as local conditions, resource placement, and factors as specific as the amount of shade a building sees.

With designers and contractors facing countless resource combinations and weightings, Cove.Tool looks to make it easier to identify and implement the most cost-effective and efficient resource bundles that can be used to hit a building’s energy efficiency requirements.

Cove.Tool users begin by specifying a variety of project-specific inputs, which can include a vast amount of extremely granular detail around a building’s use, location, dimensions or otherwise. The software runs the inputs through a set of parametric energy models before spitting out the optimal resource combination under the set parameters.

For example, if a project is located on a site with heavy wind flow in a cold city, the platform might tell you to increase window size and spend on energy efficient wall installations, while reducing spending on HVAC systems. Along with its recommendations, Cove.Tool provides in-depth but fairly easy-to-understand graphical analyses that illustrate various aspects of a building’s energy performance under different scenarios and sensitivities.

Cove.Tool users can input granular project-specifics, such as shading from particular beams and facades, to get precise analyses around a building’s energy performance under different scenarios and sensitivities.

Traditionally, the design process for a building’s energy system can be quite painful for architecture and engineering firms.

An architect would send initial building designs to engineers, who then test out a variety of energy system scenarios over the course a few weeks. By the time the engineers are able to come back with an analysis, the architects have often made significant design changes, which then gets sent back to the engineers, forcing the energy plan to constantly be 1-to-3 months behind the rest of the building. This process can not only lead to less-efficient and more-expensive energy infrastructure, but the hectic back-and-forth can lead to longer project timelines, unexpected construction issues, delays and budget overruns.

Cove.Tool effectively looks to automate the process of “energy modeling.” The energy modeling looks to ease the pains of energy design in the same ways Building Information Modeling (BIM) has transformed architectural design and construction. Just as BIM creates predictive digital simulations that test all the design attributes of a project, energy modeling uses building specs, environmental conditions, and various other parameters to simulate a building’s energy efficiency, costs and footprint.

By using energy modeling, developers can optimize the design of the building’s energy system, adjust plans in real-time, and more effectively manage the construction of a building’s energy infrastructure. However, the expertise needed for energy modeling falls outside the comfort zones of many firms, who often have to outsource the task to expensive consultants.

The frustrations of energy system design and the complexities of energy modeling are ones the Cove.Tool team knows well. Patrick Chopson and Sandeep Ajuha, two of the company’s three co-founders, are former architects that worked as energy modeling consultants when they first began building out the Cove.Tool software.

After seeing their clients’ initial excitement over the ability to quickly analyze millions of combinations and instantly identify the ones that produce cost and energy savings, Patrick and Sandeep teamed up with CTO Daniel Chopson and focused full-time on building out a comprehensive automated solution that would allow firms to run energy modeling analysis without costly consultants, more quickly, and through an interface that would be easy enough for an architectural intern to use.

So far there seems to be serious demand for the product, with the company already boasting an impressive roster of customers that includes several of the country’s largest architecture firms, such as HGA, HKS and Cooper Carry. And the platform has delivered compelling results – for example, one residential developer was able to identify energy solutions that cost $2 million less than the building’s original model. With the funds from its seed round, Cove.Tool plans further enhance its sales effort while continuing to develop additional features for the platform.

The value proposition Cove.Tool hopes to offer is clear – the company wants to make it easier, faster and cheaper for firms to use innovative design processes that help identify the most cost-effective and energy-efficient solutions for their buildings, all while reducing the risks of redesign, delay and budget overruns.

Longer-term, the company hopes that it can help the building industry move towards more innovative project processes and more informed decision-making while making a serious dent in the fight against emissions.

“We want to change the way decisions are made. We want decisions to move away from being just intuition to become more data-driven.” The co-founders told TechCrunch.

“Ultimately we want to help stop climate change one building at a time. Stopping climate change is such a huge undertaking but if we can change the behavior of buildings it can be a bit easier. Architects and engineers are working hard but they need help and we need to change.”

Powered by WPeMatico

The New York City Taxi and Limousine Commission has approved new rules designed to provide a minimum hourly wage of $17.22 (after expenses) for drivers who work with app-based services like Uber, Lyft, Via and Juno.

Fast Company reports that the rules try to deliver that wage by requiring drivers be paid according to a formula that incorporates mileage, time and utilization rate (the average percentage of time drivers have passengers in their cars). They also call for a higher payment when drivers have to take passengers far outside the city (to compensate for them for the return trip).

A proposed bonus payment for drivers offering Uber Pool and other shared-ride options appears to have been removed from the rules.

The Independent Drivers Guild, a labor organization that advocates for drivers, has been advocating for these changes, and it praised the TLC vote in a press release.

“Today we brought desperately needed relief to 80,000 working families,” said IDG founder Jim Conigliaro, Jr. “All workers deserve the protection of a fair, livable wage and we are proud to be setting the new bar for contractor workers’ rights in America. We are thankful to the Mayor, Commissioner [Meera] Joshi and the Taxi and Limousine Commission, City Council Member Brad Lander and all of the city officials who listened to and stood up for drivers.”

And The New York Taxi Workers Alliance issued a statement from Executive Director Bhairavi Desai:

It’s the first real attempt anywhere to stop app driver pay cuts, which is an Uber and Lyft business practice at the heart of poverty wages … Ultimately, the TLC needs to regulate Uber and Lyft passenger rates, guarantee that app drivers get 80 percent of those rates, and regulate the yellow/green meter to charge the same minimum rates, so drivers across the industry can earn a raise.

Uber and Lyft, meanwhile, criticized the decision, though with careful wording emphasizing that the companies aren’t opposed to ensuring that drivers receive a living wage.

“Uber supports efforts to ensure that full-time drivers in NYC – whether driving with taxi, limo or Uber – are able to make a living wage, without harming outer borough riders who have been ignored by yellow taxi and underserved by mass transit,” said Uber Director of Public Affairs Jason Post in a statement. “The TLC’s implementation of the City Council’s legislation to increase driver earnings will lead to higher than necessary fare increases for riders while missing an opportunity to deal with congestion in Manhattan’s central business district.”

Post argued that the rules do not account for the bonuses and other incentive payments that Uber and other companies might make. He criticized the TLC for adopting “an industry-wide utilization rate that does not hold bases accountable for keeping cars full with paying passengers.”

And here’s the statement from Lyft:

Lyft believes all drivers should earn a livable wage and we are committed to helping drivers reach their goals. Unfortunately, the TLC’s proposed pay rules will undermine competition by allowing certain companies to pay drivers lower wages, and disincentive drivers from giving rides to and from areas outside Manhattan. These rules would be a step backward for New Yorkers, and we urge the TLC to reconsider them.

Specifically Lyft says that companies would be able to essentially pay drivers less by claiming a higher utilization rate than the industry average. It also says that it will be nearly impossible to implement the higher out-of-town payment rates in the 30-day window before the new rules take effect.

Update: You can read the new Driver Income and Transparency Rules here.

“Convenience costs, and going forward, that cost will no longer be borne by the driver,” said TLC Chair Meera Joshi in a statement. “Today’s rules will raise driver earnings by on average $10,000 a year and require companies to be completely transparent on how they calculate pay and car leasing costs.”

Powered by WPeMatico

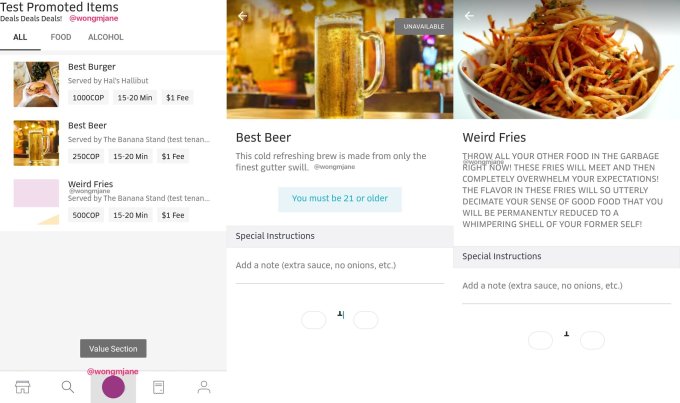

Uber Eats has effectively invented its own native ad unit. Uber confirmed to TechCrunch that a test quietly running in markets around India allows restaurants to bundle several food items together and sell them at a discounted price in exchange for promoted placement by Uber Eats in a featured section of local “Specials.” In some cases, restaurants foot the cost of the discount, while in others Uber pays for the discounts.

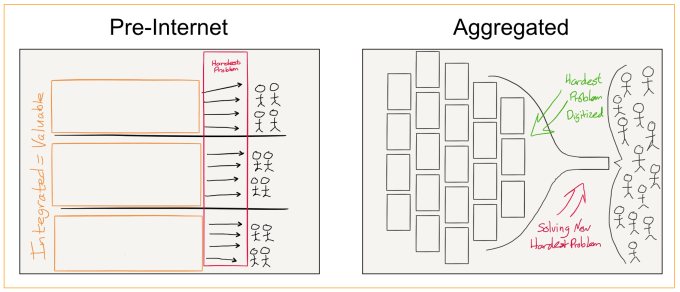

The Uber Specials feature demonstrates the massive leverage awarded to food delivery apps that aggregate restaurants. Users often come to Uber Eats and its competitors without a specific restaurant in mind. Uber can then point those customers to whichever food supplier it prefers. The suppliers in turn will increasingly compete for the favor of the aggregators — not just in terms of food quality, speed and review scores, but also in terms of discounts. The aggregators will win users if they offer the best deals; creating a network effect makes restaurants more keen to play ball.

TechCrunch first learned of Uber’s ambitions in the space from a mock-up of the Promoted Items Value Section feature spotted in its app by mobile researcher and frequent TC tipster Jane Manchun Wong. The fictional food items included “Best Beer” that “is made from only the finest gutter swill” and “Weird Fries” that “will so utterly decimate your sense of good food that you will be permanently reduced to a whimpering shell of your former self!” This jokey text that seemingly was never meant for public viewing also noted that the fries are so good you should “throw all your other food in the garbage right now!” Uber assured us these weren’t real.

But what it did confirm is that the discounts for promoted placement test is live in India. “We’re always experimenting with ways to make it easier to find your favorite foods on Uber Eats,, according to a statement provided by an Uber spokesperson.

The feature allows restaurants to create a bundled meal at a certain price point, such as a chicken sandwich, french fries and a drink at a price that’s less than the sum of its parts. The company tells me the goal is to take the friction out of ordering by giving people pre-set meals at a better price prominently available in the app. Attracting more customers that have plenty of other options could offset the discount. Businesses could also use it to bundle high-margin items, like soft drinks, with meals, or to get rid of overstock.

Ben Thompson’s aggregation theory describes how power accrues to aggregators that match supply with demand

It’s already common for restaurants to make “specials” out of food they have too much of. That butternut squash ravioli might only be featured because they can’t get rid of it. In that sense, you could think of Uber Specials as the inverse of surge pricing. When supply is too high, restaurants can offer discounts to gain more demand. It’s also not far off from Google Search’s keyword ads where business pay for more visibility.

Uber wouldn’t discuss whether it plans to bring the strategy to other markets, but it makes sense to assume it’s considering expansion. Done wrong, it could look a bit like Uber Eats is pressuring restaurants to surrender discounts if they want to be discoverable inside its app. If restaurants within Uber Eats get into heated competition to offer discounts, it could drive down their profits. But done right, Specials could look like a triple-win. Restaurants can offload surplus and bundle in high-margin items while scoring new customers from enhanced placement, customers get cheaper food options and Uber Eats becomes people’s go-to app for easy-to-order discounted meals.

Powered by WPeMatico