Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

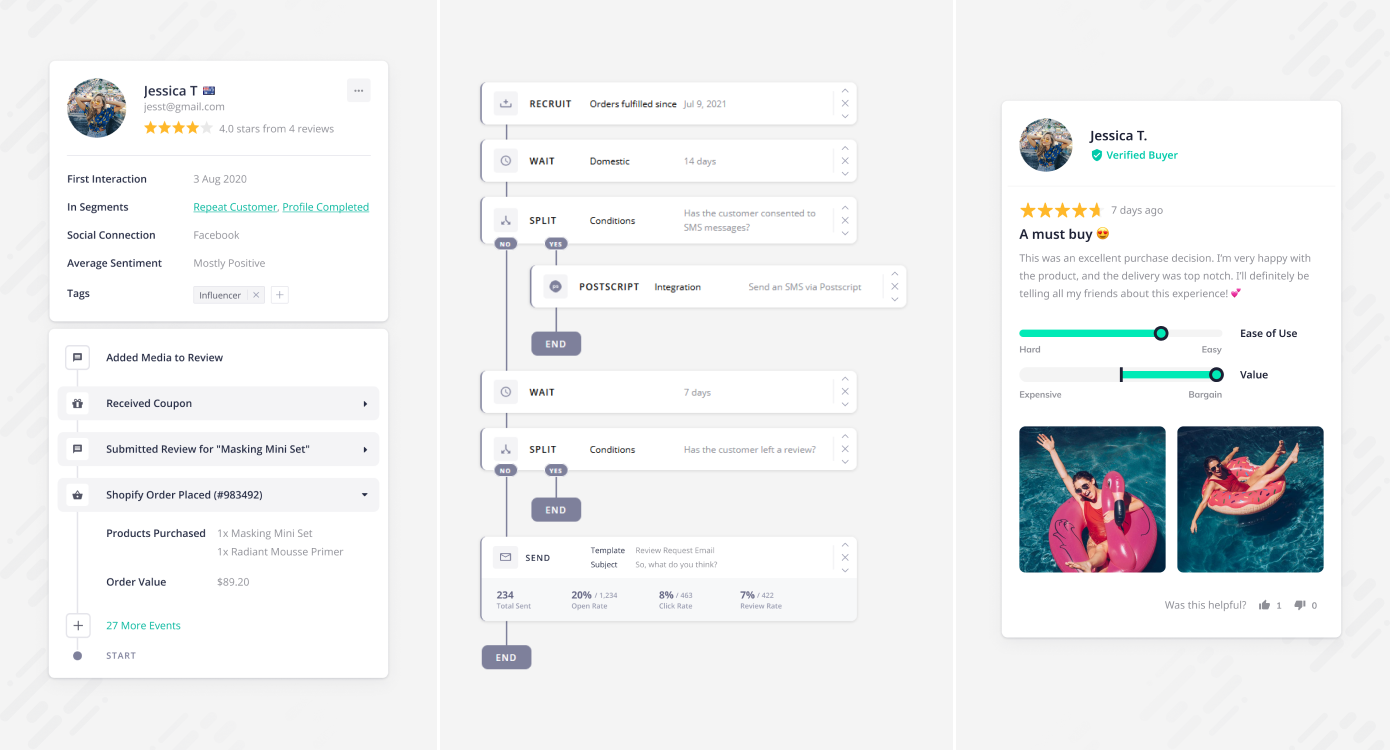

While direct-to-consumer growth has exploded in the past year, some brands are finding there’s still plenty of room to forge ahead in building a more direct relationship with their customers.

Sydney-based Okendo has made a splash in this world by building out a popular customer reviews systems for Shopify sellers, but it’s aiming to expand its ambitions and tackle a much bigger problem with its first outside funding — helping brands scale the quality of their first-party data and loosen their reliance on tech advertising kingpins for customer acquisition and engagement.

“Most DTC brands are still very dependent on Big Tech,” CEO Matthew Goodman tells TechCrunch.

Gathering more customer review data directly from consumers has been the first part of the puzzle, with its product that helps brands manage and showcase customer ratings, reviews, user-generated media and product questions. Moving forward Okendo is looking to help firms manage more of the web of cross-channel customer data they have, standardizing it and allowing them to give customers a more personalized experience when they shop with them.

via Okendo

“Merchants have goals and want to better understand their customers,” Goodman says. “As soon as a brand reaches a certain level of scale they’re dealing with unwieldy data.”

Goodman says that Apple’s App Tracking Transparency feature and Google’s pledge to end third-party cookie tracking has pushed some brands to get more serious about scaling their own data sets to insulate themselves from any sudden movements.

The company needs more coin in its coffers to take on the challenge, raising their first bout of funding since launching back in 2018. They’ve raised $5.3 million in seed funding, led by Index Ventures. 2020 was a big growth year for the startup, as e-commerce spending surged and sellers looked more thoughtfully at how they were scaling. The company tripled its ARR during the year and doubled its headcount. The bootstrapped company was profitable at the time of the raise, Goodman says.

Today, the company boasts more than 3,500 DTC brands in the Shopify network as customers, including heavyweights like Netflix, Lego, Skims, Fanjoy and Crunchyroll. The startup is tight-lipped on what their next product launches will look like, but plans to jump into two new areas in the next 12 months, Goodman says.

Powered by WPeMatico

Here’s another edition of “Dear Sophie,” the advice column that answers immigration-related questions about working at technology companies.

“Your questions are vital to the spread of knowledge that allows people all over the world to rise above borders and pursue their dreams,” says Sophie Alcorn, a Silicon Valley immigration attorney. “Whether you’re in people ops, a founder or seeking a job in Silicon Valley, I would love to answer your questions in my next column.”

Extra Crunch members receive access to weekly “Dear Sophie” columns; use promo code ALCORN to purchase a one- or two-year subscription for 50% off.

Dear Sophie,

I handle people ops as a consultant at several different tech startups. Many have employees on OPT or STEM OPT who didn’t get selected in this year’s H-1B lottery.

The companies want to retain these individuals, but they’re running out of options. Some companies will try again in next year’s H-1B lottery, even though they face long odds, particularly if the H-1B lottery becomes a wage-based selection process next year.

Others are looking into O-1A visas, but find that many employees don’t yet have the experience to meet the qualifications. Should we look at Canada?

— Specialist in Silicon Valley

Dear Specialist,

That’s what we’re all about — finding creative immigration solutions to help U.S. employers attract and retain international talent and help international talent reach their dreams of living and working in the United States.

I’ve written a lot on how U.S. tech startups can keep their international team members in the United States. One strategy is to help the startup employees become qualified for O-1As. Another is to obtain unlimited H-1B visas without the lottery through nonprofit programs affiliated with universities. Sometimes candidates return to school for master’s degrees that offer a work option called CPT, or curricular practical training.

Image Credits: Joanna Buniak / Sophie Alcorn (opens in a new window)

But sometimes, companies end up deciding to move some of their international talent to Canada to work remotely. Recently, Marc Pavlopoulos and I discussed how to help U.S. employers and international talent on my podcast. Through his two companies, Syndesus and Path to Canada, Pavlopoulos helps both U.S. tech employers and international tech talent when their employees or they themselves run out of immigration options in the United States. He most often assists U.S. tech employers when their current or prospective employees are not selected in the H-1B lottery.

Through Syndesus, a Canada-based remote employer — also known as a professional employment organization (PEO) — Pavlopoulos helps U.S. employers retain international tech workers who either no longer have visa or green card options that will enable them to remain in the United States or those who were born in India and are fed up by the decades-long wait for a U.S. green card. U.S. employers that don’t have an office in Canada can relocate these workers to Canada with the help of Syndesus, which employs these tech workers on behalf of the U.S. company, sponsoring them for a Canadian Global Talent Stream work visa.

Syndesus also helps U.S. tech startups without a presence in Canada find Canadian tech workers and employ them on the startup’s behalf. As an employer of record, Syndesus handles payroll, HR, healthcare, stock options and any issues related to Canadian employment law.

Pavlopoulos’ other company, Path to Canada, currently focuses on connecting international engineers and other tech talent working in the U.S. — including those whose OPT or STEM OPT has run out — who cannot remain in the U.S. find employment in Canada, either at a Canadian company or at the Canadian office of a U.S. company. These employees get a Global Talent Stream work visa and eventually permanent residence in Canada. Pavlopoulos intends to expand Path to Canada to help tech talent from around the world live and work in Canada.

Powered by WPeMatico

The payments space — amazingly — remains up for grabs for startups. Yes, dear reader, despite the success of Stripe, there seems to be a new payments startup virtually every other day. It’s a mess out there! The accelerated growth of e-commerce due to the pandemic means payments are now a booming space. And here comes another one, with a twist.

WhenThen has built a no-code payment operations platform that, they claim, streamlines the payment processes “of merchants of any kind”. It says its platform can autonomously orchestrate, monitor, improve and manage all customer payments and payments ops.

The startup’s opportunity has arisen because service providers across different verticals increasingly want to get into open banking and provide their own payment solutions and financial services.

Founded six months ago, WhenThen has now raised $6 million, backed by European VCs Stride and Cavalry.

The founders, Kirk Donohoe, Eamon Doyle and Dave Brown, are three former Mastercard Payment veterans.

Based out of Dublin, CEO Donohoe told me: “We see traditional businesses embracing e-comm, and e-comm merchants now operating multiple business models such as trade supply, marketplace, subscription, and more. There is no platform that makes it easy for such businesses to create and operate multiple payment flows to support multiple business models in one place — that’s where we step in.”

He added: “WhenThen is helping e-commerce digital platforms build advanced payment flows and payment automation, in minutes as opposed to months. When you start to integrate different payment methods, different payment gateways, how you want the payment to move from collection through to payout gets very, very complex. I’ve been doing this for over a decade now, as an entrepreneur building different businesses that had to accept, collect and pay payments.”

He said his founding team “had to build very complex payment flows for large merchants, airlines, hotels, issuers, and we just found it was ridiculous that you have to continue to do the same thing over and over again. So we decided to come up with WhenThen as a better way to be able to help you build those flows in minutes.”

Claude Ritter, managing partner at Cavalry, said: “Basic payment orchestration platforms have been around for some time, focusing mostly on maximizing payment acceptance by optimizing routing. WhenThen provides the first end-to-end payment flow platform to equip businesses with the opportunity to control every stage of the payment flow from payment intent to payout.”

WhenThen supports a wide range of popular payment providers such as Stripe, Braintree, Adyen, Authorize.net, Checkout.com, etc., and a variety of alternative and locally preferred payment methods such as Klarna Affirm, PayPal and BitPay.

“For brave merchants considering global reach and operating multiple business models concurrently, I believe choosing the right payment ops platform will become as important as choosing the right e-commerce platform. Building your entire e-comm experience tightly coupled to a single payment processor is a hard correction to make down the line — you need a payment flow platform like WhenThen”, added Fred Destin, founder of Stride.VC.

Powered by WPeMatico

Outbound sales managers typically rely on high volumes of inquiries to find customers, but this means that their revenue is often in proportion to the size of their team. Outplay helps them scale more easily with tools that automate campaigns, identifies the likeliest prospects and uses data to decide the right time to send pitches. The company announced today it has raised $7.3 million in seed funding from Sequoia Capital India.

The new capital will be used for tech development and hiring, and brings Outplay’s total raised so far to $9.3 million. Its previous funding was a $2 million raise from Sequoia Capital India’s Surge announced in March after Outplay took part in the program’s fourth cohort.

Since its seed round, Outplay says it has grown its revenue four times and now has customers in more than 50 countries, serving primarily B2B software companies.

Outplay was founded in 2019 by brothers Ram and Lax Papineni. The two previously launched AppVirality, a referral marketing tool for app developers.

Outplay was designed for sales team who contact prospects through multiple channels, like phone calls, emails, SMS, LinkedIn and Twitter. It integrates the channels into one interface, so salespeople don’t have to switch between apps. Outplay also automates sequences, or marketing campaigns that include an initial pitch sent through various channels and automatic follow-up messages if a reply isn’t received within a preset time.

The platform is meant to replace the process of cold-calling potential customers, which is time-consuming and difficult to scale, and enable salespeople to focus on the best prospects, helping them decide which channel to use and when to contact them.

Since its seed funding, Outplay has launched several new tools and features, including a Chrome extension that lets salespeople add prospects from LinkedIn and Gmail, send emails, make calls and perform other tasks without having to visit Outplay’s dashboard. It also added integrations with sales tools like Gong, Dynamics CRM and Zapier (Outplay was already integrated with customer relationship management platforms Pipedrive, Salesforce and HubSpot).

One major new feature is Magic Outbound Chat, a web chat box that is launched when a prospective customer clicks on an email link. Salespeople are notified and provided with context about the prospect. Laxman told TechCrunch that most chat boxes are designed for inbound sales teams, and Magic Outbound Chat has helped some of its teams grow their sales pipeline by 300%.

Laxman said that the onboarding process for Outplay takes just a few days and sales managers are provided with a playbook of successful sequences to help them get started.

Outplay’s competitors include unicorns Outbound and SalesLoft. Laxman said that in the mid-2000s, inbound sales processes and tech began rapidly evolving as SaaS adoption increased, but outbound sales teams still relied on the same high-volume tactics they had been using for years.

“The previous outbound sales tech disruption happened in 2011 when Outreach and Salesloft were founded. We really respect what they have done to the industry, but the approach is not scalable and the revenue eventually becomes a function of the size of the outbound sales team,” he said, adding that Outplay is changing the process by using data-driven signals to help sales representatives engage with the likeliest prospects at the right time in the right channel.

For example, Outplay’s Dynamic Sequencing automatically moves prospects from one sequence to another that has a higher chance of success. In one scenario, Outplay can be configured to move a prospective who opens a sales representative’s email more than four times to another sequence that focuses on people who appear interested in a product. Laxman said some of its customers have seen open rates as high as 80% in the second sequence with Dynamic Sequencing.

In a statement, Sequoia India principal Harshjit Sethi said, “Outbound sales needs are evolving rapidly and reps now need personalized, automated and contextual tools to drive sales which Outplay is successfully enabling. Sales reps spend an average of four hours per day on Outplay, demonstrating the effectiveness of the product which has category-leading customer reviews.”

Powered by WPeMatico

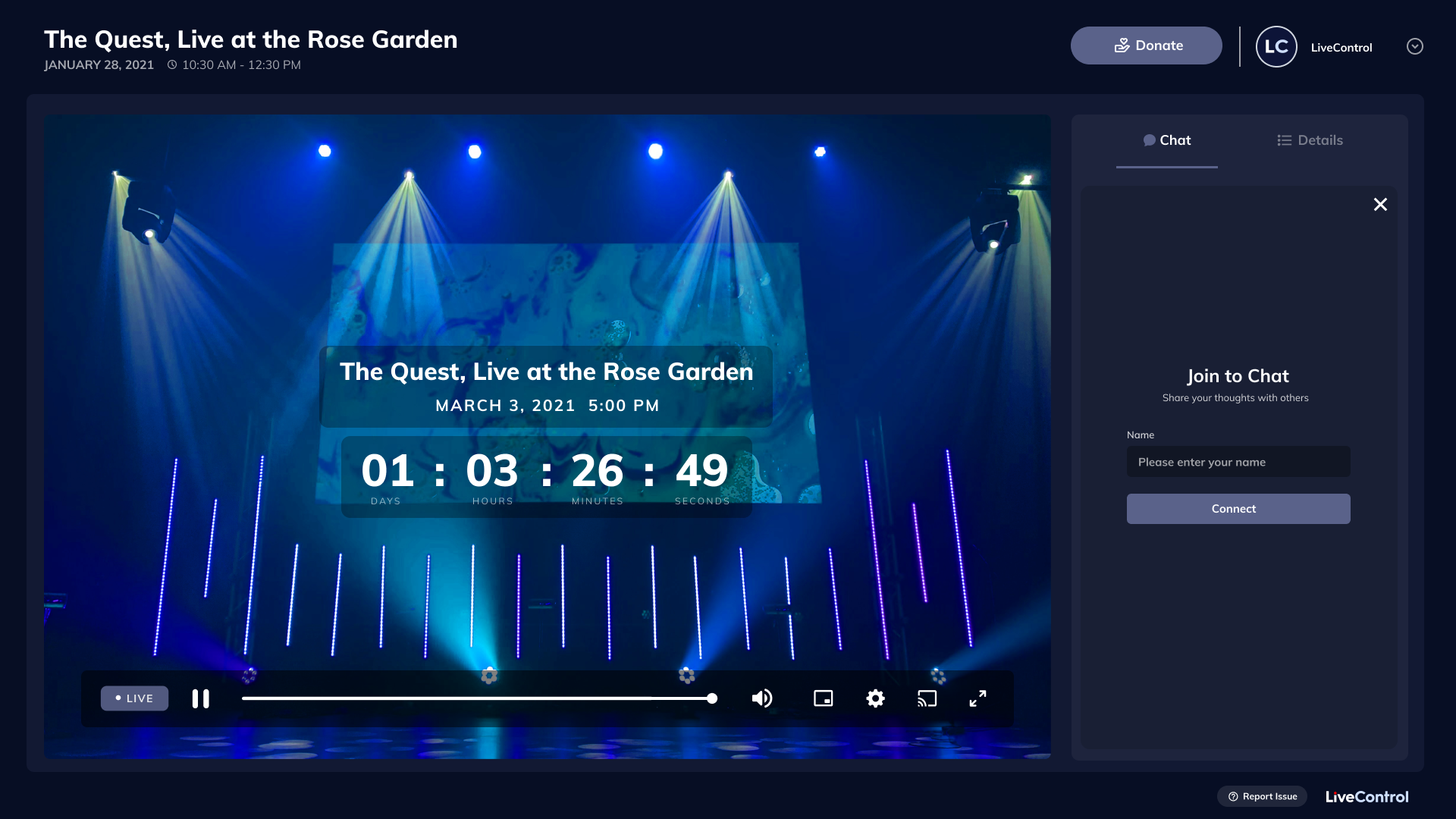

One thing seems certain: The past year-and-a-half has fundamentally transformed the world of live events. The pandemic left plenty of venues scrambling for alternative revenue streams and, in many cases, shutting down for good.

On the flip side, it’s been a massive driver for those companies working to expand the reach of in-person events. Take LiveControl, which just raised a $30 million Series A led by Coatue and featuring existing investors First Round Capital, Box Group, Susa Ventures and TriplePoint. The round brings the So Cal company’s total funding to $33 million, on the heels of a $3.2 million seed led by FRC last August.

The company offers a production suite that’s a sort of plug and play solution for venues. “What if you could snap your fingers and an entire video product crew would appear, for just $150?” CEO Patrick Coyne asked, extremely rhetorically in a comment offered to TechCrunch.

Image Credits: LiveControl

LiveControl says its technology has been deployed in “hundreds” of spots in the U.S., everywhere from music venues and comedy clubs to Broadway theaters and religious institutions. With its device agnostic software and support, the company also provides third-party camera hardware as part of a package, for a more out-of-the-box solution.

The latest funding round will go toward accelerating its technology and expanding employee headcount from 40 people to 120 over the next year and a half. LiveControl and its investors are clearly bullish on the possibilities here. But there remain broader questions around how much audience members’ interest in remote viewing regresses to the mean once venues reopen across the country and world.

“Video is now table stakes for most organizations, venues and creators,” says Coyne. “We’re only seeing it accelerate, and everyone is forward leaning to make bigger investments to improve their video quality.”

Powered by WPeMatico

Get ready for a startup throwdown of global proportions (literally). We’re the proud hosts of the Extreme Tech Challenge (XTC) Global Finals, and the pitch competition action starts tomorrow, July 22 at 9:00 am (PT).

Pro housekeeping tip: Attending this virtual pitch fest is 100% free, but you need to register here first.

Not familiar with XTC? It’s the world’s largest pitch competition focused on solving humanity’s most vexing challenges. You gotta love a competition that serves the greater good — and a startup ecosystem for purpose-driven companies determined to build a more sustainable, equitable, healthy, inclusive and prosperous world.

The road to the XTC finals was crowded, to say the least. More than 3,700 startups from 92 countries applied to compete in one of these categories: Agtech, Food & Water, Cleantech & Energy, Edtech, Enabling Tech, Fintech, Healthtech and Mobility & Smart Cities.

Talk about a daunting endeavor. Team XTC, which consisted of deeply experienced investors, entrepreneurs and executives, winnowed down that field to these seven competing finalists: Wasteless, Mining and Process Solutions, Testmaster, Dot Inc., Hillridge Technology, Genetika+ and Fotokite.

Tomorrow’s competition takes place in two rounds, and each startup team will have to bring its best if they hope to impress this panel of judges — all leaders in sustainability and social impact.

Young Sohn, co-founder, XTC and chairman at Harmann International; Bill Tai, co-founder, XTC and partner emeritus, Charles River Ventures; Regina Dugan, president and CEO of Wellcome Leap; Jerry Yang, founder/partner of AME Cloud Ventures and co-founder of Yahoo!; Lars Reger, CTO and EVP at NXP Semiconductors; and Michael Zeisser, managing partner at FMZ Ventures.

In a classic, “but wait, there’s more” moment, the day also features several presentations from some of the leading voices in sustainability. Take a look at the two examples below, and check out the complete XTC finals agenda and the roster of speakers:

The Extreme Tech Challenge Global Finals starts tomorrow, July 22. Join us and thousands of people around the world for this free, virtual pitch competition. Register here for your free ticket.

Powered by WPeMatico

Safe Security, a Silicon Valley cyber risk management startup, has secured a $33 million investment from U.K. telco BT.

Founded in 2012, Safe Security — formerly known as Lucideus — helps organizations measure and mitigate enterprise-wide cyber risk using its security assessment framework for enterprises (SAFE) platform. The service, which is used by a number of companies, including Facebook, Softbank and Xiaomi, helps businesses understand their likelihood of suffering a major cyberattack, calculates a financial cost to customers’ risks and provides actionable insight on the steps that can be taken to address them.

This funding round saw participation from Safe Security’s existing investors, including former Cisco chairman and chief executive John Chambers, and brings the total amount raised by Safe Security to $49.2 million.

BT said the investment, which is its first major third-party investment in cybersecurity since 2006, reflected its plans to grow rapidly in the sector. Philip Jansen, BT CEO said: “Cybersecurity is now at the top of the agenda for businesses and governments, who need to be able to trust that they’re protected against increasing levels of attack.

“Already one of the world’s leading providers in a highly fragmented security market, this investment is a clear sign of BT’s ambition to grow further.”

The startup’s co-founder and chief executive Saket Modi said he was “delighted” to be working with BT.

“By aligning BT’s global reach and capabilities with SAFE’s ability to provide real-time visibility on cyber risk posture, we are going to fundamentally change how security is measured and managed across the globe,” he said.

As part of the investment, which will see Safe Security double its engineering team by the end of the year, BT will combine the SAFE platform with its managed security services, and gain exclusive rights to use and sell SAFE to businesses and public sector bodies in the U.K. BT will also work collaboratively with Safe Security to develop future products, according to an announcement from the company.

Safe Security’s competitors include UpGuard, Exabeam and VisibleRisk.

Powered by WPeMatico

Is the trading boom of 2020 and 2021 slowing?

That’s a question The Exchange has had on its mind since Robinhood released its latest IPO filing. The popular U.S. consumer-focused investing app told investors in the document that it expects revenues to decline in the third quarter compared to its Q2 performance. The company highlighted historically strong crypto volumes in preceding quarters as part of the reason for its anticipated revenue decline.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Naturally, we got to thinking about Coinbase.

It’s likely fair to say that Coinbase and Robinhood are bullish enough about the cryptocurrency market to be unbothered by short-term changes to crypto trading volumes. Coinbase discussed rising and falling consumer interest in trading cryptos in its own IPO filings, for example.

The now-public unicorn has lived through crypto ups and crypto downs. A decline in consumer interest in the next few months or quarters is not a huge deal, assuming one keeps a long enough perspective and the crypto-infused future that its fans expect comes to pass.

The boom in crypto demand among U.S. consumers lifted many a boat in recent quarters. Coinbase posted insanely good early-2021 results thanks to a bull run in cryptocurrency prices that drove retail interest and trading fees. Robinhood also saw a rush of crypto demand, something that TechCrunch explored here. And Square itself has seen crypto revenues explode.

The boom in crypto demand among U.S. consumers lifted many a boat in recent quarters. Coinbase posted insanely good early-2021 results thanks to a bull run in cryptocurrency prices that drove retail interest and trading fees. Robinhood also saw a rush of crypto demand, something that TechCrunch explored here. And Square itself has seen crypto revenues explode.

Sure, equities interest and demand for options also elevated the fortune of many consumer fintechs during the COVID-19 savings and investing boom. But crypto revenues had a big part to play. Let’s examine both situations through the lens of the latest from Robinhood.

There are some 316 mentions of “cryptocurrency” in Robinhood’s latest IPO filing. We’re going to stick to those we consider the most important.

As context, Robinhood shared preliminary Q2 data. We discussed it here if you want to go deeper into the aggregate figures. But after its disclosure of hard numbers, Robinhood had some interesting notes about the current quarter (emphasis TechCrunch):

Trading activity was particularly high during the first two months of the 2021 period, returning to levels more in line with prior periods during the last few weeks of the quarter ended June 30, 2021, and remained at similar levels into the early part of the third quarter. We expect our revenue for the three months ending September 30, 2021 to be lower, as compared to the three months ended June 30, 2021, as a result of decreased levels of trading activity relative to the record highs in trading activity, particularly in cryptocurrencies, during the three months ended June 30, 2021, and expected seasonality.

And in a discussion of some other performance metrics, including funded accounts and the like, Robinhood had this to say (emphasis TechCrunch):

We anticipate the rate of growth in these Key Performance Metrics will be lower for the period ended September 30, 2021, as compared to the three months ended June 30, 2021, due to the exceptionally strong interest in trading, particularly in cryptocurrencies, we experienced in the three months ended June 30, 2021, and seasonality in overall trading activities.

Falling revenue and slowing KPM growth is not really the world’s best set of metrics to flash up during an IPO run. But a quick scan of Robinhood’s 2020 revenues indicates it’s unlikely that the unicorn will be able to post year-over-year growth in the final two quarters of 2021. Still, its period of rapid-fire revenue growth appears to have come to an end after Robinhood posted top-line expansion in every quarter since Q4 2019.

Powered by WPeMatico

Global investment group Eurazeo invested $53 million in Pangaea Holdings for a minority investment in the Los Angeles e-commerce company rooted in creating premium men’s personal care brands.

The investment is part of a larger $68 million round that includes $15 million in Series B funding from a group of backers including Unilever Ventures and GPO Fund and existing investors Base10 Partners and Gradient Ventures. This brings the company’s total funds raised to $87 million since the company was founded by Richard Hong and Darwish Gani in 2018.

Harlem Capital’s Henri Pierre-Jacques invested in both Pangaea’s seed round in 2019 and Series A in 2020. He’s known Gani since college and worked with Hong over the past two years, calling the pair “one of the most data-driven and founder market fits I have seen.”

“At the seed stage, the business was already a seven-figure business and has continued to see astonishing growth,” he added. “Pangaea, to date, has been a brand incubator, but post the Series B will expand to be a vertically integrated e-commerce platform for other brands. We are even more excited for this next phase of their growth.”

Hong started Pangaea with the launch of men’s skincare brand Lumin that contains natural Korean-based formulations. In fact, he was among a group of people living together in an apartment using Korean beauty products and hiding it from their roommates, Gani told TechCrunch.

Gani later joined Hong as a co-founder to scale the business, as they realized there was a bigger opportunity for global e-commerce.

“Men are actually into skincare, but not as comfortable talking about it,” Gani said. “For Richard, he came from a place where skincare was more culturally accepted. His idea was to provide high-quality products, but presented in a way that people can understand their use and help them to form a habit.”

Pangaea ended up developing proprietary infrastructure, including warehousing, payments and shipping, as a holding company to grow and scale direct-to-consumer brands. It’s latest brand, Meridian, offering grooming products, launched in 2020. Products are now selling in more than 70 countries.

Though headquartered in Los Angeles, the company is basically remote, with more than 300 employees across its major hubs in LA, Lagos, Nigeria, Singapore and Europe.

The company is already cash flow positive, and the new funding will enable Pangaea to round out leadership roles in its brands and reach the next stage of growth with the goal of being “omnichannel male megabrands,” Gani said. The company is also investing in additional product categories, new brands and potentially licensing its proprietary software.

Gani said he is excited to work with Eurazeo, which he referred to as “experts in building and scaling consumer brands.” The firm will work with Pangaea to continue developing the Lumin and Meridian brands and accelerate its international expansion.

Jill Granoff, Eurazeo’s managing partner and brands CEO, said in a written statement that the company “is well-positioned for future growth.”

“Richard and Darwish have launched a platform and products that address a significant need in an attractive, growing market,” Granoff added. “The team has achieved impressive results in a short period of time across geographies and categories, demonstrating strong product appeal to global consumers. They have also built a highly scalable technology that can support future brand development.”

Powered by WPeMatico

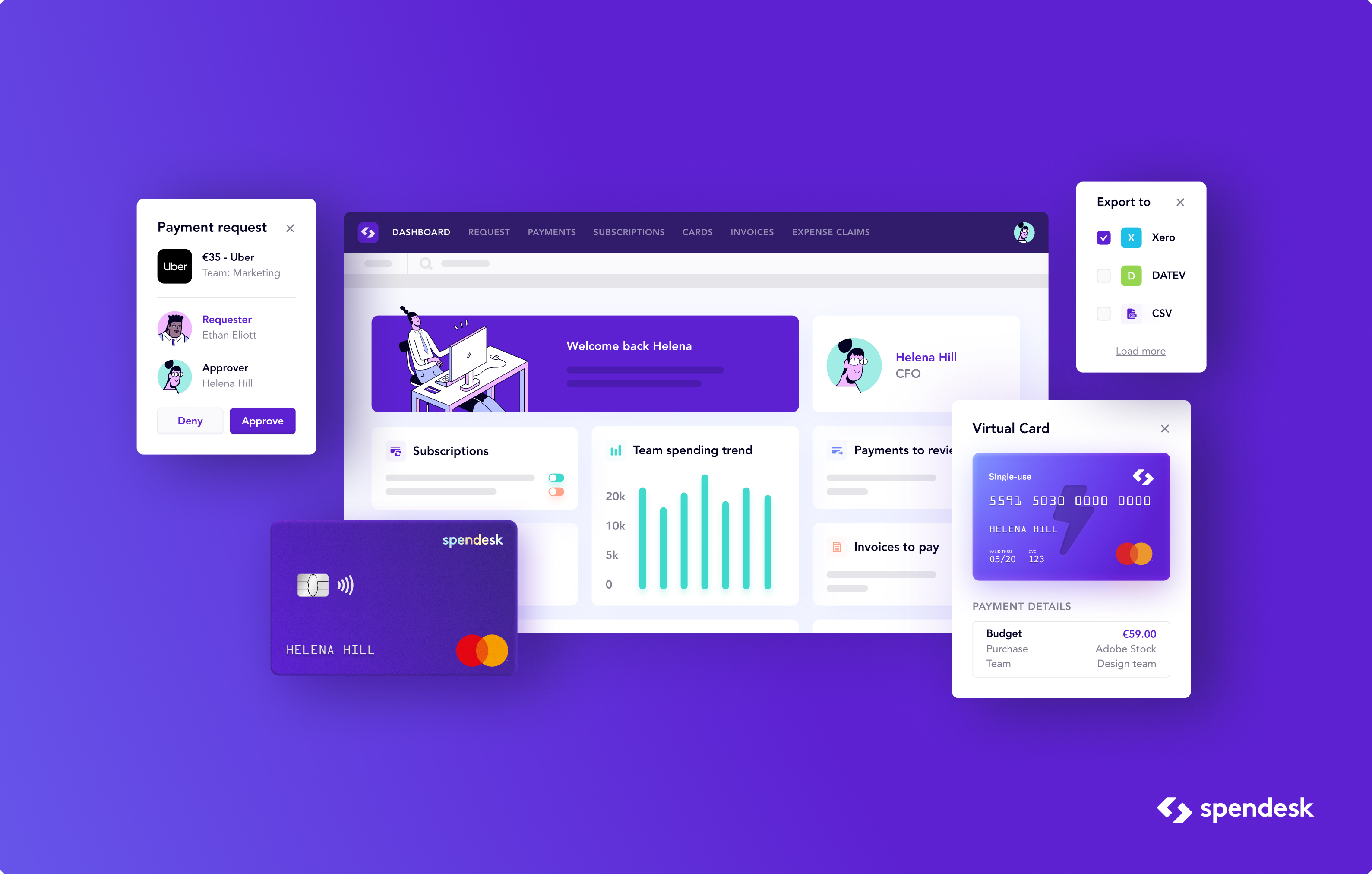

French startup Spendesk has announced earlier today that it has raised a $118 million funding round (€100 million) led by General Atlantic. Overall, the company has raised $189 million (€160 million) since its inception.

Existing investors Index Ventures and Eight Road Ventures participated once again in today’s funding round.

Spendesk, as the name suggests, focuses on all things related to spend management. Originally founded in startup studio eFounders, the startup first offered virtual and physical company cards for employees. While corporate cards are quite popular in the U.S., many small and medium companies in France can’t give a card to every single employee.

That’s why spending your company’s money can be a cumbersome process. You can borrow your boss’ card but they’ll have to trust you with it. You can pay with your own personal card but you want to be reimbursed as quickly as possible.

By combining a SaaS platform with corporate cards, it opens up a ton of possibilities. For instance, you can create an approval workflow for expensive purchases. You can set different budgets for different teams.

Over time, Spendesk has expanded beyond cards to manage expenses and invoice processing. It tries to automate some repetitive accounting tasks as well. Employees are automatically reminded that they have to attach a receipt for each transaction. You can export everything to Xero, Datev, Sage, Cegid or Netsuite.

If that pitch sounds familiar, it’s because there are a handful of European startups that are all doing well in this field. Soldo recently raised $180 million while Pleo snatched $150 million at a $1.7 billion valuation.

And yet, Spendesk doubled its revenue over the past year. Its team grew from 150 to 300 employees and it plans to double its headcount again over the next couple of years.

It means two things — the market opportunity is important and many customers are switching from old school workflows to modern SaaS products. That’s why three startups can grow at the same time.

“Traditionally, finance teams haven’t been equipped with the tools that can support this transformation,” Spendesk co-founder and CEO Rodolphe Ardant said in a statement. “In the past few years we have built the reference spend management solution for finance teams in Europe, which frees businesses and their people from administrative constraints of spending and managing money at work. While our solution is about empowering finance teams, we are actually delivering value to the entire business through the finance team.”

Spendesk currently has 3,000 clients, including Algolia, Soundcloud, Curve, Doctolib, Gousto, Raisin, Sezane and Wefox.

Image Credits: Spendesk

Powered by WPeMatico