funding

Auto Added by WPeMatico

Auto Added by WPeMatico

On Friday, former Tiger Global Management investor Lee Fixel registered plans for the second fund of his new investment firm, Addition, just four months after closing the first. According to a report on Friday by the Financial Times, the outfit spent last week finalizing the fundraising for the $1.4 billion fund, which Addition reportedly doesn’t plan to begin investing until next year.

But a source close to the firm now says the capital has not been raised. That’s perhaps good news for investors who were shut out of Addition’s $1.3 billion debut fund and who might be hoping to write a check this time around.

The mere fact that Fixel is back in the market already has tongues wagging about the dealmaker, one whose reluctance to talk on the record with media outlets seems only to add to his mystique. Forbes published a lengthy piece about Fixel this summer, in which Fixel seems to have provided just one public statement, confirming the close of Addition’s first fund and adding little else. “We are excited to partner with visionary entrepreneurs, and with our 15-year fund duration, we have the patience to support our portfolio companies on their journey to build impactful and enduring businesses,” it read.

According to Forbes, that first fund — which Fixel is actively putting to work right now — intends to invest one-third of its capital in early-stage startups and two-thirds in growth-stage opportunities.

Whether that includes some of the special purpose acquisition vehicles, or SPACs, that are coming together right and left, isn’t yet known, though one imagines these might appeal to Fixel, who has long seemed to be at the forefront of new trends impacting growth-stage companies in particular. (A growing number of SPACs is right now looking to transform into public companies some of the many hundreds of richly valued private companies in the world.)

Clearer is that Addition is wasting little time in writing some big checks. Among its announced deals is Inshorts, a seven-year-old, New Delhi, India-based popular news aggregation app that last week unveiled $35 million new funding led by Fixel.

The deal represents Addition’s first India-based bet, even while Fixel knows both the country and the startup well. He previously invested in Inshorts on behalf of Tiger; he’s also credited for snatching up a big stake in Flipkart on behalf of Tiger, a move that reportedly produced $3.5 billion in profits when Flipkart sold to Walmart.

Addition also led a $200 million round last month in Snyk, a five-year-old, London-based startup that helps companies securely use open-source code. The round valued the company at $2.6 billion — more than twice the valuation it was assigned when it raised its previous round 10 months ago.

And in August, Addition led a $110 million Series D round for Lyra Health, a five-year-old, Burlingame, California-based provider of mental health care benefits for employers that was founded by former Facebook CFO David Ebersman.

A smaller check went to Temporal, a year-old, Seattle-based startup that is building an open-source, stateful microservices orchestration platform. Last week, the company announced $18.75 million in Series A funding led by Sequoia Capital, but Addition also joined the round, having been an earlier investor in the company.

According to PitchBook data, Addition has made at least 17 investments altogether.

Fixel — whose bets while at Tiger include Peloton and Spotify — isn’t running Addition single-handedly, though according to Forbes, he is the single “key man” around which the firm revolves, as well as the biggest investor in Addition’s first fund.

He has also brought aboard at least three investment principals from Wall Street and a head of data science who worked formerly for Uber (per Forbes). Ward Breeze, a longtime attorney who worked formerly in the emerging companies practice of Gunderson Dettmer, is also working with Fixel at Addition.

(Correction: An earlier version of this story reported that Fixel’s newest fund was already raised, per the FT.)

Powered by WPeMatico

Lawmatics, a San Diego startup that’s building marketing and CRM software for lawyers, is announcing that it has raised $2.5 million in seed funding.

CEO Matt Spiegel used to practice law himself, and he told me that even though tech companies have a wide range of marketing tools to choose from, “lawyers have not been able to adopt them,” because they need a product that’s tailored to their specific needs.

That’s why Spiegel founded Lawmatics with CTO Roey Chasman. He said that a law firm’s relationship with its clients can be divided into three phases — intake (when a client is deciding whether to hire a firm); the active legal case; and after the case has been resolved. Apparently most legal software is designed to handle phase two, while Lawmatics focuses on phases one and three.

The platform includes a CRM system to manage the initial client intake process, as well as tools that can automate a lot of what Spiegel called the “blocking and tackling” of marketing, like sending birthday messages to former clients — which might sound like a minor task, but Spiegel said it’s crucial for law firms to “nurture” those relationships, because most of their business comes from referrals.

Lawmatics’ early adopters, Spiegel added, have consisted of the firms in areas where “if you need a lawyer, you go to Google and start searching ‘personal injury,’ ‘bankruptcy,’ ‘estate planning,’ all these consumer-driven law firms.” And the pandemic led to accelerated the startup’s growth, because “lawyers are at home now, their business is virtual and they need more tools.”

Spiegel’s had success selling technology to lawyers in the past, with his practice management software startup MyCase acquired by AppFolio in 2012 (AppFolio recently sold MyCase to a variety of funds for $193 million). He said that the strategies for growing both companies are “almost identical” — the products are different, but “it’s really the same segment, running the same playbook, only with additional go-to-market strategies.”

The funding was led by Eniac Ventures and Forefront Venture Partners, with participation from Revel Ventures and Bridge Venture Partners.

“In my 10 years investing I have witnessed few teams more passionate, determined, and capable of revolutionizing an industry,” said Eniac’s Tim Young in a statement. “They have not only created the best software product the legal market has seen, they have created a movement.”

Powered by WPeMatico

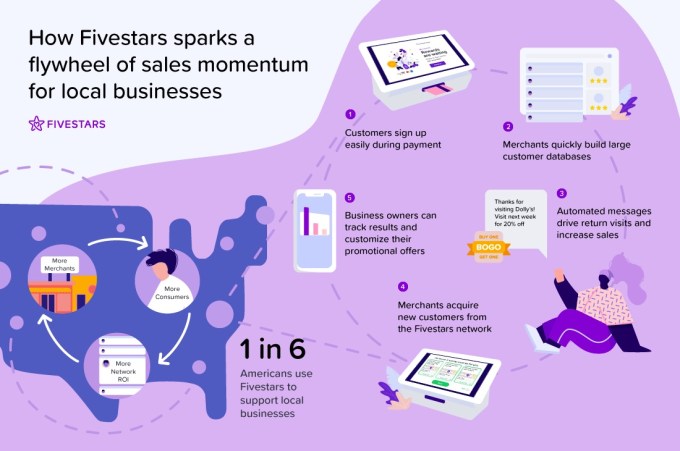

It’s a difficult time for small businesses — to put it mildly. And Fivestars CEO Victor Ho said that many of the big digital platforms aren’t really helping.

Ho argued that those platforms (whether they offer delivery services, user reviews or marketing tools) all have the same underlying model: “They seek to take over a small business’ customer base and then charge them a tax to start reaching those customers.”

Superficially, a company like Fivestars, which has created software to support small business payments and marketing, might not sound that different.

But Ho said that the startup actually takes the “opposite” approach, because Fivestars isn’t trying to build up a big “walled garden” of its own customers that businesses pay to access. Instead, businesses pay for the software, which they use to build a database of their own customers; they don’t have to pay to reach those customers.

“The incentives are more aligned,” he said.

Image Credits: Fivestars

The Fivestars platform includes its own payment product, integration with other point-of-sale systems, marketing automation that delivers personalized messages to customers and a broader network of 60 million shoppers, allowing for cross-promotion across different Fivestars businesses.

The startup is announcing today that it has raised $52.5 million in new funding, combining a Series D equity round as well as debt and bringing its total funding to $145.5 million. The round was led by Salt Partners, with participation from Lightspeed Venture Partners, DCM Ventures, Menlo Ventures and HarbourVest Partners.

Ho said Fivestars actually closed the round before the COVID-19 pandemic, but the team decided to hold off on the announcement because it seemed like a bad idea to “flaunt” the company’s bank account when so many of its customers were suffering.

The company has seen “record usage” during the pandemic, with 1 million new shoppers joining the network every month. At the same time, Ho acknowledged that the pandemic has caused Fivestars to shift its strategy. Originally, the goal for the funding was “just to keep growing our portfolio of merchants across our existing products,” but he said, “What changed pretty dramatically through this period for us was emphasizing the payments piece and the network” and focusing on “what small businesses need more than ever.”

Ho also noted that during the pandemic, the company has provided customers with more than $1 million worth of credits and also made more of its products free to use.

“It’s very clear that small businesses are incredibly resilient,” he added. “Particularly when it comes to the category of experiences — you’re not going to take your wife on a date to Pizza Hut; when you go to Paris, you’re not going to go to generic chains.”

In the funding announcement, Natasha Teague of Fort Lauderdale health food store Tropibowls described the Fivestars platform as “a huge help.”

“The value of being able to communicate with our customers and share updates in real-time has been immeasurable,” Teague said in a statement. “The power of Fivestars’ expansive network and payment tech has made our reopening process seamless and a lifesaver as we navigate new needs as a result of the pandemic.”

Powered by WPeMatico

There are more than 2 billion websites in existence in the world today, millions of apps and a growing range of digital screens where people and businesses present constantly changing arrays of information to each other. But all that opportunity also has a flip side: How can you say what you want, just how you want to say it, without technical hurdle after hurdle getting in your way?

A startup called Sanity has built a platform to help businesses (and their people) do that more easily with a SaaS platform that lets developers create code and systems to manage content. Now, after picking up some 25,000 customers, from “traditional” publishers like Conde Nast and National Geographic through to hundreds of others like Sonos, Brex, Figma, Cloudflare, Mux, Remarkable, Kleiner Perkins, Tablet Magazine, MIT, Universal Health Services, Eurostar and Nike, it is announcing funding of $9.3 million to fuel its growth.

The funding, a Series A, is being led by Threshold Ventures (the VC formerly known as Draper Fisher Jurvetson, rebranded in 2019 after none of the namesakes remained at the firm), with an interesting cast of others also participating.

They include Ev Williams (who knows a thing or two about “content” as the co-founder of Blogger, Twitter and most recently Medium); Adam Gross, ex-CEO of Heroku; Guillermo Rauch, inventor of NextJS and CEO and co-founder of Vercel; Stephanie Friedman (ex-Xamarin and Microsoft); and Monochrome Capital, the new firm launched by Ben Metcalfe (the co-founder of WP Engine, among many other roles).

Heavybit and Alliance Venture, which led its seed round of $2.4 million last year, also participated. Other existing investors include Mathias Biilman and Chris Bach, co-founders of Netlify; Jon Dahl, CEO and co-founder of Mux; and Edvard Engesæth, co-founder of NURX.

Sanity bills itself as a “content platform”, and the open-ended idea of what that could possibly mean is essentially the essence of what the company is about.

Led by co-founder and CEO Magnus Hillestad, it has crafted a set of tools that can help developers structure how and where content gets created, input and eventually presented to people, with its target audience being any organization or person that might be putting together a digital experience whose content is regularly updated and is not static.

Hillestad said that thinking of content as a separate and dynamic element in digital experiences represents a “paradigm shift” in terms of how the web and other content experiences are developing. The idea, he said, is for an organization “not to be held back by features but to have the code to make the components they want.” He described it as a progression along the same trajectories of “what Twilio did by coming in with APIs for communications, and Figma did with its concept of collaboration.”

While e-commerce has typically been a major customer of such “headless” platforms — they will use services like these to help design and manage the front end, with another service like Shopify to manage the commerce at the back end — it’s actually a basic framework that has been applied to a pretty wide range of use cases at Sanity.

They do include e-commerce experiences, but also companies building interactive tools for customers to look at, mix and match various light fixtures from a lighting consultancy; more standard publishing services; and for helping tailor materials for emergency medical training services.

These days, the medium, as they say, is the message, and in that regard “publishing” has taken on a new meaning in the digital age. Whereas in the past it only referred to materials prepared for print, such as books, magazines and newspapers, these days it can be any kind of content prepared for the web or any other endpoint where it will not only be “read” but potentially manipulated in some way, and likely also changed by the producers as well. The very un-static nature of that content makes it fun and interesting, but also a pain to manage.

Sanity has a notable origin that speaks to how it has always given a wide berth and prime positioning to the sanctity of content. It was built originally by an agency in Oslo, Norway, as part of a remit to rethink and recast how to present works for a new website for OMA, the architecture firm co-founded by the iconic Dutch designer Rem Koolhaas.

The information matrix and content management system concept that they put together was strong enough to use the agency to build more sites using the CMS, and eventually the firm spun Sanity out as its own independent firm, founded by Even Westvang, Hillestad, Oyvind Rostad and Simen Svale Skogsrud.

Part of the team, including Hillestad, relocated to the Bay Area to build the startup and integrate it deeper with the bigger tech ecosystem in the region and build out the concept under a SaaS model, while others remained in Oslo.

In its move to the U.S., Sanity has over the past few years been tapping into a growing market for services to enable those who rely on the web to do business do it in a more creative and dynamic way.

“A decade ago, I co-founded WP Engine with the goal of bringing the power of WordPress to the enterprise and small business buyer,” said Metcalfe in a statement. “Not only are we moving away from monolithic codebases to API-driven services, but the way we think about content is changing; as we create once and expect it to appear across web, apps and even IoT devices. Sanity has reimagined the headless CMS, bringing content closer to the developer where it can exist as the defacto content system of record across an entire organization. With CMS so close to my roots, I couldn’t be more delighted that Sanity is the inaugural investment for Monochrome Capital.”

It is not the only company in this wider area getting a lot of attention. Last week, Shogun — which focuses only on e-commerce and front-end design, raised $35 million. Others include Commercetools, Commerce Layer, Strapi, Contentful and ContentStack. Sanity stands out partly by keeping its focus wider than e-commerce and by not using the words “content” or “commerce” in its name.

“We’re seeing a tidal wave of companies transform and digitize every aspect of their business, but the tools they use limit their progress,” said Josh Stein, partner, Threshold Ventures, in a statement. “Sanity’s content platform liberates content and content owners by enabling a truly collaborative and customizable experience, while treating content as data to maximize content velocity across all customer touchpoints and surfaces. We’re excited to back the Sanity team and their impressive developer-focused content management platform.”

Stein and Jesse Robbins, a partner at Heavybit, are both joining Sanity’s board of directors with this round.

Powered by WPeMatico

Vivun’s co-founder and CEO, Matt Darrow used to run pre-sales at Zuora and he saw that pre-sales team members had a lot of insight into customers. He believed if he could capture that insight, it would turn into valuable data to be shared across the company. He launched Vivun to build upon that idea in 2018, and today the company announced an $18 million Series A.

Accel led the round with participation from existing investor Unusual Ventures. With today’s investment, Vivun has raised a total of $21 million, according to the company.

Darrow says that the company has caught the attention of investors because this is a unique product category and there has been a lot of demand for it. “It turns out that businesses of all sizes, startups and enterprises, are really craving a solution like Vivun, which is dedicated to pre-sales. It’s a big, expensive department, and there’s never been software for it before,” Darrow told TechCrunch.

He says that a couple of numbers stand out in the company’s first year in business. First of all, the startup grew annual recurring revenue (ARR) six fold (although he wouldn’t share specific numbers) and tripled the workforce growing from 10 to 30, all while doing business as an early stage startup in the midst of a pandemic.

Darrow said while the business has grown this year, he found smaller businesses in the pipeline were cutting back due to the impact of COVID’s, but larger businesses like Okta, Autodesk and Dell Secureworks have filled in nicely, and he says the product actually fits well in larger enterprise organizations.

“If we look at our value proposition and what we do, it increases exponentially with the size of the company. So the larger the team, the larger the silos are, the larger the organization is, the bigger the value of solving the problem for pre-sales becomes,” he said.

After going from a team of 10 to 30 employees in the last year, Darrow wants to double the head count to reach around 60 employees in the next year, fueled in part by the new investment dollars. As he builds the company, the founding team, which is made up of two men and two women, is focused on building a diverse and inclusive employee base.

“It is something that’s really important to us, and we’ve been working at it. Even as we went from 10 to 30, we’ve worked to pay close attention to [diversity and inclusion], and we continue to do so just as part of the culture of how we build the business,” he said.

He’s been having to build that workforce in the middle of COVID, but he says that even before the pandemic shut down offices, he and his founding partners were big on flexibility in terms of time spent in the office versus working from home. “We knew that for mental health strength and stability, that being in the office nine to five, five days a week wasn’t really a modern model that would cut it,” he said.

Even pre-COVID the company was offering two quiet periods a year to let people refresh their batteries. In the midst of COVID, he’s trying to give people Friday afternoons off to go out and exercise and relax their minds.

As the startup grows, those types of things may be harder to do, but it’s the kind of culture Darrow and his founding partners hope to continue to foster as they build the company.

Powered by WPeMatico

The coronavirus pandemic has thrown the fitness space for a loop. Caliber, a startup that focuses on one-to-one personal training, is today launching a brand new digital coaching platform on the heels of a $2.2 million seed round led by Trinity Ventures.

Caliber launched in 2018 with a content model, offering an email newsletter and a library of instructional fitness content.

“My co-founders started testing the idea of coaching people individually and that’s where the light bulb really went off,” said co-founder and CEO Jared Cluff. “They saw that more than anything, people need expert guidance and a really genuinely personalized plan for their fitness routine.”

That was the origin of Caliber as it is known today.

When users join the platform they are matched with a Caliber coach. The company says that it brings on about five of every 100 applications for coaches on the platform, accepting only the very best trainers.

These coaches then take into account the goals of users and build out a personalized fitness plan in conjunction with the user, which begins with a video or phone consultation. Once the plan, which is comprised of strength training, cardio and nutrition, is finalized, the coach loads it into the app.

Users then follow the instructions from their instructor via the app and log their progress. Interestingly, these aren’t live video appointments with a trainer, but rather an asynchronous ongoing conversation with a coach that is facilitated by the app.

Users can also integrate their Apple Health app with Caliber to track nutrition and cardio, giving the coach a full 360-degree view of their progress.

Alongside providing feedback and encouragement, the coach ultimately provides a layer of accountability.

This combination of real human coaching in a less synchronous, time-intensive manner has allowed for Caliber to charge at a higher price than your standard workout generator apps but come in much lower than the average cost of an actual, in-person personal trainer.

Most Caliber users will pay between $200 and $400 per month to use the platform. Coaches, which are 1099 workers on Caliber, take home 60% of the revenue generated from users.

Pre-launch, Caliber has more than tripled its membership across the last six months and increased the number of workouts per member by 150%, according to the company. Cluff says the startup is doing north of $1 million in annual recurring revenue.

Of the 41 trainers on the platform, 37% are female and about a quarter are non-white. On the HQ team, which totals seven people, one is female and two-thirds of the founding team are LGBTQ.

“The biggest challenge is not dissimilar to the challenge we faced at Blue Apron, where I was most recently, in that we wanted to create the category around meal kits,” said Cluff. “We want to build a category around fitness training in a space that is super fragmented with no branded leader.”

Powered by WPeMatico

As companies continue to shift more quickly to the cloud, pushed by the pandemic, startups like Armory that work in the cloud-native space are seeing an uptick in interest. Armory is a company built to be a commercial layer on top of the open-source continuous delivery project Spinnaker. Today, it announced a $40 million Series C.

B Capital led the round, with help from new investors Lead Edge Capital and Marc Benioff along with previous investors Insight Partners, Crosslink Capital, Bain Capital Ventures, Mango Capital, Y Combinator and Javelin Venture Partners. Today’s investment brings the total raised to more than $82 million.

“Spinnaker is an open-source project that came out of Netflix and Google, and it is a very sophisticated multi-cloud and software delivery platform,” company co-founder and CEO Daniel R. Odio told TechCrunch.

Odio points out that this project has the backing of industry leaders, including the three leading public cloud infrastructure vendors Amazon, Microsoft and Google, as well as other cloud players like CloudFoundry and HashiCorp. “The fact that there is a lot of open-source community support for this project means that it is becoming the new standard for cloud-native software delivery,” he said.

In the days before the notion of continuous delivery, companies moved forward slowly, releasing large updates over months or years. As software moved to the cloud, this approach no longer made sense and companies began delivering updates more incrementally, adding features when they were ready. Adding a continuous delivery layer helped facilitate this move.

As Odio describes it, Armory extends the Spinnaker project to help implement complex use cases at large organizations, including around compliance and governance and security. It is also in the early stages of implementing a SaaS version of the solution, which should be available next year.

While he didn’t want to discuss customer numbers, he mentioned JPMorgan Chase and Autodesk as customers, along with less specific allusions to “a Fortune Five technology company, a Fortune 20 Bank, a Fortune 50 retailer and a Fortune 100 technology company.”

The company currently has 75 employees, but Odio says business has been booming and he plans to double the team in the next year. As he does, he says that he is deeply committed to diversity and inclusion.

“There’s actually a really big difference between diversity and inclusion, and there’s a great Vernā Myers quote that diversity is being asked to the party and inclusion is being asked to dance, and so it’s actually important for us not only to focus on diversity, but also focus on inclusion because that’s how we win. By having a heterogeneous company, we will outperform a homogeneous company,” he said.

While the company has moved to remote work during COVID, Odio says they intend to remain that way, even after the current crisis is over. “Now obviously COVID been a real challenge for the world, including us. We’ve gone to a fully remote-first model, and we are going to stay remote-first even after COVID. And it’s really important for us to be taking care of our people, so there’s a lot of human empathy here,” he said.

But at the same time, he sees COVID opening up businesses to move to the cloud and that represents an opportunity for his business, one that he will focus on with new capital at his disposal. “In terms of the business opportunity, we exist to help power the transformation that these enterprises are undergoing right now, and there’s a lot of urgency for us to execute on our vision and mission because there is a lot of demand for this right now,” he said.

Powered by WPeMatico

After announcing a modest $28 million raise earlier this year, the user-generated gamified e-learning platform Kahoot today announced a much bigger round to double down on the current surge in demand for remote education.

The Norwegian startup — which has clocked 1.3 billion “participating players” in the last 12 months — has picked up $215 million from SoftBank, specifically by way of a “private placement to a subsidiary of SoftBank Group Corp., through issuance of 43,000,000 new shares.” The placement was made at 46 Norwegian Krone per share, working out to NOK1,978 million (or $215 million), and the funding will be used for acquisitions and also to continue its expansion.

Kahoot is traded on the Merkur Market in Oslo — a stepping stone between being a fully private startup and a publicly listed company — and today the company is trading more than 15% up on the news. At market open today, it was valued at NOK22.2 billion, or about $2.4 billion — so by the end of the day that market cap is likely to have gone up as a result of today’s investment.

“Kahoot! is experiencing strong momentum and accelerated adoption as enterprises increasingly seek engaging, trustworthy and user-friendly ways to build corporate culture, educate and interact,” the company noted in a statement. “At the same time, schools and educators are looking to enhance the learning experience, whether virtually or in the classroom. The Company intends to use the net proceeds from the Private Placement to finance accelerated growth through value-creating non-organic opportunities and continue to build a unique platform company.”

We are reaching out to SoftBank for a direct comment on the news — which was announced by Kahoot in the briefest of terms necessary for disclosure as a publicly traded company — and will update as we learn more.

Update: A spokesperson said SoftBank declined to provide further comment.

SoftBank has had a long track record with investing in both gaming and online education, backing the likes of Supercell (another European gaming hit startup, now majority owned by Tencent), and most recently Unacademy, an e-learning startup in India.

Indeed, the company has been one of the more prolific investors in the startup world, both from SoftBank Group as well as via its Vision Fund and other related VC funds that it has set up.

Not all of those investments have been great: The company has come under fire for sinking hundreds of millions into growth rounds for buzzy startups that hemorrhaged cash and failed to turn a profit — OYO, WeWork and Uber being prime examples — and in some cases appeared to be run in a way that didn’t indicate that they would turn things around anytime soon. The takeaway message for some was that SoftBank, once a gold standard in investing, felt hasty and poorly managed itself.

But despite that, it has continued to remain very active, and the head of the Vision Fund, Rajeev Misra, recently highlighted e-learning as one of the three areas it’s focusing on for investments at the moment, in light of COVID-19.

Kahoot, meanwhile, has been building a two-pronged business: first, a platform aimed at school children to build and use, and browse and use others’ online learning content; and second, a platform where corporates can build, use, and use others’ corporate training materials. The former puts an emphasis on free usage, while the latter is a paid product.

In both cases, Kahoot’s content is built around the idea of gamification — learning designed as games — to make the process more fun and engaging. It has described itself as the “Netflix of Education” — but I think of it a little more like YouTube, because of the user-generated element of a lot of the material.

Kahoot has been successful in its model so far. It says that it has had 1.3 billion participating players, with 200 million games played and 100 million user-generated Kahoots, in the last 12 months.

As a point of comparison, last month, when it announced an acquisition to boost its corporate learning business — it bought an enterprise engagement platform called Actimo for about $33 million — it said that it had counted some 1 billion “participating players,” on top of some 4.4 billion users, since first launching the platform in 2013.

In its Q3 earnings released earlier this month, the company said it posted invoiced revenue of $11.6 million, up 240% increase on the same quarter a year earlier. It posted $5.2 million in positive cash flow from operations, compared to $-0.6 million in Q3 2019, and had 360,000 paid subscriptions, up 160% on the year earlier.

SoftBank is not the company’s first high-profile investor. Other backers in the company include Microsoft and Disney, as well as the well-known regional VCs Northzone and Creandum. The company tells me it has now raised a total of $325 million (based on current exchange rates).

Online education has been on a slow incline for years, as schools and students turn to the internet to supplement and in some cases replace teaching in physical classrooms, tapping into infrastructure that has further reach, in some cases (like higher education) costs less and is popular with students.

But, as with some other areas of tech, 2020 has seen that trend accelerate drastically as many schools have reduced teaching or shut down altogether in an effort to curtail the spread of the novel coronavirus that leads to COVID-19.

That has led to a huge boost of activity — sometimes quite urgent and not as a choice but a necessity — and investor attention in the last year for e-learning startups. Others announcing funding in the last couple of months have included Outschool (which raised $45 million and is now profitable), Homer (raised $50 million from an impressive group of strategic backers), Unacademy (raised $150 million) and the juggernaut that is Byju’s (most recently picking up $500 million from Silver Lake).

Alongside e-learning, gaming companies have been one of the categories of tech that have had a windfall of sorts this year by providing content to divert and occupy people as some normal activities have been curtailed because of the global health pandemic. Just yesterday the gaming giant Roblox, last valued at $4 billion, announced that it had quietly filed to go public.

Powered by WPeMatico

Flash Express, a two-year-old logistics startup that works with e-commerce firms in Thailand, said on Monday it has raised $200 million in a new financing round as it looks to double down on a rapidly growing market spurred by demand due to the coronavirus pandemic.

The funding, a Series D, was led by PTT Oil and Retail Business Public Company Limited, the marquee oil and retail businesses of Thai conglomerate PTT. Durbell and Krungsri Finnovate, two other top conglomerates in the Southeast Asian country, also participated in the round, which brings Flash Express’ to-date raise to about $400 million.

Flash Express, which operates door-to-door pickup and delivery service, claims to be the second largest private player to operate in this space. The startup, which also counts Alibaba as an investor, entered the market with delivery fees as low as 60 cents per parcel, a move that allowed it to quickly win a significant market share.

The startup has also expanded aggressively in the past year. Flash Express had about 1,100 delivery points during this time last year. Now it has more than 5,000, exceeding those of 138-year-old Thailand Post.

Flash Express currently delivers more than 1 million parcels a day, up from about 50,000 during the same time last year. The startup says it has also invested heavily in technology that has enabled it to handle over 100,000 parcels in a minute by fully automated sorting systems.

Komsan Lee, CEO of Flash Express, said the startup plans to deploy the fresh funds to introduce new services and expand to other Southeast Asian markets (names of which he did not identify). “We are also prepared to create and develop new technologies to achieve even greater delivery and logistics efficiency. More importantly we intend to assist SMEs in lowering their investment costs which we believe will provide long-term benefit for the overall Thai economy in the digital era,” he said.

Retail Business Public Company Limited plans to leverage Flash Express’ logistics network as it looks to meet the rising demand from consumers, said Rajsuda Rangsiyakull, senior executive vice president for Corporate Strategy, Innovation and Sustainability at Retail Business Public Company Limited.

Flash Express competes with Best Express — which, like Flash, is also backed by Alibaba — and Kerry Express, which filed for an initial public offering in late August.

Even as online shopping and delivery has accelerated in recent months, some estimates suggest that the overall logistics market in Thailand will see its first contraction in the history this year. Chumpol Saichuer, president of the Thai Transportation and Logistics Association, said last month Thailand’s logistics business has already been hit hard by the slowing global economy.

Powered by WPeMatico

Bangalore-headquartered Razorpay, one of a handful of Indian fintech startups that has demonstrated accelerated growth in recent years, has joined the coveted unicorn club after raising $100 million in a new financing round, the payments processing startup said on Monday.

The new financing round, a Series D, was co-led by Singapore’s sovereign wealth fund GIC and Sequoia India, the six-year-old Indian startup said. The new round valued the startup at “a little more than $1 billion,” co-founder and chief executive Harshil Mathur told TechCrunch in an interview.

Existing investors Ribbit Capital, Tiger Global, Y Combinator and Matrix Partners also participated in the round, which brings Razorpay’s total to-date raise to $206.5 million.

Razorpay accepts, processes and disburses money online for small businesses and enterprises. In recent years, the startup has expanded its offerings to provide loans to businesses and also launched a neo-banking platform to issue corporate credit cards, among other products.

Mathur and Shashank Kumar (pictured above), who met each other at IIT Roorkee, started Razorpay in 2014. They began to explore opportunities around a payments processing business after realizing just how difficult it was for small businesses such as young startups to accept money online less than a decade ago. There were very few payment processing firms in India then, and startups needed to produce a long list of documents.

The early team of about 11 people at Razorpay shared a single apartment as the co-founders rushed to meet with over 100 bankers to convince banks to work with them. The conversations were slow and remained in a deadlock for so long that the co-founders felt helpless explaining the same challenge to investors numerous times, they recalled in an interview last year.

To say things have changed for Razorpay would be an understatement. It’s become the largest payments provider for business in India, said Mathur. Razorpay, which competes with Prosus Ventures’ PayU, accepts a wide-range of payment options, including credit cards, debit cards, mobile wallets and UPI.

“Razorpay has established itself as a clear leader, with its strong focus on customer experience and product innovation,” said Choo Yong Cheen, chief investment officer for Private Equity at GIC, in a statement. “GIC has a long track record of partnering with leading fintech companies globally and is delighted to partner with Razorpay in its journey to transform payments and banking.”

India’s Razorpay launches corporate credit cards, current accounts support in major neo banking push

Some of Razorpay’s clients include budget lodging decacorn Oyo, fintech firm Cred, social giant Facebook, e-commerce Flipkart, top food delivery startups Zomato and Swiggy, online learning platform Byju’s, supply chain platform Zilingo, travel ticketing firms Yatra and Goibibo, and telecom giant Airtel .

The startup expects to process about $25 billion in transactions — up five times from last year — for nearly 10 million of its customers this year, said Mathur.

He attributed some of the growth to the coronavirus pandemic, which he said has accelerated the digital adoption among many businesses.

On the neo-banking and capital side, Mathur said, Razorpay expects RazorpayX and Razorpay Capital to account for about 35% of the startup’s revenue by the end of March next year.

Mathur said the startup’s payment processing service continues to be its fastest-growing business and does not need much capital to grow, so the startup will be deploying the fresh funds to expand its neo-banking offerings to include vendor payment, and expense and tax management and other features.

The startup, which aims to work with more than 50 million businesses by 2025, may also acquire a few firms as it explores opportunities around inorganic expansion in the neo-banking category, said Mathur.

“We will continue to make an impactful contribution to the growth of the industry, aid adoption in the under-served markets and drive new practices and a new thinking for the industry to follow. And this investment fits perfectly with our growth strategy,” he said.

While the coronavirus pandemic has slowed down deal-makings in India, about half a dozen startups in the country, including online learning platform Unacademy, and Pine Labs, have secured the unicorn status.

Powered by WPeMatico