funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Deep learning has made tremendous strides in recent years, with new systems and models like GPT-3 offering higher-quality interpretations of human language, empowering developers to use these concepts in more diverse applications. We can see these developments in our text-to-speech voice recorders and dual language translation apps, which have gotten shockingly good these days.

But what is the next wave of functionality that this AI infrastructure can empower? Hebbia wants to find out.

Hebbia today is a startup but really a product studio, a sort of sketchpad for AI ideas founded by George Sivulka (a PhD student from Stanford currently on leave) and a mélange of three other Stanford AI researchers and engineers. The group, using the new deep learning techniques and models available today, is trying to push the boundaries of what knowledge graphs, semantic analysis and AI can ultimately do for human productivity.

Sivulka was inspired to focus on this domain from witnessing his friends’ experiences working in the knowledge economy. “A lot of my peers … everyone goes into these white-collar jobs where they’re sitting down and just reading immense quantities of information all day,” Sivulka said. “People become banking analysts and dig through SEC forms for one or two lines of information, or go to law school or become legal analysts and do the same thing… [They’re] just bogged down by these walls of text, by this like avalanche of information that is impossible to make sense of.”

(Tell me about it).

What he and his team want to do is supercharge human productivity by building search, analysis and summarization tools that can help you make sense of your own, personal universe of knowledge. “The idea is that Hebbia is building these productivity tools for thought that augment the way you do work. They’re things that actually control the information input and outputs that you have to deal with every day,” Sivulka said.

It’s an ambitious vision, so they had to start somewhere. Their first product, which is what got me excited about the vision, is a Chrome plugin that’s been in private beta and is being released to the world more broadly today (note: it’s still unlisted in the Chrome Store for now). The plugin upgrades the search functionality in Chrome to go beyond mere text pattern matching to begin to comprehend what your query actually is and how it might be answered given the text on a page. Here’s a demo of the plugin on TechCrunch:

Hebbia’s Ctrl-F product on TechCrunch. Image via Hebbia.

So, for instance, you could Ctrl-F on a Wikipedia page and ask “Where did this person live?” and the plugin can determine that you are asking for locations and begin to highlight text on that page with relevant information. It’s AI, and pretty beta AI at that, so of course, your experience can and will be inconsistent right now. But as Hebbia tunes its models and improves its understanding of text, the hope is that browser search can be completely transformed and become a massive productivity boost.

Sivulka is something of an early wunderkind. He worked at NASA as a teenager, and graduated from his bachelor’s at Stanford in 2.5 years, finishing his master’s a bit more than a year later, and started a PhD before getting waylaid by Hebbia.

Hebbia’s vision has already attracted the notice of VCs in just its early months. Ann Miura-Ko at Floodgate led a $1.1 million pre-seed round that was joined by Naval Ravikant, Peter Thiel, Kevin Hartz, Michael Fertik and Cory Levy.

Sivulka notes that their Ctrl-F product is the main focus for the company right now, and acts as a sort of gateway into the larger potential that knowledge graphs and personal productivity offer. “This is one of the final frontiers of what computers can do,” Sivulka said, noting that computation has already revolutionized many fields by digitizing data and making it easier to process. With Ctrl-F, “this is a baseline technology, [we’re] just scratching the surface of what we can do with this.”

Powered by WPeMatico

Priori Legal, a startup rethinking the way that large corporations hire outside counsel, has raised $6.3 million in Series A funding.

Founded by CEO Basha Rubin and CPO Mirra Levitt (who met while classmates at Yale Law School), Priori launched as a legal marketplace for small and medium businesses before finding its current model in 2016.

Rubin explained that although Fortune 500 companies have their own in-house legal teams, they still spend an average of $150 million a year on outside legal counsel. And finding that counsel can be an arduous process — a consumer goods company, for example, might need to hire lawyers in all 50 states.

So by creating a marketplace of vetted lawyers (it says it only accepts 10% of applicants), by running a bidding process for the work and by streamlining the billing and on-boarding process, the startup can save companies an average of 60% of the money they spend on outside counsel and reduce the search time by 80%.

“We don’t get involved in the substance of the lawyer-client relationship,” Levitt added. “We are not a law firm, we don’t do any of the legal work. Our innovation is focused entirely on the process of rapidly identifying the right talent and, once the matter is up and running, making billing seamless.”

There are currently more than 1,500 lawyers in the marketplace, representing all 50 states in the U.S., as well as 47 countries and 700 practice proficiencies. Levitt said that while the first lawyers to join the platform were usually independent or worked at small firms that might not previously had access to these kinds of clients, there are now larger firms signing up as well.

Priori founders Mirra Levitt and Basha Rubin

And Rubin said interest in Priori has only grown during the pandemic and the resulting economic downturn. Companies are trying to do “more with less,” and “part of our value proposition is fundamentally cost savings.” For example, she noted that client spending on the platform has increased 200% in the last year.

“We began to see so much inbound demand that we would log onto Slack at 11pm and the entire team would be working,” she said. “We have a truly extraordinary team, but a) that’s not sustainable from a human perspective, and b) we saw an opportunity to really grow dramatically if we could throw resources at it.”

The Series A comes from Hearst Corporation (also a Priori customer), Great Oaks Venture Capital, Jambhala, Tim Steinert (former general counsel of Alibaba Group), Mindset Ventures, Bridge Venture Fund and Orrick’s Legal Technology Fund.

In addition to growing the team, Rubin said that the new funding will allow Priori to expand its network of lawyers, especially internationally.

“From a product perspective, we’re really building out our use of data throughout the platform,” Levitt said, adding that the company plans to use machine learning to improve attorney vetting, matchmaking, bidding, project scoping and more.

Powered by WPeMatico

VPNs, or virtual private networks, are a mainstay of corporate network security (and also consumers trying to stream Netflix while pretending to be from other countries). VPNs create an encrypted channel between your device (a laptop or a smartphone) and a company’s servers. All of your internet traffic gets routed through the company’s IT infrastructure, and it’s almost as if you are physically located inside your company’s offices.

Despite its ubiquity though, there are significant flaws with a VPN’s architecture. Corporate networks and VPNs were designed assuming that most workers would be physically located in an office most of the time, and the exceptional device would use a VPN. As the pandemic has made abundantly clear, fewer and fewer people work in a physical office with a desktop computer attached to ethernet. That means the vast majority of devices are now outside the corporate perimeter.

Worse, VPNs can have massive performance problems. By routing all traffic through one destination, VPNs not only add latency to your internet experience, they also transmit all of your non-work traffic through your corporate servers as well. From a security perspective, VPNs also assume that once a device joins, it’s reasonably safe and secure. VPNs don’t actively check network requests to make sure that every device is only accessing the resources that it should.

Twingate is fighting directly to defeat VPNs in the workplace with an entirely new architecture that assumes zero trust, works as a mesh and can segregate work and non-work internet traffic to protect both companies and employees. In short, it may dramatically improve the way hundreds of millions of people work globally.

It’s a bold vision from an ambitious trio of founders. CEO Tony Huie spent five years at Dropbox, heading up international and new market expansion in his final role at the file-sharing juggernaut. He’s most recently been a partner at venture capital firm SignalFire . Chief Product Office Alex Marshall was a product manager at Dropbox before leading product at lab management program Quartzy. Finally, CTO Lior Rozner was most recently at Rakuten, and before that Microsoft.

Twingate founders Alex Marshall, Tony Huie and Lior Rozner. Photo via Twingate.

The startup was founded in 2019, and is announcing today the public launch of its product, as well as its Series A funding of $17 million from WndrCo, 8VC, SignalFire and Green Bay Ventures. Dropbox’s two founders, Drew Houston and Arash Ferdowsi, also invested.

The idea for Twingate came from Huie’s experience at Dropbox, where he watched its adoption in the enterprise and saw firsthand how collaboration was changing with the rise of the cloud. “While I was there, I was still just fascinated by this notion of the changing nature of work and how organizations are going to get effectively re-architected for this new reality,” Huie said. He iterated on a variety of projects at SignalFire, eventually settling on improving corporate networks.

So what does Twingate ultimately do? For corporate IT professionals, it allows them to connect an employee’s device into the corporate network much more flexibly than a VPN. For instance, individual services or applications on a device could be set up to securely connect with different servers or data centers. So your Slack application can connect directly to Slack, your JIRA site can connect directly to JIRA’s servers, all without the typical round-trip to a central hub that a VPN requires.

That flexibility offers two main benefits. First, internet performance should be faster, since traffic is going directly where it needs to rather than bouncing through several relays between an end-user device and the server. Twingate also says that it offers “congestion” technology that can adapt its routing to changing internet conditions to actively increase performance.

More importantly, Twingate allows corporate IT staff to carefully calibrate security policies at the network layer to ensure that individual network requests make sense in context. For instance, if you are a salesperson in the field and suddenly start trying to access your company’s code server, Twingate can identify that request as highly unusual and outright block it.

“It takes this notion of edge computing and distributed computing [and] we’ve basically taken those concepts and we’ve built that into the software we run on our users’ devices,” Huie explained.

All of that customization and flexibility should be a huge win for IT staff, who get more granular controls to increase performance and safety, while also making the experience better for employees, particularly in a remote world where people in, say, Montana might be very far from an East Coast VPN server.

Twingate is designed to be easy to onboard new customers according to Huie, although that is almost certainly dependent on the diversity of end users within the corporate network and the number of services to which each user has access. Twingate integrates with popular single sign-on providers.

“Our fundamental thesis is that you have to balance usability, both for end users and admins, with bulletproof technology and security,” Huie said. With $17 million in the bank and a newly debuted product, the future is bright (and not for VPNs).

Powered by WPeMatico

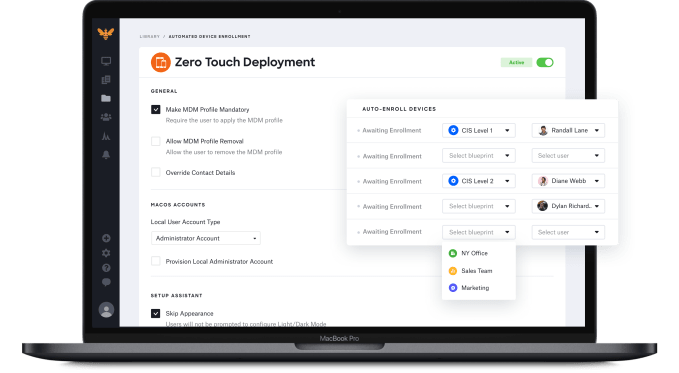

Kandji, a mobile device management (MDM) startup, launched last October. That means it was trying to build the early-stage company just as the pandemic hit earlier this year. But a company that helps manage devices remotely has been in demand in this environment, and today it announced a $21 million Series A.

Greycroft led the round, with participation from new investors Okta Ventures and B Capital Group, and existing investor First Round Capital. Today’s investment brings the total raised to $28.4 million, according to the company.

What Kandji is building is a sophisticated zero-touch device management solution to help larger companies manage their fleet of Apple devices, including keeping them in compliance with a particular set of rules. As CEO and co-founder Adam Pettit told TechCrunch at the time of his seed investment last year:

We’re the only product that has almost 200 of these one-click policy frameworks we call parameters. So an organization can go in and browse by compliance framework, or we have pre-built templates for companies that don’t necessarily have a specific compliance mandate in mind.

Monty Gray, SVP of corporate development at Okta, says Okta Ventures is investing because it sees this approach as a valuable extension of the company’s mission.

“Kandji’s device management streamlines the most common and complex tasks for Apple IT administrators and enables distributed workforces to get up and running quickly and securely,” he said in a statement.

It seems to be working. Since the company’s launch last year it reports it has gained hundreds of new paying customers and grown from 10 employees at launch to 40 today. Pettit says that he has plans to triple that number in the next 12 months. As he builds the company, he says finding and hiring a diverse pool of candidates is an important goal.

“There are ways to extend out into different candidate pools so that you’re not just looking at the same old candidates that you normally would. There are certain ways to reduce bias in the hiring process. So again, I think we look at this as absolutely critical, and we’re excited to build a really diverse company over the next several years,” he said.

Image Credits: Kandji

He notes that the investment will not only enable him to build the employee base, but also expand the product too, and in the past year, it has already taken it from basic MDM into compliance, and there are new features coming as they continue to grow the product.

“If someone saw our product a year ago, it’s a very different product today, and it’s allowed us to move up market into the enterprise, which has been very exciting for us,” he said.

Powered by WPeMatico

Only a few weeks after the successful public offering of Array Technologies proved that there’s a market for technologies aimed at improving efficiencies across the solar manufacturing and installation chain, Leading Edge Equipment has raised capital for its novel silicon wafer manufacturing equipment.

The $7.6 million financing came from Prime Impact Fund, Clean Energy Ventures and DSM Venturing, and the company said it would use the technology to ramp up its sales and marketing efforts.

For the last few years researchers have been talking up the potential of so-called kerfless, single-crystal silicon wafers. For industry watchers, the single-crystal versus poly-crystalline wafers may sound familiar, but as with many things with the resurgence of climate technology investment, maybe this time will be different.

Silicon wafer production today is a seven-step process in which large silicon ingots created in heavily energy-intensive furnaces are sawed into wafers by wires. The process wastes large amounts of silicon, requires an incredible amount of energy and produces low-quality wafers that reduce the efficiency of solar panels.

Using ribbons to produce its wafers, Leading Edge’s manufacturing equipment uses the floating silicon method to reduce production to a single step, consuming less energy and producing almost no waste, according to the company.

Leading Edge Equipment was founded by longtime experts in the silicon foundry industry — Alison Greenlee, a quadruple-degreed graduate of the Massachusetts Institute of Technology who worked on floating silicon method that reduces waste in the manufacturing of silicon for solar cells; and Peter Kellerman, the progenitor of floating silicon method technologies.

The two founded Leading Edge Equipment to rejuvenate a project that had been mothballed by Applied Materials after years of research.

The two won $5 million in federal grants and raised an initial $6 million from venture capital firms in 2018 to kick off the technology.

Leading Edge expects that its equipment could become the standard for silicon substrate manufacturing.

Kellerman, now the emeritus chief technology officer, was replaced by Nathan Stoddard, a seasoned silicon manufacturing technology expert who has worked on teams that have brought three different solar wafer technologies from concept to pilot production. Stoddard, a former colleague of Greenlee’s at 1366 — one of the early companies devoted to new silicon production technologies — was won over by Greenlee and Kellerman’s belief in the old Applied Materials technology.

The company claims that its technology can reduce wafer costs by 50%, increase commercial solar panel power by up to 7% and reduce manufacturing emissions by more than 50%.

To commercialize the project, earlier this year the team brought in Rick Schwerdtfeger, a longtime innovator in solar technology who began working with CIGS crystals back in 1995. In the 2000s Schwerdtfeger spent his time in building out ARC Energy to scale next-generation furnace technologies.

“After critical technology demonstrations and the development of a new commercial tool, we are now ready to launch this technology into market in 2021,” said Schwerdtfeger in a statement. “Having recently secured a 31,000 square foot facility and doubled the size of our team, we will use this new funding to prepare for our 2021 commercial pilots.”

Powered by WPeMatico

Simple, link-centric user profiles might not sound like a particularly ambitious idea, but it’s been more than big enough for Linktree.

The Melbourne startup says that 8 million users — whether they’re celebrities like Selena Gomez and Dua Lipa or brands like HBO and Red Bull — have created profiles on the platform, with those profiles receiving more than 1 billion visitors in September.

Plus, there are more than 28,000 new users signing up every month.

“This category didn’t exist when we started,” CEO Alex Zaccaria told me. “We created this category.”

Zaccaria said that he and his co-founders Anthony Zaccaria and Nick Humphreys created Linktree to solve a problem they were facing at their digital marketing agency Bolster. Instagram doesn’t allow users to include links in posts — all you get is a single link in your profile, prompting the constant “link in bio” reminder when someone wants to promote something.

Meanwhile, most of Bolster’s clients come from music and entertainment, where a single link can’t support what Zaccaria said is a “quite fragmented” business model. After all, an artist might want to point fans to their latest streaming album, upcoming concert dates, an online store for merchandise and more. A website could do the job in theory, but they can be clunky or slow on mobile, with users probably giving up before they finally reach the desired page.

Linktree founders Anthony Zaccaria, Alex Zaccaria and Nick Humphreys. Image via Linktree.

So instead of constantly swapping out links in Instagram and other social media profiles, a Linktree user includes one evergreen link to their Linktree profile, which they can update as necessary. Selena Gomez, for example, links to her latest songs and videos, but also her Rare Beauty cosmetics brand, her official store and articles about her nonprofit work.

Zaccaria said that after launching the product in 2016, the team quickly discovered that “a lot more people had the same problem,” leading them to fully separate Linktree and Bolster two years ago. Since then, the company hasn’t raised any outside funding — until now, with a $10.7 million Series A led by Insight Partners and AirTree Ventures. (Update: Strategic investors in the round include Twenty Minute VC’s Harry Stebbings, Patreon CTO Sam Yam and Culture Amp CTO Doug English.)

“We had the option to just continue to grow sustainably, but we wanted to pour some fuel on the fire,” Zaccaria said.

In fact, Linktree has already grown from 10 to 50 employees this year. And while the company started out by solving a problem for Instagram users, Zaccaria described it as evolving into a much broader platform that can “unify your entire digital ecosystem” and “democratize digital presence.” He said that while some customers continue to maintain “a giant, brand-immersive website,” for others, Linktree is completely replacing the idea of a standalone website.

Zaccaria added that Instagram only represents a small amount of Linktree’s current traffic, while nearly 25% of that traffic now comes from direct visitors.

Image Credits: Linktree

Black Lives Matter has also been a big part of Linktree’s recent growth, with activists and other users who want to support the movement using their profiles to point visitors to websites where they can donate, learn more and get involved. In fact, Linktree even introduced a Black Lives Matter banner over the summer that anyone could add to their profile.

Linktree is free to use, but you have to pay $6 a month for Pro features like video links, link thumbnails and social media icons.

Zaccaria said that the new funding will allow the startup to add more “functionality and analytics.” He’s particularly eager to grow the data science and analytics team, though he emphasized that Linktree does not collect personally identifiable information or monetize visitor data in any way — he just wants to provide more data to Linktree users.

In a statement, Insight Managing Director Jeff Lieberman said:

As the internet becomes increasingly fragmented, brands, publishers, and influencers need a solution to streamline their content sharing and connect their social media followers to their entire online ecosystem, ultimately increasing brand awareness and revenue. Linktree has successfully created this new “microsite” category enabling companies to monetize the next generation of the internet economy via a single interactive hub. The impressive traction and growing number of customers Linktree has gained over the last few months demonstrates its proven market fit, and we could not be more excited to work with the Linktree team as they transition to the ScaleUp phase of growth.

Powered by WPeMatico

It’s only been a few months since Lili announced its $10 million seed round, and it’s already raised more funding — namely, a $15 million Series A.

The startup, founded by CEO Lilac Bar David and CTO Liran Zelkha, is creating a bank account and associated products designed for freelancers, with features like early access to direct deposit payments and the ability to set aside a percentage of income for taxes.

The account (and associated Visa debit card) is free of overdraft fees or minimum balance requirements; Bar David said the company only makes money from card processing fees.

She also said that the platform has seen rapid growth this year, with transactions up 700% since the beginning of the pandemic and nearly 100,000 accounts opened since the launch in 2019.

Bar David suggested that the economic turmoil caused by COVID-19 has prompted (or forced) more skilled workers — such as programmers and digital marketers — to turn to freelancing. Meanwhile, she’s also seen “a big shift from part-time freelance to full-time freelance.”

Lili CEO Lilac Bar David

Bar David predicted that the recent growth of the freelance economy won’t simply disappear once the pandemic is over, because workers are discovering the benefits of freelancing.

“If you have a 9-to-5 job, you’re dependent on one employer,” she said. “If something happens you’re out of a job … If you’ve got a diversified customer base, you’re not dependent on just one source of income.”

In recent months, Lili has added new features like automatically generated quarterly income and expense reports, a digital debit card (which customers can use before the physical card arrives in the mail) and the ability to send and receive money via Google Pay (Lili already supported Cash App and Venmo) .

Bar David said the startup decided to raise more funding to expand its engineering team and further accelerate its growth. Apparently she was preparing for a traditional Series A fundraising process (albeit one that was conducted in the middle of a pandemic), but “our current investors were so tremendously impressed by the product-market fit and the growth” that they were willing to fund almost all of the new round.

So the Series A was led by previous investor Group 11, with participation from Foundation Capital, AltaIR Capital, Primary Venture Partners and Torch Capital — along with new backer Zeev Ventures.

“As the global workforce evolves at a rapid pace, we are excited to lead another round of funding to help Lili capitalize on unprecedented demand and offer an entirely new solution to help freelancers seamlessly save time and money,” said Group 11’s Dovi Frances in a statement.

Powered by WPeMatico

Buildings are the bedrock of civilization — places to live, places to work (well, normally, in a non-COVID-19 world) and places to play. Yet how we conceive buildings, architect them for their uses and ultimately construct them on a site has changed remarkably little over the past few decades. Housing and building costs continue to rise, and there remains a slow linear process from conception to construction for most projects. Why can’t the whole process be more flexible and faster?

Well, a trio of engineers and architects out of MIT and Georgia Tech are exploring that exact question.

MIT’s former treasurer Israel Ruiz along with architects Anton Garcia-Abril of MIT and Debora Mesa of Georgia Tech have joined together on a startup called WoHo (short for “World Home”) that’s trying to rethink how to construct a modern building by creating more flexible “components” that can be connected together to create a structure.

WoHo’s Israel Ruiz, Debora Mesa and Anton Garcia-Abril. Photo by Tony Luong via WoHo.

By creating components that are usable in a wide variety of types of buildings and making them easy to construct in a factory, the goal of WoHo is to lower construction costs, maximize flexibility for architects and deliver compelling spaces for end users, all while making projects greener in a climate unfriendly world.

The team’s ideas caught the attention of Katie Rae, CEO and managing partner of The Engine, a special fund that spun out of MIT that is notable for its lengthy time horizons for VC investments. The fund is backing WoHo with $4.5 million in seed capital.

Ruiz spent the last decade overseeing MIT’s capital construction program, including the further buildout of Kendall Square, a neighborhood next to MIT that has become a major hub for biotech innovation. Through that process, he saw the challenges of construction, particularly for the kinds of unique spaces required for innovative companies. Over the years, he also built friendships with Garcia-Abril and Mesa, the duo behind Ensamble Studio, an architecture firm.

With WoHo, “it is the integration of the process from the design and concept in architecture all the way through the assembly and construction of that project,” Ruiz explained. “Our technology is suitable for low-to-high rise, but in particularly it provides the best outcomes for mid-to-high rise.”

So what exactly are these WoHo components? Think of them as well-designed and reusable blocks that can be plugged together in order to create a structure. These blocks are consistent and are designed to be easily manufactured and transported. One key innovation is around an improved reinforced cement that allows for better building quality at lower environmental cost.

Conception of a WoHo component under construction. Photo via WoHo

We have seen modular buildings before, typically apartment buildings where each apartment is a single block that can be plugged into a constructed structure (take for example this project in Sacramento). WoHo, though, wants to go further in having components that offer more flexibility and arrangements, and also act as the structure themselves. That gives architects far more flexibility.

It’s still early days, but the group has already gotten some traction in the market, inking a partnership with Swiss concrete and building materials company LafargeHolcim to bring their ideas to market. The company is building a demonstration project in Madrid, and targeting a second project in Boston for next year.

Powered by WPeMatico

Yin Wu has co-founded several companies since graduating from Stanford in 2011, including a computer vision company called Double Labs that sold to Microsoft, where she stayed on for a couple of years as a software engineer. In fact, it was only after that sale she she says she “actually understood all of the nuances with a company’s cap table.”

Her newest company, Pulley, a 14-month-old, Mountain View, Ca.-based maker of cap table management software aims to solve that same problem and has so far raised $10 million toward that end led by the payments company Stripe, with participation from Caffeinated Capital, General Catalyst, 8VC and numerous angel investors.

Wu is going up against some pretty powerful competition. Carta was reportedly raising $200 million in fresh funding at a $3 billion valuation as of the spring (a round the company never official confirmed or announced). Last year, it raised $300 million. Morgan Stanley has meanwhile been beefing up its stock plan administration business, acquiring Solium Capital early last year and more recently purchasing Barclay’s stock plan business.

Of course, startups often manage to find a way to take down incumbents and a distraction for Carta, at least, in the form of a very public gender discrimination lawsuit by a former VP of marketing, could be the kind of opening that Pulley needs. We emailed with Yu yesterday to ask if that might be the case. She didn’t answer directly, but she did mention “values,” as well as sharing some more details about what she sees as different about the two products.

TC: Why start this company? Has Carta’s press of late created an opening for a new upstart in the space?

YW: I left Microsoft in 2018 and started Pulley a year later. We skipped the seed and raised the A because of overwhelming demand from investors. Many wanted a better product for their portfolio companies. Many founders are increasingly thinking about choosing with companies, like Pulley, that better align with their values.

TC: How many people are working for Pulley and are any folks you pulled out of Carta?

YW: We’re a team of seven and have four people on the team who are former Y Combinator founders. We attract founders to the team because they’ve experienced firsthand the difficulties of managing a cap table and want to build a better tool for other founders. We have not pulled anyone out of Carta yet.

TC: Carta has raised a lot of funding and it has long tentacles. What can Pulley offer startups that Carta cannot?

YW: We offer startups a better product compared to our competitors. We make every interaction on Pulley easier and faster. 409A valuations take five days instead of weeks, and onboarding is the same day rather than months. By analogy, this is similar to the difference between Stripe and Braintree when Stripe initially launched. There were many different payment processes when Stripe launched. They were able to capture a large portion of the market by building a better product that resonated with developers.

One of the features that stands out on Pulley is our modeling feature [which helps founders model dilution in future rounds and helps employees understand the value of their equity as the company grows]. Founders switch from our competitors to Pulley to use our modeling tool [and it works] with pre-money SAFEs, post-money SAFEs and factors in pro-ratas and discounts. To my knowledge, Pulley’s modeling tool is the most comprehensive product on the market.

TC: How does your pricing compare with Carta’s?

YW: Pulley is free for early-stage companies regardless of how much they raise. We’re price competitive with Carta on our paid plans. Part of the reason we started Pulley is because we had frustrations with other cap table management tools. When using other services, we had to regularly ping our accountants or lawyers to make edits, run reports or get data. Each time we involved the lawyers, it was an expensive legal fee. So there is easily a $2,000 hidden fee when using tools that aren’t self-serve for setting up and updating your cap table.

TC: Is there a business-to-business opportunity here, where maybe attorneys or accountants or wealth managers private label this service? Or are these industry professionals viewed as competitors?

YW: We think there are opportunities to white label the service for accountants and law firms. However, this is currently not our focus.

TC: How adaptable is the software? Can it deal with a complicated scenario, a corner case?

YW: We started Pulley one year ago and we’re launching today because we have invested in building an architecture that can support complex cap table scenarios as companies scale. There are two things that you have to get right with cap table systems, First, never lose the data and second, always make sure the numbers are correct. We haven’t lost data for any customer and we have a comprehensive system of tests that verifies the cap table numbers on Pulley remain accurate.

TC: At what stage does it make sense for a startup to work with Pulley, and do you have the tools to hang onto them and keep them from switching over to a competitor later?

YW: We work with companies past the Series A, like Fast and Clubhouse. Companies are not looking to change their cap table provider if Pulley has the tool to grow with them. We already have the features of our competitors, including electronic share issuance, ACH transfers for options, modeling tools for multiple rounds and more. We think we can win more startups because Pulley is also easier to use and faster to onboard.

TC: Regarding your paid plans, how much is Pulley charging and for what? How many tiers of service are there?

YW; Pulley is free for early-stage startups with less than 25 stakeholders. We charge $10 per stakeholder per month when companies scale beyond that. A stakeholder is any employee or investor on the cap table. Most companies upgrade to our premium plan after a seed round when they need a 409A valuation.

Cap table management is an area where companies don’t want a free product. Pulley takes our customers’ data privacy and security very seriously. We charge a flat fee for companies so they rest assured that their data will never be sold or used without their permission.

TC: What’s Pulley’s relationship to venture firms?

YW: We’re currently focused on founders rather than investors. We work with accelerators like Y Combinator to help their portfolio companies manage their cap table, but don’t have a formal relationship with any VC firms.

Powered by WPeMatico

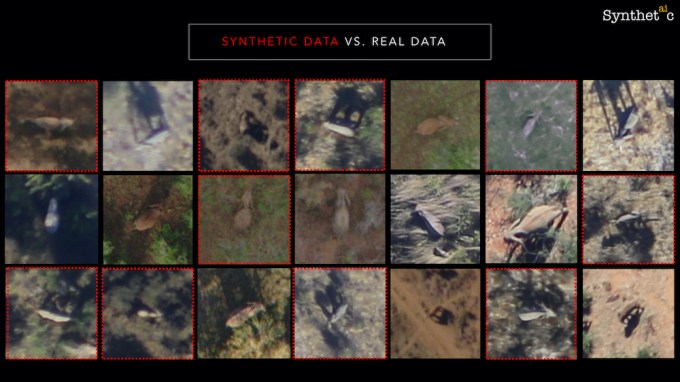

Synthetaic is a startup working to create data — specifically images — that can be used to train artificial intelligence.

Founder and CEO Corey Jaskolski’s experience includes work with both National Geographic (where he was recently named Explorer of the Year) and a 3D media startup. In fact, he told me that his time with National Geographic made him aware of the need for more data sets in conservation.

Sound like an odd match? Well, Jaskolski said that he was working on a project that could automatically identify poachers and endangered animals from camera footage, and one of the major obstacles was the fact that there simply aren’t enough existing images of either poachers (who don’t generally appreciate being photographed) or certain endangered animals in the wild to train AI to detect them.

He added that other companies are trying to create synthetic AI training data through 3D worldbuilding (in other words, “building a replica of the world that you want to have an AI learn in”), but in many cases, this approach is prohibitively expensive.

In contrast, the Synthetaic (pronounced “synthetic”) approach combines the work of 3D artists and modelers with technology based on generative adversarial networks, making it far more affordable and scalable, according to Jaskolski.

Image Credits: Synthetaic

To illustrate the “interplay” between the two halves of Synthetaic’s model, he returned to the example of identifying poachers — the startup’s 3D team could create photorealistic models of an AK-47 (and other weapons), then use adversarial networks to generate hundreds of thousands of images or more showing that model against different backgrounds.

The startup also validates its results after an AI has been trained on Synthetaic’s synthesized images, by testing that AI on real data.

For Synthetaic’s initial projects, Jaskolski said he wanted to partner with organizations doing work that makes the world a better place, including Save the Elephants (which is using the technology to track animal populations) and the University of Michigan (which is developing an AI that can identify different types of brain tumors).

Jaskolski added that Synthetaic customers don’t need any AI expertise of their own, because the company provides an “end-to-end” solution.

The startup announced today that it has raised $3.5 million in seed funding led by Lupa Systems, with participation from Betaworks Ventures and TitletownTech (a partnership between Microsoft and the Green Bay Packers). The startup, which has now raised a total of $4.5 million, is also part of Lupa and Betaworks’ Betalab program of startups doing work that could help “fix the internet.”

Powered by WPeMatico